Cadjpyanalysis

CADJPY Forming Descending ChannelCADJPY is currently trading within a clean descending channel on the 4H chart, offering a classic technical setup for a potential bullish breakout. The pair has been consolidating for several sessions within this structure, making higher lows off key support. The channel is acting as a controlled retracement in a broader uptrend, and price is now reacting from the lower boundary—indicating a strong possibility of a bullish reversal toward the upper zone near 202.70.

Fundamentally, the British pound remains supported by strong wage growth and persistent inflation, which keeps the Bank of England on alert for further rate action. Traders are pricing in the potential for policy tightening to continue or remain elevated longer than expected. In contrast, the Japanese yen stays under pressure due to the Bank of Japan’s ultra-loose stance and its reluctance to normalize interest rates, especially after the latest BOJ meeting reaffirmed dovish policy despite a weakening yen.

The technical setup aligns perfectly with the fundamental landscape. CADJPY is positioned to benefit from yield differentials and risk-on sentiment in the market. A clean breakout above the channel resistance around 199.50 could trigger a wave of bullish momentum, targeting the 202.70 zone and potentially higher if bullish fundamentals persist. The current support zone around 197.40 serves as a tight invalidation level, providing a favorable risk-to-reward for swing buyers.

With this descending channel structure and macro tailwinds favoring strength and CADJPY weakness, I'm anticipating a breakout soon. This setup is one to watch closely, as it blends technical precision with fundamental divergence—a high-probability scenario that aligns with my trading plan.

#CADJPY:Targeting 130.00 Almost 30,000 Pips Swing TradeThe long-term outlook for CADJPY remains extremely bullish in the coming week. My initial target is 115, followed by 120, and ultimately 130. This would result in a total of 30,000 pips of movement in the swing. Please use this analysis for educational purposes only.

Good luck and trade safely!

Like, comment, and share this idea!

Team Setupsfx_

❤️🚀

"Loonie-Yen Heist: CAD/JPY Bullish Blueprint in Motion"🕶️💼 “Operation Loonie-Yen: The CAD/JPY Clean Sweep Blueprint” 💼🕶️

(Scalp & Swing Strategy by the Thief Trader Guild)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Movers & Strategic Operators, 🤑💰✈️

This blueprint is part of our 🔥Thief Trading Style🔥 operation—a fusion of technical precision and fundamental edge designed to tactically exploit the CAD/JPY (Loonie-Yen) setup.

🎯 Mission Objective:

Infiltrate the Bullish Zone & secure profits before the authorities (sellers) regroup.

📌 Entry Point:

"The vault's wide open!"

🔓Buy into momentum at any key level OR set a buy limit on recent swing lows using the 15m–30m charts. Wait for a pullback? Perfect—join the crew on the next dip.

🛑 Stop-Loss (SL):

Place it just below the 4H swing low (105.900) candle body wick.

But remember, your SL should match your risk style, position size, and trade frequency. Risk management is part of every successful heist.

🎯 Target Zone:

Aim for 108.500 – but exit smart if market behavior changes. Lock profits and vanish before the trap closes!

⚔️ Scalpers' Game Plan:

Only long-side jobs here. Got deep pockets? Dive right in. If not, team up with swing robbers and ride the trend. Use trailing SLs to secure every coin.

🧠 Fundamentals & Sentiment:

CAD/JPY strength is supported by intermarket flow, macro shifts, and trader sentiment. Check reports and correlations to stay a step ahead.

📰 Trading Alerts:

Be cautious around news releases—volatile spikes could trigger alarms. Avoid new entries during major drops and always protect active trades with trailing SLs.

💖 Support the Heist:

Hit that Boost button to power up the crew. Every push fuels another successful strategy. Thief Trading Style isn’t just a tactic—it’s a movement. 🏆💪

Stay alert. More heist blueprints coming soon.

Till then, trade smart. Loot legally. Vanish profitably. 🐱👤📈💸

Forex Bank Job: CAD/JPY Profit Extraction Strategy🏦 "Operation Loonie Lift-Off" – CAD/JPY Forex Heist Blueprint! 💰💣

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

To all fellow Market Bandits & Profit Seekers, 🕶️💸💼

We’ve scoped out our next target – the CAD/JPY vault – and the blueprint is ready. This isn’t just a trade... it's a full-blown Forex infiltration mission based on undercover technical and fundamental recon 🔎📊.

🎯 The Mission Plan:

📍Entry Point – The Vault's Backdoor

💥 Strike at Pullback Zones 1 & 2

→ Use 15–30 min timeframe to ambush at recent lows or swings.

The best loot lies in waiting – buy limits only!

🛡️Stop Loss – Escape Routes

Set SL like a pro thief:

Pullback 1 ➤ 104.800

Pullback 2 ➤ 105.600

Base it on your crew’s bankroll and lot size. Always prep a clean getaway.

🏁Target – Secure the Goods

Primary loot zone: 106.000

(Or vanish before heat arrives 🚓💨)

⚔️ Scalpers’ Special Ops:

Only operate long side. Big wallets = quick hits. Small stacks? Join the swing squad and trail your SL like a shadow 🕶️🔐.

🔥Why This Hit?

CAD/JPY is in bullish mood driven by:

COT shifts 📈

Sentiment setups 🧠

Macro flow + cross-asset whispers 🔄

🚨 But remember: market conditions flip like fake IDs. Stay alert.

🧠 Final Tips from HQ:

🔕 Avoid new ops during major news drops

💣 Use trailing SLs to lock profits before the sirens go off

💖 Smash that 💥BOOST💥 to fund the next big mission

💼 From the Black Market Desks of the Thief Trading Syndicate™

This ain't your grandpa's trade plan — it's a strategic smash-and-grab with style and smarts. 📡🔐

💬 Drop a comment, hit the like, and recruit more to the crew.

📍See you in the next chart heist. Keep it stealthy, sharp, and profitable. 🤑🚀👊

CADJPY is in the Up Trend Hello Traders

In This Chart CADJPY HOURLY Forex Forecast By FOREX PLANET

today CADJPY analysis 👆

🟢This Chart includes_ (CADJPY market update)

🟢What is The Next Opportunity on CADJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

CAD/JPY Bank Heist: Bullish Breakout (or) Bearish Trap?🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Money Makers & Market Robbers, 🤑💰💸✈️

Based on the 🔥Thief Trading Style🔥, here’s our master plan to loot the CAD/JPY "Loonie-Yen" Forex Bank Heist! Follow the strategy on the chart—Long Entry is the play. Our escape? Near the high-risk Danger Resistance Zone. It’s a risky level—overbought, consolidating, potential reversal—where bearish robbers lurk. 🏆💸 Take profits fast, traders! You earned it! 💪🎉

📈 Entry: The Heist Begins!

Wait for the breakout above 105.700—then strike! Bullish profits await.

Buy Stop Orders above Moving Average OR

Buy Limit Orders (15-30min timeframe) near swing lows/highs for pullback entries.

📌 Set an ALERT! Don’t miss the breakout.

🛑 Stop Loss: Protect Your Loot!

🔊 Yo, listen up! 🗣️

Buy Stop Orders? Don’t set SL until after breakout.

Place SL at nearest/swing low (4H timeframe)—adjust based on your risk & lot size.

Rebels, set SL wherever… but don’t cry later! 🔥⚡

🎯 Target: 107.300

Scalpers: Only go LONG. Use trailing SL to lock in gains.

Swing Traders: Ride the wave or join late—robbery is teamwork! 🤝

💥 Why CAD/JPY? Bullish Momentum!

Fundamentals, COT Reports, Sentiment, Intermarket Trends—checkk our bio for full analysis. 🔗🔗🔗

⚠️ Trading Alert: News = Danger!

Avoid new trades during news.

Use trailing stops to protect profits.

💖 Support the Heist! Hit the BOOST Button!

More boosts = More robberies = More profits! 💰🚀

Stay tuned—next heist coming soon! �🤗🎉

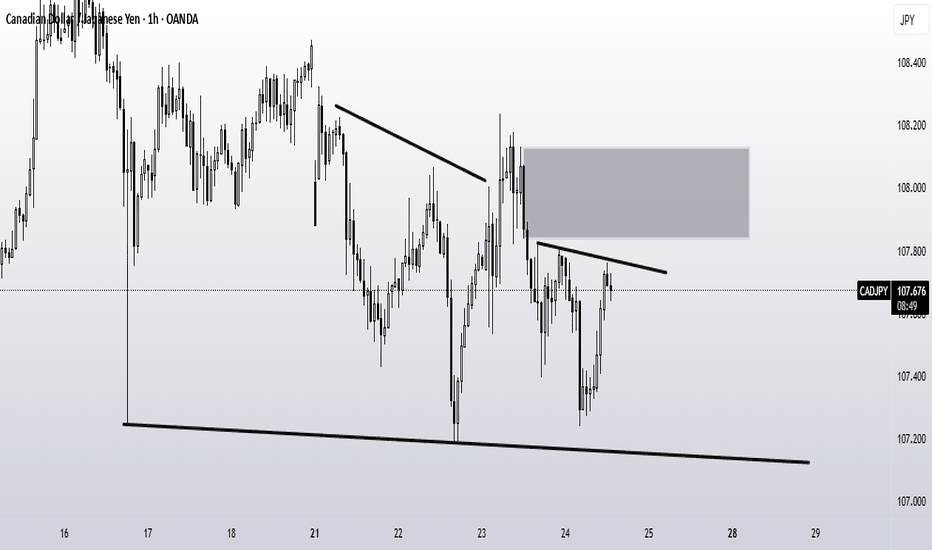

CADJPY - Looking To Sell Pullbacks In The Short TermM15 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

CADJPY..BUY📈 On the daily timeframe, CADJPY is in a clear uptrend.

🔁 After a healthy correction, price has reached our key support level, and I’m ready to enter a long position here.

⚠️ As always, if this level breaks and the market moves against us,

I’ll open a risky short trade until we reach the next buy zone.

📉 The market does whatever it wants—nothing is guaranteed.

✅ We’re here to use smart risk management and make profit in every possible scenario.

For detailed entry points, trade management, and high-probability setups, follow the channel:

ForexCSP

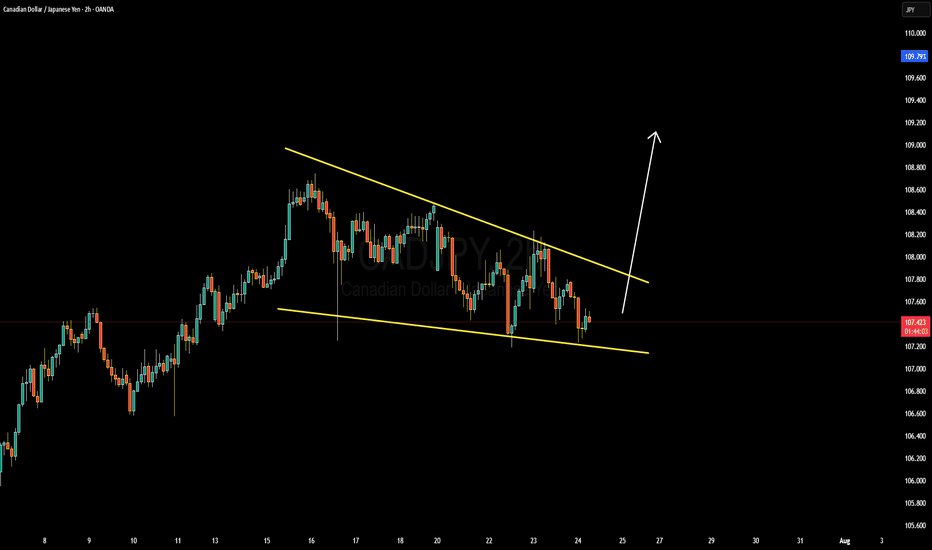

CAD/JPY Holds Trendline Support with Bullish Bias IntactFenzoFx—CAD/JPY dipped from 107.34, finding support at a bullish FVG while staying above the ascending trendline.

The Stochastic Oscillator signals oversold, suggesting a potential reversal. The outlook remains bullish above 105.61, targeting a retest of 107.35. A break below 105.61 would invalidate the bullish scenario.

#CADJPY:1700+ PIPS Swing Concept On The Way,Three Profit TargetsJPY initiated a bearish trend and anticipates a rapid reversal in all JPY pairs, such as CADJPY. We expect a significant swing move, potentially reaching 2000+ pips in the long term. Additionally, we have set three targets based on our analysis, which can aid in identifying potential trade opportunities. Good luck and trade safely.

Good luck and trade safely.

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

CADJPY: Bullish Momentum vs. Overextension Risk!🚀 CADJPY Analysis 🚀

CADJPY is in a strong bullish trend on the 4H chart, with momentum still pushing higher. However, I’m noticing signs that the pair might be overextended 📈. While there could be a bit more upside, both the weekly and daily timeframes show price pushing into previous highs, which often leads to a retrace back to equilibrium ⚖️.

🔍 Key Levels:

I’m watching the Fibonacci 61.8% retracement for a potential pullback, with the 50% level also marked as a key equilibrium zone. I’m not looking to go long at these elevated prices—prefer to wait for a healthy retrace for a more optimal entry 🎯.

💡 Macro Consideration:

We also took a look at the NASDAQ 🧑💻, since tech stocks can impact the JPY as flows move between risk assets and safe havens. With a lower high forming on the NASDAQ, risk sentiment could shift, impacting CADJPY as well.

🗓️ It’s Monday—let’s trade cautiously and wait for the best setups! Patience pays.

Not financial advice.

CAD/JPY "Loonie-Yen" Forex Bank Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CAD/JPY "Loonie-Yen" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for pullback entries

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 30Min timeframe (104.800) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 106.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

CAD/JPY "Loonie-Yen" Forex Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.☝🏻👆🏻☝🏻👆🏻

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets..., go ahead to check 👉👉👉🔗

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CADJPY I Long Opportunity to Middle of the ChannelWelcome back! Let me know your thoughts in the comments!

** CADJPY Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

CAD/JPY "Loonie-Yen" Forex Bank Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CAD/JPY "Loonie-Yen" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Major Support breakout then make your move at (101.000) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (104.000) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 98.500 (or) Escape Before the Target

💰💵💸CAD/JPY "Loonie-Yen" Forex Market Heist Plan (Scalping/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CAD/JPY Rally Could Fade Near Resistance – Watch for ShortsThe CAD/JPY pair is currently trading within a well-defined descending trendline. Multiple rejections are visible around the 108.300, 105.864, 105.434, and 105.044 levels, confirming strong bearish control over the medium term.

Price has recently bounced from a critical horizontal support near 101.246, forming a short-term bullish move toward the descending trendline. We are now approaching a confluence zone near the 103.800–104.000 area, where the downtrend line intersects. This zone is a potential supply area and could act as a strong resistance.

Trade Idea: Sell Setup Near Trendline (103.800–104.000)

Target: 102.532, 101.250

Invalidation: Break and close above 104.200