Inside a Candle: How to Read Hidden Order Flow Without a DOM

Difficulty: 🐳🐳🐳🐋🐋 (Intermediate+)

This article is for traders who want to understand the “story” behind a candle’s shape — and learn to spot aggressive buying/selling, absorption, and traps without needing footprint or order book tools.

🔵 INTRODUCTION

Most traders see candles as static shapes — green or red, big or small. But each candle is a battlefield of orders . Even without access to a DOM or volume footprint, you can still extract valuable information from just the candle's body, wick, and context .

🔵 ORIGINS: WHERE CANDLESTICKS COME FROM

Candlestick charts trace back to 18th-century Japan, where rice traders needed a way to visualize price movements over time. A legendary trader named Munehisa Homma , who traded rice futures in Osaka, is credited with developing the earliest form of candlestick analysis.

Homma discovered that price wasn’t just driven by supply and demand — but also by trader psychology . He created visual representations of market sentiment by tracking:

The opening and closing price of rice

The highest and lowest price reached during the session

This system became known as the “Sakata rules,” and it laid the foundation for many patterns still used today — such as Doji, Engulfing, and Marubozu.

Western traders only began using candlesticks widely in the 1990s, when analyst Steve Nison introduced them to the broader financial world through his book Japanese Candlestick Charting Techniques.

Today, candlesticks remain one of the most powerful and intuitive ways to visualize order flow, momentum, and market psychology — even without a Depth of Market (DOM) or depth of book.

In this article, you’ll learn how to read hidden order flow by analyzing:

Wick length and positioning

Body-to-range ratios

Candle clustering and sequences

🔵 HOW A CANDLE FORMS

Before you can read a candle, you need to understand how it comes to life . A single candle represents the full auction process during its time window.

Here’s how it builds, step by step:

Candle opens — this is the open price .

As price moves up during the session → the high] updates.

As price moves down → the low] updates.

The final traded price when the time closes → this becomes the close price .

The wick = price areas that were tested but rejected

The body = where the majority of aggressive trades occurred

If buyers push price up quickly but sellers slam it down before the close — the candle will have a long upper wick and close near the open, revealing seller absorption.

Understanding this flow helps you recognize traps, fakeouts, and reversals in real time.

🔵 CANDLE BODY: WHO'S IN CONTROL

The body of the candle reflects the result of the battle between buyers and sellers. A wide body with minimal wicks means dominance and commitment.

Big body, small wick → clear conviction

In an uptrend: buyer aggression

In a downtrend: panic or aggressive selling

Small body, long wicks → indecision, absorption, or trap

Often appears near tops/bottoms

Indicates both sides were active but neither won clearly

www.tradingview.com

🔵 WICKS: THE SHADOWS OF REJECTION

Wicks are not just “leftovers” — they show where price was rejected after being tested.

Long upper wick = seller presence or absorption at highs

Long lower wick = buyer defense or trap spring

Double wick = liquidity sweep / false breakout

Use wick direction to spot:

Failed breakouts

Smart money traps

Exhaustion candles

🔵 HIDDEN ORDER FLOW PATTERNS

1️⃣ Absorption Candle

A large wick with little movement afterward — shows that big orders absorbed market pressure.

2️⃣ Trap Candle

A candle that sweeps above/below a key high/low and closes opposite — classic smart money fakeout.

3️⃣ Imbalance Candle

Large-bodied candle that closes near the high/low with no wick on the other end — implies one-sided aggression (and often leaves an imbalance).

🔵 CLUSTERING & SEQUENCES MATTER

Never read a candle alone. The sequence of candles tells the full story:

3+ rejection wicks near resistance? Liquidity building before breakout or trap

Bearish engulfing after long upper wick = smart money selling into retail buying

Tight-range dojis + volume spike = compression before expansion

Context + volume + structure = hidden flow decoded.

🔵 PUTTING IT TOGETHER: A REAL EXAMPLE

Price breaks above previous high

Candle closes with long upper wick and smaller body

Next candle opens, dumps fast, leaving imbalance behind

Buyers trapped — move likely to continue down

This is how you read order flow from candle anatomy .

🔵 TIPS FOR MASTERY

Use a lower timeframe (1M–5M) to see microstructure

Watch how wicks behave near S/R or OBs

Confirm with volume spikes or delta-style indicators

Use replay mode to slow down the story and study cause/effect

🔵 CONCLUSION

Every candle is a message. You don’t need expensive tools to read order flow — just your eyes, context, and curiosity.

Learn to see candles not as symbols, but as evidence of behavior . Absorption, imbalance, and traps are all visible if you look closely.

Candlestickpattern

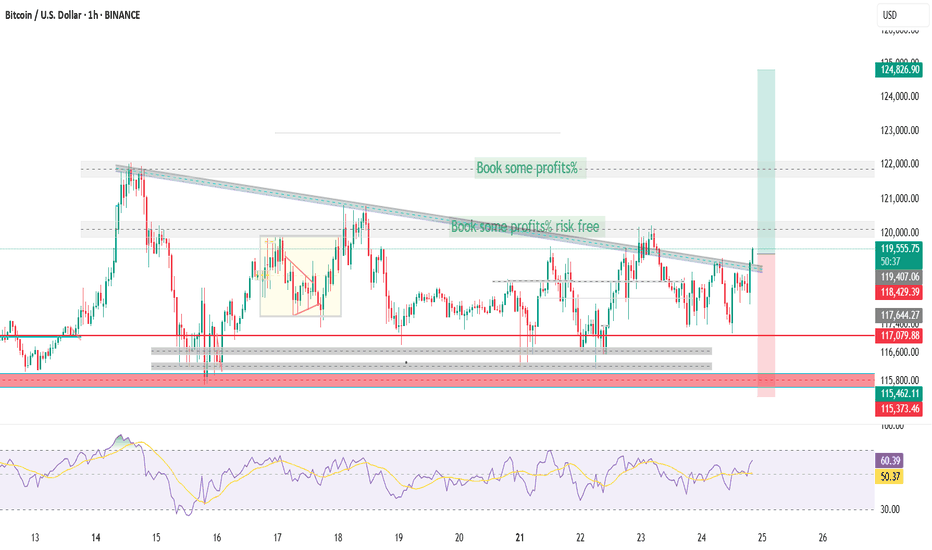

+330% this morning $1.25 to $5.38 on massive 270 million volume🚀 +330% this morning 💥 $1.25 to $5.38 on massive 270 million shares traded volume so far

NASDAQ:SNGX money maker of the day!

2 Buy Alerts sent out, also posted it in my premarket watchlist while it was still up only +30%!

Forget about NASDAQ:MSFT NASDAQ:META NASDAQ:AMZN NASDAQ:NVDA NASDAQ:AAPL AMEX:SPY NASDAQ:QQQ they will never be able to create such gains in a single day or should I say minutes

This isn't options trading either, it's a stock that went up that much this morning

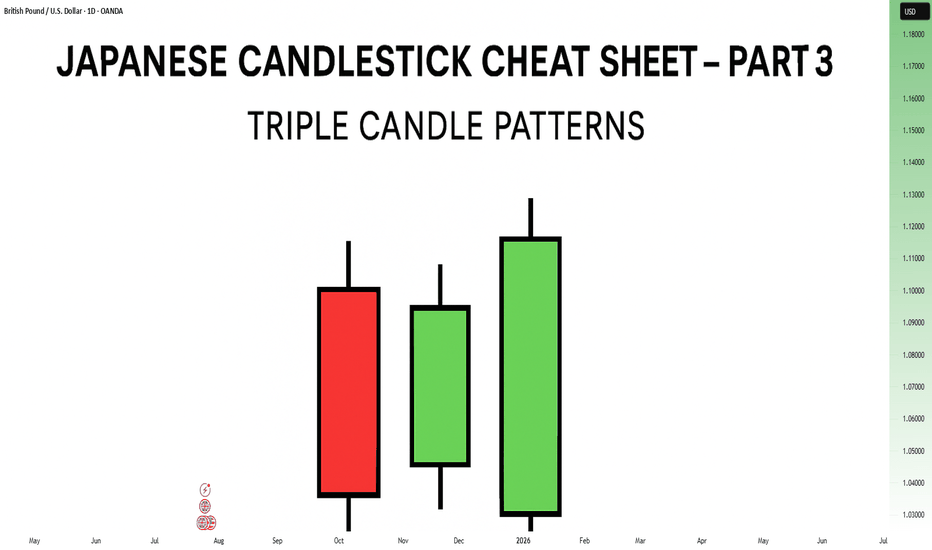

Japanese Candlestick Cheat Sheet – Part Three- 3 candle patternsSo far in this series, we've broken down single candle formations ( Part 1 ) and explored double candle signals ( Part 2 ) — the kind of patterns that give you quick, often powerful hints about the market’s mood.

But now it’s time to go a step further.

👉 In Part 3, we dive into triple candlestick formations — patterns that take more time to form, but often offer stronger confirmation and a more reliable narrative.

They’re like reading three full sentences from the market instead of just one or two words.

If you’re ready to spot momentum shifts (not noise), this lesson is for you.

Let’s decode the story behind formations like Morning Star, Three White Soldiers, and so on.

MORNING STAR

Bias: Bullish

What is the Morning Star pattern?

The Morning Star pattern consists of a bearish candle, a small-bodied middle candle, and a bullish candle, forming at the end of a downtrend to signal potential reversal. This pattern reflects a shift from seller dominance to buyer strength, as the middle candle marks a pause before a reversal. The Morning Star is a reliable signal that buyer interest is reemerging.

Understanding Morning Stars helps traders anticipate shifts in momentum, providing valuable entry points for new uptrends.

Meaning:

Found in downtrends; signals potential bullish reversal as buyers gain control, with strength confirmed by the third candle closing above the first.

BULLISH ABANDONED BABY

Bias: Bullish

What is the Bullish Abandoned Baby pattern?

The Bullish Abandoned Baby is a rare but powerful reversal pattern that consists of a bearish candle, a gapped doji, and a bullish candle. The middle doji reflects indecision, while the third bullish candle confirms the reversal. This pattern highlights a dramatic shift in sentiment, showing that buyers are prepared to take control.

Recognizing the Bullish Abandoned Baby can offer traders insights into pivotal market shifts.

Meaning:

Appears in downtrends; suggests a strong bullish reversal, as the middle doji shows indecision, with confirmation by a strong bullish move.

THREE WHITE SOLDIERS

What is the Three White Soldiers pattern?

The Three White Soldiers pattern consists of three consecutive bullish candles, each closing higher than the last, often appearing in downtrends to signal a potential bullish reversal. This pattern reflects sustained buying pressure, indicating that buyer sentiment is strong. Psychologically, it shows that buyers are steadily gaining confidence, pushing prices upward.

For traders, Three White Soldiers provide a clear signal of momentum, ideal for capturing emerging trends.

Meaning:

Found in downtrends; signals potential trend reversal, showing sustained buying strength, often signaling the start of a bullish trend.

MORNING DOJI STAR

What is the Morning Doji Star pattern?

The Morning Doji Star pattern is similar to the Morning Star, but with a doji as the middle candle, indicating greater indecision before a reversal. This pattern consists of a bearish candle, a doji, and a bullish candle, highlighting a transition from bearish to bullish sentiment. The doji reflects a moment when market sentiment is balanced, but the third candle confirms a bullish shift.

Interpreting Morning Doji Stars can help traders identify turning points in downtrends, providing valuable entry opportunities.

Meaning:

Appears in downtrends; signals potential bullish reversal, with indecision from the doji and confirmation by a strong bullish candle.

EVENING STAR

What is the Evening Star pattern?

The Evening Star is a three-candle pattern that appears at the top of an uptrend, signaling a potential bearish reversal. It consists of a bullish candle, a small-bodied middle candle, and a bearish candle, showing a transition from buyer control to seller strength. This pattern often appears at market peaks, where optimism is giving way to caution.

Understanding the Evening Star pattern helps traders anticipate downtrend formations, allowing them to time their exits.

Meaning:

Found in uptrends; signals potential bearish reversal as sellers gain control, confirmed if the third candle closes below the first.

BEARISH ABANDONED BABY

What is the Bearish Abandoned Baby pattern?

The Bearish Abandoned Baby is the bearish counterpart to the Bullish Abandoned Baby and consists of a bullish candle, a gapped doji, and a bearish candle. This pattern reveals a dramatic shift in sentiment from bullish to bearish, highlighting a sudden reversal at the top of an uptrend.

Recognizing the Bearish Abandoned Baby can offer traders insight into market tops and impending trend changes.

Meaning:

Appears in uptrends; indicates strong bearish reversal, as indecision in the doji is followed by selling strength.

THREE BLACK CROWS

What is the Three Black Crows pattern?

The Three Black Crows pattern consists of three consecutive bearish candles, each closing lower than the last, appearing in uptrends to signal potential reversal. This pattern reflects sustained selling pressure, indicating that sellers are gaining control. The Three Black Crows highlight a moment when buyer confidence wanes, marking the beginning of downward momentum.

For traders, this pattern provides a clear signal to avoid buying into weakening trends or even entering short trades.

Meaning:

Found in uptrends; signals potential bearish reversal, with sustained selling pressure often marking the start of a downtrend.

EVENING DOJI STAR

What is the Evening Doji Star pattern?

The Evening Doji Star is similar to the Evening Star, but with a doji as the middle candle, highlighting greater indecision. This pattern consists of a bullish candle, a doji, and a bearish candle, indicating a shift from bullish to bearish sentiment. The doji suggests that buyers are losing control, with sellers prepared to reverse the trend.

Understanding Evening Doji Stars allows traders to recognize market tops, helping them avoid overextended trends.

Meaning:

Appears in uptrends; signals potential bearish reversal, as the doji suggests indecision, confirmed by strong selling on the third candle.

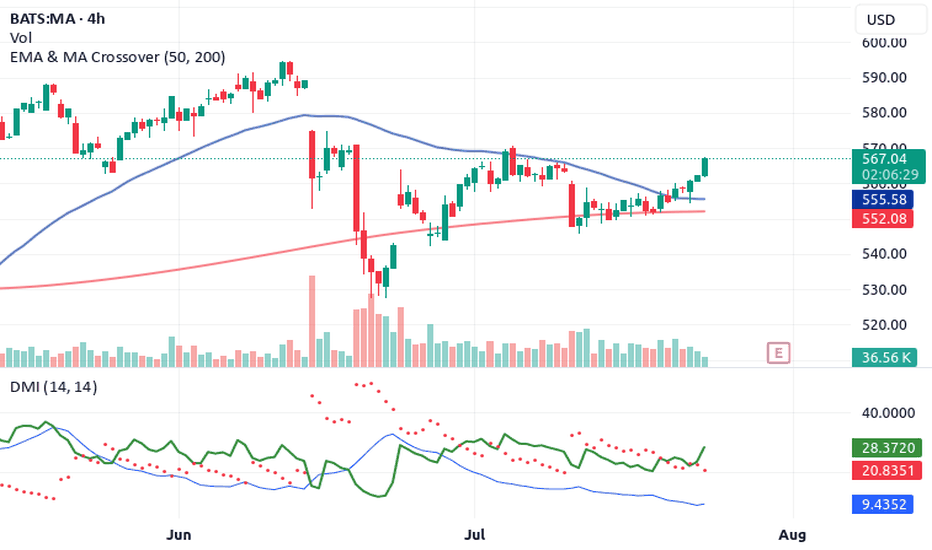

Top 4 Buy Signals Lighting Up Mastercard (MA) 🚀 Top 4 Buy Signals Lighting Up Mastercard (MA) | Rocket Booster Strategy

Mastercard Inc. (MA) is showing explosive potential, and it’s not just one signal—it’s a whole confluence of confirmations. When

you align this much market momentum, you don’t ignore it. Let’s break down how Rocket Booster Strategy gives us a powerful buy indication on the daily chart.

🔍 The Confluence Setup

✅ 1. DMI Buy Signal

The Directional Movement Index (DMI) is in bull mode. ADX is

rising and the +DI is firmly above -DI. This shows the trend is not just alive—it’s gaining strength.

🔻 2. Volume Oscillator Pullback

While Volume Oscillator is down, this is seen as constructive and not bearish. It suggests a quiet zone before the thrust—just like fuel loading before a rocket launch.

Smart traders know: momentum can build silently.

💥 3. Awesome Oscillator = Strong Buy

The Awesome Oscillator is green and firing hard. We’ve seen a clear twin-peak bullish formation followed by a break above zero

—classic acceleration sign.

🕯️ 4. Rising Window (Japanese Candlestick Pattern)

A Rising Window—a bullish continuation gap—has formed. This is one of Steve Nison’s top continuation patterns. It signals strong

institutional conviction in this trend.

📈 What Does This Mean?

When DMI, AO, candlestick patterns, and our own Rocket Booster Strategy all point up, it’s time to pay attention. This setup is rare—and high-probability.

🧠 Rocket Booster Strategy Recap

This strategy uses 3 momentum alignment points:

High Momentum Indicator (like AO) in Buy Mode

Pattern Confirmation (Rising Window or Engulfing)

Volume Correction Before Breakout (Fuel Before Fire)

When all 3 click into place, we have ignition.

🎯 Final Thoughts

Mastercard is looking primed for takeoff on the daily timeframe. Whether you’re an investor or a swing trader, this chart is

speaking loud and clear. But as always, risk management is your co-pilot.

✅ Add it to your watchlist.

🚀 Simulate entries.

🧠 Trust the confluence.

Rocket Boost This Content To Learn More

Disclaimer: This is not financial advice. Always use a simulation/demo account before committing real capital. Trade responsibly.

Japanese Candlestick Cheat Sheet – Part Two- 2 candle patternsTwo-Candle Patterns That Signal Shifts in Sentiment

Single candles whisper…

But two candles talk to each other — and when they do, they often reveal the first signs of a reversal or continuation.

In this second part of the series, we go deeper.

From engulfings to haramis, tweezer tops to piercing lines — these patterns don’t just look good on charts… they capture the psychological tug-of-war between buyers and sellers.

Price doesn’t lie.

And two candles in a row can say: “Something just changed.”

Learn to spot them early. Learn to listen when the chart speaks.

This is Part Two of your practical guide to mastering candlestick formations.

BULLISH KICKER

Bias: Bullish

What is the Bullish Kicker pattern?

The Bullish Kicker forms when a strong bullish candle follows a bearish one with no overlap between the two, indicating a sudden shift in sentiment. This pattern is a powerful indicator of a reversal as buyers take control. The sharp contrast between the bearish and bullish candles reflects a dramatic shift in market psychology, where bears are caught off-guard and forced to cover their positions.

Bullish Kickers are rare but extremely telling, providing a clear signal that sentiment is favoring buyers. Recognizing such decisive patterns can be a game-changer.

Meaning:

Found after downtrends or sell-offs; suggests a sudden shift in sentiment, indicating strong buying interest and potential trend reversal.

BULLISH ENGULFING

Bias: Bullish

What is the Bullish Engulfing pattern?

The Bullish Engulfing pattern occurs when a large bullish candle fully engulfs the previous smaller bearish candle, signaling a potential trend reversal. This pattern highlights a moment when buyers overpower sellers, often marking the beginning of upward momentum. Psychologically, it suggests that buyer confidence is returning, and sellers are losing their grip.

For traders, understanding Bullish Engulfing patterns can provide crucial entry points into emerging trends. Learning to identify and trade such patterns is essential for capturing momentum and new trends.

Meaning:

Typically found in downtrends, this pattern signals a potential bullish reversal as buyers overpower sellers, often indicating a shift toward upward momentum.

BULLISH HARAMI

Bias: Bullish

What is the Bullish Harami pattern?

The Bullish Harami consists of a small bullish candle within a preceding larger bearish one, indicating a pause in downward momentum and hinting at a potential reversal. This pattern shows that sellers are beginning to weaken as buyers cautiously test the waters. The Harami reflects a shift in sentiment from bearish to neutral, often marking a transitional phase in the market.

Interpreting the Bullish Harami helps traders spot moments when sentiment is shifting, potentially signaling the start of a trend change.

Meaning:

Seen in downtrends, it suggests indecision, with possible bullish reversal if the following candles confirm buying strength, indicating a weakening bearish trend.

PIERCING LINE

Bias: Bullish

What is the Piercing Line pattern?

The Piercing Line forms when a bullish candle opens below the previous bearish candle’s low but closes over halfway into it. Found in downtrends, this pattern reflects strong buying pressure as buyers step in at lower prices, creating a potential bullish reversal. The Piercing Line pattern suggests that sentiment may be shifting as buyers gain confidence.

This pattern’s strength lies in its psychological impact, revealing moments when buyers are willing to take risks. Recognizing these signs early can provide valuable insights for traders looking to time entries.

Meaning :

Found in downtrends, this pattern suggests a possible bullish reversal if buying continues, as sellers lose control to buyers.

TWEEZER BOTTOM

Bias: Bullish

What is the Tweezer Bottom pattern?

The Tweezer Bottom pattern is characterized by two consecutive candles with nearly identical lows, one bearish and one bullish. This pattern often signals the end of a downtrend, as the matching lows suggest a strong support level where buyers are stepping in. The Tweezer Bottom highlights market psychology at work, with sellers unable to push prices lower, reflecting renewed buying interest.

Tweezer Bottoms are ideal for traders looking to identify support zones and potential reversal points. By understanding this pattern’s significance, traders can make informed decisions.

Meaning:

Found in downtrends, it signals potential reversal, showing strong support at the matching low, suggesting buyers are stepping in.

BEARISH KICKER

Bias: Bearish

What is the Bearish Kicker pattern?

The Bearish Kicker is the inverse of the Bullish Kicker, forming when a strong bearish candle follows a bullish one without overlap, indicating a sharp sentiment shift. This pattern often marks a sudden reversal, with sellers taking control after an initial bullish period. Psychologically, Bearish Kickers are powerful, signaling that buyers are caught off-guard and losing momentum.

Recognizing Bearish Kickers provides traders with insights into sudden shifts in market dynamics, helping them avoid buying into weakening trends.

Meaning:

Found after uptrends; indicates a sudden sentiment shift, signaling potential trend reversal and intensified selling pressure.

BEARISH ENGULFING

Bias: Bearish

What is the Bearish Engulfing pattern?

The Bearish Engulfing pattern forms when a large bearish candle engulfs the previous smaller bullish candle, suggesting a potential reversal in an uptrend. This pattern signals that sellers have regained control, often marking the start of downward momentum. The Bearish Engulfing reveals a psychological shift, as selling pressure overtakes buying interest.

This pattern is a powerful tool for traders who aim to catch trend reversals, allowing them to align with emerging downward momentum.

Meaning:

Typically found in uptrends, this pattern signals a potential bearish reversal as sellers overpower buyers, often indicating a downward momentum shift.

BEARISH HARAMI

Bias: Bearish

What is the Bearish Harami pattern?

The Bearish Harami consists of a small bearish candle contained within a larger preceding bullish one, reflecting indecision and a potential trend reversal. Found in uptrends, it hints that buyers are losing strength, while sellers are cautiously testing the market. This pattern highlights moments when buyer momentum begins to wane, suggesting caution.

Interpreting the Bearish Harami allows traders to spot potential shifts in sentiment, helping them manage risk and time their exits.

Meaning:

Seen in uptrends, it suggests indecision with a potential bearish reversal if following candles confirm, indicating a weakening bullish trend.

DARK CLOUD COVER

Bias: Bearish

What is the Dark Cloud Cover pattern?

The Dark Cloud Cover appears when a bearish candle opens above the previous bullish candle but closes over halfway into it, reflecting a shift in control from buyers to sellers. This pattern suggests that bullish momentum may be fading, hinting at a potential reversal. Dark Cloud Cover patterns reveal moments when sentiment shifts from optimism to caution.

For traders, understanding this pattern helps them anticipate reversals at the top of uptrends.

Meaning:

Found in uptrends; signals potential bearish reversal if selling continues, as buyers lose control to sellers.

TWEEZER TOP

Bias: Bearish

W hat is the Tweezer Top pattern?

The Tweezer Top is formed by two candles with matching or nearly matching highs, typically one bullish and one bearish. This pattern signals potential resistance, as sellers are consistently pushing back against the same level. The Tweezer Top reflects a moment of seller strength, often marking the end of an uptrend.

Recognizing Tweezer Tops helps traders spot resistance zones and potential reversal points, allowing them to avoid buying into weakening trends or even shorting the asset.

Meaning:

Found in uptrends, it signals potential reversal, showing strong resistance at the matching high, suggesting selling pressure.

🧭 Final Thought

Two-candle formations often appear at key turning points — right where most traders hesitate or get trapped.

Learn to read them not just as patterns, but as conversations between candles — one pushing, the other reacting.

And if this is your first time reading the series, don’t miss Part One – where we covered single-candle signals like dojis, hammers, and marubozus — the very foundations of candlestick reading.

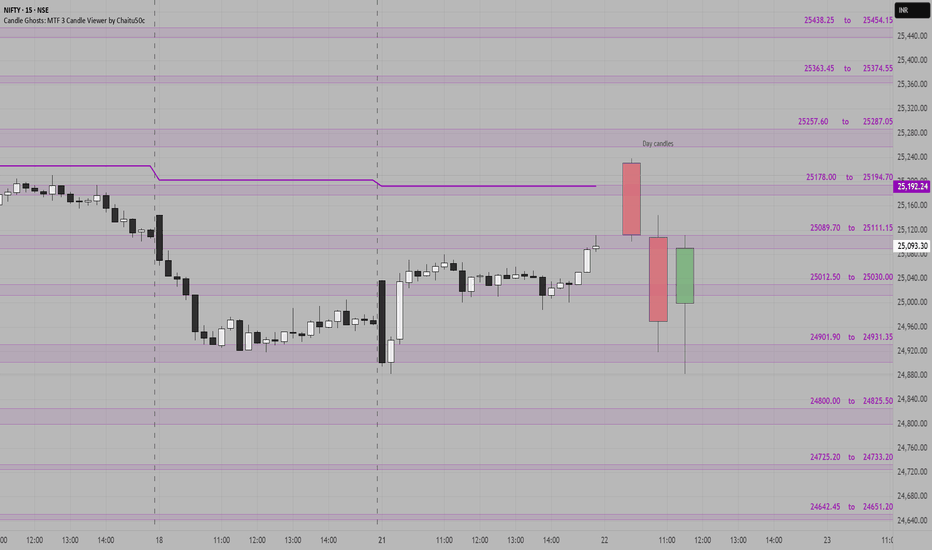

NIFTY SUPPORT & RESISTANCE ZONES FOR 22-07-2025Nifty Support & Resistance Zones for Tomorrow 22-07-2025

Based on price cluster analysis and recent market structure, the following key support and resistance levels have been identified for the upcoming session:

Resistance Zones:

25438.25 – 25454.15

25363.45 – 25374.55

25257.60 – 25287.05

25178.00 – 25194.70

25089.70 – 25111.15

Support Zones:

25012.50 – 25030.00

24901.90 – 24931.35

24800.00 – 24825.50

24725.20 – 24733.20

24642.45 – 24651.20

These levels are derived from high-probability zones where price has shown repeated interaction in the recent past. Watch how Nifty reacts at these zones for potential breakout, reversal, or pullback setups.

Japanese Candlestick Cheat Sheet – Part OneSingle-Candle Formations That Speak

Before you dream of profits, learn the one language that never lies: price.

Indicators are just subtitles — price is the voice.

Japanese candlesticks are more than just red and green bars — they reflect emotion, pressure, and intention within the market.

This series will walk you through the real psychology behind candlestick patterns — starting here, with the most essential:

🕯️ Single-candle formations — the quiet signals that often appear before big moves happen.

If you can’t read a doji, you’re not ready to understand the market’s hesitation.

If you ignore a hammer, you’ll miss the moment sentiment shifts.

Let’s start simple. Let’s start strong.

This is Part One of a five-part series designed to build your candlestick fluency from the ground up.

1. DOJI

Bias: Neutral

What is the Doji pattern?

The Doji candlestick pattern forms when a candle’s open and close prices are nearly identical, resulting in a small or nonexistent body with wicks on both sides. This pattern reflects market equilibrium, where neither buyers nor sellers dominate. Dojis often appear at trend ends, signaling potential reversals or pauses.

As a fundamental tool in technical analysis, Dojis help traders gauge the psychological battle between buyers and sellers. Proper interpretation requires context and experience, especially for spotting trend shifts.

Meaning:

Indicates market indecision or balance. Found during trends and may signal a reversal or continuation based on context.

LONG-LEGGED DOJI

Bias: Neutral

What is the Long-Legged Doji pattern?

The Long-Legged Doji captures a moment of intense uncertainty and volatility in the market. Its long wicks represent significant movement on both sides, suggesting that neither buyers nor sellers have control. This back-and-forth reflects the psychology of market participants wrestling for control, which often foreshadows a shift in sentiment. When traders see a Long-Legged Doji, it highlights the need to monitor for potential changes in direction.

They can appear within trends, at potential reversal points, or at consolidation zones. When they form at the end of an uptrend or downtrend, they often signal that the current trend may be losing momentum.

Meaning:

The prominent wicks indicate volatility. Buyers and sellers pushed prices in opposite directions throughout the session, ultimately reaching an indecisive close.

SPINNING TOP

Bias: Neutral

What is the Spinning Top pattern?

A Spinning Top is a candlestick with a small body and long upper and lower wicks, indicating that the market has fluctuated significantly but ultimately closed near its opening price. This pattern often points to a moment of indecision, where both buyers and sellers are active but neither dominates. Spinning Tops are commonly found within both uptrends and downtrends and can suggest that a trend is losing momentum.

For traders, a Spinning Top provides a valuable insight into market psychology, as it hints that the prevailing sentiment may be weakening. While Spinning Tops alone aren’t always definitive, they can serve as a precursor to larger moves if the following candles confirm a shift in sentiment.

Meaning:

Shows indecision between buyers and sellers. Common in both up and downtrends; signals potential reversal or pause.

HAMMER

Bias: Bullish

What is the Hammer pattern?

A Hammer candlestick appears at the end of a downtrend, with a small body and a long lower wick. This shape reflects a moment when sellers pushed prices lower, but buyers managed to absorb the selling pressure and drive prices back up before the close. This pattern is particularly important for spotting potential reversals, as it indicates that buyers are beginning to reassert control.

Hammers reveal the underlying psychology of a market where buying confidence is emerging, even if sellers have dominated for a while. To successfully trade this pattern, it’s essential to confirm the reversal with subsequent candles.

Meaning:

Showing rejection of lower prices. Signals potential bullish reversal, especially if followed by strong buying candles.

INVERTED HAMMER

Bias: Bullish

What is the Inverted Hammer pattern?

The Inverted Hammer forms at the bottom of a downtrend, with a small body and long upper wick. This pattern shows that buyers attempted to push prices higher, but sellers ultimately brought them back down by the close. The Inverted Hammer is an early sign of buyer interest, hinting that a trend reversal may be underway if subsequent candles confirm the shift.

Interpreting the Inverted Hammer helps traders understand where sentiment may be shifting from bearish to bullish, often marking the beginning of a recovery. Recognizing these patterns takes practice and familiarity with market conditions.

Meaning:

Showing rejection of higher prices. Can signal bullish reversal if confirmed by subsequent buying pressure.

DRAGONFLY DOJI

Bias: Bullish

What is the Dragonfly Doji pattern?

The Dragonfly Doji has a long lower wick and no upper wick, forming in downtrends to signal potential bullish reversal. This pattern reveals that sellers were initially in control, pushing prices lower, but buyers stepped in to push prices back up to the opening level. The Dragonfly Doji’s unique shape signifies that strong buying support exists at the lower price level, hinting at an impending reversal.

Recognizing the psychology behind a Dragonfly Doji can enhance a trader’s ability to anticipate trend changes, especially in markets where support levels are being tested.

Meaning:

Found in downtrends; suggests possible bullish reversal if confirmed by a strong upward move.

BULLISH MARUBOZU

Bias: Bullish

What is the Bullish Marubozu pattern?

The Bullish Marubozu is a large, solid candle with no wicks, indicating that buyers were in complete control throughout the session. This pattern appears in uptrends, where it signals strong buying momentum and often foreshadows continued upward movement. The absence of wicks reveals that prices consistently moved higher, with little resistance from sellers.

For traders, the Bullish Marubozu offers a glimpse into market psychology, highlighting moments when buyer sentiment is particularly strong. Learning to identify these periods of intense momentum is crucial for trading success.

Meaning:

Showing complete buying control. Found in uptrends or at reversal points; indicates strong buying pressure and likely continuation of the trend.

SHOOTING STAR

Bias: Bearish

What is the Shooting Star pattern?

The Shooting Star appears at the top of an uptrend, characterized by a small body and a long upper wick, indicating a potential bearish reversal. Buyers initially drove prices higher, but sellers took over, bringing prices back down near the open. This shift suggests that buyers may be losing control, and a reversal could be imminent.

Interpreting the Shooting Star gives traders valuable insights into moments when optimism begins to fade, providing clues about a potential trend shift.

Meaning:

Indicating rejection of higher prices. Signals a potential bearish reversal if followed by selling pressure.

HANGING MAN

Bias: Bearish

W hat is the Hanging Man pattern?

The Hanging Man candle forms at the top of an uptrend, with a small body and long lower wick. This pattern suggests that sellers attempted to drive prices down, but buyers regained control. However, the presence of a long lower shadow hints that sellers may be gaining strength, potentially signaling a bearish reversal.

The Hanging Man pattern reflects market psychology where buyers might be overextended, making it a valuable tool for identifying potential tops in trends.

Meaning:

Signals potential bearish reversal if confirmed by selling candles afterward.

GRAVESTONE DOJI

Bias: Bearish

What is the Gravestone Doji pattern?

With a long upper wick and no lower wick, the Gravestone Doji reveals that buyers pushed prices up, but sellers eventually regained control. Found in uptrends, it suggests that a bearish reversal could be near, as the upper shadow indicates buyer exhaustion. The Gravestone Doji often appears at market tops, making it a valuable indicator for those looking to anticipate shifts.

Understanding the psychology behind this pattern helps traders make informed decisions, especially in markets prone to overbought conditions.

Meaning:

Showing rejection of higher prices. Found in uptrends; signals potential bearish reversal if followed by selling activity.

BEARISH MARUBOZU

Bias: Bearish

What is the Bearish Marubozu pattern?

The Bearish Marubozu is a large, solid bearish candle without wicks, showing that sellers held control throughout the session. Found in downtrends, it signals strong bearish sentiment and suggests that the trend is likely to continue. The lack of wicks reflects consistent downward momentum without significant buyer support.

This pattern speaks about market psychology, offering traders insights into moments of intense selling pressure. Recognizing the Bearish Marubozu can help you align with prevailing trends and avoid buying into weakening markets

Meaning:

Showing strong selling pressure. Found in downtrends; signals continuation of the bearish trend or an intensifying sell-off.

👉 Up next: Double-candle formations – where price meets reaction.

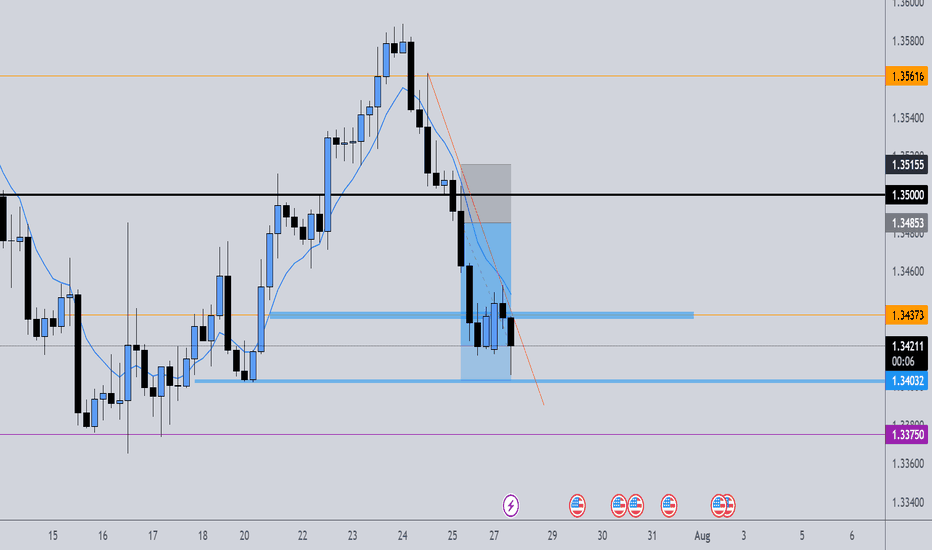

EURUSD📉 EURUSD – 30min Short Plan

📊 Structure: LLs & LHs forming – bearish trend confirmed

🕯️ Pattern: Bearish Engulfing at Lower High

🎯 Entry: instant

📌 Trade 1

– 🎯 TP1: 1:1

– ⚠️ Risk: 1%

📌 Trade 2

– 🎯 TP2: larger reward

🛠️ Execution:

– Place both trades at same entry

– Trail SL after TP1 hit

📎 Bias: Bearish

Candlestick Patterns - How to read them like a ProOverview

Candlestick charts serve as a cornerstone in technical analysis, presenting price activity in a visually digestible format. By examining how prices move over a given timeframe, traders gain key insights into potential market direction, sentiment shifts, and trend strength.

Mastering candlestick interpretation is essential for identifying bullish or bearish sentiment, as well as for spotting possible trend reversals or continuations. Still, candlesticks alone don’t paint the full picture—using them without broader context increases the risk of false signals.

---

What You'll Learn

What are candlestick charts?

Common bearish candlestick patterns

Common bullish candlestick patterns

How to apply candlestick analysis in trading

---

What is a Candlestick Chart?

A candlestick provides a snapshot of an asset’s price behavior during a specific time interval, whether it's one minute, one hour, or one day. This format allows traders to quickly assess how the price has moved within that period.

Each candle reveals four price points:

* Open – the price at the beginning of the interval

* Close – the price at the end of the interval

* High – the highest price reached

* Low – the lowest price during that time

Anatomy of a Candlestick:

* Body: The thick section between the open and close. A green (or white) body means the close was higher than the open (bullish), while red (or black) means the opposite (bearish).

* Wicks (or Shadows): Thin lines extending from the body to indicate the high and low.

* Upper wick: Marks the highest traded price

* Lower wick: Marks the lowest traded price

---

Bearish Candlestick Patterns

Understanding bearish candlestick patterns helps traders identify moments when buying momentum might be running out—setting the stage for a potential downward shift.

Evening Star

A three-candle formation that signals a shift from buying pressure to selling dominance. It starts with a strong bullish candle, followed by a small-bodied candle of indecision, and concludes with a large bearish candle that cuts deep into the first. This pattern often appears at the end of an uptrend.

Bearish Engulfing

This setup includes a small bullish candle followed by a large bearish candle that completely swallows the previous one. It indicates that sellers have seized control, potentially marking the beginning of a downward trend.

Shooting Star

With a small real body near the low and a long upper wick, this pattern reflects strong early buying that is ultimately rejected by the close—suggesting fading bullish momentum.

Gravestone Doji

This candle opens, closes, and hits its low all around the same price, leaving a long upper wick. It suggests that bulls pushed higher during the session but were overpowered by bears by the close.

Three Crows

Three consecutive bearish candles, all approximately the same size. These indicate that a sell off is coming soon.

---

Bullish Candlestick Patterns

Bullish patterns can alert traders to possible reversals after a downtrend or strengthen conviction during an uptrend.

Morning Star

This three-candle formation marks a potential turning point from bearish to bullish. It begins with a strong bearish candle, followed by a smaller candle showing indecision, and ends with a large bullish candle breaking upward—signaling buying strength is returning.

Bullish Engulfing

This two-candle pattern begins with a bearish candle, then a larger bullish candle that completely envelops the previous body. It reflects a sharp transition in sentiment, suggesting renewed buying pressure.

Dragonfly Doji

A single candle where the open, close, and high are all very close, with a long lower wick. It shows sellers pushed prices lower but buyers stepped in and brought them back up—an early sign of possible reversal.

Hammer

A classic bullish reversal signal that features a small real body near the top and a long lower shadow. It indicates a battle where sellers initially dominated, but buyers managed to close near the open price.

Three soldiers

Three consecutive bullish candles, all approximately the same size. These indicate that a big buy is coming soon.

---

Trading with Candlestick Patterns

Candlestick patterns become more meaningful when they align with major chart areas—such as previous support or resistance, trendlines, or retracement zones. A bullish signal at a support level can hint that the downward pressure is fading, while a bearish pattern at resistance may warn of an upcoming decline.

To increase the reliability of your trades, combine candlestick patterns with other forms of technical analysis:

* Support & Resistance Zones: These are price levels where the market has historically reacted. Candlestick patterns forming near these zones have stronger potential implications.

* Fibonacci Levels : These help identify likely retracement areas. When a candlestick pattern forms near a key Fibonacci level like 61.8%, it adds strength to a potential reversal setup.

* Liquidity Areas: Clusters of orders (buy or sell) tend to create strong reactions. When patterns appear in these zones, they often precede more decisive moves.

* Technical Indicators : RSI, MACD, Moving Averages, and Stochastic RSI can provide confirmation. For instance, a bullish reversal pattern that appears when RSI is oversold strengthens the signal.

💡 Tip: Don’t rush into trades based on one candlestick alone. Always wait for the next candle or price confirmation (e.g., a break of a previous high/low) to validate your signal.

---

Thanks for Reading!

✨ If you found this helpful, show some love by liking or commenting!

🔔 Don’t forget to follow for more technical breakdowns and trading insights coming soon!

Buy IOC short term target 155, 165 & Medium Term tgt 185, 250 Indian Oil Corporation does business in the entire hydrocarbon value chain - from Refining, Pipeline transportation and marketing of Petroleum products to R&D, Exploration & production, marketing of natural gas and petrochemicals. It has the leadership position in the Oil refining & petroleum marketing sector of India.

The company aims to strengthen EV mobility infrastructure by setting up charging points and battery-swapping facilities at its fuel stations. It has also signed a binding term sheet with Panasonic Group to form a JV for manufacturing cells in India.

The company’s R&D is focused on emerging fields such as nanotechnology, Solar, Bioenergy, Hydrogen, etc. It has an effective patent portfolio of 1636. It spent Rs 946 Cr in FY24 on R&D.

The company’s R&D is focused on emerging fields such as nanotechnology, Solar, Bioenergy, Hydrogen, etc. It has an effective patent portfolio of 1636. It spent Rs 946 Cr in FY24 on R&D.

Market Cap ₹ 2,07,370 Cr.

Annual Sales - ₹ 758,106 Cr

Dividend Yield - 8.20 %

Stock P/E - 17.0

Industry PE - 29.2

Debt to equity - 0.82

ROCE - 7.37 %

EPS - ₹ 9.63

Fundamentally, this big company is trading at a very low valuation. The Crude Oil price is expected this year to be on lowest, so we can expect good profit margin and this company is into green energy business so it should have PE multiple of that business as well. We Expect growth in EPS by 30% to 12.5 And re-rating of PE multiple to 20 so that give the share price to ₹ 250 which gives return of 70.88% from current price level of 146.30.

Technically, this is very bullish on weekly, daily timeframe. Price is trading above all short term, medium term averages. It has formed a bullish candlestick pattern on daily and weekly chart, so we expect immediate strong upside to 155, 165 and eventually 185 level and investment target of 250 levels.

Bullish Monthly Candle Expected?4210 Analysis

Closed at 178 (24-06-2025)

Monthly Closing above 173.20 would be

a very +ve Sign.

Crossing & Sustaining 181 on Weekly Basis, may

result in further upside towards 200 - 205.

However, it should not break 136 now; else we

may witness further selling pressure towards 110 - 111.

$XAU Showing Bearish Flag Pattearn & Dropped $3K Support area...TVC:XAU Showing Bearish Flag Pattearn & Dropped $3K Support area. Price dropping now and back to $3K price level area. price FVG touch and Strong support $3K Price Level area. Here is many support Holder.

Stoploss: $3,536

Entry: $3,377

1st Target point $3,377

2nd Target point $3,249

3rd Target point $3,028

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

3 Line Strike Pattern: What It Means and How to Use It3 Line Strike Pattern: What It Means and How to Use It in Trading

Candlestick patterns are crucial tools for traders, offering valuable insights into market sentiment and potential price movements. Among these patterns, the Three Line Strike setup is particularly sought after by traders in forex, stock, commodity, and index markets. This article explores the intricacies of the Three Line Strike, explaining how to identify it on charts, highlighting its unique characteristics, and discussing how to incorporate it into trading strategies.

Three Line Strike Pattern: An Overview

The Three Line Strike is a candlestick pattern used in technical analysis to trade trend continuations. However, it often appears ahead of trend reversals. The pattern consists of four candlesticks and can be found in up- and downtrends.

Bearish Three Line Strike

The bearish 3 Line Strike candlestick pattern suggests a continuation of a downtrend. It starts with three consecutive bearish candles, each opening and closing lower than the previous one. This is followed by a large bullish candle, which opens lower and closes above the open price of the first bearish candle. This pattern reflects the strength of the downtrend. Still, it may appear at the bottom of the downtrend and signal a trend reversal.

Bullish Three Line Strike

The bullish 3 Line Strike candlestick pattern suggests the potential continuation of a solid uptrend. It starts with three consecutive bullish candles, each opening and closing higher than the last. This is followed by a large bearish candle, which opens higher and closes below the close of the first bullish candle. This pattern indicates that the solid uptrend may continue, but it may signal the market will turn down if it’s formed at the peak of the uptrend.

Analysing Three Line Strike Patterns

As the Three Line Strike pattern can provide both reversal and continuation signals, it’s vital to combine it with other analytical tools, including trend indicators like moving averages and oscillators like the Relative Strength Index. Also, traders consider the overall trend on higher timeframes.

- Entry: To enter a trade using the Three Line Strike, traders identify the overall trend. They may wait for the pattern to be formed and the following candle to close. If the following candle is bearish, traders usually open a sell position. If it is bullish, they consider an opportunity to go long. However, traders also may enter the market at the closure of the pattern’s fourth candle.

- Stop Loss: Risk management is crucial, and traders typically set their stop-loss levels above/below the fourth candle, considering the trend strength. Alternatively, they may place the stop-loss order below or above the nearest swing point or support/resistance level, considering market volatility and risk tolerance.

- Take Profit: Traders aim to secure their potential profits by setting profit targets based on the risk/reward ratio. This could be at the next significant support or resistance level or based on technical indicators, including Fibonacci retracements.

A trader finds a bullish 3 Line Strike setup on the daily chart of Qualcomm stock. However, this time, it serves as a reversal signal. They enter the short position at the close of the candle, following the pattern. Their stop loss is above the setup, with the take profit at the next support level.

A bearish Three Line Strike setup is formed on the hourly chart of Brent Crude Oil. A trader takes a long position at the close of the fourth candlestick. Their stop loss is below the formation, with the take profit placed at the next resistance level.

Psychology Behind the Three Line Strike Pattern

The effectiveness of the Three Line Strike pattern relies on understanding the underlying psychological factors influencing market participants. Greed, fear, hope, and anxiety drive buying and selling decisions.

- Initial Sentiment: The first few candlesticks in a Three Line Strike candlestick pattern represent the prevailing sentiment in the market. Typically, this sentiment is characterised by either greed (in an upward trend) or fear (in a downward trend), depending on the market direction prior to forming the pattern.

- Potential Reversal: Although this pattern is considered continuation, in most cases, it provides a reversal signal. A strong fourth candle that engulfs three smaller candlesticks reflects the change in the market sentiment. The reversal signal triggers market participants to reassess existing positions and strategies.

- Reaction: Those who were previously aligned with the old trend may feel fear or anxiety, leading them to unwind their positions to avoid potential losses. Meanwhile, contrarian traders, driven by a sense of opportunity and confidence, may enter new positions in anticipation of the emerging trend reversal, fueled by their belief that market sentiment is shifting.

Application in Trading Strategies

Applying the 3 Line strike pattern in trading strategies encompasses various elements beyond just its recognition. Let's delve into how traders implement additional steps to enhance their overall trading performance.

- Seeking Additional Confirmation: Traders often seek additional confirmation from other technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or Bollinger Bands. These indicators offer complementary insights into market dynamics, validating the signals generated by the Three Line Strike pattern.

- Strategic Placement and Timeframe Alignment: Traders may align the pattern with key support or resistance levels on higher timeframes to validate its significance and potential reversal points. Through multi-timeframe trading, traders may gain a more comprehensive understanding of market trends to analyse future price movements.

- Entry and Risk Management: Traders should place their entry and exit points carefully. As the pattern may provide continuation and reversal signals, incorporating disciplined risk management techniques might help traders protect their capital and minimise their potential losses.

Caveats to the Pattern

High volatility periods can amplify the occurrence of false signals and erratic price movements, potentially leading to misguided trades. Conversely, during periods of low volatility, price action may be sluggish, and confirmations could be delayed. Therefore, it's important for traders to adapt their strategies accordingly.

Another important consideration is the possibility of false breakouts. Despite the apparent formation of a Three Line Strike pattern, there's a risk of the price briefly breaching the pattern's boundaries before reverting to its original direction. These false breakouts can deceive traders into entering premature trades, resulting in losses. To mitigate this risk, traders can exercise patience and vigilance, waiting for strong confirmation signals before committing to a trade.

Key Differences Between Three Line Strike and The Three Black Crows/Three White Soldiers

The key differences between the Three Line Strike pattern and the Three Black Crows/Three White Soldiers patterns lie in their trading formations and implications:

Aspect - Three Line Strike Pattern

Formation - Consists of four consecutive candlesticks, with the fourth candlestick completely engulfing the previous three.

Implication - Indicates either a trend continuation or a reversal in market sentiment, either from bullish to bearish or vice versa.

Aspect - Three Black Crows/Three White Soldiers

Formation - Consists of three consecutive candlesticks with progressively lower (crows) or higher (soldiers) closing prices.

Implication - Reflects a strong momentum in the direction of the prevailing trend, suggesting a continuation of the trend rather than a reversal.

The Bottom Line

The Three Line Strike is a complicated pattern as it may provide continuation and reversal signals. Despite its complexity, it often appears on a price chart, making it a valuable tool for traders. Mastering price action chart analysis is a gradual process. However, with skill, traders can potentially improve their trading efficiency.

FAQs

What Is the 3 Strike Rule in Trading?

The 3 strike rule in trading refers to the Three Line Strike pattern. The pattern consists of three consecutive up/down candles followed by a fourth long bearish/bullish candle that opens above/below the previous candle’s close but closes below/above the first candle's open. It’s believed to provide continuation signals, but it often appears before a trend reversal.

What Is the Three Strike Strategy?

The Three Strike Strategy refers to the 3 Line Strike candlestick pattern. It’s based on the assumption that the pattern will be followed by either a reversal or a continuation of the trend. Traders often wait for the candlestick to close above/below the pattern for an entry point, place a profit target, considering the closest resistance/support levels, and potentially limit losses by placing a stop-loss order below/above the pattern.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

What Is a Morning Star Pattern & How Can You Use It in Trading?What Is a Morning Star Pattern, and How Can You Use It in Trading?

The morning star candlestick is a popular price action pattern that technical analysts and traders use to identify potential trading opportunities. It indicates a reversal from a bearish to a bullish trend and is a valuable addition to any trader's toolkit. In this article, we will cover all the technical aspects of the morning star candlestick pattern.

What Is the Morning Star Candlestick Pattern?

The morning star in technical analysis is a reversal formation that appears at the end of a downtrend and signals a trend reversal. It consists of three candles.

To identify it on the chart, you should look for the following:

1. Downtrend: The market should be in a downtrend, and the first candle should be long and bearish.

2. Indecision: The second candle is usually expected to have a gap down, but gaps are uncommon in forex. Therefore, a small-bodied candle is considered sufficient. It's worth noting it can be either bullish or bearish, but if it’s bullish, the signal is stronger.

3. Significant increase: The third candle should be strong and bullish and close above the midpoint of the first bearish one. If it forms with a gap up, the buy signal is considered stronger.

When Morning Star Candlestick Patterns Occur

Traders can identify the morning star candlestick pattern in stocks, forex pairs, commodities, and cryptocurrencies*. It may also be observed across various timeframes, from minutes to weeks.

Generally speaking, a morning star pattern can be considered more reliable when it appears on a higher timeframe. For instance, a morning star candlestick pattern has more significance when it occurs over three days vs three minutes, given the increased amount of price action and market participation reflected over longer periods.

Psychology Behind the Pattern

The morning star reversal pattern reflects a shift in market sentiment from bearish to bullish. Initially, a strong bearish candle indicates prevailing selling pressure. The second candle, with its small body, suggests indecision as the market stabilises and neither bulls nor bears dominate. This pause indicates that sellers are losing momentum. The third morning star candle, a strong bullish one, confirms the shift as buyers take control, driving prices higher. This pattern signals that the downtrend is likely exhausted, and a potential reversal is underway due to increasing buyer confidence.

Trading with the Morning Star

Traders can use the following steps to trade this setup:

1. Identify the setup: Look for a setup on the chart formed after a solid downtrend.

2. Confirmation: After identifying the formation, traders should confirm it before entering a long position.

3. Enter a long position: Consider entering a long position once the formation is confirmed.

4. Determine a take-profit target: Although candlesticks don’t provide specific entry and exit points, traders may consider the closest resistance level to take potential profit.

5. Monitor the trade: Continuously monitor the trade and adjust the stop-loss and take-profit levels as needed based on market conditions.

What Is the Morning Star Candlestick Strategy?

The morning star trading strategy leverages the formation's ability to signal a bullish reversal after a downtrend. The formation's reliability increases when it occurs at a support level and is confirmed by a momentum indicator like the RSI or MACD.

Entry:

- Traders look for the full morning star to form at a support level.

- They then look for a confirmatory bullish signal from a momentum indicator, such as RSI showing oversold conditions, a bullish MACD crossover, or a bullish divergence in either.

- Traders may wait for additional confirmation, like RSI moving back above 30, or enter on the close of the third candle in the pattern.

Stop Loss:

- A stop loss might be set below the swing low of the setup.

- Alternatively, traders may place the stop loss beyond the lower boundary of the established support level.

Take Profit:

- Profits might be taken at a predetermined risk-reward ratio, like 2:1 or 3:1.

- Traders also often aim for an opposing resistance level where a further reversal might occur.

Morning Star and Other Formations

Traders should not confuse the morning star candle formation with other formations, such as the evening star, which is the complete opposite.

Doji Morning Star

In a traditional morning star reversal pattern, the candle that appears in the middle of the formation has a small real body, meaning there is a clear difference between the opening and closing prices.

In a morning doji star formation, the second candlestick has characteristics of a doji, where the opening and closing prices are very close to each other, resulting in a very small real body. This reflects the indecision as neither bulls nor bears can take control of the market.

The doji setup is less common than the traditional formation, but it still signals a potential upward movement after a prolonged downtrend.

Evening Star

In contrast to a morning setup, an evening star is a bearish setup occurring after an uptrend. It also consists of three candles – a long bullish one, a small-body one (it can also be a doji), and a long bearish one that closes below the midpoint of the first bullish candle. This suggests that the market is about to turn down.

Benefits and Limitations of the Morning Star Candle

The morning star is a useful tool for traders seeking to identify potential market reversals, but it does come with some benefits and limitations.

Benefits

- Strong Reversal Signal: Indicates a bullish reversal after a downtrend, helping traders anticipate upward moves.

- Broad Applicability: Effective across various financial instruments such as forex, stocks, commodities, and cryptocurrencies*.

- Timeframe Flexibility: It can be observed on different timeframes, from intraday to weekly charts.

Limitations

- False Signals: Like all patterns, it can produce false signals, especially in volatile markets.

- Confirmation Needed: A morning star pattern entry requires confirmation from additional indicators or formations to improve accuracy.

- Experience Required: Identifying the formation correctly and interpreting its signals requires experience and a good understanding of price action.

Final Thoughts

While candlestick formations such as the morning star can be useful for traders to identify potential trading opportunities, it is crucial to remember that they are not foolproof and should not be the sole choice of market participants when making their trading decisions. Traders should also incorporate technical indicators and develop risk management techniques to potentially minimise losses.

FAQ

What Is a Morning Star in Trading?

The meaning of a morning star in trading refers to a bullish reversal formation consisting of three candles. It appears at the end of a downtrend, indicating a potential shift to an uptrend. The setup includes a long bearish candle, a small-bodied candle, and a long bullish candle.

Is the Morning Star Bullish or Bearish?

It is a bullish candlestick pattern that indicates a potential reversal from a downtrend to an uptrend in the market. It suggests that the selling pressure is subsiding, and buying pressure is beginning to take over.

What Does the Morning Star Pattern Indicate?

It is a three-candle price action, often indicating a bullish reversal in the market. It suggests that selling pressure has been exhausted, and buyers are starting to gain control of the market.

How Do You Read the Morning Star Pattern?

To read the morning star formation, traders should look for the following characteristics: a long bearish candle formed in a solid downtrend and followed by a bullish or bearish candle with a small real body, which in turn is followed by a long bullish candle closing above the midpoint of the first one.

What Is the Opposite of Morning Star?

The opposite of a morning star is the evening star, a bearish reversal pattern. It appears at the end of an uptrend, signalling a potential shift to a downtrend. The morning and evening stars are similar, except the latter mirrors the former, consisting of a long bullish candle, a small-bodied candle, and a long bearish candle.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.