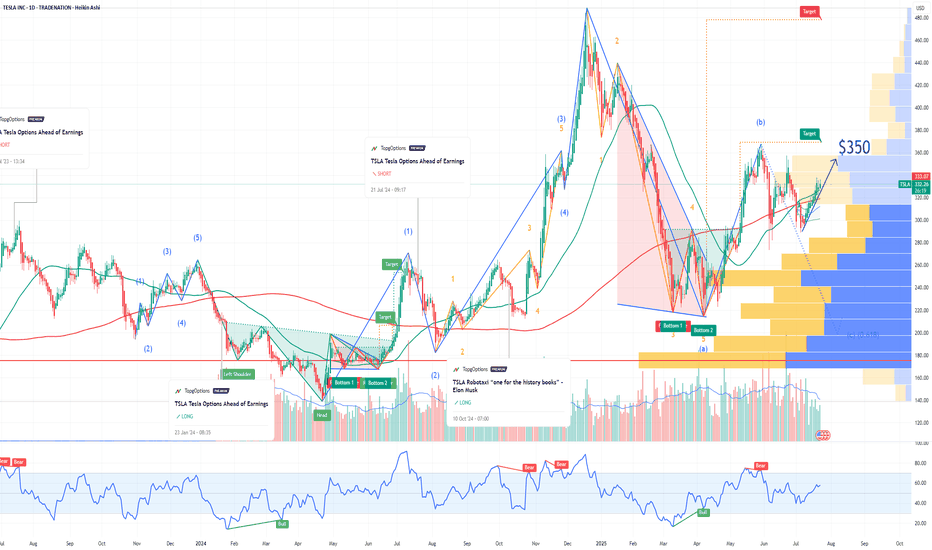

TSLA Tesla Options Ahead of EarningsIf you haven`t bought TSLA before the recent rally:

Now analyzing the options chain and the chart patterns of TSLA Tesla prior to the earnings report this week,

I would consider purchasing the 350usd strike price Calls with

an expiration date of 2025-8-15,

for a premium of approximately $14.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Buy-sell

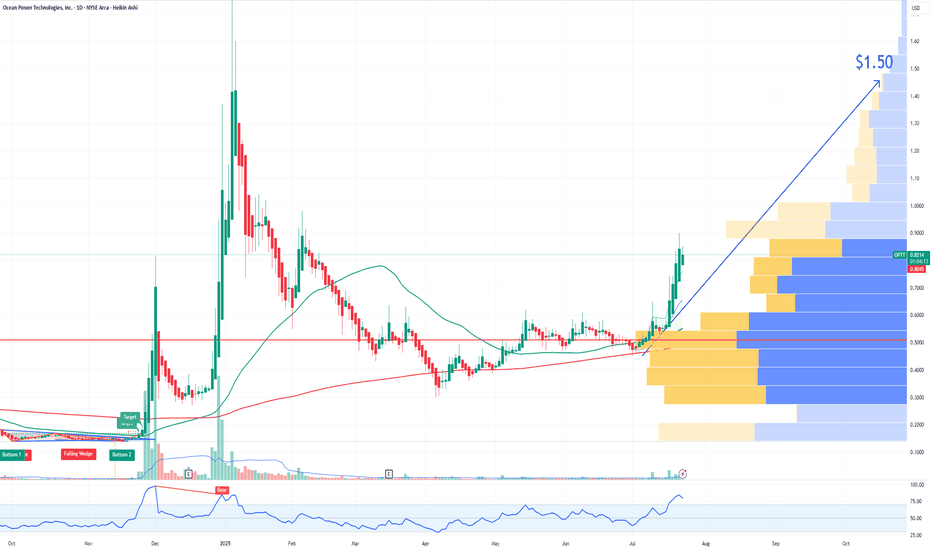

OPTT Ocean Power Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of OPTT Ocean Power Technologies prior to the earnings report this week,

I would consider purchasing the 1.50usd strike price Calls with

an expiration date of 2025-11-21,

for a premium of approximately $0.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

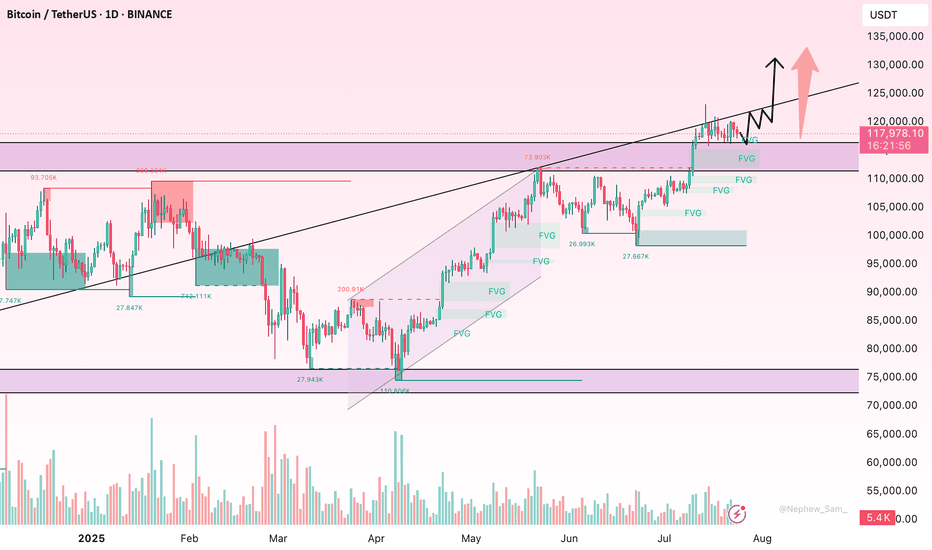

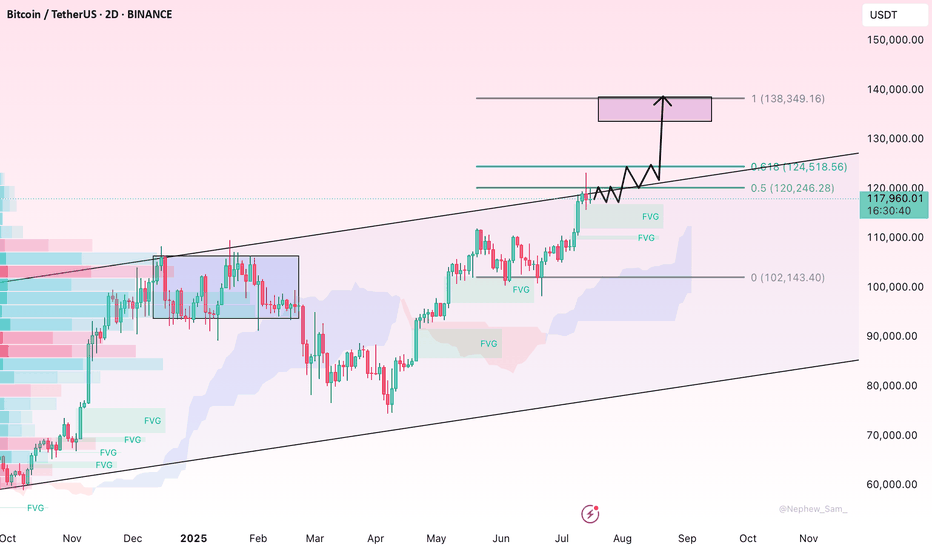

BTC Consolidates Below Key Resistance – Is a Breakout Imminent?Bitcoin is currently consolidating beneath the major psychological resistance near $120,000. The medium-term trend remains bullish, supported by a series of higher highs and higher lows. However, recent candlesticks with long upper wicks reflect hesitation among buyers at elevated levels, pointing to potential exhaustion in short-term momentum.

Despite this, there are no clear signs of bearish divergence or strong reversal patterns. The sideways range between $112,000–$120,000 likely represents a healthy consolidation phase after a strong rally. If the price maintains support around $113,000 and breaks above $120,000 with convincing volume, the next leg higher could follow swiftly.

For now, buyers remain in control, provided BTC holds key structural supports. A breakout confirmation is crucial for bullish continuation.

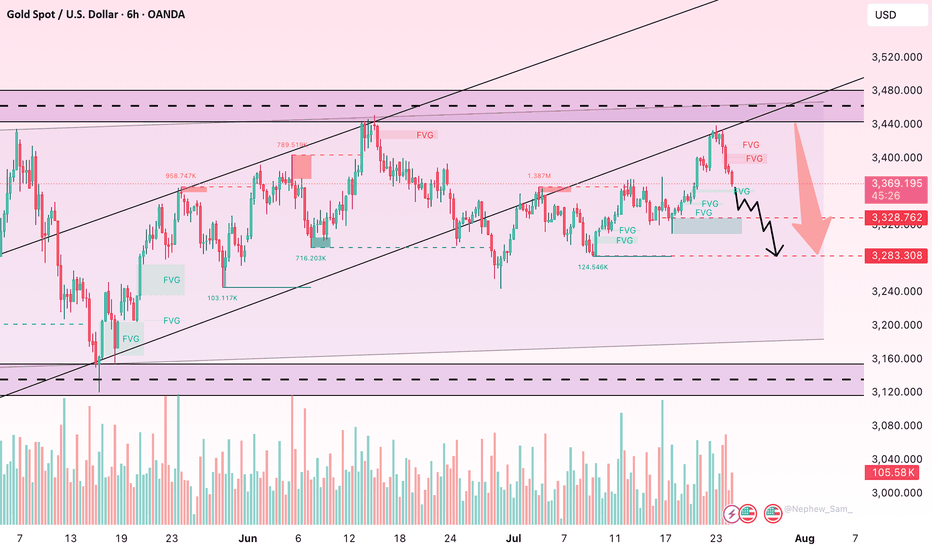

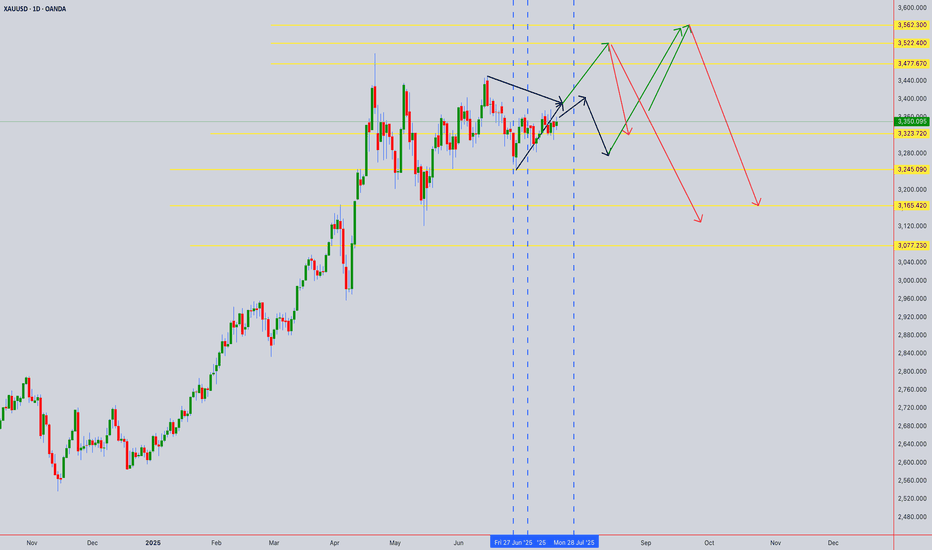

Gold’s Next Move: Bounce or Breakdown?Gold is pulling back after breaking the 3,360 USD resistance on the 6-hour chart. Price is currently testing the nearest fair value gap (3,370–3,380), but upside momentum is stalling, partly due to unfilled supply zones above.

A retest of the lower FVG near 3,340 will be key. Holding above this level could trigger renewed buying, while a break below may invalidate the bullish structure.

Traders should closely monitor whether downside gaps continue to fill and how price behaves near support zones. Lack of strong liquidity could lead to a false breakout.

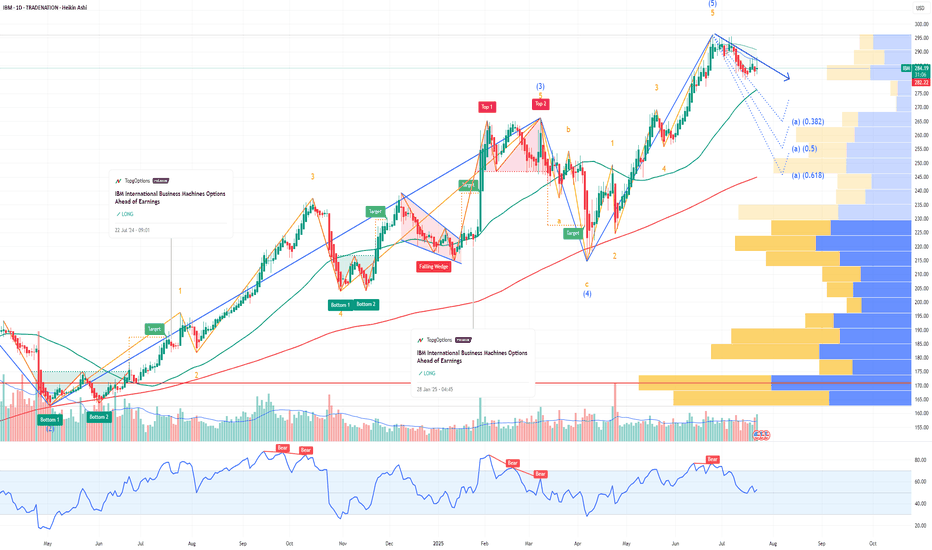

IBM International Business Machines Options Ahead of EarningsIf you haven`t bought IBM before the rally:

Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 290usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $17.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

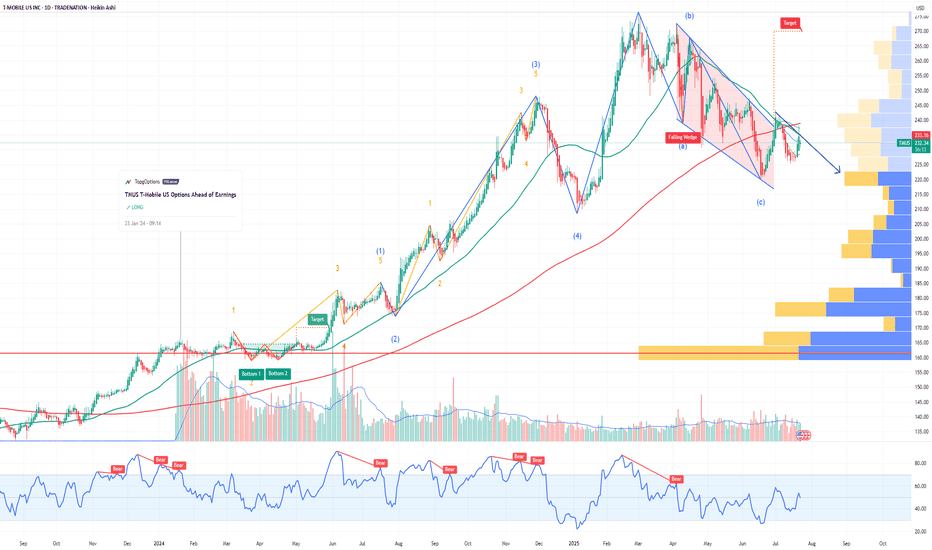

TMUS T-Mobile US Options Ahead of EarningsIf you haven`t bought TMUS before the rally:

Now analyzing the options chain and the chart patterns of TMUS T-Mobile US prior to the earnings report this week,

I would consider purchasing the 227.5usd strike price Puts with

an expiration date of 2025-7-25,

for a premium of approximately $3.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

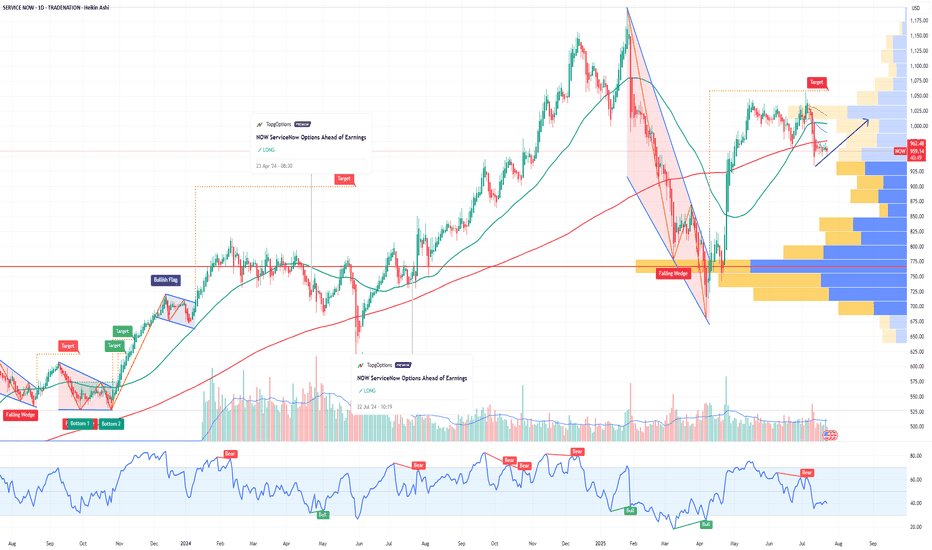

NOW ServiceNow Options Ahead of EarningsIf you haven`t bought NOW before the recent rally:

Analyzing the options chain and the chart patterns of NOW ServiceNow prior to the earnings report this week,

I would consider purchasing the 960usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $97.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

LVS Las Vegas Sands Options Ahead of EarningsIf you haven`t bought LVS before the rally:

Now analyzing the options chain and the chart patterns of LVS Las Vegas Sands prior to the earnings report this week,

I would consider purchasing the 48.5usd strike price Puts with

an expiration date of 2025-7-25,

for a premium of approximately $1.22.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

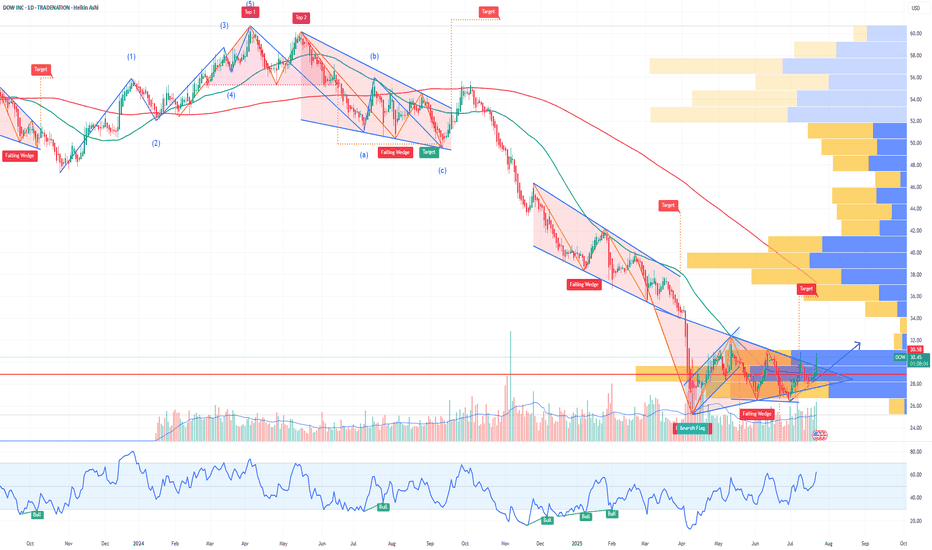

DOW Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DOW prior to the earnings report this week,

I would consider purchasing the 30usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $2.36.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOOGL Alphabet Options Ahead of EarningsIf you haven`t bought GOOGL before the rally:

Now analyzing the options chain and the chart patterns of GOOGL Alphabet prior to the earnings report this week,

I would consider purchasing the 215usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $8.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD 24-Hour Technical Analysis Forecast - UTC+4 Current Price: $3,350.095 (Close: Friday, July 18th, 2025) UTC+4

Analysis Period : Next 24 Hours (July 21-22, 2025) UTC+4

Market Status: Weekend - Preparing for Monday Open 02:00AM 21st July 2025

EXECUTIVE SUMMARY - 24H OUTLOOK

Primary Bias: Neutral to Bearish (Short-term)

Key Resistance: $3,375 - $3,390

Critical Support: $3,285 - $3,300

Expected Range: $3,300 - $3,380

Volatility Level: Moderate to High

CANDLESTICK PATTERN ANALYSIS

Friday's Close Formation

Pattern: Doji-like formation at resistance zone

Significance: Indecision after testing $3,350+ levels

Volume: Moderate - no strong conviction breakout

Context: Failed to close decisively above $3,375 resistance

Expected 24H Patterns

Monday Gap: Potential gap down to $3,320-3,330 area

Reversal Patterns: Watch for hammer/doji at support levels

Continuation Signals: Break below $3,300 could trigger bearish continuation

HARMONIC PATTERN ANALYSIS

Current Harmonic Setup

Primary Pattern: Potential Bearish Bat completing

X: $3,285 (previous low)

A: $3,390 (recent high)

B: $3,320 (61.8% retracement)

C: $3,375 (78.6% projection - current area)

D (Target): $3,300-3,285 (88.6% completion zone)

Fibonacci Levels (24H Focus)

Golden Ratio Resistance: $3,375 (current test area)

61.8% Support: $3,320

78.6% Support: $3,300

88.6% Critical Support: $3,285

Pattern Completion Probabilities

Bearish Bat Completion: 70% probability targeting $3,285-3,300

Bullish Cypher Setup: 30% if break above $3,390

ELLIOTT WAVE THEORY - 24H COUNT

Primary Wave Count

Macro Structure: Wave 5 of larger impulse possibly topping

Current Sub-wave: Wave (c) of corrective structure

Mini Count: 5-wave decline from $3,390 high in progress

24-Hour Wave Projection

Wave 1: $3,390 → $3,320 (Completed)

Wave 2: $3,320 → $3,360 (Completed - 50% retrace)

Wave 3: $3,360 → $3,285 (In Progress - Target Area)

Wave 4: $3,285 → $3,310 (Projected)

Wave 5: $3,310 → $3,260 (Extended target)

Critical Levels

Wave 3 = 1.618 × Wave 1: $3,285 (Primary target)

Invalidation: Above $3,390 (Wave 2 high)

WYCKOFF THEORY - 24H PHASE

Current Market Phase

Phase Assessment: Distribution Phase C (Testing Supply)

Composite Operator Action: Testing demand at $3,350 area

Volume Analysis: Declining volume on recent rallies (bearish)

Expected 24H Wyckoff Action

Phase Transition: Moving toward Phase D (Markdown begins)

Supply Test: Failed test at $3,375 confirms distribution

Target: Initial markdown to $3,285-3,300 area

Key Wyckoff Signals (24H)

No Demand: Expected at current levels

Selling Climax: Possible if break below $3,285 with high volume

Automatic Rally: Dead cat bounce to $3,320-3,330

W.D. GANN THEORY - 24H ANALYSIS

Square of Nine Analysis

Current Position: 3350° on Gann wheel

Next Cardinal Point: 3375° (90° angle - strong resistance)

Support Angles: 3300° (natural support), 3285° (critical angle)

Geometric Progression: $3,285 = perfect square root relationship

Time Theory - 24H Cycle

Natural Time Window: 24-hour cycle from Friday's high

Critical Time: 14:00-16:00 UTC Monday (historical turning point)

Lunar Influence: New moon phase approaching (bearish for commodities)

Angle Theory

45° Line: Currently at $3,320 (rising support)

63.75° Line: $3,285 (steep support angle)

26.25° Line: $3,375 (resistance angle)

Price Forecasting (Gann Methods)

Primary Target: $3,285 (Square root of 81²)

Secondary Target: $3,240 (Square root of 80²)

Resistance: $3,375 (Square root of 82.5²)

Time Forecasting

Turn Time 1: 06:00 UTC Monday (18 hours from Friday close)

Turn Time 2: 14:00 UTC Monday (26 hours from Friday close)

Major Turn: 22:00 UTC Monday (34 hours - Fibonacci time)

MULTI-TIMEFRAME INTRADAY ANALYSIS

5-Minute Chart Analysis

Trend: Bearish momentum building

Pattern: Lower highs, lower lows since Friday high

Key Levels:

Resistance: $3,360-3,365

Support: $3,330-3,335

RSI: Approaching oversold (35-40 range)

Volume: Increasing on down moves

15-Minute Chart Analysis

Structure: Bearish flag formation

Breakdown Level: Below $3,340

Target: $3,300-3,310 (flag pole projection)

Moving Averages: Price below EMA 20 ($3,358)

MACD: Bearish crossover confirmed

30-Minute Chart Analysis

Primary Trend: Corrective phase active

Chart Pattern: Descending triangle

Apex: Around $3,335-3,340

Breakout Direction: 65% probability downward

Volume Profile: Heavy selling at $3,350-3,375

1-Hour Chart Analysis

Major Structure: ABC correction in progress

Current Position: C-wave development

Fibonacci Target: $3,285 (127.2% extension)

Bollinger Bands: Price touching lower band

Stochastic: Oversold but no divergence yet

4-Hour Chart Analysis

Macro Trend: Still bullish above $3,200

Correction Depth: 23.6% retracement maximum expected

Support Zone: $3,280-3,300 (confluences)

Resistance Zone: $3,375-3,390 (proven strong)

Ichimoku: Price approaching cloud support

TECHNICAL INDICATORS MATRIX

Momentum Indicators

RSI (4H): 42 (Neutral-Bearish)

RSI (1H): 35 (Oversold approaching)

Stochastic: %K: 28, %D: 35 (Oversold)

Williams %R: -75 (Strong oversold)

Trend Indicators

MACD (4H): Bearish crossover pending

ADX: 28 (Moderate trend strength)

Parabolic SAR: $3,365 (Sell signal if broken)

Volume Indicators

OBV: Declining (distribution pattern)

Volume Rate of Change: Negative

Accumulation/Distribution: Slight distribution

KEY SUPPORT & RESISTANCE LEVELS (24H)

Immediate Resistance Levels

R1: $3,365 (Previous support turned resistance)

R2: $3,375 (Major psychological & Gann resistance)

R3: $3,390 (Recent swing high)

R4: $3,410 (Extended resistance)

Critical Support Levels

S1: $3,330 (Immediate support)

S2: $3,300 (Psychological & Fibonacci)

S3: $3,285 (Major harmonic & Gann target)

S4: $3,260 (Extended support)

24-HOUR TRADING SCENARIOS

Scenario 1: Bearish Breakdown (60% Probability)

Trigger: Break below $3,330 with volume

Target 1: $3,300-3,310

Target 2: $3,285-3,290

Extended Target: $3,260-3,270

Stop Loss (Shorts): Above $3,370

Scenario 2: Range-Bound Consolidation (25% Probability)

Range: $3,320-3,375

Strategy: Fade extremes

Buy Zone: $3,320-3,330

Sell Zone: $3,365-3,375

Breakout Confirmation: Volume spike

Scenario 3: Bullish Reversal (15% Probability)

Trigger: Break above $3,375 with volume

Target 1: $3,390-3,400

Target 2: $3,410-3,420

Invalidation: Below $3,285

RISK FACTORS & CATALYSTS (24H)

Bearish Catalysts

US Dollar strength continuation

Risk-off sentiment from geopolitical tensions

Profit-taking ahead of weekend

Technical breakdown confirmation

Bullish Catalysts

Safe-haven demand surge

US Dollar weakness

Central bank buying speculation

Technical oversold bounce

High-Impact Events (Next 24H)

Asian market opening sentiment

US Dollar Index movement

Cryptocurrency correlation effects

Weekend gap analysis

TRADING RECOMMENDATIONS (24H)

For Scalpers (5M-15M)

Strategy: Fade bounces to resistance

Entry: $3,355-3,365 area

Target: $3,335-3,340

Stop: $3,375

Risk/Reward: 1:2

For Swing Traders (1H-4H)

Primary Setup: Short on retracement

Entry Zone: $3,350-3,360

Target 1: $3,300

Target 2: $3,285

Stop Loss: $3,385

Conservative Approach

Wait for: Clear breakdown below $3,330

Entry: $3,325 (confirmation)

Target: $3,285-3,290

Stop: $3,345

CONFLUENCE FACTORS

Bearish Confluence at $3,285

Harmonic Bat pattern completion (88.6% level)

Gann Square of Nine critical angle

Elliott Wave 3 = 1.618 × Wave 1 target

Fibonacci 78.6% retracement level

Previous significant support area

Wyckoff markdown initial target

Resistance Confluence at $3,375

Gann 90-degree angle resistance

Harmonic pattern resistance

Elliott Wave corrective high

Previous breakout level

Psychological round number

FINAL 24H FORECAST SUMMARY

Expected Price Action: Controlled decline toward $3,285-3,300 support zone with potential for brief consolidation before further weakness.

Primary Targets (Downside):

First: $3,300-3,310

Second: $3,285-3,290

Extended: $3,260-3,270

Key Invalidation: Sustained break above $3,375 would shift bias bullish toward $3,390-3,410.

Risk Management: Position sizing should be conservative due to high volatility expectations and weekend gap risks.

Probability Assessment:

60% - Bearish scenario

25% - Sideways consolidation

15% - Bullish reversal

Disclaimer: This analysis is for educational purposes only. Gold trading involves substantial risk. Always use proper risk management and never risk more than you can afford to lose.

Volume profile resistance

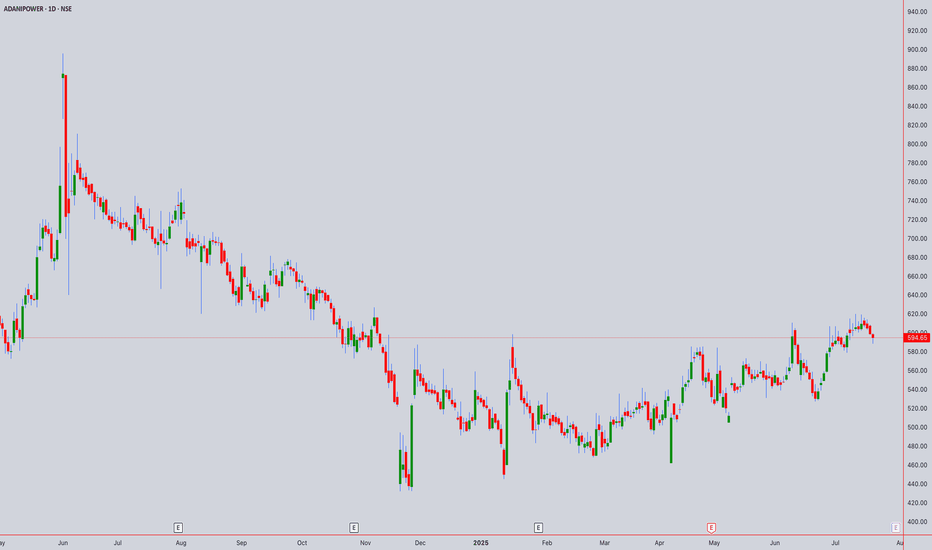

Adani Power (NSE:ADANIPOWER) Technical Analysis July 18th, 2025Current Price : ₹594.65 (as of July 18th, 2025, 02:00PM UTC+4)

Target Price: ₹633.67 (+6.56% upside potential)

Executive Summary

Adani Power is currently showing mixed signals across different timeframes. The stock has broken through key resistance levels but is facing overhead resistance. Multiple technical theories suggest a consolidation phase with potential for upward movement.

1. CANDLESTICK PATTERN ANALYSIS

Intraday Patterns (5M-1H)

Current Formation: Doji/Spinning top patterns indicating indecision

Key Pattern: Inside bar formations suggest consolidation

Volume Profile: Moderate volume with no significant breakout confirmation

Swing Patterns (4H-Weekly)

Primary Pattern: Rectangle/Channel formation identified

Support Zone: ₹513-520 (Strong support)

Resistance Zone: ₹588-600 (Current testing area)

2. HARMONIC PATTERN ANALYSIS

Potential Patterns

ABCD Pattern: Incomplete - monitoring for completion around ₹630-650 zone

Gartley Pattern: Potential bearish setup if rejection occurs at current levels

Fibonacci Levels:

Support: ₹450 (S1), ₹300 (S2), ₹200 (S3)

Resistance: ₹700 (R1), ₹850 (R2), ₹1,000 (R3)

3. ELLIOTT WAVE THEORY

Wave Count Analysis

Primary Wave: Currently in Wave 3 of a larger impulse structure

Sub-wave: Wave 4 correction potentially completing around ₹580-590

Target: Wave 5 projection towards ₹700-750 zone

Invalidation Level: Below ₹513 would negate current count

Time Cycles

Short-term: 5-8 day correction cycle

Medium-term: 21-34 day impulse cycle active

4. WYCKOFF THEORY ANALYSIS

Current Phase Assessment

Phase: Potential Mark-up Phase (Phase D-E transition)

Volume Analysis: Accumulation patterns visible on weekly charts

Smart Money: Institutional interest evident from volume profiles

Composite Operator: Testing supply around ₹600 levels

Key Levels

Spring Test: ₹513 level held as key support

Supply Line: ₹588-600 acting as resistance

Upthrust Potential: Break above ₹605 could trigger mark-up

5. W.D. GANN THEORY ANALYSIS

Square of Nine Analysis

Current Position: 594° on the wheel

Next Resistance: 625° (₹625) - significant Gann angle

Support Level: 576° (₹576) - 45-degree angle support

Cardinal Points: 600° represents a critical decision point

Time Theory

Natural Time Cycles: 90-day cycle completion expected by August 2025

Anniversary Dates: Historical significant dates align with current timeframe

Time Windows: July 25-30, 2025 represents important time cluster

Angle Theory

1x1 Angle: Currently trading above the 1x1 rising angle from ₹513 low

2x1 Angle: Resistance at ₹630 level (steep angle)

Price/Time Squares: Next square at ₹625 (25²)

Forecasting

Price Target: ₹625-650 based on geometric progressions

Time Target: 15-20 trading days for next significant move

Harmony Level: ₹594 is in harmony with previous swing levels

6. ICHIMOKU KINKO HYO ANALYSIS

Cloud (Kumo) Analysis

Current Position: Price trading above the cloud (bullish)

Cloud Thickness: Thin cloud ahead suggests easier breakout potential

Cloud Color: Green cloud in coming periods (bullish bias)

Line Analysis

Tenkan-sen (9): ₹587 - price above (bullish)

Kijun-sen (26): ₹571 - price above (strong bullish)

Chikou Span: Clear of price action (no interference)

Senkou Span A: ₹579 (support)

Senkou Span B: ₹562 (key support)

7. TECHNICAL INDICATORS

RSI Analysis

Current RSI: 58-62 range (neutral to slightly bullish)

Divergence: No major divergences detected

Overbought/Oversold: Not in extreme zones

Bollinger Bands

Position: Price in upper half of bands

Squeeze: Bands expanding, indicating increased volatility

Signal: Potential for continued upward movement

VWAP Analysis

Daily VWAP: ₹591 (price above - bullish)

Weekly VWAP: ₹584 (strong support)

Volume Profile: Heavy volume around ₹570-580 zone

Moving Averages

SMA 20: ₹583 (bullish crossover)

EMA 20: ₹586 (price above)

SMA 50: ₹567 (strong support)

EMA 50: ₹569 (upward sloping)

SMA 200: ₹524 (long-term bull market)

8. MULTI-TIMEFRAME ANALYSIS

Intraday Timeframes

5-Minute Chart

Trend: Sideways with bullish bias

Key Level: ₹592-596 range bound

Signal: Wait for breakout above ₹600

15-Minute Chart

Trend: Consolidating triangle pattern

Volume: Decreasing (typical in consolidation)

Target: ₹605-610 on upside breakout

30-Minute Chart

Trend: Higher highs and higher lows intact

Support: ₹590-592

Resistance: ₹598-602

1-Hour Chart

Trend: Bullish flag pattern forming

Breakout Level: Above ₹602

Target: ₹625-630

4-Hour Chart

Trend: Strong uptrend since ₹513 low

Pattern: Bull flag consolidation

Key Level: ₹588 as crucial support

Swing Timeframes

Daily Chart

Trend: Primary uptrend intact

Pattern: Rectangle between ₹513-588 broken upside

Target: Next resistance at ₹700 zone

Weekly Chart

Trend: Long-term bullish structure

Support: ₹450-500 major support zone

Resistance: ₹700-750 target area

Monthly Chart

Trend: Recovery from major lows

Long-term View: Potential for ₹850+ targets

Time Horizon: 6-12 months for major targets

9. FORECAST & OUTLOOK

Intraday Forecast (Next 1-5 Days)

Bias: Neutral to Bullish

Range: ₹585-610

Breakout Level: Above ₹605 for ₹625 target

Stop Loss: Below ₹582

Swing Forecast (Next 2-8 Weeks)

Primary Target: ₹633-650

Secondary Target: ₹700-720

Support Zone: ₹570-580

Risk Level: Medium (volatility expected)

Key Risk Factors

Overall market sentiment and Adani group developments

Earnings disappointment (recent -23.91% surprise noted)

Broader power sector dynamics

Regulatory changes in power sector

Trading Strategy Recommendations

For Intraday Traders

Buy: Above ₹602 with ₹610-615 target

Sell: Below ₹590 with ₹582-585 target

Risk Management: 1-2% position sizing

For Swing Traders

Accumulate: ₹580-590 zone

Target: ₹633-650 (first target)

Stop Loss: Below ₹570 (daily close basis)

Time Horizon: 4-8 weeks

Confluence Factors Supporting Bullish View

Multiple theories align for ₹625-650 targets

Strong volume accumulation patterns

Technical breakout from rectangle formation

Ichimoku cloud support

Gann squares and angles alignment

Warning Signals to Watch

Daily close below ₹580

RSI divergence formation

Volume decrease on any upward moves

Broader market weakness

Disclaimer: This analysis is for educational purposes only. Always consult with financial advisors and conduct your own research before making investment decisions. Past performance does not guarantee future results.

Gold prices fall in the short term – What's next?Hello everyone, what’s your take on gold?

Today, gold continues to attract short-term selling pressure as USD buying momentum returns and expectations for Fed rate cuts diminish. On the other hand, an overall positive risk sentiment is also seen as another factor weighing on the precious metal.

At the time of writing, gold is trading around the EMA 34 and 89 near 3,336 USD. With no major updates expected, the market is likely to remain steady throughout the day.

From a technical perspective, the bearish trend persists, with prices capped below the trendline. A series of lower highs and lower lows could push XAUUSD to retest deeper levels, potentially reaching the 3,300 USD mark. However, lingering trade uncertainties may limit losses for this safe-haven asset.

This is just my view on the market, not financial advice.

BTC Nears $120K – Pullback Risk or Breakout Launchpad?Bitcoin has rallied strongly after breaking its multi-week consolidation, now hovering just under the key psychological and historical resistance at $120K. The daily chart shows price floating above the 20EMA, with no signs of distribution—yet. However, the dense liquidity pocket between $110K–$114K remains a magnet in case of a technical pullback.

If bulls defend $118K and price cleanly breaks above $121K with strong volume, the next target lies in the $125K–$128K zone. Spot ETF inflows remain healthy, and any dovish pivot from the Fed could set off another crypto-wide bull wave.

UAL United Airlines Holdings Options Ahead of EarningsIf you haven`t exited UAL before the recent selloff:

Now analyzing the options chain and the chart patterns of UAL United Airlines Holdings prior to the earnings report this week,

I would consider purchasing the 92.5usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $5.12.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Arbitrage Opportunity!I believe I’ve identified an arbitrage opportunity involving the DEFI cryptocurrency: it trades at $0.003200 on Bybit, compared to only $0.002390 on MEXC.

I recall encountering a similar situation with Shiba Inu, when the price gap between Binance and Coinbase was as high as 8X. Feel free to play the chart below to see the outcome:

I also remember the 2016–2017 period, when such arbitrage opportunities existed even with Bitcoin, due to price discrepancies between Asian exchanges and those available to European traders.

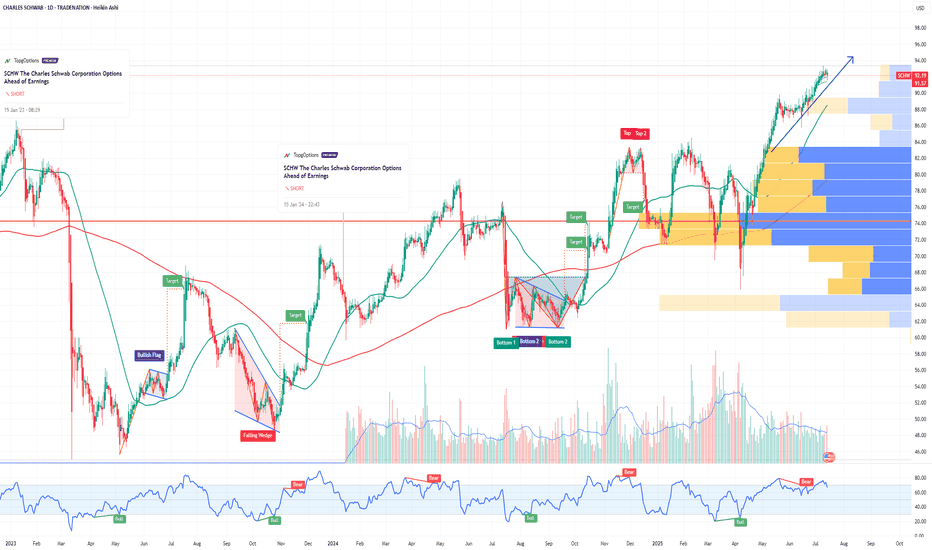

SCHW The Charles Schwab Corporation Options Ahead of EarningsIf you haven`t sold SCHW before the sell-off:

Now analyzing the options chain and the chart patterns of SCHW The Charles Schwab Corporation prior to the earnings report this week,

I would consider purchasing the 92.5usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $7.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

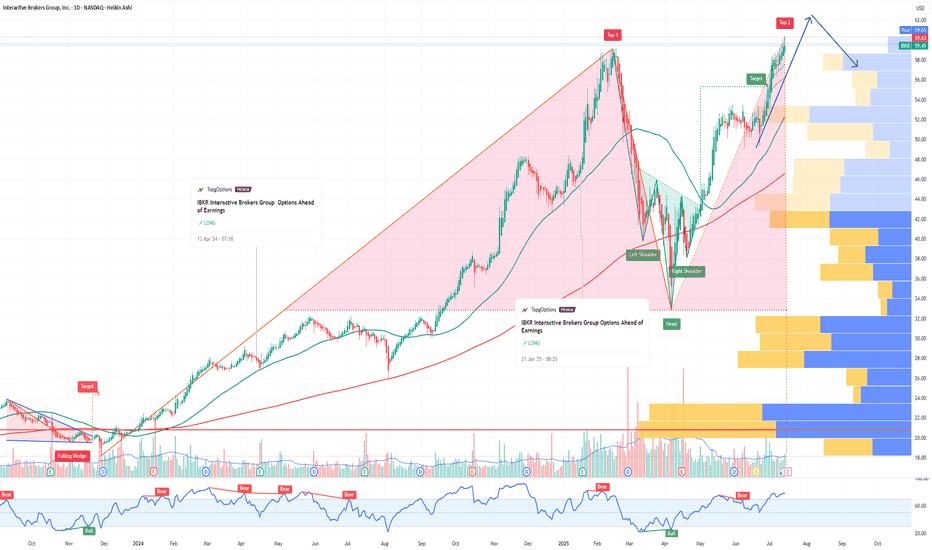

IBKR Interactive Brokers Group Options Ahead of EarningsIf you haven`t bought IBKR before the rally:

Now analyzing the options chain and the chart patterns of IBKR Interactive Brokers prior to the earnings report this week,

I would consider purchasing the 60usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $3.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AXP American Express Company Options Ahead of EarningsIf you haven`t bought AXP before the rally:

Now analyzing the options chain and the chart patterns of AXP American Express Company prior to the earnings report this week,

I would consider purchasing the 480usd strike price Calls with

an expiration date of 2027-1-15,

for a premium of approximately $6.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

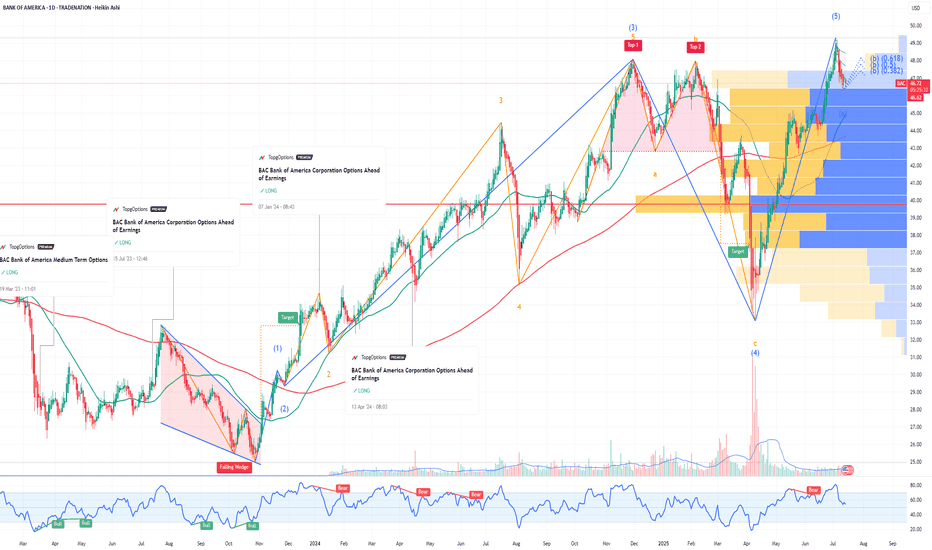

BAC Bank of America Corporation Options Ahead of EarningsIf you haven`t bought BAC before the rally:

Now analyzing the options chain and the chart patterns of BAC Bank of America Corporation prior to the earnings report this week,

I would consider purchasing the 48usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $0.34.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

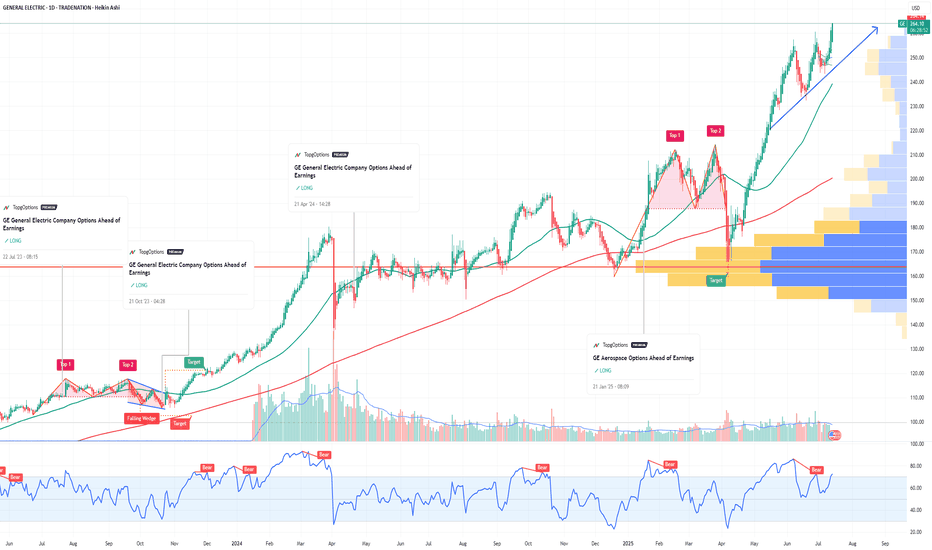

GE Aerospace Options Ahead of EarningsIf you haven`t bought GE before the rally:

Now analyzing the options chain and the chart patterns of GE Aerospace prior to the earnings report this week,

I would consider purchasing the 270usd strike price Calls with

an expiration date of 2025-8-15,

for a premium of approximately $8.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

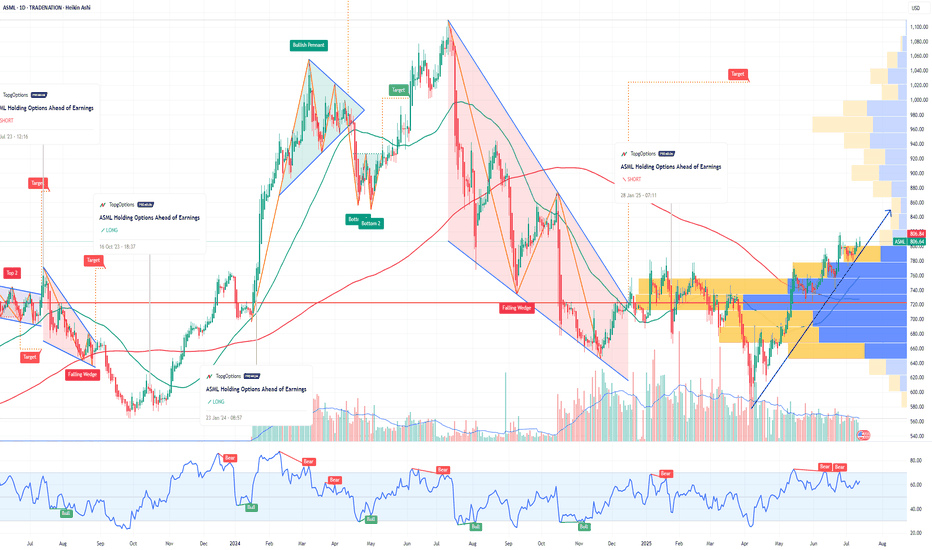

ASML Holding Options Ahead of EarningsIf you haven`t bought the dip on ASML:

Now analyzing the options chain and the chart patterns of ASML Holding prior to the earnings report this week,

I would consider purchasing the 800usd strike price Calls with

an expiration date of 2025-7-25,

for a premium of approximately $32.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NFLX Netflix Options Ahead of EarningsIf you haven`t bought NFLX before the previous earnings:

Now analyzing the options chain and the chart patterns of NFLX Netflix prior to the earnings report this week,

I would consider purchasing the 1260usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $71.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.