BX : First Attempt at Silent StockBlackstone has now decided to invest in Europe.

The stock is technically above the 50 and 200 period moving averages.

After leveling the trend line, an increase in volume was also observed.

In that case, holding a short-medium term or opening a long position with a reasonable risk/reward ratio in a small position size will not hurt us.

I have kept the stop-loss a little tighter now because even if the stop level comes in a sudden drop, it can be tried again. If that happens, I will share it as a new idea.

Risk/Reward Ratio : 3.00

Stop-Loss : 132.53

Take-Profit : 141.73

BX

BX EARNINGS TRADE (07/24)

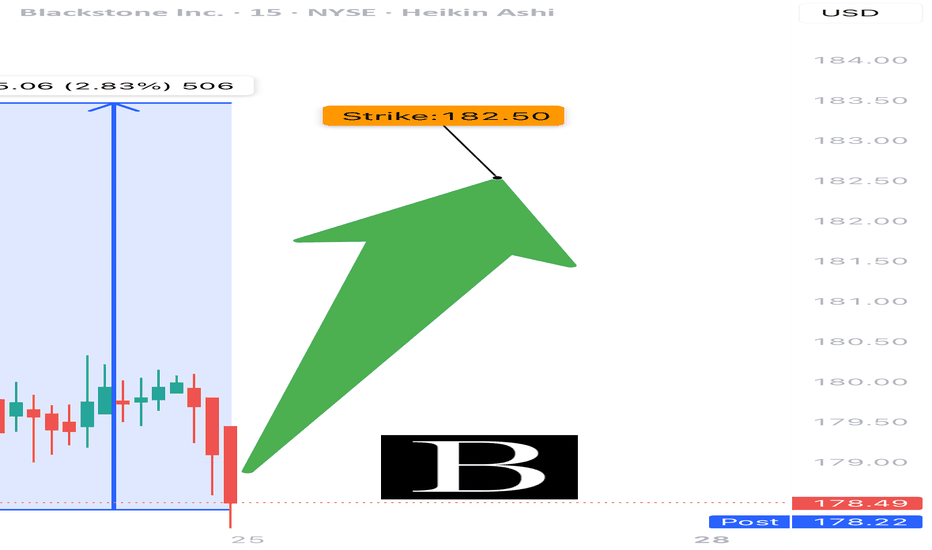

🚨 BX EARNINGS TRADE (07/24) 🚨

💼 Blackstone drops earnings after close — setup looks 🔥 bullish

🧠 Key Insights:

• 📉 TTM Revenue: -8.2%, but Q2 bounce back = $764M profit

• 💰 Margins: Strong → 45.3% operating, 20.6% net

• 📈 RSI: 73.88 = HOT momentum

• 🧠 AUM: $1.2 Trillion = 🐘 heavyweight

• 🔥 Options Flow: Call skew at $182.50 = institutional bullish bets

• 🧮 Expected move: ~5% post-earnings

💥 TRADE SETUP

🟢 Buy BX $182.50 Call exp 7/25

💰 Entry: $0.69

🎯 Target: $1.38–$2.07 (200–300%)

🛑 Stop: $0.34

📈 Confidence: 85%

⏰ Entry: Before Close Today (Pre-Earnings)

📊 IV Rank: 0.75 → options decently priced

⚠️ Watch resistance at $185 — breakout = 🚀

Tight risk, big reward. Pure earnings momentum play.

#BX #EarningsPlay #OptionsTrading #Blackstone #UnusualOptionsActivity #CallOption #TradingView #FinanceStock #InstitutionalFlow #OptionsAlert

What is a war chest and lessons we can learn from Blackstone...In case you haven't heard, NYSE:BX is hogging over $100 billion of dry powder that is ready for deployment at the snap of a finger. Now, just because we cant get our hands on hundreds of billions of dollars doesn't mean that we shouldn't have a war chest of our own.

Why a war chest is a must have

Firstly, having dry powder ready for the next trading day could be the determining factor of a make or break trade. Specifically think back to when the current market downturn started. If I had to guess, many of you reading were far too exposed to the market and got scared from the "red wave" that shocked the market heatmaps. I would also like to bet that many of you sold positions for a loss to stop the bleeding and are now looking for a better entry. However, consider what would have happened if you had spare cash on your side to keep your positions alive.

Here is an example of over exposure.

And here's an example of keeping about a 20% war chest by your side...

I understand that it seems like a small amount of money, but trading is a game of pennies and a winning position of pennies is much better than a losing position of $140. This is the same tactic that firms like Blackstone use to protect large positions from poisonous events such as this recent downturn in the market. So in order to make money like a bank, we need to learn to think like a bank...

BX Blackstone Options Ahead of EarningsIf you haven`t bought BX before the previous earnings:

Now analyzing the options chain and the chart patterns of BX Blackstone prior to the earnings report this week,

I would consider purchasing the 160usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $13.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BX Blackstone Options Ahead of EarningsAnalyzing the options chain and the chart patterns of BX Blackstone prior to the earnings report this week,

I would consider purchasing the 140usd strike price Calls with

an expiration date of 2024-10-18,

for a premium of approximately $6.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BX Blackstone Options Ahead of EarningsLooking at the BX Blackstone options chain ahead of earnings , I would buy the $86 strike price Puts with

2023-2-17 expiration date for about

$3.50 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

Short on Private Equity - BXA lot of people are thinking that this bear market is already in it's later innings. If anything, it's probably the opposite given that inflation has not yet broken, employment may only be starting to see it's cyclical decline, etc.

Private equity has been heavily levered during this cycle, and in general has dumped gobs of $ into shit investments (see the amount of private equity $ flowing into crypto junk over the past 2 years for example) that will eventually need to be marked down. Private equity has long been very pro-cyclical, and as the bear shifts into a proper more traditional recession, the publicly traded PE giants should all fall in tandem. Some will get hurt worse than others - picking BX here simply since it's the largest. Other targets include firms like $KKR, $CG $APO, $OWL, or you can even just short the etf $PSP.

AS of today (11/14/2022), a lot of these have retested top ends of bearish ranges and are getting smacked back down. With a big opex and things relatively pinned, I think there is still good opportunity through November to get good positions short of these, but I still think there will be chop for at least a little bit.

Support broken on Blackstone. BXBlackstone is going down.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Confirmation level, where relevant, is a pink dotted, finite line. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

Blackstone Inc joins the overbought clubBased on historical movement, the peak could occur anywhere in the larger red box. The final targets are in the green boxes. The pending bottom should occur within the larger green box as has been the historical case. Half of all movement has ended in the smaller green box. In this instance, the signal indicated SELL on May 26, 2022 with a closing price of 118.28.

If this instance is successful, that means the stock should decline to at least 117.58 which is the top of the larger green box. Three-quarters of all successful signals have the stock decline 2.609% from the signal closing price. This percentage is the top of the smaller green box. Half of all successful signals have the stock decline 5.353% which is the end point of the black dotted arrow. One-quarter of all successful signals have the stock decline 9.08% from the signal closing price which is the bottom of the smaller green box. The maximum decline on record would see a move to the bottom of the larger green box. These are the same concepts for the levels in the red boxes as well.

The ends/vertical sides of the boxes are determined in a similar fashion. The trough of the decline can occur as soon as the next trading bar after signal close, while the max decline occurs within the limit of study at 40 trading bars after the signal. A 0.5% decline must occur over the next 40 trading bars in order to be considered a success. Three-quarters of successful movement occur after at least 10 trading bars; half occur within 29 trading bars, and one-quarter require at least 36 trading bars.

The black dotted arrow represents median historical movement. Medians are a good metric, but they are just one of many I use when forecasting future movement.

As always, the stock could decline the very next bar after the signal without looking back (therefore the red boxes would not come into play) or the stock may never decline (and the green boxes may never come into play).

Blackstone sinking to bottom. BXGoals 102, 89. Invalidation at 131.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe

Post 10/21Q3 FY21' Earnings Analysis$AAL, $LUV, $BCS, $BX, $CMG, $INTC, $SAP, $SNAP, $T, $VLO

$AAL - American Airlines - posted better-than-expected revenue numbers, although down (25%) from Q3 of 2019 - shares were up +1.3% at the ended of the day, with this being their smallest quarterly loss since the pandemic

$BX - Blackstone - earnings nearly doubled YoY - reported an ATH of distributable earnings, success that’s largely driven by their focus on investing in high-growth areas of the economy

$T - AT&T - fell slightly after posting big subscriber gains -investors questioning the impact of promotions on the company’s future growth

$CMG - Chipotle Mexican Grill - reported better-than-expected EPS and revenue numbers - including a sales jump of 22% citing higher menu prices as a reason for the offset of rising costs

$SNAP - Snapchat - Snap fell (22%) after Q3 revenue missed estimates - thanks to its advertising business being disrupted by Apple privacy changes introduced earlier this year

Blackstone to have big month ahead?Based on historical movement, the trough could occur anywhere in the larger red box. The final targets are in the green boxes. The pending top should occur within the larger green box as has been the historical case. Half of all movement has ended in the smaller green box. In this instance, the signal indicated BUY on August 13, 2021 with a closing price of 114.37.

If this instance is successful, that means the stock should rise to at least 115.14 which is the bottom of the larger green box. Three-quarters of all successful signals have the stock rise 3.0665% from the signal closing price. This percentage is the bottom of the smaller green box. Half of all successful signals have the stock rise 5.1565% which is the end point of the black dotted arrow. One-quarter of all successful signals have the stock rise 8.523% from the signal closing price which is the top of the smaller green box. The maximum rise on record would see a move to the top of the larger green box. These are the same concepts for the levels in the red boxes as well.

The ends/vertical sides of the boxes are determined in a similar fashion. The peak of the rise can occur as soon as the next trading bar after signal close, while the max rise occurs within the limit of study at 40 trading bars after the signal. A 0.5% rise must occur over the next 40 trading bars in order to be considered a success. Three-quarters of successful movement occur after at least 10.5 trading bars; half occur within 22.5 trading bars, and one-quarter require at least 36.0 trading bars.

The black dotted arrow represents median historical movement. Medians are a good metric, but they are just one of many I use when forecasting future movement.

As always, the stock could decline the very next bar after the signal without looking back (therefore the red boxes would not come into play) or the stock may never decline (and the green boxes may never come into play).