Canadastock

CadJpy on 4hrs(Sell)CadJpy seen retracting on resistance parameters so therefore we see it head to next support ranging there for a little while then proceed further downwards to bottom trendline/supports. Like and share your ideas on this particular pair too. Also always apply proper risk managements thanks!

Action off the squeeze NUTSXV:NU

I've been watching this approaching its 52 week low for some time and as a business they fail to really excite me. As a trading opportunity, however...

In the life of this stock it has touched the top of the BB9 on the weekly chart three times after a squeeze. Each time was followed by significant upward action. As the volume profile tells us that most of this stock was traded in the 14 to 18 cent range, I am quite happy taking a position around 8 or 9 cents. Given the industry that they are in and the revenue the cannabis industry is currently enjoying, I cannot see this stock breaking it's 52 week low of 6.5 cents, which is where my stop loss would be for a loss of 1.5 cents per share. Risking a potential loss of around 18% for a potential easy gain of 50% to potentially much more, in an industry that is booming globally, on a stock that has historically demonstrated upward action off performance it is exhibiting currently - I feel strongly that this is a no brainer for a 'quick buck'.

Daily Canada S&P/TSX CAD stock market index forecast timing anal27-Jun

Price Forecast timing analysis by pretiming algorithm of Supply-Demand strength

Investing position about Supply-Demand(S&D) strength: In Falling section of high risk & low profit

Supply-Demand(S&D) strength Trend Analysis: In the midst of a downward trend of strong downward momentum price flow marked by temporary rises and strong falls.

Today's S&D strength Flow: Supply-Demand(S&D) strength flow appropriate to the current trend.

read more: www.pretiming.com

D+1 Candlestick Color forecast: RED Candlestick

%D+1 Range forecast: 0.0% (HIGH) ~ -0.2% (LOW), -0.1% (CLOSE)

%AVG in case of rising: 0.3% (HIGH) ~ -0.3% (LOW), 0.2% (CLOSE)

%AVG in case of falling: 0.2% (HIGH) ~ -0.5% (LOW), -0.3% (CLOSE)

Price Forecast timing is analyzed based on pretiming algorithm of Supply-Demand(S&D) strength.

CANOPY - Possible BULLISH Pennant breakout to new highs of $80Trying my beginners luck on my first post on stocks. I've been watching price action for Canadian weed stocks the past few months and it is now

finally breaking out of bearish bias, especially Canopy.

BEFORE entry, please look for confirmation on candlestick patterns or price action at important S/R lines.

If this chart helped at all, leave a like or follow.

I would love any feedback/advice about my chart to correct any of my mistakes and learn more about TA.

DISCLAIMER: Not a financial advisor, I don't suggest using my ideas for your own as I am a complete amateur for TA.

Good luck to everyone!

Hybrid Analysis (RTI.TSXV)Overlaying fundamental factors on technical information (known as hybrid analysis) allows for analysts to understand what moves the market.

Hybrid analysis is useful in particular when it comes to stocks and options (as opposed to currencies and futures) as direct links can be more easily drawn between stock price and fundamental factors. When used in penny-stocks, knowing what moves the market is key to making rewarding trades whilst minimizing risk.

Hybrid analysis requires good understanding in the economic factors that move the market, knowledge that is often overlooked by retail analysts.

GLDFF Golden Leaf HLDGS LTD, Massive Gains! MMJ Rush?keeping it simple.

It seems to have bounced higher then the previous low and has been squeezing long on the WEEKLY.

This is bullish in the MMJ market at the moment, and has been over looked due to the mainstream stocks.

They have a positive revenue report.

I dont see any sell signals currently, just a small pull back to retest the higher levels, with possible breakout. This is a long hold for me, as Ive played the regular MMJ stocks already and some are just too far up as it is.

Momentum is also bullish.

Happy trading, debating and speculating! FOLLOW FOR UPDATES, and check out my other crazy accurate charts, including the only Tilray chart before it blew up 400%.

Significant Reversal in WEF?1. Daily chart shows "Three White Soldiers" or three bullish candles. Price is closed out quite well. Three such candles haven't been seen before at a low point in the downtrend. This suggests that this may be a significant low point.

2. Weekly chart show a bullish hammer followed by a week with a higher high and higher low.

3. On both time frames, bullish price action is happening at the lower bollinger band .

Go long at 2.40. Stop Loss at 2.21.

Projected price range is 2.75-2.85.

Give it a little extra room, in case of a immediate pull-back.

The bull is back Descending triangle pattern formed and broke out. As you can see the chart you can see that the volume add confirmation to the breakout as well the gap up from 18th to 22nd of May. A lot of people are looking for entry since the third and final vote on the bill to pass will be held on June 7th,2018. According to Peter Harder the senate never rejected a bill on the second reading. If the bill passes ACB will reach a possible new high by legalization.

PAT Short-Term Reversal1. Multiple bullish hammers indicating that bulls are winning at the end of the day. Today, bulls really took over with a big move up.

2. The bullish candles are at PAT's lower bollinger band as well.

3. A slow stochastic is turning up from its oversold zone and there is also a MACD crossover

Trade aiming for 1.75 in the next few days.

Mean Reversion in FIRE?!FIRE has dropped down to the $1.60-1.70 range a few time in the couple months only to bounce back. This is probably a support level for FIRE.

Every time it hits its support level, a bullish candle is formed and it pushed towards $2+ in the next few days.

Basically, FIRE is shown movement that has been bullish historically.

The slow stochastic supports this oversold idea.

Short Term Trade, stop loss at 1.68.

Nice cup and handle pattern with breakoutBombard has long been a TSX laggard but, much like blackberry, its looking at big gains in 2018 following the release of C-series that was heavily delayed on many fronts (which was not good for them) In the last weeks it has broken through resistance that was holding it back for almost 3 years at the $2.80 region and has broken out from a cup and handle formation on exceptional volume.

I'd defenetly be looking to enter long around $2.95-3.00 region as this stock has become a beauty to hold again for 2018 from a technical and fundamental standpoint.

Buy FCC now!A simple analysis of the uptrend shows the end of a pullback in the FCC uptrend.

FCC bounces back at 1.06-1.07. I see the next move up being up to 1.28-1.30.

Short term reversal in TSXV:EMC?The bullish hammers of the last few days indicate a trend reversal in TSXV:EMC.

Stochastic has been slowly climbing out of the oversold zone and it may just be the right time to buy in.

I am hoping to buy in around 1.44-1.45, and I will place a stop one ATR below at 1.31-1.32 which is below their 52week low (hopefully it holds).

Trend Reversal within trading range in NEPT!?We see a potential reversal in TSX:NEPT indicated by a bullish hammer at its lower bollinger band AND also at a long held support level!

I see TSX:NEPT working its way up to its resistance level at least. Hopefully it can break through the trading range.

TSX:NEPT can be a very volatile stock as indicated by the Average True Range, so buy in very carefully.

RTI Uptrend?1. Bullish hammer at lower bollinger band on 02/02/2018

2. Higher lows the following days.

3. Price closed strongly on 04/02/2018

4. Stochastic turning upwards from a near oversold zone

I identify this as a reversal point for RTI.

I expect it to at least reach $1.7 in the next few days possibly climb up to $1.85-2 level by next week.

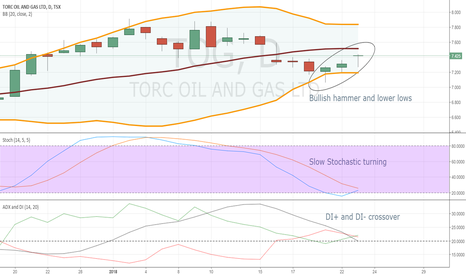

Strong Reversal in TOG?!We see bullish hammers and stochastic turning from its oversold zone.

The DI+ and DI- crossover tells us that the market might trend upwards in the short term!