USDCAD Tactical SHORTEntering into a tactical short position on USDCAD. This is a pure position play, medium to long term I am bullish the USD, however I believe CAD is in oversold territory. USD is on a rip right now due to Powell pivot which the USD should be supported by US yield vs bond differentials. CAD positioning is in oversold territory ever since the last Bank of Canada rate meeting. There is an event risk in the upcoming BoC meeting but I would rather enter now and re-enter if I do get stopped out.

Technical perspective - two cup and handle patterns finished, one on the left between April - July and another between Aug - Dec (orange fractal) and in between both was a head and shoulder pattern (in purple). Speculating that a another potential head and shoulder pattern will form again where I am entering on the left shoulder drop + a bearish Engulfing candle + a close below the 5 EMA.

US10/CA10Y bond differentials are supporting a lower USDCAD paired with an oversold Oil primed to return to the 80s level.

OIL vs USDCAD

US10Y vs CA10Y

Backwardation Oil contracts support CAD strength

CA10Y

10 Year Rates Rocket on inflation fearsBond Yields are going higher and fast. Since January bond yields have increased across the board, rising quickly in the USA, Australia, New Zealand and Canada especially.

Economies are rebounding and looking to show significant GDP growth during 2021 thanks to the rollout of the vaccine and reopening. This growth may (In the case of the US) be fuelled by additional fiscal stimulus but is certainly being underpinned by monetary stimulus which kept rates low during 2020.

The rise in bond yields can be attributed directly to investors expectations of future inflation expectations. The growing rates signals that investors are seeing inflation rising faster than what Central Banks have predicted and predicting that Central Banks to lift rates earlier than most have indicated (typically around 2024).

The perceived rise in inflation is largely driven by rapidly rising commodity prices. Commodity prices are at either all time highs or at record levels not seen for at least 10-15 years in the case of Copper and Iron Ore. As commodity prices increase this will flow through into inflation into the economy. E.g. Rising Iron ore prices drives up the price of steel, which makes everything from houses to cars to more expensive.

It is important to note that this is all "predicted inflation", inflation in most economies is well below the levels needed for Central Banks to act. (See numbers below). Fed Chair, Jerome Powell has a view that a rebounding economy can live with slightly higher rates and a rise in commodity prices is not enough to drive inflation across the whole market. His view is that when wages and consumer prices lift, we would start to have a problem.

US Actual = 1.4% Target = Moderately above 2.0%

AU Actual = 0.9% Target = 2-3%

CA Actual = 1.6% Target = Sustainably above 2%

NZ Actual = 1.4% Target = sustained at 2% per annum

Powell argues that the rise in commodity prices can be easily absorbed, and believes that much of that rise is just a temporary condition reflecting the reopening, and that prices will revert back to “normal” levels over time.

However, investors are seeing that if inflation takes off, the Fed and other Central Banks will be unable to hold rates at current low levels. And if the current trend in higher yields continues, this will have significant impacts for the stock market.

'Giant Panda' surrender of the AUD bid📌 Surrendering of the AUD bid

The following play is an example of how easily a premature surrender of the ladder can lead to a correction.

In light of that, for the news flow we have a two course dinner:

1️⃣ A dovish RBA on deck notably showing signs of distress with Australian 10Y Yield and opening the door for more QE. This is going to keep the downward pressure on AUD in the immediate term while CB's and governments around the globe prepare to tap into the overdraft one more time.

2️⃣ Regular readers will know we have been tracking PBOC for some time. The "Giant Panda" has been spotted (more than once on the AUD bid and quite practicably so. The importance here comes from them effectively pressing the release valve via banning Australian coal.

3️⃣ Any last minute USD outflows ahead of election event risk will be positive CAD in the immediate term. A Trump victory would then likely unwind those, while a Biden sweep I suspect accelerates the flows from US to Canada.

📌 The following swing that we are tracking is a combinatory complication .

From a flows perspective, sellers can resign after testing the previous resistance turned support, with the threat of penetration towards the previous centre in the orderblock. The floor will depend on risk passing, for now let's keep working shorts and use CAD to park as a defensive move to ride the pig on any last minute U.S election outflows; 0.930x -> 0.900x looks within reach.

Thanks as usual for keeping the feedback coming 👍 or 👎

ridethepig | Breakout in Canadian 10Y YieldsWe are going to intentionally cycle through many Yield chart updates, which will be rolled out over the next few days. The game of currency speculation must include Yield analysis to have a compromising effect.

It is evident that the exchange in control at the 0.48x lows has lead to a change in momentum. Buyers have forced the technical break and negated the current downtrend, this is a loud warning sign that sellers need to start treading more skilfully. The directional change means buyers must now advance towards 0.85x and 1.07x and absorb the remaining pressure. Gaining tempo with the breakout cannot be dismissed with a quick shrug of the shoulders either!!

Buyers have shown courage, intentionally forming a basing pattern at the 0.48x lows and have completely outplayed late sellers. Look to target 0.85x and 1.07x for the second half of 2020. Depending on the handling of the recovery we can explode to the topside here and unlock 1.325 and 1.844. We can come back to this idea when our wheat blooms.

Good luck and thanks as usual for keeping the support coming with likes, comments, charts, questions and etc!

CA10Y: Next target is 0.8, can it rally?First off, please don't take anything I say seriously or as financial advice. As always, this is on an opinion based basis. That being said, the bonds market for Canada, especially for its government been quite bullish recently. The last close was at +7.07%. Although, some resistance seems to be on its way, I think the next target in price to look for milestone-wise would be at $0.8. Afterwards, one could then look at it carefully and see if it worth a long hold, risk mitigation, or reinvesting. Again, just my opinion.

Canada | Bond Yeilds and Recession WatchLooking at the chart we can see the 3 month yield inverted with the 10 year yield a few weeks ago so recession could be anywhere from 12-18 months out. The question is, where do we stabilize in this current down swing? Things will probably go sideways for a while before we break support and rates dive to zero. The catalyst will be nGDP figures and Bank of Canada policy.

Canada | Recession WatchThe 10 year Canadian yield is now below the 1 year and 3 month yield, which is a good indicator of a potential recession ahead. Rates follow economic growth, so we can interpret yields as a function of the economy. These interest rates also impact the price of money (CAD interest rates). One way to interpret lower interest rates in the Canadian economy is that economic activity is lower and cheap money indicates a discount on loans due to a lack of credit demand. Lack of credit demand could be an issue related to demand itself, access, or credit worthiness. So lower interest rates can quickly impact CAD valuations against other currencies in the FX market.

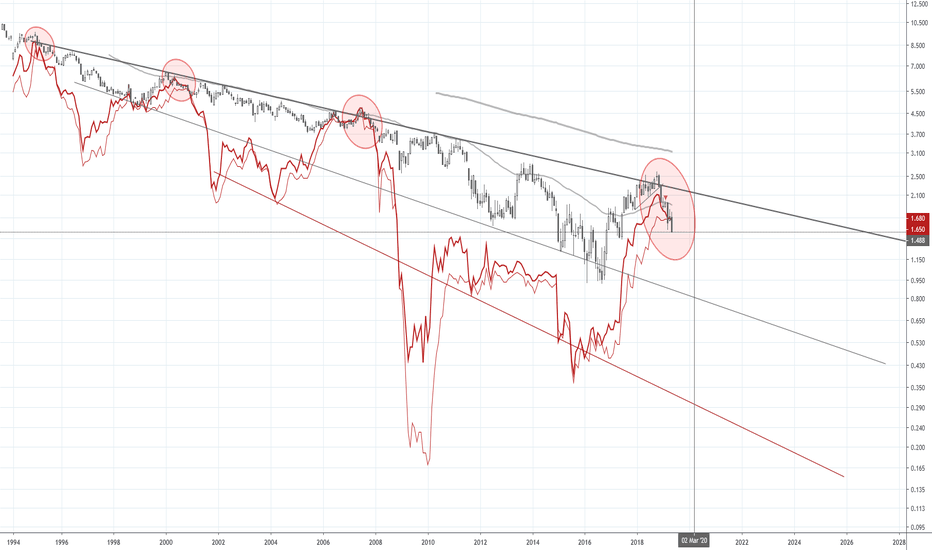

The trend is pretty clear going back to the early 90s; the 10 year provides a kind of ceiling for yields. There is a kind of megaphone pattern as well, which could indicate that rates will go sharply lower in the coming years, with short term rates bottoming out hard and perhaps even going negative.

Gov't Bond Yields & Bank StocksFollowing government bond yields can be crucial to understanding the underlying price action of banks stocks. Take this example of Canadian bonds and stocks. We can clearly see how, following a steady expansion in yields of various maturities, a trend break where bonds suddenly appreciated (yields go down when bond prices go up) the results were a change in trend for the bank stock (in this case CIBC). The inversion of the 3 month and 10 month yields resulted in a trend change confirmation on the smaller timeframes. This is not just a coincidence: bank business models are heavily influenced by their central bank regulator.

CA10Y | Rate Cuts Ahead for Canada. Watch the Banks!Back in November (2018) the yield on the 10 year Canadian treasury hit the upper boundary historical trendline and reversed sharply after briefly overshooting. Fundamentally, interest rates follow GDP figures so we can use these technicals to give us a bit of a prognoses for the financial and economic wellbeing of the country... and its not looking good.

Today the central bank confirmed the fears so expect Canadian rates to drop across the board (but I expect spreads to rise between safe paper and junk). It will be interesting to watch what happens to bank stocks over the next 12-18 months as the economy slows down. Will we see a credit crunch? How will this impact the Loonie versus the US dollar?

I am expecting trouble for Canadian banks as they are now dealing with a red hot housing market, the rout in commodities, and now, rising consumer delinquencies. Most importantly, bank capital (equity) will likely get squeezed, which will put tension on bank balance sheets and their eagerness to extend credit. A policy for negative interest rates is already primed and ready in the Bank of Canada's toolbox. But luckily Canada doesn't have "reserve requirements" for banks ;)

***This is not investment advice and is simply an educational analysis of the market and/or pair. By reading this post you acknowledge that you will use the information here at YOUR OWN RISK