Position USDCADA great opportunity in USDCAD for position in the weekly chart with excellent risk-return.

The price follow the trend for more than 15 months and now again we are testing channel support. Since December, the price has dropped sharply following the cloud trend to channel support. It has been traded in less than 1.31 in confluence with Fibonacci retracement 61%.

Yesterday it closed with white Marubozu candle indicating strong buy, breaking the short-term down trend in the channel, triggering the operation in a "safe" level. In the middle of the road we still have a resistance at 1.335 which should not be too difficult to break, but delays the process of achieving take profit.

Looking to CCI the price should follow the trend, at the daily chart the indicator is above 0 and in the weekly is almost there.

This trade carries a risk-return of 1: 2.7 which is a good reward, in return it can be time-consuming. We can exclude the factors from the economic calendar tomorrow, probably projecting downside to the pair, and also the others that come.

Trade wisely.

Canadian

USDCAD Potential Breakout to 1.33 Levels? ~ Probability: HighAfter moving sideways for the past couple days, finally momentum has increased and a potential breakout back to 1.33 levels are probable. Otherwise a heavy rejection from the Orange range will continue to pull us further downwards following the Red Arrow to the lower 1.32350 support.

USDCAD POTENTIAL SHORT OPPORTUNITY (1H AND 4h CHARTS) USDCAD POTENTIAL SHORT OPPORTUNITY

This setup is going to be similar to the GBPCAD setup that was posted this week as well. If you look at this pair you can see that recently the market had a very dominant seller move to the downside. The biggest tell if the selloff is legit or not is going to be the RE-TEST. The re-test is a huge tell sign of whether or not that move was legit or not. As traders we must trade high probable setups so that our potential of winning is greater than of losing. This is how we will become consistent over time and it takes strong discipline to do so. Let's take a look at this USDCAD setup.

4H Chart:

* on this timeframe we can see that the market had come to a high point and was followed by a very strong seller push to the downside

*you only want to sell the market at high point and sell at low points. This may sound very obvious for most people but that's not the problem. The problem is that most people do not apply it to their trading

*look at this timeframe for a weak re-test by the buyers to confirm the seller is in control

1H Chart:

*use this timeframe to watch the pullback on a more specific level

*use this timeframe also to watch and see if seller interest comes back in on the re-test (if it doesn't we wont be looking to trade this currency pair)

*make sure to have good risk/reward based on this timeframe

MAKE SURE TO ALWAYS IMPLEMENT PROPER RISK. NO SETUP IS A GUARANTEE THAT IT WILL GO THAT WAY. WE ARE TRADING BASED ON PROBABILITY AND YOU SHOULD ALWAYS USE PROPER RISK MANAGEMENT.

PLEASE LIKE AND FOLLOW MY PAGE FOR MORE PROFITABLE TRADE SETUPS. CHEERS!

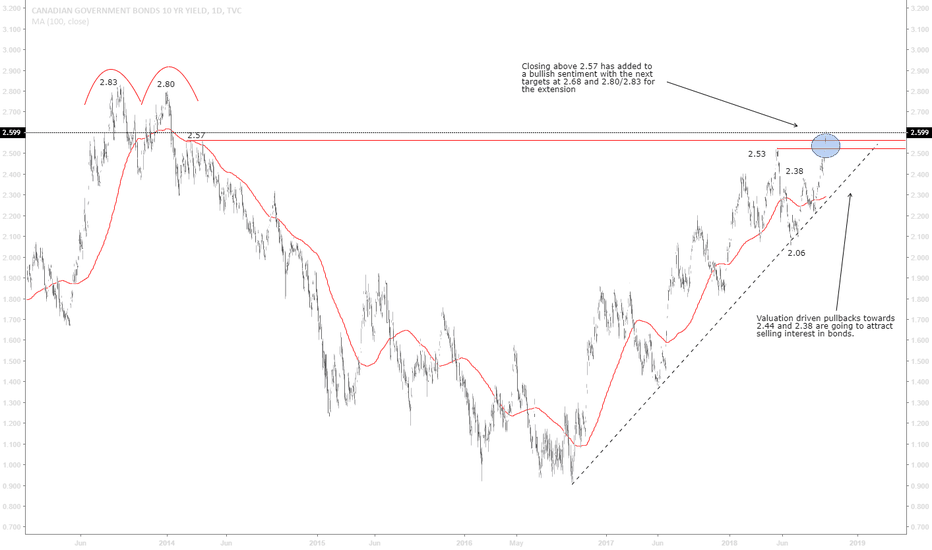

Canadian yields reaching new 4 year highs=> Global yields are on the move as we all know and have been expecting for since the beginning of the year.

=> Here in Canada we can see the same scenario playing out as we break above a 4 year high and unlock 2.80/2.83 for a test.

=> This is a major turning point for the global economy and we are witnessing it live here on tradingview. Highly recommended for all those wanting to dig deeper in these discussions to jump in and join the telegram channel as we are advancing the conversation in real-time.

=> Bookmark this chapter in your economic textbooks as we are in for a very active few quarters ahead.

=> GL those trading in Canadian equities

USDCAD: GapUSDCAD opened the week with a gap. This is an indication of more downside, especially since we saw a good respect of new resistance on the opening of the week. Ideally, we would like to see the gap to be filled before moving lower. I am currently long for first target and will be looking to short at 2nd target.

What are your thought?

USDCAD on bearish mode since June 27thWhat's next on USDCAD? Around 1.2800 is a level to consider, maybe a good support for it, but is it really where the Canadian dollar is trying to stop at all? No, the trendline is calling for the price, so it would be nice to take some profits around 1.26304. In the long term, I'm looking for 1.16500.

Learn how to beat the market as Professional Trader with an ex-insider!

Have a Nice Trading Week!

Cream Live Trading, Best Regards!

U.S. Dollar is going to drop compared to Canadian!The U.S. Dollar is going to drop compared to the Canadian dollar because of the recent election in Canada. Having the Liberal party out of the Parliament means that PC will stop the damage that was a ongoing problem with the Liberal Party. The PC party will be creating jobs and will be pulling the Canadian debt back from where it currently is as the liberals buried us in it. the liberals dropped our Dollar about 23.4% over time and that will flip with the new Party in government. So i hope you either will get out or stay in long and hope i am wrong but this is my analysis after the current Election.

- Jon Matthews

USDCAD Making A MoveThe USDCAD is somewhat neutral overall. By looking at the monthly and weekly timeframe, there seems to be an equal balance between buyers and sellers with the scale slightly favors the sellers at this point. Hence why the bounce on the chart could be limited to 1.31 level. Because we anticipate a bounce on USD Index, USDCAD should also follow suit before heading lower - That's the story for another day, until then...

Happy Trading, folks!

Cheers!

Sell the breakoutWe had a shooting star followed by bearish 3 crows (ranks 7th among bearish reversal patterns) on MONTHLY USDCAD chart. Price already did the pullback into monthly 3 crows pattern and now we should be rolling down...And on daily we just got very fine bearish Counter Atack, Evening Star and double top. Price might pull back half way into the evening star before falling. Look for bearish setups on 4 hours and 1 hour charts.