Is this how I should outperform bitcoin? $PEPE-trending channel

-log scale (weekly candles)

-PEPE was first listed April 2023, this will be its first bull

-this is bitcoins world and we're just living in it, when it climbs, this upside is available to be captured

-price rising up its upper channel gets you 1000% (a reasonable target) (much higher upside probable)

-blue box is dated until last week Dec 2025

Is this a trade you'd be willing to take modern man?

Bullrun

ETH => Shift In Momentum Almost Done!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📉 Since breaking below its last major low in December 2024, Ethereum (ETH) has been stuck in a bearish trend.

But don’t lose hope, bulls! 🐂

⚠️It’s evident from the last correction phase, marked in blue, that it's larger than the previous ones — a clear sign that the bulls are stronger than ever.

A growing correction phase is often the first signal of an upcoming momentum shift.

This shift will be confirmed once ETH breaks above the last major high marked in red at $2,100.

📈A break above $2,100 would flip ETH’s trend from bearish to bullish, signaling the potential start of the Altcoin season!

Until then, patience is key. 🧘♂️

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

BTC Testing Red Resistance – Potential Breakout Ahead!🚀 CRYPTOCAP:BTC Testing Red Resistance – Potential Breakout Ahead! 📈

CRYPTOCAP:BTC is currently testing the red resistance zone. A potential breakout could be coming soon, and we might see a new all-time high (ATH)! 🔥

Let’s watch this breakout closely! 💼💸

Fridays BULL RUN CONTINUATION, Sunday EntryFridays entry at Break of POi(Point of interest) 59.892

Entry 2: Sunday Night 10pm

price retested previous high 61.084

Previous high, turned into new price Low

SetUp: Retest, Break + CLose of 1hr wick (61.281

Entry:

stops below hourly Low (60.970]

TP: 63.135 : filled @ 3am EST London Session Open

+174 pips banked

BTC - From Bullish to Extreme Bullish...Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

🏢 BTC Building Blocks:

📈 Bullish:

BTC is currently trading within the second floor, between $92,000 and the previous all-time high (ATH) at $109,000.

As BTC retests the $96,000 demand zone, we’ll be looking for trend-following long setups!

📈 Extreme Bullish:

For the momentum to shift from Bullish to Extreme Bullish and enter the price discovery phase, a break above the previous ATH around $109,000 is needed.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

BTC - The Perfect Retest!Hello TradingView Family / Fellow Traders! This is Richard, also known as theSignalyst.

The picture says it all!

🔄Is history about to repeat itself?

If so, we are currently in Phase 2. 📈

What’s next? A dip toward the $87,000 - $88,000 zone would be the perfect retest to look for trend-following longs and expect the start of Phase 3.

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

BULLRUN 2025 LOADING? #Bitcoin Weekly Update

Bitcoin is bouncing from the 50 EMA on the weekly chart. Every time this has happened before, a strong rally followed.

The weekly MACD has also made a bullish crossover. In the past, when Bitcoin held the 50 EMA and the MACD crossed up, the price moved much higher.

Right now, Bitcoin is showing strong support and fresh momentum.

Stay alert. The next few weeks are crucial.

Retweet if you're bullish

#Bullrun2025 #CRYPTOMOJO_TA

MANTA/USDT – Bullish Structure Forming MANTA/USDT – Bullish Structure Forming

MANTA is showing early signs of a trend reversal, with multiple confluences indicating strength from the bulls. After a prolonged downtrend, the asset has not only broken key resistance levels but also flipped the 50 EMA, a major dynamic resistance, into support.

✅ Key Technical Highlights:

Double Bottom Formation:

The chart has clearly printed a double bottom, one of the most reliable reversal patterns.

This formation suggests that bears are losing control and buyers are starting to step in with conviction.

Breakout Above the 50 EMA:

Price has decisively broken above the 50 EMA (~0.2127), which had previously acted as dynamic resistance during the downtrend.

Notably, the price retested the 50 EMA and successfully bounced, confirming it now as support.

Resistance Flip to Support:

The previous horizontal resistance zone has been breached and retested, reinforcing its role as a demand zone.

Market Structure Shift:

Lower highs and lower lows have now transitioned into higher lows and higher highs, signaling a structural shift from bearish to bullish.

Momentum and Candle Structure:

The bullish candles post-retest show strong momentum with minimal upper wicks — a sign of buyer strength.

Crypto Bulls Awaken – Is This Just the Beginning?In the past 48 hours, the crypto market has brought joy to traders and investors who managed to buy near the bottom.

(Sorry to the cryptobros still holding floating losses—your time will come too! 😊)

Some of you might be thinking it's too late to ride this bull run. But if you zoom out and look at the bigger picture, there's still plenty of room for the bull to run.

Just switch to a higher timeframe like the weekly or monthly chart, and you'll see the potential upside.

One coin that looks particularly interesting is BINANCE:SUIUSDT .

There's been a pullback from 2.1829 - 1.7997, and it's supported by bullish divergence, suggesting a continuation of the impulsive move with 7.6108 as the first major target.

This bullish scenario remains valid as long as the price holds above 1.7174.

You might be wondering,

" So can I just buy/long BINANCE:SUIUSDT now? "

Not yet.

For a better entry and a more favorable risk-reward ratio, I suggest using the daily chart.

Wait for a pullback, then look for confirmation using candlestick patterns.

(I'll cover those patterns in my next post—stay tuned!)

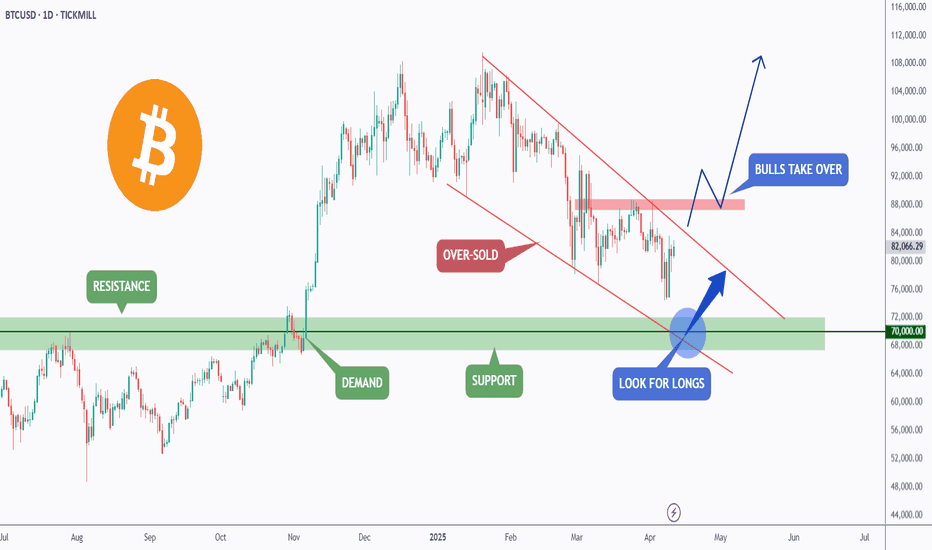

BTC - Two Bullish Scenarios...Hello TradingView Family / Fellow Traders! This is Richard, also known as theSignalyst.

📉 BTC has been overall bearish, trading within the falling channel marked in red.

The $70,000 area is a key confluence zone — it aligns with the lower red trendline, horizontal support, a psychological round number, and a potential demand zone.

📚 According to my trading style:

As #BTC approaches the blue circle zone, I’ll be looking for bullish reversal setups — such as a double bottom pattern, trendline break, and more.

🏹In parallel, for the bulls to take over long-term, and shift the entire trend in their favor, a break above the last major high marked in red at $88,888 is needed!

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

WIF Bulls Charge After Breakout – Can It Hit $2?SEED_WANDERIN_JIMZIP900:WIF has broken above the descending trendline, a key structure that had been capping price for several weeks. This breakout, paired with today’s nearly +10% surge, suggests bullish momentum is building.

The price is now approaching the 50 EMA, which may act as short-term resistance. A clean breakout and close above this level could trigger a strong upside move toward higher zones, as marked on the chart.

Targets remain open toward $0.80, $1.30, and possibly $1.97 if momentum holds.

DYOR, NFA

AUDIO Breakout Alert: Parabolic Move Loading?SEED_DONKEYDAN_MARKET_CAP:AUDIO has successfully broken above the long-term descending resistance line, signaling a strong shift in momentum. However, the price is currently facing rejection from the upper marked resistance zone.

If AUDIO manages to close decisively above this zone, it could trigger a parabolic upmove, opening the path for a significant rally. Watch closely for confirmation — this breakout could be the beginning of something big.

DYOR, NFA

XRP - Breakout will push the price to 5+ USDPrice got reject around the previous resistance line formed after hitting the new ATH on 2017. After 7 long years XRP was able to hit the previous ATH value.

After getting reject from the ATH XRP is trading inside the channel, a breakout from this channel would push the price to previous ATH and a strong breakout from previous resistance is needed to reach new ATH.

Lets see if the price break the channel.

Cheers!

GreenCrypto

Bitcoin - Trading below 50 and 200 EMACurrently bitcoin is trading below 50 and 200 EMA after multiple failed attempt to breach the these EMA levels. 1D candle closed above 200 EMA however, failed to close above 50 EMA

Additionally price is around the trendline which is acting as resistance, a strong breakout from this resistance is needed for bullish momentum to continue.

In the next couple of days we will get to know if price will break the resistance or gets rejected.

Stay tuned for more updates

Cheers

GreenCrypto

Bullrun is Still Here, $120,000 - $130,000 Soon?The price drop over the last 2 months from $109,000 to $74,000 has made many people think the bull run is over or that the cycle has ended.

But if we look closer, this move appears to be just a correction. The price structure is still forming higher lows and higher highs — a clear sign of a bullish trend.

Will it form another higher low between $77,090 and $73,808?

This is the real question, because it will determine whether the bullish trend is still intact.

If you notice, during the drop from $109,000 to $74,000, the stochastic indicator didn't make a lower low. That suggests the decline wasn't supported by momentum — a positive sign, as it shows buyers still have strength to push the price higher.

From a price action perspective, $88,624 is a key confirmation level. If the price breaks above it, there's a high chance we’ll see a new higher high, surpassing $109,000 and targeting the $120,000–$130,000 range.

BITCOIN | 1 DAY | '' Bitcoin will fall to $72,000 ''Hey everyone 💙

In the long run, I expect BINANCE:BTCUSD to drop to around $72,000. But don’t worry—this could actually be a sign of a massive rally ahead. If you're holding spot positions, there's no need to panic!

Big moves up often come after strong corrections. In my opinion, this dip is just a profit-taking phase, and the whales are setting the stage to push Bitcoin above $100K in the long term.

If you enjoy these insights, don’t forget to hit that like button🚀

K.I.S.S => ETHHello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📉 ETH Market Update – Keeping It Simple 📉

Since breaking below its last major low in December 2024, Ethereum (ETH) has been stuck in a bearish trend.

But don’t lose hope, bulls! 🐂

For the long-awaited altseason to kick off, ETH needs to flip the script and break above its last major high — currently sitting at $2,100.📈

Until then, patience is key. 🧘♂️

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

ETH - 4 Red Monthly CandlesThis is the second time we’ve seen four consecutive red monthly candles for ETH. The last occurrence was during the 2018 bear market, where ETH crashed 88% from its peak.

This time, the four-month decline has resulted in a 57% drop so far. However, with the price now at a key support zone, I anticipate that the April 2025 candle will be green, signaling a strong recovery—potentially exceeding the previous month’s losses.

If April turns out to be another red month, we could see ETH dropping further toward the $1,300 level before finding a stronger bottom.

Let’s see how this plays out!

Cheers,

GreenCrypto

ETH - is the worst over ? Can we expect reversal ?As shown in the chart, ETH has reached the trendline support and is currently trading near a key support zone. This critical level will determine whether ETH initiates a reversal from its long-term downtrend that began last December.

I anticipate this support to hold, leading to a strong rebound in ETH's price. If the reversal occurs from this zone, ETH could reach its peak around Q4 2025.

Let’s see how it unfolds!

Cheers,

GreenCrypto

ALT Market cap - Dip before 3TThe Crypto Total Market Cap Excluding BTC (CRYPTOCAP) is currently testing a critical support zone at the 21-month Simple Moving Average (SMA). Historically, this moving average has acted as a strong dynamic support, marking significant market reversals and uptrends.

✅ Price is bouncing off the 21 SMA, similar to previous bull market cycles.

✅ The recent correction appears to be a healthy retest of support rather than a trend reversal.

✅ The formation of higher lows suggests bullish momentum building up.

✅ If price holds above this level, we could see a strong rally in altcoins, pushing the total market cap higher.

A successful bounce from the 21 SMA could trigger a bullish continuation, leading to a market expansion toward 1.6T - 2.3T levels in the coming months.

🔸 A monthly close below the 21 SMA could invalidate this setup, leading to a deeper correction.

🔸 Key support zone to watch: $900B - $950B

🔸 Breakout confirmation: Monthly close above $1.1T

If history repeats, this could be the perfect accumulation zone before the next major altcoin season! Keep an eye on the monthly close and volume confirmation for the next big move.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

Speculating Bitcoin's Cycle Top!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📚 Back to basics.

🗓️ This is the BTC monthly log chart.

📊 By applying two simple channels—one short-term (🔴) and one long-term (🔵)—we see both upper bounds aligning right around the 💰 $300,000 mark. A classic case of confluence at a key psychological level 🧠✨

👇 What do you think—are we headed there this cycle, or is it just hopium? Drop your thoughts in the comments!

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich