Cannabis Crazy Coin Numbers (100,000+% Profit Potential)Welcome to this update analysis on CANNBTC Let's get right to it!

Cannabis would be equivalent to a rise of 100,000%~ Therefore, if 0.00000247 can hold support line, things could get very interesting,

and cannabis coin is one of the small market cap and one huge boost.

CANNBTC Targets:

0.00000135

0.00000210

0.00000247

For more content, be sure to hit that follow button

TRANSPARENCY Strategy!

This information is to be used for educational purposes only

Cannabis

But... But.... We were supposed to get high...Long of course on MJ, but if we don't keep the support, we're in for a crash and a nap.

HMMJ going back down to 15$The cannabis market is a volatile one.

HMMJ has risen quite a bit in the last couple weeks and is now overbought. It's time to come back down at around 15$.

Selling will start after they pay out the dividends on April 11.

I'm LONG in the longterm!

But taking profit here makes sense.

RQB Trend Line (Close Watch)Hey guys, so I'm a young eager investor and I've taken up technical analysis as my focus. RQB is not a stock I place much value in through technical analysis.. as it's a speculative. For instance HC licenses change everything.

However, I want you to take a look at the daily volume on this stock.

Notice there's been a whole lot more buying volume (green), than selling (red). That's a good thing to see, especially before a breakout... those HC licenses are gonna be printed on shets of green paper.

In addition, I marked a trend line about a month ago... and we're still bouncing off of it.

We're getting close to the line... so it will be interesting to see if it continues to trend downward or if it's gonna be increasing finally haha.

Cann Group - Will it breakout ?The Cann Group is involved with medicinal cannabis from cultivation to distribution/supply of medicinal cannabis. It has the potential to breakout of the long term down trend and a move above the previous support/resistance around $2.50 (red dotted line) will provided a potentially bullish move. Wait and watch for a setup.

CGCTightening hourly range

-hourly support: 43.66, 43.35

-hourly resistance: 44.85, 45.35

-if hourly breaks bullish, look for a daily lower high compared to 48.60

-if hourly breaks bearish, next support at 42.91 then 41.68

CO2 GRO Inc. Blue Sky Breakout!Update to my previous analysis on GROW. I've been following GROW for over a year now, and sp had been stuck in the 0.10-0.30 range. With a close above 0.40 the breakout from previous trading range is evident. Highest share price since their CO2 startup took over, so we are looking at a blue sky breakout. Sustained bullish volume, with good support being built on the way up.

Lot's of catalysts coming up for this company, financials end of April with $1.5 mill in cash from warrants in late fall. Aggressive expansion with many new contracts being signed, projected $10mill revenue run rate by end of 2019. Market cap only $27mill. Still an early stage start up with great potential, time ot get in is now.

CGC with a massive indecision on the weekly.When this thing breaks, I would expect a massive move either way. What's it going to be heading towards summer ? Is Canopy primed for another leg up after this gigantic bull flag ? Or is it going back down ......what do you think ?

ACB Short- catching large corrections bull marketACB is a great stock. Super cheap for amount they produce. I'm long in the long run

But I think there's substantial opportunity to make profit by shorting the stock as it experiences corrections in it's uptrend

Normally I wouldn't recommend timing a stock like this or trading against the trend, but it's not seeing 10% pullbacks on upward moves, it's seeing 50+ % corrections, which makes the strategy viable.

The macd indicates the stock is currently bearish, and if this correction follows the pattern of large pullbacks, we're about 1/3 into the move, leaving more room for upside than for downside- A nice KISS (Keep it simple, stupid) strategy

LIMIT: $9.90 (-5.50%)

STOP: $10.30

TARGET: $8.90 (+10.00%)

Beautiful Bullish Pennant EQ -Break coming!Topside resistance: 48 psychological, break could lead to previous highs 50-55 range, up to 15% profit potential, if not ATH.

Bottom support: 45 psychological & 43,71 previous Higher Low/trendline coming in. Break could lead to HL compared to 25.15, => further tightening EQ range on the Weekly.

Watch for volume when break occurs, in order to avoid fake-outs.

Good luck! ;)

If you had some value from my analysis, give it a thumbs-up & comment it, because the mechanism shows my analysis to other people then. Make also sure to follow me so you get notified on my analyses! I wish you a good trading! :)

Edgy is providing online education & tools only. We are not a financial advisor, nor do we hold any formal qualifications in this area. You're trading at your own risk. No matter what you do, please set your stop loss. Please be aware, that you can lose all your money on the online exchanges.

$AGRA.CNCSE:AGRA

Technical analysis shows consolidation happening at 0.55. Current forecast is continued sideways consolidation or a pullback for another two weeks. Demand will pick again in April with anticipation of big news. April price estimate is $0.80.

Will Aurora Cannabis Reach ATH soon ?The volume was quite impressive last week, smashing through the 8$ resistance and closing very strong above the pink trend line. What's interesting about this trend line is that you can extend it back 2 years when the price was under 1$ and it's been tested again and again, acting both as support and resistance. Next weeks we might see some follow through with resistance around the 10$, 11$ and 12$ levels, but more importantly the all time high is in sight. I don't know what's driving this surge for the past 2 weeks and I must admit I'm a bit skeptical. If for some reason there's a pullback that bounces on the pink trend line, it could be a good opportunity to make an entry. Other than that, I'll be careful as this stock and this sector can drop quickly, so this chart is more to help look for an area where buying could happen IF there's a sudden drop.

AURORA CANNABIS - Overvalued (PUT Position)i saw the green arrows as points of resistance, and its been rallying recently in general, but at those points the price dropped pretty significantly after each test. on the MACD chart u can see the MA flattening out which probably indicates that the bears r going to probably take control. the blue lines show the lines that its been tested at and the first major support is $9.42, the next major support is at $9.20ish if it breaks out. The RSI is nearing the tip which means that its overbought slightly which will signal a selloff by bozos. the trend has been doing so well recently but i rly think theres going to be a dip/correction before rallying again to new highs

FLAWS: My analysis was done a short time frame, will take into more consideration about having a longer period to draw on. However, my hypothesis still stands as the stock seems slightly overbought.

WLDCF is your ticket to capitalize on the Cannabis Bull Rally!

View This Email In Your Web Browser | Unsubscribe

Don't Miss Our Next Huge Winner...

Text 'GAINS' to '67076'

to have our Trade Alerts

Delivered Direct

to your Cell Phone.

(There is no charge.

Msg&data rates may apply.)

=====================

ICC International Cannabis Corp. (WLDCF)

Alert Price: $0.339

Chart Analysis

Investor Presentation

Website | Recent News

========================

Members,

In case you haven't noticed, the cannabis sector has been on quite the rally this week.

New Jersey legislators joined Democratic Governor Phil Murphy in announcing Tuesday a bill that would allow adult-use marijuana in the Garden State.

Shares of major cannabis companies rallied Tuesday after New Jersey politicians outlined plans to legalize the adult use of recreational marijuana in the state.

One such company operating in this space that could rally hard on this latest cannabis bull run is ICC International Cannabis Corp. (WLDCF).

Trading at just around $0.34 per share, we believe that WLDCF offers more upside than any other ticker in the sector.

Over the past three quarters, WLDCF has deployed an aggressive acquisition strategy, amassing a robust portfolio of vertically integrated cannabis assets and industry partnerships

WLDCF By the Numbers

110 clients representing approximately 39,100 pharmacies in 16 countries

19 licenses or cultivation, spanning three continents

2,400kg of CBD isolate produced in 2018

50.000kg of CBD isolate in 2019

740,000kg of forecasted dired cannabis production from outdoor cannabis cultivation

Over 2,700 cannabis strains

13 hectacres of optimal agricultural land dedicated to cannabis cultivation located in Funza, Colombia

16 acres of fertile agricultural land dedicated to industrial cultivation and CBD extractuib siturated within the Greek prefecture of Imathia

2,400 pharmacies included in their distribution portfolio of independent and corporate pharmacies across South Africa

55k sq/ft fully automated IMC-GAP, ISO:9001 and European GMP compliant greenhouse facility to be constructed in Denmark

With the predicted shortfall in supply and overwhelming demand for Cannabis in Canada, the industry appears poised to be growing at a breakneck pace.

According to Grand View Research, the legal cannabis market is projected to be worth over $140B by 2025. That’s a compound annual growth rate of over 30% during the forecast period.

Needless to say, the opportunity for those trading this Once-in-a-Lifetime Sector is huge.

And being the first of all the G7 Countries to legalize weed, Canadian Cannabis companies have the distinct advantage of taking their operations international before anyone else!

WLDCF is using this opportunity to their full advantage, and is rapidly making their footprint felt across the globe.

The worldwide legal cannabis industry is exploding!

WLDCF Is capitalizing on the rapid legalization of cannabis worldwide and the growth of the industry by growing equally as fast with an extensive global footprint that extends to many of those same new-to-the-market countries.

This is a true cannabis value play in our opinion.

We have yet to find a company operating in this sector as diversified and as global as WLDCF.

With many of the companies operating in this space trading at or near their all-time highs, WLDCF offers traders the rare chance to build a position in this red hot sector at what we believe is still a ground-floor price.

About ICC International Cannabis

ICC International Cannabis, through its subsidiaries, has operating assets and is developing a world class platform. Most importantly, this platform will be used for cultivation, extraction, formulation and distribution across the globe. As a result, ICC has operations in the United Kingdom, Denmark, Poland, Switzerland, Germany, Macedonia, Bulgaria, Greece, Italy, Portugal, Malta, Colombia, Argentina, Australia, South Africa and Lesotho.

WLDCF's Asset Portfolio

German medical Cannabis import license, three-year supply contract to import 35,000 kg of medical cannabis, 165 hectares of CBD cultivation operations, annual production of over 2,400 kilograms of CBD isolate, German indoor medical THC cultivation license application;

820,000 square foot Ebersbach facility located just outside of Dresden, Germany:

Replacement cost of 110 million euros;

Of the many applicants to apply for German medical THC cultivation licenses, only two have a completed facility, and of those that do, the largest is 14,000 square feet or 1.7 per cent the size of the Ebersbach facility

Danish medical THC cultivation and manufacturing license:

Stage A will include a 49,600 square foot cultivation unit, as well as a production and processing structure. All structures scheduled for construction have been designed to comply with EU-GMP standards;

100 acre land package;

Engagement of leading greenhouse engineering and manufacturing firm, Azrom;

No medical cannabis production cap or quotas;

Access to skilled agricultural and manufacturing labor force;

Local plant breeding and genetics expertise; and

Well-financed health care system

Distribution or supply agreements with over 39,000 corporate and independent pharmacies, augmented by various value-added services, including strategic procurement, warehousing, product registrations and regulatory representations;

155 metric tonnes of extraction-ready hemp inventories, resulting in near-immediate access to superior CBD concentrates;

Exclusive supply agreement for the delivery of 400 metric tonnes of certified organic hemp from a licensed Croatian producer;

First European Guaranteed Issue Medical Cannabis Coverage:

First of its kind transformative coverage for cannabinoid therapeutic treatment via the BuyWell Care platform;

Online medical cannabis coverages utilizing a proprietary pricing methodology;

Over 500 million potential consumers; \u2028

Over 1.6 million health care practitioners; and, \u2028

Annual healthcare expenditures of $1.79 trillion in 2018. \u2028

CBD Health and Wellness e-commerce marketplace;

Catalog of 430 proprietary genetics, seeds and strains;

Polish hemp processing and extraction license:

Operations are currently producing CBD distillate, isolate, bulk oils, and tinctures;\u2028

Access to over 850 acres of premium hemp crops, estimated to yield up to 6,800 tons of material for CBD extraction;

Existing extraction and manufacturing facility; and,

Existing sales agreements across various EU member countries

60,000 square foot Swiss cannabis cultivation facility, proprietary genetics portfolio available for export, THC distillate import capabilities and pending material revenues from Haxxon AG operations;

Leading candidacy for one of seven medical cannabis licenses to be issued by the Italian government, as well as an pending ownership interest in a joint venture to produce cannabis products;

Licenses for medical cannabis cultivation, manufacturing, distribution, transport, research and import/export in the Kingdom of Lesotho;

Rich soils, ideal climate, skilled agricultural work force, low-cost labor and access to key infrastructure;

300 days of sunshine annually;

First African nation to legalize medical cannabis; and,

Ideal climate for low-cost greenhouse cannabis production \u2028

Supply agreement to provide cannabis products to over 2,800 independent and corporate pharmacies across South Africa;

Maltese license to manufacture finished-dose medical cannabis;

Portuguese hemp cultivation and processing license:

Notable importer of EU licensed hemp seeds;

Access to 400 acres of fertile agricultural land located in the Castelo Branco region of Portugal; and,

Progressing towards a full spectrum cannabis license;

Colombian licenses for THC/CBD production, extraction and export, as well as pending access to a European Union good-manufacturing-practice-certified API facility for cannabis distillate processing;

90-per-cent working interest in a Greek industrial hemp license and medical cannabis pre-approval support letter:

16 acre land package situated within the Greek prefecture of Imathia;

Exclusive agreement with an existing Macedonian licensed facility, permitting the cultivation, manufacturing, extraction and export of medical cannabis:

3,000,000 square feet of cultivation space built under glass; one of the largest impending European cannabis facilities;

30 hectare land parcel in Valandovo, Macedonia

Licenses in Bulgaria for the production, manufacturing and export of both hemp and medical cannabis;

Leading candidacy for a United Kingdom-based medical cannabis import license;

Leading candidacy for an Australian late-stage medical cannabis;

Leading candidacy for the first Argentine federal medical cannabis license and existing supply agreements for CBD products;

Eugene Beukman, Chief Executive Officer and a Director of International Cannabis, stated:

“International Cannabis is equipped with an unparalleled ability to supply the overwhelming demand for cannabis and cannabis extracts in Europe. With $1.3-trillion in annual forecasted health care expenditures, government subsidized European health care systems are primed to become the largest single market for cannabis in the world, as the liberalization of regulations in favor of plant-based medicine continue. International Cannabis is uniquely positioned to capture significant market share, as the European THC and CBD industries continue to mature. We have tactically secured cornerstone assets Denmark and Germany- jurisdictions armed with broad insurance coverage, affording the Company the ability to realize substantially higher margins, while insulating our operations from margin compression”.

The Company’s acquisition strategy, including its proposed transaction with Wayland Group, further reinforce the ICC’s corporate mandate of:

Optimizing its upstream, downstream, and distribution capabilities;

Integrating operational best practices into its medical plant production, extraction, active pharmaceutical ingredient isolation and finished dose manufacturing operations;

Executing upon its first-mover advantage in rapidly maturing jurisdictions;

Providing a robust suite superior quality products; and,

Championing the European consumer’s THC/CBD retail experience.

Mr. Beukman, continued: “Our extraction-ready hemp stockpiles, deep-seated understanding of regional business practices and vast Pan-European distribution footprint safeguards our ability to maximize opportunities in Europe’s emerging CBD and THC markets. The Company continues to place particular emphasis on furthering its operations in the European and LATAM regions and will look to execute an assertive acquisition strategy focused on Asia Pacific theater over the upcoming quarter”.

As you can see WLDCF is well positioned to monetize the cannabis sector from every possible angle!

You would be hard pressed to find a company better positioned for growth in this multi billion dollar market than WLDCF.

Recent Developments

International Cannabis to Integrate Global Distribution Management System With Leading Cannabis Dispensary Point of Sale and Security Platform

The Company announced the formal integration of its Global Distribution Management System; the International Cannabis Exchange (“Intercannex”) into leading cannabis technology and security provider, Helix TCS, Inc. (“Helix”) (OTCQB: HLIX).

The Companies will integrate Intercannex with Helix’s industry-leading point-of-sale (“POS”) system, BioTrackTHC. The unified platform will leverage the technological capabilities of Intercannex, a secure Electronic Cannabis Market (“ECM”) to enable superior pricing, improved regulatory reporting and reduced costs. BioTrackTHC ranks as the #1 revenue-generating platform within the highly competitive dispensary POS category and has processed US$18 billion in cannabis sales since inception.

As International Cannabis rapidly advances towards production in nine separate jurisdictions, the company will leverage Intercannex and BioTrackTHC to:

Manage and scale mission critical supply chain, inventory, auditability and compliance infrastructure;

Optimize upstream and downstream product pricing capabilities;

Incorporate advanced cannabis track/trace and security solutions into its existing production facilities;

Facilitate real-time transactions of wholesale cannabis products between licensed operators in regulated markets;

Compile actionable industry data resulting in superior data-driven marketing and product decisions;

Effectively augment existing distribution partnerships, as well as implement dispensary/retail loyalty programs;

Realize accretive revenues from the high growth ancillary cannabis services market;

Instantaneously monitor product availability across 16 countries and four continents, enhancing ICC’s cannabis procurement capabilities; and,

Securely record QA lab results and archive strain analysis;

Eugene Beukman, Chief Executive Officer and a Director of International Cannabis, stated:

“As the next phase of cannabis normalization emerges, the ancillary cannabis services market is set to experience exponential growth. Through the integration of the unified Intercannex/BioTrackTHC platform into ICC’s expansive distribution channels, the company is well positioned to capture considerable market share; while ensuring compliance through each stage of the cannabis value chain. With vertically integrated operations countries across four continents, International Cannabis is at the epicentre of global cannabis industry. Intercannex/BioTrackTHC affords us a secure, centralized platform to manage and effectively scale our global cannabis cultivation, production and end-distribution capabilities.”

Market Outlook

According to Grand View Research, the legal cannabis market is projected to be worth over $140B by 2025. That’s a compound annual growth rate of over 30% during the forecast period.

Arcview and BDS state that the South American medical cannabis market may grow from $125 Mil 2018 to $776 Mil in 2027. Meanwhile, they forecast Australia’s legal cannabis market to grow from $52 Mil in 2018 to $1.2 Bil in 2027, the 5th largest in the world—WLDCF has invested in the growth of the global cannabis market on both continents with holdings in Australia and in South America (Colombia and Argentina).

Worldwide legal cannabis spending hit $12.2 Bil in 2018, and according to Arcview Market Research and its research partner BDS Analytics, the industry is projected to grow another 38% to $16.9 Bil in 2019. This is a significant jump from $9.5 Bil in 2017—just two short years ago.

With twice as many citizens as the United State and Canada combined, Europe could become the world’s largest legal cannabis market over the next five years if every or most of the continent’s roughly 50 nations introduces legislation and regulations, according to a new report.

The second edition of the European Cannabis Report – produced by London-based advisory group Prohibition Partners – suggests that with 12% of the continent’s 739 million people being either “irregular and intensive” cannabis consumers, Europe’s annual:

• Overall marijuana market will reach 56.2 billion euros ($66.8 billion)

• Potential medical marijuana market will hit 35.7 billion euros ($42.8 billion)

• Potential recreational market value will reach 20.5 billion euros ($24 billion)

• Estimated hemp market will hit 48.9 million euros ($57.2 billion)

This is all without including the ancillary business and secondary market.

The report notes that several European countries have passed medical marijuana legislation in the past couple of years, and there is a “50%” chance a few countries could pass recreational laws in the next few years.

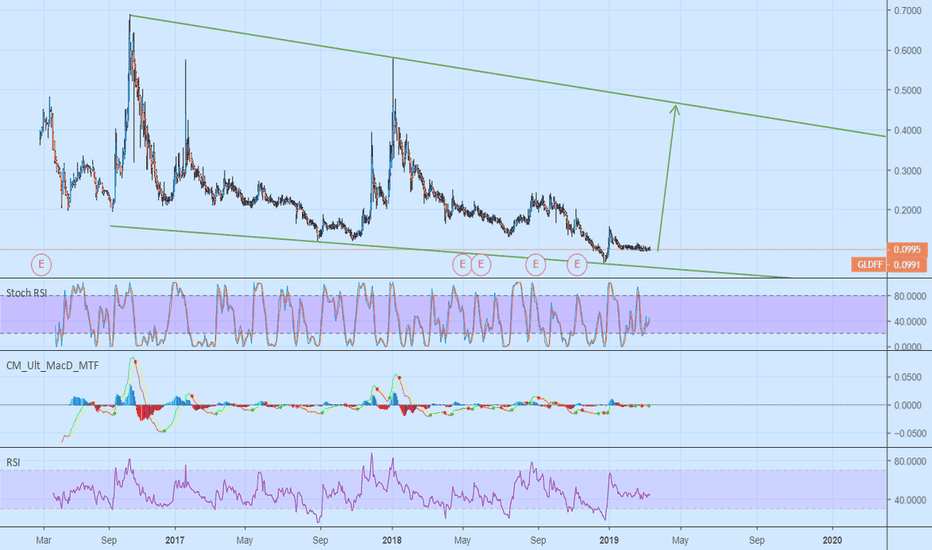

Technical Analysis

Trading at just around $0.34 per share, we believe that WLDCF offers more upside than any other ticker in the sector.

The Company is trading well below it's 52-week high of $0.5250.

A run back to that high would net our traders an over +54% ROI!

We've done our very own chart analysis on WLDCF an see the potential for a move of around +70%!

As we stated above, this is a true cannabis value play in our opinion.

We have yet to find a company operating in this sector as diversified and as global as WLDCF.

With many of the companies operating in this space trading at or near their all-time highs, WLDCF offers traders the rare chance to build a position in this red hot sector at what we believe is still a ground-floor price.

As such we are urging everyone to start their research now, add it to the top of their watchlist, and consider building a position tomorrow morning at 9:30AM EST.

(*Remember to use a Stop-Loss Order or basic Limit Order to protect your gains, as well as limit possible losses.)

Best Regards,

The TopMarketGainers Team

Don't Miss Our Next Huge Winner...

Text 'GAINS' to '67076'

to have our Trade Alerts

Delivered Direct

to your Cell Phone.

(There is no charge.

Msg&data rates may apply.)

DISCLAIMER

This newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. This newsletter is owned, operated and edited by both MJ Capital, LLC and PennyStockLocks, LLC. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” refers to MJ Capital, LLC and PennyStockLocks, LLC. Our business model is to be financially compensated to market and promote small public companies. By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature, and are therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis of making investment decisions, and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. MJ Capital does NOT own any shares of the companies mentioned herewithin, nor intends to buy any in the future.

MJ Capital’s business model is to receive financial compensation to promote public companies. We have been compensated five thousand dollars by a third party to conduct investor relations advertising and marketing for WLDCF. Any compensation is a major conflict of interest in our ability to be unbiased. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. The investor relations marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, MJ Capital often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice.

PHOT - GrowLife breakout potential.Consolidated triangles ready for breakout. New trend reversal in place. This company sells growing products such as lights for cannabis industry. This whole sector is ready to breakout.

Information purposes only. Not advice or recommendation. This is my humble opinion. I have 20,000 shares at $0.00835.

Aurora Cannabis - Bullish outlook BUT....Good night everyone,

Quick look at ACB stock

As we can see on daily chart, bullish outlook, but we are reaching a resistance level and that huge volume bars concerns me.

I expect some drop on the next days and a good place to buy is at 7~7.50 zone (demand zone) IF price action shows rejection on it like a low test candle.

The suplly waves are weak so far (just check the volume on the down waves) so i believe this stock will touch 10.0 again soon and maybe a new ATH at 14.0 level.

This Trading Idea is to be used for educational purposes only. This idea does not represent financial advice and its NOT a signal. You should trade based only on your own technic and knowledge.