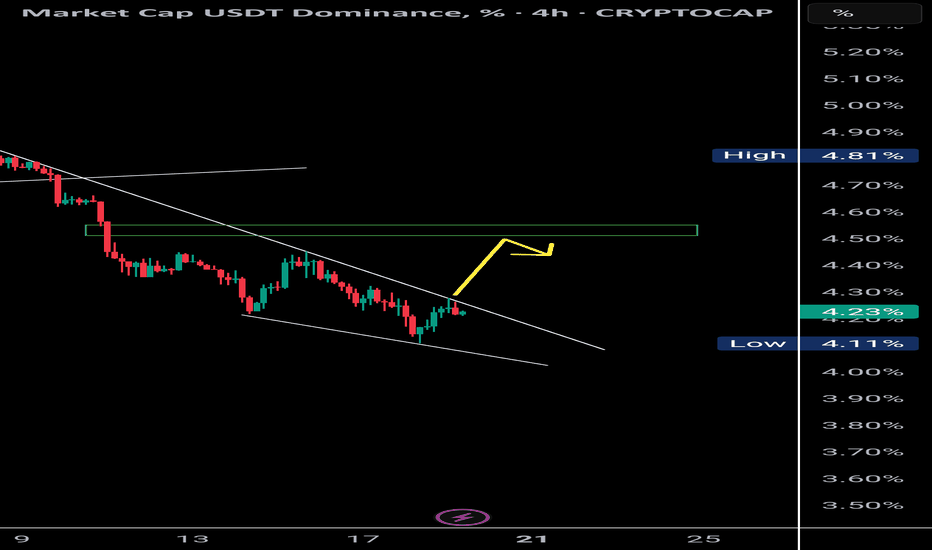

USDT Dominance Forming Bullish Divergence | Altcoins May Retest 📉 USDT Dominance (4H):

Currently forming a bullish divergence with RSI, supported by a falling wedge structure. Price is respecting a clear supply OB (resistance zone) and might retest the 4.55% level.

🔁 Historically, a rise in USDT.D signals short-term corrections in BTC and altcoins, creating opportunities for OB/supply fills and long setups.

📊 This could be the retest phase for major crypto assets before resuming upward momentum.

🧠 Use this phase wisely — it’s where strong setups begin to form.

Bullish Divergence

Bullish Divergence on Bigger tf.TPLP Analysis

Closed at 9.72 (07-07-2025)

Bullish Divergence on Bigger tf.

However, important to Sustain 9.25 - 9.50

Bullish Momentum will start once it will

cross & Sustain 14.60 - 16.10 zone.

Then the Targets can be around 22 - 24 initially.

It should not break 6.20 now.

Bullish divergence on MKC Daily

Bullish div on ME, mLines, ATR channels and slightly on sRSI

Impuls on factor 5 TF is red, but EFI is turning from an extreme level and factor 3 is blue impulse

E: 72,73

TP: 75,43

SL: 70,86

RR: 1:1.44

Trade #00012

Note:

I posted this when price was 72.45, at market open, but I could not post my regular charts as of now on Tradingview does not allow it when you publish indicators that are private.

So this chart already shows part of the move.

This is trade number 12.

Score so far is: 7 out 11 63,6% hitrate

LTCUSD💡 LTC/USDT – 4H Chart Setup

Bullish Divergence spotted on the 4H timeframe.

📌 Trade Plan

Entry (Buy Stop): 91.08 (Break of Lower High)

Stop Loss (SL): 81.95

Take Profit 1 (TP1): 98.89

Take Profit 2 (TP2): 106.86

📈 Risk Management

Open 2 positions

Once TP1 is hit, trail SL to Entry (EP) to secure risk-free run toward TP2

🧠 Reasoning:

Bullish divergence indicates potential reversal. Entry planned above the LH to confirm momentum shift.

Bullish Divergence

Closed at 26.89 (05-06-2025)

27.50 - 28 is an Immediate Important

Resistance that needs to cross & sustain

for further upside.

There is a Bullish Divergence which may

help this time to break the resistance.

But better approach would be to wait

for the Resistance to cross & then take entry.

If it does, 32 - 33 is easily reachable.

On the flip side, it should not break 23.50

otherwise there would be more selling pressure.

Bullish Flag Pattern on Bigger tf + Bullish Divergence

Closed at 60.50 (02-06-2025)

Bullish Flag Pattern on Bigger tf + Bullish Divergence

is there.

54.50 - 62.50 is an Important Support

Zone. If this level is Sustained, we may

witness further upside towards 70-71.

A very Important Resistance Level is around 90-92

which if Crossed with Good Volumes, may expose

new highs.

On the flip side, breaking 51 may bring more selling

pressure.

Hidden Bullish Divergence on Bigger tf.IMAGE

Closed at 21.94 (27-05-2025)

Hidden Bullish Divergence on Bigger tf.

Monthly Closing above 20.70 will be a

positive sign.

Upside Targets can be around 26 - 26.50

On the flip side, 20.50 - 20.68 is a Good

Support zone and then around 19.

Should not break 17.30, otherwise we may

witness nd Reversal.

Failed Wedge, New Setup. Is SUI About to Break Out?In my previous post about BYBIT:SUIUSDT , I mentioned a potential falling wedge pattern. However, the breakout above the 4.0040 resistance turned out to be a false breakout, and the price eventually dropped to the invalidation level at 3.5868. This made the setup invalid.

But despite the failed wedge breakout, BYBIT:SUIUSDT remains in a bullish trend overall. During the current consolidation, the price appears to be forming a new bullish pattern — a Descending Broadening Wedge (DBW).

This pattern typically starts with low volatility and gradually widens. Once price reaches its lower boundary, it often experiences a strong breakout to the upside.

Let’s break down the key price action in this DBW setup:

Price is moving within a Descending Broadening Wedge and is currently near the lower boundary of the pattern.

It’s also sitting around a key support level at 3.4833.

A rejection candle formed right at 3.4833, showing the market’s response to this support area.

A reversal confirmation would come if the price breaks above 3.6102.

A bullish divergence is also visible — price is forming lower lows, while the stochastic indicator is forming higher lows.

Based on these five price action signals, it seems that buyers are still in control, even though short-term volatility has created a series of lower lows.

That’s why I still believe BINANCE:SUIUSDT has more room to go up. What’s your take on this?

Coiling for a Breakout – Watch This LevelAfter a strong upward move, BYBIT:SUIUSDT is currently consolidating in a sideways range, forming what appears to be a falling wedge pattern — a classic bullish continuation setup.

If this pattern plays out, there's a good chance the price will resume its uptrend, supported by a bullish divergence forming within the wedge. The key level to watch is the resistance at 4.0040. A clean breakout above this level should be backed by strong momentum. However, if the price breaks above but quickly drops back below 4.0040, it could signal a lack of buying pressure — increasing the risk of a failed breakout.

This bullish scenario remains valid as long as the price holds above 3.5868. The next potential upside targets are 4.7996 and 5.0552.

Keep an eye out for a high-volume breakout and a strong candle close above 4.0040 to confirm the move.

What’s your take on BINANCE:SUIUSDT ?

Bullish Divergence.

Bullish Divergence.

Weekly Closing above 51.30 - 51.50

would be a healthy sign.

However, 55 is an Important Resistance level.

immediate targets if 51.50 is Crossed & Sustained

will be around 55 & then 58.

Since it is moving in a range, so both sides must be

kept in mind.

Support Zone is around 45 - 47. & this time if it

breaks 44, we may witness further downside. which is

(for the time being) negligible because of Bullish Divergence.