CAD/JPY "Loonie-Yen" Forex Bank Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CAD/JPY "Loonie-Yen" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Major Support breakout then make your move at (101.000) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (104.000) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 98.500 (or) Escape Before the Target

💰💵💸CAD/JPY "Loonie-Yen" Forex Market Heist Plan (Scalping/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Cadjpypattern

CAD/JPY "Loonie-Yen" Forex Bank Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

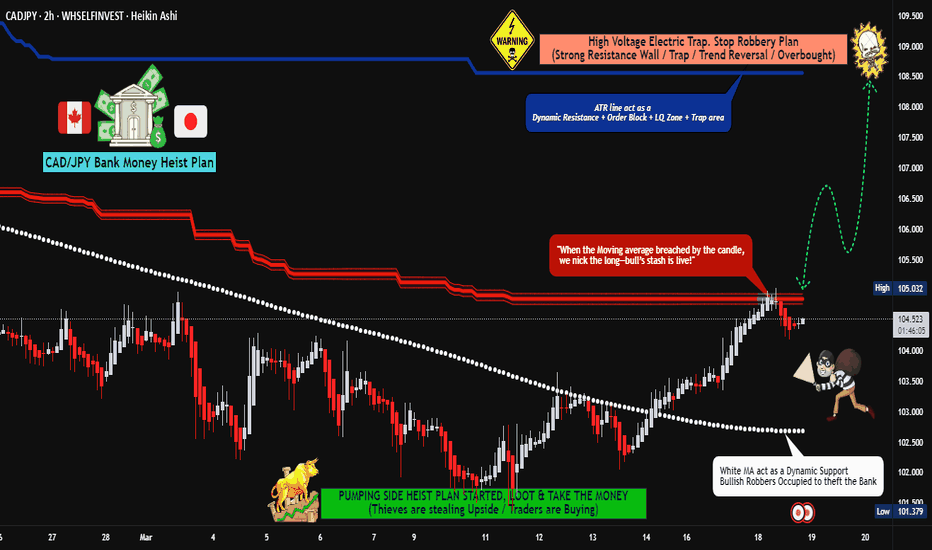

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CAD/JPY "Loonie-Yen" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Yellow MA Line. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (104.800) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 1H timeframe (103.000) Day / Scalping trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 107.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

CAD/JPY "Loonie-Yen" Forex Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CAD/JPY "Loonie-Yen" Forex Bank Heist Plan (Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CAD/JPY "Loonie-Yen" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (105.100) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 2H timeframe (103.300) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 108.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

CAD/JPY "Loonie-Yen" Forex Bank Heist Plan (Swing Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend...

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CAD/JPY "The Loonie-Yen" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CAD/JPY "The Loonie-Yen" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (108.500) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout MA or placing the Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 107.100 (swing Trade Basis) Using the 4H period, the recent / Swing Low or High level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 112.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

CAD/JPY "The Loonie-Yen" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🟣Fundamental Analysis

Economic Indicators: Influenced by Canada's GDP, employment change, consumer price index, and Japan's GDP, inflation rates.

Monetary Policies: Impacted by Bank of Canada (BOC) and Bank of Japan (BOJ) interest rate decisions, quantitative easing, and forward guidance.

Trade Balance: Canada's trade balance, particularly with the US, and Japan's trade balance with China and the US.

Energy Prices: Correlated with energy prices, as Canada is a major oil exporter.

Safe-Haven Currency: Japanese yen considered a safe-haven currency during times of market stress.

🟡Macroeconomic Analysis

Global Economic Trends: The global economic slowdown and trade tensions are impacting both Canada and Japan

Commodity Prices: Canada's economy is heavily influenced by commodity prices, particularly oil prices

Japan's Trade Balance: Japan's trade balance has been impacted by the ongoing trade tensions between the US and China

🔵COT Data Analysis

Net Long Positions: Institutional traders have increased their net long positions in CAD/JPY to 58%

COT Ratio: The COT ratio has risen to 2.1, indicating a bullish trend

Non-Commercial Traders: Non-commercial traders, such as hedge funds and individual traders, have increased their long positions to 62%

⚪Market Sentimental Analysis

Bullish Sentiment: 55% of client accounts are long on this market, indicating a bullish sentiment

Bearish Sentiment: 45% of client accounts are short on this market, indicating a bearish sentiment

🔴Positioning Data Analysis

Institutional Traders: Institutional traders are positioning themselves for a bullish trend, with some predicting a move to 112.00

Corporate Traders: Corporate traders are also monitoring the pair's performance, considering factors like interest rates and global economic trends

🟠Technical Analysis

Trend Line: The pair is holding comfortably above the ascending trend line

Moving Averages: The 200-period and 100-period Simple Moving Averages (SMA) are indicating a bullish bias

Relative Strength Index (RSI): The RSI indicator on the 4-hour chart stays above 50, indicating a bullish trend

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CAD/JPY "Loonie-Ninja" Bank Money Heist Plan on Bullish SideHola! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist CAD/JPY "Loonie-Ninja" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss 🛑 : Recent Swing Low using 2h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

CADJPY : Current Situation & Technical , Fundamental View#CADJPY

- CADJPY is currently selling after a STRUCTURE BREAK because the current MARKET SENTIMENT is NEUTRAL. Somehow, JPY is becoming somewhat STRONG. Similarly, the YEILD given by the BOJ to JP10Y increased, making the JPY STRONG.

- The reason for that is because the Central Bank of Japan did not intervene in the long term to strengthen the JPY, they are strengthening the JPY in other ways without raising the rate. Meanwhile, the price of OIL has gone down a bit, so the CAD has become very weak in the last few days. Anyway, as expected in the BOC RATE DECISION the other day, the RATE HIKE was done.

- But somehow the CANADIAN CENTRAL BANK has become HAWKISH. Therefore, CADJPY should definitely be slightly UP until the 103.110 LEVEL. Before that, there is definitely a very high possibility to sell to the 95.92 LEVEL. So FOLLOW STRUCTURES. If JPY becomes strong, it can sell at 93.01 level.

CADJPY : Current Situation & Technical , Fundamental View#CADJPY

- CADJPY is currently selling after a STRUCTURE BREAK because the current MARKET SENTIMENT is NEUTRAL. Somehow, JPY is becoming somewhat STRONG. Similarly, the YEILD given by the BOJ to JP10Y increased, making the JPY STRONG. The reason for that is because the Bank of Japan did not intervene in the long term to strengthen the JPY, they are strengthening the JPY in other ways without raising the rate. Meanwhile, the price of OIL has gone down a bit, so the CAD has become very weak in the last few days. Anyway, as expected in the BOC RATE DECISION the other day, the RATE HIKE was done.

- But somehow the CANADIAN CENTRAL BANK has become HAWKISH. Therefore, CADJPY should definitely be slightly UP until the 103.110 LEVEL. Before that, there is definitely a very high possibility to sell to the 96.68 LEVEL. So FOLLOW STRUCTURES.

CADJPY : Current Situation & Technical , Fundamental View#CADJPY

- By this time, CADJPY was very well BUY with the G7 MEETING with some positive comments regarding OIL. So CAD automatically went up. The other reason is the RATE HIKE done by the BOC. Also, in the last few days, JPY WEAKNESS came unexpectedly. They are the FUNDAMENTAL event.

- But after that the price of OIL rose very fast. Due to this reason CAD became STRONG very fast before. You can check it by going to CAD CHARTS.

But now with JPY WEAKNESS, CADJPY is getting BUY very fast.

- Right now the MARKET is getting somewhat RISK ON, JPY is going down, so CADJPY is getting BUY.

- Definitely CADJPY should be slightly DOWN until 107.621 LEVEL. After that, the possibility of moving to 112.862 LEVEL is very high. The reason for that is because even now OIL PRICES are going up a bit. After that CADJPY price can go down to 103.955 LEVEL. We focus on MARKET UPDATES and MARKET SENTIMENT.

CADJPY : Current Situation & Technical , Fundamental View#CADJPY

- By this time, CADJPY was very well BUY with the G7 MEETING with some positive comments regarding OIL. So CAD automatically went up. The other reason is the RATE HIKE done by the BOC. That was the recent FUNDAMENTAL incident.

- But after that the price of OIL went down very fast. Due to this reason CAD went down very fast. You can check it by going to CAD CHARTS. But now with JPY WEAKNESS, CADJPY is getting BUY very fast.

- Right now the MARKET is getting somewhat RISK ON, JPY is going down, so CADJPY is getting BUY.

- There is a very high possibility that CADJPY will move up to the 108.032 level. The reason for that is because even now OIL PRICES are going up a bit. After that CADJPY price can go down to 102.990 LEVEL. We focus on MARKET UPDATES and MARKET SENTIMENT. cadjpy

CADJPY : Current Situation & Technical , Fundamental View#CADJPY

Due to MARKET RISK ON, CADJPY went up a bit. But now CAD UP is being done again. We expect CADJPY to go UP again.

Either way, that price can retrace to the CADJPY MAIN TRENDLINE. After that the MARKET can go UPSIDE. The reason for that may be due to OIL PRICES UP. JPY WEAKNESS will also affect this. You can definitely buy at the CADJPY 108.691 level. For that, MARKET RISK should be ON SHORT TERM.

But according to the STRUCTURE, CADJPY can move up to 103.340 LEVEL on the TREND LINE. The reason for that is the idea that the MARKET SENTIMENT in the OVERALL MARKET will be RISK ON in the coming days. We must pay attention to the MARKET SENTIMENT.

CADJPY : Current Situation & Technical , Fundamental View- The Canadian Dollar is a COMMODITY BASED CURRENCY and continues to follow market sentiment. CADJPY BUY NOT BE WITHOUT VIX DOWNING THE JAPANESE YEN is also slightly down. For these reasons, the CADJPY price may rise further. Today is the day of the CAD CENTRAL BANK DECISION. So you definitely have to pay attention to it.

- CAD FEATURE currently stands at 0.7902 LEVEL. Also the JPY FEATURE stays at 0.0077 LEVEL. The CADJPY PRICE is located above the DYNAMIC S / R LEVELS. Therefore, most of the time the PRICE can be down after a RETRACEMENT SHORT TERM.

- STOCKS are currently DOWN. And VIX is becoming DOWN. Also COMMODITIES OVERALL DOWN. Also BONDS PRICES are becoming NEUTRAL. Also BONDS SPREADS are DOWN. Currently the MARKET RISK ON status has been weighed down. So definitely create a UP TREND for AUD CAD NZD and a DOWN TREND for JPY CHF USD.

- The CADJPY PRICE can be UP to the RESISTANCE AREA above before the SHORT TERM DOWN. That is 104.183 LEVEL can be UP. If the MARKET SENTIMENT does not continue to function or the MARKET RISK is OFF then the PRICE can be DOWN to CADJPY 97.84 LEVELS.

CADJPY : Current Situation & Technical , Fundamental View⛔️ There is no special INDICATOR for Canadian dollars today. Also, there is no special INDICATOR DATA for JPY. This is why CAD OIL PRICE and JPY MARKET SENTIMENT are FOLLOWED.

⛔️ The Canadian Dollar is a COMMODITY BASED CURRENCY and continues to follow market sentiment. CADJPY BUY NOT BE WITHOUT VIX DOWN BY THE JAPANY YEN is also slightly up UP at the moment. For these reasons, the CADJPY price may fall further.

⛔️ CAD FEATURE is currently at 0.7665 LEVEL. Also the JPY FEATURE stays at 0.00778 LEVEL. The CADJPY PRICE is located below the DYNAMIC S / R LEVELS. Therefore, most of the time the PRICE can be DOWN after another RETRACEMENT SHORT TERM.

⛔️ STOCKS are currently DOWN. And VIX is becoming UP. Also COMMODITIES OVERALL DOWN. Also BONDS PRICES are going down. Also BONDS SPREADS are becoming UP. By now the MARKET RISK is OFF. So definitely create a DOWN TREND for AUD CAD NZD and a UP TREND for JPY CHF USD.

⛔️ The CADJPY PRICE can be UP to the SUPPORT AREA above before the SHORT TERM DOWN. That is, 100.255 LEVEL can be UP. After that, if this MARKET SENTIMENT continues to operate, the PRICE can be down to CADJPY 95.71 LEVELS. There is not much important news for Japanese YEN and CAD today but most of the CADJPY MARKET SENTIMENT is FOLLOWED. According to the MARKET SENTIMENT, the CADJPY price may move slightly lower. Stay tuned for VIX and OIL PRICES.

CADJPY : Current Situation & Technical , Fundamental View- INDICATOR DATA CORE RETAIL SALES, RETAIL SALES are to be released today especially for the Canadian Dollar. There is no significant news release for the Japanese YEN today. Because of this, if there is any change in the price of oil for CAD, it could have an impact on the Canadian dollar.

- The Canadian Dollar is a COMMODITY BASED CURRENCY and continues to follow market sentiment. CAPJPY BUY NOT BE WITHOUT VIX DOWN BY THE JAPANY YEN is also slightly up UP at the moment. For these reasons, the CADJPY price may fall further.

- CAD FEATURE is currently at 0.7914 LEVEL. Also the JPY FEATURE stays at 0.0078 LEVEL. CADJPY PRICE is located on DYNAMIC S / R LEVELS. So most likely the PRICE can be UP again SHORT TERM.

- Currently STOCKS are getting somewhat DOWN. And VIX is getting a bit UP. Also COMMODITIES OVERALL DOWN. It's something special. Also BONDS PRICES are a bit GREEN. Also BONDS SPREADS are DOWN. There is currently no CLEAR DIRECTION in the MARKET. Maybe today's Friday because it's MARKETS CORRECTION. Currently the market has a NEUTRAL BIAS.

- CADJPY PRICE can be DOWN to DYNAMIC LEVEL before UP. Then you can UP to 103.950 LEVEL. There is not much important news for the Japanese YEN today but the RETAIL SALES DATA for the CAD is about to be released. According to the MARKET SENTIMENT, the CADJPY price may move slightly lower. Stay tuned for VIX and OIL PRICES.

CADJPY Could Go Lower

Welcome back Traders, Investors, and Community!

Hi Traders, CADJPY on H4 after rejection from the Trend Line bye large red candles it’s expected to go lower.

⬇️Sell now or Sell at 87.69

⭕️SL @ 88.11

✅TP1 @ 86.66

✅TP2 @ 86.00

✅TP3 @ 85.06

We will have more FREE forecasts in TradingView soon

❤️ Your Support is really appreciated!❤️

Have a Profitable Day