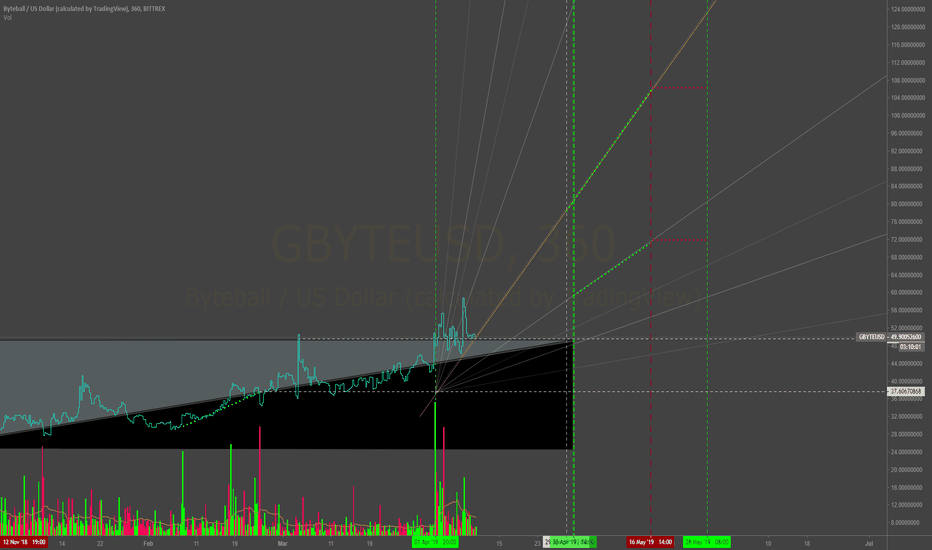

OByte Gbyte ByteBall Triangulation - Weighted Volume Method Gann, volume, and some magic. I might just be a little biased, really starting to like the fundamentals on this coin so take this with a Shill Pill.

$OBYTE $GBYTE

Byteballbtc

Byteball Road Back To $1000-Orange line is GBTE/BTC-

The Future is bright for byteball. Amazing project, if you are unfamiliar with it they use a DAG based "blockchain" you can catch up by reading the whitepaper first byteball.org or check out thier medium page for fast reads medium.com

,

Dyor.

Updates for March: medium.com

ByteBall Bytes (GBYTE) Climbing Fast

• Resistance = .08276 SATS

• Support = .05966 SATS

• Next Target = .09528 SATS

• RSI = 54.87

As always, I recommend for every one to further expand their knowledge and do as much research as possible when investing. These are my own personal opinions and should be considered educational resources rather than financial advice. Good luck out there cryptonauts!

About ByteBall

Byteball enables trust where trust couldn’t exist before. When a contract is created on Byteball platform, it can be trusted to work exactly as agreed upon. Why? Because it is validated by multiple nodes on the decentralized network, which all follow the same immutable rules. The counterparty, even if it is a total stranger, has to behave honestly because only the rules have authority. Such a contract is called a smart contract. See below for examples of working smart contracts available today.

Byteball allows you to do something that traditional currencies can't: conditional payments. You set a condition when the payee receives the money. If the condition is not met, you get your money back.

Buy insurance from peers to get paid in case a negative event occurs. Sell insurance for profit. Insurance is just a simple smart contract that can be unlocked by the insured — if the event in question did occur, or by the insurer — otherwise. To insure against flight delay, find your counterpart in #p2p_insurance channel on our Slack, create a contract, and if your flight arrives late, chat with flight delays oracle to have it post the data about the delay, then unlock the contract.

ByteBall White Paper: byteball.org

GBYTE: Interest Inevitable For a Low Cap Directed Acyclic GraphMark the date for this coin as 1/26/2018 to 1/30/2018. That's the strike zone left to right, while the strike zone has a low to high of 0.05368BTC to 0.06253332BTC. Swing your bat for a home run in this area. We'll round the bases together.

What I see on this chart is strong Resistance (capital 'R') being broken down with each new day. I think that a surge in Bitcoin's price will actually be a boon for this coin. People seem to be hesitant in going long on Bitcoin or any other Generation 1 proof of work coin. This is totally flawed thinking and I am ready to profit from the irrationality or - in other terms wide-reaching speculation - that the value of Bitcoin will fall in terms of new generation, DAC based coins. The preeminent - and lowest market cap by chance - DAC coin on the market is ByteBall. From a fundamental perspective GBYTE is undervalued in terms of IOTA and especially Raiblocks. GYBTE will see a run up in BTC value for the year 2018 as investors research what's the, "next step" for cryptocurrencies. I think this trade has the potential for massive volume and swing trading with current potential being somewhere between the stratosphere and the moon!

From a technical analysis standpoint GYBTEBTC is playing well within the lines that I drew using Gann fans and Fib levels from key points on the high-to-low and from 7/77/231 MA crosses on this 4 hour chart. What do these indicators provide as a story? GBYTEBTC broke through long term resistance on its last wave up. Right now this coin is traversing Bitcoin consolidation related price action, being strongly resistant to the recent sell off in a short term supportive trend. Furthermore, there is a point of reckoning approaching in which two resistance lines - one long term and one short term - intersect with strong support at the 0.0603 BTC level on January 28, 2018. This spells a price hike going forward as much more talented & veteran traders than I here on trading view and within my network suggest that Bitcoin will continue to test support in a bearish manner through consolidation at around 7k-10k USD. However, I remain unconcerned with the trash of US Dollars. My driving goal is to ante up bitcoin on the deck to earn more bitcoin and add to a core position of elite coins. GBYTE is one such coin. The reason I do not sell Bitcoin into tether or dollars is because I believe in the project at an emotional level and will use Bitcoin as a method of payment in spite of dollars; this is ideological as I do not support the use of US Dollars for which the world's tax money is used to fund it's interest payment and vampiresque war financing. On the other hand, I am also a believer in this project of Byteball going forward (as I am with Monero, Stratis and in varying degrees Litecoin) with the same commitment to Bitcoin.

For these reasons GBYTEBTC is a great asset, not only to profit in terms of Bitcoin, but also as a standalone addition to one's portfolio going forward. This comes from both fundamental market trends with the adoption of DAC based distributed ledger technology and from a current price action technical analysis insight. Many people are now in, "HODL" mode, while I am in buy-buy-buy mode with the instinct that 2018 will be a great year for ByteBall and a few other gems.

Disclaimer:

I know nothing and I am totally asleep at the wheel as a person. Do not ever think that this is valid or actioinable information that is presented above. Do not act on this information.