Canada

"NZDCAD: Top and Bottom Analysis" by ThinkingAntsOkDaily Chart Explanation:

- Price is on an important Support Zone .

- Bullish Divergence on MACD .

-If price starts its up move from here, it has potential to break the Descending Channel and, then, go towards the Middle Resistance Zone . If price also breaks it, there is potential to move up towards the Major Resistance Zone .

Weekly Vision:

"USDCAD" by ThinkingAntsOk4H Chart Explanation:

- Price broke the Ascending Trendline.

- Price was on a Bearish Corrective Structure that was broken after bouncing on the Resistance Zone.

- Price should continue its down move from here, with a main target on the Major Support Zone.

- We are looking for sell setups on lower timeframes.

Weekly Vision:

Daily Vision:

Updates coming soon!

Kinda smelling bear over here?!Brexit uncertainty spirals back after the Bojo sad defeat on his plan. October 31 will be extended for a small-time period seem so and PM Johnson can blame the opposition for mucking up the schedule . The EU is in no hurry. Is it 10 days or 3 months? Who knows. Break below the horizontal trendline of the descending triangle should only consider the future bearish movement in price.

"USDCAD: Top and Bottom Analysis" by ThinkingAntsOkDaily Chart Explanation:

- Price bounced on the Resistance Zone.

- It is near the Weekly Ascending Trendline.

- If price breaks it, the down move will be started. It has potential to move down towards the Middle Support Zone first and, then, towards the Support Zone.

- We are looking for sell setups on lower timeframes.

Weekly Vision:

Updates coming soon!

HEXO Potential TurnaroundHEXO may be going through a falling wedge pattern, which has the chance of reversing the trend to an upside. It's reached strong support from its long-term trend, and it looks bullish on the 3-day MACD after crossing back in September. Look for it to breakout above the resistance.

AUDCAD Short Term Trade (1:2.67 Risk to Reward)HELLO EVERYONE,

Coming to Analysis of AUDCAD :

--Price has rejected the demand zone clearly after the stops were taken, and also completed the retracement to 23.6% fib, expecting a ABC Move from here.

--Currently I am looking for a short term trade here, will post a new chart for Swing Trade Idea.

--Expecting to take entry at 0.89850 with a Risk to Reward ratio (1: 2.67).

--The Targets have been defined over Critical Demand/Supply zone to ensure accuracy over the targets.

COMMENTS ARE WELCOME >.

.

To get in touch or our services, please DM.

USDCAD LONG I am seeing a potential inverse head and shoulders pattern on the 4 hour timeframe for this pair. I will have to wait for the completion of the left shoulder for confirmation. So far the pair has been showing bullish signs and had a recent break of its down-trendline from September 19, 2019. Price has been holding highs within a range around 1.3200. Once we see a significant break out of this range, then it will add confirmation that is needed for the right shoulder. If 1.3400 highs are broken then I will take price up 200 pips to 1.3600. Anything can happen, especially with NFP coming this Friday so I am prepared to get out with a defensive strategy if need be and be prepared to take a short at the break of 1.3100 support.

USDCAD sitting in support. Possible short term buy on this areaUSDCAD is dancing in the 1 hour chart. If I will trade on what I see, I'll place a buy order at around 1.32450 and Trailing stop when it goes up by 20 - 30 pips in a positive position. If it goes down then I'll place a pending sell order at around 1.32250. Manage your risk management for God's sake

Get our free signals here: t.me

Like us on Facebook: www.facebook.com

Reading the right side of the chart : CADCHF 26 SeptI am bullish CADCHF at the moment. I missed the "anchor" signal yesterday but there are still opportunities to buy the dips. I am looking at 0.74560 - 0.74650 price zones and 0.74300-0.74400 as an "anchor" to long this pair towards the 20-week AWR upside projection or the levels at 0.75100-0.75200 depending from which price levels I long this pair

There are no risk events for Canada and Switzerland today.

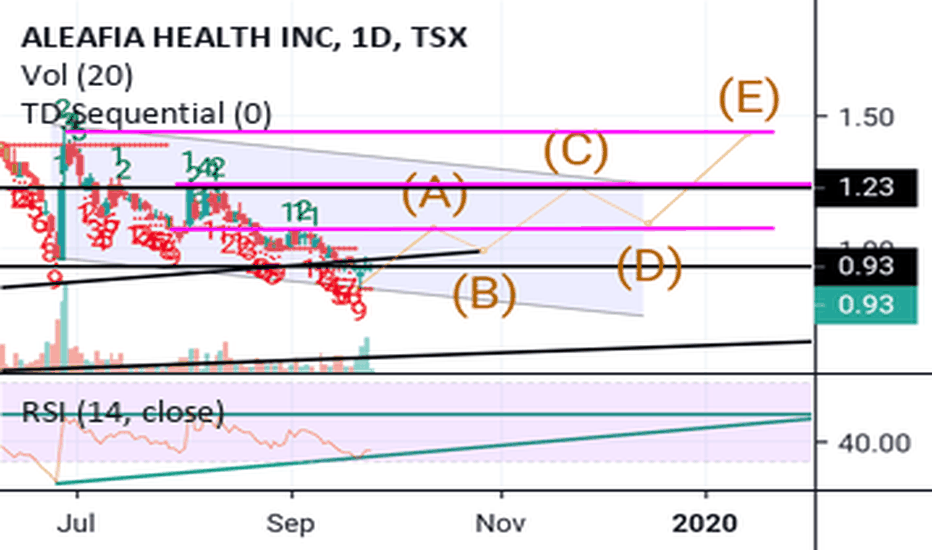

Possible scenario for ALEFThis is roughly what I am looking at right now. A lower low would invalidate this.

Time for an Aleafia bounce?Aleafia looks like it is ready for a bounce at the very least.

The RSI is also forming an ascending triangle.

Easy risk to reward on this one. Either it breaks out from a $1 entry with a target around $1.50 or it breaks down from the $1 level, invalidating this trade idea.

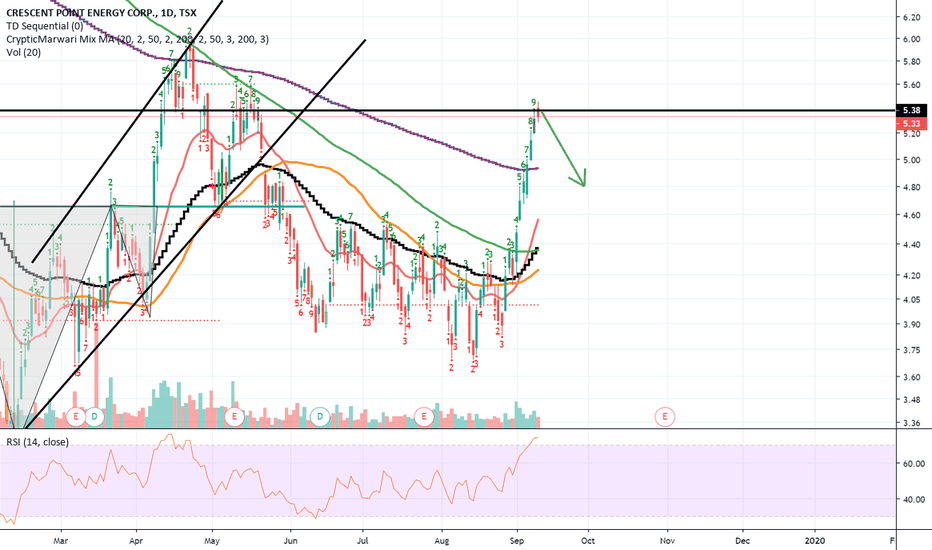

Short term pullback on Crescent Point Energy likelyDaily 9 on the TD Sequential. CPG has gone up exponentially so I am expecting a pullback at the very least the prior support level. A daily close above 5.6 would invalidate this trade idea.

"USDCAD: Top and Bottom Analysis" by ThinkingAntsOk4 Hour Chart Explanation:

- Price broke the Daily Ascending Trendline.

- Price is currently on an Ascending Trendline that seems to be a Corrective Structure.

- If price breaks it, it has potential to move down towards the Major Support Zone.

Weekly Vision:

Daily Vision:

Updates coming soon!

Preparing for Fed verdict, analyzing the state of the oil marketThe attacks on Saudi Arabia's oil infrastructure led to the biggest jump in global prices. The correction was not observed until the American session started. We recommended on Tuesday to open short positions in oil because we were confident in the corrective movement and the end, the recommendation justified itself at 100%. In just 10 minutes, oil lost over 4%. The reason for the decline was the information that Saudi Arabia has officially confirmed - production capacity will be restored by the end of September. And to compensate for losses in production associated with the attack, the Saudis will increase production up to 12 million bpd by the end of October. So those of our readers who trust our experience and analytics should have made good money.

As for trading on the oil market today, then after the strongest fall yesterday, everything looks rather ambiguous. And although we continue to incline toward asset sales you should be careful with that.

As for the Fed and the Open Market Committee. An event that was devoid of intrigue just a couple of weeks ago (100% of traders set a minimum rate reduction of 0.25) may surprise. The current probability of a Fed rate cut is slightly above 60%. And if you take into account that yesterday's data on industrial production in the USA were frankly surprising: 0.6% m / m with a forecast of + 0.2% m / m and July outcome -0.1% m / m, the Fed can keep the rate unchanged.

Our position remains unchanged. We expect the rate to be lowered by 0.25%. There are enough reasons for this: an interest rate reduction by ECB rate last week, a deterioration of the US labor market and the US economy condition as a whole, threat of a global recession and intensified trade war, multiplied by the risk of a US military campaign in Iran - all of this obliges the Fed to act and reduce the interest rate to prevent the US economy downfall. Anyway, reinsurance is better than solve the consequences duo to the lack of action.

Accordingly, our position on the dollar today is also unchanged - we will sell it. At the same time, we do not forget the euro and its movement after the ECB meeting last week. The probability of false movements is great and it is extremely important to follow a predetermined plan. But at the same time, it is worthwhile to put stops so as not to go against the market will.

In addition to the decision of the Fed and the subsequent explosion of volatility in the foreign exchange market, it is worth paying attention to inflation data from the UK and Canada.

As for the UK. Despite Johnson's unsuccessful meeting in Luxembourg, the pound did not react that much. This means that we will continue to look for an opportunity to buy the British pound. First of all, against the euro and the US dollar.

The tactics of buying gold in the area of local lows continue to be justified, so we will continue to adhere to it today.

Reading the right side of the chart : CADCHF 18 Sept 2019Yesterday the daily range was 32 pips whilst the 20-day ADR was 52 pips. Price missed the daily range hence I expect a decent price expansion of above today's 20-day ADR of 48 pips or at least hitting the exact range projection.

I am bullish bias for CADCHF hence I am looking at the liquidity pool at 0.74800-0.74880 and/or 0.74700-0.74600. If price enters into this price zone, then it is a bullish activation for me and I would proceed to look for a bullish trigger to long this pair.

There is a CPI number for Canada today at 8.30 pm (Singapore/Malaysia time). I have looked at the last 3 data release of CPI. My concern of risk event is generally only the inevitable stop hunt that occurs during this time hence I only look at the reaction candle (the 30-minute candle at the time of the release of the economic number).

On June 19th, 2019, when the number came out better than expected with +0.3% deviation (0.4% vs 0.1%), there was a 25 pip bullish spike (30 min candle) followed by retracement taking out the 25-26 pips bullish spike and price movement was flat until NY close. The price moved up again and closed above the high of that 30-min candle at NY close. The price went into an intraday bearish move the following day. The underlying trend at that time was Bearish.

On July 17th, 2019, the number came out better than expected with a +0.1% deviation (-0.2% vs -0.3%), there was a 17 pip run. That 30-min candle closed as a spinning top type candle and price moved down and closed below the close price of this 30-min candle at NY close. The price went into a bearish move the following day. The underlying technical narrative at that time was Bearish as there was a Double top at a significant level.

On August 21st, 2019, the number came out better than expected with a +0.4% deviation (0.5% vs 0.1%), there was a 24 pip bullish spike. That candle closed as a solid bullish candle and price moved slightly flat after NY close. The price went moderately bullish the following day. The underlying technical trend at that time was Bearish (which the price went into a bearish intraday trend 2 days after the CPI numbers released)

Based on these small sample data (but rest assured I have checked larger sample size but for the sake of simplicity and avoiding this post to be a very dragging and long post, I just present the last 3 CPI numbers that came out), very often the candle spike reacts according to the headline numbers but the price action afterward were somewhat mixed and "random".

The candle spike did show there was a stop hunt i.e June 19th, after the bullish spike, the price went down at the next several candles and July 17th, there were two-sided spike even though it was only 17 pips but the candle closed as spinning top which suggested there was an "accumulation" in that 30 minute period.

I will trade around this risk event and looking for a stop-hunt at the levels I have determined as liquidity pool so I can Long CADCHF. The forecast is -0.2%, huge decrease from previous 0.5% (-0.7% deviation). If the actual number is somewhat better than -0.2% with huge deviation, then I expect a 20-25 pip bullish spike. I will enter the trade after the 8pm candle close (enter a trade at 9 pm Singapore time) BUT only if the price at the time was already tapped into the liquidity pool. IF not, then I will wait until the next day and see if the market can give me new and fresh structures to work on.

If the number came out worse than expected, then I expect 20-25 pips bearish spike. As I mentioned, the aftermath of this event seems to be random and that suggests me I can proceed to trade according to my technical bias. The reactionary bearish spike, at which I hope will be the catalyst of liquidity run towards the levels I have determined so I can look for bullish triggers to long CADCHF