OUST Ouster Options Ahead of EarningsAnalyzing the options chain and the chart patterns of OUST Ouster prior to the earnings report this week,

I would consider purchasing the 20usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $0.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Buy

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t sold FDX before the previous earnings:

Now analyzing the options chain and the chart patterns of FDX FedEx Corporation prior to the earnings report this week,

I would consider purchasing the 240usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $12.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AVGO - It's time to Turnaround and GO!NASDAQ:AVGO

Monster Earnings and Move have been shrugged off...

- Ascending Triangle Successful Retest

- 50 WMA Successful Retest

- Volume Shelf

- Key S/R Zone

- Green Support Beam on Wr%

If market gets going then Broadcom is heading to $270 QUICK!

Not financial advice

AMD - Advanced Money Destroyer...Not For Long!NASDAQ:AMD

Has been decimated but the DIP BUY BOX holds strong! $85-$100 could lead to an easy 2x!

- Key S/R Zone

- Massive Volume Shelf

- Bearish WCB Breakout will give Bullish Cue

- Lowest RSI since 2022 BOTTOM

A turnaround here could lead to outsized performance in portfolios.

Not financial advice

MSTR - MicroStrategy : Long Strategy

This stock Microstrategy Inc is showing some good recovery price action here on the 1Hr chart. It is a triple bottom and this is strong market structure, typical of a reversal sequence

The neckline is about 314 which will soon be taken. The chart has a very popular indicator FBB, Fibonacci Bollinger Bands. The middle line is derived from volume moving averages.

It is also bullish on the daily and weekly.

Fundamentals are good, I did hear they burnt through stacks of cash but this was for inventories. Future is bright for this techy and its these companies, Nvidia, Apple, Google etc that lead the markets bullish out of corrections.

TESLA (TSLA)What I’m Watching:

I’m focusing on the 245–250 neckline for a decisive reaction. If buyers defend this level, it could signal a continuation of the bullish trend from the inverted pattern’s breakout. If sellers break below, the bullish bias could change, leading to a potential correction.

A strong bounce from the neckline would align with the prior uptrend, while a break below could shift the short-term bias to bearish.

Bullish Bounce:

If buyers hold the 245–250 neckline and push the price higher, expect to resume the bullish trend, targeting the recent high of 490, with potential to push toward 500–510 if momentum builds. A break above 300 would confirm buyer strength and support the inverted pattern’s bullish target.

Bearish Correction:

If sellers break below the 245 neckline and sustain the move, it could indicate a failure of the inverted head-and-shoulders pattern, leading to a correction. A break below this level might target the 215 - 210 zone (right shoulder support) or lower to 210–180 if selling pressure intensifies. External factors, such as negative Tesla news or a broader market downturn, could drive this decline.

BITCOIN (BTC/USD)BTC/USD – Technical Outlook

Bias: Bearish

BTC/USD has completed the ABCD pattern and is now printing lower highs and lower lows, confirming a shift in market structure to bearish.

Price is currently retesting a previous support, now turned resistance. If this level holds, it could open the door for continued downside; with the 68K–50K zone as a potential BTD (buy-the-dip) area.

TARGET 1 (78K):

A key structural zone. A clean break and close below this level would confirm bearish momentum and increase the likelihood of price falling.

TARGET 2 (66K):

Likely to act as a magnet; a previous resistance turned support that launched price toward 100K. A return here would retest the foundation of the previous rally to 100k.

TARGET 3 (50K):

From a fractal and psychological standpoint, double tops often retrace to the origin of the bullish move. In this case, around the 50K zone.

Invalidation:

A reclaim of 85K–90K would shift bias back to bullish, signalling potential for upside momentum.

DXY Will Move Higher! Long!

Here is our detailed technical review for DXY.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 103.733.

The above observations make me that the market will inevitably achieve 104.118 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

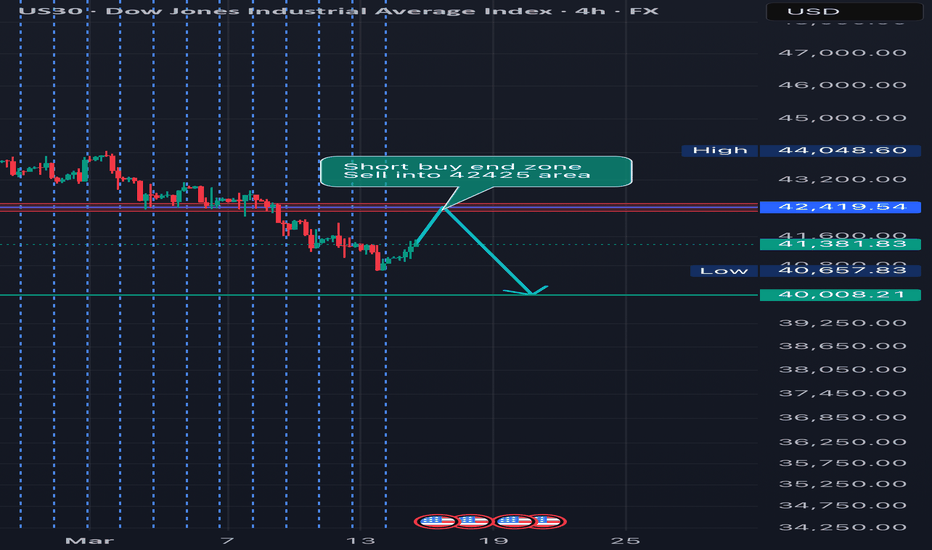

US30 BULLS WILL DOMINATE THE MARKET|LONG

US30 SIGNAL

Trade Direction: long

Entry Level: 41,378.4

Target Level: 43,046.4

Stop Loss: 40,263.5

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Ripple is Nearing Important SupportHey Traders, in today's trading session we are monitoring XRPUSDT for a buying opportunity around 2.35 zone, XRP is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 2.35 support and resistance area.

Trade safe, Joe.

NZDUSD Is Going Up! Buy!

Here is our detailed technical review for NZDUSD.

Time Frame: 10h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 0.575.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 0.582 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AAPL BULLS ARE GAINING STRENGTH|LONG

AAPL SIGNAL

Trade Direction: long

Entry Level: 213.28

Target Level: 232.17

Stop Loss: 200.88

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SWING USD/JPY BUYThis swing trade highlights key points where additional sell orders might be initiated. Stay tuned for updates, as this trade will extend over several days, weeks, or even months.

This analysis relies on the provided image and should not be considered financial advice. Trading carries risks; it is essential to do your own research and seek guidance from a financial advisor before making trading decisions.

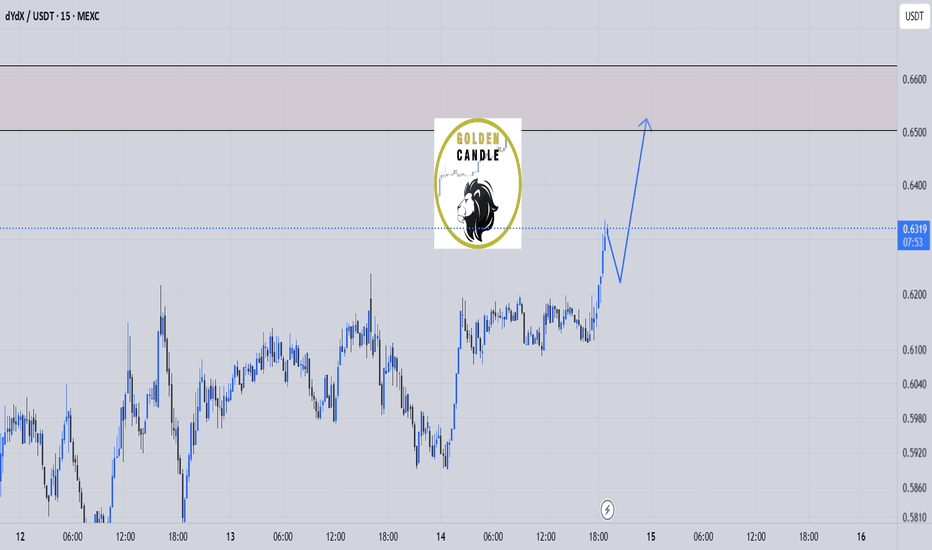

dydx buy midterm "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

US500 Is Bullish! Buy!

Here is our detailed technical review for US500.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 5,568.9.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 5,791.3 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!