Cannabis

$HIPH Breaks out on Massive coverage by Respected MJ News SourceHYDRO INFUSED CBD WATER: Huge Potential Benefits For Millions of Athletes

NEW YORK, Sept. 11, 2018 (GLOBE NEWSWIRE) -- Cannagreed.com News Commentary

American Premium Water, Corp. (OTC:HIPH) BREAKING NEWS: LALPINA HYDRO CBD WATER can go a long way towards administering doses of cannabinoid (CBD) for those who deal with chronic ailments such as, inflammation, pain and anxiety disorders. There are also huge potential benefits for athletes who may not only use LALPINA to hydrate, but also to minimize the inflammation, pain, and stress that physical activity places on the body.

The Company began selling its LALPINA Hydro CBD product August 27th on its website. The Company has been able to procure a domestic manufacturer who can provide the supply to meet the growing demand of LALPINA Hydro CBD.

“With a new product like LALPINA Hydro CBD, there were some teething issues in the ramp up to production. This product is a market frontrunner right out the gate considering the lack of a comparable product currently on sale. Unlike the other CBD waters that are currently at retail, the molecular structure of LALPINA Hydro CBD allows for greater bio availability which leads to a greater & quicker absorption rate compared to regular CBD oil or CBD water. The Company will need to use less CBD to create a greater benefit, which will allow for a higher gross margin per unit,” added CEO Ryan Fishoff.

LALPINA HYDRO CBD could improve workouts by providing hydration and muscle relief. Several studies have shown CBD could provide workout recovery health benefits thanks to its analgesic, anti-inflammatory and neuroprotective properties that include:

Anti-Inflammatory

Muscle Spasm Relief

Protection of the Heart, Lungs and Brain

Reduction of Nausea

Increases in Appetite

Sleep Aide

Recent reports indicate that the CBD market is estimated to grow 700% by 2020. Hemp Business Journal, a market intelligence research firm, projects that the CBD market will grow to $2.1 billion by 2020, an astronomical jump in value compared to the 2017 CBD market value of $202 million. Athletes, amateur and professional, are a segment that is helping drive this exponential growth. Research has shown that in addition to physical effects, CBD could have positive effects on well-being, reduction in anxiety, and a tangible impact on mental recovery, all traits that have appeal to athletes at all levels and could lead to CBD infused water becoming part of athletes regimen.

The Company has been working with The Brewer Group (www.thebrewergroup.com) and CEO Jack Brewer to help recruit current and retired professional athletes to promote LALPINA Hydro and LALPINA Hydro CBD beverages. Studies have shown that there are many potential health benefits from ingesting hydro nano infused products, including short term benefits to enhance workouts and aid in recovery. The Company is also working with Mr. Brewer on initiatives with current and former NFL players with the Company’s LALPINA Hydro CBD beverage. Mr. Brewer, a 6-year National Football League veteran and CBD proponent, has the network to assist the Company’s efforts to educate the public about the benefits of hydrogen and hydrogen infused CBD. Mr. Brewer was instrumental in getting LALPINA placed at events and parties at the Super Bowl in Minneapolis earlier this year. The Company and Mr. Brewer see the potential for LALPINA Hydro CBD to be an all-natural replacement for opioids, which would benefit retired players, whose struggle with opioid addiction has been well documented. And with the removal of CBD from the World Anti-Doping Agency’s list of banned substances, in addition to the imminent passage of the Farm Bill Act, large scale CBD use by current athletes is not very far away.

“Working with Jack (Brewer) and the Brewer Group has been great for the Company. He has opened many doors for the Company, specifically in distribution and exposure. I am excited to work with all the athletes that are in his network to promote and educate the public on the benefits of CBD infused beverages. Incorporating retired and active athletes will be a game changer in my opinion, and I’m excited about all the content that Jack’s team will be creating to help us achieve this goal,” added Mr. Fishoff

Based on the demand that the Company has received for it’s LALPINA HYDRO CBD beverage, the Company has had exploratory discussions about developing a THC infused hydrogen infused beverage. Developing a THC infused beverage would allow the Company to enter the exploding cannabis market.

www.otcmarkets.com

Next Leg up on $HIPH Confirmed Closing the Week Nicely GreenIt seems the market is finally realizing the full potential of CBD/Hemp products under the cornucopia that is $HIPH

The website which is being fully revamped and updated will be showing a line of products that may include other products from acquisitions $HIPH has already undertaken and brought into the company's fold and future acquisitions. The CEO Ryan Fishoff has been working dutifully to get the company up and running again, future uplistments to Pink Current then OTCQB along with several other product lines in store which will run into the CBD and Hemp niche markets.

I predict a very nice rebound here next week and possible new Highs as we head into the future updates and of course the impending MJ Rush later this year.

Love Terra Tech. and all they've got going!Downward pennant, bearish reversal pattern. Likely to bounce up in the coming month.

This company is strategically placed to quickly take advantage of further legalization here in the U.S. and outside as well. Check out their other enriched food products besides cannabis as well! They've got a bunch of hydroponic food farms that are prepped for cannabis when legalized in those areas. Love this company, and going to be holding for a long time.

www.terratechcorp.com

MPXEF is bargain compared to CRON, TLRYMPXEF is now the third largest publicly traded cannabis operation by quarterly sales. Only WEED and ACB have higher sales. It leaves CRON, TLRY, and TRST in the dust when it comes to already-reality sales. It also trades at a nice discount to those other more famous names on a sales-basis. It also has not yet run much this MJ season. If you want something top-notch quality with very real revenues and profits, this seems like a good option.

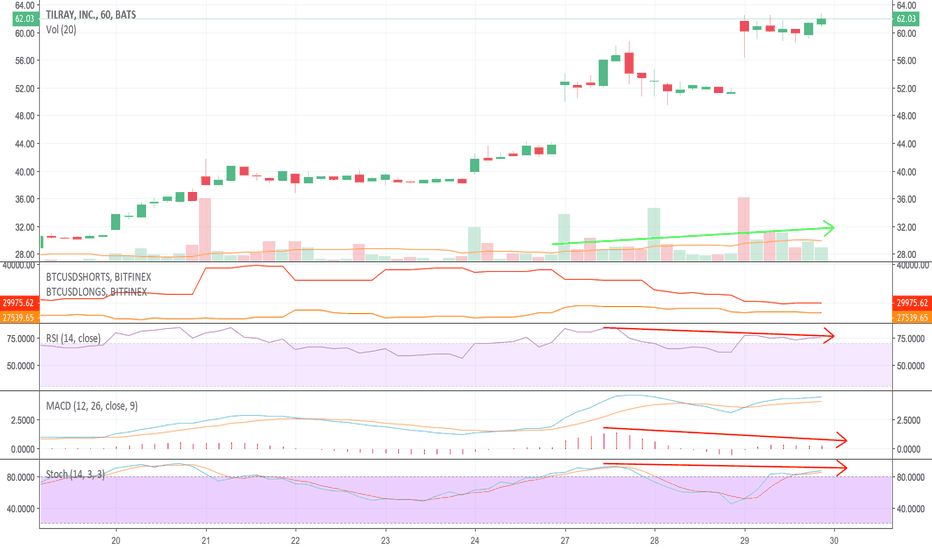

The pennant on the green flagpole is a continuation pattern. There are a million different ways you can draw this pennant and for some of them, it tried to break downward out of the pennant today. However, I like the strong bounce from that failed attempt by the bears. After taking a look at this, I'm buying some more at open.

Here are a few tweets/articles with useful further info:

- third largest by sales

- comparison to peers price-wise

- investor call and expansion plans

- more peer comparison and SS

- peer comparison

Long ALEF.ca (TSX)This cannabis stock is finally breaking out after an early entry and patience. Cannabis sector hot right now. $CGC $MJ

APHQF - APHRIA turning up TSX: APH

OTC: APHQF

Aphria stock breaking out of cup and handle for entry and weed growth as CGC, CRON, and other same sector are up 30% this week.

Entry in low $9.30-9.40 range. Been a busy week and missed ideal entry.

Big turning points coming for CNXXFAcquiring one of the largest extract companies in California. 8/28/18 they are due to report financials. Time to enter a long position before these guys start reporting their cash flows. Interview done on 8/1218 can be found here.

www.youtube.com

EVIO breaking up isn't hard to do in this industryEVIO

* Fib retracement bottomed at $0.70US and now at 0.79 uptick

* Uptick started and CCI moved up on day chart to buy

* Cannabis Industry getting traction with CBD sales

* Test lab approvals CA, OR (trace metals, solvents, pesticides, THC)

* 50% partnership with Keystone Labs Canada

Viewers come to own conclusion.

SHOP - The w[E]ed-[Commerce] solution from CANADA So you should know this buy now

www.cbc.ca

And if you are from Ontario and over 19 years old, I bet you also know what happens on October 17, 2018.

www.ontario.ca

Shopify Inc. (Nasdaq: SHOP) is a company that’s about to make billions from the end of marijuana prohibition without ever touching the leaf.

It’s the online retailer – not Amazon.com Inc. (Nasdaq: AMZN) – that just inked a contract to provide an e-commerce platform for a major Canadian cannabis retailer.

You see, when Canada goes fully legal later in summer 2018, pot companies will want to sell (and their customers will want to buy) their wares online. Makes sense.

And the great news for investors in Shopify? The Ontario Cannabis Retail Corp. (OCRC) – the government agency in charge of sales in the province – is relying on Shopify, and only Shopify, to make it happen.

That’s going to be a huge boon for cannabis investors. Ontario is home to 13.6 million people, with bustling Toronto and its financial sector at the heart of the province.

That’s the perfect place to begin cashing in on Canada’s legal weed market, which Deloitte says could hit $8.7 billion over the next few years.

But that’s really just the beginning for Shopify.

This tech-forward company develops the kind of sophisticated software that allows small retailers to plug into e-commerce platforms like Amazon and sell their stuff.

With Shopify’s platform, they can manage orders, collect sales dollars, and send out emails to buyers. Or, if they prefer to go it alone, Shopify can help small retailers build their own online storefront, handle multiple sales channels, and plug into social media for customer outreach.

That business model alone qualifies this as a solid choice for investors. Its sales grew an average 85% over the past three years, compared to 26% growth for Amazon during that stretch.

Now, OCRC has picked to exclusively use Shopify’s e-commerce platform for cannabis sales online. Shopify’s technology will also be used inside OCRC’s Ontario Cannabis Stores to process transactions and for digital kiosks displaying product information.

And Ontario is just the “first mover” here. Many of Canada’s other nine provinces are likely to follow the leader here in choosing the home-grown Shopify (which is based in Ottawa) as their e-commerce partner.

That could double Shopify’s total market opportunity there.

In fact, Quebec province-based grower Hydropothecary Corp. has already chosen Shopify to help it sell medical marijuana online.

Thanks to moves like the OCRC deal, Shopify’s total addressable market stands to exceed $50 billion…

As a side note, just imagine if they integrate cryptocurrencies

CANN - The one stop shop for legal weedWith General Cannabis Corp. (OTC: CANN), you are investing in the end of marijuana prohibition with a company that quite literally does it all.

This Denver-based firm is like a weed mutual fund.

It offers real estate and consulting services, dispensary security, and financing for cannabis companies. It also supports cannabis companies with brand development, product design services, and more.

General Cannabis also grows cannabis for its own sales and helps new producers get started in the business.

The company already has major clients in several states and is perfectly positioned to profit from the 15 states set to legalize marijuana this year.

Anybody looking to enter the cannabis business at any level may have little choice but to do business with the firm.

The security component of General Cannabis’ operations, Iron Protection Group (IPG), represents a compelling opportunity.

You see, as long as federal cannabis drug statutes remain inconsistent with state cannabis laws, most banks – especially federally insured ones – refuse to handle transactions from cannabis retailers and growers. Those cannabis operators have been forced to rely almost exclusively on cash to transact business.

And that’s left a tremendous need for security, which is where the IPG comes in.

While banks will likely eventually start accepting commercial deposits from weed companies, a growing number of cannabis-based enterprises will still need to secure their stores and move their cash. And agricultural security, especially for highly remunerative strains, will remain a challenge for growers and a serious long-term growth opportunity for IPG.

So right now, IPG’s business is tied to the planting and harvesting cycles of the crops.

That cyclicality affects earnings, which wax and wane with the seasons. But that’s why smart companies diversify. General Cannabis can offset declining earnings in one division via growth in another.

General Cannabis is essentially a “one-stop shop” for ambitious weed startups. One of its clients may begin working with Chiefton branding, then hire a Next Big Crop consultant, and then start working with IPG.

Sell off with a planThis little stock had a good run recently. The difference in a little profit taking and a falling knife is fear. Follow the trend but I see a bounce coming with any little catalyst

Troubling signs for WEED continueFake out Breakout has reversed and rising wedge pattern has failed as well. This should negatively impact the whole space until investors get some fresh new reason to get excited. legalization in Canada and other countries has shown slowed progress and buyers don't really seem to excited to pile in a these elevated prices.

$ACB buyers are searching for a cheaper entry - dilution is goodWhile TSX:ACB is sitting at a new support of $7 - buyers are looking for a new avenue while production lags behind the Oct 11th date.

While FOMO locks into place we will see a new entry around $5.50 and maybe as low as $4 before the new year and before production starts.

LEAFers are still waiting for new shares.

Dilution is good.

another CGC pennantcannabis has been good to me... let's see if the trend continues and she goes higher :)

ACB see's a dip to $7.92 after announcement about MedReleaf" ACB announces it has received shareholder approval at a special meeting, held today, for the issuance of shares in consideration for the planned acquisition of MedReleaf Corp. ("MedReleaf"), a well-known Canadian Licensed Producer based in Markham, Ontario that delivers premium medical cannabis products to domestic and global markets, and compelling brands to the adult-use recreational market."

Dillution, is a fact of company issuing shares for operating expenses, in this case it's a merger.

There won't be a dillution, more shares will be issued and capital value of company will increase. So, currently 4.2bln, and it will be 7.6 bln, about the same as Canopy. It's the reason why Canopy is declining, because Aurora is bigger now.

Leaders in the industry get higher p/e and share price as result... soon will be back at $9. There's some selling by Medreleaf are going on Aurora side, it's a reason, why we can't push back above 50 days.

More Information about the Announcement here:

Industry-leading scale: Funded capacity will increase to over 570,000 kg of high-quality cannabis per year, to be delivered through nine facilities in Canada and two in Europe

Low production costs and industry-leading yields: Aurora's automated 'Sky Class' greenhouses are expected to deliver industry-leading efficiencies and ultra-low production costs of well below $1 per gram, delivering sustainably robust margins. MedReleaf's high-yield cultivation techniques are expected to further enhance productivity and reduce costs across the combined entity's facilities.

International distribution: Aurora has established a strong and rapidly growing footprint in the international medical market. The combined entity is now well-positioned to rapidly gain market share in a number of significant markets. Most notable among these, is the European Union, which will have in excess of 400 million people following Brexit.

Expanding brand leadership: Aurora, CanniMed and MedReleaf represent three well-established medical cannabis brands, and a growing portfolio of premium consumer and wellness brands including San Rafael '71, Woodstock, and AltaVie that are backed by detailed consumer and marketplace insights and advanced analytical frameworks. This brand leadership positions the combined entity well to drive accelerated growth through its existing distribution channels for the domestic medical and consumer markets, as well as the international medical markets.

Scientific leadership: Each company is actively engaged in clinical trials and medical studies, which has resonated strongly with the international medical community, driving above-average prescription rates and referrals. Further, both companies have developed considerable expertise in cannabis plant genetics, enabling the development of new cultivars with specific traits for a variety of domestic and international markets, as well as strains optimized for automated cultivation.

R&D: The combined company will have an industry leading Science and Research & Development team that includes approximately 40 PhDs and MScs. Both companies have a proven track record in developing new products, adopting new technology throughout the value chain, and integrating innovations from third parties. Combining these capabilities will accelerate product development and technology adoption, creating strong, defensible competitive advantages, including, management believes higher-margin offerings to drive above average profitability.