3rd Wave About to Start in Ingersoll Rand (IR)Good looking Elliott Wave setup in NYSE:IR

Stock rose in clean 5 waves impulse wave followed by 3 waves down in ABC to almost exactly at 61.8% level around 75. If the wave C low 73.87 holds then we can expect another 5 wave rise in larger (3) or (C) on the upside. As per wave equality principle, we can expect it to be same in size as the previous 5-wave rise seen in the chart. That gives a potential target of 98.7 for current levels. 1.618 times of the move is at 114.04 which could be second (extended) target.

Note that invalidation level for this setup is wave C low at 73.87.

Buysignal

LONG ON EUR/USDEUR/USD is currently at a major demand level after sweeping sell side liquidity.

The Dxy (Dollar) is overall bearish. I expect the dollar to fall and EUR/USD to rise to the previous high / supply level for over 200-300 pips.

News most likely will affect this pair in terms of volatility.

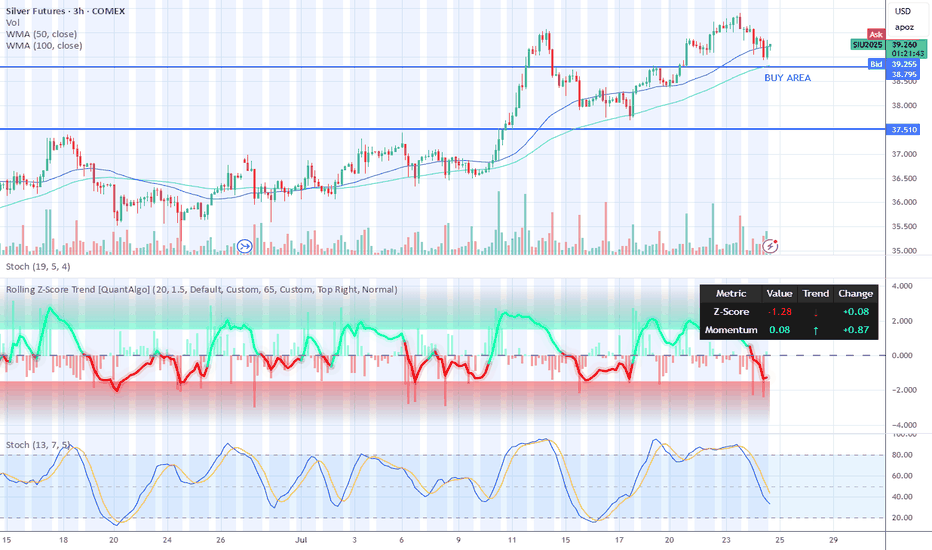

Short term buying opportunity Silver Futures ComexRecent weakness in silver futures could be an buying opportunity on 3 hour candel chart.

Wait for both indicators below to reach oversold levels like it is showing now. Long term 1 day chart showing long term bull trend with much higher upside. I expect silver prices to remain in uptrend. All time highs could be reached in 6 to 1 year period from now.

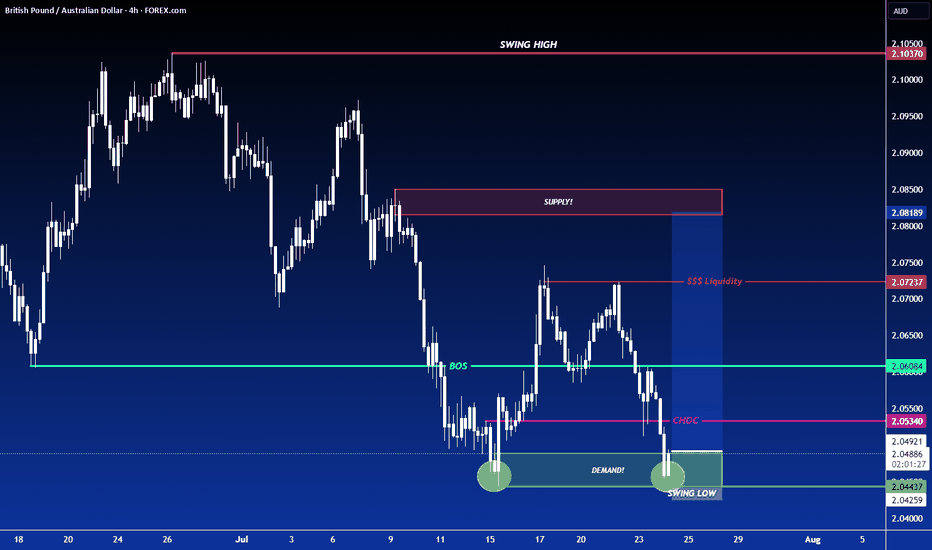

LONG ON GBP/AUDGA has given us a CHOC (change of character) to the upside after making a new low.

Price has since pulled back to the demand area that created that change leaving us with a possible double bottom forming.

I expect GA to rise to sweep buy side liquidity at the equal highs then reaching the previous supply level / previous High.

Looking to catch 200-300 pips.

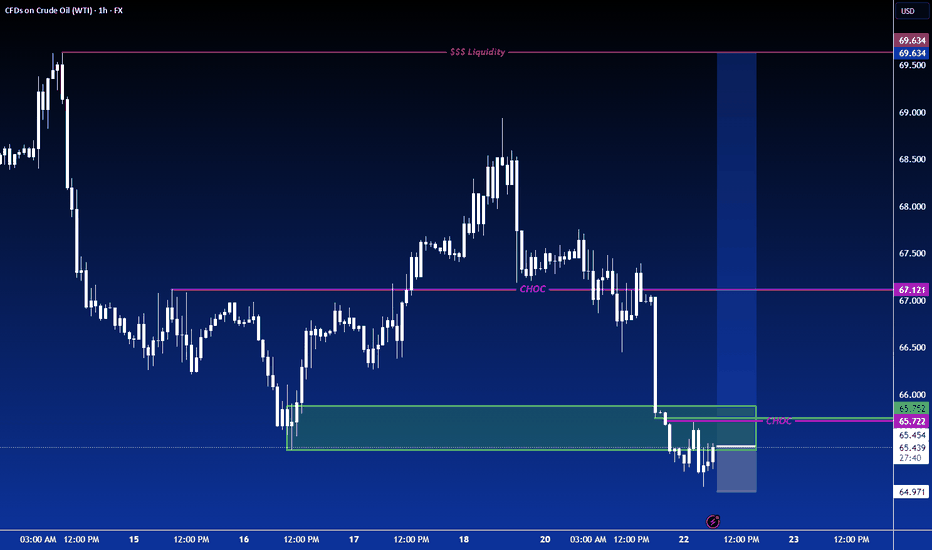

LONG ON USOIL OIL has just completed a sweep of sell side liquidity, leaving behind lots of BUY side liquidity.

DXY is falling on top of economic news stating trump will possibly fire Jerome Powell.

All this with OPEC increase oil production.

I expect oil to make a $5-$10 move throughout the rest of the week.

That's 500-1000 pips!

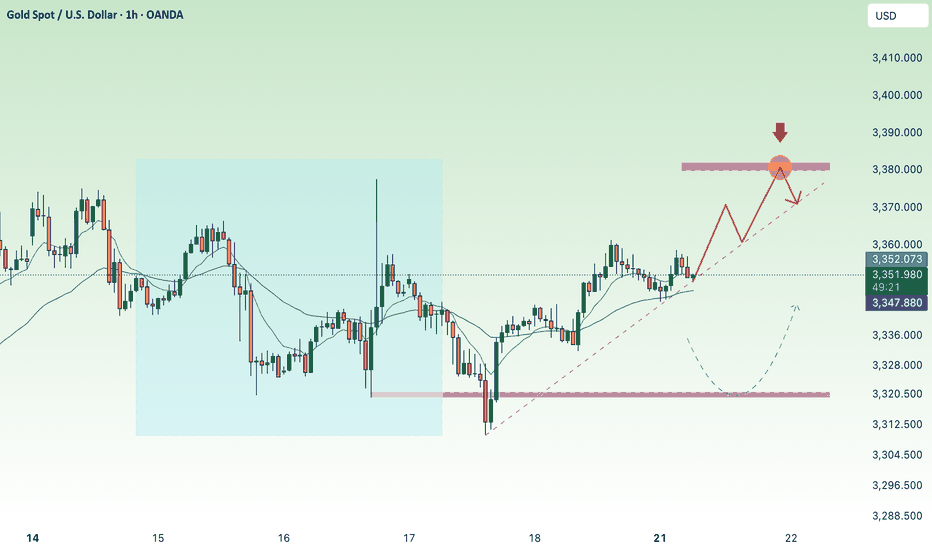

3380 gold price recovered at the beginning of the week⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) trade with modest gains around $3,350 in early Asian hours on Monday, supported by persistent uncertainty surrounding global trade negotiations as the US tariff deadline approaches. Lingering concerns over fresh levies are likely to sustain demand for the safe-haven metal. Investors now look ahead to comments from Federal Reserve (Fed) Chair Jerome Powell, scheduled for Tuesday, for clearer policy direction.

On Sunday, US Commerce Secretary Howard Lutnick confirmed that August 1 remains the firm deadline for countries to comply with Washington’s tariff demands. While President Trump’s earlier announcements saw shifting deadlines, the White House now insists this date is final. This cloud of uncertainty continues to bolster gold’s appeal as a hedge in volatile markets.

⭐️Personal comments NOVA:

Gold prices continued to recover last weekend, mainly still accumulating above 3300.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3380- 3382 SL 3387

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3322-$3320 SL $3315

TP1: $3333

TP2: $3345

TP3: $3356

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BABA: triangle with tensionOn the weekly chart, BABA has already formed a golden cross - price is above both MA50 and MA200, confirming a bullish trend shift. The stock is now approaching the upper edge of the symmetrical triangle and the key resistance at $122, which also aligns with the 0.5 Fibonacci level.

The numbers inside the triangle represent the contraction phases, not Elliott waves. This is a classical consolidation before a potential breakout. If the $122 level is broken and retested, upside targets are $128 (0.618), $137 (0.786), and eventually $148–181 (1.0–1.618 extension).

Volume is rising, MACD is flipping bullish, and RSI is climbing out of oversold territory — all signs point to growing bullish momentum.

Fundamentally, Alibaba benefits from China's economic rebound, possible regulatory relief, and ongoing share buybacks. With Chinese tech rotating back into favor, BABA could lead the rally.

So if you're still waiting for a signal - it's already here. The golden cross is done, price is flying above moving averages, and all that’s left is a clean breakout. Watch $122 — that’s the launchpad.

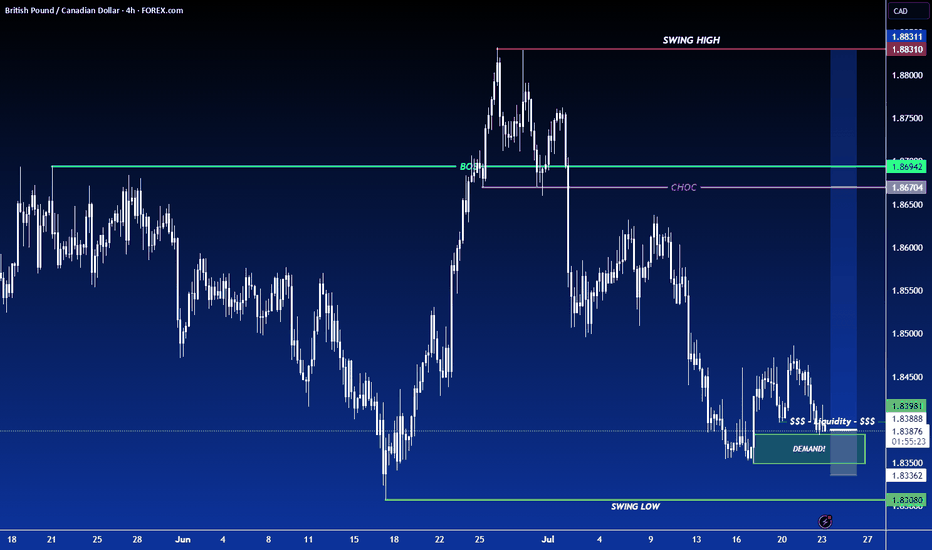

LONG ON GBP/USDGU is currently in its pullback phase of its uptrend.

We have a nice sell side Liquidity sweep being completed at this moment.

Price should now tap into previous demand that broke a high to repeat history and rise again.

Very Nice Setup over 300 pips on the table to the previous high/supply zone.

Golden Bitcoin Signal: A Great Investment Opportunity🔔 Our Bitcoin Investment Bot has issued an exclusive signal! This signal, backed by 15 years of historical data analysis, marks the perfect time to enter the market. 🎯 Take Profit Target: $120,975 (equivalent to a potential 50.5% profit)

⚖️ Professional Risk Management: This signal comes with a Stop Loss at $66,835 (16.8% risk), offering an ideal balance of profit and risk. Our bot, with its advanced and data-driven strategies, identifies the most valuable investment opportunities.

⏳ Opportunities don’t last forever! This signal could be the start of a significant move. Now is the best time to act and take advantage of this precise analysis. With our bot, you’re one step closer to sustainable profitability. 🌟

FOMO price increase, create new ATH💎 Update Plan BTC weekend (July 11)

Continuously creating a new ATH, preparing to have a short sale?

The reinforcement of Bitcoin price around the upper boundary of the previous consolidation area was broken at $ 108,355, which ended on Wednesday. The price has soared to the highest level of the new time of $ 116,868 on Thursday. At the time of writing on Friday, the price is fluctuating above $ 116,600.

When BTC entered the price exploration regime and if the trend of increasing continues, the price can expand the momentum to an important psychological level of $ 120,000.

Technical analysis angle

Our community has continuously chose the trend of increasing as the mainstream for all previous transactions and currently preparing to welcome 120k as forecast.

The relative power index (RSI) on the daily chart reaches 71, higher than the excess buying 70, showing a sharp increase. However, traders should be cautious because the ability to adjust the decrease is very high due to over -purchase. Meanwhile, the average divergence dynamic indicator (MACD) has shown a price intersection at the end of June. The indicator also shows that green histograms are increasing on neutral zero, showing that the rising momentum is being strengthened and continues to increase.

However, if BTC must be adjusted, the price may extend the decline to search and support around the upper boundary of the unified area that has been broken earlier at $ 108,355.

Plan has been constantly accurate in the past 2 months, which is the positive signal of the channel that brings value to the community.

Please follow the channel to receive accurate scenarios about gold and BTC

==> Comments for trend reference. Wishing investors successfully trading

maintain bullish, break H1 trend⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) trade in the red near $3,330 during Tuesday’s Asian session, weighed down by a stronger US Dollar (USD). The precious metal loses ground amid easing trade tensions, following US President Donald Trump’s announcement of a tariff deadline extension and his openness to further negotiations.

Market anxiety subsided after Trump signaled flexibility around the August 1 tariff deadline, describing it as “not 100% firm” and suggesting room for continued adjustments. This renewed optimism over trade policy has strengthened the Greenback, thereby pressuring USD-denominated assets like Gold, which becomes more expensive for holders of other currencies.

⭐️Personal comments NOVA:

Gold price accumulates waiting for news of new tariff information, breaking H1 trend. Good buying power

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3364- 3366 SL 3371

TP1: $3350

TP2: $3340

TP3: $3330

🔥BUY GOLD zone: $3300-$3298 SL $3293

TP1: $3310

TP2: $3325

TP3: $3340

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

LONG ON USD/JPYUSD/JPY has given us a CHOC (change of character) from down to up.

It has engineered sell side liquidity right above a demand zone.

I expect price to sweep sell side liquidity, tap into the demand zone then take off to the upside.

looking to catch 150-250 pips on UJ. (Economic News could set this trade on Fire!)

BTC buying power is gradually increasing💎 Update Plan BTC at the beginning of the week (June 30)

Notable news about BTC:

Anthony Pompliano has merged Procap BTC with Columbus Circle Capital I, established Procap Financial - a Bitcoin warehouse company up to $ 1 billion. The company will deploy lending activities, derivatives ... in order to create a collection line from BTC, according to the similar model

Bitcoin price is stable at about $ 107.4K on June 27, before the expiry date of options worth up to US $ 40 billion, capable of causing strong fluctuations. At the same time, on June 29, BTC exceeded $ 108k, up ~ 0.68% compared to the previous day

In the past 7 days, BTC maintained around $ 104–107K despite tensions in the Middle East and the US economic data is not heterogeneous. Reduce slightly but receive support from organized cash flow and global trade progress.

Technical analysis angle

Overview of trends - many signs of increasing

Looking at the candle is signaling "Strong Buy" on many time frames, especially healthy momentum, the ability to breakout $ 116k if surpassed the $ 110k resistance

ETF liquidity and organizational capital flows are supporting the trend of increasing, strengthening the possibility of breakthrough.

Moving Averages:

Frame 1H: 64% Bullish signal (MA20 reversed), but there is a neutral signal from short -term ghosts

Daily/Weekly: Golden Cross (Golden Cross) between 50‑ and 200‑ MA, is a long -term trend increase signal

Oscillators:

RSI frame Daily ~ 55, showing neutral momentum, not too much purchased but there is a rise. Double Rounded Top model on the chart Daily, the current trend is neutral - Bearish if the breakdown supports Neckline ~ $ 106k; In contrast, strong recovery above $ 114k will invalid this model

Long -term / Swing Trade: Keep the position if the price is maintained> $ 106k, use $ 103–104K as a spare hole stop.

Short -term / Scalp Trade: can be in order when the test price is $ 106k–107k, small latches around $ 110k.

==> Comments for trend reference. Wishing investors successfully trading

BTC Efforts to break the trend to create a new ATHPlan BTC today: 30 June 2025

Related Information:!!!

As of Monday, Bitcoin (BTC) is trading around $108,500, approximately 3% below its all-time high. Ethereum (ETH) has closed above a key resistance level, indicating the potential for a sustained upward movement. Meanwhile, Ripple (XRP) is approaching a critical threshold; a confirmed breakout could strengthen bullish momentum in the near term.

Bitcoin approaches record highs

The price of Bitcoin surged by 7.32% last week, closing above the $108,000 mark. As of the latest update on Monday, it remains near $108,500.

Should the current upward trend persist, BTC may extend its rally toward the all-time high of $111,980 recorded on May 22. A decisive close above this level could pave the way for further gains, potentially establishing a new all-time high at $120,000."

personal opinion:!!!

BTC buying pressure is prevented by selling pressure according to H4 trendline, accumulating and soon surpassing ATH

Important price zone to consider :!!!

support zone : 107.000 ; 104.600

Sustainable trading to beat the market

GDP and price range accumulated above 3300⭐️GOLDEN INFORMATION:

Gold prices held firm during the North American session on Wednesday, climbing over 0.30% as easing tensions between Israel and Iran boosted risk sentiment. Meanwhile, disappointing US housing data could prompt future action from the Federal Reserve (Fed). However, Fed Chair Jerome Powell's continued hawkish stance has limited further upside for the precious metal.

At the time of writing, XAU/USD is trading around $3,334, up 0.34%, as the US Dollar pares earlier gains and Wall Street posts modest advances.

⭐️Personal comments NOVA:

moving in accumulation range following 2 trend lines, trading above 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3364- 3366 SL 3371

TP1: $3352

TP2: $3345

TP3: $3330

🔥BUY GOLD zone: $3302-$3300 SL $3295

TP1: $3315

TP2: $3328

TP3: $3340

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BTC recovers, price range sideways trend line💎 Update Plan BTC (June 25)

Notable news about BTC:

🌐 Growth stimulus factor

Reducing geopolitical tensions: The ceasefire agreement between Iran and Israel has helped improve investor psychology, promote capital inflows into risky assets like Bitcoin.

The dollar weakened: The USD index dropped to the lowest level in a year due to concerns about the economic impact from President Trump's tax policies, making Bitcoin a more attractive choice for investors to search for replacement assets.

Expectations for monetary policy: The decision of the US Federal Reserve (Fed) on keeping interest rates stable and interest rate cutting capacity in July has motivated the cryptocurrency market.

Technical analysis angle

Bitcoin may increase to the highest level of all time

Bitcoin price reached the lowest level of $ 98,200 on Sunday but has recovered strongly 5% in the next two days, closed on the dynamic average line according to the 50 -day exponential jaw at $ 103,352. At the time of writing on Monday, the price continued to trade higher at about $ 106,500.

If BTC continues to increase, the price can expand the momentum to the highest level of all time is $ 111,980 on May 22.

The relative power index (RSI) on the daily chart is 54, higher than the neutral level of 50, showing the motivation for price increase. The average divergent divergence (MACD) is referring to the price intersection (the MACD is about to cut on the signal line), if completed, the purchase signal will be made.

==> Comments for trend reference. Wishing investors successfully trading

Long OKTA To 128.50 For Nearly 30% PP. 1:2 RRR.Good Afternoon Trading Fam,

We are nailing it with our stock trades since implementing my new liquidity indicator. I've got another buy signal given here on OKTA with a 1:2 rrr ratio and potential profit of nearly 30%.

On the technical side, you can see that we are just above a large liquidity block where buyers have stepped in en masse in the past. Additionally, we have nice support being offered by our trendline. And finally, we have a large gap which often acts as a magnet and will most likely be filled sooner rather than later. The MACD has just crossed up, and our RSI is doing the same near oversold territory. All of these indications make this an easy choice for me, with an excellent opportunity to profit yet again.

More details on this trade and all of the others can be seen on my public portfolio, as always.

Best,

Stew