CADUSD

CADJPY approaching resistance, potential drop!CADJPY is approaching our first resistance at 83.43 (50% Fibonacci retracement , 100% Fibonacci extension, horizontal pullback resistance )where we might see a drop in price to our first support at 81.34 ( 38.2% Fibonacci retracement , horizontal swing low support ).

Stochastic (89,5,3) is also approaching resistance and we might see a corresponding drop in price should it react off this level.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks

CAD off, JPY on=> Here we are tracking risk-off for the US mid term elections and using CADJPY as a strategic hedge.

=> This is because of Canada primarily funding its deficit through portfolio inflows and with tightening liquidity conditions we see less investment into Canada for the foreseeable future.

=> Later this month we have a BoC hike priced in as well as another 2 before May 2019.

=> To the other side higher oil prices and NAFTA risk cleared CAD looks poised to fall.

=> In this environment it's important to bring back CAD, AUD and NZD to the operating room as funding scarcity and tighter liquidity conditions will mean the USD rally won't be universal.

=> GL on this one guys, a very interesting call

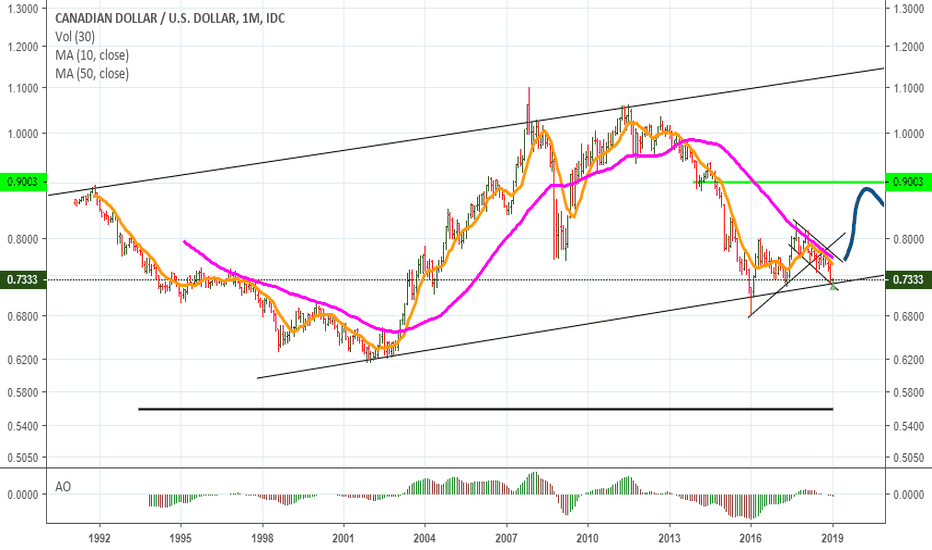

USDCAD TRADING PLACES 2019Hi Guys, today we're looking at the trading pairs CADUSD (USDCAD) side by side. If you have been following you will have seen the chart we posted on Crude oil and calling for a reversal at the 42 dollar area and it has respected this request and the 200 SMA on the 2 month chart with lots of historical support. With the rise in crude prices expected we can now look at the Canadian dollar for strengthening also over the next few months.

The US dollar has had a great run over the last year but fundamentally the cracks are begining to show. Many hedge funds have been unwinding their US$ positions for sometime now and the commercials are begining to wake up now too. On the technical side USDCAD has just topped in our opinion coinciding with the previous level of resistance in the 1.37 area and in fact some exchange charts I have been watcing showed a spike to 1.41 over the past two days. We expect downside to occur now on the USD side and CAD to move up two fib levels to the 200 SMA on the monthly chart. This would be about .86 cents to the US dollar area.

With commodities gold, silver and oil etc., generally showing some bullishness, will also have and effect on weakening the US dollar as commodities are still settled in US dollar. Canada being a resource based economy tends to benefit when resouce commodity prices move higher.

The indicators are mixed right now as we are a bit ahead of the curve with our predictions on these monthly charts and you can see StochasticRSI on the CAD side has bottomed but not turned yet as with MACD which does seem to say more upside for the US dollar so it is not yet clear and this could mean more temporary weakness in CAD but these big reversals do take time especially charting at this time scale. So we will watch and revise as the story plays out and becomes more clear.

NZDCAD SELL @0.9220Hello traders,

BOC will increase interest rate, DEC job report will be better due to more jobs because the holidays, also sales will be better, oil prices is getting higher soon. We expect Trend is going down from 0.9220 NOW to 0.88 In a month.

Trade safe, if it goes up high to 0.93 Then give it another sell from there, it will come back.

Manage your lot size safely, market will not end, but your account will if you get greedy.

Hope best for all.

Please leave your comments.

USDCAD Short playBreak of the upwards trend line, we have a gap as well that will probably work as an resistance. But i first want to see some rejection around the current level. So wait and see how things turn out before getting into a position here. So probably at least a few hours more before i get in, maybe even tomorrow.

Previous analysis:

USDCAD Bearish Wedge Part 2Previous trade was a perfect one, took risked some profit with the second 50% position to trail stop for an ever bigger drop but those got hit. Now from the looks of it we might have a bear flag now, but not convinced yet so i am going in with half a position here and will wait for a break of the yellow zone to get in with the second part. Still a chance for a big drop for the mid-term

Please don't forget to like if you appreciate this :)

Previous analysis:

USDCAD Currency Pair Update Nov 7, 2018@12:50 pm ETAs of writing, November 7, 2018 @ 12:26pm, the CAD’s hammer against the USD is packing 0.17% punch while the USD’s hammer against the CAD is packing -0.16% punch. So, at this moment, the Canadian dollar is packing a stronger punch, which means that the Canadian dollar is gaining strength against the USD. So, traders can take advantage of this strength difference by buying the currency with the stronger upside momentum and selling the currency with the weaker upside momentum. These momentum strength differences change over time, however.

At some point, we will have to sell the Canadian dollar and take profits because we bought it early in the early stages of its upward momentum. So, it will soon start to give up all the gains that it has acquired during its uptrend. This is where our trading strategy comes in handy, telling us when to get the hell out of the market when its time, and don’t stay a second longer. We have deduced our opinion from observing the 1-hour USD/CAD and CAD/USD charts (both charts revealed the same signal).

We will follow this up with more detailed technical analysis.

Please click here for the full article.

USDCAD catching a bid for the London open...Firstly, well done to all of those tracking the FED flow into USD... I know a few in the telegram who made their slice of the pie on this one.

Firing a bullet here in USDCAD in what is a very technical environment as markets continue to digest the December hikes.

=> It's going to be a quick and sharp leg to the upside with a quick test of the previous 50 fib level for reference.

=> NAFTA remains in the picture and we are set for more headlines coming to our theatres as mid-term elections enter into play.

=> Expecting in the broader view this pair will remain in chop until October hikes in BoC so taking advantage of the highs and lows in that range.

We have some major updates coming to our macro portfolio this weekend as we approach the quarterly close.

Good luck all trading and tracking this one live

CAD charged and stretched to maximumpassively enter into such a tense market ... I would advise waiting for the closing of the monthly candle and further making decisions. the only thing I can advise - if the red news at the end of the week or sharply flies in, then buying a pair is more reliable than selling! if I decide to enter, the signals will be on my channel (see profile and subscribe)

CADUSD not looking so good (monthly analysis)On the monthlys we can see CADUSD has painted a picturesque bear flag as it continues to lower. With the current pipe line purchase we are gearing for a larger fall overall around the Canadian dollar as we sell cheap oil to foreign interests and buy it back at a higher rate. The fall to 0.5 is only a rough estimate based off the current flag structure but we may fall even further than that.

as always this is not in anyway, shape or form, financial advice and always enter at your own risk

USD CAD - 2 Points Buying Opportunity - Falling W & CypherHello,

I am posting my current trade setup for the USD-CAD pair. It offers 2 entry points depending on the price action.

I am posting this because

1. I am using a free membership so I want to save this trade setup and not loose it when i look at other charts and close the browser.

2. I would like to receive some feedback and comments in regards to validity of this trade or other potential flaws in the trade that I might not be seein on a longer time frame.