LTCUSD Technical Analysis 4 hour - Buy opportunity approachingHi there.

Current state:

Out. Waiting to get in. Price action has been mostly lateral, although there are some signs the price may be moving up.

Indicators/Charts analysis:

RSI is in the oversold area still. This means there is room to go up.

Stock RSI approaching overbought area. Watch out for this one since it is not confirming what the RSI is telling us so it could mean a break out, possibly in the down direction.

Renko (0.74 brick) main trend is still down. Although like I said, price action has been lateral so no new red bricks have been forming.

EMA 12, 26, 50 beginning to turn horizontal.

Candle sticks are moving sideways.

Awesome indicator shows bulls have more power than the bears at the moment and it is slowly moving towards 0.

Price is moving below BB media. This suggests there is room to go up.

RSI and Stoch RSI in renko are in the oversold area. This also suggests the possibility of a trend change. They have been there for several periods, so we have to watch out for an up move.

Stop Loss:

$43.78 - This is our possible entry point to the trade. I usually set it slightly above 2 renko bricks from the last red brick.

Target:

$46.49 (+6.1%) - Target was selected based on current volume profiles and Fib retractments (black ribbon in golden river - bottom right chart). We may adjust once we enter the trade and have a better feel for what the market behavior is. Remember we have to be extra patient with our wining trades.

Alarms:

Price crossing up $42.87. This is an early warning that we may be approaching our entry point for our trade.

Conclusion:

Hold. Keep an eye on the market as we may be entering the trade soon.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

If you like this, you can donate LTC to:

LZKza6vBcBnkfaDMHYXXUd6ud8Jf87Lfm3

Any donations will help me keep posting analysis. Also, don't forget to share your comments!

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

***This information is not a recommendation to buy or sell. It is to be used for educational purposes only.**

Buy-signal

NZDCAD buy idea. Am I the only 1 looking at head and shoulders??Well i guess this is clearly a HEAD and SHOULDERS PATTERN for thouse who dont know about it head and shoulers is a pattern that can show us

that the price will probably go on back to the way it came and the way the last shoulder goes on. so in our case it looks like a BUY to me but always keep in mind the supports and be ready all the time :)

GBPUSD bullish until end of 2018, Gann and GartleyA lot of criteria is met for a 90-day reversal that will last until the end of 2018. Extremely bullish.

Zones of note:

1. Bullish Gartley complete.

2. Price support around the 315-degree Square of 9 level.

3. 61.8% Gann arc.

4. Rising volume into the bottom of the swing lows.

5. Bullish Pivot between he last 3 daily candlesticks (middle bullish hammer has a lower low and lower high than the two outside candlesticks).

6. Very close to November 9th, which is the 50% level in time in the Law of Vibration time cycle.

7. The 180-day cycle (Gann wrote that these can be extended +9 days per every 90-day cycle, so the 180-day cycle and go from 180 days to 198 day). From the 2018 high on April 17th.

Metaverse (ETP) x20 Growth PotentialDuring the past month, Metaverse has been one of the best performers against the USD as well as BTC. Throughout entire month of July price was rising consistently and from $0.46 low it has already reached $2.24 high, resulting in almost 400% gain against the USD.

ETP currently looks even stronger, after it broke the 23.6% Fibs resistance at $1.82. After the breakout price corrected down and found the support at the previous Fib resistance level, after which produced a new high.

Higher high and higher lows pattern along with the break above the resistance indicates on a strong uptrend which is likely to continue.

Based on previous analysis on multiple cryptocurrencies, price usually increases by 10 or 20 times, which is regular in the strong bull market. It is possible that ETP/USD bull market has already started, that could bring price up to the $20 or even $25 area.

This would result in a growth of at least 20 times from the recent low at $0.46, which is enormous potential that can be achieved in a relatively short time-frame.

EUR/CHF - INTRADAY SIGNAL - STAY TUNED FOR THE UPDATESPay attention to the updates section as I will be posting when I will be entering my trade.

The analysis is made based on order flow using volume profile + EW

For risk and money management purposes, always determine a max. of 2% risk on every trade.

For example on a $50,000 account, this would be equivalent to 1,25 Lots with an 80 pip stop loss.

Targets and closure of positions may be subject to alteration throughout the course of the trade. This is due to the ever-changing and unpredictable nature of the market.

This post is set to be used and serve as an example and in an educational manner and is not to be taken as direct investment advice.

FCTBTC Cup&Handle will help to breakout from Descending wedgeFactom is in the Descending wedge and can breakout of it upper edge in the near future.

The current price range looks like a solid support, which in the past has been a good reflection of the market decline and has become a turning area for building the recent wave of growth.

At this moment, indicators and trend analysis of the 1-hour timeframe chart suggest that Cup&Handle which is supported by Ichimoku clouds will help to break out of the descending wedge which can be seen on the 1-day timeframe chart. This will start a new wave of growth

If the price drops below 0.00088, then the development of a positive scenario for this asset may take much longer time and you should follow our updates.

Flag-Pattern forming a nice Buy-Chance! #PotentialHey tradomaniacs,

another Chance is forming right now.

A Flag-Pattern is usually a trend continuation pattern and should give us a nice Buy-Signal as soon as we see the Breakout. :-)

If we Break down below the important support we could also sell.

Just be ready for all scenarios. :-) VOLUME inc.

Peace and good trades

Irasor

Trading2ez

Wanna se more? Don`t forget to follow me! :-)

Any questions? Need education or more signals? Pm me. :-)

Metaverse Strong Growth Against BitcoinOn the 24th of June, Metaverse formed a double bottom at 7820 satoshis, after which price went up sharply, resulting in a 160% growth against the Bitcoin. Price has found the resistance at 20900 satoshis, where it has rejected the 38.2% Fibonacci retracement level.

But at the same time ETP/BTC broke above the descending channel and closed above the 200 Moving Average on the daily chart. This could mean the beginning of an uptrend, with the strong upside potential.

Still, the corrective move down could take place, especially after such a strong growth. ETP could decline towards 38.2% Fibonacci support at 15875 satoshis, and perhaps even lower, prior to the uptrend continuation.

There are two scenarios where investors could take advantage of the potential uptrend. Either wait a corrective wave down, the rejection of the Fibonacci support, or trade the breakout above the current resistance level.

Numerai Might Outperform Bitcoin by 55%Yesterday Numerai has tested the low, hitting 81k satoshis. At the same time it found the support at 327.2% Fibonacci, applied to the corrective wave up after the uptrend trendline breakout.

The support is at 85.6k satoshis, and althogh price spiked lower, closing price stayed above that level, suggesting the potential bottom. Although it might seem very risky to consider bying NMR/BTC, the risk/reward ration is very attractive.

If the 81k satoshis support holds, price is likely to encrease towards the 38.2% Fibs, that is 140k satoshis. this level previously acted as the support as well as resistance, which once again could play the same role. When/if the resistance would be reached, NMR would gain 55% over the bitcoin, while if the 81k satoshis is broken, this would be only a 11% loss.

Break below 81k satoshis, would certainly invalidate bullish outlook and is likely to result in a downtrend continuation.

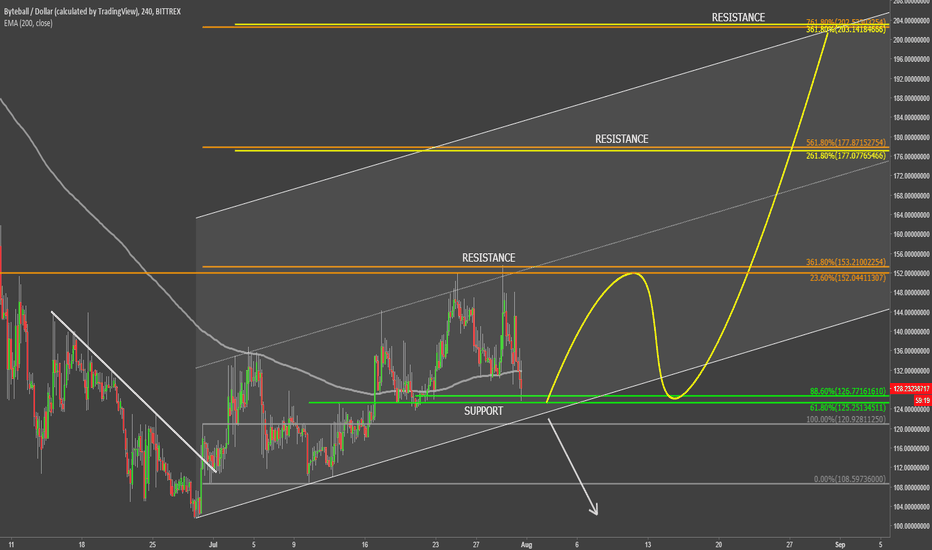

ByteBall at the Support - Uptrend Might ContinueAt the end of June Byteball has tested the low at $100, which is a strong psychological support. After bounce, price went up and broke above the downtrend trendline, corrected down, and went up again, this time breaking above the 200 Moving Average.

GBYTE/USD then bounced off strong resistance area at $150 and went down sharply. Currently it is trading at the $125 support, which could be the starting point for the uptrend continuation. It is worth mentioning that the 200 Moving Average is also acting as the support, as price still failed to break below with confidence.

If GBYTE stays above the $125 level, the uptrend is likely to continue, towards one of the Fibonacci resistance levels. First is at $177, and second is at $200 area, which is the next strong psychological resistance.

All-in-all, trend is bullish, but if the current support is broken, Byteball might once again move down towards the $100 area.

Bitcoin Fast Growth ScenarioOn the 29th of June, Bitcoin has formed a double bottom near $6k key psychological support. At the same time BTC/USD rejected the 4/1 Gann Fan, which also occurred back on the 6th of February, where BTC has rejected 2/1 Gann Fann trendline.

Recently, on the 27th of July, Bitcoin broke above the 200 Moving Average on the daily chart, which is a strong indication of the upside momentum being built. What is also very important is the break above the triangle pattern, which eventually might result in a fast growth.

Going along with the uptrend trendline and 561.8% Fibonacci retracement level, price could jump very soon, reaching $17700 by the end of September. This could be a potential growth of over 100% in less than two month.

Yes, this is a very optimistic scenario, but, it has it's probability which could and should be considered. Nevertheless, it is worth watching few resistance levels of the potential uptrend. First resistance is seen at $10.7k, and second $12.7k. Break above both would be required for the BTC to reached the final upside target at $17.7k.

On a downside, the Bitcoin currently found the support at 200 Moving Average, that has been rejected cleanly few days ago. While the price stays above the $7815, the fast uptrend would have a very high probability. Although break and close this level could result in a correction down prior to moving higher. And finally, only break and close below $5755 would invalidate bullish scenario would would extend the downtrend or a consolidation period.

DigitalNote Double Bottom FormationOn the 15th of June, DigitalNote has formed a double bottom at $0.005 level. This is 161.8% Fibonacci retracement applied to the corrective wave up after the uptrend trendline breakout.

The Fibonacci support has been rejected twice cleanly after which price went up and broke above the 50 moving Average and the descending channel at the same time. On the corrective wave down, XDN/BTC has rejected the upper trendline of the descending channel and went up once again.

It seems that the 50 Moving Average is currently acing as the support and from this point onward XDN might start moving higher. The strong resistance is seen at 38.2% Fibonacci retracement that is $0.01 strong psychological level. Break above it could confirm the bullish trend formation for the long term, while rejection is likely to result in a strong wave down.

On a downside, break and close below the $0.005 support will invalidate short or long term bullish scenario and could send price to new lows.

Decentraland Established The UptrendSince 11th of July, Decentraland has been moving steadily upwards producing higher highs and higher lows. On the 17th of July price reached the high at $0.135, which has resulted in a 53% growth in less than a week.

Then price corrected won to $0.11, where MANA/USD has rejected cleanly 50% Fibonacci retracement level. Today MANA broke above the ascending channel, suggesting the continuation of the uptrend.

There are several resistance levels to watch. First 161.8% at $0.14, second 261.8% at $0.17, and the final upside target and strong resistance is at 361.8% Fibs, that is $0.2.

Substratum Trend Reversal?Substratum did hit the bottom on the 29th of June, where it hit $0.16. At that stage RSI formed a bullish divergence on the 4h timeframe suggesting the correction up.

Currently it is obvious that price started to print higher highs and higher lows, and recently broke above the 200 Moving Average, reaching $0.3 high. On the small corrective move down, SUB/USD has rejected the 200 Moving Average and 38.2% Fibonacci support at $0.25.

Such price action suggest the continuation of the corrective move upwards, and price could reach 38.2% Fibs at $0.45, which also corresponds to the 461.8% Fibs applied to the current corrective wave down.

When/if the resistance is rejected and broken, further growth potential shall become quite likely and could mean trend reversal for the Substratum, which at the end might result in a new all-time high.

ICON vs Bitcoin Slowly Moving UpICON seem to have found the bottom at btc 0.0002 area. Since 14th of June price has been slowly but steadily moving upwards, producing higher highs and higher lows.

While rising, on a correctional wave down ICX/BTC rejected the 2/1 Gann Fan trendline along with the 50% Fibonacci retracement level at btc 0.000215.

Icon has approached the 200 Moving Average, but failed to reach it. It is highly likely that on the next wave up, the Moving Average will be reached, the question is whether it will be broken or rejected.

If broken ICX should continue going higher towards either 61.8% or 76.4% Fibonacci retracement level. But, if Moving Average will be rejected, Icon might correct down, perhaps to test the btc 0.000215 support yet again.

Groestlcoin Upside TargetGroestlcoin has formed a double bottom on the 12th of June and since then price has been climbing up consistently, while rejecting the uptrend trendline. Price broke above the extended descending channel and the 200 Moving Average.

The channel and MA breakout occurred simultaneously just today, suggesting further upside potential. GRS/USD is now highly likely to move up towards the key resistance seen at $0.9. This is the 23.6% Fibonacci retrenchment level, where previously price bounced off a number of times.

If the $0.9 resistance is broken, GRS should test the strong psychological price at $1. And finally, break and close above $1 should confirm the trend reversal, at least for the short to medium term, which could result in a strong growth.

Currently, the correction down is possible, perhaps down to the 200 Moving Average, but only break and close below the $0.48, should invalidate bullish outlook, where Groestlcoin shall continue trending down.

INS Ecosystem Correction UpINS Ecosystem found the bottom at $0.52, that has been tested on the 12th of June. There INS/USD formed a double bottom and rejected the downtrend trendline as well as 127.2% Fibonacci retracement level for the second time, suggesting that the bottom might have been reached.

Today price has been going upwards and broke above the 50 Moving Average. Perhaps this is the first strong sign of a potential upcoming corrective wave down, that should result in a growth towards 88.6% Fibonacci retracement. This is $0.9 level, which corresponds to the previous support formed back in April.

Break above that resistance would most likely result in a growth towards the key psychological support at $1. If INS will managed to break and close above that price, it could mean the beginning of an uptrend and not only a corrective move up.

On a downside, if INS Ecosystem will close below the recent low at $0.52, the bullish outlook should be invalidated, resulting in a continuation of a downtrend or the beginning of a consolidation phase.