BellRing Brands (BRBR) Weekly Gartley@ Key Levels + Kijun SignalIn March 2025, I previously took a look at this budding public company BellRing Brands, Inc. for a long-term investment horizon. It was priced around 74 at the time, then the fall of the overall market status put additional pressure on its stock, although the company itself is booming and meets my fundamental parameters. See the following:

Since then, we had an awesome and confident forward guidance from the company in the last earnings call in May 2025: bellring.com

Now, looking at BellRing Brands (BRBR) once again, on a weekly chart, key technical patterns have formed that look very promising and solid with its many confluences.

TECHNICALS:

WEEKLY:

Many weekly confluences have appeared from a technical perspective. Here is what I see:

(1) There is a clear Bullish Gartley-ish pattern in a weekly retracement to 50% followed by a retracement to 78.6% of a preceding move.

(2) The price is around 78% fib support.

(3) Horizontal area of support: The 50 - 58 area is a whole prior area of horizontal support that was a prior resistance area back in July 2024, and the price has landed back on that area. You know what we say as technicians and investors: past resistance = future support.

(4) MACD Hidden Bullish Divergence (weekly)

(5) The price tested the weekly cloud and broke through; however, bullish extremes were triggered when that happen, which is rare based on all my personal studies. In fact, the current level 55-58 marks the end of a bearish double top cycle that began around March 2025.

(6) A weekly Doji with volume support (classified as a "dVa" in my old notes of Volume Price Analysis).

Here is the weekly chart:

MONTHY:

BRBR is poised to rally Q3 and Q4 2025.

We have a potential monthly bounce of the kijun forthcoming along with good fundamentals going forward supporting the growth of the company in the long term.

** potential monthly Kijun Trend Bounce **

Here is the monthly chart:

Target:

Currently, the price is 58.54. My tentative target is around 140 by March 2026.

Thus, with all the fundamental support, good forward-looking guidance, and the technical I believe that BellRing Brands (BRBR) is at a great price right now. It is prime to continue its stretch of growth for 2025. Looking forward with investor foresight, the case for BellRing Brands and its stock (BRBR) is not only a high-probability outlook of positivity, but a high odds outcome of technical price pattern success. What a great discount.... :)

Bullish Gartley

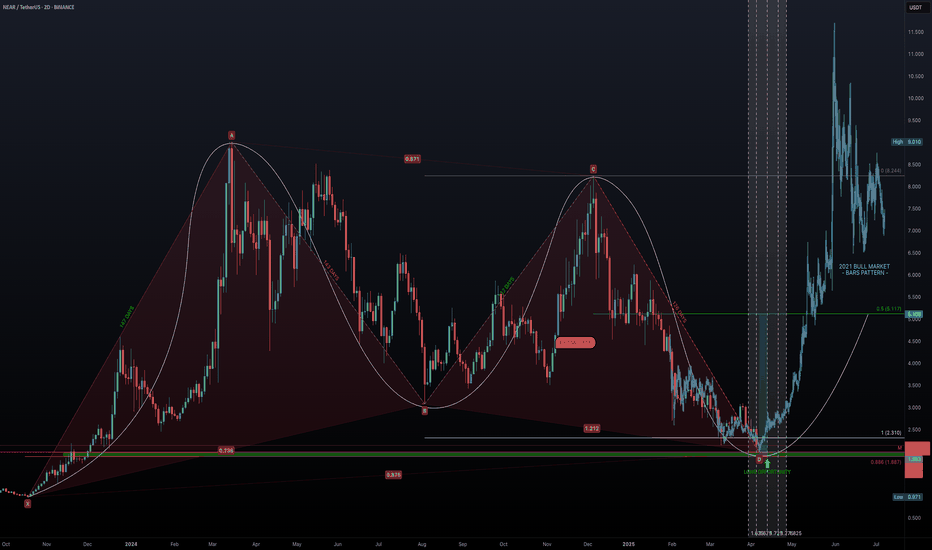

NEAR the Bottom? - The Crash Ends HereBack in October 2023, NEAR embarked on an incredible bull run lasting 147 days, surging from a low of $0.971 to a high of $9.01—an astounding +828% gain. Following this euphoric phase, the market sentiment shifted dramatically. Over the subsequent 392 days, NEAR retraced to around $2, marking a -78% decline. Now, with the market at a critical juncture, the question remains: when does the madness of the crash end, and can we finally see a reversal?

Harmonic Patterns & Fibonacci Confluence

Chart Pattern Analysis: The XABCD Framework

Using the XABCD pattern tool, we identify the following key points:

Point X: $0.971

Point A: $9.01

Point B: $3.076

Point C: $8.244

Point D: $1.978

Durations:

X-A: 147 Days

A-B: 143 Days

B-C: 122 Days

C-D: 126 Days

These durations show remarkable symmetry—with the up-move phases (X-A and A-B) nearly matching in time, and similarly for the correction phases (B-C and C-D). This time symmetry supports the presence of a harmonic structure, and the retracement levels help validate the potential for a reversal.

Fibonacci Implications

Fib Retracement of XA: Point B is at 0.738

Fib Retracement of AB: Point C sits at 0.871

Fib Retracement of BC: Point D lands at 0.875

Fib Extension of BC: Point D is at 1.212

While Point D’s retracement at 0.875 is slightly deeper than the classic 0.786 level expected for a Gartley Harmonic, it remains close enough to validate a harmonic correction, especially considering market noise. Additionally, the expansion of BC at 1.212 is close to the 1.27 range, lending further credence to this being a Gartley-type pattern.

Time Factor: Fibonacci Time Extensions & Exhaustion

147-day Bull Run: NEAR rose from $0.971 to $9.01 in 147 days.

392-day Bearish Correction: Since hitting $9.01, the price has retraced for 392 days.

Fibonacci Time Extensions:

1.618 multiplier: 147 × 1.618 ≈ 238 days. A Classic "golden ratio" reversal target. This period coincided with a +135% surge in November.

2.618 multiplier: 147 × 2.618 ≈ 385 days. High-probability exhaustion point. This is nearly equal to the current 392 days, suggesting that time-based exhaustion may be imminent.

The alignment of these time-based measures with the price retracement (approximately 87.5% retracement of the original move) signals a critical juncture where the bearish phase could soon be over.

Identifying the Support Zone & Long Opportunity

Based on harmonic and Fibonacci analyses, the confluence of key support levels points to a potential bottom:

Harmonic Point D: Trading near $2.

Monthly Level: $1.99 acts as a strong support benchmark.

Fibonacci Retracement (0.886): at $1.887.

These levels create a long opportunity window between $1.99 and $1.887. This confluence offers a solid entry region for long positions.

Additionally, other confluence factors include:

Fibonacci time extension at the 2.618 level (around 385 days) aligning with the current duration of the bearish phase.

The symmetry of the XABCD pattern adds to the reliability of the support structure.

High-Probability Trade Setup

Long Entry:

Entry Zone: Accumulate positions in the $1.99 to $1.887 range.

Target: Aim for the 0.5 Fibonacci retracement level of the bull run, approximately $5.00, which represents a potential +150% gain from current levels.

Risk-to-Reward (R:R): With the setup targeting a substantial rebound, the risk-reward ratio is very attractive, particularly if entry is taken in the defined confluence zone.

Market Outlook:

Current Sentiment: NEAR is in a significant downtrend, evidenced by a dramatic -78% retracement after an explosive bull run.

Reversal Indicators: The harmonic pattern, Fibonacci retracements, and time exhaustion (392 days approaching the 2.618 extension) all point towards a possible bottom formation in the coming month, particularly during April.

Potential Reversal: If NEAR holds within the $1.99 to $1.887 window, a reversal back towards $5.00 appears plausible, echoing the conditions seen at previous market cycle reversals.

Key Takeaways

Historic Run & Severe Correction: NEAR surged over +828% in 147 days only to retrace -78% over the following 392 days.

Harmonic Confluence: The XABCD pattern and Fibonacci levels create a compelling argument for a turnaround.

Time & Price Alignment: Fibonacci time extension around 385 days combined with an 87.5% price retracement suggests market exhaustion.

Solid Long Entry Zone: The support between $1.99 and $1.887 offers an attractive risk entry point with the potential to target a move back up to $5.00.

After decades in the trading arena, one thing is clear—the market often cycles through periods of euphoria and despair before turning a corner. NEAR's confluence of harmonic symmetry, Fibonacci retracement, and time-based exhaustion is almost too aligned to ignore. With a defined long entry window between $1.99 and $1.887, this might be the moment to consider a high-probability long trade. As always, manage your risk diligently and wait for clear confirmation.

Wrapping it up here, happy trading =)

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

EURUSD BUYEURUSD had a rejection from support level and we have witnessed a double bottom on support level and also seen HH and HL pattern on H4 to H1 time frame also another confluence for being bullish over this moment of time is we have seen a fibonachi retracement of bearish move completed with 68% of retracement we are bearish over the pair from higher TF prespective but bearish on lower ones

Comprehensive Analysis of the Gartley Harmonic PatternThe Gartley Harmonic Pattern, a cornerstone of harmonic trading, was first introduced by H.M. Gartley in his 1935 book "Profits in the Stock Market." This pattern leverages Fibonacci retracement levels and geometric price formations to identify potential market reversals, providing traders with a strategic edge.

__________________________The Bullish Gartley Pattern___________________

Structure:

X-A Leg: The initial upward movement.

A-B Leg: A retracement of approximately 61.8% of the X-A leg.

B-C Leg: An upward move retracing between 38.2% and 88.6% of the A-B leg.

C-D Leg: The final downward movement, retracing 78.6% of the X-A leg, marking the pattern completion at point D.

Entry Criteria:

Entry Point: Enter a long (buy) position at point D, where the price is expected to reverse upward. This is typically the 78.6% Fibonacci retracement level of the X-A leg.

Stop-Loss:

Placement: Set a stop-loss order slightly below point X to safeguard against unexpected price movements. This minimizes potential losses if the pattern fails.

Take Profit:

First Target: Place the initial take profit target at point B, the retracement level of the A-B leg.

Second Target: Set the second target at point C, the retracement of the B-C leg.

Extended Targets: For a portion of the position, consider holding to capture further gains if the price continues to rise.

_________________________The Bearish Gartley Pattern_____________________

Structure:

X-A Leg: The initial downward movement.

A-B Leg: A retracement of approximately 61.8% of the X-A leg.

B-C Leg: A downward move retracing between 38.2% and 88.6% of the A-B leg.

C-D Leg: The final upward movement, retracing 78.6% of the X-A leg, completing the pattern at point D.

Entry Criteria:

Entry Point: Enter a short (sell) position at point D, where the price is anticipated to reverse downward. This corresponds to the 78.6% Fibonacci retracement level of the X-A leg.

Stop-Loss:

Placement: Set a stop-loss order slightly above point X to limit potential losses if the pattern does not play out as expected.

Take Profit:

First Target: Place the initial take profit target at point B.

Second Target: Set the second target at point C.

Extended Targets: Consider holding a portion of the position for additional gains if the price continues to decline.

_________________________Key Considerations__________________________

Precision: Accurate measurement of Fibonacci levels is critical. Even slight deviations can invalidate the pattern.

Confirmation: Utilize additional technical indicators or price action signals to confirm the pattern before initiating a trade. This can include moving averages, trend lines, or oscillators.

Risk Management: Adhere to strict risk management practices. This includes setting appropriate stop-loss levels and managing position sizes to protect capital.

____________________________Conclusion______________________________

The Gartley Harmonic Pattern is a sophisticated and reliable tool for identifying potential market reversals. By mastering the intricacies of both the bullish and bearish Gartley patterns, traders can enhance their analytical capabilities and improve trading outcomes. Integrating these patterns with other technical analysis methods and maintaining rigorous risk management protocols is essential for consistent trading success.

Incorporating the Gartley pattern into your trading strategy involves practice and diligence. Ensure that you continuously refine your skills in identifying these patterns and executing trades accordingly, always mindful of market conditions and broader economic factors.

#SALZERELEC#SALZERELEC

SALZERELEC Good for Holding around 6 TO 9 Months ..... Current Price at 848.05......... Keep SL at 802. .... (On Closing Basis ... Means ... Daily Candle closed Below 802 )….. After Close Crossing 913 …. Trail SL to 913 Targets are Shown on Chart in Greens .

Patent

It has received a patent for ‘Integral Cam Operated Rotary Switches’ for a duration of 20 years, ending 2031. It has registered a Patent for Rotary Switches, five product patents in process.

Diversification into Smart Meter

In Feb,24, the company announced the establishment of a Smart Meter Manufacturing Business in Coimbatore with an annual production capacity of 4 million smart energy meters which will be increased to 10 million in Phase Two. The first batch of smart meters is expected to roll out in Q1 FY25.

Clientele

Valeo, Delta, Siemens, L&T, Schneider Electric, Nuclear Power Corporation, Kone, Indian Railways CED, ABB etc

Market Share

The Co is the largest manufacturer of Cam Operated Rotary Switches with 25% market share.

Promoter holding has increased by 2.08% over last quarter.

Long on EURJPY with CautionThis week, I'm taking a long position on EURJPY based on the 4-hourly chart. While some may see it as a Bullish Gartley pattern with a warning sign, others may interpret it differently, perhaps as a Bullish Gartley on PEZ or a key support level.

My Trade Plan on EURJPY

1. Long position initiated based on the 4-hourly chart.

2. Watching closely for any violation of 161.23, which could prompt a reevaluation.

3. Awaiting the market to hit the first target.

Share your thoughts and trade plans for EURJPY. How are you interpreting the pattern?

Let's continue the discussion!

Bullish Bias on GBPJPY1. Bullish Bias:

- I have a more bullish outlook on GBPJPY compared to GBPUSD.

- Clear violation of the Daily Chart on both GBPUSD and GBPJPY.

2. Trading Setup:

- A Type2 Bullish Gartley Pattern on GBPJPY is the key trading setup.

- Aiming to go long on GBPJPY.

Share your insights and trade plans for the week. What's catching your eye?

Let's discuss and navigate the markets together!

LUMN: Bullish Gartley Visible on the 3-Month ChartShares of Lumen Technologies are currently sitting at the HOP Level of a Massive Bullish Gartley that is visible on higher timeframes such as the Monthly and Quarterly Charts. It is also showing Bullish Divergence on the MACD and RSI and looks to be ready to make a move towards $6.00 in the short term, but the situation could evolve into a bigger long term move towards $25.00 and $50.00

VLCN: Bullish Gartley with Bullish Divergence at a Double BottomVolcon is potentially forming a Double Bottom with Bullish Divergence and is doing so at the potential HOP Level of a Bullish Gartley on the Hourly with Bullish RSI BAMM Confirmation. If this Gartley plays out we would expect a move towards $3.00 this move towards $3.00 could then lead to a Double Bottom breakout which would take the price up to around $7.00

BLUR---->Long (but What's Next Move?)Hello to all

Regarding the Todays Sharp movement, it seems that the general view of BINANCE:BLURUSDT.P is very bullish , but after such a movement, it is not out of mind to expect a correction of 20 to 50% at most .

In my personal opinion , the price in this trend will not have the necessary momentum to break and cross the $0.45 range , and the price correction will start after the price is rejected from the $0.45 area.

And it will continue until the price of 0.3$ and maybe even more intense up to the area of 0.2$ .

And after that, we can expect the start of the next price rally towards the points indicated in the chart, especially $0.55 and $0.9 .

My Personal setup :

Entry 0.3$ - 0.22$

TP 0.55$ - 0.77$ - 0.9$ - 1.2$

SL under 0.20$

Also, if the price breaks out from the yellow line, we will have a good position to enter and profit from higher targets:

Entry 0.45$

TP 0.9$ - 1.2$

SL Bullish Trend End Confirmations!

Intel: Bullish Gartley with Bullish Divergence Targeting $64.19Leading to the most recent earnings report, Intel had reached a 61.8% retrace from High to Low and was showing signs of reversing, so I decided to take profit on Intel. Now, upon spotting a potential trend continuation Bullish Gartley I now think it's possible for INTC to recover from here and perhaps go all the way for the 0.886 at $64.90, so I will be buying back in at these lower prices.

For context on the previous bullish setup, check the chart below:

Long Trade Opportunity on Bullish Gartley PatternFor those who are bullish on GBP and bearish on AUD, the suggested pair for trading and going long is GBPAUD.

The trader is looking to long GBPAUD on a Bullish Gartley Pattern that is expected to complete at 1.9261.

Emphasizing the importance of having a personal trade plan and trading accordingly.

What's your trade plan for GBPAUD?

ADM: Bullish Harami on the Weekly at a Bullish Gartley HOP LevelArcher-Daniels-Midland is sitting at the HOP level of a Bullish Gartley aligning with support with a Bullish Harami Visible on the Weekly Timeframe after setting record-breaking weekly volume into the test of the Support Zone.

ADM will close and confirm the Weekly Harami in less than an hour and from there we would expect to see ADM make an effort to fill the weekly gap above, perhaps going all the way up to the 61.8% retracement.

I'm Bullish. Here's WhyHi Traders,

PLTR is oversold on the 2HR, 4HR, and daily charts and has nearly completed a corrective wave. This corrective wave is denoted by the yellow ABC pattern (also known as a Zig Zag pattern) in Elliot Wave analysis. The Wave Trend indicator is extremely oversold since the signal is far below the green boundary as shown on the chart. I anticipate PLTR will close the small gap around the $14.96-$15.94 area, which is also a BULLISH demand zone and a trend support zone. I've decided to use this area as an entry zone. Once price is in this area, consider a bullish position targeting $17. If PLTR closes above $17, target $18.64 based on harmonic pattern analysis, which currently indicates a bullish Gartley. Here's my bullish case, strictly using Technical Analysis:

Harmonics

PLTR is showing three bullish harmonic patterns (Gartley, Black Swan, and Anti-Nen Star). I'd like to focus on the gartley pattern, which statistically has a 75% likelihood in reaching T1 ($18.66). In the chart below, you can also see the oversold RSI at a value of 28.74

Price Action

There is a bearish order block around the $14.75 as denoted in the chart below. Bearish traders sold PLTR back in NOV 23, but PLTR didn't decline further in price. Instead, it gapped up, which indicates Bearish traders exhausted their selling power and will likely be eager to close their positions by buying PLTR at this price point, thereby constituting a bullish demand zone.

Trends

Trend resistance is $16.98 with trend support at $14.40 as denoted by the trend lines on the chart below. The 200 period moving average (yellow line) is $14.80, which coincides with trend line support, gap analysis, and price action order blocks. I consider this strong support for now. The 9 period (purple line) 21 period (blue line) moving averages act as resistance (for now) and are $16.74 and $17.31 respectively. Both coincide with trend resistance at $16.98. The chart also shows positive divergence on the VMMACD and MACD indicators.

Trading Plan

I trade options, and while I do own several hundred shares of PLTR, I generate income by selling CALL and PUT options based on the volatility (i.e. price swings) of PLTR. Since I anticipate PLTR is nearing a LOW, I will likely sell several $14 or $15 PUTs option with a 45 DTE (Date Till Expiration) to collect premium. When PLTR reaches my upside targets, I will sell COVERED CALL options (maybe $18 or $19 strikes) to collect premium, because I know that these upside targets act as supply zones (i.e resistance) and price may decline from these areas.

Happy Trading!

Open to OpportunitiesEURUSD maintains a Weaker Bull Trading setup on the Weekly Chart.

This week, I'm flexible and ready to engage any compelling trading setup.

Eyeing the 1-hourly chart, I'm particularly interested in a sideway consolidation trade, anticipating the completion of a Bullish Gartley Pattern.

What's your take on EURUSD? Any specific strategies in mind? Share your thoughts!

Bullish Gartley Pattern Alert on 8 Range Bar ChartA Bullish Gartley Pattern has emerged on GBPJPY's 8 range bar chart, presenting an opportunity for those leveraging TradingView Pro account alerts. Alternatively, setting alerts on the 15-minute chart is viable for this setup.

This pattern aligns with a buying opportunity that could ride the bullish wave, in conjunction with the Type2 Bullish Shark Pattern on the daily chart.

What's your trade plan or analysis for GBPJPY?

Share your insights or strategies below!

ACHUSD: Bullish Consolidation Above Support LineBack in October ACHUSDT confirmed a Double Bottom at the PCZ of a Bullish Gartley and has since climbed back above the major Support/Resistance Zone represented by the green horizontal line as well as the 200 SMA and 55EMA and has formed a Channel of Ascending Consolidation.

In addition, it is doing this while trading to the right of a previously Bearish Trend line, so if we can get some true follow through from this action, I would be looking for a 50%, 61.8%, and 0.886% retrace target.

Navigating Contrasting Trends for Optimal Trading StrategiesThe 4-hourly chart showcases a compelling Bullish 5-0 Pattern retest accompanied by an RSI Divergence.

While direct engagement in the trade is an option, I'm personally inclined towards waiting for a Bullish Gartley Pattern retest around 186.39.

This approach significantly mitigates risk while still allowing for favorable profit potential—a strategy centered on lower risk for higher returns.

What are your thoughts or trade plans on this opportunity?

Feel free to share below!

Contradictory Patterns & Potential Buy SetupIt seems that the USDJPY is presenting challenges in trading decisions.

Despite the presence of a valid bearish fib-3 bat pattern, your interest lies in seeking a buying opportunity, expected to materialize potentially by Tuesday based on further market development.

You've also noted the invalidation of a Bullish Gartley Pattern on the 1-hourly chart, cautioning against trading this setup without proper understanding, suggesting seeking guidance if unclear.

What trade plan or strategy are you considering for USDJPY? Feel free to share your insights or plans below!