Bullishsetup

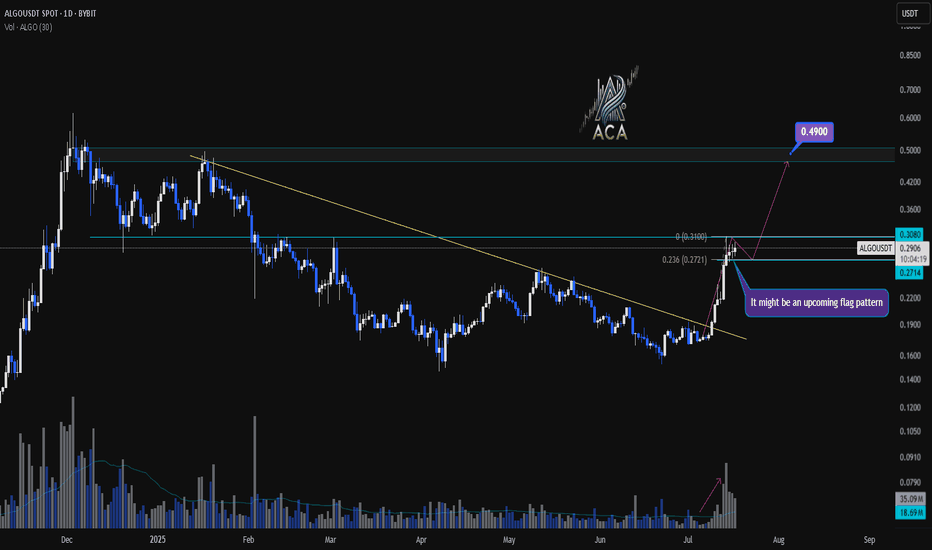

ALGOUSDT Daily Chart Analysis | Continuational patternsALGOUSDT Daily Chart Analysis | Momentum Picks Up on Higher Timeframe

🔍 Let’s break down the latest ALGO/USDT daily chart, highlighting a shift in market structure and key bullish signals.

⏳ Daily Overview

A decisive breakout above the long-standing descending trendline has flipped the narrative for ALGOUSDT. Increased volume during the breakout points to robust bullish momentum, suggesting buyers are regaining control at this multi-month inflection point.

🔔 Flag Pattern & Chart Structure

- Bullish flag pattern is emerging after the recent breakout, as price consolidates in a tight range—a classic continuation formation.

- Former trendline resistance is now acting as support, confirming a notable shift on the higher timeframe.

📐 Fibonacci & Target Levels

- The 0.236 Fibonacci retracement at $0.2771 is providing immediate support, with price consolidating above this anchor level.

- Upside targets:

- First resistance at $0.3080, which aligns with horizontal supply and previous pivot highs.

- If the flag pattern resolves upward, the next Fibonacci extension points to $0.4900, marking a significant confluence and potential for further gains.

📊 Key Highlights

- Strong daily candle and surging volume confirm momentum shift.

- Watch the developing flag pattern for breakout confirmation.

- Major trendline break on the daily signals structural reversal.

- $0.3080 is the immediate target; $0.4900 is the extended objective from the flag/Fibonacci alignment.

🚨 Conclusion

ALGOUSDT is setting up a compelling bullish scenario—keep a close eye on price behavior at the flag and $0.3080 level. A breakout may trigger the next impulsive move toward $0.4900.

MARA Is Waking Up And Looks Promising For The Crypto MarketMARA Is Waking Up And Looks Promising For The Crypto Market, as it can send the price even higher this year from a technical and Elliott wave perspective.

Marathon Digital Holdings with ticker MARA nicely and sharply recovered away from the strong support after a completed projected higher degree abc correction in wave B/2. So, similar as Crypto market, even MARA can be forming a bullish setup with waves »i« and »ii« that can soon extend the rally within wave »iii« of a five-wave bullish cycle within higher degree wave C or 3, especially if breaks above 21 first bullish evidence level. It could be easily supportive for the Crypto market if we consider a positive correlation.

DPRO falling wedge breakoutDPRO has broken out of a falling wedge on the weekly. Ticker will respond well to Trump's "Big Beautiful Bill" which includes over $30 billion for defense/military spending. The drone company is already making progress with US military projects and is setting up for a strong rally.

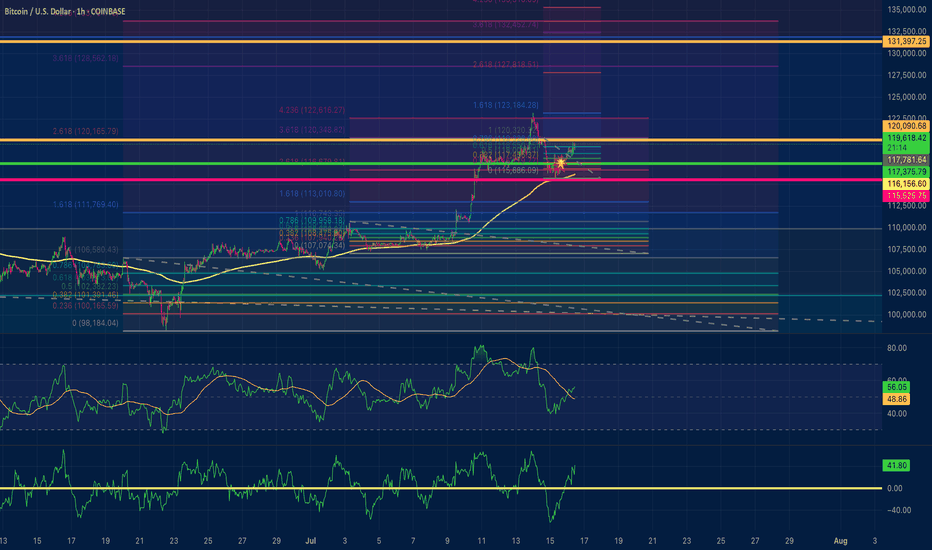

Bitcoin positive diversion to $131,000Using fibonacci retracements for price targets based off of positive divergences on the 15 min time frame and hourly time frame. I am utilizing 2 ioscilating indicators: RSI length is 36 with smma at 50 and the Chande momentum oscillator with a length of 24. My conservative estimate is $131,000 for a safe trade close. $132,400 exact area for pullback to $128,500?

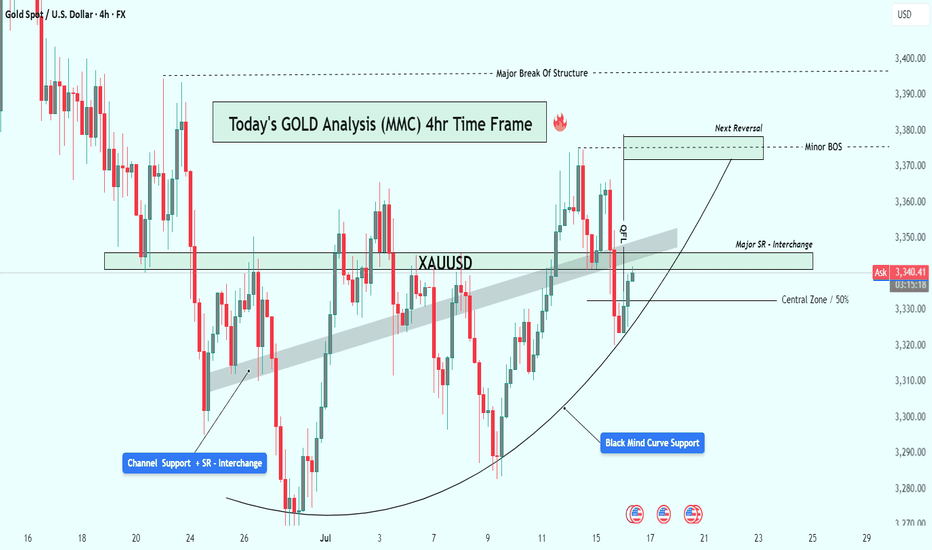

XAUUSD Analysis : Gold's Bullish Comeback + Target📊 Chart Overview:

Gold has shown a technically strong structure on the 4-hour time frame, respecting multiple layers of support, while slowly shifting momentum in favor of buyers. What stands out most in this chart is the parabolic curve formation at the bottom, labeled the "Black Mind Curve Support" — a key psychological zone that has guided price action back to the upside.

Let’s walk through the key elements and why this current setup deserves your attention:

🧠 1. Black Mind Curve Support – Bullish Base Formation:

This curved structure at the bottom is no ordinary pattern. It reflects gradual accumulation and buyer dominance, often seen in textbook rounded bottom formations. The market printed multiple higher lows along this curve, suggesting a deliberate and patient entry by smart money.

Whenever price touched this curve, it found strong demand — a clear sign that the bulls are defending their territory.

🧱 2. Channel Support + SR Interchange – Historical Demand:

Zooming into the left side of the chart, you’ll notice how price dropped into a converging zone where a descending channel support intersected with a historical support/resistance (SR) level. This confluence created a high-probability buy zone — the very origin of the current bullish wave.

This channel breakout also represents a structural shift, marking the beginning of bullish control.

🔁 3. Major SR – Interchange Zone:

One of the most critical areas in this chart is the Major SR Interchange zone, where former resistance was broken and later retested as support. This is a classic support-resistance flip — the type of zone institutional traders watch closely.

This level currently acts as a launchpad for bulls, reinforcing bullish structure and offering low-risk long opportunities when respected.

⚔️ 4. Minor BOS (Break of Structure):

Recently, the price broke above a short-term lower high, indicating a minor bullish break of structure. This is confirmation that momentum has shifted in the short term. Such BOS events are powerful signals, especially when backed by curve support and SR flips.

This also paves the way for the price to push into the next liquidity pocket above.

🧭 5. Central Zone – 50% Equilibrium:

The horizontal line drawn around the $3,330 level marks the central 50% zone — the midpoint of this entire price range. This acts as a natural equilibrium zone where buyers and sellers usually fight for control.

Price is now trading above this zone, giving the upper hand to bulls. Holding above the 50% line increases the probability of continuation to higher resistance levels.

🧨 6. Target Area – "Next Reversal Zone":

Looking ahead, the $3,370 – $3,380 range is labeled as the Next Reversal Zone. This is where sellers previously stepped in and rejected price hard. However, if momentum remains strong and bulls can push price into this zone again, we might witness either:

A sharp pullback (if bearish reaction occurs), or

A major breakout above toward the $3,400 key resistance (if buyers overpower).

This is the zone to watch for either short-term profit taking or potential trend continuation setups.

📌 Key Technical Levels:

Immediate Support: $3,330 – $3,315 (Central + Retest Zone)

Major Support: $3,290 (Mind Curve Base)

Short-Term Resistance: $3,370 – $3,380 (Reversal/Reaction Zone)

Bullish Continuation Target: $3,400+

📒 Conclusion & Strategy Insight:

This chart presents a textbook bullish reversal setup with clean structural progression:

Price formed a rounded base

Broke out of previous range resistance

Retested multiple key SR zones

Now targeting liquidity above

The bulls are in control as long as the price remains above the curve and the major SR zone. A retracement into $3,330 could offer an ideal long entry, targeting the $3,370–$3,380 zone with tight risk.

✅ Suggested Trading Approach:

Buy Opportunities: On pullbacks toward $3,330–$3,315 with confirmation

Sell Watch: Near $3,375–$3,380 if bearish divergence or strong rejection appears

Invalidation: Break and close below $3,290 curve support

🧠 Final Thoughts:

Gold continues to build a strong bullish base. The parabolic nature of the support curve suggests rising demand. As long as support holds, the bulls may take price to fresh highs in the coming days.

Keep an eye on how price behaves around the Next Reversal Zone — that will reveal whether this bullish rally is ready for a breakout or a cooldown.

KALV FDA approval rallyKALV received FDA approval this week for a new drug, has $220mln in cash, and just bounced off the daily 21EMA (overlayed on this 4H chart).

Recently rejected off the monthly 100ema two times (overlayed on this 4H chart). Breakout beyond the monthly 100ema and first target is $20. Numerous price target increases, most notably, one at $27 and another increased from $32 to $40.

EURUSD Analysis : Eyes on Bullish Breakout Setup + Target🧭 Current Market Context:

The EURUSD pair is currently trading near 1.16765 on the 4H timeframe, displaying classic accumulation behavior at a key Support-Resistance Interchange Zone (SR Flip). After an extended bearish correction from the previous swing high, price has started compressing in a descending structure underneath a well-respected trendline. This tightening range near a historic support zone suggests that a major breakout could be on the horizon.

🧠 Technical Confluences:

🔹 1. Descending Trendline - Bearish Control Line:

The trendline drawn from the July highs has acted as a clear resistance line, rejecting multiple bullish attempts to break higher.

Price has failed to close above it on the 4H chart, showing sellers are still in control—but momentum is fading.

A breakout of this line is a crucial confirmation of buyer strength returning.

🔹 2. SR Flip Zone - Interchange Area:

This zone previously acted as resistance, capping the rally in June.

After price broke above it, the same area now acts as support, confirming its role as an SR flip zone—a textbook demand level.

Smart money often steps in at these interchange areas to accumulate long positions.

🔹 3. Re-accumulation Phase (Smart Money Behavior):

Market structure is showing a rounded bottom formation, hinting at possible absorption of sell-side liquidity.

Price action is compressing into the support zone, reducing volatility—a signal that a reversal or breakout is near.

The previous similar move ("Same Like This") from late June led to a strong bullish impulsive wave—this historical behavior adds confidence in the current bullish outlook.

🔹 4. Potential Bullish Pattern:

Price needs to develop a bullish reversal pattern (e.g., inverse head & shoulders, bullish engulfing, or a sweep of the low with rejection).

Only then will the setup be validated. This is not a blind buy zone, but a zone of interest for high-probability longs if price confirms.

🧨 Trade Plan Scenarios:

✅ Scenario 1 - Confirmation Breakout:

Wait for a clean breakout above the descending trendline.

Enter on breakout + retest structure.

Target the next major reversal zone at 1.18500.

🐢 Scenario 2 - Early Long Entry:

Enter on bullish confirmation (engulfing, pin bar, etc.) at the SR Interchange zone.

Stop loss below the support box.

Ride early for better R:R if the breakout confirms.

❌ Invalidation:

A clean breakdown below 1.1600 with momentum will invalidate the bullish bias.

In that case, reevaluate based on new structure.

📊 Projected Path:

If the trendline breaks, expect a bullish rally toward the next major resistance zone (1.18500).

That zone has historically acted as a major reversal and profit-taking level for bulls, and we expect price to react again if tested.

🔍 Macro View (Optional Insight):

USD may show weakness due to macro data (CPI/FED talks), helping EURUSD lift.

Eurozone data stability could further fuel demand for EUR.

📌 Final Thoughts:

This EURUSD setup is forming at a high-value area, backed by technical structure, historical behavior, and smart money positioning. If the price reacts positively from this zone and breaks the descending trendline, it could trigger a bullish leg toward 1.18500, offering a rewarding risk-to-reward opportunity for both swing and short-term traders.

Stay patient. Let the market confirm the direction before execution. 📈

SUIUSDT Weekly Chart Analysis | Breakout Confirmed!SUIUSDT Weekly Chart Analysis | Breakout Confirmed, Massive Liquidity at $4–$4.20

🔍 Let’s dive into the SUI/USDT weekly chart after a decisive breakout from the symmetrical triangle, highlighting the critical liquidity zone and what it means for price action.

⏳ Weekly Overview

SUI has broken out of its multi-month triangle pattern following a textbook fakeout, with volume dynamics confirming renewed bullish momentum. The breakout is now awaiting daily candle confirmation for full validation.

🔺 Bullish Breakout & Key Liquidity Zone

A major liquidity cluster sits between $4.00 and $4.20, with more than $140 billion in liquidity concentrated in this range. This zone is crucial for several reasons:

- It represents a significant area where large buy and sell orders are stacked, likely leading to heightened volatility as price approaches or breaks through.

- Clearing this liquidity could unlock rapid moves toward the next upside targets at $7.03 and $9.50, as shown on the chart.

📊 Key Highlights

- Symmetrical triangle resolved with a bullish breakout, confirmed by increasing volume.

- The $4.00–$4.20 range holds over $140B in liquidity, making it a pivotal battleground for bulls and bears.

- Daily candle confirmation remains essential for trend validation.

- SUI ecosystem has reached a new all-time high in DeFi TVL, adding fundamental strength to the bullish case.

🚨 Conclusion

The breakout above the triangle, combined with surging volume and a record DeFi TVL, sets the stage for a potential rally. Watch the $4.00–$4.20 liquidity zone closely—how price interacts with this level could determine the speed and magnitude of the next move. Stay alert for daily confirmation and be prepared for volatility as SUI tests this high-stakes region.

#SUI #CryptoAnalysis #TradingView #Altcoins #ACA

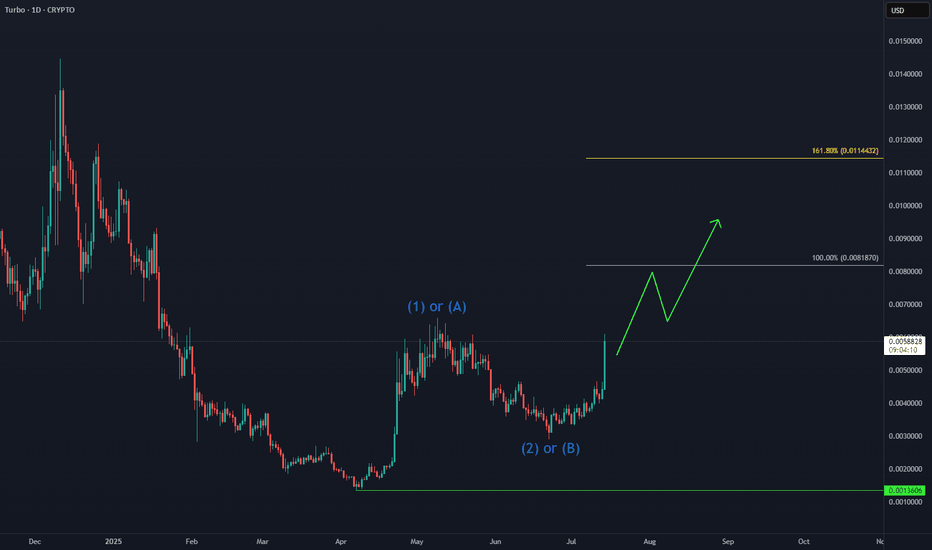

TURBO: Next Leg Higher in Progress📈 CRYPTO:TURBOUSD is building momentum after holding key support levels, with Elliott Wave projections pointing toward the equal legs target zone at $0.008–$0.011. The recent bullish structure suggests continuation, especially following its Binance US listing and strong community backing.

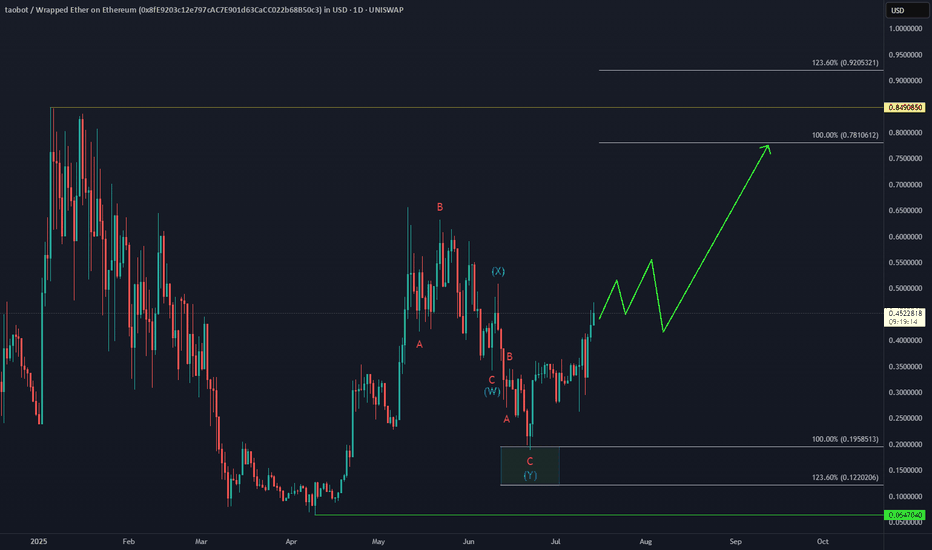

Bittensor TAO Eyes Next Upside Target📈 BINANCE:TAOUSD attracted strong demand in the Blue Box buying zone at $302–$214, triggering the next bullish leg.

Elliott Wave projections now point toward a move into the $608–$684 target area, supported by impulsive structure and rising momentum.

As long as price holds above the recent low, the bullish sequence remains intact.

XAUUSD Analysis : Bullish Move Toward Key Resistance + Target🟩 Overview:

Gold is currently showing a clear bullish breakout on the 2-hour timeframe. The market structure has shifted from a downtrend into a bullish phase, with price now approaching a critical Reversal Zone. Let’s break down the key levels, structure shifts, and potential trade opportunities.

🔍 1. Structure Shift – Trendline Break & BOS Signals:

The price previously followed a Blue Ray Descending Trendline, which acted as dynamic resistance and guided the bearish trend.

As highlighted, “Blue Ray Always Continue Trend” – but in this case, we’ve seen a clean Break of Structure (BOS) that invalidated the bearish setup.

A Minor BOS occurred first, which hinted at weakening selling pressure.

Later, a Major BOS confirmed the bullish transition as the price broke above a key resistance level with strong momentum.

This transition was supported by consistent higher lows and a breakout above the descending resistance trendline — a classic reversal signal.

🟩 2. Demand Zone Reaction – Major Support Held Firm:

The Major Support Zone between $3,280 – $3,300 provided a strong base for buyers.

Multiple wick rejections and bullish engulfing patterns near this zone indicated aggressive buyer interest.

This support has now become the foundation for the recent bullish rally.

🎯 3. Next Target & Reversal Zone:

The current price is hovering around $3,358, showing strong bullish momentum.

The next major resistance area is marked between $3,380 – $3,400, identified as the Next Target + Reversal Zone.

This zone is critical — it aligns with a historical supply area and the previous market swing highs.

Traders should be cautious here, as price may react sharply. Reversal patterns (like bearish engulfing, pin bars, or double tops) could signal a potential retracement.

⚠️ 4. Trade Plan:

🟢 Bullish Bias (Short-Term):

If you entered from the support or trendline breakout, continue to hold long positions until price nears the reversal zone.

Trail stop-loss under the most recent higher low to secure profits.

🔴 Bearish Scenario (Near-Term Reversal Play):

Watch for bearish rejection patterns in the $3,380 – $3,400 zone.

If confirmation appears, potential short setups could offer a retracement back to $3,330 – $3,320.

📌 Key Levels Summary:

Major Support Zone: $3,280 – $3,300 ✅

Next Target + Reversal Zone: $3,380 – $3,400 ⚠️

Current Price: $3,358

Major BOS Level: Confirmed

Trendline: Broken with strong bullish pressure

🧠 Final Thoughts:

Gold has officially shifted gears. The bullish breakout is in motion, and the trendline break + BOS combo supports further upside — at least until the reversal zone is tested. However, this is also where the market could exhaust, making it crucial to monitor price action closely.

Stay patient, wait for confirmation, and let the levels guide your next move.

Bitcoin Makes New ATH – Next Sequence in Play 🚀 CRYPTO:BTCUSD has officially broken into new all-time highs, confirming the next bullish sequence is underway.

The upside projection now opens toward the $135K–$144K zone, aligning with long-term Fibonacci extensions and cycle projections.

📌 As always, it won’t be a straight line—expect step-by-step progress, with consolidations and pullbacks along the way. But the structure remains bullish, and the path is unfolding.

1INCH ANALYSIS🔮 #1INCH Analysis 🚀🚀

💲💲 #1INCH was trading in a Descending Broadening Wedge Pattern, give a perfect breakout and will retests the levels. If the price of #1INCH sustains the breakout then we will see a bullish move. 📈📈

💸Current Price -- $0.2220

📈Target Price -- $0.2510

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀💸

🏷Remember, the crypto market is dynamic in nature and changes rapidly, so always use stop loss and take proper knowledge before investments.

#1INCH #Cryptocurrency #Breakout #DYOR

SUI Next Upside Target🚀 After holding above the April low and completing a 3-wave pullback in wave (2), CRYPTO:SUIUSD is now advancing in a potential wave (3).

Momentum is building, and the next upside target lies in the equal legs zone at $4.80 – $5.40, which could eventually lead to a new all-time high.

SUI may be ready for next moveSUI has been consolidating for last 60 days and has tested the Daily FVG couple of weeks back. It looks like it is ready for trend line BO and should give 35% profit for recent high. But be cautious of low volume in the current move. Only a close above 3.08 with strong volume can confirm this.

GH 3D: breakout forming inside ascending channelThe price of GH continues consolidating within the top of an ascending channel, confirming bullish structure. The rectangular accumulation has lasted for over three months, with price staying above all major EMAs and MAs - a strong trend confirmation. On the last impulse, volume increased, and now the price is compressing again. A breakout with a retest would serve as a valid entry. First target lies near 61.38, second at 73.66, and third at 87.37 - aligned with the upper range of the medium-term Fibonacci extension. Fundamentally, GH remains a promising biotech pick amid sector rotation and potential Fed easing. EMAs and MAs sit below price, and D/A supports the breakout scenario. Waiting for confirmation before entering.

BTCUSD Structure Analysis : Bullish Zone From Support + Target🔍 Current Market Structure Overview:

Bitcoin is currently trading around $108,375, hovering just above a clearly respected rising support zone (shaded area). This dynamic support has held price multiple times and continues to act as a springboard for short-term bullish moves.

The chart illustrates a classic bullish continuation setup forming, with key structural levels marked as Minor BOS (Break of Structure) and Major BOS, indicating potential areas of trend validation and momentum acceleration.

🔹 Key Technical Elements:

✅ Support Zone:

The shaded diagonal support zone has acted as a bullish trendline base, holding up since late June.

BTC recently dipped into this area, found buyers, and is now attempting a reversal from this level.

This reinforces market interest and confirms the accumulation behavior in this zone.

⚠️ Break of Structure (BOS) Levels:

Minor BOS is marked near $109,800, signaling the first key intraday resistance.

A break above this level would signal bullish intent and open the way for price expansion.

Major BOS around $110,600–$110,800 is critical. A clean break here will likely validate a trend continuation toward the next objective.

🟩 Next Reversal Zone (Target Area):

Highlighted around $111,500–$112,000, this green zone represents a potential liquidity grab/reversal area where sellers could re-enter.

This zone aligns with previous price exhaustion levels and may trigger consolidation or a short-term pullback.

📈 Projected Price Path (Wave Schematic):

The chart outlines a wave structure projection, suggesting:

A possible retest of the minor BOS.

Follow-through into the major BOS area.

Final push into the reversal zone before potential rejection or sideways action.

🔧 Bias & Strategy:

Bias: Moderately Bullish as long as BTC respects the support zone.

Invalidation: A decisive breakdown below the trendline support and close under $107,500 would invalidate this bullish setup and shift bias to neutral/bearish short-term.

Trading Plan Ideas:

📥 Buy Opportunity: On minor dips within the support zone, targeting BOS levels.

📤 Sell Watch: Near reversal zone ($111.5K–$112K) if signs of exhaustion or bearish divergence appear.

📌 Final Notes:

BTC appears to be gearing up for a breakout from consolidation, and price action is coiling with higher lows. Market participants should watch closely how BTC reacts at the minor and major BOS zones, as they could define the next leg for either bullish continuation or rejection.