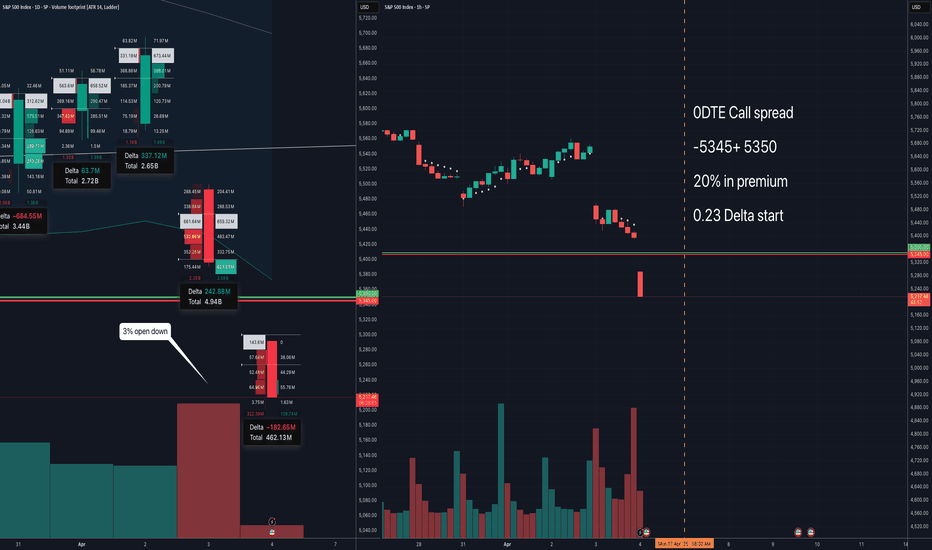

Market Structure is broken - Another - 0 DTE Call Spread on SPXThis may be my last super aggressive Call Spread on SPX, then will watch how the market plays out rest of this week.

-5000 +5005 expires today, 18%

Everything is off atm.

Only options play this week, otherwise I'm a huge buyer of Crypto.

Callspread

PCC Spiking, Last Time was March 2020Wanted to get this posted for anyone who's got active trades open... particularly long positions.

$PCC above 1 is generally bearish, below 1 is generally bullish.... basically showing volume of Puts & Calls traded.

With Put trading spiking like this, extreme caution should be taken with tight stops.

Ascending Triangle in the XLEThe Macro trends of 2022 are no secret to any of us. Sky rocketing inflation and the war in Ukraine have lead to soaring energy costs around the world. As a result, Oil has seen a period of extreme volatility, reaching a high of closing high price of 129.44 on March 8th. As a result, the XLE has followed suit and is up about +30% year to date. Exxon, the largest holding in the XLE, reports earnings on April 29th and has expressed that the anticipate setting record profits. Buy the rumor?

The XLE appears to be forming a nice Ascending Triangle, which could be suggesting a bullish continuation. The Ascending Triangle isn't a particularly strong pattern from a statistical perspective with only about a 60% chance of realizing the bullish continuation. Take it with a big grain of salt, but there is also a very slight Hidden Bullish Divergence on the MACD. Nevertheless, it warrants paying attention to as a potential swing trade.

A lot will depend on what Oil does, and the fact that XOM and CVX are reporting earnings on the 29th muddies the waters a bit. However, it could offer a nice opportunity for a shot in the dark trade to the upside looking for a pop the upside in advance of the earnings. Maybe something like an OTM Call spread around the .30 delta in XLE 30 days out or so...

$HYZN - Another low priced meme stock with expensive DOTM callsOn the back of our early success with yesterday’s bullish call spread on $ATER up 10.53% today.. we’ve found another similar play.. a low priced meme stock getting huge volumes but not yet blown out with a RSI of only 65.. $HYZN was up 23% today on 8m shares traded, whilst not huge yet it could be.. and as usual with these low priced meme stocks option dealers are forced to price calls higher than puts (opposite of most stocks) to account for melt-up risk, so to take advantage of the right sided skew we buy a bullish call spread.. we’re looking at the OCT’15 $10/15 call spread for a debit of $1.15 and potential reward of $3.85 giving us a reward/risk of 3.34..

$TSLA bulltrend continues? Long call vertical spread!TESLA smooth RSI confirms the breakout, well defined loss level.

Max profit: $165

Probability of Profit: 60%

Profit Target relative to my CAP: 46%

Max loss with my risk management: ~$100

Req. Buy Power: $355 (max loss without management at expiry, no way to let this happen!)

Tasty IVR: 16 (relative low)

Expiry: 51 days

Buy 1 TSLA May21' 595 Call

Sell 1 TSLA May21' 600 Call

Debit Call spread for 3.35db, because IVR is relative low.

Stop/my risk management : Closing immediately if daily candle is closing BELOW the box, max loss in my calculations in this case could be 100$. Probability of loss in this way: ~20% .

Take profit strategy: 50% of max.profit in this case with auto sell order at 4.2cr. Probability of profit this way: ~80%.

Of course I'll not wait until expiry in any case!

If you liked this article, check my other ideas.

Anyway: HIT THE LIKE BUTTON BELOW , and for fresh option ideas FOLLOW ME( @mrAnonymCrypto ) on tradingview !

APPLE BULL SPREAD - oversold breakoutHere is some big tech-play.

1) Divergence in oversold territory

My Smooth RSI indicator absolutely in the oversold territory, some bullish divergence detected.

2) Momentum confirmed with volume

Some buy volume finaly arrived.

3) Parallel charting

I love parallel speed-, or trendlines on chart.

Now another breakout.

4) Not everything is an utopie

The dangerous resistance in background! Previous support could acting as resistance later!

CONCLUSION :

APPLE DEBIT BULL SPREAD

Max profit: $64

Probability of Profit: 70%

Profit Target relative to my Buying Power: 27%

Buy Power: 236$ (max loss without management)

Max loss with my risk management: ~ 70$

Tasty IVR: 18.8

Expiry: 38 days

Buy 1 AAPL April23' 115 Call

Sell 1 AAPL April23' 118 Call

Long call spread for 2.36 debit

Stop/my risk management : Closing immediately if daily candle is closing below $117

Take profit strategy: I'm taking at the 50% of max.profit in this case with auto sell order. (at 2.68 credit)

If you liked this article, check my other ideas.

Anyway: HIT THE LIKE BUTTON BELOW , and for fresh ideas follow me : @mrAnonymCrypto on tradingview anyway!

Recommendation: thanks for @csemez to pointing on this trade!

FUNKO LONG CALL VERTICAL: high PoP (66%) and good ROI (30%)Look at that volume in uptrend!

Max profit: ......................................................... $113

Probability of Profit: .............................................66%

Profit Target relative to my Buying Power: ......30%

Max loss with my risk management: ...................~ $100

Buy Power: $387 (max loss without management at expiry, no way to let this happen!)

Tasty IVR: 13 (relative low)

Expiry: 58 days

Buy 1 FNKO May21' 10 Call

Sell 1 FNKO May21' 15 Call

Debit Call spread for 3.87db, because IVR is relative low.

Stop/my risk management : Closing immediately if daily candle is closing BELOW the box, max loss in my calculations in this case could be 100$. Probability of loss in this way: ~15% .

Take profit strategy: 60% of max.profit in this case with auto sell order at 4.55cr. Probability of profit this way: ~85%.

Of course I'll not wait until expiry in any case!

If you liked this article, check my other ideas.

Anyway: HIT THE LIKE BUTTON BELOW , and for fresh option ideas FOLLOW ME( @mrAnonymCrypto ) on tradingview !

AbbVie Inc - Long Call Vertical SpreadQuick trade for monday on $ABBV

Breakout formation

1) Swing Pivot

Last swing pivot breaked at 109$

2) RSI in the middle zone

Many space up and down too.

3) Squeeze indicator

On my squeeze indicator "prepare for storm" sign.

This in dicator I'm using for predicting any significant move in near future.

See examples in the past.

CONCLUSION

LONG CALL VERTICAL AbbView Inc

Max profit: 120$

Probability of Profit: 64%

Profit Target relative to my Buying Power: 31%

Buy Power: $380 ( max loss without management)

Max loss with my risk management: ~ $140

Tasty IVR: 6.9

Expiry: 66days

Buy 1 ABBV May21' 100 Call

Sell 1 ABBV May21' 105 Call

Debit call spread for 3.8 debit

Stop/my risk management: Closing immediately if daily candle is closing below $103.8

Take profit strategy: I'm taking at the 55% of max.profit in this case with auto sell order. (at 3.85 credit)

If you liked this article, check my other ideas.

Anyway: HIT THE LIKE BUTTON BELOW, and follow my fresh ideas ( @mrAnonymCrypto on tradingview ).

[ X ] United States Steel Corp short call vertical spreadLazy day, lazy trade.

My Iron Condor Hunter script indicated a potential iron condor for this instrument for the 12 - 23 range.

Let's check for the best setup for this signal.

(1) Basic TA to background check

After a quick TA I judged it too risky, because it limiting the downside potential correction.

The script indicated good ranges in the past 4 years, but now I'm a little bit hesitating about the downside move limit.

The script shows me 12$ as secury bottom target in the next 30 days, but the lowest low may be ~10$, based the green trendline

(2) Murrey Math levels

-1/8 and +1/8 are used for some kind of attempt to catch a trend reversal. -1/8 is an extreme support level during a bearish trend , while +1/8 is an extreme resistance during a bullish tendency.

A test of these lines indicates that the current trend is weakening. As a rule, the price doesn’t revers here and starts corrections towards 0/8 and 8/8. After that, the previous trend resumes.

On the weekly perfectly fit to my Murrey Math Lines Auto +1/8 script.

(3) Daily divergence

Divergence on daily chart , without any more comment..... Indicated local correction.

Breaked down my custom oscillator => correction validated.

CONCLUSION :

Modifying the strategy from the originally planned Iron Condor to Vertical Spread.

Sell 1 X Apr16' 21 call

Buy 1 X Apr16' 23 call

Max profit: ...... $80

Max loss: ......... $120

IVR: ................... 18.3

Probability of Profit: 73%

Expiry: .............. 45days

Strategy: Short call vertical

Risk management: I'm closing the trade immediately - if the daily bar closing outside my strikes - and I'm cutting my loss. (no matter what I'm believing)- usually I'm losing mutch less than my max profit in this case. Danger zone starts at 20.28$

Profit management: I'm sending an order at the 50% of max profit, immediately after my position opened - as usually.

Call Bull spread vs Call Bear spreadA lot of traders don’t understand why when they entering a spread they don’t receive most of the money even if the stock price is going their way immediately, in this post we will see why.

A spread is a position in which we buy one option and sell another option on the same stock. All the options are Calls, with put spreads all the options are puts.

There are three types of spreads (when you buy one option and sell another, unlike ratio spread). Vertical, horizontal, and diagonal.

What you see on the charts are Vertical spreads.

Vertical – The calls have the same expiration dates but different strike prices.

From the chart: Bull spread (Left chart)->Call upper strike (sold)-> 85, Call lower strike (Bought) -> 80, the expiration date is the same on the 18 of December 2020.

Horizontal – The calls have the same striking price but different expiration dates, for example, both sold and bought calls have the same strike price of 80, but the one that is being sold ends on the 18 of December 2020, and the one that bought on the 15 on January 2021.

Diagonal – a mix of vertical and diagonal, not the same strike and not the same expiration date.

I will only show here the Vertical spreads.

In the call bull spread, the position will profit if the price will be above the upper strike price (85) at expiration, and will lose if the position will be under the lower strike price (80). The options will not be worthless so to avoid commissions the position will be closed before expiration.

We can also see from the chart that in order to close the spread early, the stock will need to do relatively big moves.

A call bull spread is a debit spread.

In the call bear spread (right chart), the position will profit if the price will be under the lower strike price (80) at expiration, and will lose if the position will be above the upper strike price (85). Under 80, all the options are worthless at expiration and all the credit will be received .

The amount by dollars, not percent that the stock needs to move to close this position early in the bear spread is lesser than the bull spread, but on the other hand, the directions are different and we should not take a position based only on this criteria.

If the implied volatility will decrease all the lines will move to the center.

If the implied volatility will increase the lines will move from the center.

In the next post, I will show the ratio spread.

PTON Bullish and bearish flow before earningsBacktested the breakout point ($72.1) on Sep 4 or pivot point and held the 20 SMA. Earnings whisper is expecting .13c EPS and $560 mill revenue. Previous Q was $524 Mill, which was a beat. Bullish option flow bought Sep 2 - Over 4000 Sep 11 $120 calls bought and 2900 $110 calls (These would be all down). Bearish flow - On sep 1, Oct/ Jan 2021 call spread $80 bought sold the $85's. Sep 4, the Apr 2021 $90 calls were sold. I would play the run up into ER, then sell.

BYND signaled a little while back and finally looking decentBYND has a target at $162. It's looking pretty decent here for a run. May not hit if it runs here. Could take another leg up before closing the books on this signal. Ready to trim on a spike and rebuy on a dip. this is like learning to surf the market waves lol

Applied Materials - Bullish pullback trade ?Applied Materials ( NASDAQ:AMAT ) has an interesting chart in that it tends to pull back below the 21 EMA on the daily chart. I tried to identify a clear area of support for each pullback, but it seems arbitrary. You can see the Keltner Channel falls just short of where the stock reverses the second time and the most recent pullback is actually pulling back to the 34 EMA which I initially did not want to put on my chart to avoid too many lines... but I figured, seeing is believing, so I put a big fat orange line to add to the chart.

AMAT is an upward trending stock and has decent volume...approx 5 million shares traded today...I sorted the S&P 500 constituents by volume and AMAT was #19 in volume (#1 being highest volume which was GE). I did see other stocks that were pulling back as well, but something about their charts didn't convince me.

OK prediction time... so based on what I see on the charts I think we might see AMAT find support at $62.65 ... from there I think its going to ride back up. It is oversold based on the 60 min time frame, but not quite there on the daily time frame... so keep an eye on it tomorrow. If it comes down to $62.65 or to the lower Keltner channel band I wouldn't be surprised... but be wary if it breaks below that. Those considering to go long now, might be a little early...or could be lucky and end up hitting it right on the nose because it doesn't tend to stray too far below the 21 EMA and today's red candle was a decent size.

Draft Kings is a Monster - Long Live Sports BettingsDraft Kings I personally believe is worth double what it is now. However, sports not being played all that makes it scary for investors. With news on earnings today I think you see a big time change. I think it will consolidate in the corner forming an ascending triangle and breakout the top. If it doesn't I also marked put options where to enter and wher to check on the way down.

Personally I am long not just on 30% rev earnings, but I love draft kings myself, their customer support, overall experience and its a money making machine with little overhead.

Trading Edge 2020 Portfolio -Trade #6 - WMT - Asymmetric Spread Ticker: WMT

*This trade is a little more complex, than the others, as it has 2 separate spreads, but stick with me

Position: 1st leg

- Call debit spread

- 21st Feb 2020 expiry

- Long 114 Strike call = $4.85 - D = 0.99

- Short 115 Strike call = $4.25 - D = 0.95

- Net cost of 1st leg = $0.6

Position: 2nd leg

- Put debit spread

- 21st Feb 2020 expiry

- Long 120 Strike put = $3.88 - D = 0.88

- Short 119 Strike put = $3.30 - D = 0.73

- Net cost of 2nd leg = $0.58

Total net cost to run 1x of EACH spread = $1.18 <-------- This is the key number to pay attention to (DO NOT ENTER if this price is above $1.30)

Profit Target/ Exit:

- Maximum profit at expiration is $0.82 (both spreads finish at max value)

- Maximum risk = $0.18 (one of the spreads is guaranteed to finish at maximum value ($1.00), therefore the maximum risk is simply the excess, in this case $0.18

- This gives us a "Return on Risk" (RoR) multiple of 4.5, this is a very good asymmetric trade, but it is entirely dependent on the price paid for BOTH spreads, this is why the highest price i would pay is $1.30 for both spreads, lower than $1.25 would be ideal

- Even the worse case scenario of paying $1.30 would still result in a $0.30 risk to make $0.70, which is still a RoR multiple of 2.3

- Exit, let the spreads run their course for the duration, we are risking the full exposed premium (so limit your risk assuming it will fail)

Rationale:

- The high RoR multiple is the major rationale, coupled with the relatively low risk and entry cost

- So long as WMT finishes within the outlined white lines, the trade will be profitable

- If WMT finishes within the red lines, the trade will achieve maximum profit

- Position size only so that your are risking a relatively small amount, i will risk no more than around $400

- Technically, WMT does appear to be more bullish than bearish, if this does eventuate, then a simple way to play that would be to incorporate a naked bought call, to capture the upside, however this would also make this a directional trade, whereas currently this is a theta dependent trade.

*Note, the specific entry prices will likely vary, however so long as the net cost to run 1x of BOTH spreads is less than $1.30, ideally less than $1.25, then it will still be a valid trade

- TradingEdge

Trading Edge 2020 Portfolio -Trade #5- MCD - Call Debit SpreadTicker: MCD

Position:

- Feb 14th Expiry

- Long 210 Strike call = 3.78 - Delta 0.92

- Short 212.50 Strike call = 1.90 - Delta 0.62

- Net cost = $1.88

- Break even at expiry = $211.88

- Max profit = $0.62 (33%)

- Run 5x contracts = $940

Profit/ Exit targets:

- Exit position if MCD closes below the 21 ema on the daily

- Max profit is target, you may wish to run 80% max value of spread as your exit ($2.376 GTC sell order for spread)

Rationale:

- MCD has bounced off the 21 ema

- MACD is signaling a potential bullish continuation on both daily and lower time frames (4hr, 1hr etc.)

- MCD is within 4% of prior highs

- Moving averages are all stacked bullishly

- Appears to be in a solid uptrend, looking for some near-term trend continuation

-TradingEdge