CAD/CHF BULLS ARE GAINING STRENGTH|LONG

CAD/CHF SIGNAL

Trade Direction: long

Entry Level: 0.586

Target Level: 0.607

Stop Loss: 0.572

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Buy

AUD/USD Breakdown: Bears in ControlThe AUD/USD pair has officially broken below its medium-term ascending channel on the daily chart, signaling a strong shift in momentum. After failing to hold above the resistance zone at 0.6311 – 0.6386, the pair reversed sharply and is now trading around 0.6213.

🔍 Key technical highlights:

A confirmed breakout beneath the channel support, accompanied by strong bearish candles, suggests growing seller dominance.

Both the EMA 34 and EMA 89 are now positioned well above the current price, reinforcing a medium-term bearish trend.

A potential short-term pullback to the 0.6240 – 0.6266 area may occur before further downside continuation.

📉 Next downside target: If bearish momentum persists and price fails to reclaim the broken support, the pair is likely to slide toward the marked support at 0.59142.

💬 With the USD gaining strength amid hawkish Fed expectations and the AUD facing domestic economic headwinds, selling the rallies remains the favored strategy in the current environment.

DXY Breakdown: Bearish Momentum Builds Amid Weak U.S. DataThe U.S. Dollar Index (DXY) is maintaining a clear bearish trajectory, with price action on the H4 chart showing a consistent pattern of lower highs and lower lows inside a descending channel. The technical structure points to continued selling pressure, and recent fundamental developments only reinforce this view.

📰 Key drivers behind the decline:

The latest U.S. CPI data came in weaker than expected, signaling easing inflationary pressure and fueling expectations that the Federal Reserve may cut interest rates sooner than anticipated.

A slight uptick in jobless claims has raised concerns that the U.S. labor market may be losing momentum.

Simultaneously, global players like China and Japan are shifting toward more stable monetary policy, prompting capital flows away from the dollar.

📉 From a technical perspective, DXY has broken below the key 100.817 support zone and is now trading around 99.7. Each attempt at a bullish pullback has been short-lived, with sellers regaining control quickly. The green arrows on the chart indicate potential reaction zones, but the descending channel structure remains firmly intact.

Outlook: If the index fails to reclaim the 100.8 – 101.3 resistance area, there’s a high probability of further downside toward the 98.5 – 98.0 support region.

In short, DXY is under pressure both technically and fundamentally, which explains the current bullish momentum in EUR/USD, GBP/USD, and especially gold (XAU/USD).

CAD_CHF RISKY LONG|

✅CAD_CHF has retested a key support level of 0.5892

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 0.5949 is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ProShares Short VIX Short-Term Futures ETFInvestment Thesis

ProShares Short VIX Short-Term Futures ETF (SVXY) is a fund that allows you to bet on a decline in volatility with a 0.5x ratio. That is, with a 10% decrease or increase in volatility, this fund will respond with a 5% movement in the opposite direction.

Volatility has significantly increased amid uncertainty due to mutual tariffs between the U.S. and the rest of the world. This presents good opportunities for opening long positions in SVXY.

The risk/reward ratio looks attractive, given that current VIX quotes are near the levels reached during the correction amid the pandemic in 2020. It is also worth noting that the share of S&P 500 components above the 50-day moving average is at local lows, which historically happens rarely and may signal a local potential for market recovery, and thus, a decline in the level of "fear" in the market.

In the base case scenario, we expect that countries will be able to reach agreements regarding the imposed tariffs, which will smooth out the overall impact on the U.S. economy and lead to a reduction in market uncertainty.

Target price – $46.8

Recommendation – Buy

Upside potential – 28%

We recommend setting a stop-loss at the level of $29.9.

DXY Will Move Higher! Long!

Take a look at our analysis for DXY.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 102.170.

Taking into consideration the structure & trend analysis, I believe that the market will reach 102.904 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Road to 3200Gold had a strong 4hr timeframe rejection from the 2960-2980 zone.

Also had a triple bottom in the same area.

Showing super strong signs of another bullish run.

Gold is making the strong move up to the 3140 area once 3100 is broke.

Should get a small rejection off the 3140 zone before a strong push up to a new all time high.

Next all time high goal is 3200 🚀

Short Notes:

•Run up to 3140 (Small rejection/load up zone)

•Then Load up zone 3110-3100

•Take Profit area 3200

As always, trade safe during these high volatility times and go crush it!💰

USOIL SENDS CLEAR BULLISH SIGNALS|LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 57.67

Target Level: 66.44

Stop Loss: 51.82

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/CHF BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

Previous week’s red candle means that for us the EUR/CHF pair is in the downtrend. And the current movement leg was also down but the support line will be hit soon and lower BB band proximity will signal an oversold condition so we will go for a counter-trend long trade with the target being at 0.943.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USDJPY Analysis: Reversal Estimations Based on Trading MathDear Trader,

Please find attached my analysis of $Subject, which uses mathematical calculations to identify potential reversal times and price levels. The analysis details projected south and north price targets (horizontal lines on the chart), along with estimated time frames for possible reversals (vertical lines on the chart, accurate to within +/- 1-2 candles). Please note that all times indicated on the chart, including the vertical lines representing potential reversal times, are based on the UTC+4 time zone.

To increase the probability of these analyses, I recommend monitoring the 5-minute and 15-minute charts for the following key reversal candlestick patterns:

Doji’s

Double Bottom/Top

Engulfing Bullish /Bearish

Hanging Man

Hammer/Inverted Hammer

Morning Star

Shooting Star

Triple Top/Bottom

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya Trade

Price levels

Price DH Price DL

144.52194 144.63007

144.48096 144.67107

144.38595 144.76618

144.19602 144.95648

144.00622 145.14691

143.81654 145.33746

143.62698 145.52814

143.43756 145.71894

143.24825 145.90987

143.05907 146.10093

142.30361 146.86639

141.55015 147.63385

140.79868 148.40332

140.04922 149.17478

139.30176 149.94824

138.55630 150.72370

137.81283 151.50117

137.07137 152.28063

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

GOLD BEST PLACE TO BUY FROM|LONG

GOLD SIGNAL

Trade Direction: long

Entry Level: 3,008.04

Target Level: 3,136.65

Stop Loss: 2,921.80

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

eth buy midterm "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

LONG ON NZD/USDNZD/USD has been oversold since last week.

It has finally given a change of character (choc) on the lower timeframe witching to bullish.

it is currently in the pullback/retracement phase of the new change.

With the dollar in a overall downtrend and getting ready to fall, this correlation should cause the NZD/USD pair to rise.

I have brought NZD/USD looking to make 200-300 pips this week.

USDJPY Will Go Up From Support! Long!

Here is our detailed technical review for USDJPY.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 146.391.

The above observations make me that the market will inevitably achieve 150.489 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USDCAD Will Go Higher! Buy!

Take a look at our analysis for USDCAD.

Time Frame: 6h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 1.424.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.440 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

CADJPY Will Go Up! Long!

Please, check our technical outlook for CADJPY.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 102.695.

Considering the today's price action, probabilities will be high to see a movement to 106.707.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

SILVER SENDS CLEAR BULLISH SIGNALS|LONG

SILVER SIGNAL

Trade Direction: long

Entry Level: 3,050.2

Target Level: 3,274.5

Stop Loss: 2,899.9

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 8h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

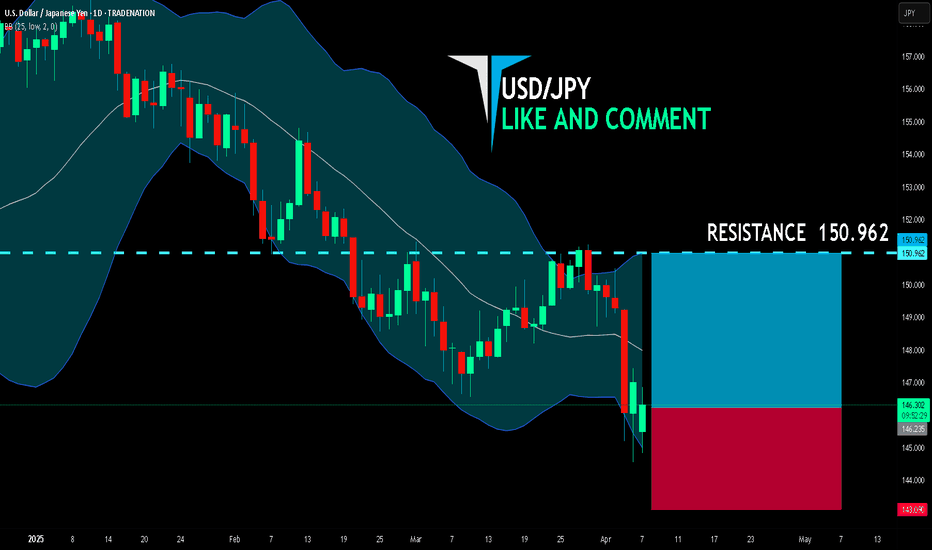

USD/JPY BULLS ARE GAINING STRENGTH|LONG

USD/JPY SIGNAL

Trade Direction: long

Entry Level: 146.235

Target Level: 150.962

Stop Loss: 143.090

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZD/USD BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

We are going long on the NZD/USD with the target of 0.568 level, because the pair is oversold and will soon hit the support line below. We deduced the oversold condition from the price being near to the lower BB band. However, we should use low risk here because the 1W TF is red and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅