Gold price accumulates above 3300, new week⭐️GOLDEN INFORMATION:

Gold (XAU/USD) faced some selling pressure around the $3,335 mark during Monday’s early Asian session, as easing trade tensions slightly dampened demand for the safe-haven asset. The recent softening in rhetoric surrounding global trade disputes has contributed to the metal’s pullback, though upcoming economic events could shift momentum.

On Sunday, US President Donald Trump announced a delay in imposing the proposed 50% tariffs on the European Union until July 9, easing fears of an imminent escalation in trade hostilities. This development has weighed on bullion prices by reducing immediate risk aversion in the markets.

Nonetheless, investor attention now turns to Wednesday’s release of the FOMC Minutes, which could offer further clarity on the Federal Reserve’s monetary policy outlook. Meanwhile, market participants will continue to monitor trade negotiations between the US and Japan, as well as other major economies. Any renewed tensions or setbacks in these discussions could quickly revive demand for gold as a protective hedge.

⭐️Personal comments NOVA:

Gold prices reacted slightly lower after the official announcement of tariff postponement. Accumulated above 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3388- 3390 SL 3395

TP1: $3376

TP2: $3363

TP3: $3350

🔥BUY GOLD zone: $3301- $3299 SL $3294

TP1: $3312

TP2: $3325

TP3: $3338

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Buygold

Tariffs heat up again, gold recovers✍️ NOVA hello everyone, Let's comment on gold price next week from 05/26/2025 - 05/30/2025

🔥 World situation:

Gold resumed its upward momentum on Friday, surging nearly 2% on the day and over 5% for the week, as the US Dollar weakened amid renewed trade tensions. The yellow metal climbed to $3,359, rebounding from an intraday low of $3,287, as escalating rhetoric from Washington fueled investor demand for safe-haven assets.

US President Donald Trump intensified the trade standoff with the European Union, declaring that talks were “going nowhere” and threatening to impose 50% tariffs on EU imports starting June 1. Adding to the pressure, US Treasury Secretary Scott Bessent remarked that the EU’s trade proposals have fallen short compared to offers from other key partners. Mounting concerns over US fiscal policy and an increasingly strained global trade environment continue to bolster gold’s appeal.

🔥 Identify:

Tariff news is starting to heat up again, the US and other countries around the world have not reached a consensus on negotiations, gold prices benefit from the increase. The large time frame shows that prices are breaking out and continuing the upward trend.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3412, $3436

Support: $3315, $3280, $3245

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Bulls push price to 3360, prepare for PMI⭐️GOLDEN INFORMATION:

Gold prices climbed over 0.50% on renewed safe-haven demand, holding firm above the $3,300 threshold as investor anxiety grows ahead of the U.S. tax bill vote and mounting geopolitical tensions in the Middle East. At the time of writing, XAU/USD trades around $3,317, rebounding from an intraday low of $3,285.

Sentiment remains fragile, with U.S. equity markets slipping into negative territory and Treasury yields ticking higher. All eyes are on the impending vote on President Trump’s tax reform proposal, which the Congressional Budget Office (CBO) estimates could inflate the national debt by approximately $3.8 trillion. Uncertainty around the fiscal outlook continues to fuel demand for gold as a defensive asset.

⭐️Personal comments NOVA:

Gold price recovered well, pay attention to the price zone 3358. Adjusted down, continued to accumulate around 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3358- 3360 SL 3365

TP1: $3350

TP2: $3337

TP3: $3322

🔥BUY GOLD zone: $3264- $3266 SL $3259

TP1: $3275

TP2: $3288

TP3: $3300

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

recovery, gold price traded above 3300 mark⭐️GOLDEN INFORMATION:

Beth Hammack of the Cleveland Federal Reserve emphasized that current U.S. government policies have made it increasingly challenging for the Fed to steer the economy effectively and fulfill its dual mandate of price stability and full employment. She also warned that the risk of a stagflationary environment—marked by stagnant growth and persistent inflation—is on the rise. In contrast, St. Louis Fed President Alberto Musalem recently argued that the current monetary policy stance remains appropriately calibrated.

Despite elevated U.S. Treasury yields, gold has struggled to gain traction, suggesting that higher yields alone are not enough to drive safe-haven demand under current conditions.

However, global monetary easing could provide a tailwind for the precious metal. In the latest moves during the Asian session, the People’s Bank of China (PBoC) cut its benchmark rate, followed by the Reserve Bank of Australia (RBA), which unexpectedly reduced its Cash Rate from 4.10% to 3.85%—actions that typically support non-yielding assets like gold.

⭐️Personal comments NOVA:

Gold prices recover due to military instability in the Middle East, growth momentum above 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3354- 3356 SL 3361

TP1: $3345

TP2: $3332

TP3: $3320

🔥BUY GOLD zone: $3252 - $3250 SL $3245

TP1: $3260

TP2: $3270

TP3: $3280

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Trading around 3200 at the beginning of the week⭐️GOLDEN INFORMATION:

Gold (XAU/USD) is staging a recovery from recent losses, trading around $3,230 per troy ounce during Monday’s Asian session, as investors seek refuge in safe-haven assets amid growing anxiety over the US economic outlook and fiscal sustainability.

The rebound comes on the heels of Moody’s decision to downgrade the US credit rating by one notch, from Aaa to Aa1, citing mounting debt and a rising burden from interest payments. This follows earlier downgrades by Fitch in 2023 and S&P in 2011. Moody’s now projects US federal debt to surge to roughly 134% of GDP by 2035, up from 98% in 2023, driven by ballooning debt-servicing costs, expanding entitlement programs, and weakening tax revenues—all of which have intensified investor concerns and lent fresh support to gold prices.

⭐️Personal comments NOVA:

Gold traded around 3200 at the beginning of the week, not much news impact, continue sideways

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3259- 3261 SL 3266

TP1: $3250

TP2: $3240

TP3: $3230

🔥BUY GOLD zone: $3192 - $3190 SL $3185

TP1: $3200

TP2: $3210

TP3: $3220

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

PATIENCE PAYS 〉BEARS TRAPPED - HODL TO $4,000As illustrated, Im trying to visualize the beginning of the next impulse toward $4,000

This is an intraday - swing trade opportunity to 1H highs; however, it would be just the first move toward a longer term path to ATH above $3,500

Ride this wave as you can, but know that the yellow metal still has a lot of strength and power to continue growing.

June might still behave strangely as it is a consolidation month on average 5-10-15 years; however, It wouldn't surprise me if market structure holds important support prices instead of ranging back below $3,200 - $3,150 ; in other words, that range might be strong longterm support.

--

GOOD LUCK!

SECURE PROFITS.

persaxu

Cumulative recovery above 3190, maintain⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) fails to build on Thursday’s sharp rebound from the $3,120 area — its lowest level since April 10 — and comes under renewed selling pressure during Friday’s Asian session. The 90-day trade truce between the US and China has alleviated some of the strain on global financial markets, weighing on demand for the safe-haven metal.

Nevertheless, lingering geopolitical tensions and a weaker US Dollar continue to offer underlying support, limiting the downside. Additionally, growing market expectations for further interest rate cuts by the Federal Reserve may deter traders from adopting strong bearish positions on gold in the near term.

⭐️Personal comments NOVA:

Gold prices recover, buyers are determined to keep prices stable around the 3200 mark in May. Waiting for new bullish momentum after tariff negotiations end

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3287- 3290 SL 3294

TP1: $3270

TP2: $3260

TP3: $3250

🔥BUY GOLD zone: $3173 - $3175 SL $3168

TP1: $3188

TP2: $3200

TP3: $3218

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

3419 , gold price can reach today⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) pulls back slightly from its intraday peak near a two-week high reached during Tuesday’s Asian session, but remains firm around the $3,360 mark, extending its winning streak for a second day. Improved US economic data has helped temper recession fears, offering modest support to the US Dollar. Meanwhile, signs of a potential thaw in US-China trade tensions have curbed safe-haven demand for gold, prompting some investors to adopt a wait-and-see approach ahead of the highly anticipated two-day FOMC policy meeting.

⭐️Personal comments NOVA:

Bulls regain the upper hand, uptrend nears 3400 ahead of market interest rate cut expectations

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3418- 3420 SL 3425

TP1: $3410

TP2: $3400

TP3: $3385

🔥BUY GOLD zone: $3323 - $3321 SL $3316

TP1: $3330

TP2: $3340

TP3: $3358

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

new peak 3520, waiting for gold price to touch⭐️GOLDEN INFORMATION:

Gold prices extended their record-breaking surge on Tuesday, soaring past the $3,450 mark during the Asian session as investors sought refuge in the traditional safe-haven asset amid mounting fears of a US recession and broader financial market volatility.

Persistent concerns over the economic outlook and waning confidence in the US Dollar (USD) have continued to drive demand for the USD-denominated precious metal. The greenback remains under pressure, further amplifying gold's appeal.

Adding to the uncertainty, US President Donald Trump once again criticized Federal Reserve Chairman Jerome Powell, stoking fears about the central bank’s independence. Reports suggesting the administration explored legal avenues to potentially remove Powell have only deepened market unease, boosting the allure of gold as a hedge against policy and economic instability.

⭐️Personal comments NOVA:

Fomo price increase, trade tension, gold price benefits

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3519- 3521 SL 3526

TP1: $3505

TP2: $3490

TP3: $3465

🔥BUY GOLD zone: $3403 - $3405 SL $3398

TP1: $3415

TP2: $3430

TP3: $3445

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

surpassing the old peak, gold price will reach above 3400 soon⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) resumes its upward momentum, climbing to a fresh all-time high around $3,375 during Monday’s early Asian session, as markets reopen following the extended holiday weekend. The surge comes amid renewed investor appetite for safe-haven assets, fueled by ongoing geopolitical tensions and lingering uncertainty surrounding US President Donald Trump’s aggressive tariff agenda.

With fears mounting over the broader economic fallout from escalating trade conflicts, gold has soared over 25% year-to-date. “In today’s environment of intensifying tariff ambiguity, slowing global growth, sticky inflation, and rising geopolitical risks, the strategic case for increasing gold exposure has never been stronger,” noted analysts at UBS, emphasizing a shift toward diversification away from US assets and the US Dollar.

⭐️Personal comments NOVA:

Big increase, gold price continues to rise thanks to tariff momentum

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3404- 3406 SL 3409 scalping

TP1: $3395

TP2: $3380

TP3: $3370

🔥SELL GOLD zone : 3415- 3417 SL 3422

TP1: $3405

TP2: $3390

TP3: $3370

🔥BUY GOLD zone: $3357 - $3355 SL $3350

TP1: $3365

TP2: $3380

TP3: $3405

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold bull cycle continues, 3400✍️ NOVA hello everyone, Let's comment on gold price next week from 04/21/2025 - 04/25/2025

🔥 World situation:

Gold prices are poised to close the week on a strong footing, gaining over 2.79% as the precious metal surged nearly $90 amid continued US Dollar (USD) weakness driven by lingering global trade uncertainties. At the time of writing, XAU/USD is trading around $3,326.

Despite touching a fresh all-time high of $3,358, the rally has cooled slightly as traders lock in profits ahead of the extended Easter weekend, with both European and US markets closed. Meanwhile, real yields have ticked higher, offering a modest headwind. On the policy front, San Francisco Fed President Mary Daly noted that the US economy remains resilient, though some segments are showing signs of slowing. She emphasized that monetary policy is still restrictive enough to keep inflation in check, while also suggesting that neutral rates could be on the rise.

🔥 Identify:

Gold price is still in a big uptrend, short-term corrections only make gold price accumulate more and continue to reach new ATH, tariffs are tense, gold price continues to increase strongly: 3382, 3400

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3357, $3382, $3400

Support : $3284, $3236, $3155

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

3382 , next ATH number today, GOLD⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) enters a phase of consolidation on Thursday, trading within a narrow range near its all-time high reached during the Asian session, as investors digest conflicting market signals. Stronger-than-expected US Retail Sales figures and hawkish remarks from Federal Reserve (Fed) Chair Jerome Powell have lent support to the US Dollar (USD), curbing some of gold’s upside momentum. Meanwhile, the upbeat sentiment across equity markets and mildly overbought technical conditions are prompting traders to remain cautious, limiting fresh buying interest in the precious metal for now.

⭐️Personal comments NOVA:

Gold price continues to increase today, the fomo still has no end, pay attention to the new ATH price zone 3382

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3381- 3383 SL 3388

TP1: $3370

TP2: $3355

TP3: $3333

🔥BUY GOLD zone: $3302 - $3300 SL $3295

TP1: $3310

TP2: $3320

TP3: $3330

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

continue to grow, conquer new ATH, XAU⭐️GOLDEN INFORMATION:

US economic data delivered mixed signals. Import prices stayed subdued, while the New York Fed Manufacturing Index outperformed expectations, with several internal components also showing strength. However, inflationary pressures resurfaced as prices paid climbed back into expansionary territory, and the six-month business outlook showed signs of weakening.

Looking ahead, gold traders will closely monitor March Retail Sales and remarks from several Federal Reserve officials, particularly Fed Chair Jerome Powell’s speech on Wednesday. Additional focus will be on upcoming housing figures and weekly Initial Jobless Claims to gauge the broader economic landscape.

⭐️Personal comments NOVA:

After accumulating at the beginning of the week, gold price started to grow strongly reaching 3275 and will continue to move towards the new ATH zone.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3288- 3290 SL 3295

TP1: $3270

TP2: $3250

TP3: $3235

🔥BUY GOLD zone: $3167 - $3165 SL $3160

TP1: $3180

TP2: $3200

TP3: $3220

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

sideway, keep waiting for new ATH 3271⭐️GOLDEN INFORMATION:

The US Dollar (USD) continues to face headwinds, failing to mount a meaningful rebound from its lowest level since April 2022, hit last Friday. Lingering concerns over the economic consequences of sweeping tariffs have fueled recession fears, while growing expectations that the Federal Reserve (Fed) will soon restart its rate-cutting cycle keep USD bulls on the back foot. This environment continues to favor the non-yielding Gold, offering support to XAU/USD. However, a temporary tariff reprieve announced by President Trump has helped lift overall market sentiment, potentially limiting further gains in bullion.

⭐️Personal comments NOVA:

No news at the beginning of the week, gold price is sideways waiting for price increase and continue to create new ATH

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3271- 3273 SL 3277

TP1: $3260

TP2: $3250

TP3: $3240

🔥SELL GOLD zone : 3244- 3246 SL 3250 scalping

TP1: $3240

TP2: $3230

TP3: $3220

🔥BUY GOLD zone: $3189 - $3187 SL $3182

TP1: $3195

TP2: $3210

TP3: $3225

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

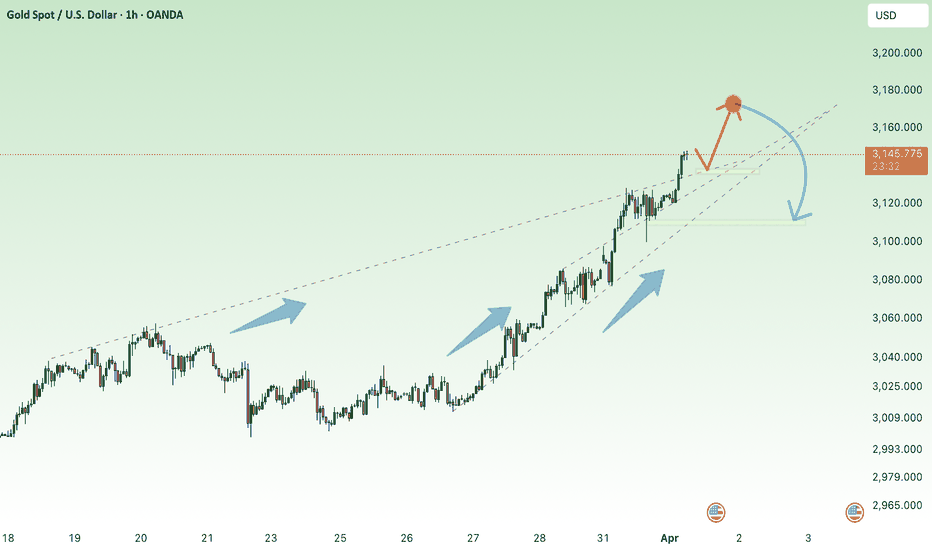

UPDATE: Gold target on the way to 3,337 Since we posted the analysis on Gold - it smashed through the psychological $3,000 level and has been rallying since.

We did have the normal correction where liquidity was tested at $3,000, but clearly there was more buying than selling.

Now, we can expect gold to continue up for a number of reasons.

🏆 Why Gold Is Rising (and Could Climb More)

1. ⚔️ Geopolitical Tensions

Middle East conflict and global unrest drive safe-haven demand.

2. 💵 Weaker Dollar Boosts Gold

A falling U.S. dollar makes gold cheaper for global buyers.

3. 📉 Lower Real Yields

If bond yields drop or inflation stays high, gold becomes more attractive.

4. 🏦 Fed Rate Cut Hopes

Traders expect the Fed to cut rates later this year, lifting gold prices.

5. 🛡️ Central Bank Buying

Global central banks are loading up on gold to diversify reserves.

ANd technically, we had the restest and now it's on the way back to the $3,3337 what a power number. Your thoughts?

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

keep aiming for new ATH next week✍️ NOVA hello everyone, Let's comment on gold price next week from 04/14/2025 - 04/18/2025

🔥 World situation:

Gold extended its remarkable rally for a third consecutive session on Friday, surging to a fresh record high of $3,245 amid intensifying US–China trade tensions. The precious metal posted impressive gains of over 2% as fears of a prolonged trade war and its potential fallout on the global economy sent investors flocking to safe-haven assets. At the time of writing, XAU/USD is trading around $3,233.

The North American session saw China retaliate with a 125% tariff on US imports, following President Donald Trump’s move to raise tariffs on Chinese goods to 145%. The heightened geopolitical strain triggered a flight to safety, propelling Gold higher. Further fueling the rally was a sharp decline in the US Dollar, which tumbled to a near three-year low, with the US Dollar Index (DXY) falling to 99.01.

🔥 Identify:

The huge growth shows no signs of stopping, gold prices continue to benefit from tariff policies, continue to find new ATH early next week

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3255, $3280

Support : $3157, $3070

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

growth - new ATH - gold hits 3246⭐️GOLDEN INFORMATION:

Trump announced Wednesday that tariffs would be temporarily reduced for dozens of countries, offering a short-term reprieve. However, he simultaneously hiked tariffs on Chinese imports to 125% with immediate effect, following Beijing’s retaliatory move to impose 84% duties on US goods. The escalating trade conflict between the world’s two largest economies has reignited concerns over global growth, prompting investors to seek refuge in safe-haven assets like Gold.

“Gold is reclaiming its safe-haven status and appears poised to chart fresh all-time highs,” said Nikos Tzabouras, Senior Market Analyst.

Meanwhile, scaled-back expectations for aggressive Federal Reserve rate cuts could lend support to the US Dollar, potentially limiting gains for the USD-priced metal. That said, traders still anticipate the Fed will begin easing in June, with markets pricing in a full percentage point of rate reductions by year-end.

⭐️Personal comments NOVA:

Gold price continues to increase greatly, the fomo market and attention are focused on the gold investment channel: safe, continue to find new ATH zones

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3245- 3247 SL 3252

TP1: $3230

TP2: $3210

TP3: $3190

🔥BUY GOLD zone: $3168 - $3166 SL $3163 scalping

TP1: $3175

TP2: $3183

TP3: $3190

🔥BUY GOLD zone: $3134 - $3132 SL $3127

TP1: $3145

TP2: $3160

TP3: $3175

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

XAUUSD AnalysisCurrent Price: $3,148.890

Support Zone: $3,145 - $3,148 (Price has respected this level multiple times.)

Resistance Levels:

First Target: $3,155

Second Target: $3,165 - $3,170

Demand Zone Holding: The purple zone represents a demand area where buyers are stepping in.

Potential Breakout: If price holds above $3,145, it could continue its bullish trend.

Sine Wave Indicator: Suggests that Gold is currently at a cyclical low, indicating a possible upward move.

Volume Analysis: Increasing bullish volume supports the case for an upside move.

✅ Bullish Entry: $3,147 - $3,148 (Confirmation needed.)

🎯 Target: $3,155 - $3,170

🛑 Stop-Loss: Below $3,143

Bullish Bias Above $3,145

Potential Move Toward $3,165 - $3,170

Watch for a Breakout Confirmation

Tariff highlights, gold price up or down ?⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) find support from dip-buyers during the Asian session on Wednesday, pausing the previous day’s pullback from a fresh record high. Investors continue to seek shelter in safe-haven assets amid uncertainty surrounding US President Donald Trump’s sweeping reciprocal tariffs and their potential repercussions on the global economy.

Additionally, escalating geopolitical tensions provide further support for bullion. Mounting concerns over a potential US recession, coupled with growing expectations of additional Federal Reserve (Fed) rate cuts, fuel demand for the non-yielding yellow metal.

⭐️Personal comments NOVA:

Gold price is still in a very stable uptrend, market tariff information waiting for the next price increase fomo

⭐️SET UP GOLD PRICE:

🔥 ATH : SELL 3173 - 3175 SL 3180

TP: 3165 - 3150 - 3140

🔥BUY GOLD zone: $3058 - $3060 SL $3053

TP1: $3070

TP2: $3080

TP3: $3090

🔥BUY GOLD zone: $3106 - $3108 SL $3103 scalping

TP1: $3113

TP2: $3118

TP3: $3125

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

New ATH , GOLD is comming 3173⭐️GOLDEN INFORMATION:

US President Donald Trump dismissed expectations that the new tariffs would target only a select group of nations with the largest trade imbalances, declaring on Sunday that reciprocal tariffs would apply universally. This announcement, coupled with the existing 25% duties on steel, aluminum, and auto imports, has intensified fears of an escalating global trade war.

Additionally, investors are increasingly convinced that the economic slowdown triggered by these tariffs will pressure the Federal Reserve (Fed) to resume rate cuts, despite persistent inflation concerns. As a result, Gold has surged to a fresh record high, marking its strongest quarterly performance since 1986.

⭐️Personal comments NOVA:

The backdrop of everything from technical to political and economic is supporting the increase in gold prices in the first quarter of 2025. Gold prices have the highest growth in history.

⭐️SET UP GOLD PRICE:

🔥 ATH : SELL 3162 - 3164 SL 3169

TP: 3155 - 3140 - 3127

🔥BUY GOLD zone: $3093 - $3091 SL $3086

TP1: $3100

TP2: $3110

TP3: $3120

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account