CAKE/USDT Bullish Trend Continues? Heres My Trade Plan📊 CAKE/USDT Trade Setup Overview

Taking a closer look at CAKE/USDT, price action has been moving nicely with a strong bullish trend on the 4H chart — printing consistent higher highs and higher lows 🔼📈.

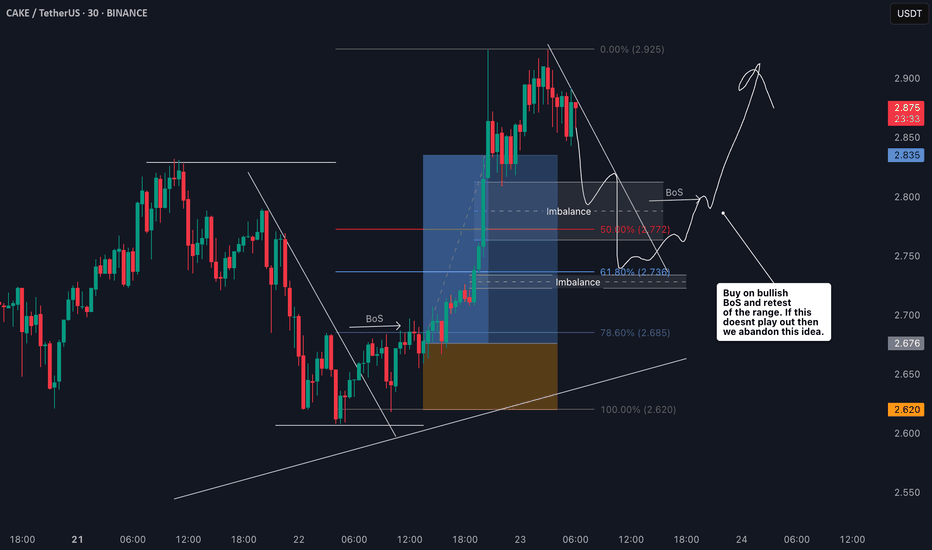

Right now, it’s looking a little overextended, and I’m eyeing a potential pullback into my optimal entry zone around the 50%–61.8% Fibonacci retracement level 🎯📉.

That’s my point of interest, but it's important to keep in mind that the pullback may either be shallow or extend deeper before stabilizing 🌀. The key for me is to wait for price to find support in that zone, followed by a bullish break in market structure on the lower timeframe (15m or 30m) 🧱✅ — that would be my signal to enter long.

This is not financial advice — always do your own analysis before trading. ⚠️

Cakebullish

CAKEUSDT | Massive Upside PotentialThe blue box on the chart represents a potential demand zone, where buyers might be stepping in to accumulate CAKE tokens. This area often indicates a region where the price has previously shown signs of strong support or reversal, suggesting that buyers are willing to purchase aggressively at this level.

Key Observations Supporting Buyer Accumulation:

Volume Increase in the Zone: A noticeable uptick in trading volume within this zone suggests active participation, likely from buyers. Increased volume at such levels often confirms accumulation.

Price Rejection Wicks: If the candles show long wicks rejecting lower prices, it indicates that selling pressure is being absorbed by buyers.

Historical Significance: If this blue box aligns with a previously tested support zone or a Fibonacci retracement level, it reinforces its strength as an accumulation area.

Market Sentiment: Look for signs of a broader market recovery or bullish sentiment in the overall crypto space, which could encourage accumulation in CAKE.

Indicators Alignment: Tools like RSI being in oversold territory or bullish divergence can further confirm that buyers are gaining control in this zone.

What to Watch Next:

Breakout Confirmation: A strong bullish candle breaking above the resistance of the zone confirms the buyer's dominance.

Retest of the Zone: If the price revisits this area after breaking out and holds above it, it solidifies this zone as a demand level.

I keep my charts clean and simple because I believe clarity leads to better decisions. Trading doesn’t have to be overly complicated, and I enjoy sharing setups that have worked well for me.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups. It’s all about learning and growing together as traders, and I’m here to share what I see.

The markets can confirm what the charts whisper if we’re paying attention. I hope these levels help you as much as they’ve helped me in the past. Let’s see how this plays out!

Why follow me ?

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

cakeusdt gold signal Hi

#CAKE has broken out of the symmetrical triangle with high volume and has also surpassed the horizontal resistance. An upward move is anticipated as long as it continues to trade above the horizontal support,

buy zone : 2.90 to 3.15

targets:

3.30-3.46-3.60

thank you follow me

Delicious Cake ❤️❤️Thanks for boosting 🚀 and supporting us!

📈Optimal entry for a broken price is $2.371 on the trendline, and similarly, entry with the activation of a position on the broken sresistance is $2.5154.

📊 (Buy) : 2.371

🔴 Stop Loss : 2.067

🎯 Take Profit : 3.120

🔗 For more communication with us, send a message in TradingView.

CAKE → PancakeSwap Bull Breakout! What are the Price Targets?PancakeSwap executed a beautiful bull run and pullback, forming an arched pattern toward the 200EMA where we bounced and broke out! The price is in meander mode toward the upside on new support.

How do we trade this? 🤔

We do not have any signal candles or patterns to suggest the next move, any trade here carries a low probability of profit. If we long, our protective stop should be under the 200EMA which is a fair distance away. If we short, we have the 200EMA acting as potential support and where do we place our stop loss? The proper place is above the previous high of over $2.84, which is a bad Risk/Reward ratio.

We should wait until the price falls to the 200EMA and the RSI comes down closer to 40.00 and starts to cross above the Moving Average. This tightens our stop loss and gives us enough room to 1:2 Risk/Reward our trade.

Until then, let's see how the price action plays out. FOMO (Fear of Missing Out) is your worst enemy. This is where you enter the market prematurely, worried that you'll miss potential profits but instead, you end up in a bad trade. I find combating FOMO is best conceptualized as " You're making more money by not falling for the seduction of market profit ."

💡 Trade Idea 💡

Long Entry: $2.3037

🟥 Stop Loss: $2.1860

✅ Take Profit: $2.5395

⚖️ Risk/Reward Ratio: 1:2

🔑 Key Takeaways 🔑

1. Bull Trend Consolidating Pattern Complete. Bull Breakout.

2. Established New Support, Currently in Uptrend.

3. Wait for Pullback to 200EMA to consider long.

4. Do Not Long until we see Strong Bull Support after Pullback.

5. RSI at 53.00, below Moving Average. Supports Short.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and comment if you found this analysis useful!

CAKE → Bounce to the Moon! Take Advantage of This Opportunity!PancakeSwap is bullish in more ways than one! The price is playing out a beautiful two-legged pullback after a strong bull run; an indicator that the bulls are in control and more upside is probable.

How do we trade this?

With a two-legged pullback after a bull run and the RSI above the Moving Average with room to spare on the upside, we have to remain bullish. We're missing one critical piece of the puzzle to enter a long trade; the bull signal and confirmation bars. The bull signal bar will have a long tail and a close on or near its high, followed by a strong bull candle closing on or near its high. The confirmation candle should close above the resistance line and re-test it as support. That would be the ideal long setup as depicted in my analysis.

This is a conservative long, taking profits just prior to the double top high. You could close half of your position and take profits at a 1:1 Risk/Reward and swing the remainder to a 1:3 Risk/Reward or until you see a sell signal. Trade depending on your strategy!

Be aware, we could also fail to break resistance and end up with a strong bear signal, completely changing our trading bias. Always be ready to change your bias and learn to recognize those signals.

Trade Idea

Long Entry : $2.26

Stop Loss: $2.02

Take Profit: $2.74

Risk/Reward Ratio: 1:2

Key Takeaways

1. Bull Trend Consolidating, Bias to Long.

2. Double Top followed by Two-Legged Pullback, Bullish.

3. Watch for Support at 200EMA.

4. Do not Long until Bull Signal Bar and Confirmation Above Resistance.

5. RSI at 53.00, above Moving Average. Supports Long.

You are solely responsible for your trades, trade at your own risk!

If you found this analysis helpful, click the Boost button and let us know what you think in the comment section below!

CAKE Gearing Up for a Bull Run!? This Analysis Shows the Way!CAKE is crawling sideways in between a bull channel and above the Weekly Resistance. The price hasn't been able to break above the 30EMA nor has it broken below the Weekly Support.

How do we trade this?

The overarching trend is bullish, so we should set our bias to long. The price is establishing support at the previous Weekly Resistance, so it's reasonable to look for a long entry at that level. Given that the price is failing to break above the 30EMA, we should wait for the price to pull back to the Weekly support line and then look for a long entry. A protective stop should be below the Previous Weekly Resistance line and at least a partial take profit at the previous highs around $2.80.

Key Points

1. Bull Channel, Long Bias.

2. Multiple Tests of Previous Weekly Resistance, Showing Support.

3. Failing to break above 30EMA, Fall to Channel Support.

4. Bull signal at Channel Support, Long Setup.

5. RSI at 50.00 above Moving Average, Weak Indicator.

You are solely responsible for your trades, trade at your own risk!

Let us know what you think in the comment section below!

CAKE Weekly Analysis - Long the Descending Wedge Bull Pattern!?CAKE is in a descending wedge pattern and currently flirting with breaking out. After last week's bull bar closing near its high, we had a slight pullback to the 30EMA and bounced back to the top of the wedge. We have yet to breakout let alone confirm a breakout. Until then, this is what we have for data:

Key Points

1. The Descending Wedge Pattern is Bullish

2. We should wait to enter long until the breakout is confirmed

3. We have some support on the 30EMA

4. Bitcoin is a leading indicator for the alt market. Bitcoin needs to confirm a breakout of the Weekly Resistance

5. RSI has room to move up but has more to fall. We should wait for more price action.

You are solely responsible for your trades, trade at your own risk!

Let us know what you think in the comment section below!

CAKE/USDT BULLISHCAKE has been in a downtrend since ATH, the bottom could be in. The price is also at an all-time low currently.

Boilinger Bands indicator show a breakout at 7,50ish. If price movement could break through 9,00 resistance, we will see an uptrend. Combination of breakout on Boilinger Bands and resistance level could be huge.

Fundamentals: Pancakeswap (CAKE) is the market leader for BSC DEX´s. Pancakeswap holds the most number of coins, pairs, visits and also has the highest market share on BSC (Binance Smart Chain).

Entry: 7 - 10 USD

Target: 40 USD (300 - 400% gain)

Not financial advice.

CAKE-USDT Expecting a BreakoutCAKE-USDT currently accumulating under 21$ & forming a descending triangle chart pattern in 4H & 1D time frames. This should breakout soon since price action is almost near the apex of the triangle. Please wait for a clear breakout with above-average volume to enter for the trades.

BTC price & Dominance will be directly affected to the above prediction.