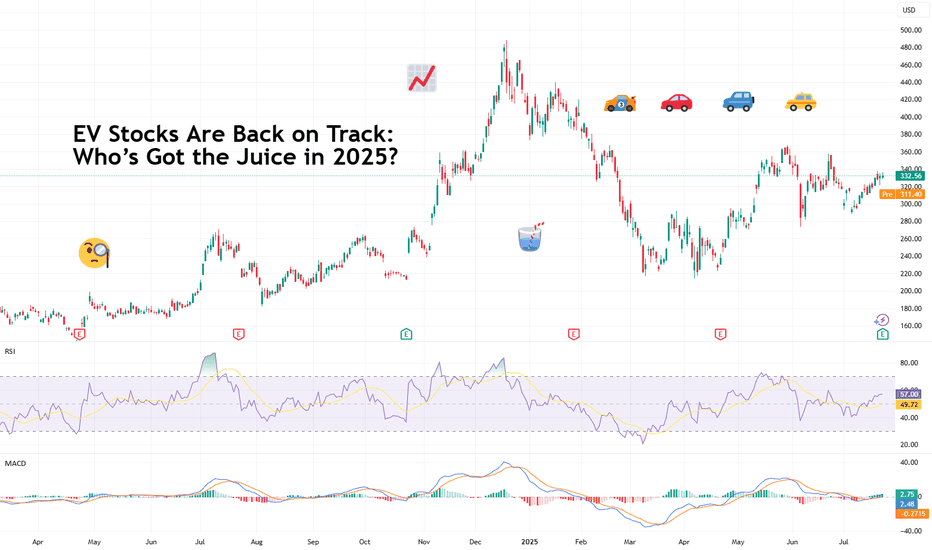

EV Stocks Are Back on Track: Who’s Got the Juice in 2025?This year is big for the EV sector so we figured let’s do a piece on it and bring you up to speed on who’s making moves and getting traction — both in the charts and on the road.

What we’ve got here is a lean, mean lineup of real contenders. Let’s go for a ride.

🚗 Tesla: Still King of the Road (for Now)

Tesla NASDAQ:TSLA isn’t just an EV company. It’s a tech firm, an AI shop, a robotaxi rollout machine, and an Elon-flavored media event every quarter. Even so, when it comes to margins, global volume, and name recognition, Tesla is still the benchmark everyone else is chasing.

In 2025, Tesla’s bounceback is fueled not just by EV hype but by its push into autonomous driving and different plays into the AI space.

The stock is down about 13% year-to-date. But investors love a narrative turnaround. Apparently, the earnings update didn't help the situation as shares slipped roughly 5%. Well, there's always another quarter — make sure to keep an eye on the Earnings Calendar .

🐉 BYD: The Dragon in the Fast Lane

BYD 1211 is calmly racking up sales, expanding across continents, and stealing global market share without breaking a sweat. The Chinese behemoth is outselling Tesla globally and doing it with less drama and more charge… literally .

Vertical integration is BYD’s secret weapon — they make their own batteries, chips, and even semiconductors. The West might not be in love with BYD’s designs, but fleet operators and emerging-market governments are. And that’s where the real growth is.

⛰️ Rivian: Built for Trails, Not Earnings (Yet)

Rivian NASDAQ:RIVN still feels like the Patagonia of EV makers — rugged, outdoorsy, aspirational. Its R1T pickup truck has cult status, but the company had to tone down its ambitions and revised its guidance for 2025 deliveries to between 40,000 and 46,000. Early 2025 projections floated around 50,000 .

The good news? Rivian is improving on cost control, production pace, and market fit. The bad news? It’s still burning cash faster than it builds trucks. But for investors betting on a post-rate-cut growth stock rally, Rivian may be the comeback kid to watch. It just needs a few solid quarters.

🛋️ Lucid: Luxury Dreams, Reality Checks

Lucid NASDAQ:LCID , the one that’ll either go under or make it big. The luxury carmaker, worth about $8 billion, came into the EV game promising to out-Tesla Tesla — with longer range, more appeal, and a price tag to match.

But here’s the rub: rich people aren’t lining up for boutique sedans, especially when Mercedes and BMW now offer their own electric gliders with badge power and a dealer network.

Lucid’s challenge in 2025 is existential. The cars are sleek, the tech is strong, but the cash runway is shrinking and demand isn’t scaling like the pitch deck promised.

Unless it nails a strategic partnership (Saudi backing only goes so far), Lucid could end up as a cautionary tale — a beautifully engineered one, but a cautionary tale nonetheless. Thankfully, Uber NYSE:UBER showed up to the rescue ?

💪 NIO : Battling to Stay in the Race

Remember when NIO NYSE:NIO was dubbed the “Tesla of China”? Fast forward, and it’s still swinging — but now the narrative is more about survival than supremacy. NIO's battery-swap stations remain a unique selling point, but delivery volumes and profitability are still trailing.

The company’s leaning into smart-tech partnerships and next-gen vehicle platforms. The stock, meanwhile, needs more than just optimism to get moving again — it’s virtually flat on the year.

✈️ XPeng: Flying Cars, Literally

XPeng’s NYSE:XPEV claim to fame used to be its semi-autonomous driving suite. Now? It's working on literal flying vehicles with its Land Aircraft Carrier. Innovation isn’t the problem — it's execution and scale.

XPeng is beloved by futurists and punished by spreadsheets. It’s still getting government love, but without a clear margin path, the stock might stay grounded.

🏁 Li Auto: The Surprise Front-Runner

Li Auto NASDAQ:LI doesn’t get the headlines, but it’s quietly killing it with its range-extended EVs — hybrids that let you plug in or gas up. A smart move in a country still building out its charging infrastructure.

Li is delivering big numbers, posting improving margins, and seems laser-focused on practicality over hype. Of all the Chinese EV stocks, this one might be the most mature.

🧠 Nvidia: The Brains of the Operation

Okay, not an EV stock per se, but Nvidia NASDAQ:NVDA deserves a spot on any EV watchlist. Its AI chips are running the show inside Tesla’s Full Self-Driving computers, powering sensor fusion in dozens of autonomous pilot programs, and quietly taking over the brains of modern mobility.

As self-driving becomes less sci-fi and more of a supply-chain item, Nvidia's value-add grows with every mile driven by data-hungry EVs.

🔋 ChargePoint & EVgo: Picks and Shovels

If you can’t sell the cars, sell the cables.

EV charging companies were once seen as the “safe bet” on electrification. Now they’re just seen as massively underperforming.

ChargePoint BOATS:CHPT : Still the leader in US charging stations but struggling with profitability and adoption pacing. Stock’s down bad from its peak in 2021 (like, 98% bad).

EVgo NASDAQ:EVGO : Focused on fast-charging and partnerships (hello, GM), but scale and margin pressures remain.

Both stocks are beaten down hard. But with billions in infrastructure funding still flowing, who knows, maybe there’s potential for a second act.

👉 Off to you : are you plugged into any of these EV plays? Share your EV investment picks in the comments!

BYD

BYD–Smart Money Push Back Zone | Impulsive Bullish Move Coming?HKEX:1211 Description / Idea:

So, BYD will reach the purple "Push Back" zone this week or at the latest next week, where many long traders and probably also the smart money will come back into the market.

📌 Entry: between 110 and 115 HKD

📌 Stop Loss: below April low (~101 HKD)

📌 Take Profit: I will share the exact TP later as it depends on timing and the upper trendline, where the higher highs usually get rejected.

🔍 The upward move is forming like the last one in an ABC pattern and will most likely run between the 78.6% and 50% Fibonacci levels. I plan to hold it continuously as long as the structure remains bullish.

⚠️ If the stock falls below the April low, I would rather sell at around 102 HKD.

💡 Since BYD fell below the 78.6% Fibonacci level last night and the split shares were released today, the sell-off could already begin today if the level is retested beforehand.

#BYD #HongKongStocks #SmartMoney #PushBackZone #SwingTrading #Fibonacci #ABCPattern #TradingAnalysis #TechnicalAnalysis #BullishSetup

BYD: Heading for the Low!BYD remains on a downward trajectory, with the current leg expected to carve out the low of magenta wave while staying above key support at HK$111. Under our primary scenario, this level should trigger a strong upward reversal, which should set the stage for the completion of the broader green wave . Only after this upside move do we expect a deeper correction, which should eventually break through support at HK$111 and HK$67.60 to form the low of green wave . That said, we can’t rule out an earlier breakdown. There’s a 33% probability that the high of green wave alt. is already in. In this case, the price could breach support sooner, suggesting the low of wave alt. may form ahead of schedule.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

BYD Analysis📈 Summary:

BYD has completed a clear ABC corrective structure followed by a strong impulsive wave, reaching a significant resistance zone. Multiple Fibonacci extensions and a long-term trendline converge around the 185–188 level, indicating a potential local top. The market appears overextended, and a retracement is likely.

📊 Technical Analysis:

The chart shows multiple Elliott Wave patterns, with two corrective ABC structures visible prior to the recent rally.

Price has reached the 1.618 Fibonacci extension (~188) of the previous impulse, aligning with a strong resistance zone and a long-term trendline.

A bearish rejection is starting to form around this zone, suggesting a possible trend reversal.

The red arrow indicates the projected downward move, with potential support around 135–140 and possibly down to 112.3, where the 1.618 extension of the prior correction lies.

Volume shows signs of weakening as the price climbs, often a sign of exhaustion in bullish momentum.

🔍 Key Levels:

Resistance: 185–188 (Fibo extension & trendline confluence)

Support Zones: 149.2 (0.786 retracement), 135.8 (0.5 Fibo), 123.4 (0.236), and 112.3 (1.618 extension)

📆 Timeframe: 1h chart (short- to mid-term outlook)

EV Crossroads: Is BYD's Price War the Future of Mobility?The electric vehicle (EV) sector is currently navigating a period of significant turbulence, exemplified by the recent stock decline of Chinese EV giant BYD Company Limited. This downturn follows BYD's aggressive strategy of implementing sweeping price cuts, ranging from 10% to as much as 34% across its electric and plug-in hybrid models. This bold maneuver, primarily aimed at reducing a burgeoning inventory that swelled by approximately 150,000 units in early 2025, has ignited fears of an intensified price war within China's fiercely competitive EV market. While analysts suggest these discounts could temporarily boost sales, they also underscore deeper anxieties stemming from slowing EV demand, persistent economic sluggishness in China, and ongoing US-China trade frictions, leading to concerns about margin compression across the industry.

In stark contrast to BYD's emphasis on manufacturing scale, vertical integration, and aggressive pricing, Tesla distinguishes itself through a relentless pursuit of technological supremacy, particularly in autonomous driving. Tesla's foundational commitment to autonomy is evident in its Full Self-Driving (FSD) software, which has accumulated over 3.5 billion miles of data, and its substantial investments in the "Dojo" supercomputer and custom AI chip development. While BYD is also investing in advanced driver-assistance systems (ADAS), including the adoption of DeepSeek’s R1 AI model, Tesla's ambitious Robotaxi project represents a higher-risk, higher-reward proposition centered on true unsupervised autonomy, a strategy that proponents believe could fundamentally transform its valuation.

Further complicating the competitive landscape are escalating geopolitical tensions between the US and China, casting a long shadow over Chinese companies with exposure to US capital markets. Despite BYD's strategic avoidance of the US passenger car market by focusing on other international regions like Europe and Southeast Asia, the broader implications of Sino-American friction are inescapable. Chinese firms listed on US exchanges face rigorous regulatory scrutiny, the persistent threat of delisting under legislation like the Holding Foreign Companies Accountable Act (HFCAA), and the chilling effect of broader trade restrictions. This environment has led to stark warnings from financial institutions, with Goldman Sachs, for instance, outlining an "Extreme Scenario" where the collective market value of US-listed Chinese stocks could effectively vanish, highlighting how geopolitical stability is now as crucial to investment outcomes as any balance sheet.

Tesla (TSLA) - The Big Short?Can Tesla save itself from the Big Short? With earnings coming up on April 29, the anticipated sales and earnings may be dismal. If hedge funds and retirement managers decide to lighten their exposure, this could lead to abrupt moves in the price of Tesla. Basically, if people want to sell and no one wants to buy at this price, then price has to go down. Also if Tesla hits a certain price on the way down, then all the loans like those used to purchase Twitter may margin call due to risk, more selling. This would not be good for Tesla or the market in general. Also keep in mind that April may be a pullback month for the S&P500 and Nasdaq anyway. So, what does Tesla need to do to combat this? 1. Deliver new products or announce the delivery of new product. 2. Deliver on full self driving along with the Robo Taxi service 3. Deliver on a new cheaper Tesla Model that can be used by individual owners to participate in the Robo Taxi network (Income for the buyer). 4. Deliver on a redesigned Cyber Truck. The current design in getting banned in European countries. Therefore, missing out on sells. 5. Deliver on mass productoin of humanoid robots and AI agents (someone has to be first). This will create excitement but can be tricky since it will unleash AI on the world which can be great but also introduce risk that have not been vetted. Such as, who controls the AI? Who is the AI 'loyal' to? What can people or Tesla ask AI to do? Are there morality rules? Is AI subject to the law? Who's laws based on the Country, State, or county/city it resides or where it was manufactured? 6. Advertise all the positive things about Tesla as a company and the cars as a product. Explain why someone should buy a Tesla over a BYD brand electric car in markets around the world.

These are just a few suggestions for Tesla to avoid The Big Short. What are some of your ideas?

BYD - What next post-earnings and the BoC's stimulus?HKEX:1211 has had a strong year in growth prospects, reporting solid earnings growth thanks to its robust EV sales and expanding footprint in international markets. The recent earnings beat highlighted an impressive increase in revenue, driven by the demand for both their electric and hybrid vehicles. But what we can notice is that the stock has only reflected this as a c.16% rise in price YTD. However, the question now is: where does BYD go from here?

- More recently, the BoC's latest stimulus measures, including rate cuts and support for the real estate sector, could indirectly benefit BYD. With increased liquidity and consumer confidence, domestic demand for EV's could rise, especially if coupled with additional green energy incentives.

- As for the earnings release, the markets reacted well, and with this new-found optimism in the markets, with both the SEE Composite Index SSE:000001 and the Hang Seng Index TVC:HSI up 5.78% and 9.28% in the past 5 days, is this the turn-around for China as a whole?

TSLA Main Trend 02 2025Logarithm. Time frame 1 month (no need for less). Chart until 2031

🟢At the moment we are running a big triangle that broke through upwards .

🔄 There is a rollback now , to retest the breakout zone. All according to technical analysis, due to the super success of the company and the liquidity of its shares. As for me, the retest should be successful, and then the trend will continue.

🔴But, they can do, like in the last cycle (I specifically highlighted this and showed %), a reset (for some grandiose news) and only then a reversal. If this happens, remember, this is a "temporary phenomenon". Do not play locally in shorts, the main trend is bullish, and it will clearly dominate in the long term.

Fundamental analysis. Competition with BYD.

That's why I'll write a lot of text about how this will greatly affect the price of TSLA shares in the future (real supply/demand) due to trade wars for sales markets.

1️⃣ The only competitor in the world is only the Chinese BYD . Which will become an order of magnitude stronger for TSLA in monetary terms and the popularity of more technologically advanced and affordable cars. Its main advantage, why it can give a cheaper price for a higher quality product, is complete control over the production of the most expensive unit of an electric car - batteries. From the extraction of raw materials for production to the assembly of the battery, without intermediaries. But, it is worth noting that the future super giant BYD will be denied access (as is currently partially the case) to countries where politics is subject to US influence.

This is the so-called "gray zone" where a "trade war" will develop for the sale of products. The one who pays more will win, or their government (USA or China) will use greater leverage. For example, as now, in Brazil. The construction of the BYD plant is closed due to "inhumane working conditions" (and this is in a company with 500 billion in capital) in an important region (Latin America), where "the enemy does not sleep" and plans to begin construction of TSLA-Brazil in 2026. You probably understand what the matter is...

The main “trade battle” will naturally take place for the European market . The European electric car industry will not be competitive with TSLA and BYD (two main flagship companies in the transition of internal combustion engines to electric transport on earth).

It is worth noting that TSLA is now very popular in China. There is a large plant (Shanghai). 40,000 pre-orders for the new Model Y. The Chinese government does not interfere with this. But if unfair play continues in other markets, it is unlikely that TSLA will not be thrown out of China. Competition must be fair. Duties on cars are similar. So far, this is conditionally observed, but there are negative signs from the United States.

2️⃣ The reality of the launch of a new hydrogen engine from Toyota. There are rumors that it is being developed jointly with BMW. This is a completely new level of hydrogen engines. Instead of refueling with hydrogen, distilled water will be poured into the tank. The engine converts it into hydrogen. Serial production will allegedly begin in 2028, when the first hydrogen BMW models will roll off the assembly line.

In some sources, also together with Mercedes-Benz, and even Porsche. Perhaps this is just a news teaser for a potential future buyer, to save the catastrophic decline in sales last year and this year, due to the virtual loss (due to the inability to compete) of the world's largest sales market — China.

It is probably logical to assume that the release of this hydrogen engine to the masses will negatively affect TSLA shares. Provided that TSLA does not follow this fuel trend. My opinion is that they are unlikely to give mass production to something like this. It is like the mass production of electric cars in the 1990s and 2000s, in the era of the reign and monopoly of the hegemonies of oil capital, and as a consequence of internal combustion engines.

3️⃣ Massive power outages around the world. The next point is probably more of a “conspiracy theory”, but I can't help but mention the extremely unlikely scenario of impact on stock prices (a sharp drop).

It is worth noting that the shares of any company that is associated with electricity are extremely “afraid” of a massive power outage and its rise in price, especially accompanied by extremely negative news. If, at least for a week, with a significant transition to electric vehicles (for example, 20-30%) in a large city there are power outages, then this can have an extremely negative impact on the shares of companies associated with the production of electric vehicles and components for them, which is logical. To scare and save and, as a result, "get your way".

4️⃣ Also, a gradual but rapid rise in the price of electricity , as a result of some events or policies, will discourage people from using electric vehicles (they will buy and drive less). This could also have a negative impact on the earnings of these companies like TSLA and BYD, and as a result on their speculative assets.

PS . Of all the points, probably the most important is 1 (real competition and trade war). Then 2, after 2028. Before that, I think TSLA and other companies related to electric cars will pump up a lot.

BYD Co. (BYDDY) AnalysisCompany Overview: BYD Co. (Build Your Dreams), a leader in electric vehicles (EVs) and renewable energy, has firmly established itself as a global powerhouse in the EV market. Known for its vertically integrated model and diverse vehicle lineup, BYD continues to expand its dominance across key regions, solidifying its position as a top competitor in the EV and clean energy sectors.

Key Developments:

Market Leadership: OTC:BYDDY has surpassed Tesla as the world's largest EV seller, delivering 822,094 vehicles in Q3 2023 compared to Tesla's 435,059 deliveries. This achievement highlights BYD's growing global market share and its ability to meet surging demand, even in a highly competitive industry.

Diverse Product Lineup: BYD’s expansive vehicle range—from affordable compact cars to luxury models—appeals to a broad consumer base, reducing its dependence on a single market segment. This diversification strengthens its resilience and positions the company to capture additional market share across income brackets.

International Expansion: BYD is aggressively entering new markets, including Europe, Southeast Asia, and Latin America, tapping into regions with rising EV adoption rates. This international growth strategy provides BYD with new revenue streams, insulating it from potential regional economic fluctuations.

Rising EV Demand: With global EV adoption continuing to accelerate, BYD benefits from a tailwind of policy support for renewable energy and consumer demand for eco-friendly transportation options.

Investment Outlook: Bullish Outlook: We are bullish on BYDDY above the $62.00-$63.00 range, driven by its market leadership, product diversification, and robust international growth strategy.

Upside Potential: Our price target is set at $123.00-$125.00, reflecting the company’s potential to capitalize on its global expansion and strengthen its position as the top EV maker worldwide.

🚗 BYD—Driving the Future of EVs Globally! #ElectricVehicles #BYD #CleanEnergyRevolution

HK50 gave back all of its gains over the past month

BYD and Li Auto dropped by 5.57% and 7.29%, respectively, exerting a decisive impact on the decline of HK50. Despite BYD's reporting of favorable 2Q earnings with a 26% increase in sales, the results fell below expectations. Meanwhile, Li Auto's 2Q performance was down 45% YoY, while sales increased by 10%. However, the 5.6% decline in electric vehicle deliveries in Aug compared to the previous month raised concerns about the Chinese EV market. With growing export tensions, the outlook for Chinese EV manufacturers will likely worsen in 2024, further amplifying the negative sentiment toward the index.

HK50 gave up all the two-week gains and closed at around 17150. The index still holds above the descending channel's upper bound but slid below both EMAs, sending apparent bearish signals. If HK50 fails to hold above both EMAs and breaks the 16700 support, the index may reenter the descending channel and fall further to the 15850 support. Conversely, if HK50 climbs above both EMAs and extends its uptrend to the short-term high at 18200, the index could gain upward momentum to the resistance at 18600.

75: BYD to Open Major Electric Vehicle Factory in TurkeyExciting times for BYD as the company announces a significant $1 billion investment to establish a major electric vehicle factory in Turkey. This strategic move is set to help BYD circumvent the recent EU tariffs on Chinese electric cars, creating 5,000 jobs and enhancing their production capabilities to 150,000 vehicles annually. This development not only strengthens BYD's foothold in the European market but also showcases their adaptability and long-term growth strategy.

The chart is currently indicating an uptrend, which began after the price successfully reclaimed the $54.80 level. This reclamation has set a strong foundation for the current upward momentum.

The price has also sustained above the high of $58.01, further solidifying this bullish trend. Holding above this level is crucial for the next phase of the uptrend.

The immediate target for BYD’s stock is the $64.91 price level. Reaching this level will confirm the strength of the current trend and open up possibilities for further gains.

Once the stock achieves the $64.91 mark, we can set our sights on the next significant target at $76.75. Breaking through this level could lead to even higher valuations, reflecting continued investor confidence and market strength. On the flip side, if the stock loses its grip on the $58.01 level, it could signal a reversal, with the next major support found around $43.48. Monitoring these levels is essential for adjusting trading strategies accordingly.

NIO ? Are traders ready to love it again LONGNIO on the daily is 95% below its ATH Winter of 2021 and 50% lower YTD. In China NIO is

competing well with XPEV, LI , BYD and TSLA while it makes further penetrative into the

EU market. Its unique concept in action is battery leasing and battery swapping making

charging time no longer relevant. Apparently, the battery swapping time from a depleted

battery to one carrying a charge is 15-20 minutes. Being a bottom-seeking bargain hunter quite

often, I will take a long trade here with a planned duration of two earnings periods.

Tesla among top 10 losers. Next what?Tesla is the 7th worst performer YTD in the Nasdaq-100. It is the 11th worst performer in the S&P 500. The stock stands 28% lower.

Still, after reaching its lowest level on 22/April, the stock has rallied a remarkable 30%. On 24/April, the stock rallied 12% after the positive earnings call. On 29/April, the stock jumped another 15% after the announcement of the Baidu ( HKEX:9888 ) partnership.

Yet in the longer term, outlook remains cloudy as margin compression owing to fierce competition from Chinese EV makers and the wider EV industry slowdown.

MUSK'S CHINA VISIT LEADS TO BAIDU DEAL

Last Sunday, Elon Musk flew to China on a surprise visit. The last minute visit led to speculation over a push to launch full self driving (FSD) in China.

Persons close to the matter stated that Musk was expected to discuss the rollout of FSD software and permission to transfer data overseas, as reported in Reuters .

One of the key hold-ups for the rollout of FSD in China has been access to map data. Musk’s recent trip seems to have addressed that as Tesla announced a partnership with Baidu for map data access. While, Musk has long claimed that Teslas will be able to run FSD without map data, this will allow them to roll-out the offering much sooner and boost the slowing revenue in one of their leading markets in China.

FSD has been a recent revenue driver for Tesla. In 2024, Siena Capital analysts estimated that Tesla recognized almost USD 700 million in revenue, which represents 4.3% of their automotive revenue after stripping regulatory credits.

BYD PARTNERSHIP

Another strategic partnership that has helped boost investor sentiment at Tesla has been the strategic partnership with BYD ( HKEX:1211 ).

While both companies are major competitors, BYD recently overtook Tesla as the largest EV manufacturer in terms of overall vehicle sales (including hybrids). However, the fierce competition has also taken a toll on both companies as it has led to price cuts to win over more customers.

That’s why a technology-sharing partnership between the two companies is positive. While, they continue to compete, the partnership – specifically related to the use of BYD’s LFP battery technology in certain low-cost Tesla models – remains a positive for Tesla as it allows them to diversify their battery supply chain, reduce production costs, and enhance range for their lower-cost models.

LOW-COST MODELS COMING SOONER THAN EXPECTED

A recent hurdle for Tesla has been delay behind the upcoming low-cost Model 2 vehicle which plays a pivotal role in Tesla’s growth strategy. According to a Reuters report , Tesla had opted to cancel or indefinitely postpone plans for the upcoming Model 2. Instead, it would focus its attention on Robo-Taxis. The low-cost car represented the next phase of Musk’s long-term master plan to produce affordable electric vehicles through manufacturing process improvements.

Fears were that fierce competition in the low-cost category by Chinese manufacturers would make Tesla’s efforts unfeasible.

Yet, Elon Musk disputed the Reuters report and at the Q1 earnings investor call, it was verified. The Model 2 strategy is still on track. In fact, it may come sooner than expected at the end of 2024. Musk stated that Tesla was accelerating the launch of more affordable models that will be available to produce on its existing manufacturing lines.

Tesla aims to fully utilize its current production capacity towards these efforts and grow manufacturing 50% over 2023 before they start investing in new manufacturing lines.

Additionally, the robo-taxi push is also underway. Elon Musk stated that Tesla will launch its long-awaited robo-taxi product as soon as 8/August/2024. The autonomous driving robo-taxis will earn revenue for their owners. Moreover, owners will be able to add their Tesla's to the robo-taxi shared fleet with just one click on the Tesla app.

BEARISH CLOUDS PERSIST

Despite these recent developments, the outlook for Tesla remains undeniably cloudy. At its Q1 earnings, Tesla reported dismal results. But it’s not just Tesla which is struggling, it’s the wider EV industry.

EARNINGS SUMMARY

Tesla's Q1 2024 earnings report released on 23/April revealed a challenging quarter marked by margin compression and a slowdown in electric vehicle (EV) sales, influenced by strategic price cuts and broader economic factors.

Financially, Tesla reported a reduction in its automotive gross margin to 17.4%, down from previous quarter, reflecting the impact of significant price reductions across its model lineup intended to stimulate demand amid a softening global market.

These price adjustments, while successful in driving a short-term uptick in sales volumes, did not fully counterbalance the revenue per unit loss, leading to an overall revenue of $21.3 billion and earnings per share (EPS) of $0.45, both figures below analyst expectations. Quarterly revenue and deliveries were the lowest since 2022.

One of the bright spots has been Tesla’s efforts to control costs. Not only did the company recently announce layoffs. It also stated that it would slow the growth of its Supercharger network to bring costs under control.

Moreover, investors were not as concerned about the concerning financials following the investor call where Musk re-affirmed Tesla’s long-term strategy while maintaining that Tesla would remain lean by producing the new lineup on existing manufacturing lines, assuaging fears of spiraling costs.

Critical to note that it is not just Tesla which struggled in Q1. BYD also reported that its profits fell 47% YoY. Vehicle sales also slowed QoQ. It is the wider industry that is experiencing a slowdown.

Unfortunately for Tesla, margin compression is more concerning for it compared to its Chinese competitors. Particularly as Chinese manufacturers are able to keep costs lower with help from government subsidies. Not only does the Chinese government offer direct subsidies to manufacturers, it also offers subsidies for EV buyers in China which has led to a boom in EV sales, which has benefited Chinese EV manufacturers.

Economic slowdown from high interest rates and a domestic slowdown in China may keep EV sales subdued for some time. In which case, Tesla would be forced to continue with its price cuts which would continue to pressure margins.

TESLA'S FINANCES STRAINED UNTIL AFFORDABLE MODEL LAUNCH

With recent positive news, Tesla stock has recovered sharply. Yet, it remains one of the worst performing stocks in the S&P 500 YTD.

Bearish clouds persist for Tesla as margin compression continues due to competitive price cuts by Tesla. Amid an industry-wide sales slowdown, Tesla may be forced to continue with its strategy to offer price discounts on its cars, keeping its margins pressured. Moreover, Tesla continues to face pressure from low-cost Chinese EVs until it can launch its own low cost models.

While, Tesla’s new models are expected sooner than expected, they are still several quarters away. In the meantime, fundamental factors are likely to continue impacting Tesla’s profitability and subsequently its stock.

BYD Shares Down 15% as it Faces Earnings Test The Chinese biggest EV maker broke with its usual practice of not providing guidance ahead of its earnings report due later Monday. This month, the stock’s volatility jumped to the highest since October 2022, indicating increased investor demand for downside protection.

Last year, new competitors ramped up pressure in the Chinese EV market. Savvy investors will be scrutinizing NYSE:BYD ’s results comments for plans for further actions after a move to cut prices on mass-market models ahead of peers this year scored success.

NYSE:BYD has gained momentum lately taking market share from internal combustion-engine cars,” said Daisy Li, fund manager at EFG Asset Management HK Ltd.

Reduction in price helped NYSE:BYD sell about 300,000 vehicles in March, rebounding from a pronounced weakness in the prior month. That helped the stock, which is down less than 1% in Hong Kong this year, while a gauge of global EV makers has declined more than 15%.

The resilience may leave the shares vulnerable to selling pressure if the results disappoint. NYSE:BYD is expected to post sales growth of 10% for the seasonally slow first quarter, which would be its lowest in four years. Gross profit margin is estimated to decline to 19.6% compared with 21.2% in the fourth quarter.

While the price cuts for cheaper models have likely hurt its profitability, NYSE:BYD ’s growth in higher-end models and overseas sales are among the key points traders will be watching for potential positives.

NYSE:BYD ’s strategy is to leverage domestic mass products to maintain production utilization and operating leverage, and balance profit margins with premium models and exports,” said Bing Yuan, a fund manager at Edmond de Rothschild Asset Management.

NYSE:BYD has been expanding its luxury lineup, including the Auto China show launch of the Denza Z9GT, a shooting-brake style design with a heavy emphasis on technology. It rolled out its $200,000-plus Yangwang U9 supercar to rival offerings from Ferrari NV and Lamborghini in February.

NYSE:BYD has a target of selling 500,000 vehicles outside China this year and then doubling that in 2025. It also plans to build its first European car factory in Hungary.

Robert said: “Exports coming from a low base are expected to continue to show strong growth — this will remain a key supporting factor for BYD’s revenue growth and likely margin,” Mumford, a portfolio manager at GAM Hong Kong Ltd. “Outside the leaders, we have been fairly bearish on the sector given high levels of competition and pricing pressure.”

Build Your Dreams (BYD): Moving Higher!Build Your Dreams (BYD): HKEX:285

After closely examining the Chinese electric vehicle manufacturer BYD, we've concluded that there is a very appealing and interesting opportunity to start building positions. We are currently in an overarching Wave III. Wave II concluded at the low of 13.20 HKD, and the all-time high is currently at 63.10 HKD. We are now likely in a Wave 5, which should coincide with the completion of Wave (1). Subsequently, a deeper correction to Wave (2) is expected, where we aim to place our next long-term entries, but we also want to place a short-term entry now.

We have successfully completed Wave 4 and since developed Waves ((i)) and ((ii)). This Wave ((ii)) held precisely at the 61.8% Fibonacci retracement level at 28.19 HKD, and we should not fall below this before completing the overarching Wave 5 or Wave (1). We should also surpass the Wave 3 high of 40.40 HKD.

BYD: Engine Breakdown 🚘We consider the recent setback merely as part of the substructure of the magenta wave (1). This wave should lead to a sustained rise above the resistance line at HK$280.60. However, our 30% probable alternative scenario should also be noted. This would attest to the corrective nature of the upward movement that has been underway since February. Although the price should continue above HK$280.60 in this case, a significant sell-off should then set in, which would take the price to complete the green wave alt. below the support at HK$161.70.

NIO Long on Disappointing EarningsNIO's disappointing earnings were not a surprise. Given the context of China's recession, NIO

did better than many expected. TSLA is down as well. NIO is doing as well as most of its peers.

On the 120 minute chart, NIO is down 60% from the end of the year highs. The RSI indicator

confirms that NIO is in oversold undervalued territory. NIO is at the bottom of the high volume

area of the profile and has been trending down with the first lower VWAP line as resistance.

I see NIO as likely to trend up as the China economy improves and for that to be reflected

in the next earnings report. NIO's innovative battery swapping program where the car owner

buys a car without a battery and is able to swap out an energy depleted battery for a freshly

charged one in 3 minutes at any of the NIO owned battery stations as a way for NIO

to excel no matter competition from the others in China including TSLA. NIO is now selling

cars in Scandinavia which should serve as steeping stone to further expansion in Europe.

TSLA to NIO market cap comparisonOn a down market day I decided to look at the comparision of market cap between TSLA and NIO by a share price ratio basis. On the daily chart, albeit with fluctuations, TSLA is continuously gaining market cap compared with NIO. This ratio allows for a tool to help decide whether to buy TSLA or NIO.

In short, TSLA is a buy at the low pivots of the ratio, while NIO is the buy at the high pivots which is right now.

Conversely, TSLA is a sell or short at the high pivots while NIO is a sell at the low pivots.

The trade right now is sell TSLA to decrease the position and use the proceeds to buy

NIO either in bulk or in increments to average in.

UCAR a penny China stock now at bottom 300X upside LONGUCAR, a NASDAQ penny stock and a Chinese auto dealership enterprise is experiencing a huge

relative volume spike. UCAR had a great week in very active trading.

Now priced at about 0.07 per share, my near term target is 1.58

representing a consolidation pivot on the chart.

The all time high is the is 300X upside more or less. This is a risky play. It could get delisted

although NASDAQ will give it some more quarterly reports to make a case for regulatory

compliance and stock price stability I will take a small position here given the

risk. Warren Buffet got in on the cheap with BYD over the counter, he has been massively

rewarded for his very large position. Retail traders can make good profits with undervalued

penny stocks. I think that this right now is one of them. I will use a zig zag strategy

to take profits at high pivots and add into the position at low pivots along the way.

When long strong resistance becomes support..BYD Company Limited ($BYDDF)

THE COMPANY:

BYD Company Limited, together with its subsidiaries, primarily engages in the research, development, manufacture, and sale of automobiles and related products worldwide. It operates through three segments: Rechargeable Battery and Photovoltaic Products; Mobile Handset Components and Assembly Service; and Automobiles and Related Products. The company offers internal combustion, hybrid, and battery-electric passenger vehicles; buses, coaches, and taxis; logistics, construction, and sanitation vehicles; and vehicles for warehousing, port, airport, and mining operations. It also manufactures and sells lithium-ion and nickel batteries, photovoltaic products, and iron batteries primarily for mobile phones, electric tools, and other portable electronic instruments; mobile handset components, such as housings and keypads; and automobiles, and auto-related molds and components, as well as provides assembly, and automobiles leasing and after sales services. In addition, it offers rail transit equipment; consumer electronics; and solar batteries and arrays, as well as involved in the urban rail transportation business.

THE TRADE:

Support and resistance levels are important points in time where the forces of supply and demand meet. These support and resistance levels are seen by technical analysts as crucial when determining market psychology and supply and demand. When these support or resistance levels are broken, the supply and demand forces that created these levels are assumed to have moved, in which case new levels of support and resistance will likely be established.

A key concept of technical analysis is that when a resistance or support level is broken, its role is reversed. If the price falls below a support level, that level will become resistance. If the price rises above a resistance level, it will often become support. As the price moves past a level of support or resistance, it is thought that supply and demand has shifted, causing the breached level to reverse its role. (source: Investopedia)

Sales of new energy vehicles surged 148% in September, data from the China Association of Automobile Manufacturers showed, spurred by Beijing’s promotion of greener vehicles to cut pollution.

I'm long with a stop below the line.

Long term investment.

Trade safe!