Canada

RTI Uptrend?1. Bullish hammer at lower bollinger band on 02/02/2018

2. Higher lows the following days.

3. Price closed strongly on 04/02/2018

4. Stochastic turning upwards from a near oversold zone

I identify this as a reversal point for RTI.

I expect it to at least reach $1.7 in the next few days possibly climb up to $1.85-2 level by next week.

pound aud long analysis Hi everyone here is my analysis on Pound Aud

great potential for a good pip trade if it plays out , at the moment I have drawn in the key areas where it will hit along with some key pitchfork and trend lines I will be looking at in the coming days looking at this trade

any questions let me know Kris

#USDCAD: US Dollar 'Short' 1.1950, then 'Long' 1.2510 OANDA:USDCAD

Observations

1)During 2017, USDCAD experienced 4-Massive Bearish Candles: January, May, June, July, and December.

2)When you zoom those months' performance, you find that all shorts from 'High to Low' could have banked a max accumulation of (600) pips.

3)January 2018, trades from 1.2590 to 1.2282 which translates only to (290) pips meaning; if TVC:DXY keeps bleeding at least until it lands near 86.85, then USDCAD has all the ingredients to drift lower and hit 1.20s, there I could see a 'TRAP' touching 1.1915-1.1880 region and reversing.

4)Never forget NAFTA 'Gallo Tapao' (Latino quote to describe a strong player that everybody knew was there from day 1)

Stand: Short to squeeze extra +-300 pips, then building longs towards 61.8% Fibonacci level 1.2550 or from low calculate +480 pips max, that's it.

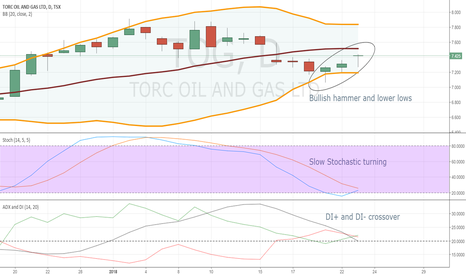

Strong Reversal in TOG?!We see bullish hammers and stochastic turning from its oversold zone.

The DI+ and DI- crossover tells us that the market might trend upwards in the short term!

10% move in THO?Trend reversal emphasized by a bullish hammer and higher lows in subsequent days.

Price is turning from an oversold zone according to stochastic.

I see it rising to a price of $6.4 in the short term.

MYMMF pennant breakout with gap up confirmationMYMMF canadian cannabis company made a small breakout yesterday evening shown by my previous graph yesterday. This morning full confirmation breakout, it gaped up on relatively higher volume through heavy resistance at 2.8$ resistance. Here would be good entry for a run up, this stock might test new all time highs in the coming weeks.

ACB in its last correction wave releasing good newsACB looking like its completing one last correction wave before stabilizing somewhere in the $9-$11 region. That being said they have just released great news so this could interrupt the last correction and continue on its bullrun but i find this unlikely.

All in all, don't try and fight the bull market. Cannabis is exploding right now and you'd best hold this one, it still has much more room to grow. That being said, a short around soon to be 13$ could be possible since id like to see it consolidate around 11$ before taking off again.

MYMMF wedgeMYMMF making a wedge (ascending/descending?) and could break high before stabilizing again around $2.5 region and consolidating before making another bullrun before legalization

OGC Reversal after a long downtrend, great buying opportunityThe last few trading days show that this is a good buying opportunity and stock has probably reversed.

Stochastic shows it climbing up from an oversold position and MACD histograms show that the market is trending positively.

I believe OGC could rise up to its previously long held position of $3.45-3.50.

I am placing a stop loss at $3.00, to give myself about 2% breathing space as the stock has been in a downtrend for a long time and the bulls may need some time to gain momentum.

short above $6.00legal pot is 6-8 months away in Canada - actual revenue vs mkt cap above 2 billion is literally a joke

close short near EoY

UBiQ- B2B Smart Contract - Undervalued - The chart is showing strong positive sign for growth in 2018. One of the biggest emerging Canadian exchange showed interest to add UBIQ in fiat pair which will boost the price up to . The real money in Crypto is for B2B solutions that's why UBiQ understand the supply and demand economy of coin. The UbiQ only have 38 Million coin with such small supply, the price gain can be huge for the coming year.

As per July reports, 12 million Canadian people owned crypto which can be 20 million by now . A boost from Canadian market can be easily seen next year on following coins. Ubiq could be one of the top pick for 2018.

-Ethereum

-Kin

-QASH

Ubiq is a decentralized platform which allows the creation and implementation of smart contracts and decentralized applications. Built upon an improved Ethereum -1.42% codebase, the Ubiq blockchain acts as a large globally distributed ledger and supercomputer, allowing developers to create decentralized and automated solutions to thousands of tasks which today are carried out by third party intermediaries.

blog.ubiqsmart.com

blog.ubiqsmart.com

github.com

ubiqscan.io

ubiqsmart.com

Trend Reversal in SMF, expecting it to rise at least 9%Bulls are taking over.

Indicated by the strong bullish hammer and stochastic turning from the oversold area.

Added in MACD to further enforce the arising bullish trend.

Shows signs of being a good growth stock but definitely worth swing trading over the next two weeks.

Entry Point AIR CANADAI called the reversal about 3 weeks ago and I think that AC is trying to prove that this was just a temporary sell-off. The stock has fallen from highs of $28.50 to $21 and is now trading at $24.93. Fundamentally AC is strong with a good position in the Canadian market. It is showing on the chart attached that it is hovering around support zones and will probably continue to keep trickling upwards until it has a reason for a bigger breakout to new highs. RSI is showing that the stock is not overbought nor oversold, but it's hovering in the 45-55 range which could indicate this is building up a base. Furthermore, the 50, 100, and 200 moving averages are converging which could show that this is pent up and ready for a breakout.

CAD/JPY: finally SHORTConfluences:

1/ Trend

2/ Fib play

3/ 91 as resistance

4/ High test candle ( 2 in a row )

5/ Bearish MACD

6/ We are bouncing of the 200 EMA on the Weekly chart

After day one of the trade, U can see that we broke the CTL, which is a great sign for this pair to finally head lower again.

It is not too late to enter, because today we got a pullback.

Target 89

BLEVF Canadian Cannabis big upside potentialBeleave Cannabis... is it going higher? You better Beleave it! Lol... Target 3.20 range but potentially a bit higher... That's the three Cannabis stocks for today in the mid priced range. I have been trading some in the 10 to 20 cent range with fantastic profitability but these are safer plays. The smaller ones are still waiting on their licences from Health Canada so are more risky.

SPRWF Supreme Pharmaceutical 100% upside gains comingHere's a second Canadian Cannabis stock posting for today and I will give you guys one more. These smaller companies are ripe for take overs by the big boys. They have all begun to rally to make the second significant wave higher. If you want to see how these stocks are rallying check out the leaders of the pack ACBFF and TWMJF.