MSOS Long with 150% Upside - Cannabis Rescheduling Catalyst💠 Catalyst: Cannabis is currently classified as a schedule I drug alongside heroin, bath salts, and synthetic opioids that kill thousands every year — all while being safer than Tylenol and legal in over half the country. Cannabis is likely to be rescheduled to a schedule III drug soon after Terry Cole is confirmed as the head of the DEA. The vote to confirm him is expected to take place...TODAY

As a schedule I drug, cannabis companies can’t deduct regular business expenses for tax purposes, have limited access to banking, must transact with customers in all cash, and US multi-state operators are unable to list on the major US exchanges.

Terry Cole will be confirmed as the new head of the DEA, and when he is confirmed, the stalled process to reschedule cannabis from a schedule I to a schedule III drug should resume. If cannabis is rescheduled, that will pave the way for further research, destigmatize it, and open the door to banking and uplisting of US multi-state operators to the major exchanges in the near future.

This trade capitalizes on the fact that investors are not positioned for reform and further positive catalysts. The worst-case scenario is priced into the MSOS ETF, and when good news on rescheduling hits the tape, that should start a NEW Bull market in the MSOS cannabis stocks.

💠 Technical Setup:

Bear Market

• Multi-year bear market throughout the entire Biden administration on promises to reschedule that were never followed through on

• Capitulation when Trump won the election on the prospect of potentially another 4 years of no reform

Bearish to Bullish Technical Transition!

• LT Stage 1A Bottom Signal (Price > 50D SMA)

• ST Stage 2A Breakout (First day Price > 10D EMA and 20D SMA)

• Hourly Chart – Breaking out above Weekly Value Area

• Daily Chart – Trading above the Monthly Value Area

• Overlapping prior monthly value areas in sight!

• VPOC in sight!

• Weekly Chart – Targeting a retest of the Yearly POC

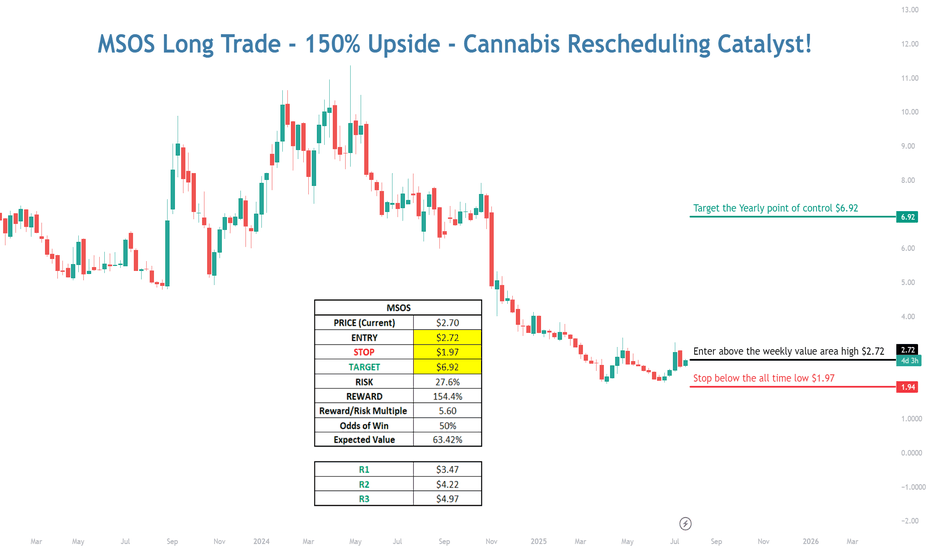

💠 Trade Plan

ENTRY: $2.72 (Break above weekly value area high)

STOP: $1.97 (Below the prior all-time-low)

TARGET: 6.92 (A retest of the yearly point of control from 2024)

RISK: 27.6%

REWARD: 154.4%

R/R Multiple: 5.6X

Probability of Win: 50%

Expected Value: 63.42%

Cannabis

Curaleaf: Target Zone in SightIn small steps, the CURA stock continues to move upward – however, we primarily interpret these movements as the internal structure of the downward wave v in orange. Therefore, the final low of this wave should soon be marked within the orange Long Target Zone between C$0.82 and C$0.37. Upon completion of wave v, the overarching wave II in beige should also end. Once this foundation is laid, a long-term upward movement should begin – initially driven by wave 1 in turquoise, which should carry the price above the resistance at C$4.93.

Innovative Industrial Properties: Low AheadThe stock of Innovative Industrial Properties managed to stabilize somewhat at the upper edge of our green Target Zone (coordinates: $53.48 – $16.80) but should soon initiate the next downward impulse. In the short term, we expect a final corrective movement deeper into our green Target Zone to establish the low of the overarching wave in green. Once the wave low is settled, the impulsive wave in green should take over and carry the stock beyond the resistance at $137.90.

Green Thumb, Cannabis Growth stock at good entry price multi year 25% earnings grower trading at 25 pe here.

double over sold with rsi and bollinger bands showing low readings.

peg ratio of 1.

tangible book value at 3.02.

buying calls and stock, will take profits on the calls to pay for the stock.

ride the stock for free for years.

TLRY Tilray Brands Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TLRY Tilray Brands prior to the earnings report this week,

I would consider purchasing the 2usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $0.32.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

$HITI - Rising with the tide, BIG MOVE INBOUND! High Tide - NASDAQ:HITI 🌊

Daily Chart Analysis:

-Green H5 Indicator

-Bullish Falling Wedge breakout inbound

-Volume Shelf Launch

-Price GAP filled before heading higher

-Weekly chart still intact and looking great

-Weekly Williams Consolidation Box thriving

🔜🎯$4.15

They know this is where the Liquidity Zone is I am bullish on Pot Stocks here but I believe a shakeout is in order before the next bullish impulse and the bear is dead. This clear "support" line if broken will provide ample liquidity for big fish to get in as there are likely many stops and much fears below this trend line. I think this will likely mean a broader pot stock dump before we can finally have a new bull market. Good luck.

$SNDL: A MASSIVE 1600% OPPORTUNITY FOR THIS CANNIBIS MICROCAP!NASDAQ:SNDL A MASSIVE 1600% OPPORTUNITY FOR THIS CANNIBIS MICROCAP STOCK! 🌿🤯

Are cannabis stocks back?!

3 Reasons Why in this Video: 📹

1⃣ My "High Five Trade Setup" strategy

2⃣ Catalyst: Decriminalization of MJ in Germany back in April and acquisition of NOVA.

3⃣ Symmetrical Triangle Breakout

Video analysis 2/5 dropping today. Stay tuned!🔔

Like ♥️ Follow 🤳 Share 🔂

Are cannabis stocks back?! Let me know in the comments below.

Not financial advice.

OTC:CRLBF OTC:TCNNF NASDAQ:TLRY TSX:ACB OTC:CURLF OTC:GTBIF AMEX:IWM NASDAQ:QQQ #TradingSignals #TradingTips #options #optiontrading #StockMarket #stocks #CannabisLegalisierung

CGC Canopy Growth Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CGC Canopy Growth Corporation prior to the earnings report this week,

I would consider purchasing the 8usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $0.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TLRY cannabis stocksHexo turned out to be a bummer pick

but TLRY is still remaining

Which leads me to believe that the only thing that could cause a price to drop this much and then project this high upwards, has got to be due to federal legalization THC drinks and possibly more.

Lots of legal hoops to jump through for states and cannabis and more, but there is good that comes from legalization, meaning research money, meaning jobs, meaning genetics, meaning new ways of grow cannabis and using it that could ultimately be safer to consume vs now, maybe leads to dosages being figured out and effects to be specifically altered per user or use or effect or whatever you want to imagine.

Maybe not every state is ready to allow it but it seems across the board, it's a favorable issue for a lot of members of both parties. I've heard trump say, he doesn't need or want to use it but he has seen it do amazing things to help other, I've heard Kamala can help undo damage done during the course of a long a difficult career, and allow people who were simply selling to get by vs selling to commit crime and harm others, which ultimately means, she could probably do some good with the current fentanyl issue. As clearly she is now thinking about it from some views other than her own and how it can be used as a net good.

On top of that, it's clear the big companies or execs maybe even pharma companies need a look and a whole lot of questions asked about why cannabis caused the inability to fund through loans, borrow money, pay with credit and more.

So TLRY has overseas connections, favorable politics swinging their way through years of work, and drinks infused with THC, which as more research comes out, there might be ways to safely allow bars to serve drinks without someone being unable to get home within a reasonable amount of time. Would this ever occur, maybe, but the important key to take away is open research and money into science and then obviously trying to work with Mexico to literally end cartels (I have deep core ties to Columbia) and Escobar from stories I've heard personally and have no idea if they are true, really took care of the area he controlled, but yeah, he also probably was doing some awful stuff to others.

Lesson to learn here is that maybe some evil can be treated with a new direction, but some evil needs two major governments and police/technology and security that both keeps each place within their areas trying to solve a common goal and allowing each other to assist when a task is too difficult to handle on their own or ours. And clearly show the world that Mexico won't allow groups of evil to thrive and America can secure the border by doing it all in Mexico which could then theoretically lead to a an open border discussion, but say what you want. There is a major issue with cocaine usage and literally and knowingly killing other humans to profit, which is maybe evil, and something we could easily do which defense stocks getting obviously so much money pretty much all the time.

Again, why can't we help our vets to the point where it's not a issue? And they can seek help without losing status, rank, pay, benefits and more.

again, political views aside, America has a bad ass military that runs one hell of task, why aren't we using them to flush out corruption and evil and still find a way to maintain being an ideal view of how the military used to stand up to bad, and maybe we should have listened better should a former president suggest that money can cause an issue where oversight is gone, paraphrasing of course, as it's quite obvious this president have some serious foresight and tried to express that concern.

finally, cut anything out of this that you want to make it make sense in your world, but to make short a sweet, legalization allows the states more power, gives institutions power to direct lots of money towards meaningful research, gives avenues where we can actually start to work on the drugs that are laced with awful stuff coming into the country so frequently. And then you figure out who funds it and destroy whatever is left of that system, maybe dismantle is a better term, and start to setup some form of life that means someone in south america shouldn't feel the need to risk their life to leave their home, or why so many innocent people die for "drugs" which is probably a way better start a securing the border. A big wall can still have value in metal, and value can lead to an even better wall for cyber crimes, especially as we head to space. The space force is no joke, It was some well done prep work from former presidents and a realization of how much valuable stuff will be in a space making it targets for "evil"

Why do I say all of this, probably because a big first step is exactly the one I mention, legalization, and then locking up or whatever the leader decides is needed at that time. Ideally with a new lens of money being used to manipulate others at will. but my view is just one, I can't say my way is best, right or even possible, but again, legal leads to open freedom in safe environments. In fact, maybe the best person to handle an issue like that is someone who is potentially willing to legalize something that her decisions in the past have led to jail or worse.

TLRY Tilray Brands Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TLRY Tilray Brands prior to the earnings report this week,

I would consider purchasing the 1usd strike price in the money Calls with

an expiration date of 2024-10-11,

for a premium of approximately $0.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SNDL Options Ahead of EarningsAnalyzing the options chain and the chart patterns of SNDL prior to the earnings report this week,

I would consider purchasing the 2usd strike price Calls with

an expiration date of 2024-10-18,

for a premium of approximately $0.48.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

[W] ACB - SMA 9/20/50 Golden Cross - BuyI've never researched cannabis stocks before, I don't know anything about the industry, and I might be dead wrong about what I'm seeing but based on candlesticks, oscillators, fibonacci, and moving averages I'm seeing this being an opportunity to buy and hold until price hits EMA 200 on the up side around $50. Do your own analysis and see what you can see.

Philip Morris: New Motivation!Philip Morris has gained new motivation, stretching visibly higher in its chart. Still, the price has more upward distance to cover before reaching our turquoise Target Zone between $119.47 and $123.80. Once the top of the turquoise wave B has been established there, the stock should sell off below the support at $82.95 and, afterward, into our green Target Zone between $77.61 and $62.42. The low of the green wave should then initiate a bullish trend reversal. However, we consider it 35% likely that the green wave alt. has already been finished. In this case, PM would surpass our turquoise Target Zone.

CGC bout to get high? Elliottwave If you find this information inspiring/helpful, please consider a boost and follow!

Looks like wave 3 price action.

The news is early so we shall see if the PA holds up.

looking for the sharp move up to give a bit of a pull back.

I would look to play the wave 4 of the wave 3 at this point, it depends, but that is my conservative variety.

I can use the smaller degree and the geometry as confluence for an entry.

on the watch list.

Cannabis PropositionConsidering the recent political shift regarding cannabis scheduling and the changing landscape of the drug war, I am closely monitoring the prolonged underperformance of the cannabis industry. Since the legalization of cannabis in Colorado and Washington state, proponents have touted the potential of legal cannabis policies in curbing crime rates. We anticipate witnessing the ongoing evolution of this transformative movement.

TLRY - 420 to the MOON or is CANNABIS FINISHED?This chart is pretty explanatory, and probably doesn't require much explanation.

I'm bullish on this stock.

I'm 90% sure Dems push cannabis legislation through as it's a bipartisan issue for the most part, and will look good for both parties pre election. Starts with credit cards and banks, imo.

Don't follow green line path as gospel, it is often incorrect, but helps me plan a preliminary "ideal" path based on indicators. It helps with backtracking predictions, and keeping emotions in check, as you know what "past you" saw.

I like 1.89 as a big time buy target, but it could easily go lower.

Relevant trends and targets marked.

Watch out, current trends are showing the run-up into earnings, which would allow for a drop.

Does this mean anything? Not always, but it's good to note.

current bullish price movement doesn't have to end if rejection trends and targets start to break and confirm.

Good luck!

send $acb back to $1002024 has been very busy for NASDAQ:ACB

- Aurora Introduces Medical Cannabis Pastilles for Patient Relief in Australia

- Aurora Completes Final Repayment of Convertible Senior Notes Representing ~$465 Million in Total Repayments Since 2021; Cannabis Operations Are Now Debt Free

- Aurora Partners with Script Assist to Provide Better Access to UK Medical Cannabis

- Aurora Cannabis Announces CFO Transition and Completion of Previously Announced Share Consolidation

when looking at the chart we can see obvious price discovery to the downside, and the last year of lows have come with heavy market selling. however on the plus side the buy pressure has been positive in the background suggesting someone is happy to scoop up the stock down here.

its only a matter of time before NASDAQ:ACB picks up again given the company are now debt free :-)

MJ ETF (cannabis) - Potential Double Bottom Pattern - MonthlyMJ ETF (cannabis) has potentially double-bottomed over the past 6 months (october 2023 to march 2024).

Either a possible tradable bounce, or a long-term rally could occur over time as more countries partially legalize cannabis and marijuana.

Long-term resistance price targets would be: $6, $9, $14, $18.

Support price targets below would be $3, $2.50, $2, $1.

Cannabis companies and stocks are highly sensitive to Government Laws & Regulation changes, Fundamental Catalysts, and Corporate Earnings.

Tilray's 8% Surge: High-Risk Gamble or a Path to Redemption?Tilray Brands (NASDAQ: NASDAQ:TLRY ), once a shining star in the cannabis industry, finds itself in turbulent waters as its stock price struggles amidst a series of setbacks last week. Despite aggressive growth through acquisitions, Tilray's stock has plummeted, trailing behind major indices and leaving investors questioning the efficacy of its strategy.

The Acquisition Frenzy:

Tilray's growth trajectory has been marked by a flurry of acquisitions, positioning itself as a major player in both the cannabis and alcoholic beverages markets. From snapping up eight beer brands from AB InBev to acquiring Truss Beverage from Molson Coors, Tilray seemed determined to diversify its revenue streams and mitigate the inherent risks of the cannabis industry.

Revenue Growth vs. Mounting Losses:

While acquisitions have propelled Tilray's revenue growth, with annual revenues soaring from $179.3 million in 2019 to over $700 million in the trailing twelve months, the company's bottom line tells a different story. Net losses have ballooned, surging from $36.1 million in 2019 to over $1.4 billion in the same period, raising concerns about the sustainability of its expansion strategy.

Cannabis vs. Beverages: A Shifting Landscape:

Despite its roots in cannabis, Tilray's focus seems to be shifting towards alcoholic beverages, evident in its recent revenue breakdown. While the cannabis segment still contributes significantly to its revenue, the beverages segment is gaining ground, a trend likely to continue as integration efforts persist.

Challenges on Multiple Fronts:

Tilray ( NASDAQ:TLRY ) faces an array of challenges, both domestically and internationally. In Canada, its home market, saturation is squeezing margins, while regulatory hurdles in the United States pose obstacles to expansion. Even in Germany, touted as a potential growth market, barriers loom large, underscoring the uphill battle Tilray faces in realizing its ambitious revenue targets.

Stock Price Forecast:

Tilray's ( NASDAQ:TLRY ) stock price paints a bleak picture, with a strong downward trend persisting throughout the year. Despite its downward trend, Tilray ( NASDAQ:TLRY ) stock was up 8% in early market trading this could be a sign of a bullish breakout after the stock's poor performance last year. Technical indicators suggest that further downside could be in store, with key support levels looming as potential targets.