CADJPY Multi-Timeframe Price Analysis: Trade SetupIn this video, we analyse the CADJPY across multiple timeframes (4H, 1H, and 15M) to identify a high-probability long trade setup based on structural price action, momentum shifts, and Fibonacci retracement levels.

🔍 4H Analysis (Momentum High Formed)

The CADJPY has shown a strong bullish recovery on the 4-hour chart, forming a Momentum High — a key signal that often precedes price movement. According to the principle "Momentum Precedes Price," we anticipate a corrective pullback to form a Higher Low (HL). This HL is expected to become a decision point for buyers looking to join the uptrend.

⏱ 1H Analysis (Confirmation of Structure)

On the 1-hour timeframe, price has formed a Higher Market Low (ML), confirming the structural HL observed on the 4H chart. Price has now entered the Fibonacci Buy Zone, providing a high-probability entry area for bullish trades.

📉 15M Analysis (Failure Setup & Entry Trigger)

The 15-minute chart shows a Failure to Make a Lower Low (LL). While a higher low is a positive sign, confirmation comes only after a break above the last Lower High (LH) that failed to produce a new low. We’re watching for a break above 104.128 to confirm this failure setup and trigger our long entry.

🎯 Trade Setup

✅ Entry: Long above 104.128

🛑 Stop Loss: Below London session low at 103.74 ± 5 pips

🎯 Targets:

T1: 106.92

T2: 108.64

💬 Wishing you a successful trading week! Don’t forget to like, comment, and follow for more technical analysis and trade ideas.

Bullishsetup

Gold (XAU/USD) Bullish Retest SetupMarket Structure & Analysis:

Uptrend Confirmation: Price has been in a strong bullish trend, forming higher highs and higher lows.

Resistance & Retest: The price recently hit a resistance zone around $3,054 and pulled back for a retest.

Support Zone: A key support level is marked at $3,010, which has held multiple times.

Bullish Retest Setup: If the price successfully retests this support level and confirms bullish momentum, we can anticipate a potential move toward the next resistance level.

Target Levels:

First Target: $3,054 (recent high)

Final Target: $3,089 (next major resistance)

Trading Plan:

Buy Setup: Enter after confirmation of bullish price action at the support level ($3,010).

Stop Loss: Below $3,010 to avoid false breakouts.

Take Profit:

TP1: $3,054

TP2: $3,089

Risk Factors:

If the support at $3,010 breaks, price may drop toward the next major support at $2,911, invalidating the bullish setup.

Economic events (such as FOMC meetings, CPI data, or geopolitical risks) may cause unexpected volatility in gold prices.

Ethereum (ETH/USD) Bullish Breakout – Eyes on $2,500+ Target 📈 Chart Overview:

Timeframe: 4H (Ethereum/USDT)

Trend Reversal: Ethereum has broken out of a falling wedge pattern, indicating a shift from bearish to bullish momentum.

Support Level: Around $1,800 - $1,900, where price previously found strong buying interest.

Retest Confirmation: ETH successfully retested the breakout level (~$2,020), confirming a potential bullish continuation.

Resistance Zone: The next key resistance area is around $2,250, followed by a potential move towards the $2,530 - $2,550 target zone.

📊 Trade Setup:

Bullish Bias: Price action suggests an upward move towards $2,250 and potentially $2,530.

Risk Management: A stop-loss can be set below $2,020 to minimize downside risk.

🔥 Conclusion: If Ethereum maintains momentum above the retest zone, it could see a strong rally in the coming days! 🚀

#BERAUSDT shows bullish momentum 📈 Long BYBIT:BERAUSDT.P from $8.080

🛡 Stop loss $7.905

🕒 1H Timeframe

⚡️ Overview:

➡️ The main POC (Point of Control) is at 6.699, indicating the area of highest volume accumulation.

➡️ The 7.905 level acts as the nearest support zone and is a key stop-loss reference point.

➡️ The chart BYBIT:BERAUSDT.P shows a strong bullish breakout with consolidation above previous range, signaling a possible trend continuation.

➡️ Rising volume confirms strength behind the move.

🎯 TP Targets:

💎 TP 1: $8.204

💎 TP 2: $8.320

💎 TP 3: $8.430

📢 Watch key levels closely — better to enter after signal confirmation!

📢 If the price holds above $8.080, the TP targets are likely to be hit.

📢 If stop level is breached, the setup may need reevaluation.

BYBIT:BERAUSDT.P shows bullish momentum — looking for further upside!

Daily bias for Spot gold #xauusd I have spotted an absolute Low so we should definitely see some bullish pressure on gold for the rest of the day

Take a look at my markup as I have marked previous day high and low and from experience determined that the previous days low is an absolute low so we should definitely see some bullish pressure building up as the day goes on.

Trading Setup for CHF/USD – Triple Bottom Breakout Strategy📌 Chart Pattern: Triple Bottom with Trendline Breakout

This CHF/USD chart showcases a triple bottom formation, a bullish reversal pattern that signals a potential uptrend after three consecutive lows at a strong support level. The price action respects this support zone and attempts a trendline breakout, suggesting a shift in momentum from bearish to bullish.

📊 Full Chart Breakdown & Professional Analysis

1️⃣ Key Levels & Structure:

✅ Support Level (1.1300 - 1.1270):

The price has tested this region three times, indicating strong buying interest.

This forms a triple bottom, a reliable reversal pattern in technical analysis.

✅ Resistance Zone (1.1400 - 1.1420):

The price previously reversed from this zone, making it a key short-term resistance level.

✅ Target Level (1.1457):

A breakout above resistance could drive the price toward this measured move target, representing a 1% potential gain.

✅ Stop Loss (1.1269):

Placed below the support zone to minimize risk in case of a breakdown.

2️⃣ Price Action & Trendline Breakout:

📌 Triple Bottom Formation:

Price hits the same support level three times, signaling strong demand.

Each bounce from support indicates a gradual weakening of bearish momentum.

📌 Trendline Breakout:

The price broke a downward-sloping trendline, suggesting a potential bullish move.

A successful retest of the trendline could confirm further upside.

📌 Expected Move:

Scenario 1: Price confirms the breakout, retests, and moves toward resistance.

Scenario 2: If resistance is broken, price targets the next major level at 1.1457.

3️⃣ Trading Strategy – How to Trade This Setup?

🎯 Buy Entry:

Enter long after a confirmed breakout and retest of the trendline.

📉 Stop Loss:

Below 1.1269 (beneath triple bottom support) to limit downside risk.

🎯 Take Profit Targets:

Target 1: 1.1400 (Resistance Area)

Target 2: 1.1457 (Measured Move Projection)

💡 Risk-Reward Ratio:

Favorable risk-reward ratio of 1:3, making it an attractive setup for traders.

4️⃣ Market Psychology Behind This Move:

Bears losing strength: Multiple failed attempts to break support indicate sellers are exhausted.

Bulls gaining momentum: Trendline breakout shows buyers are stepping in with confidence.

Breakout confirmation: If resistance breaks, a strong rally toward 1.1457 is likely.

📌 Summary: Bullish CHF/USD Trade Idea

🔹 Pattern: Triple Bottom + Trendline Breakout

🔹 Entry: Buy on retest confirmation

🔹 Stop Loss: 1.1269

🔹 Target: 1.1400 & 1.1457

🔹 Risk-Reward: Favorable 1:3 setup

🚀 This is a high-probability trade setup with strong technical confirmation, making it a great opportunity for breakout traders! 🚀

#VANAUSDT is forming a confident bounce from key levels📉 LONG BYBIT:VANAUSDT.P from $8.180

🛡 Stop loss $8.000

1H timeframe

❗️Before entering the trade, closely monitor the levels. If the price consolidates above $8.180 with volume, this confirms the entry signal.

✅ Overview BYBIT:VANAUSDT.P :

➡️ On the chart, we can see that after a downward movement, the price formed a local bottom around $8.000, followed by an upward impulse.

➡️ A structure resembling a reversal pattern has appeared: the price broke through a slanted resistance (blue line) and consolidated above $8.180, indicating weakening sellers.

➡️ The price is now moving toward a resistance zone marked as POC (Point of Control) at $8.353, which could be the first target.

➡️ The entry is set at $8.180, aligning with the breakout level, supported by increasing volume and a short-term uptrend.

The volume profile on the left shows a low-liquidity zone above the current price (between $8.345 and $8.590), which may allow the price to quickly reach the TP levels.

🎯 TP Targets:

💎 TP 1: $8.345

💎 TP 2: $8.590

💎 TP 3: $8.775

⚡️ Plan:

➡️ Monitor the price reaction at TP1 ($8.345) — a pullback is possible. It’s recommended to close part of the position.

➡️ Wait for confirmation of the breakout above $8.180 (already happened, price is above).

➡️ Enter LONG after a retest (with volume) — in this case, the retest has already occurred, and the price is moving up.

➡️ Place the stop below the last low — at $8.000.

BYBIT:VANAUSDT.P is forming a confident bounce from key levels, and if it holds above the entry zone, we expect an upward movement!

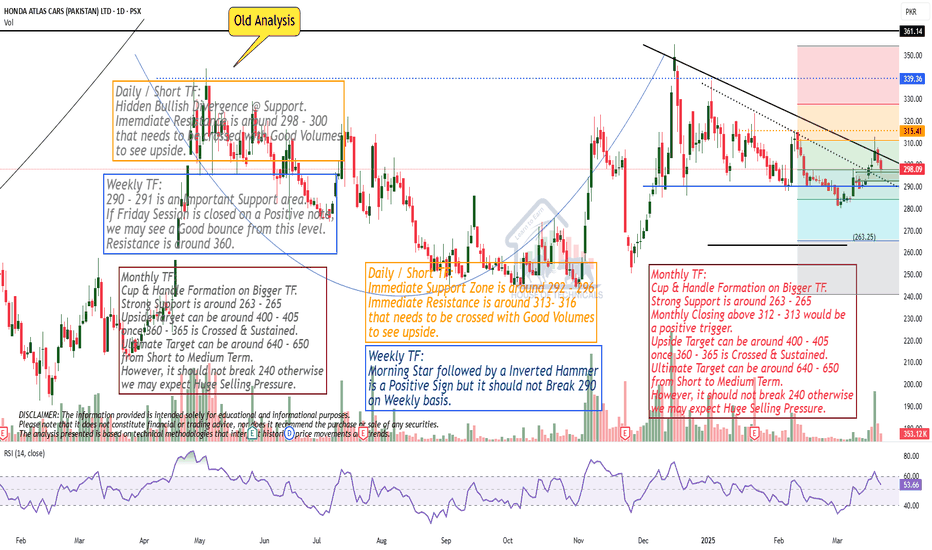

Monthly TF:

Cup & Handle Formation on Bigger TF.

Strong Support is around 263 - 265

Monthly Closing above 312 - 313 would be

a positive trigger.

Upside Target can be around 400 - 405

once 360 - 365 is Crossed & Sustained.

Ultimate Target can be around 640 - 650

from Short to Medium Term.

However, it should not break 240 otherwise

we may expect Huge Selling Pressure.

Bearish Divergence has started appearing but...Bearish Divergence has started appearing

on Weekly TF but not yet on Monthly, so

a pressure might be seen around 116 - 117.

& Sustaining this level will expose 135 - 138 targets.

On the flip side, 101 - 109 may act as a Good

Support zone in case of pressure.

CHF/USD Bullish Cup Formation | Support & Breakout Target Pattern Formation: Bullish Cup & Handle Breakout Setup

The price action on this CHF/USD 1-hour chart exhibits a Cup & Handle pattern, which is a well-known bullish continuation setup. This pattern suggests that buyers are gradually gaining control and a breakout could be imminent.

1️⃣ Understanding the Cup Formation

The cup shape (curved blue line) signifies a gradual accumulation phase, where price initially declined, formed a rounded bottom, and then started recovering.

This indicates that buyers are regaining momentum after a consolidation period.

The lowest point of the cup formed around March 16, from where the price began a steady upward move.

2️⃣ Key Support & Resistance Levels

Support Level: The strong demand zone is established around 1.1300 - 1.1320, as shown by multiple price bounces.

Resistance Level & ATH (All-Time High): The price struggled to break 1.1450 - 1.1470, indicating a major resistance zone where sellers previously took control.

3️⃣ Handle Formation & Pullback

After reaching resistance, the price formed a slight retracement (small descending wedge), which created the handle of the pattern.

The pullback was necessary to clear short-term overbought conditions before a potential breakout attempt.

4️⃣ Trading Strategy & Price Projection

🔹 Entry & Breakout Confirmation

If CHF/USD breaks above 1.1450 - 1.1470 with volume confirmation, this will validate the Cup & Handle breakout.

A confirmed breakout suggests further upside momentum toward 1.1570 - 1.1600, aligning with the pattern’s measured move.

🔹 Stop-Loss Placement

A logical stop-loss should be placed below the handle’s low (~1.1300 - 1.1320), in case of a false breakout or sudden market reversal.

🔹 Target Projection Based on Pattern Measurement

The height of the cup (~200 pips from bottom to resistance) is projected upwards from the breakout level.

This results in a take-profit target of 1.1575 - 1.1600.

5️⃣ Additional Technical Confluences

✅ Trendline Support: The price is respecting an ascending trendline, indicating continued higher lows and bullish sentiment.

✅ Bullish Momentum: The series of higher lows confirms a strong uptrend, favoring buyers.

✅ Potential Fakeout Risks: A failed breakout below 1.1300 could invalidate the bullish outlook, leading to a deeper retracement.

6️⃣ Final Thoughts: Is This a Good Setup?

📌 Overall Bias: Bullish ✅

📌 Breakout Confirmation Needed: Above 1.1450 - 1.1470

📌 Target: 1.1570 - 1.1600 🎯

📌 Risk Management: Stop-loss below 1.1300

If CHF/USD sustains momentum above resistance, traders can anticipate a strong bullish rally toward the projected target. However, it’s essential to wait for confirmation before entering long positions. 📈🔥

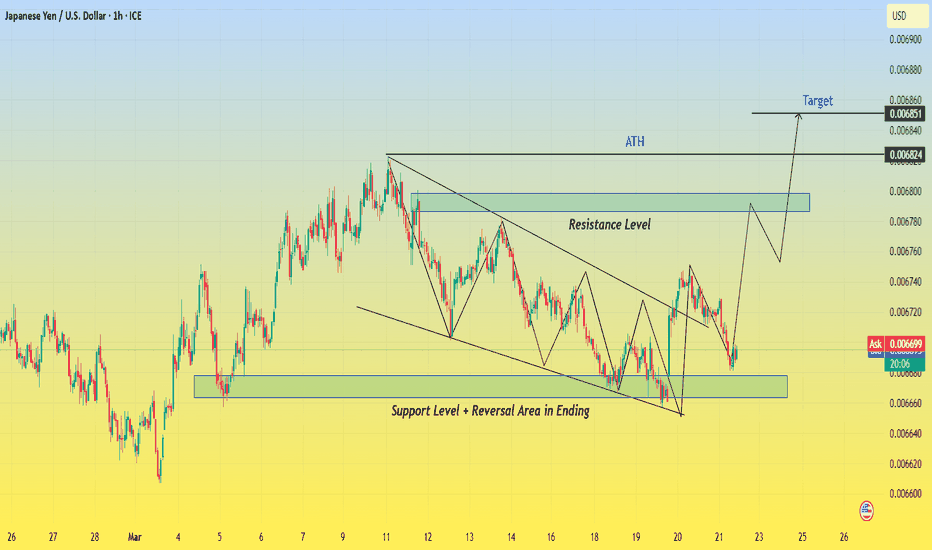

JPY/USD Trading Setup – Falling Wedge Breakout & Bullish MoveThe JPY/USD 1-hour chart is displaying a well-defined falling wedge pattern, which is typically a bullish reversal setup. This pattern forms as price action moves within converging trendlines, indicating that selling pressure is gradually weakening. The breakout from this pattern signals a potential trend reversal, and the price may be heading toward key resistance zones and an eventual bullish target.

This analysis will break down the chart structure, market psychology, key levels, and a trading setup to help traders make an informed decision.

1. Understanding the Falling Wedge Pattern

The falling wedge is a common price action pattern characterized by:

🔹 Lower highs and lower lows forming within two downward-sloping trendlines.

🔹 Decreasing volume, indicating that sellers are losing momentum.

🔹 A breakout above the upper trendline, confirming a shift in trend and signaling the start of bullish momentum.

Market Psychology Behind the Wedge Pattern:

📉 During the wedge formation, the market is in a downtrend, and sellers are in control. However, with each new lower low, the price finds strong support, and buyers start stepping in.

📊 As the wedge narrows, the downward momentum weakens, and sellers struggle to push the price lower. Eventually, demand exceeds supply, leading to a breakout to the upside, which is exactly what we see on this chart.

2. Key Levels & Market Structure

🔹 Support Zone & Reversal Area:

The support zone between 0.006660 - 0.006680 acted as a strong demand area, preventing further downside.

This is also labeled as a reversal area, meaning buyers were aggressive in this zone.

The final touch at this support led to a strong bounce, initiating the breakout.

🔹 Resistance Level:

The price is now approaching a key resistance area at 0.006780 - 0.006800, which previously acted as a supply zone.

A break and retest of this level would further confirm bullish momentum.

🔹 All-Time High (ATH) & Target Level:

The ATH region is marked on the chart as a historical resistance level where price faced strong selling pressure before.

If the current breakout holds, price action could aim for the 0.006851 target level, completing the measured move from the wedge pattern.

3. Trading Strategy & Execution Plan

📈 Entry Strategy:

There are two main ways to enter this trade:

1️⃣ Aggressive Entry: Enter immediately after the breakout above the falling wedge.

2️⃣ Conservative Entry: Wait for a breakout AND retest of the previous resistance turned support (0.006780 zone) before entering long.

🔻 Stop-Loss Placement:

To manage risk, traders should consider placing stop-loss orders:

Below the previous support zone (0.006660) to minimize downside risk.

Alternatively, below the wedge breakout point if using a tight stop-loss.

🎯 Take-Profit Targets:

1️⃣ First Target: 0.006780 (near-term resistance level).

2️⃣ Final Target: 0.006851 (based on wedge breakout projection).

4. Confirmation & Risk Management

🔎 Key Confirmation Factors for a Strong Breakout:

✅ Price breaks above the falling wedge with strong bullish candles.

✅ Volume increases, showing strong buying interest.

✅ RSI or other momentum indicators confirm bullish divergence.

⚠️ Potential Risks to Consider:

False Breakout: If price falls back inside the wedge, this could invalidate the bullish setup.

Rejection at Resistance: If buyers fail to push price above the 0.006780 resistance, it could lead to another consolidation.

5. Final Thoughts & Trading Outlook

📌 This JPY/USD chart presents a high-probability bullish setup due to the breakout from a falling wedge pattern.

📌 The breakout, strong support zone, and bullish price action indicate further upside potential.

📌 Risk management is key—waiting for confirmation can increase the probability of success.

💡 Final Verdict: Bullish Bias – Watching for Retest & Continuation to Target! 🚀

#FORMUSDT: Quick Breakdown of a Long Setup!📉 Long BYBIT:FORMUSDT.P from $1.9037

🛡 Stop Loss: $1.8313

🕒 1H Timeframe

⚡️Overview:

➡️ Current Price: $1.8831 — this is where BYBIT:FORMUSDT.P is trading right now.

➡️ The price recently dropped from around $2.0000 to $1.4000 — a sharp decline! But then it started recovering and is now in a consolidation zone.

➡️ Volume: At the bottom of the chart, you can see volume bars. There was a particularly large volume at the $1.4000 level, where the price reversed. This suggests a lot of activity — possibly big players starting to buy.

➡️ Key Levels: The right side of the chart shows important price levels:

➡️ $1.8313 — stop loss to protect us from losses.

➡️ $1.8932 and $1.88313 — the nearest resistance levels that the price needs to break to move higher.

➡️ $1.7464 — a support level below, in case the price goes down.

🎯 TP Targets:

💎 TP 1: $1.9690

💎 TP 2: $2.0400

💎 TP 3: $2.0890

⚡️ Plan:

➡️ Entry Point: $1.9037 — this is the level to enter the buy. The price is currently slightly below ($1.8831), so we need to wait for it to rise to this mark.

➡️ Stop Loss: $1.8313 — if the price falls below this, the trade will close with a small loss to minimize risks.

Risk/ Reward: If we calculate, the distance from the entry to the stop loss is $0.0724, and to TP1 — $0.0653 (a ratio of nearly 1:1). To TP2 — $0.1363 (1:1.88), and to TP3 — $0.1853 (1:2.56). This is a good profit potential if the price moves up!

📢 The BYBIT:FORMUSDT.P price just bounced off the strong $1.4000 level, where there was high volume. This could be a signal that big players started buying, and the market is ready to rise.

📢 The $1.9037 level (entry point) aligns with the POC (Point of Control) — the zone with the highest trading volume, which often attracts the price.

📢 If the price breaks the resistance at $1.8932, it could easily reach $1.9037 and then move toward our targets.

🎯 How Does This Signal Relate to the Market?

The recent news about the resolution of the #Ripple vs. #SEC case, which I wrote about earlier, creates a positive backdrop for the entire crypto market.

➡️ When major projects like #Ripple gain clarity, it adds confidence to investors.

➡️ Altcoins like BYBIT:FORMUSDT.P can catch this wave of optimism.

➡️ If the market continues to rise, BYBIT:FORMUSDT.P has a chance to break resistance and move toward our targets!

➡️ Important: The crypto market is volatile, so don’t forget about risk management. Don’t risk more than 1-2% of your deposit on a single trade.

Bitcoin (BTC/USD) – Bullish Breakout in Progress📈 Chart Pattern:

Bitcoin has been trading inside a descending channel for several weeks. Recently, BTC has broken out of the channel’s upper boundary, indicating a potential shift in momentum.

🔹 Key Levels:

Support: $80,043.75 (Critical stop-loss level)

Resistance: $87,500 (Short-term)

Target: $92,944.17 (Upside projection)

📊 Trading Plan:

BTC might retest the breakout zone before continuing the upward move.

A confirmed higher low formation could signal strong bullish momentum.

If BTC remains above $85,500, further upside toward $92,944.17 is possible.

⚠️ Risk Management:

If BTC drops below $80,043.75, the bullish setup could become invalid.

Traders should wait for confirmation before entering long positions.

💡 Conclusion:

This breakout could lead to a strong uptrend, but traders should watch for a successful retest before making a move. 🚀🔍

#FARTCOINUSDT is showing bullish momentum📈LONG BYBIT:FARTCOINUSDT.P from $0.3590

🛡 Stop Loss: $0.3465

🕒 Timeframe: 1H

⚡️ Overview:

➡️ BYBIT:FARTCOINUSDT.P is showing bullish momentum on the 1-hour timeframe.

➡️ The price has recently broken through the resistance zone at $0.3590, which could serve as an entry point for a long position.

➡️ The chart shows an accumulation zone in the $0.3374–$0.3590 range, where volumes (visible on the volume profile to the left) indicate strong buyer interest.

➡️ The POC (Point of Control) is at $0.3462, confirming support below the current price.

➡️ The price is maintaining an uptrend structure: higher lows and highs are forming, and the breakout at $0.3590 is accompanied by increasing volumes, signaling bullish activity.

➡️ The #RSI (14) indicator on the 1H timeframe is at 65, indicating bullish momentum without being overbought, leaving room for further growth.

🚀 Plan:

➡️ Entry: Buy above $0.3590 after the 1-hour candle closes above this level to confirm the breakout.

➡️ Stop Loss: Set at $0.3465 (below the support zone and POC), which provides a 3.5% risk from the entry point and protects against false breakouts.

➡️ Risk/Reward Ratio: From 1:2 (for TP1) to 1:5.5 (for TP3), making this trade attractive from a risk management perspective.

🎯 Take Profit Targets:

💎 TP1: $0.3660

(nearest resistance level, +1.9% from entry)

💎 TP2: $0.3730

(zone of previous highs, +3.9%)

💎 TP3: $0.3790

(key growth target, +5.6%)

📢 A price consolidation above $0.3590 with sustained volume increases the likelihood of reaching the targets. The $0.3660 and $0.3730 levels may act as profit-taking zones, so monitor price action in these areas.

📢 Risks: If the price drops below $0.3465, it could signal a false breakout and a return to the consolidation zone of $0.3374–$0.3465. In this case, consider reassessing the position.

📢 Market Context: The rise of BYBIT:FARTCOINUSDT.P may be supported by the overall positive sentiment in the crypto market. As of March 19, 2025, BYBIT:BTCUSDT.P is trading steadily above $90,000, creating a favorable backdrop for altcoins.

BYBIT:FARTCOINUSDT.P is showing strength and potential for growth on the 1H timeframe. A confirmed breakout above $0.3590 is your signal to act! We expect a move toward the $0.3660–$0.3790 levels.

#RAREUSDT continues its downtrend📉 Short BYBIT:RAREUSDT.P from $0,08345

🛡 Stop loss $0,08460

🕒 1H Timeframe

⚡️ Overview:

➡️ The main POC (Point of Control) is 0,09094

🎯 TP Targets:

💎 TP 1: $0,08196

💎 TP 2: $0,08050

💎 TP 3: $0,07950

📢 Monitor key levels before entering the trade!

BYBIT:RAREUSDT.P continues its downtrend — watching for further movement!

TradingView Idea for EUR/AUD (4H Chart)

Market Overview:

The EUR/AUD 4-hour chart displays a downtrend followed by a consolidation phase at a critical support zone. The price is currently reacting within a demand area, indicating a potential bullish reversal.

Key Levels:

Support Zone: ~1.7050 - 1.7100 (Highlighted in dark grey)

Resistance Zone: ~1.7200 (Short-term)

Target Level: ~1.74217

Potential Trade Scenarios:

Bullish Scenario: If the price holds above the support zone, we could see a rebound towards 1.7200, with further continuation towards the 1.74217 target.

Retest and Breakout: A slight pullback into the support zone, followed by a breakout above 1.7200, could confirm a strong buying momentum.

Bearish Risk: A failure to hold above support may lead to further downside continuation.

Trade Plan:

Entry: Look for bullish confirmation in the demand zone.

Stop Loss: Below the support zone (~1.7050).

Take Profit: First at 1.7200, then 1.74217 for an extended move.

Bias: Bullish if support holds, bearish if price breaks below.

EUR/JPY Bullish Continuation in an Ascending Channel

This EUR/JPY 4-hour chart shows a strong bullish trend within an ascending channel, indicating a potential continuation of upward momentum.

Key Highlights:

✅ Ascending Channel – Price is trading within a well-defined upward channel, showing steady bullish movement.

✅ Support Zones – Two key support areas marked, which could act as potential entry zones on a retracement.

✅ Target Level – The projected target is around 165.831, aligning with previous resistance zones.

✅ Price Action Expectation – A pullback to the support level within the channel before another bullish impulse toward the target.

Trading Plan:

📌 Bullish Bias: Wait for a retracement toward the marked support zones for a potential long entry.

📌 Invalidation: A strong break below the channel and support zones would invalidate the bullish setup.

#1000XUSDT is setting up for a breakout📉 Long BYBIT:1000XUSDT.P from $0,05470

🛡 Stop loss $0,05297

1h Timeframe

⚡ Plan:

➡️ POC is 0,04229

➡️ Waiting for consolidation near resistance and increased buying activity before the breakout.

➡️ Expecting an impulsive upward move as buy orders accumulate.

🎯 TP Targets:

💎 TP 1: $0,05640

💎 TP 2: $0,05775

🚀 BYBIT:1000XUSDT.P is setting up for a breakout—preparing for an upward move!

USD/CHF - Bullish Reversal Setup

This 4-hour chart of USD/CHF shows a potential bullish reversal from a key support level.

Support Zone: The price is approaching a strong support level around 1.10193 - 1.12261, where previous price action has reacted.

Reversal Expectation: A bounce from this level could trigger a bullish move toward the 1.15719 resistance level.

Target Projection: If price respects the support, a 3.00% potential upside is expected.

Trading Plan:

Buy Entry: Look for bullish confirmation signals at the support zone.

Stop-Loss: Below the support area to minimize risk.

Take Profit: First target at 1.15719.

Technical Indicators to Watch:

Bullish Candlestick Patterns at support.

RSI / MACD for momentum confirmation.

Trendline Breakout for additional bullish confirmation.