Illuminating the Path: Decoding Candlestick Patterns in Forex 🕯

Illuminating the Path: Decoding Candlestick Patterns in Forex 🕯️📈

✅Candlestick charting is a fundamental tool for analyzing price movements in forex trading. Each candlestick provides valuable insights into market sentiment and can assist traders in making informed trading decisions. In this comprehensive guide, we will delve into the art of reading candlestick patterns in forex, offering practical examples to enhance your understanding.

1 candle on a daily time frame on Gold composes the price action for 24 hours.

✅ Decoding Candlestick Patterns:

1. Understanding the Basics: Candlesticks are comprised of a body and wicks (or shadows). The body represents the open and close prices, while the wicks show the high and low prices during the time frame. Different candlestick patterns convey varying market dynamics, such as indecision, trend continuation, or trend reversal.

2. Popular Candlestick Patterns: Recognizing patterns such as doji, engulfing, and hammer can aid traders in assessing potential market movements and formulating trading strategies based on these insights.

3. Multiple Candlestick Patterns: Identifying sequences of candlestick patterns, such as a doji followed by a strong bullish candle, can provide significant indications of market sentiment and potential price reversals.

1 candle on a 4H time frame represents the price action for 4 hours.

✅ Examples:

Example 1: Bullish Engulfing Pattern in Forex

A bullish engulfing pattern occurs when a small bearish candle is followed by a larger bullish candle that engulfs its body. This pattern often signals a potential trend reversal, indicating a shift from bearish sentiment to bullish momentum.

Example 2: Doji Reversal Signal in Forex

A doji candle, characterized by its small body with wicks on both sides, signals market indecision. When a doji appears after a strong uptrend, it may suggest a potential reversal, prompting traders to exercise caution or consider implementing reversal trading strategies.

Hourly candle shows the price action for 1 hour.

By mastering the art of reading candlestick patterns, forex traders can gain valuable insights into market dynamics and improve their ability to anticipate potential price movements. Illuminating the path with candlestick charting can empower traders with a deeper understanding of market sentiment, facilitating more refined trading decisions. Happy candlestick decoding! 📊💡

Candlestick analysis

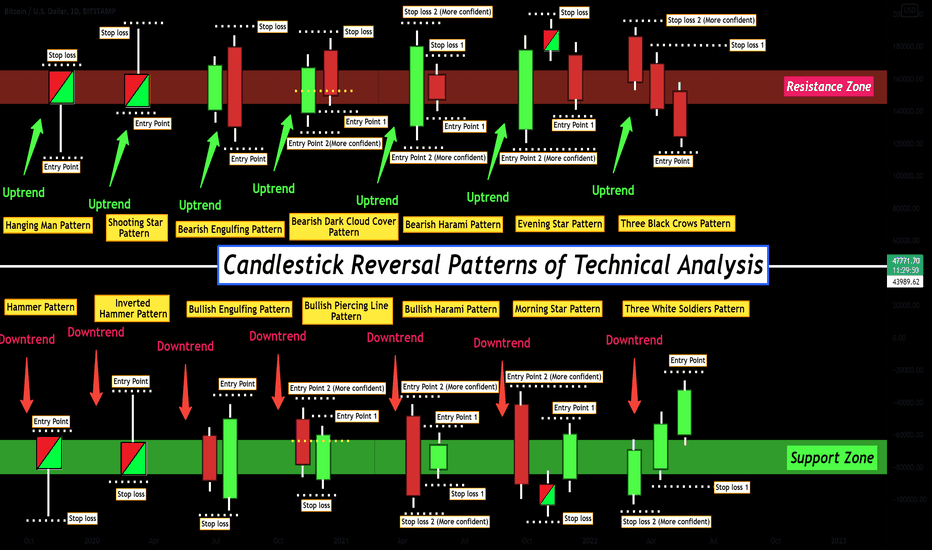

Candlestick Reversal Patterns of Technical Analysis !!!👨🏫 In this post, I tried to show you the most important Candlestick Reversal Patterns of Technical Analysis with Entry points & Stop loss points . you can use these patterns for Triggers of your traders at any timeframe ⏰ (These patterns are more valid at higher timeframes).

Please do not forget the ✅ 'like' ✅ button 🙏😊 & Share it with your friends, Thanks, and Trade safe.

What Is A Candlestick ❗️❓

A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a security for a specific period. It originated from Japanese rice merchants and traders to track market prices and

daily momentum for hundreds of years before becoming popularized in the United States. The wide part of the candlestick is called the "real body" and tells investors whether the closing price was higher or lower than the opening price

(black/red if the stock closed lower, white/green if the stock closed higher).

Bullish Pattern 🌅:

🟢 Hammer Pattern : A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. This pattern forms a hammer-shaped candlestick, in which the lower shadow is at least twice the size of the real body. The body of the candlestick represents the difference between the open and closing prices, while the shadow shows the high and low prices for the period.

🟢 Inverted Hammer Pattern : The inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is pressure from buyers to push an asset’s price up. It often appears at the bottom of a downtrend, signaling a potential bullish reversal. The inverted hammer pattern gets its name from its shape – it looks like an upside-down hammer. To identify an inverted hammer candle, look out for a long upper wick, a short lower wick, and a small body.

🟢 Bullish Engulfing Pattern : A bullish engulfing pattern is a white candlestick that closes higher than the previous day's opening after opening lower than the previous day's close. It can be identified when a small black candlestick, showing a bearish trend, is followed the next day by a large white candlestick, showing a bullish trend, the body of which completely overlaps or engulfs the body of the previous day’s candlestick. A bullish engulfing pattern may be contrasted with a bearish engulfing pattern.

🟢 Bullish Piercing Line Pattern : A piercing pattern is a two-day, candlestick price pattern that marks a potential short-term reversal from a downward trend to an upward trend. The pattern includes the first day opening near the high and closing near the low with an average or larger-sized trading range. It also includes a gap down after the first day where the second day begins trading, opening near the low and closing near the high. The close should also be a candlestick that covers at least half of the upward length of the previous day's red candlestick body.

🟢 Bullish Harami Pattern : The Bullish Harami candle pattern is a reversal pattern appearing at the bottom of a downtrend. It consists of a bearish candle with a large body, followed by a bullish candle with a small body enclosed within the body of the prior candle. As a sign of changing momentum, the small bullish candle ‘gaps’ up to open near the mid-range of the previous candle. The opposite of the Bullish Harami is the Bearish Harami and is found at the top of an uptrend.

🟢 Morning Star Pattern : A morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. A morning star forms following a downward trend and it indicates the start of an upward climb. It is a sign of a reversal in the previous price trend. Traders watch for the formation of a morning star and then seek confirmation that a reversal is indeed occurring using additional indicators.

🟢 Three White Soldiers Pattern : Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of the current downtrend in a pricing chart. The pattern consists of three consecutive long-bodied candlesticks that open within the previous candle's real body and a close that exceeds the previous candle's high. These candlesticks should not have very long shadows and ideally open within the real body of the preceding candle in the pattern.

Bearish Patterns 🌄:

🔴 Hanging Man Pattern : The hanging man is a type of candlestick pattern. Candlesticks display the high, low, opening, and closing prices for a security for a specific time frame. Candlesticks reflect the impact of investors' emotions on security prices and are used by some technical traders to determine when to enter and exit trades. The term "hanging man" refers to the candle's shape and what the appearance of this pattern infers. The hanging man represents a potential reversal in an uptrend. While selling an asset solely based on a hanging man pattern is a risky proposition, many believe it's a key piece of evidence that market sentiment is beginning to turn. The strength in the uptrend is no longer there.

🔴 Shooting Star Pattern : A shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. It appears after an uptrend. Said differently, a shooting star is a type of candlestick that forms when a security opens, advances significantly, but then closes the day near the open again. For a candlestick to be considered a shooting star, the formation must appear during a price advance. Also, the distance between the highest price of the day and the opening price must be more than twice as large as the shooting star's body. There should be little to no shadow below the real body.

🔴 Bearish Engulfing Pattern : A bearish engulfing pattern is a technical chart pattern that signals lower prices to come. The pattern consists of an up (white or green) candlestick followed by a large down (black or red) candlestick that eclipses or "engulfs" the smaller up candle. The pattern can be important because it shows sellers have overtaken the buyers and are pushing the price more aggressively down (down candle) than the buyers were able to push it up (up candle).

🔴 Bearish Dark Cloud Cover Pattern : Dark Cloud Cover is a bearish reversal candlestick pattern where a down candle (typically black or red) opens above the close of the prior up candle (typically white or green), and then closes below the midpoint of the up candle. The pattern is significant as it shows a shift in the momentum from the upside to the downside. The pattern is created by an up candle followed by a down candle. Traders look for the price to continue lower on the next (third) candle. This is called confirmation.

🔴 Bearish Harami Pattern : A bearish harami is a two-bar Japanese candlestick pattern that suggests prices may soon reverse to the downside. The pattern consists of a long white candle followed by a small black candle. The opening and closing prices of the second candle must be contained within the body of the first candle. An uptrend precedes the formation of a bearish harami.

🔴 Evening Star Pattern : An evening star is a stock-price chart pattern used by technical analysts to detect when a trend is about to reverse. It is a bearish candlestick pattern consisting of three candles: a large white candlestick, a small-bodied candle, and a red candle. Evening star patterns are associated with the top of a price uptrend, signifying that the uptrend is nearing its end. The opposite of the evening star is the morning star pattern, which is viewed as a bullish indicator.

🔴 Three Black Crows Pattern : Three black crows is a phrase used to describe a bearish candlestick pattern that may predict the reversal of an uptrend. Candlestick charts show the day's opening, high, low, and closing prices for a particular security. For stocks moving higher, the candlestick is white or green. When moving lower, they are black or red. The black crow pattern consists of three consecutive long-bodied candlesticks that have opened within the real body of the previous candle and closed lower than the previous candle. Often, traders use this indicator in conjunction with other technical indicators or chart patterns as confirmation of a reversal.

USDJPY - Sell Zone for aggressive traderIf you are looking for a shorting opportunity in USDJPY, you may be in luck. You can wait for the market to head into the consolidation zone to short which could be as early as the red dotted line. I would wait for a candlestick confirmation before engaging the trade.

Breaking down APPL once again to the T!! Last years NASDAQ:AAPL analysis on my Tradingview was perfected to the T in detail. I'm glad to know that a lot of my followers took profit following my entries & exits.:) Go check it out on my page if you still haven't!

After hundreds of request since last year. I have decided to go ahead and make another breakdown for 2022.

**Disclaimer**

Before entering a trade three types of analysis should be performed.

Fundamental Analysis = The study of financial statements and economic news. (Overall Trend)

Technical Analysis = The study of chart history. (Entry & Exit Strategies)

Sentimental Analysis = The study of the markets current psychology and traders psychology.(Instinct)

After performing the three analysis below are my results:

NASDAQ:AAPL

Fundamental Analysis = LONG (BUY)

Technical Analysis = SHORT-TERM SELLING (Pull back into our LONG positions)

Sentimental Analysis = Market is taking a breather due to USD valuation increasing.

To better explain:

This means that right now momentum is headed downwards technically but the overall trend is up fundamentally.

So since we know the overall trend is upwards but we are currently headed downwards it creates the perfect timing to use our Fibonacci Retracement tool. A tool that is used to find important entry and exit levels in a trending market. Which is traditionally applied to the low & high of a trend. Here were my results:

As you can see in the chart above we have already retraced lightly down to the 23.6% fib level. Markets are showing a bit of a slowdown in momentum as US dollar decides it's next move. If momentum continues downward we can eventually see an amazing bargain price at the following fib levels below.

MY SUGGESTION:

Place LONG orders totaling anywhere from 0.5-5% of your total trading capital on each retracement level below:

(SPREAD THOSE POSITIONS!!)

23.6% = $172.50 (BUY) *Currently prices are around here*

38.2% = $166.00 (BUY)

50.0% = $155.50 (Great trade opportunity) (BUY)

61.8% = $119.15 (What i consider the PERFECT IDEAL TRADE) (BUY)

78.6% = $148.00 (ABSOLUTE BARGAIN!!) (BUY)

Take profit 1: $177.00 Secure about 10-25% of profits in this zone

Take profit 2: $182.94 at the previous ATH . (All Time High) Be patient and trust the process. Take some more or all profits at this level as well. This monster of a tech stock will most definitely return to break more records in the upcoming months when the continuation wave arrives. If not just stand back, take notes and analyze price action.

Take profit 3: $193 This would be the first take profit from the Fib Extension.

If you guys enjoyed this break down please drop a LIKE/COMMENT & make sure to go hit that FOLLOW button. Cya' Soon!

USDCAD Trade #46Personally, I am not in this trade. USDCAD looks like it is in a monthly range which is probably the best way to learn how to trade. If weekly/monthly trendline breaks and demand dries up it's safe to say bears may take prices down to 1.06 or lower (from a technical point of view). Look for the negative correlation between oil and the Canadian dollar. I would plot on the daily/weekly. Very rarely I look at the monthly but so far everything looks clean (Daily<-Weekly<-Monthly) in that order. If you take the Fibonacci tool and go from prices 1.44 to 0.93 looks like the 0.50% is confluent with weekly demand.

CADJPY - Bullish Deep GartleyIf you have followed me, you would have known that I've shorted CADJPY on the Range Bar Chart as a Bearish Bat Pattern path the way.

What I did is to engage, took my conservative target, shift stops to entry and stretch my final target to the Bullish Deep Gartley Pattern.

Before you start thinking out of the box, your fundamental has to be right.

USDJPY-Weekly Market Analysis-Feb22,Wk2USDJPY is at its consolidation phase. The overall setup tends to have a Bullish setup. On the 4-hourly chart, you can wait for a Bullish Gartley complete at 114.00.

If you are an intra-day trader, you can consider engaging the Bullish Flag trading opportunity within the 8 Range Bar chart.

Reversal candlestick patterns in crypto you only needHello, everyone!

While Bitcoin is playing out our long signal it’s time for educational content. Today I wanna show you the candlestick formations which predict the reversals in crypto. I know that in the books we can find more formations with different names, but in practice only these patterns does matter in reversals. All these formations play out with the best performance on the 4h+ timeframes.

Bullish Formations

1. This is the strongest bullish formation. When we observe the downtrend and the bullish hammer candle with the increased volume appears at the end, it is almost 100% sign of reversal, the huge bounce or the new uptrend is anticipated when you see this pattern.

2. This formation does not mean that the downtrend is finished, but the big bounce can be anticipated.

3. This formation is the weakest. If it appeared we can wait just for the local bounce.

Bearish Formations

4. The strongest bearish formation which appears at the uptrend end with the increased volume at the bearish hammer candle.

5. The big correction can be anticipated if you see this formation but not the new downtrend.

6. Local correction can play out in case of this bearish formation.

Please, remember that the candlestick formation without conformation can’t be the long or short signal. Exception are 1 and 4 formations. For other patterns we have to see the divergence to confirm the trend reverse.

DISCLAMER: Information is provided only for educational purposes. Do your own study before taking any actions or decisions at the real market.

GBP/USD - Potential SellPrice is currently in a downtrend on multiple timeframes and has started retracing from the last low it made. It has left a big imbalance in price and this could be a decent area to look for an entry. Ideally an entry slightly above the imbalance from the 4h OB. The entry area also aligns almost perfectly with the 0.88 fib level, which is an additional confluence. Will be looking for price to drop to the area of liquidity below and potentially to the -61.8 level of the fib as a take profit.

There is a new release happen on the following day of this trade idea about 'Job openings' which could potentially impact the USD heavily. If the news release is a positive one, we can hopefully expect the Dollar to go up in value, causing GBP/USD to make its way down and create a new LL.

GBPAUD - Bullish Deep Gartley Some traders may read this as a type 2 Bullish Bat Pattern but are certainly not for me. If you are having that conclusion by reading the candlestick pattern, you aren't wrong, but once again not for me.

I would prefer to engage the trade based on the latest Harmonic Patterns formed in the chart, which is the Bullish Deep Gartley Pattern. The Deep Gartley Pattern form near the Buy Zone within the 4-hourly chart.

Have a closer look at this on Monday if not latest by Wednesday, it should form up if it is meant to.

USDJPY-Weekly Market Analysis-Jan22,Wk4A Type 2 Bullish Shark Pattern has formed in the USDJPY 4hourly chart. A type2 Harmonic Patterns mean that the market has fulfilled at least Target1 of the entire setup. At times we can have a weaker(slower) move towards the upside.

On the 1-hourly chart, you could plot a trendline and set an alert to wait for a break and close above the trendline as an additional filter for your long entry.

GBPUSD-Weekly Market Analysis-Jan22,Wk4We are already in this trade. The 1-hourly chart Bullish Shark Pattern, check the link within the TradingView for more insights on this trade. But if I were you, I will wait for a break and close above of the blue trendline that was highlighted in the chart, that will give further assurance on the trade, but you will have to trade it off with the better entry price you are getting at this moment and the RSI has a RSI Divergence at this moment, but I were you, I will be waiting and that is because there is a Bullish Butterfly Pattern that complete at a lower price at its 4-hourly chart.

To be honest, even within the Butterfly Pattern in the 4-hourly chart. It is definitely a good idea to have one more filter checked off.

What would it be like for you?

1. Engage Now

2. Wait for candle break and close above the trendline

3. Wait for Bullish Butterfly on the 4-hourly chart.

Comment down below.

EURUSD-Weekly Market Analysis-Jan22,Wk4If you remember what we spoke about last week you would have seen how the market fell and was held by the trendline which is part of the Ascending Triangle.

You would also notice how the candle respects the trendline, bounce off of it and refused to break and close below the trendline.

If you had shorted when the market break and close below the support you would earn approximately 97pips, that is 970USD per lot traded and if you would have long from the trendline, at this moment you would have earned approximately 42pip which is 420USD per lot traded.(check out the link within the TradingView post)

What has passed, has passed. This week I'm waiting for a Bearish Shark shorting opportunity or a retest of the trendline, perhaps a formation of Bullish Gartley or a Bullish Bat Pattern setup for a buying opportunity in this trend trading setup.