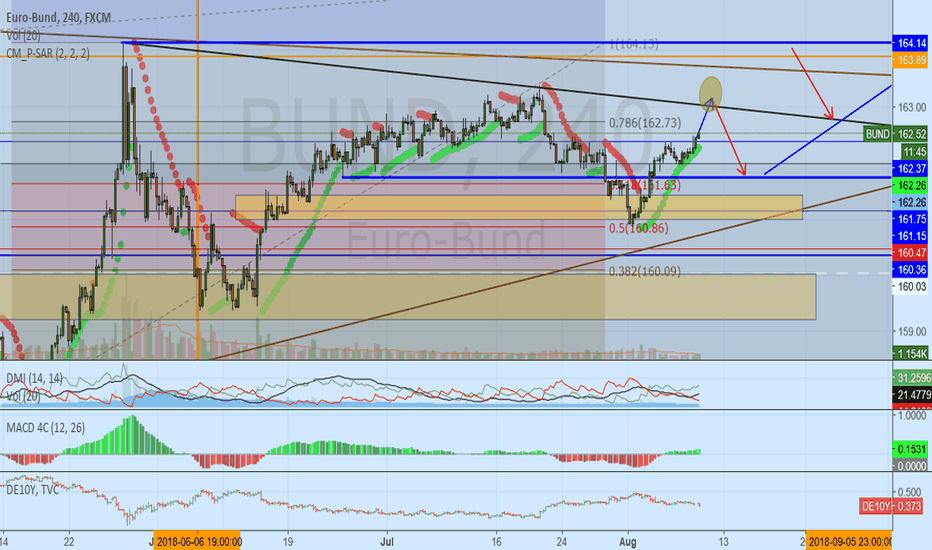

German Yields at Extreme LowsHere we are tracking the completion? of an ABC sequence. This should attract buying interest in usual circumstances however alarm bells are ringing after the ECB could only go one month with the tap turned off.

Tracking these lows very carefully over the coming days with risk from Brexit, Meuller and Turkey around the corner.

All the best.

BUND

Why Deutche Bank is NOT GOING TO ZEROI have read an article today about the possible merger between Commerzbank and Deutsche Bank, few people seem to be reading up on it! Very soon we will hear about how EU banks are a zero and Deutsche will be the first to collapse. A backdoor bailout is likely to change that.

BundFuture - Uncertainty prevailsThe BundFuture has a very high level of resilience and is likely to continue to decline until the first half of 2019. This indicates that a slight increase in interest rates on 10-year German Bunds is to be expected at least in the short term.

As of mid-2019, uncertainty in the euro-area should prevail again and thus demand for the "safe" harbour of-BRD-bonds rise and thus the 10-year-olds again slip below 0% interest rates.

After the completion of wave 5, a waterfall event should lead to a sharp increase in interest rates and over 1-2 decades to massive social upheavals.

Greeting

Stefan Bode from Hannover

P.S. If you like it - Thumbs up!

RECESSION CLOCK STARTED An inverted yield curve means a market situation in which the yields offered, for longer maturities, are lower than the yields of the short-term portion of the curve (in this case the "short" is usually considered as the rates up to 2 years). This is a situation that is at first sight counter-intuitive. Those who have studied Finance will certainly remember the mantra for which 1 euro today is better than 1 euro tomorrow; an inverted curve, instead, says exactly the opposite: better 1 euro tomorrow. This means that investors, on average, are moving towards long-term investments, despite lower yields than short-term investments.

DE10Y / D1 : already showing signs of upward trending to come.We may show some short term demand on bonds because of equities volatility that I already expect. But I think anyway the EU bond market will remain under the bigger catalyst that this market will have to forecast new prices to settle to after ECB will pull out in december.

My trading plan here is to remain bullish on the december future expiration and buying all interesting pullbacks.

Hope this idea will inspire some of you !

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

Strength in Investment-Grade Debt Shows Flight to Safety$TLT #Bonds #bund #gild #treasuries

These custom support resistance indicator lines show decent places to enter or exit.

The Blue indicator line serves as a Bullish Trend setter.

If your instrument closes above the Blue line, we think about going Long.

If your instrument closes below the Red line, we think about Shorting.

For Stocks, I prefer to use the Yellow line as my Bearish Trend setter (on Daily charts).

Find out more. Send Private Mail (PM) to @MasterCharts

Bunds at Crossroads#Bund chart is at a very critical point. This area had previously served as both resistance and support multiple times before. If bulls manage to break this stiff resistance upwards we can say the reflation trade is going to be dead for a long time, but if they fail and price descends impulsively, yields will soar globally and stock markets will crash.

Good luck,

Ali Sharifazadeh, CFTe

Bund back on support, potential for a bounce!Bund is back on major support at 159.26 (Fibonacci retracement, horizontal overlap support) and a potential bounce could occur at this level to push price up to at least 160.65 resistance (Fibonacci retracement, horizontal pullback resistance).

RSI (34) is also making a nice pullback to previous resistance-turned-support line.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

BUND more longIdea:

*Looking for increasing strength from 159.78

* 159.55 to show support, possible retest of the level

DISCLAIMER:

This is where I practice ideas and work on my trading techniques. Please note I am only providing my own trading information for insight to my trading techniques, you should do your own due diligence and not take this information as a trade signal. Trade at your own risk.

Bund has made a bullish exit, potential for further rise!Bund has made a bullish exit and sees major support at 159.26 (Fibonacci retracement, horizontal overlap support). A strong rise could occur from here pushing price up to 160.65 resistance (Fibonacci retracement, horizontal pullback resistance).

RSI (34) has made a bullish exit signaling that there’s a change in momentum from bearish to bullish.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

Bund right above major support, prepare for a potential bounce!

Bund is hovering really nicely above major support at 160.40 (Fibonacci extension, Fibonacci retracement, horizontal swing low support) and a bounce could occur at this level. If price breaks through our descending resistance line, this would add much more conviction to the potential bounce up to 161.88 resistance (Fibonacci retracement, horizontal overlap resistance).

RSI (34) also sees a descending resistance line holding price down really well. Only a break above this could trigger a corresponding bullish bounce in price.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

Bund on major support, potential upcoming bounce!

Bund is seeing major support above 160.40 (100% Fibonacci extension, 78.6% Fibonacci retracement) and a potential bounce could occur at this level to drive price up to at least 161.88 (38.2% Fibonacci retracement, horizontal pullback resistance, 61.8% Fibonacci extension).

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

Bund ShortIdea: Possible resistance and return to the down trend.

DISCLAIMER:

This is where I practice ideas and work on my trading techniques. Please note I am only providing my own trading information for insight to my trading techniques, you should do your own due diligence and not take this information as a trade signal. Trade at your own risk.

Update idea