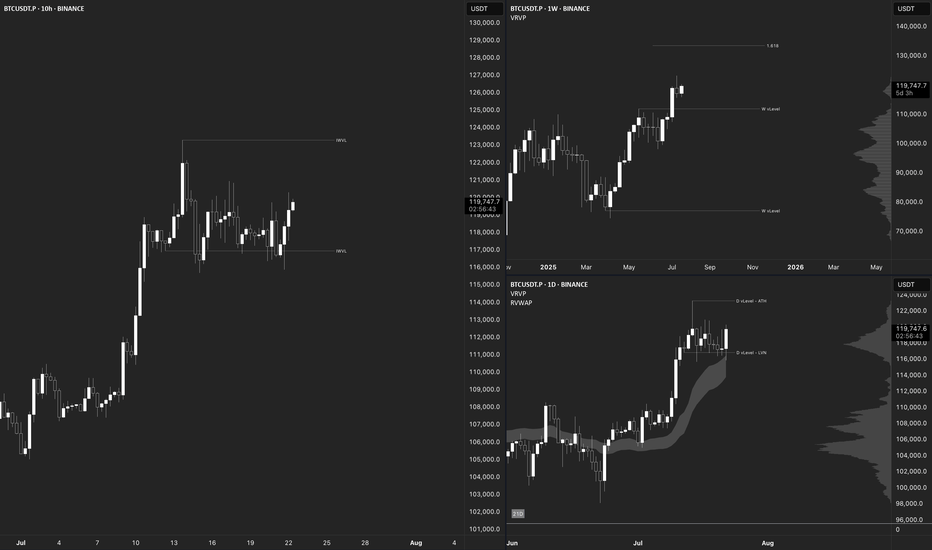

$BTC Macro UpdateBitcoin Macro Outlook BINANCE:BTCUSDT.P

Weekly

Bias & momentum remain bullish. Price is pressing toward new ATHs despite last week’s pullback.

Next macro target: ~$133,550 (extension of the current DeCode V-Range: 111,959.5 – 77,111.0).

A weekly close back inside that range (<111,968.0) = Failed Auction → serious red flag for reversal.

Daily

Clean rejection off the 21-Day Rolling VWAP + bounce at the structural HL V-Level (116,862.4).

A strong bullish engulfing today would set the tone for follow-through this week.

10-Hour

Structure is still bullish. Multiple Failed Auctions from ~116,960.0 are driving price toward the ATH.

Intraday

Choppy and hugging range lows → harder read. That behavior near balance edges triggers AMT Rule #5: “If time/volume builds at the edge of balance, price is likely to push through.”

Auction Market Theory – Quick Reminders

Price : advertises opportunity

Time : regulates opportunity

Volume : tells you if the auction is succeeding or failing

Rule #5 (above) is in play right now. Stay patient, wait for confirmation, and don’t FOMO.

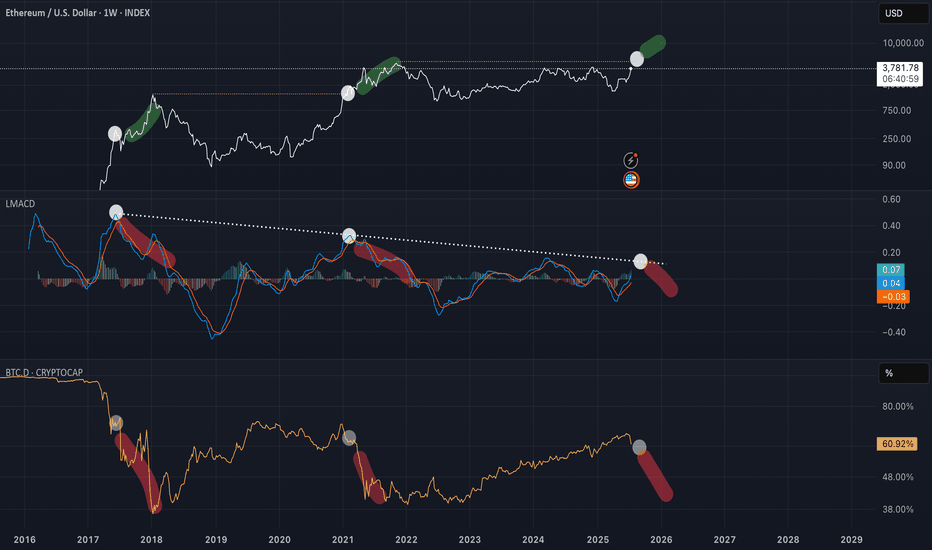

Bullmarkets

Gaussian suggesting the last leg to the upside!As we approach close to the ~1000 days of bull market conditions above the green GC. Volatility to the upside should be coming before peaking at some point probably in October. Make sure to sell some coins before we get back to the core of the Gaussian. We could be seeing the price tank from 40k-50k later next year. Cheers!

Close to 200k is doable for this cycle!I don't like to bet on targets, I prefer taking profits around October 2025 as I mentioned multiple times. But this idea about topping around 194k is doable according to fib levels. Either way I am going to step out around October no matter the price, even if its bellow 100k.

Altseason, just a thought ! Basically, right now we’re chilling in a major confluence zone — a whole bunch of important levels are stacked right here.

We’ve got:

The 0.78 Fib retracement holding it down

Volume profile support giving us a comfy cushion

That good old accumulation support from 2019–2021 saying “welcome back”

…just to name a few.

IMO, we’re in that sneaky “deviation/manipulation” phase before the real markup begins — a.k.a. altseason is warming up in the locker room.

If we actually hit the bull flag target… well, let’s just say the numbers start looking spicy. But hey, let’s not get ahead of ourselves — things can (and probably will) move faster than you think.

Alright, that’s the vibe. Let’s see how it plays out. Good night! 😴🚀

Bitcoin vs Gold: Driving the Point Home📉 Bitcoin vs Gold: Driving the Point Home The long-term comparison we can't afford to ignore.

Gold, after achieving mainstream status, weathered a 20-year consolidation phase, low volatility, muted investor excitement, but enduring presence. This historical precedent forces us to reconsider expectations for Bitcoin, now in its 15th year.

⚡ While Bitcoin’s adoption curve has been sharper, its market dominance has steadily declined since 2017. Despite intermittent, and often deceptive relief rallies, the trend remains downward. Altcoins, forks, and shifting narratives (DeFi, NFTs, meme tokens) continue to fragment attention and capital.

⚡ Could Bitcoin follow gold’s path and enter a prolonged era of post-hype consolidation? If so, the next bull run might be a decade away or more … if it happens at all. In an age of digital abundance, durability; not innovation, may define Bitcoin’s legacy.

📊 Chart Highlights: The latest image visualizes Bitcoin’s current phase against gold’s historical arc. The final label "Monetary Maturity" suggests a shift from speculative highs to a more sober test of endurance.

🔍 Will Bitcoin evolve into a true store of value or fade as just another chapter in financial innovation? Let the markets answer, but history offers clues. Only Time will tell.

#Bitcoin #Gold #CryptoAnalysis #BTCdominance #CryptoHistory #DigitalAssets #TradingView

CRYPTO:BTCUSD INDEX:BTCUSD TVC:SILVER NASDAQ:MSTR NASDAQ:MARA NASDAQ:COIN NASDAQ:TSLA TVC:DXY NYSE:CRCL

"Crypto Charts Whisper—Are You Listening?"As I’ve mentioned before, the market is manipulated. In a previously published idea, “VSA vs BTC: Into a Bearish Scenario or Not?”, this manipulation becomes obvious. The big players—whales, institutions, banks—are deliberately engineering traps to absorb liquidity from uninformed retail traders, boosting their profits and power.

Some informed retail traders like you and me understand that behind these entities are teams of insiders and highly trained traders operating around the clock—24/7, 365 days a year. That’s what it takes to survive in such a demanding environment.

This is especially true in the crypto market, which—despite its explosive growth—is still a baby in terms of total market cap. That’s why price fluctuations are so extreme, whether it’s Bitcoin, Ethereum, or altcoins.

Many of you who have been in the space since the early days already know: Bitcoin is the king. As the first coin built on cryptography, Bitcoin leads the way—and where it goes, altcoins follow. These movements often align with changes in Bitcoin Dominance.

So, yes, Bitcoin is the king—but its movements aren’t random. Bitcoin follows rules, and these rules are shaped by data—especially macroeconomic data. One major example is the Consumer Price Index (CPI), released monthly by the U.S. Department of Labor and Statistics.

And here's the key: the big players often have early access to this kind of information. They prepare accordingly—days before the official release—and when the data hits, they move the markets up or down. Even whales don’t act on gut feelings. They follow a framework.

We, as retail traders, must adopt a similar approach. We may not have insider access, but we do have knowledge—and with an open mind, we can act in advance.

As I’ve emphasized before: learning to read Market Structure lets you decode not just market psychology, but also the intentions of the big players. Their large positions leave footprints, just like a ship cuts a path through water. That trail is visible—for those who know where to look.

If you study volume correctly, you’ll start to notice certain zones that keep coming back. That’s all I’ll say—for now.

Unfortunately, many traders rely blindly on strategies like swing trading, expecting price to react at predefined swing highs or lows. But this rarely happens on schedule—especially in crypto. Yes, swing highs and lows exist—that’s the nature of all markets—but in between those levels, the big players create hidden structures that act as signals.

These aren’t just random formations—they’re part of how the big players "communicate" with one another. First, to maintain balance within their own circles. Second, to create FOMO and trap emotional retail participants.

Look at the SHIBA INU chart I’ve shared. This technique is unfolding in real time. Do you notice how the structure is compressing? How price and new swing levels are squeezing in? Look closer at the footprints I’ve highlighted—some of those levels are being respected and reused in the future.

We’re taught from childhood that "we can’t know the future." But is that really true? Repetition of such beliefs is common—worldwide. But again, is it true? I think not.

Think about this: if you drive a car full-speed toward a wall and don’t brake, what happens? You crash. Isn’t that a form of future reading? It’s based on logic, observation, and probability. The same tools we use in market analysis.

So, I hope my words challenge your thinking.

📅 As of this writing (June 11, 2025), Bitcoin is trading at $109,588.

Today’s candle still has about 17 hours left to form, and price action on the daily timeframe is sitting within a previously established supply zone. Bulls and bears are clashing here. But zoom in: what's happening on the lower timeframes? Which signals have been tested, and which haven't?

Are we about to see a breakthrough above the all-time high?

Could this be the launch of the next leg of the bull run?

RSI suggesting a bear market comingThis is BTC and it's RSI. Bellow you can see LMACD applied on the RSI indicator to see the trend more clearly. We might be on the stage that we can see higher prices like in 2021, but the bear trend is already printed. Sell some now and buy back at 40k next year. Cheers

This Is Not a Top – It’s the Beginning of the Mega Bull RunThis is the monthly #Bitcoin chart, and honestly, how can anyone be bearish here?

CRYPTOCAP:BTC just bounced after a -31.95% correction and is now holding strong above the $101K breakout zone.

Last time, a similar setup led to a 122% pump... and this time, we could be looking at a move toward $160K that's 120% upside from here.

We’re likely entering the biggest bull market ever.

Get ready. 🚀

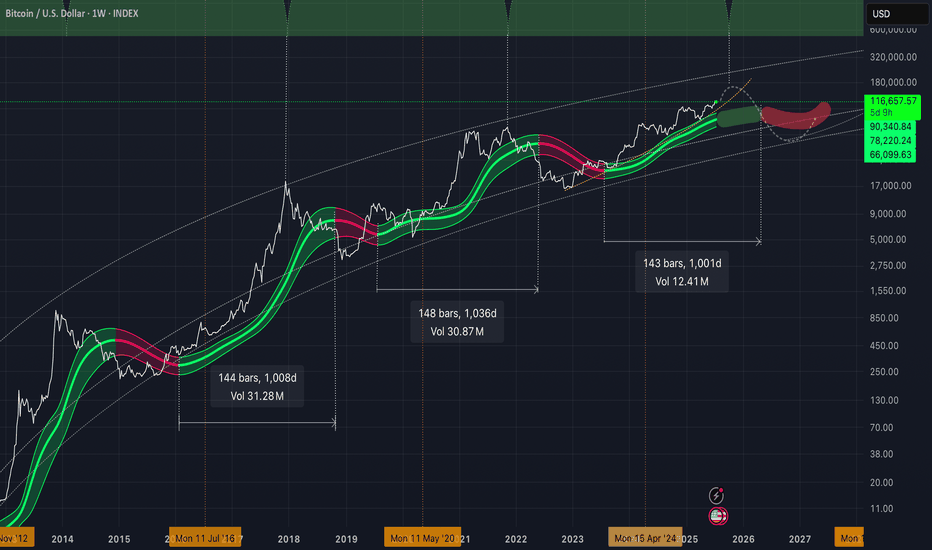

Bitcoin's Market Cycles — Are We Nearing the Top?Bitcoin is approaching a critical moment and the signs are everywhere.

After more than 900 days of steady bull market growth, BTC now flirts with all-time highs (ATH) while momentum stalls, liquidity thins, and emotions run hot. You might be asking:

Are we nearing the cycle top?

Is now the time to de-risk or double down?

What comes next?

This isn’t just a question of price. It’s about timing, structure, and psychology.

In this analysis, we’ll break down Bitcoin’s historical cycles, the current macro structure, the hidden signals from Fibonacci time extensions, and how to think like a professional when the crowd is chasing FOMO.

Let’s dive in.

📚 Educational Insight: Understanding Bitcoin Cycles

Bitcoin doesn’t move in straight lines, it moves in cycles.

Bull markets grow slowly, then explode. Bear markets fall fast, then grind sideways. These rhythms are driven by halving events, liquidity expansions, and most importantly: human emotion.

Here’s what history tells us:

Historical Bull Markets:

2009–2011: 540 days (+5,189,598%)

2011–2013: 743 days (+62,086%)

2015–2017: 852 days (+12,125%)

2018–2021: 1061 days (+2,108%)

2022–Present: 917 days so far (+623%)

Bear Market Durations:

2011: 164 days (-93.73%)

2013–2015: 627 days (-86.96%)

2017–2018: 362 days (-84.22%)

2021–2022: 376 days (-77.57%)

💡 What does this tell us?

Bull markets are growing longer, while bear markets have remained consistently brutal. The current cycle has already surpassed the average bull run length of 885 days (cycles #2–#4) and is quickly approaching the 957-day average of the two most recent cycles (#3 and #4). That makes this the second-longest bull market in Bitcoin’s history.

⏳ 1:1 Fibonacci Time Extension — The Hidden Timing Signal

In time-based Fibonacci analysis, the 1.0 (1:1) extension means one simple thing: this cycle has now lasted the same amount of time as previous cycles — a perfect time symmetry.

Here’s how I measured it:

Average bull market length #2–#4(2011–2021): 885 days

Average bull market length #3–#4(2015–2021): 957 days

Today’s date: May 27, 2025 = Day 917

✅ Result: We are well inside the time window where Bitcoin historically tops out.

You don’t need to be a fortune teller to see that this is a zone of caution. Markets peak on euphoria, not logic and this timing confluence is a red flag worth watching.

🗓️ "Sell in May and Go Away" — Not Just a Meme

One of the oldest market adages is showing its teeth again.

Risk assets — including Bitcoin — tend to underperform in the summer months. Why?

Lower liquidity

Institutional rebalancing

Exhaustion from prior run-ups

Vacations and reduced trading volumes

And here we are:

Bitcoin is hovering near ATH

It's been in an uptrend for 917 days

We just entered the time-extension top zone

Liquidity is thinning across the board

You don’t need to panic. But you do need to think like a professional: secure profits, reduce exposure, and wait for structure.

😬 FOMO Is a Portfolio Killer

This is where most traders make their worst decisions.

FOMO (Fear of Missing Out) isn’t just a meme — it’s the reason so many people buy tops and sell bottoms.

Before entering any trade right now, ask yourself:

Where were you at $20K?

Did you have a plan?

Or are you reacting to headlines?

📌 Clear mind > urgent clicks

📌 Patience > chasing green candles

📌 Strategy > emotion

Let the herd FOMO in. You protect your capital.

Will This Bear Market Be Different?

Every past cycle saw BTC retrace between 77%–94%. That was then. But this time feels… different.

Here’s why:

Institutions are here — ETF flows, sovereign wealth funds, and major asset managers

Regulation is clearer — and risk capital feels safer deploying in crypto

Supply is tighter — much of BTC is now held off exchanges and in cold storage

While a massive crash like -80% is less likely, that doesn’t mean a correction isn’t coming. Even a 30%–40% drop from here would wreak havoc on overleveraged traders.

And that brings us to…

🚨 Altseason? Or Alt-bloodbath?

Here’s the hard truth:

If BTC corrects, altcoins will crash — not rally.

Most altcoins have already seen strong rallies from their cycle lows. But if BTC drops 30%, many alts could tumble 50–80%.

Altseason only happens when BTC cools off and ranges — not when it dumps. Don’t get caught holding the bag. Be tactical. Be disciplined.

So Where’s the Next Big Level?

You may be wondering: “If this is the top… where do we fall to?”

Let’s just say there’s a very important Fibonacci confluence aligning with several other key indicators. I’ll reveal it in my next analysis, so stay tuned.

🧭 What Should You Do Right Now? (Not Financial Advice)

✅ Up big? — Take some profits

✅ On the sidelines? — Wait for real setups

✅ Emotional? — Unplug, reassess

✅ Are you new to Trading? — study, learn (how to day trade) and prepare for the next cycle

The best trades come to the calm, not the impulsive.

💡 Final Words of Wisdom

Bitcoin rewards discipline. It punishes emotion.

Right now is not about catching the last 10% of upside — it’s about:

Watching structure for potential trend change

Measuring risk

Avoiding overexposure

Protecting what you’ve earned

📌 The edge isn’t in indicators. It’s in mindset. Stay prepared, stay sharp because in this market…

🔔 Remember: The market will always be there. Your capital won’t — unless you protect it.

The next big opportunity doesn’t go to the loudest.

It goes to the most ready.

_________________________________

Thanks for reading and following along! 🙏

Now the big question remains: Is a bear market just lurking around the corner?

What are your thoughts? Let me know in the comments. I’d love to hear your perspective.

_________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

Bitcoin - An unusual chart!Over the past 3 years, I’ve noticed that Bitcoin has been moving in a consistently bullish pattern, as shown on the chart.

After breaking out of the red ellipse shape, Bitcoin tends to rally strongly—and that’s usually the signal for altcoins to follow. We’ve now broken out of this ellipse, and it looks like the real bullish move is just beginning.

In this chart, I’ve tried to illustrate both the potential upside ahead of us and the estimated timeframe in which this move could unfold.

I’ve divided the chart into segments from August 2022 to April 2025.

🔸The red numbers 1, 2, 3, 4 indicate periods of consolidation.

🔸The blue numbers 1, 2, 3, 4 represent strong Bitcoin and altcoin rallies that follow the breakouts.

While the exact percentage gains and time durations may vary, if we take the average, we can estimate the upcoming move to be around 120%, taking Bitcoin to around $165K.

Similarly, the average time duration for each bullish move has been approximately 120 days.

[b ]Welcome to the bull market.

Best Regards Ceciliones 🎯

Predicting the Next Bitcoin 200MA Peak Using Exponential DecayIn my ongoing study of Bitcoin market cycles, I noticed a compelling pattern in the behavior of the 200-day moving average (200MA) across bull markets. Specifically, I observed that the percentage rise of the 200MA from each cycle bottom to cycle top is decreasing over time, and this decline follows an exponential decay pattern.

Historical Observations:

• 2015 Cycle Bottom to 2017 Peak:

The 200MA increased by approximately +686%

• 2018 Cycle Bottom to 2021 Peak:

The 200MA increased by approximately +450%

This pattern suggested to me that the next peak in the 200MA might continue this decaying trajectory. To estimate this, I applied a simple exponential decay model using the two previous data points:

y(t) = A.e^{-kt}

Solving for the next value (t = 2), the model predicts an approximate increase of +296% in the 200MA from the current cycle bottom to the expected peak.

Implication for the Current Cycle:

Assuming the 200MA bottomed around $16,200, a +296% rise implies a target 200MA near:

$16,200 x (1 + 2.96) is approx. $64,000

This aligns remarkably well with the 2021 bull market top, reinforcing the idea that the previous all-time high (~ GETTEX:64K –$69K) could serve as a strong macro support level once this cycle matures.

Conclusion:

If this exponential decay pattern continues, we can expect the 200MA to peak around $64,000 during the current bull cycle. This target also coincides with historical resistance turned potential support, making it a critical level for long-term investors and swing traders alike.

This type of decay-based modeling, while not exact, offers a unique lens through which we can assess Bitcoin’s macro behavior across cycles. I’ll continue to monitor how this projection plays out and refine the model with new data as the market evolves.

Nasdaq 100 Fills "Liberation Day" Gap – New Bull Market?The Nasdaq 100 ( CME_MINI:NQ1! ) has officially filled the Liberation Day gap from April 3rd.

It took three weeks of grinding to recover from a three-day crash.

Bulls are now calling this the start of a new bull market... really?

📌 Technical Recap:

Gap filled ✅

Resistance area retested ✅

Next step: Follow-through needed above 19,600 to confirm strength.

🚨 Caution: A gap fill is not a breakout. FOMO is high. Momentum needs to prove itself now or risk a hard rejection.

COTI WAVE 3 is coming COTI has completed its initial phases, Wave 1, 2 of Elliot waves and is preparing for Wave 3📈.

Also COTI V2, released recently, aims to revolutionize web3 privacy.

COTI’s market capitalization is $96 million, suggesting substantial potential gains during the upcoming bull market🚀.

This information is not financial advice. Conduct thorough research before making investment decisions.

BTC - Bigger Picture of Liquidity Collection RoadmapExpanding on my last idea focusing on the first move in this sequence, here is a bigger picture of this idea and I will explain in detail how I arrive to this.

1. The market is always going to absorb liquidity.

We know this. We also know that since Dec 2022 Bitcoin has been on a steady climb up allowing for lots of long positions to open and stay open. What this creates is a lot of absorbable liquidity in the form of long position stop losses. Further more, the dominance of leverage is very high in crypto, therefor these stop loss orders are “leveraged sell orders”. This is the “fuel” that can be used to explain the possibility of a move of this magnitude.

In other words, the orders are already in place in the chart; the adverse of traders decisions via leveraged position stop losses.

2. We can identify (2) main trendlines that explains why Bitcoin has been struggling so much around these zones. Price tends to break above and below these diagonal trendlines, trading sideways in a diagonal fashion - until there is enough “fear” or justification to allow the trendline to play itself out.

The first trendline I design for you in my previous idea. This takes Bitcoin to a zone with several confluences. (1) A Volume Profile support, (2) The bottom of a bearish trendline, and (3) The absorption of a mass amount of liquidity located from the current price to that zone.

The second trendline, which you can apply the same validation methods I pointed out in my previous idea (duplicating the trendline and placing it infinitely at different areas on the chart and observing price respecting the angle), has a bottom of $7,000.

Now this Uber low may seem extraordinarily unrealistic, but there is again, a mass amount of liquidity located in those low zones that the market wants to absorb.

3. I lay out here a corrective wave sequence that would allow all of this liquidity to be absorbed.

The US Dollar on the higher timeframes shows a bearish retest of a major breakdown. With all of the negative news and geopolitical tension with the US, both technically and fundamentally this points in the direction of a falling US dollar relative to other global currencies.

4. Ultimately this is good for Bitcoin.

I present this idea for several reasons, most importantly, what I can see happening (assuming this does occur) is that many holders and investors will sell at very low prices in extreme fear that Bitcoin will go to zero, when in fact it would just be a liquidity grab prior to a true 3-5 year bull run on Bitcoin as the US Dollar loses strength.

Of course being ill prepared and selling at those extreme lows would be catastrophic for investors and traders.

So if anything, I hope this serves you with the possibility explained in detail, and in the event you see this occur, to not panic and not sell. To do the exact opposite of what the majority would do and BUY into those extreme fear zones.

Happy trading and stay safe.

For anyone wanting to argue that it’s not possible or showing their confidence that it would never happen; please understand there is no harm is looking at potential scenarios and this isn’t an ego contest about who is right or wrong. It’s ideally about looking out for each other and sharing our work, knowledge, and experience to collectively succeed in understanding this challenging market.

People may also like to point out that I’ve been speaking about this occurring for roughly a year, and have been wrong - however the timing of such events doesn’t mean it’s “wrong”. If the chart demonstrates a possibility, it remains.

Crypto Total Market Cap Analysis – The Final Ride is ComingMarket Context

The chart represents the Total Crypto Market Cap (CRYPTOCAP) on a 1W timeframe.

Historical price action shows cyclical bull and bear market trends driven by market sentiment, liquidity cycles, and macroeconomic factors.

A similar pattern to 2020’s breakout is forming, suggesting a potential parabolic rally ahead.

Current Market Position

We're here: The chart marks the current phase as a consolidation after a strong upward move.

A similar pause and accumulation phase occurred in late 2020 before the explosive 2021 bull run.

Market cap is hovering around $3.19T, forming a temporary resistance zone within the red-circled area.

Key Technical Indicators

Higher Lows & Higher Highs: A bullish structure remains intact.

Breakout Setup: Price consolidating near resistance often precedes a strong continuation.

Potential Target: The projected move suggests a rally towards $5.75T+ based on historical patterns.

Market Sentiment & Catalysts

Upcoming Bitcoin Halving (2024-2025): Historically sparks massive inflows into the crypto market.

ETF Approvals & Institutional Demand: Driving liquidity and mainstream adoption.

AI & Blockchain Innovation: Continued growth in real-world use cases enhances long-term fundamentals.

KEY DEMAND ZONE FOR ETHBTCKey demand zone here for ETHBTC holding support here is SUPER CRUCIAL for atlcoins and ethereum itself.

If we don't expect many alts to make new lows before MAYBE reversing.

A bearish ETHBTC = BTC.D bullish = alts bleeding

A bullish ETHTC = BTC.D bearish = alts pump

only time will tell. Im sitting on the sidelines and max betting on some projects out there as they are massively undervalued imo.

Goodluck.

ENA/USDT LONG TERM🚀 Position: Long ENA/USDT

🎯 Strategy: Buy the Dip, Sell the Peak!

📈 Entry Targets:

Buy at 0.52 USDT (Initial Entry)

Accumulate at 0.39 USDT (Support Level)

💰 Take Profit Targets (Based on Fibonacci Levels):

TP1: 2.5 USDT

TP2: 3.88 USDT

TP3: 7.1 USDT Very risky... consider it as a top peak bonus.

🎢 Market Overview:

We aim to catch the retracement dip at strong support and ride the recovery towards Fibonacci extension levels.

⚠️ Risk Management:

Stop-Loss: Place your stop below 0.35 USDT for capital protection.

Adjust your take profit levels to secure gains as the price climbs.

📌 Reminder: "Buy the dip, sell the peak!" Stay disciplined and avoid chasing the pump.

Are you prepared for this possibility?Imagine that we actually keep on ranging, don't have an alt szn till a few years from now and we all get desperat.

Something i personally hope it won't happen as many aren't prepared for this type of situation but definitively something to keep in mind.

Is a pro crypto president really the good thing for crypto? I start to doubt it.