Bursamalaysia

SNC - Monitor for rebound after all time highReached all time high. Monitor for rebound for entry point.

Green candle = breakout

Red cross = possible entry point

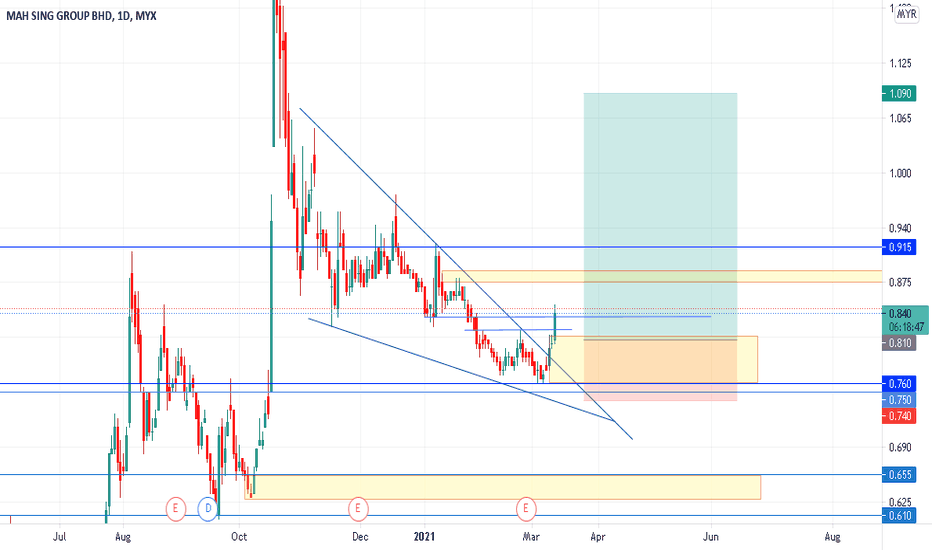

TR 381. Mahsing weekly in uptrend. EMA 20 above EMA 50. Price action just above EMA 200.

2. In H4, it is expected to be in Wave 4 where reversal after ABC at 0.382 Fibonacci level (previous reversal also at 0.382). Doji formed and broken with bullish candle.

3. From Isaham, Profit and Revenue uptrend, PE 22.7, WAFV RM0.92

TR 371. Careplus weekly have completed the ABC cycle and expecting to make another wave.

2. H4 is Wave 4 where reversal expected to be at 0.382 level (previous Wave 2 at 0.618) also an RBS area. Hammer formed and break with bullish candle.

3. From isaham, profit and revenue increasing, PE 5.3, WAFV RM2.83

Handle is forming nowHandle is forming now, by seeing double Top doji two days before, so today the candle chosen to be red, indicating the starting of forming handle.

By monitoring the possible support, 0.605-0.615 probably is dip of the handle. Next, monitor the volumes from 1-3 days when candle with low volumes at support area. That is crucial which it will determine the next direction, if it is tend to form handle, it will surge up, or else, it will go further down to next Support.

I wouldn't guess how long it will form the handle, but by monitoring volumes and candles will provide a very good signal for coming trading days.

By the way, the quarter report will be released on late May, so for the current situation is just solely technical play.

EVERGRN Buying opportunities or distribution?Why Buy?

1. Price test EMA100

2. Retest fibo retracement 61.8%

3. RSI test 40 level (Mark Up area) after a drop on 11 Jan 2021.

4. This counter is supported by multiple big boys.

Watch out for

1. RSI has tested 60 level multiple times (MarkDown area), if RSI close below level 40 there will be a chance for another spring down.

2. Recent quarter report not so good.

Pav golden bull to the rescuePrice held at the 1.35 support zone for the past 2 months and wasn't able to breakthrough (also potentially serving as the 2nd touch of a trendline) . As for now, we can see huge pump, breaking the previous bearish engulfing. Overall we can see that other REITs have showed upside movements as well. Ideal position would be a retest on the pump, but price may just shoot up anytime, so manage your own risks.

*DYOR on fundamentals

MYX:PAVREIT

CHOOBEE 5797 Lonjakan Momentum?The study is based upon Volume Price Spread Analysis and Momentum

CHOOBEE has clearly shown Momentum spike.

Close: 1.76

EP: 1.79<

SL: 1.54

TP: 1.91/ 2.02/ Open

* The NTA looks good at more than 50% discounted value.

Disclaimer: This study does not constitutes Buy/Sell per say. Please consult your financial advisor before making any trading/investing decision

MELEWAR 3778 Trend Breakout The study...is based upon Volume Price Spread Analysis and Momentum

Melewar has shown both Trend Breakout with Momentum

Close: 0.60

EP: 0.62<

SL: 0.52/0.47

TP: 0.69/ 0.77/0.81/open

*The last 2 Quarters the Company had shown consecutive increment in both Revenue and Net Profit. The current NTA stands at 0.96 which is more than 30% discount.

Disclaimer: This study does not constitutes Buy/Sell per say. Please consult your financial advisor before making any trading/investing decision

Interesting pattern in makingA flattop Triangle is forming, It could be seen lower and lower volume now but the daily candles just need to swing inside the triangle.

EMA 120 is 4.17 around, fairly priced now from TA. Fundamentally, company is doing ok.

From Fib Retracement, I'm offsetting a simple Resistant and Support line into 4.30, and 3.90 respectively.

From the current pattern, it looks good still, let see how.

GESHEN a Hidden GemMonitor for entries near support at 1.530 and 1.405 if it continues to retrace from today. Ascending nicely in parallel channel since it broke out from triangle pattern on 18 Jan and bankers are solidly in position since.

Core business is plastic injection moulding and metal stamping which are vital for EMS.

Disclaimer: Trade at your own risk.

Correction undergoing but...A beautiful Flat Bottom is forming, as usual, lower and lower volume is seen.

Now have to be careful to sustain around 1.550-1.570.

But, Head & Shoulder is forming too. First have to monitor whether it will sustain inside the Triangle, or else, it will come down to the next support.

ULICORP 7133 Breakout with MomentumStudy...based upon Volume Price Spread Analysis and Momentum

ULICORP has shown Breakout with Momentum

Close: 1.24

EP: 1.26<

SL: 1.09

TP: 1.43/1.54/1.83

Disclaimer: This study does not constitutes Buy/Sell per say. Please consult your financial advisor before making any trading/investing decision

HEXZA 3298 Momentum BreakoutStudy...based upon Volume Price Spread Analysis and Momentum

HEXZA has shown Breakout with Momentum

Close: 1.17

EP: 1.19<

SL: 1.02

TP: 1.45/1.73/open

Disclaimer: This study does not constitutes Buy/Sell per say. Please consult your financial advisor before making any trading/investing decision