VIDEO ✨ NEW: USDCAD ✨ PRE CAD NEWS ✨-SL @ 1.36681 🚫

SLO2 @ 1.3620 ⏳

SLO1 @ 1.3525 ⏳ (half position)

TP1 @ 1.3350

TP2 @ 1.3215

TP3 @ 1.2980

TP4 @ 1.2833

BLO @ 1.2795 ⏳

-SL @ 1.27278 🚫

00:00 PRE CAD NEWS

00:58 Boost, Follow, Comment, Join

01:40 Technical Analysis

02:54 Fundamental Analysis

05:42 Curve Analysis

07:42 News Anticipatory Trend

08:08 Risk-to-Reward

09:44 LIVE STREAM @ 05:15 PT / 08:15 ET 🔥

Canadian

✨ NEW: USDCAD ✨ PRE CAD News ✨-SL @ 1.36681

SLO2 @ 1.3620 (conservative)

SLO1 @ 1.3525 (aggressive)

TP1 @ 1.3350

TP2 @ 1.3215

TP3 @ 1.2980

TP4 @ 1.2833

BLO @ 1.2795

-SL @ 1.27278

TECHNICAL ANALYSIS:

Although, the pair is currently trading above the 200-day moving average, which is a bullish signal, Price Action for USDCAD is sideways. This range is a strong indication that it is consolidating before moving in a new direction — a downtrend. Traders should be aware of both the bullish and bearish signals before making any trading decisions.

FUNDAMENTAL ANALYSIS:

At this time, it's not clear what the future holds for USDCAD. The US dollar will do well if the economy is strong and interest rates go up. The Canadian dollar is being helped by a strong home market and rising oil prices. This is why the price action of USDCAD has been consolidating.

Factors affecting the USDCAD exchange rate are as follows:

(1) U.S. Interest Rates:

How interest rates are right now in the U.S. because of what the Federal Reserve does, interest rates are expected to keep going up in 2023. Buyers will want more USD, which will push the USDCAD exchange rate down.

(2) Canadian Interest Rates:

The Bank of Canada is also likely to raise rates in 2023. But the rate of growth is likely to be slower than in the United States. This could help the Canadian dollar get stronger and stop the USDCAD exchange rate from going down even more.

(3) Oil Costs:

The price of oil has never been this high. This is good news for Canada's economy and may help the value of the loonie stay the same. But if oil prices went down, the USDCAD exchange rate could be hurt.

(4) Canada's Housing Sector:

The home market in Canada is doing well right now. This is good news for Canada's economy and may help the value of the loonie stay the same. But the USDCAD could be hurt if the home market starts to slow down.

Gold in CADIt's important to look at Gold against various currencies - this can translate as a country's financial trust/stress barometer.

The Gold in CAD chart has recently formed a nice classic bull-flag on the weekly candles.

Continuation of this bullish pattern would bring Gold to a new ATH for Canadians.

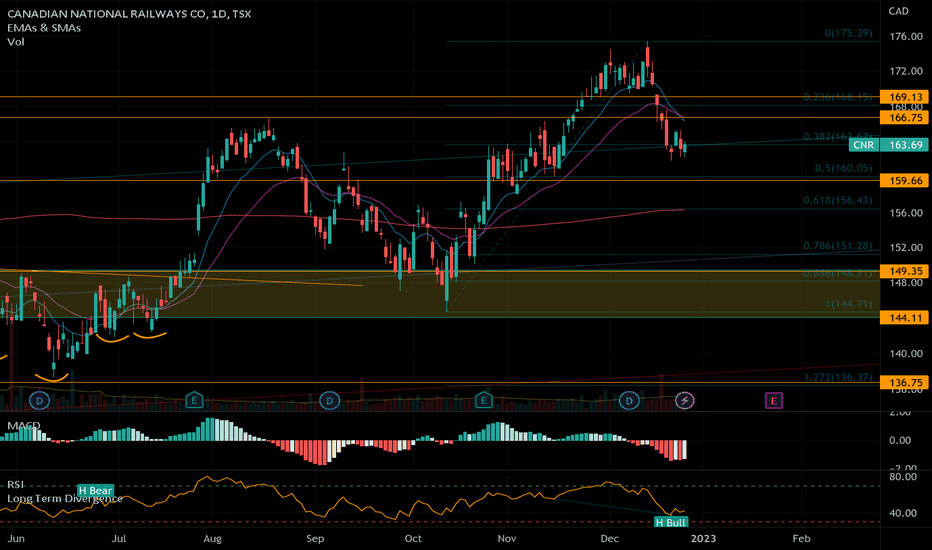

A very comfortable time to buy in - short termVery beautiful chart from Toronto Exchange Market these days. If you have TSX tickets it is now time to buy in and hold for the uptrend.

TSX broke out of the downtrend channel and I have no reason to believe it is a "fakeout". Good indicator support and good trend lines. I'm expecting a small amount of correction between 19400 and 19200 since the RSI index is still very high, but it would not be back in the downtrend channel.

Level 0.236 Long Term Trend-based Fibonacci is where I would be expecting a correction. As far as the scope of this analysis goes, I will be adding to my portfolio aggressively.

I will do analysis of major tickers affecting TSX in the ext month or so, so make sure to follow me to not miss my analysis on the Canadian tickers!

USDCAD Short Opportunity for a Deep Retrace (50%)OPEC has recently announced deep cuts to their output quotas for oil. This has resulted in the Canadian Dollar gaining strength against many currencies as it is a major oil producing economy.

Strength of the Canadian Dollar is now evident on the USDCAD chart. I believe USDCAD will drop for a 50% retrace from it's previous impulse move.

TSX another low incoming BOC meeting sept 7th We are just about half way thru earnings season for the TSX, with the next BOC meeting in September 7th and another hike of minimum 50bps is already guaranteed I think it opens up a great period for the TSX to make a new low.

Earnings have been better than expected for a lot of the bigger companies in all sectors from industrials, utilities, staples and of course energy but I think that is mostly priced in by now and even though we had a nice rally here off the June low it was over due after all markets never go down in a straight line. I am looking at further weakness in the energy sector with WTI looking overdue for a move to 70's .

I am eyeing the monthly calls with a sept 16th expiry.

I am looking at shorting XIU for tsx 60 and XEG for the energy etf and also single names such has Telus / Bell / Canopy / Superior

easy money dollaramaThe Canadian dollar has started to increase and it seemed it has a long way to go. Dollarama is one of the vital veins of the Canadian economy and the minor recovery in the economy would change this stock to a skyrocket!

% 4-5 is the easiest target for now, but in my humble opinion, $100 is not so far from today.

How am I going to trade USDCAD pair?There are several main DXY setups now. I believe in DXY drop in this year , so I confidence this pair is going to drop too. However, the reality could be fully opposite. It is high uncertainty now . So, take this under considiration trading this or fully opposite setups. Good trades to you and all the best from my side.

✅GBP_CAD LOCAL LONG🚀

✅GBP_CAD broke out of the narrowing wedge

Which made me bullish on the pair

And the price is now retesting the broken

Resistance line which became a support

So I think that we will see a rebound

And a retest of the breakout high above

LONG🚀

✅Like and subscribe to never miss a new idea!✅

usdcad canadian dollar start of the big bull phase possible The Canadian dollar is in the consolidation phase its very possible point of reversal as this zone is already be tested and respected many times. I am expecting the start of a new big side trend as you see divergence on the MACD indicator as well its sign of losing strength.

Break of bearish channel on the EURCAD.There seems to be indications that the EUR is ready to make an upside move against the Canadian dollar . The signs that would indicate this is a break of the bearish channel that had been created on the daily time frame, and signs of accumulation at the level indicated on the chart.

Easy 10% early next week on HBIT - "RRSP Bitcoin"This ETF is not really Bitcoin, it's a derivative. For a short term trade, make your gains here with and buy real Bitcoin on a real cold wallet.

With now HBUT at sub $10 is a buy. You can't tell from the charts, there's no volume on HBIT/BITI because traders need volume. There's none on that junk so its just for snipers at this point (people with Level 2 and able to pick off the arbitrage with real Bitcoin patterns, like 1 hr oversold on real BTC and snooze on fake ETF.

Anyway, I'm long HBIT, (& off BITI) before the weekend or sell everything if you think cash-is-trash is better.

This is the sub $60K stop loss attack before the run to six figures on Bitcoin. Enjoy the ride people.

Bitcoin is the true market. The rest is an illusion that is getting slowly corrected with math.

CAD/JPY Signal - JPY Leading Economic Index - 7 Sep 2021CADJPY has broken the support trendline prior to the JPY Leading economic index data, which is an economic indicator that consists of 12 indexes such as account inventory ratios, machinery orders, stock prices and other leading economic indicators. Technically the pair has broken the support trendline near the resistance trendline, and the RSI is pointing to downside.