Cadchftrend

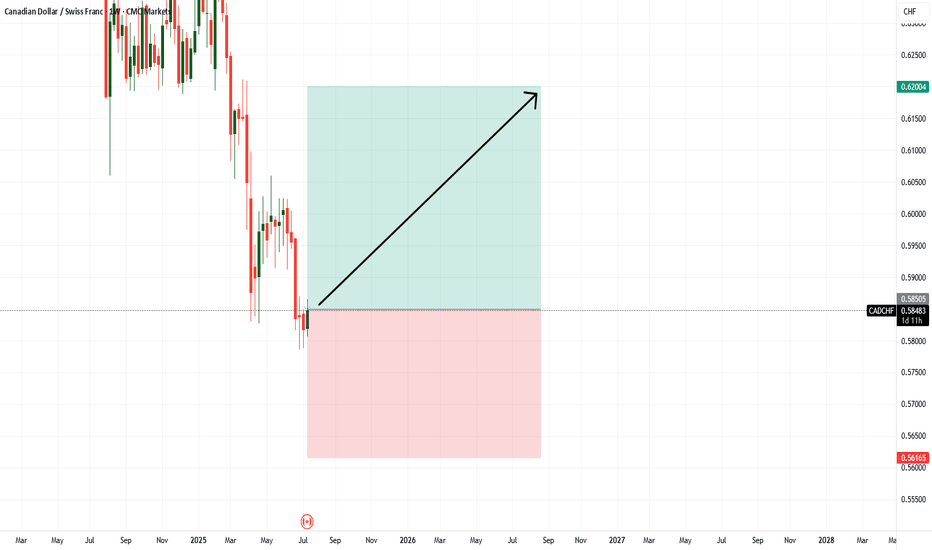

CAD/CHF "Loonie vs Swiss" Forex Bank Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CAD/CHF "Loonie vs Swiss" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (0.58600) Day/Scalping trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.61100

💰💵💸CAD/CHF "Loonie vs Swiss" Forex Bank Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. ☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CAD/CHF "Loonie-Swiss" Forex Bank Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CAD/CHF "Loonie-Swiss" Forex Bank . Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.61950) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 2H timeframe (0.61200) Day / swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.62600 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

CAD/CHF "Loonie-Swiss" Forex Bank Heist Plan (Day / Swing Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CAD/CHF "Canadian vs Swissy" Forex Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CAD/CHF "Canadian vs Swissy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at any point,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 30min period, the recent / nearest low or high level.

Goal 🎯: 0.63900

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Based on the fundamental analysis, I would conclude that the CAD/CHF (Canadian Dollar/Swiss Franc) pair is : Bullish

Reasons:

Strong Canadian economy: Canada's economy is expected to grow at a rate of 2.0% in 2023, driven by a strong labor market, increasing business investment, and a rebound in the energy sector.

High interest rates: The Bank of Canada (BoC) has kept interest rates at a relatively high level of 1.75%, which is expected to support the Canadian dollar.

Commodity prices: Canada is a major exporter of commodities such as oil, gas, and metals, and increasing prices for these commodities are expected to support the Canadian dollar.

Swiss franc weakness: The Swiss franc has been weakening against other major currencies, due to the Swiss National Bank's (SNB) dovish monetary policy and the country's low interest rates.

Diverging monetary policies: The BoC and SNB have diverging monetary policies, with the BoC expected to keep interest rates high and the SNB expected to keep interest rates low, which could lead to a stronger Canadian dollar against the Swiss franc.

However, it's essential to consider the following risks:

Global economic slowdown: A slowdown in global economic growth could reduce demand for Canadian exports and impact the country's economic growth.

Trade tensions: Escalating trade tensions between Canada and other countries, particularly the US and China, could impact the country's trade balance and economic growth.

Oil price volatility: Canada's economy is heavily dependent on the energy sector, and oil price volatility could impact the Canadian dollar.

Market Sentiment:

Bullish sentiment: 70%

Bearish sentiment: 30%

Neutral sentiment: 0%

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

CAD/CHF "Loonie-Swiss" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the CAD/CHF "Loonie-Swiss" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at any point,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 0.63300

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

CAD/CHF "Dollar-Swiss" Bank Robbery Plan on Bullish SideHallo! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist CAD/CHF "Dollar-Swiss" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point

Stop Loss 🛑 : Recent Swing Low using 2h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

CAD/CHF Money Heist Plan on Bearish SideOla! Ola! My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist CAD/CHF Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry : Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe Recent / Nearest Swing High

Stop Loss 🛑: Recent Swing High using 30m timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

CAD/CHF - Bullish Reversal Potential following Anti-ButterflyIntroduction:

CAD/CHF has recently formed an Anti-Butterfly XABCD harmonic pattern, indicating a potential bullish reversal. This technical analysis aims to provide insights into potential entry and exit points for traders interested in capitalizing on this pattern.

Pattern Formation:

The Anti-Butterfly XABCD pattern on CAD/CHF suggests a reversal in the prevailing downtrend. This pattern typically consists of four distinct price swings, labeled X, A, B, and C, followed by a potential reversal at point D.

Key Levels and Entry Points:

Based on the identified pattern, traders may consider entering the market near 0.66560. This level aligns with the anticipated bullish move from point D of the harmonic pattern. However, prudent risk management dictates placing a Stop Loss near 0.66156 to mitigate potential downside risk.

Profit Targets:

Traders can set multiple profit targets to capitalize on the expected bullish momentum. The first profit target (TP-1) is set at 0.66950, aiming to capture the initial upward momentum. Subsequent profit targets include TP-2 at 0.67340 and TP-3 at 0.67735, reflecting further potential upside potential as the bullish move unfolds.

Risk Management:

It's essential for traders to adhere to proper risk management principles, including setting appropriate stop-loss levels and position sizing based on individual risk tolerance and trading objectives.

Conclusion:

In summary, the formation of the Anti-Butterfly XABCD harmonic pattern on CAD/CHF suggests a bullish reversal scenario. Traders may consider entering the market near 0.66560, with a stop loss at 0.66156, and targeting profit levels at 0.66950, 0.67340, and 0.67735. However, as with any trading strategy, prudent risk management is crucial to navigating market fluctuations effectively.

CADCHF Technical Analysis and Trade IdeaThe CAD/CHF currency pair has demonstrated a bullish trend across both the weekly and daily timeframes, with a clear break of market structure indicating upward momentum. Presently, the price is consolidating within a range, prompting us to anticipate a break, retest, and subsequent failure of the current range high as a potential entry point for long positions. The use of a buy stop order is being considered. Our video analysis delves into the intricacies of the trend, market structure, and price action, identifying optimal levels for the placement of stop-loss and profit targets. It is crucial to emphasize that the information provided serves purely educational purposes and should not be misconstrued as financial advice.

CADCHF Technical Analysis and Trade IdeaThe CADCHF has been on an upswing lately, reaching a critical resistance level. This is indicated by higher highs and higher lows on the daily and 4-hour charts. We are looking for a pullback to the 61.8% Fibonacci level as a potential entry point for a long trade. However, it is important to remember that this is just speculation and should not be considered financial advice.

7 Dimension Analysis For CADCHF🕛 TOPDOWN - Bearish Continuation Setup for CAD/CHF

Overview: The monthly and weekly analyses signal a bearish trend, validated by a series of bearish breakouts and consolidations. The focus is now on the daily timeframe for a detailed perspective.

😇 7 Dimension Analysis

Time Frame: Daily

1️⃣ Swing Structure: Bearish - 68% probability of further downward movement.

🟢 Structure Behavior: Break of Structure (BoS).

🟢 Swing Move: Impulsive.

🟢 Inducement: Breakout with liquidity sweep indicating continued bearish momentum.

🟢 Pull Back 1st: Awaiting confirmation, position holding is crucial.

🟢 Internal Structure: Bearish.

🟢 Ext OB: Unmitigated.

🟢 Support Breakout CIP: Acts as resistance.

🟢 Post-Breakout Quality: Clearly favors bears, evident in small consolidation with bearish candle size and multiple wicks.

🟢 Traps: Shakeout observed, indicating bearish sentiment.

🟢 Time Frame Confluence: Daily.

2️⃣ Pattern

🟢 CHART PATTERNS

Reversal: Head and shoulders, double top.

Continuation: Bearish flag with a 38% tilt, shakeout continuation with flag consolidation.

Consolidation Rectangle: Small consolidation with shakeout liquidity.

🟢 CANDLE PATTERNS

Key Considerations:

Record session count with multiple dojis signals change in guard.

Long wick bearish closing indicates rejection from multiple wicks and doji area.

Momentum signals include strict engulfing.

3️⃣ Volume:

🟢 High volume on the breakout confirms its validity.

4️⃣ Momentum RSI:

🟢 Momentum is in a super bearish zone.

🟢 Range shift is evident with proper bearish indications.

🟢 Divergence: Hidden bearish divergence observed at the start of the move.

🟢 Loud moves: Momentum shifted from sideways to bearish with a loud move.

🟢 Grandfather-father-son entries indicate a strong bearish setup.

5️⃣ Volatility Bollinger Bands:

🟢 Middle band rejection at the middle band.

🟢 Squeeze starting indicates potential consolidation for volatility compression, followed by a wild bearish move.

6️⃣ Strength According to ROC:

🟢 ROC values: CAD 0.37 vs CHF 1.31, indicating CHF is much stronger.

7️⃣ Sentiment: All market parameters and top-down analysis indicate that CAD is under substantial pressure against CHF. The sentiment suggests looking for sell opportunities.

✔️ Entry Time Frame: Daily

✅ Entry TF Structure: Bearish

☑️ Current Move: Impulsive

✔ Support/Resistance Base: Bearish post buildup.

☑️ Candles Behavior: Bearish long wicks, bearish momentum.

💡 Decision: Sell at open.

🚀 Entry: 0.6443

✋ Stop Loss: 0.6505

🎯 Take Profit: 0.6118

2nd Exit if Internal Structure Changes, 3rd Trendline Breakout, FOMO.

😊 Risk to Reward Ratio: 1:4.5

🕛 Expected Duration: 30 days

SUMMARY: The analysis strongly supports a bearish continuation setup, aligning with the monthly and weekly bearish trends. Key indicators such as candle patterns, volume considerations, and momentum signals reinforce the sell decision. The strategy involves clear risk management and exit criteria.

CAD/CHF Weekly Analysis - Will We Continue to the Downside?CAD/CHF is showing no signs of a reversal on the Weekly chart. We currently have a descending triangle in a bear trend, signaling a continuation to the downside. Until we see a bull signal bar with a confirmation bar closing on or near its high, we should remain short. I would wait for a minor pullback at least to the Weekly 9EMA to short again, depending on how the price action plays out.

Key Points:

1. CAD/CHF is in a bear trend

2. Descending Triangle signals a continuation to the downside

3. RSI has room to fall

4. Until we see a bull signal with confirmation, remain short

As always, trade at your own risk, you are responsible for your trades. I hope this analysis was insightful and useful.

Trade wisely and let us know what you think in the comment section below!

20 Reasons For Sell CADCHF🔆MULTI-TIME FRAME TOP-DOWN ANALYSIS OVERVIEW☀️

1:✨Eagle eye: The market has been experiencing a strong bearish trend for many years. A Breakout-Sell (BOS) occurred 10 years ago with heavy volume. Last year, a liquidity sweep candle was formed after the breakout, indicating a further downside move. Back-to-back strong bearish candles suggest that bears are still in control of the market.

2:📆Monthly: A clear bearish structure is present, and a fakeout-type structure has formed. However, the low is not confirmed until the induction phase is complete. The closure of this candle will determine whether it is a small corrective pullback or a confirmation of the bearish trend. No notable reversal signals have appeared yet, but bears remain in power as they tapped into the extreme order block during the pullback. The overall view favors short entries.

3:📅Weekly: The structure is clearly bearish, and the low is confirmed and valid. The induction phase is also complete. If the price reaches the upcoming order block or provides a strong reversal signal based on the timeframe, a sell entry can be opened. However, it is recommended to wait for the weekly closing before making a decision.

4:🕛Daily: A strong supply area is approaching, as the price has touched this level four times before. Both a breakout or a rejection can be important at this level, but a sell entry is recommended while waiting for a sell signal. Additionally, a trendline resistance is present, and the last closing candle formed a doji at the perfect time and location. The price action tomorrow will provide further clarity.

😇7 Dimension analysis

🟢 analysis time frame: Daily

5: 1 Price Structure: Bearish

6: 2 Pattern Candle Chart: Doji and double top pattern

7: 3 Volume: No significant volume during the upside move but last leg only unable to breakout profit booking volume, indicating that volume will play an important role in the upcoming price action.

8: 4 Momentum UNCONVENTIONAL Rsi: A very powerful bearish divergence is present. After being in an overbought state, the price is struggling to stay above 60, but bears remain strong.

9: 5 Volatility measure Bollinger bands: A "M" pattern is forming, but the current leg has high volumes without breaking the previous high, indicating significant profit booking with large quantities.

10: 6 Strength ADX: Bulls are weaker at this level and appear to be resting, while bears are ready to take control again.

11: 7 Sentiment ROC: CAD is weaker than CHF.

✔️ Entry Time Frame: Daily

12: Entry TF Structure: Bearish

13: Entry Move: Impulsive

14: Support Resistance Base: Extreme order block or resistance level

15: FIB: Trigger event at an important area, including a trendline break.

☑️ Final comments: Clear sell signal

16: 💡Decision: Ready to sell after the previous candle's low is broken

17: 🚀Entry: 0.06670

18: ✋Stop Loss: 0.6864

19: 🎯Take Profit: 0.6404

20: 😊Risk to Reward Ratio: 1:4

🕛 Expected Duration: 30 days

CADCHF SELLHello traders we are currently looking at CadChf Sell for very long time the cadchf has been on a down trend, at this point we wait for price confirmation if price fails to break level 0.66694 that means we would be expecting price to complete the neck line retest at level 0.67427 on the daily time frame (TF) and if price breaks lvl 0.66694 then we would see more of bearish movement, at this point in time we patiently wait for price confirmation thank.

CADCHF top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

CADCHF Next Possible MovePair : CADCHF ( Canadian Dollar / Swiss Franc )

Description :

Bearish Channel in Long Time Frame and Rejecting from the Upper Trend Line

Consolidation

Divergence

Break of Structure

Symmetrical Triangle as an Corrective Pattern in Short Time Frame and Breakout of Lower Trend Line and Completed the Retracement

Completed " ABC " Corrective Wave

CADCHF SELLCADCHF on a sell moves, so we are on a support and resistance level, price just left our resistance level and created a nice head and shoulder pattern, leaving us with a trend line break out, so all we need to do is to patiently wait for price to get to our sell zone, well thanks guys if you like this analysis drop a comment on what you think of this.