#CAKE/USDT : Trying to break horizontal resistance#CAKE

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 2.58.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 2.55, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 2.61

First target: 2.63

Second target: 2.66

Third target: 2.71

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Cakelong

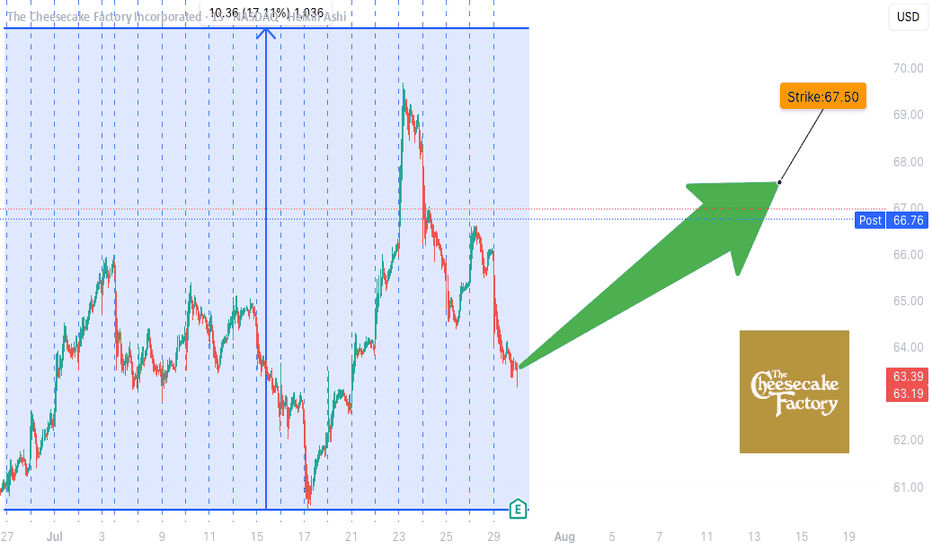

CAKE Earnings Trade Setup (2025-07-29)

**🍰 CAKE Earnings Trade Setup (2025-07-29)**

🎯 **Bullish Bias** | Confidence: **72%**

💡 **Historical Beat Rate: 88%** | Strong pre-earnings drift

**📊 TRADE DETAILS**

• **Instrument**: \ NASDAQ:CAKE

• **Strategy**: Buy CALL

• **Strike**: 67.50

• **Entry**: \$1.45

• **Target**: \$2.90+

• **Stop**: \$0.72

• **Expiry**: 2025-08-15

• **Timing**: Pre-earnings close (AMC)

**📈 Setup Rationale:**

✅ History of positive earnings surprises

✅ Stock above key MAs with room to run

⚠️ Margin pressure & mixed options flow = manage risk closely

**🔥 Risk/Reward: \~2:1+**

Cut early if earnings miss. Target 200%+ return on surprise beat.

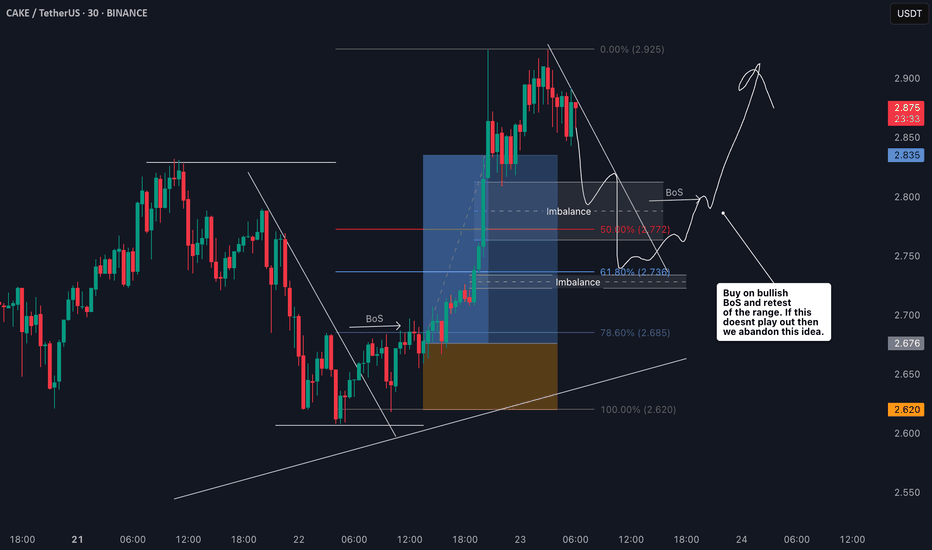

CAKE/USDT Bullish Trend Continues? Heres My Trade Plan📊 CAKE/USDT Trade Setup Overview

Taking a closer look at CAKE/USDT, price action has been moving nicely with a strong bullish trend on the 4H chart — printing consistent higher highs and higher lows 🔼📈.

Right now, it’s looking a little overextended, and I’m eyeing a potential pullback into my optimal entry zone around the 50%–61.8% Fibonacci retracement level 🎯📉.

That’s my point of interest, but it's important to keep in mind that the pullback may either be shallow or extend deeper before stabilizing 🌀. The key for me is to wait for price to find support in that zone, followed by a bullish break in market structure on the lower timeframe (15m or 30m) 🧱✅ — that would be my signal to enter long.

This is not financial advice — always do your own analysis before trading. ⚠️

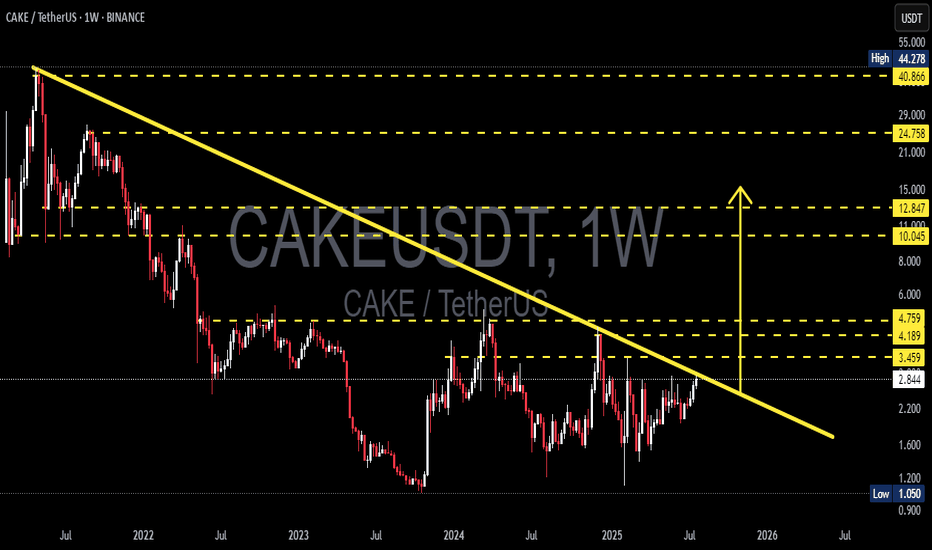

CAKEUSDT - Weekly Breakout Watch | End of the Bear Era?After enduring a brutal multi-year downtrend since 2021, CAKE/USDT is now showing clear signs of a possible major trend reversal. The weekly chart is forming an extremely compelling setup, with the price testing the upper edge of a long-term descending trendline, signaling a high-probability breakout scenario.

📉 Multi-Year Downtrend Nearing Its End

The yellow descending trendline drawn from the 2021 all-time high has served as a strong resistance for over 3 years.

Price is now trading just below the trendline, teasing a breakout.

A clean breakout above this structure would mark the transition from distribution to re-accumulation — a key signal for long-term bulls.

📈 Pattern Structure & Key Zones

Descending Triangle Breakout in progress: This classical pattern often indicates a major reversal, especially after a long period of consolidation.

Breakout Trigger Zone: 3.45 – 4.18 USDT

Validation Zone (Confirmation Resistance): 4.75 USDT

Mid-Term Target Zone: 10.04 – 12.84 USDT

Long-Term Targets (If momentum continues): 24.75 – 40.86 USDT

🟢 Bullish Scenario

If weekly candles close convincingly above the 3.45 – 4.18 USDT range:

A breakout confirmation would be in place.

Price could rally +200% to the 10 – 13 USDT region in the mid term.

If that resistance breaks, the next leg could reach 24 – 40 USDT, in line with previous cycle recovery structures.

Strong altcoin sentiment and volume spike would strengthen the bullish case.

---

🔴 Bearish Scenario

Failure to break and hold above the trendline could trigger a rejection.

Breakdown below 2.84 USDT would invalidate the breakout and shift structure back to consolidation or downside.

In a worst-case scenario, price could revisit 1.05 USDT, the all-time cycle low.

This bearish outcome could be catalyzed by macro volatility or Bitcoin correction.

📌 Key Support & Resistance Levels

Level Significance

1.05 USDT Macro Support (Cycle Low)

2.84 USDT Accumulation Support

3.45 USDT Breakout Trigger

4.18 – 4.75 USDT Confirmation & Retest Zone

10.04 – 12.84 USDT Mid-Term Target

24.75 – 40.86 USDT Major Resistance Zone

📊 Conclusion

CAKE/USDT is at a critical inflection point. A breakout from this long-standing weekly trendline could spark a powerful multi-month rally. The current setup resembles early-stage reversals seen in other altcoins prior to explosive moves.

If confirmed, this breakout might mark the beginning of a new bull cycle for CAKE — but traders should stay disciplined and monitor volume and price action closely to avoid potential traps.

#CAKEUSDT #CryptoBreakout #TrendlineBreakout #WeeklyChart #AltcoinSetup #TechnicalAnalysis #PancakeSwap #CryptoReversal #AltcoinSeason

#CAKE/USDT#CAKE

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 2.29, acting as strong support from which the price can rebound.

Entry price: 2.30

First target: 2.35

Second target: 2.40

Third target: 2.46

#CAKE/USDT#CAKE

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 2.65.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 2.72

First target: 2.82

Second target: 2.92

Third target: 3.06

CAKEUSDT | Green Zone Holding StrongCAKEUSDT has solid support around the green box levels. These zones have shown clean reactions in the past, and structure still favors buyers holding the line.

If price dips into that area again with low timeframe confirmation, it could offer a high-probability entry.

No hype, just structure and discipline.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

CAKEUSDT Pump📊 On the 4H BINANCE:CAKEUSDT chart, price has broken above the mid-term channel resistance and is currently pulling back. If the support zone holds, there’s potential for continuation toward higher resistance levels. A bullish reaction from the 2.299 USDT area could validate the next leg up.

🔄 If the correction deepens, the highlighted pink zone offers a strong re-entry opportunity. Key targets on the upside include 2.570, 2.740, and potentially 2.940 USDT if momentum continues.

✅ Key Support Levels:

🟥 2.401 USDT

🟥 2.299 USDT

🟥 2.035 USDT

🟥 1.830 USDT

🚫 Key Resistance Levels:

🟩 2.570 USDT

🟩 2.740 USDT

🟩 2.940 USDT

CAKEUSDT – Patience Pays, Wait for the Blue Box!CAKEUSDT – Patience Pays, Wait for the Blue Box!

“Chasing price is how retail traders get trapped—smart money waits for the perfect entry!”

🔥 Key Insights:

✅ Bullish Structure, But Overextended – Price needs a proper retrace.

✅ Blue Box = Ideal Buy Zone – This is where smart money steps in.

✅ FOMO Kills Accounts – The best trades feel uncomfortable because they require waiting.

💡 The Smart Plan:

Wait for Price to Reach the Blue Box – No chasing, let the trade come to us.

CDV & Volume Profile Must Confirm the Entry – We need proof buyers are stepping in.

LTF Market Structure Break = Final Green Light – Precision beats randomness.

“Discipline prints money. Wait for the blue box, take the high-probability trade, and win!” 🚀🔥

A tiny part of my runners;

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

Cake 70% profitFrom the data provided, CAKE's price has shown significant volatility. Starting around 2.027 in January, it surged to 3, indicating a strong bullish trend 🚀. However, it later corrected to around 2.110, suggesting a potential support level 📉.

The signals in the chart hint at a possible buying opportunity at support levels, especially if the price holds above 2.110 🛑. If it drops below this level, it might indicate a continued downward trend 📊.

Given the high volatility, traders should exercise caution and use risk management tools like stop-loss orders 🛡️. Staying updated with market news and developments can also aid in making informed trading decisions 📰💡.

PancakeSwap (CAKE)Comprehensive Analysis of CAKE/USDT ✨⚡

Introduction

CAKE is a prominent cryptocurrency that plays a key role in the DeFi (Decentralized Finance) ecosystem. Associated with the PancakeSwap platform, it aims to facilitate decentralized trading and enhance liquidity, capturing the attention of many investors and traders.

In this analysis, using technical tools, we examine key support and resistance zones while exploring various price scenarios. This analysis is designed to be useful for both short-term traders and long-term investors. 🌟⚔

1. Technical Analysis

Descending Channel Structure:

On the weekly chart, CAKE is currently within a long-term descending channel. This structure indicates that the price has touched the channel's upper boundary (PRZ: 4.214 - 5.298) and has entered a corrective phase.

Key Support and Resistance Zones:

Red Support Zone (1.996 - 2.228):

This is the first critical support level that plays a key role in the price's potential reversal. If this support is held, the price is likely to rise towards the channel’s upper boundary.

Gray Support Zone (1.548 - 1.709):

A break of the red support could bring the price down to this secondary support zone, which acts as a second line of defense.

Green Resistance Zone (4.214 - 5.298):

The PRZ zone is a strong resistance barrier to further price growth. A break above this zone will send a strong bullish signal.

Movement Targets:

Bullish Scenario:

First Target: Upper boundary of the descending channel

Subsequent Targets:

1.618 Fibonacci: (8.126 - 9.552)

2.618 Fibonacci: (22.698 - 27.046)

3.618 Fibonacci: (56.469 - 64.385)

Bearish Scenario:

In the case of a breakdown below the support zones, the price could decline towards the lower boundary of the descending channel.

2. Technical Indicators

RSI (Relative Strength Index):

The RSI is currently near the support zone (47.63 - 51.72). Holding this range could signal a potential reversal as buyers regain control. The trendline connecting the lows acts as a support level for upward momentum.

Volume:

An increase in volume near the red support zone confirms the start of a potential bullish move. Conversely, a decrease in volume at the green resistance zone raises the chances of a correction.

3. Investment Strategy

Step-by-Step Entry:

Enter near the red support zone (1.996 - 2.228).

Re-enter after breaking the PRZ (4.214 - 5.298) with confirmed high volume.

Managing Trading Volume:

Adjust your trading volume according to key support and resistance levels. Allocate more volume near support zones, as these areas have a higher likelihood of a price reversal, which could initiate a bullish trend. This strategy allows for risk reduction and optimizes entry prices, enhancing potential profits.

4. Risk Management

Stop-Loss:

Place your stop-loss below the gray support zone (1.548 - 1.709). This will protect against significant losses in case of a price breakdown.

Risk-to-Reward Ratio:

Ensure your risk-to-reward ratio is at least 1:2. This means that for every unit of risk, your target reward should be at least double.

Planning for Critical Scenarios:

In case of a breakdown below support zones, it is advisable to close positions and reconsider entry points at lower levels.

5. Key Takeaways

Volume:

High volume near support levels suggests the beginning of an upward move.

RSI Movement:

A bounce from the 50-level RSI or trendline confirms the potential for a price increase.

Conclusion

Currently, CAKE is in a critical zone (1.996 - 2.228). By applying risk management principles and using a step-by-step entry strategy, one can take advantage of this opportunity. A breakout above the PRZ (4.214 - 5.298) could trigger a strong bullish trend and facilitate reaching Fibonacci targets. 🚀

Remember, always prioritize capital management and risk management to safeguard yourself from the volatility of the crypto market. 🔍✨

CAKEUSDT | Massive Upside PotentialThe blue box on the chart represents a potential demand zone, where buyers might be stepping in to accumulate CAKE tokens. This area often indicates a region where the price has previously shown signs of strong support or reversal, suggesting that buyers are willing to purchase aggressively at this level.

Key Observations Supporting Buyer Accumulation:

Volume Increase in the Zone: A noticeable uptick in trading volume within this zone suggests active participation, likely from buyers. Increased volume at such levels often confirms accumulation.

Price Rejection Wicks: If the candles show long wicks rejecting lower prices, it indicates that selling pressure is being absorbed by buyers.

Historical Significance: If this blue box aligns with a previously tested support zone or a Fibonacci retracement level, it reinforces its strength as an accumulation area.

Market Sentiment: Look for signs of a broader market recovery or bullish sentiment in the overall crypto space, which could encourage accumulation in CAKE.

Indicators Alignment: Tools like RSI being in oversold territory or bullish divergence can further confirm that buyers are gaining control in this zone.

What to Watch Next:

Breakout Confirmation: A strong bullish candle breaking above the resistance of the zone confirms the buyer's dominance.

Retest of the Zone: If the price revisits this area after breaking out and holds above it, it solidifies this zone as a demand level.

I keep my charts clean and simple because I believe clarity leads to better decisions. Trading doesn’t have to be overly complicated, and I enjoy sharing setups that have worked well for me.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups. It’s all about learning and growing together as traders, and I’m here to share what I see.

The markets can confirm what the charts whisper if we’re paying attention. I hope these levels help you as much as they’ve helped me in the past. Let’s see how this plays out!

Why follow me ?

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

Signal for CAKESignal for CAKE/USDT 🎯

Entry Point (Buy):

📉 1.912 - 1.930

This is the suggested buy range based on support and the ascending channel.

Take Profit Targets (TP):

🎯 TP-1: 1.929

🎯 TP-2: 1.952

🎯 TP-3: 1.974

🎯 TP-4: 2.000

Stop Loss (SL):

❌ 1.895

If the price breaks below this level, it's recommended to close the position.

🚀 Summary:

The price is in an uptrend inside an ascending channel, and entry at the current support levels could lead to potential profit if the targets are hit. If the support fails, the stop loss will limit the downside risk.

CAKE : buy in low Analysisfor CAKE/USDT

Author: ahmadarz

In this analysis, we are reviewing the CAKE/USDT pair. According to the provided chart, the price is at the lower support area of the trading range, and the entry point is specified.

Key Points:

- Entry Point: 1.943

- Target Prices (TP):

- TP-1: 1.966

- TP-2: 1.989

- TP-3: 2.014

- TP-4: 2.042

- TP-5: 2.087

- Stop Loss (SL): 1.917

- Explanation: The best position to enter a buy trade is in this support area. Target prices are specified sequentially, and the stop loss is determined in case the support area is breached.

Caption:

🔍 Analysis of CAKE/USDT: The price is in the lower support area of the trading range. The entry point is set at 1.943, and target prices are specified. 📈

Warning: This trading signal is based solely on technical analysis, and the trader is responsible for any decisions made.

CAKE: bull-trend📊Analysis by AhmadArz:

🔍Entry: 2.723

🛑Stop Loss: 2.612

🎯Take Profit: 2.489 - 2.998 - 3.161 - 3.439

🔗"Uncover new opportunities in the world of cryptocurrencies with AhmadArz.

💡Join us on TradingView and expand your investment knowledge with our five years of experience in financial markets."

🚀Please boost and💬 comment to share your thoughts with us!

CAKE: by break trend=line📊Analysis by AhmadArz:

🔍Entry: 3.987

🛑Stop Loss: 3.859

🎯Take Profit: 4.114-4.185-4.265-4.334

🔗"Uncover new opportunities in the world of cryptocurrencies with AhmadArz.

💡Join us on TradingView and expand your investment knowledge with our five years of experience in financial markets."

🚀Please boost and💬 comment to share your thoughts with us!

#CAKE/USDT#CAKE

The 1-day bearish channel was broken strongly to the upside

Supported by stability above the Moving Average 100

It is supported by a rebound from the green support area on the chart

This support area was adhered to well

We also have a positive divergence on the RSI indicator

Entry price 2.82

First goal 3.04

The second goal is 3.30

Third goal 3.60

#CAKE/USDT#CAKE

The pair has been moving in a descending triangle since April 2022

The price broke the upper border of the triangle

Supported by the momentum of the Moving Average 100 that is about to be broken

Oversold on MACD

It is expected to break the Moving Average 100, heading toward upward targets

The price now is 20.2

The first goal is 90.4

Second goal 9.30

Which represents 400% of the current price

Support and resistance points must be taken into account as there are possible corrections that may take some time during the rise

✅Thank you, for more ideas, hit 🚀 and follow 🤝🛎!

CAKE → Three Pushes Up! Will We Reverse to $2.84? Let's Answer.CAKE (Pancakeswap) completed its third push to the upside and rendered four Daily candles in a row with large wicks on the top. Today's close marks the fifth. Does that mean we're in for a drop?

How do we trade this? 🤔

I believe a pullback here is imminent. That doesn't mean a short is justified, we are in a bull trend and our bias should remain long. However, the short-term signals like the three legs, 5 wicks on top, and a high RSI all indicate a pullback is here.

It's reasonable to short this on a lower timeframe like the 1HR but on the Daily, we should be looking for a long. Wait for the price to come back down to the $2.84 area and find support. We need to see a strong buy signal and confirmation bar to justify an entry. I caveat this proposal with the state of the crypto market as a whole, it's a pivotal moment that could spell a reversal which will likely drag CAKE down with it.

In summary, zoom into the 1HR timeframe to find a short, wait for a long entry opportunity at $2.84 per my description above.

💡 Trade Idea 💡

Long Entry: $2.937

🟥 Stop Loss: $2.64

✅ Take Profit: $3.53

⚖️ Risk/Reward Ratio: 1:2

🔑 Key Takeaways 🔑

1. Bull Channel with three pushes up, large wicks on third push.

2. Gap to Daily 30EMA.

3. Don't enter a trade here, need more price action.

4. RSI at 75.00 and above Moving Average. Supports Pullback.

5. Crypto Market at Pivotal Moment, Consider Reversal Possibility.

💰 Trading Tip 💰

You can trade any candle on the chart, the question is what trades are more worth your while and fit with your personality traits. First, understand how to analyze a chart, then understand yourself and how you best interact with your analysis such that you make money.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and comment if you found this analysis useful!

Delicious Cake ❤️❤️Thanks for boosting 🚀 and supporting us!

📈Optimal entry for a broken price is $2.371 on the trendline, and similarly, entry with the activation of a position on the broken sresistance is $2.5154.

📊 (Buy) : 2.371

🔴 Stop Loss : 2.067

🎯 Take Profit : 3.120

🔗 For more communication with us, send a message in TradingView.