Market Update: Bullish Momentum and Key Buy Levels Near ATHHey Trader! 🚀📈

We're seeing some exciting action in the market right now! After the strong bullish bias following the GDP news, the market is clearly in an upward swing 💥. We've just witnessed the market break through the all-time high (ATH) and make a new ATH 🏆, but keep an eye on key levels for potential reversal points. 🔍

One crucial level to watch is 3080 – this could be a major turning point! Before making the higher high move, we saw the market retest the previous ATH level, and there's a significant order block near this zone, suggesting a strong buying opportunity. 📊💪

👉 BUY Setup:

- Watch for a bounce around the 3070–3080 area.

- This could be your entry for a potential rally to the upside 📈💰.

Remember, always follow proper risk management to protect your capital! 🛡️ Set your stop-losses and stay disciplined!

Happy trading, and let's catch those gains! 💸💥

Buysellsignal

INTC Intel Price Target by Year-EndIntel Corporation (INTC) has been trading near a key technical support level, forming a triple bottom on the chart—a bullish reversal pattern that suggests a potential upside move. The stock currently trades with a forward price-to-earnings (P/E) ratio of 20.44, which reflects moderate valuation levels compared to industry peers.

Intel’s turnaround strategy, focused on rebuilding its foundry business and strengthening its position in the AI and data center markets, is starting to show signs of progress. The company’s push into advanced chip manufacturing and strategic partnerships with major tech firms have positioned it for improved revenue growth in the coming quarters.

Technically, the triple bottom pattern indicates strong buying interest at current levels, reinforcing the case for a potential breakout. Combined with the improving outlook for chip demand and Intel’s strategic shift toward AI, a price target of $28 by the end of the year appears achievable. This would represent approximately 15% upside from current levels.

Investors should monitor Intel’s progress in its foundry business and AI initiatives, as any positive developments in these areas could accelerate momentum toward the $28 target.

SOL/USDT: UPDATE SIGNALHello friends

You can see that after the price fell in the specified support area, buyers came in and supported the price and made a higher ceiling.

Now we can buy at the specified levels with capital and risk management and move with it to the specified targets.

*Trade safely with us*

Start adjusting before April tariff policy ! XAU ✍️ NOVA hello everyone, Let's comment on gold price next week from 03/24/2025 - 03/28/2025

🔥 World situation:

Gold prices decline for the second consecutive day but remain on track to close the week in positive territory, despite a stronger US Dollar (USD) and profit-taking ahead of the weekend. XAU/USD is currently trading at $3,019, down 0.81%.

Market sentiment remains cautious, though US equities are paring earlier losses. Meanwhile, bullion stays on the defensive as the USD regains momentum, with the US Dollar Index (DXY) edging up to 104.05, marking a 0.24% increase.

🔥 Identify:

Gold prices are in a short-term downtrend in the H4 frame, adjusting at the end of March, accumulating before tax policies in early April 2025.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3057, $3080

Support : $2982, $2910

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

SUI/USDTHello friends

Given that the price has reached a good support and buyers have entered and supported the price, you can now buy in stages at the specified levels with capital and risk management and move towards the specified goals.

If you would like to be with us in the Alt Season, send us a message.

*Trade safely with us*

AUDCAD Approaching Key Resistance — Potential Sell SetupOANDA:AUDCAD is approaching a key resistance zone, highlighted by strong selling interest. This area has historically acted as a supply zone, increasing the likelihood of a bearish reversal if sellers step in.

The current market structure suggests that if the price confirms resistance within this zone, we could see further downside movement. A successful rejection could push the pair toward 0.90700, a logical target based on prior price behavior and the current structure.

However, if the price breaks and holds above this resistance, the bearish outlook may be invalidated, potentially leading to further upside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

JUPUSDT: Weekly Outlook & Key Levels for JupiterHey everyone! 🌟

Let’s take a look at this weekly cryptocurrency price chart together. Here's what stands out:

We’re looking at two possible scenarios:

Primary Scenario: The price might bounce back from the first support level, marked with a solid yellow arrow.

Secondary Scenario: If it doesn’t, the next potential rebound is from the lower support level, shown with a dashed yellow arrow.

Keep an eye on the numbers highlighted—$0.4310 and $0.3798. These are key price levels that could guide future movements. It’s also essential to monitor liquidity, candlestick patterns, and trading volumes. A strong confirmation, like a favorable candlestick formation and sufficient volume, could signal a rebound.

However, if the price dips below these critical levels, it might shift the perspective. Staying vigilant is key.

Always remember, this is just an observation. Do your own research, stay informed, and keep learning. The journey in the crypto world is as much about growth as it is about numbers! 📚📈✨

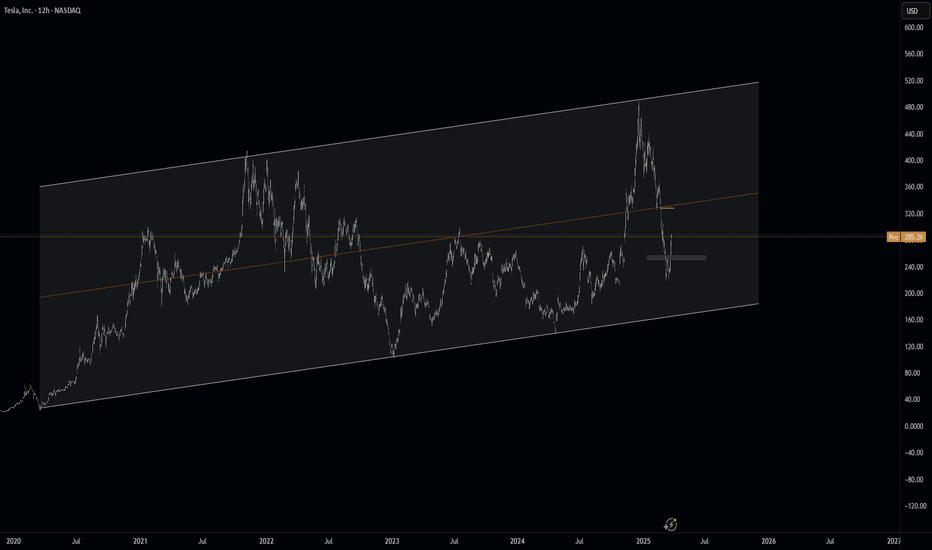

TESLA (TSLA)What I’m Watching:

I’m focusing on the 245–250 neckline for a decisive reaction. If buyers defend this level, it could signal a continuation of the bullish trend from the inverted pattern’s breakout. If sellers break below, the bullish bias could change, leading to a potential correction.

A strong bounce from the neckline would align with the prior uptrend, while a break below could shift the short-term bias to bearish.

Bullish Bounce:

If buyers hold the 245–250 neckline and push the price higher, expect to resume the bullish trend, targeting the recent high of 490, with potential to push toward 500–510 if momentum builds. A break above 300 would confirm buyer strength and support the inverted pattern’s bullish target.

Bearish Correction:

If sellers break below the 245 neckline and sustain the move, it could indicate a failure of the inverted head-and-shoulders pattern, leading to a correction. A break below this level might target the 215 - 210 zone (right shoulder support) or lower to 210–180 if selling pressure intensifies. External factors, such as negative Tesla news or a broader market downturn, could drive this decline.