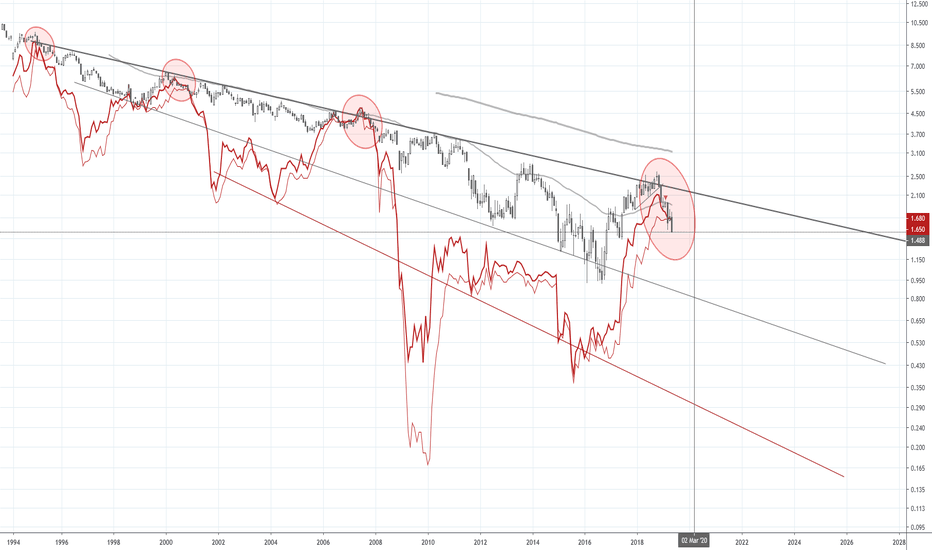

ridethepig | Breakout in Canadian 10Y YieldsWe are going to intentionally cycle through many Yield chart updates, which will be rolled out over the next few days. The game of currency speculation must include Yield analysis to have a compromising effect.

It is evident that the exchange in control at the 0.48x lows has lead to a change in momentum. Buyers have forced the technical break and negated the current downtrend, this is a loud warning sign that sellers need to start treading more skilfully. The directional change means buyers must now advance towards 0.85x and 1.07x and absorb the remaining pressure. Gaining tempo with the breakout cannot be dismissed with a quick shrug of the shoulders either!!

Buyers have shown courage, intentionally forming a basing pattern at the 0.48x lows and have completely outplayed late sellers. Look to target 0.85x and 1.07x for the second half of 2020. Depending on the handling of the recovery we can explode to the topside here and unlock 1.325 and 1.844. We can come back to this idea when our wheat blooms.

Good luck and thanks as usual for keeping the support coming with likes, comments, charts, questions and etc!

CA10

Canada | Recession WatchThe 10 year Canadian yield is now below the 1 year and 3 month yield, which is a good indicator of a potential recession ahead. Rates follow economic growth, so we can interpret yields as a function of the economy. These interest rates also impact the price of money (CAD interest rates). One way to interpret lower interest rates in the Canadian economy is that economic activity is lower and cheap money indicates a discount on loans due to a lack of credit demand. Lack of credit demand could be an issue related to demand itself, access, or credit worthiness. So lower interest rates can quickly impact CAD valuations against other currencies in the FX market.

The trend is pretty clear going back to the early 90s; the 10 year provides a kind of ceiling for yields. There is a kind of megaphone pattern as well, which could indicate that rates will go sharply lower in the coming years, with short term rates bottoming out hard and perhaps even going negative.