VET BUY SIGNALBullish Divergence on multiple time frames and indicators.

The MACD indicator makes a low and then a higher low – indicating that momentum is moving to the upside. At the same time price makes a low and then a lower low.

The MACD indicator is a momentum indicator and is based upon average prices. When it starts moving upwards it is normally the case that price is also moving upwards. In this case, the MACD indicator is going upwards and the price is continuing to go downwards. This indicates that the market is oversold and therefore a correction is likely.

Good Luck

Bullish Divergence

The Oxy Protocol Gartley Trade Lives On!We Have 4 Hour Bullish Divergence and a Double Bottom at the PCZ of this Bullish Gartley that price action has held itself together surprisingly well at during the Bearish price Action on Bitcoin. We did however see a weird wick down in the Spot Market but the Futures Market held together very well at this PCZ and we might see another decent rise up.

COTI LONG BULLISH DIVERGENCE + PENNANT!Recently Coti made a new ATH and has been testing the range of its previous ath due to a bearish divergence formed, however all is in place for continuation.

Looking at the chart we can see a bullish divergence has sowly formed leaving room for more growth.

Coupled with the bullish pennant, a breakout will lead us to new All-time Highs.

Enter with a stop below support and target first resistance(Green). You could extend targets to its aths if you wish.

Bullish Butterfly on C3.ai with Bullish Divergence on MACDI have been waiting for AI to get to this PCZ for many months now and we just gapped down slightly below it today with the RSI oversold and the MACD slightly diverging. I'm going to be a little aggressive and buy some here but if it get's back above the 1.618 Fibonacci Extension i will buy more.

APRN - Blue Apron Possible BreakoutAPRN - Blue Apron Possible Breakout

Bulls Breaking resistance aiming for a breakout back into an uptrend. Buy the open.

The bullish divergence just got bigger!This, now 20 day, bullish divergence tells a story of a coin that is going up in intrinsic value but lower in price over the period of almost a month. I can very easily see the trading price of this coin matching up with its value to its consumers very soon. Also about to break out to the upside of the MACD on the 1 day chart in a pretty big way. Remember to DYOR, DCA, and don't be a DICK!!

Paypal Bullish Shark Pattern at SupportWe might see a nice bounce from Paypal within the coming weeks but i don't expect new ATHs i expect a lower low then for it to come back down to make one final lower lower later on but for now i am quite decently Bullish as the MACD is showing Bullish Divergence, The RSI is Oversold, The price is at Old Resistance, and the Volume looks somewhat like a Selling Climax so lets atleast get a correction back up to the $200s then we can talk lower lows if it shows weakness there later.

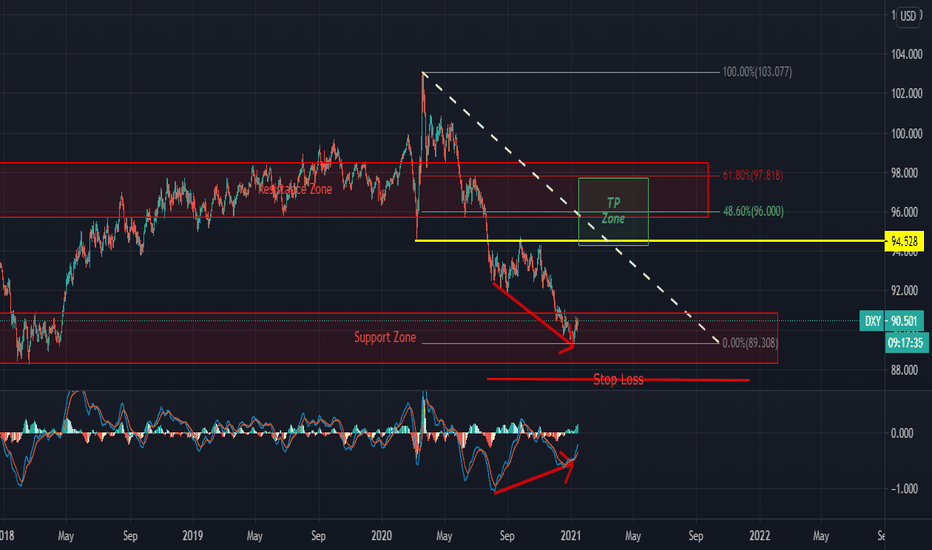

U.S. Dollar Index Bullish Divergence and US Economy Improvement here we can see DXY is showing a Bullish Divergence with MACD in Daily Time Frame

as it is a regular divergence so it can be a sign of trend reversal and start of a rally to its previews higher points and resistances

i have specified the Minimum retracement levels by Fibonacci retracement tool and the levels are combined with Price Action analysis.

we can use this data to setup our positions in may forex instruments including EURUSD and GBPUSD etc... which can be interpreted as shorting them for swing and positional Trades

i have also analyzed them so I will keep their links to the related ideas

this analysis can help us to forecast many other Asset movements and US related economic factors

please name few other uses of DXY in the Comments

and let me know how can we relate this trend change with the current US Geopolitical issues and economic status??? and obviously the US election...

$BFRIBiofrontera Inc., a biopharmaceutical company, develops and provides dermatological products for the treatment of skin diseases in the United States. It primarily develops therapies for non-melanoma skin cancer. It offers Ameluz, an aminolevulinic acid hydrochloride gel for the photodynamic therapy of actinic keratoses; and BF-RhodoLED, an LED lamp emitting red light for use in photodynamic therapy. The company was founded in 1997 and is based in Woburn, Massachusetts.

BAT Looks Very Likely to flip ETH Very SoonI uploaded a huge weekly bullish shark pattern on this pair from the Binance chart a few weeks ago that can be seen in the related section and it's since gone up 100 percent and has much more to go. Now i want to share a different bullish perspective on the Coinbase chart. We are in a big falling wedge pattern and double bottoming with divergence waiting to break above the 55 week moving average and breakout of the wedge.

BAT/ETH has looked especially bullish but this is not the only pair with bullish signals and patterns against ETH, many alts have bullish eth setups right now it's just that BAT stands out more than the others and may perform better than the other due to just how big everything is.