CADJPY

Bullish momentum to extend?CAD/JPY is falling towards the pivot which has been identified as an overlap support and could bounce to the 1st resistance which is a pullback resistance.

Pivot: 104.86

1st Support: 104.28

1st Resistance: 106.56

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

CADJPY What Next? SELL!

My dear friends,

Please, find my technical outlook for CADJPY below:

The instrument tests an important psychological level 105.42

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 104.26

Recommended Stop Loss - 106.00

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CAD/JPY: Bullish Structure Holds with Breakout PotentialThe CAD/JPY market continues to show bullish strength, forming a clear sequence of higher highs and higher lows. On the daily timeframe, an inside bar pattern has emerged, indicating a period of consolidation that may lead to a bullish continuation, especially with the candle closing above the 105.000 level.

At the moment, the price is testing Monday’s high, and a breakout above this point could trigger further upside. The market may form a range around the current level before continuing its move higher from the previous week’s high and the upward trendline. The next target is the resistance zone around 106.300

Bearish drop?CAD.JPY has reacted off the pivot which has been identified as an overlap resistance and could fall to the overlap support.

Pivot: 105.30

1st Support: 103.56

1st Resistance: 106.09

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

CAD/JPY SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

Previous week’s green candle means that for us the CAD/JPY pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 104.075.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

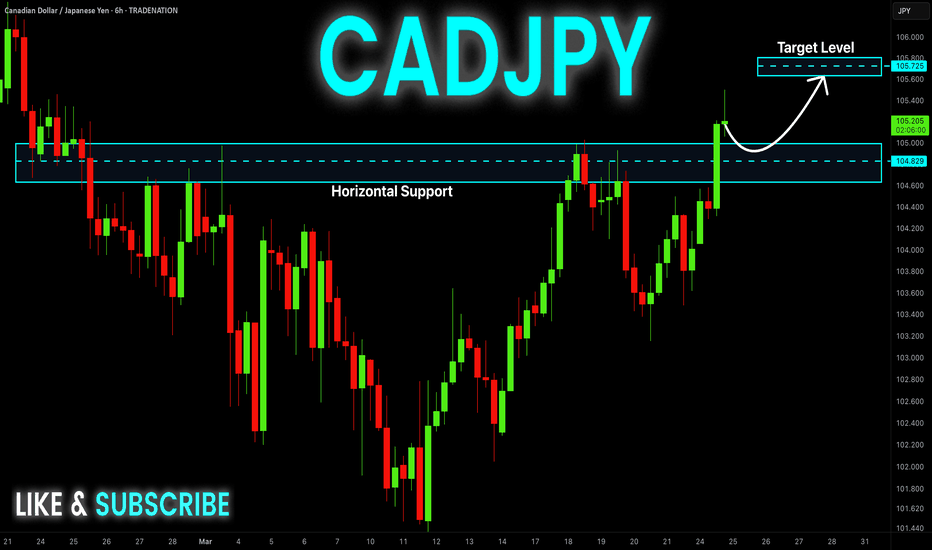

CAD_JPY POTENTIAL LONG|

✅CAD_JPY made a bullish

Breakout of the key horizontal

Level of 104.800 and the breakout

Is confirmed which reinforces our

Bullish bias and makes us expect

A further move up after the

Retest of the new support

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD-JPY Bullish Breakout! Buy!

Hello,Traders!

CAD-JPY is trading in a

Local uptrend and the pair

Made a nice bullish breakout

Of the key horizontal level

Of 104.829 which is now

A support and the breakout

Is confirmed so we are

Locally bullish biased and

We will be expecting a

Further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADJPY: Short Signal Explained

CADJPY

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short CADJPY

Entry - 105.05

Sl - 105.73

Tp - 103.81

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

CADJPY Analysis For A SELL Idea!!!!CADJPY - 4H Chart Sell Analysis

Market Structure

• The overall structure is bearish, with price forming lower highs and lower lows.

• Price attempted to rally but failed to break above 105.000, a major supply zone and previous support turned resistance.

• The most recent push above the highs appears to be a liquidity grab, followed by a strong rejection.

Supply & Resistance Zones

• Price reacted strongly to a key supply zone around 104.500 - 105.000.

• Multiple rejections and wicks in this zone suggest heavy selling interest.

• A fake breakout (bull trap) is visible, where buyers got trapped above resistance before a bearish move resumed.

Price Action Confirmation

• The bearish engulfing candle after the liquidity grab suggests a potential shift in momentum.

• Price broke below a minor support level and is currently retesting it, aligning with a lower high formation.

• The 50 EMA (blue line) is acting as dynamic resistance, further supporting the bearish bias.

Target Zones

• First target: 103.000 – a key intraday support and minor demand zone.

• Main target: 102.000 - 101.800 – a strong demand area and previous low where price may look to rebalance and tap liquidity.

Trade Setup

• Entry: Around 104.000 - 104.100 after a confirmed retest of broken support.

• Stop Loss: Above 104.500 - 104.700, outside the recent supply zone.

• Take Profit: Partial at 103.000, final TP at 102.000.

Confluences

1. Bearish trend continuation.

2. Liquidity grab above previous highs (105.000 area).

3. Rejection from major supply zone.

4. EMA resistance and structural confirmation of lower high.

Final Outlook

• If price stays below 104.300, sellers likely maintain control.

• A clean break below 103.500 will confirm further downside.

• A move and close above 105.000 would invalidate this sell setup.

CADJPY: Bearish Outlook as BOJ Stays HawkishHey Realistic Traders! BOJ’s Hawkish Stance, Will OANDA:CADJPY Turn More Bearish? Let’s Dive into the Analysis...

Technical analysis

On the H4 timeframe, CAD/JPY has repeatedly tested the 200 EMA but struggled to stay above it for long, indicating a strong bearish trend. Even the latest price correction failed to break above the 0.5 Fibonacci retracement level. Afterward, the price formed a bearish rising wedge pattern, followed by a breakout. The MACD indicator also signaled a bearish crossover, reinforcing the likelihood of further downside.

Looking ahead, CAD/JPY could drop toward the first target at 101.505 and, if selling pressure persists, potentially reach the second target at 100.159. These levels align with previous price movements and key historical support zones.

However, this bearish outlook remains valid only if the price stays below the key stop-loss level at 105.133.

Market Sentiments

Japan’s Bank of Japan (BOJ) is keeping its short-term interest rate steady at 0.5% while monitoring domestic wage growth and rising food prices. If inflation continues to rise, the BOJ may increase rates, potentially to 0.75% or higher, which could strengthen the yen and potentially make the CADJPY going lower.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on CAD/JPY"

CADJPY Under Pressure! SELL!

My dear friends,

Please, find my technical outlook for CADJPY below:

The price is coiling around a solid key level - 104.65

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 103.67

Safe Stop Loss - 105.27

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

———————————

WISH YOU ALL LUCK

CAD/JPY Triangle (BoJ Interest Rate- Today) 19.03.2025The CAD/JPY pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Triangle Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 105.50

2nd Resistance – 106.06

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Bearish drop?CAD/JPY has reacted of the pivot and could drop to the 1st support which aligns with the 50% Fibonacci retracement.

Pivot: 104.92

1st Support: 103.55

1st Resistance: 105.95

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

CAD-JPY Free Signal! Sell!

Hello,Traders!

CAD-JPY keeps going up

But as you can see there is

A strong horizontal resistance

Around 105.035 so after the

Retest a short trade can be

Entered with the TP of 104.188

And SL of 105.520

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Heading into overlap resistance?CAD/JPY is rising towards the pivot which has been identified as an overlap resistance and could reverse to the 1st support which acts as a pullback support.

Pivot: 104.92

1st Support: 103.55

1st Resistance: 105.95

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

CAD/JPY At Very Interesting Area To Buy , Don`t Miss 250 Pips !This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

Why EURUSD is still Bullish? Detailed Fundaments and technicals EURUSD is showing strong bullish momentum, currently trading around 1.087 and bouncing as predicted. The pair has respected key support levels, confirming the continuation of the **uptrend**. With increasing buying pressure, we anticipate further upside movement toward the main target of 1.1200. The **bullish structure remains intact**, and if this momentum sustains, eurusd could soon hit the projected target.

From a technical perspective, the pair has formed a solid base near recent support, aligning with key **fibonacci retracement levels** and previous demand zones. A break above **1.0900 psychological resistance** will add further confirmation to the bullish bias, leading to a potential rally toward **1.1000 and beyond**. Traders should look for volume confirmation and price action signals for additional entry opportunities.

On the fundamental side, the **us dollar is facing slight weakness**, primarily due to shifting Federal Reserve expectations and lower bond yields. Meanwhile, **eurozone economic data** has shown resilience, supporting the euro’s strength. If risk sentiment remains positive and economic conditions continue improving, eurusd could maintain its bullish trajectory and test higher resistance levels.

Overall, eurusd is still in a bullish phase, and with strong buying momentum, the price is on track to reach the **1.1200 target**. Traders should monitor key levels and market sentiment for potential breakout confirmations.

CAD/JPY "The Loonie-Yen" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CAD/JPY "The Loonie-Yen" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (108.500) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout MA or placing the Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 107.100 (swing Trade Basis) Using the 4H period, the recent / Swing Low or High level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 112.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

CAD/JPY "The Loonie-Yen" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🟣Fundamental Analysis

Economic Indicators: Influenced by Canada's GDP, employment change, consumer price index, and Japan's GDP, inflation rates.

Monetary Policies: Impacted by Bank of Canada (BOC) and Bank of Japan (BOJ) interest rate decisions, quantitative easing, and forward guidance.

Trade Balance: Canada's trade balance, particularly with the US, and Japan's trade balance with China and the US.

Energy Prices: Correlated with energy prices, as Canada is a major oil exporter.

Safe-Haven Currency: Japanese yen considered a safe-haven currency during times of market stress.

🟡Macroeconomic Analysis

Global Economic Trends: The global economic slowdown and trade tensions are impacting both Canada and Japan

Commodity Prices: Canada's economy is heavily influenced by commodity prices, particularly oil prices

Japan's Trade Balance: Japan's trade balance has been impacted by the ongoing trade tensions between the US and China

🔵COT Data Analysis

Net Long Positions: Institutional traders have increased their net long positions in CAD/JPY to 58%

COT Ratio: The COT ratio has risen to 2.1, indicating a bullish trend

Non-Commercial Traders: Non-commercial traders, such as hedge funds and individual traders, have increased their long positions to 62%

⚪Market Sentimental Analysis

Bullish Sentiment: 55% of client accounts are long on this market, indicating a bullish sentiment

Bearish Sentiment: 45% of client accounts are short on this market, indicating a bearish sentiment

🔴Positioning Data Analysis

Institutional Traders: Institutional traders are positioning themselves for a bullish trend, with some predicting a move to 112.00

Corporate Traders: Corporate traders are also monitoring the pair's performance, considering factors like interest rates and global economic trends

🟠Technical Analysis

Trend Line: The pair is holding comfortably above the ascending trend line

Moving Averages: The 200-period and 100-period Simple Moving Averages (SMA) are indicating a bullish bias

Relative Strength Index (RSI): The RSI indicator on the 4-hour chart stays above 50, indicating a bullish trend

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩