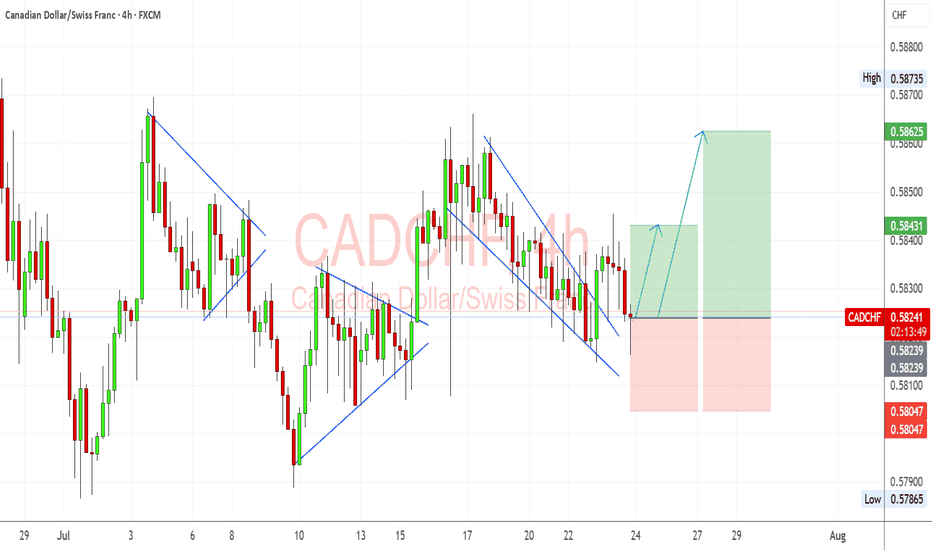

CADCHF Bullish Reversal in Motion Channel Break & Momentum ShiftCADCHF setup is developing into a potential bullish recovery after a breakout from a falling wedge. I’m looking for signs of buyer control as price attempts to build higher structure off the recent breakout.

📊 Technical View (My Setup Insight):

Falling Wedge Breakout: Price has cleanly broken out of the descending channel/wedge formation. That’s often a reversal signal, especially near support zones.

Support Holding: The pair found buyers around 0.5810–0.5820, an area tested multiple times in July. This zone has acted as a soft base.

Bullish Flag Recovery: Prior corrective patterns (flags/pennants) were followed by strong impulsive moves, and we may be repeating this pattern now.

Next Targets:

TP1: 0.5843 – aligns with previous structure and minor resistance.

TP2: 0.5862 – near the most recent high and top of consolidation.

Stop-Loss: Below 0.5800 to invalidate the reversal structure.

🧮 Fundamental Drivers (My Outlook):

CAD Support from Oil Stability: Oil prices have firmed around $78–$80, which helps the CAD via improved trade and energy revenue prospects.

SNB Stance Neutral-Dovish: Swiss inflation remains soft, and SNB has signaled comfort with its current policy rate, reducing CHF bullish pressure.

BoC Hawkish Bias: Despite softening Canadian CPI, the BoC remains cautious and hasn’t ruled out future hikes. CAD remains supported relative to CHF.

Global Risk Mood: CHF is sensitive to risk-off flows. With equities and commodities rebounding modestly, safe haven flows into CHF may slow.

⚠️ Risks to the Setup:

A sudden drop in oil prices could hurt CAD.

Risk-off sentiment due to geopolitical tensions or US equity selloffs could fuel CHF strength.

Any surprise SNB jawboning about FX could cause CHF to spike.

📆 Upcoming Events to Monitor:

Canadian GDP / Retail Sales – if strong, reinforces CAD recovery.

Swiss KOF Economic Barometer – gives insight into CHF macro tone.

Oil Inventories – strong builds or drawdowns influence CAD indirectly.

🔁 Leader/Lagger Context:

CADCHF is often a lagger, especially when risk sentiment or oil makes bigger moves. It can follow USDCHF or USDCAD behavior due to shared components.

If oil or global risk sentiment shifts, CADCHF tends to react with a small lag, making it great for secondary confirmation trades.

🧩 Summary – Bias & Watchpoints:

I currently hold a bullish bias on CADCHF following the falling wedge breakout and support defense. Fundamentals are moderately in favor of CAD due to oil stability and BoC’s cautious stance versus the more passive SNB. Key risks include any renewed CHF demand from risk-off shifts or soft Canadian economic surprises. The most critical levels now lie at 0.5843 and 0.5862 for upside targets, while 0.5800 remains key invalidation support.

CADCHF

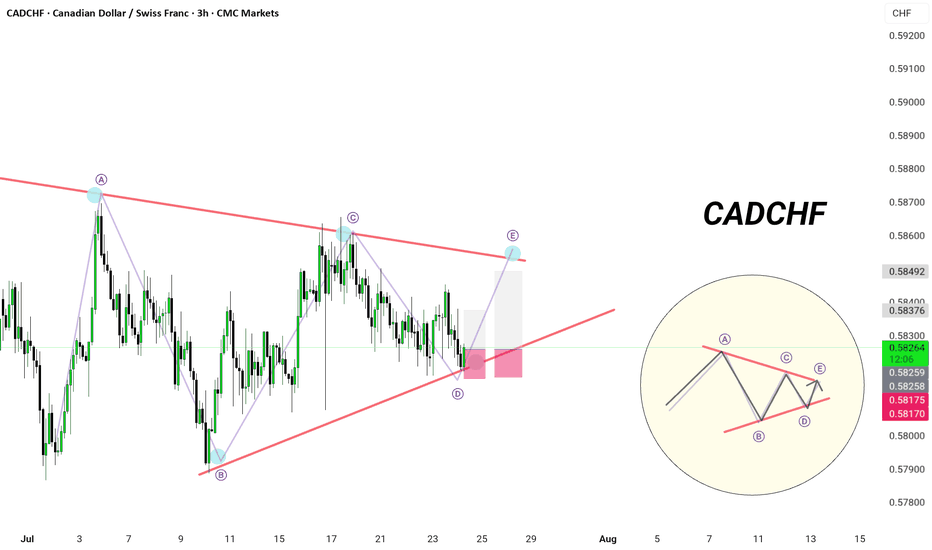

CADCHF | 3H Chart |

🎯 Triangle Tightens — Precision Required

In true Monaco fashion — elegance meets precision.

🟪 Pattern: Contracting Triangle (ABCDE)

⚙️ Price perfectly respecting dynamic structure

📍Currently printing leg D → E with bullish momentum from the base trendline

🎯 Anticipated move towards 0.5849 resistance zone

🧠 Playbook Setup:

📈 Long from 0.5817–0.5820

🎯 Target: 0.5837–0.5849

🛑 Invalidation: Close below 0.5817

🚧 Wave E = decision point

Breakout or reversal? Play the retest like a gentleman.

📊 Bias: Short-term bullish to complete the structure — then react, not predict.

CAD/CHF SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

Previous week’s green candle means that for us the CAD/CHF pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 0.578.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CADCHF Squeeze Between OB and Trendline – Big Move Coming?CADCHF is compressing within a descending triangle structure, showing signs of bullish intent as it continues to reject a key demand + 1H order block area.

🔹 Trade Idea:

I’m watching for a bullish breakout above 0.58380, which will also confirm a trendline breakout from the descending triangle. Until then, I remain on the sidelines.

🔹 Key Technical Factors:

- Price consolidating inside a descending triangle, squeezing between lower highs and a consistent demand zone

- Repeated rejections from the green demand zone suggest buyers are defending the level strongly

- A clean order block (1H) is aligned with the bottom of this structure, adding confluence for a bullish move

- Above 0.58380 breakout may trigger momentum toward 0.58630, near the supply zone

🔹 Trade Plan:

+ Buy above: 0.58380 (on breakout + close above trendline)

+ First Target: 0.58630 (next resistance/supply area)

* Invalid if: price breaks and holds below the demand zone

⚠️ Note: Entry is only valid on confirmed breakout. Until then, patience and watchfulness around structure edges are key.

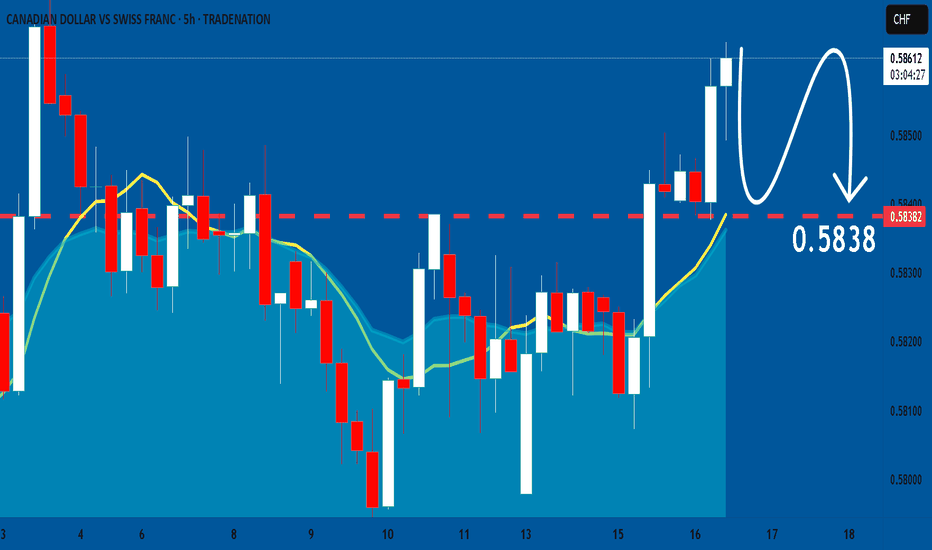

CADCHF: Bearish Continuation

Looking at the chart of CADCHF right now we are seeing some interesting price action on the lower timeframes. Thus a local move down seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

CADCHF Sellers In Panic! BUY!

My dear friends,

CADCHF looks like it will make a good move, and here are the details:

The market is trading on 0.5811 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 0.5831

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

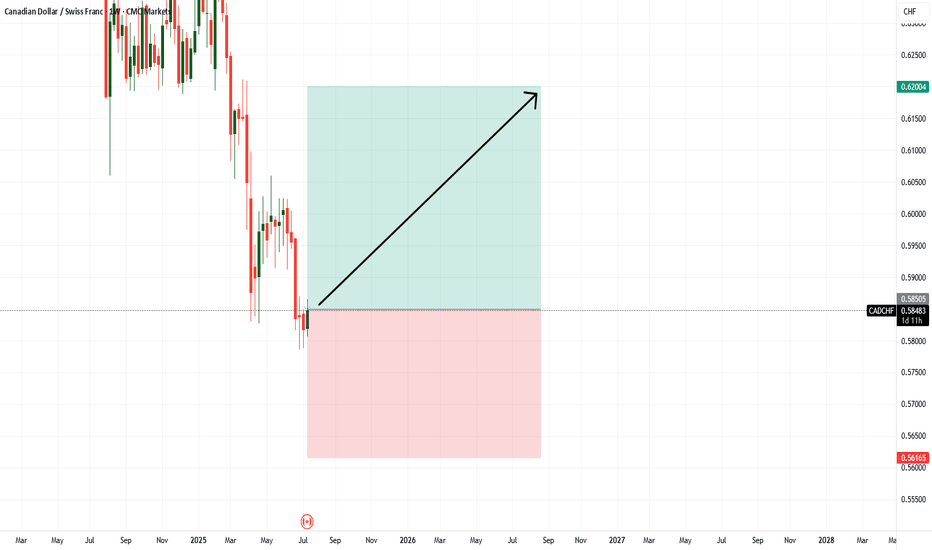

CAD/CHF BULLS ARE GAINING STRENGTH|LONG

CAD/CHF SIGNAL

Trade Direction: long

Entry Level: 0.580

Target Level: 0.603

Stop Loss: 0.565

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CAD_CHF STRONG SUPPORT|LONG|

✅CAD_CHF has been falling recently

And the pair seems locally oversold

So as the pair is approaching a

Horizontal support of 0.5790

Price growth is to be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD_CHF GROWTH AHEAD|LONG|

✅CAD_CHF made a retest

Of the horizontal support

Of 0.5820 and we are already

Seeing a bullish reaction

So we will be expecting a

Further bullish move up

On Monday

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADCHF Is Going Up! Long!

Take a look at our analysis for CADCHF.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 0.583.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 0.585 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

CAD-CHF Local Long! Buy!

Hello,Traders!

CAD-CHF made a retest

Of the horizontal support

Of 0.5832 so we are locally

Bullish biased and we will be

Expecting a local bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD-CHF Rejection From Resistance! Sell!

Hello,Traders!

CAD-CHF is trading in a

Very strong downtrend

And the recent breakout

Of the a strong key level

Of 0.5839 is confirmed

So we are bearish biased

And as the pair made a

Retest of the new resistance

We can enter a short trade

And will be expecting at

Least a local move down

In a bearish continuation

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD/CHF BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are targeting the 0.578 level area with our short trade on CAD/CHF which is based on the fact that the pair is overbought on the BB band scale and is also approaching a resistance line above thus going us a good entry option.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CAD_CHF WILL KEEP FALLING|SHORT|

✅CAD_CHF broke the key structure level of 0.5840

While trading in a strong downtrend

Which makes me bearish

And I think that after the retest of the broken level is complete

A rebound and bearish continuation will follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD/CHF Loonie Heist: Sniping Swiss Profits with Thief Trading!🌍 Hello Global Traders! 🌟

Money Makers, Risk Takers, and Market Shakers! 🤑💸✈️

Dive into our CAD/CHF "Loonie vs Swiss" Forex heist, crafted with the signature 🔥Thief Trading Style🔥, blending sharp technicals and deep fundamentals. Follow the strategy outlined in the TradingView chart, focusing on a long entry targeting the high-risk MA Zone. Expect a wild ride with overbought conditions, consolidation, and potential trend reversals where bearish players lurk. 🏆💰 Celebrate your wins, traders—you’ve earned it! 💪🎉

Entry 📈: The vault’s open! Grab bullish opportunities at any price, but for precision, set buy limit orders on a 15 or 30-minute timeframe near swing lows or highs for pullback entries.

Stop Loss 🛑:

📍 Place your Thief SL at the recent swing low on the 4H timeframe (0.59400) for scalping or day trades.

📍 Adjust SL based on your risk tolerance, lot size, and number of open orders.

Target 🎯: Aim for 0.61500.

💵 CAD/CHF is riding a bullish wave, fueled by key market drivers. ☝

Unlock the full picture—dive into Fundamentals, Macro Insights, COT Reports, Quantitative Analysis, Sentiment Outlook, Intermarket Trends, and Future Targets. Check 👉🌎🔗.

⚠️ Trading Alert: News & Position Management 📰🚨

News can shake the market hard. Protect your trades by:

Avoiding new entries during news releases.

Using trailing stops to lock in profits and shield running positions.

📌 Markets move fast—stay sharp, keep learning, and adapt your strategy as conditions evolve.

💖 Power up our heist! 🚀 Tap the Boost Button to amplify our Thief Trading Style and make stealing profits a breeze. Join our crew, grow stronger, and conquer the markets daily with ease. 🏆🤝❤️

Catch you at the next heist, traders—stay ready! 🤑🐱👤🤩

CADCHF SellOne strong reason for this trade is that the price clearly broke down from an inverted Cup and Handle pattern and confirmed the move with a small bearish flag, making this a high-probability trend continuation short setup. These patterns together signal strong bearish momentum and give a solid reason for entering a short position.

CADCHF at the Cliff's Edge – Is a Breakdown Imminent? 🧭 Technical Context

Price is currently sitting at the key support area of 0.5890–0.5900, tested multiple times since April.

This week’s candlestick shows a clear close below the intermediate micro-structure (two consecutive closes under recent lows), confirming bearish pressure.

The weekly RSI remains in a neutral-to-low zone, trending downwards with no active bullish divergence.

📉 Technical Conclusion: Active bearish bias. Watch out for potential false breaks below 0.5890 as liquidity traps.

📊 COT Report – as of June 17, 2025

🇨🇦 CAD

Non-Commercials: added +8.5k long contracts, aggressively cut −18.3k shorts

→ Excessive optimism, potential exhaustion on the buy-side

Commercials: added +31k shorts

→ Typical hedge behavior – signaling protection from CAD devaluation

🇨🇭CHF

Net positions in gradual decline with no sharp moves → CHF remains in consolidation, with a defensive tone

Open Interest dropped by −19.5k → Institutional money exiting positions

→ Interpretation: Market likely preparing for a directional breakout, CHF could act as a safe haven

📉 COT Conclusion: CAD appears overbought, CHF still gathering strength. Bearish bias on CADCHF remains intact.

📅 Seasonality – June Pattern

CHF tends to strengthen in June:

+0.0095 (10Y average), +0.0068 (5Y average)

CAD shows structural weakness in June:

−0.0027 (10Y), −0.0076 (5Y)

📉 Seasonality Conclusion: June favors CAD weakness and CHF strength → Bearish confirmation for CADCHF

🧠 Retail Sentiment

92% of retail traders are long CADCHF, only 8% are short

→ Extreme imbalance = classic contrarian signal

📉 Sentiment Conclusion: Confirms potential for continued downside on CADCHF

✅ Trade Plan Summary

📌 Base scenario:

Short CADCHF if we get a daily/weekly close below 0.5890

🎯 Target 1: 0.5820

🎯 Target 2: 0.5770

🚫 Invalidation: daily close above 0.5960 (invalidates current setup)

📌 Alternative scenario:

Short from 0.5960–0.6000 if we get a bearish rejection pattern → ideal for better R/R

CAD-CHF Bullish Rebound Ahead! Buy!

Hello,Traders!

CAD-CHF fell down sharply

And the pair was oversold

So we are not surprised to

See a bullish rebound from

The strong horizontal support

Around 0.5830 level and we

Think that we are likely

To see a further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.