MSOS Long with 150% Upside - Cannabis Rescheduling Catalyst💠 Catalyst : Cannabis is currently classified as a schedule I drug alongside heroin, bath salts, and synthetic opioids that kill thousands every year — all while being safer than Tylenol and legal in over half the country. Cannabis is likely to be rescheduled to a schedule III drug soon after Terry Cole is confirmed as the head of the DEA. The vote to confirm him is expected to take place...TODAY

As a schedule I drug, cannabis companies can’t deduct regular business expenses for tax purposes, have limited access to banking, must transact with customers in all cash, and US multi-state operators are unable to list on the major US exchanges.

Terry Cole will be confirmed as the new head of the DEA, and when he is confirmed, the stalled process to reschedule cannabis from a schedule I to a schedule III drug should resume. If cannabis is rescheduled, that will pave the way for further research, destigmatize it, and open the door to banking and uplisting of US multi-state operators to the major exchanges in the near future.

This trade capitalizes on the fact that investors are not positioned for reform and further positive catalysts. The worst-case scenario is priced into the MSOS ETF, and when good news on rescheduling hits the tape, that should start a NEW Bull market in the MSOS cannabis stocks.

💠 Technical Setup:

Bear Market

• Multi-year bear market throughout the entire Biden administration on promises to reschedule that were never followed through on

• Capitulation when Trump won the election on the prospect of potentially another 4 years of no reform

Bearish to Bullish Technical Transition!

• LT Stage 1A Bottom Signal (Price > 50D SMA)

• ST Stage 2A Breakout (First day Price > 10D EMA and 20D SMA)

• Hourly Chart – Breaking out above Weekly Value Area

• Daily Chart – Trading above the Monthly Value Area

• Overlapping prior monthly value areas in sight!

• VPOC in sight!

• Weekly Chart – Targeting a retest of the Yearly POC

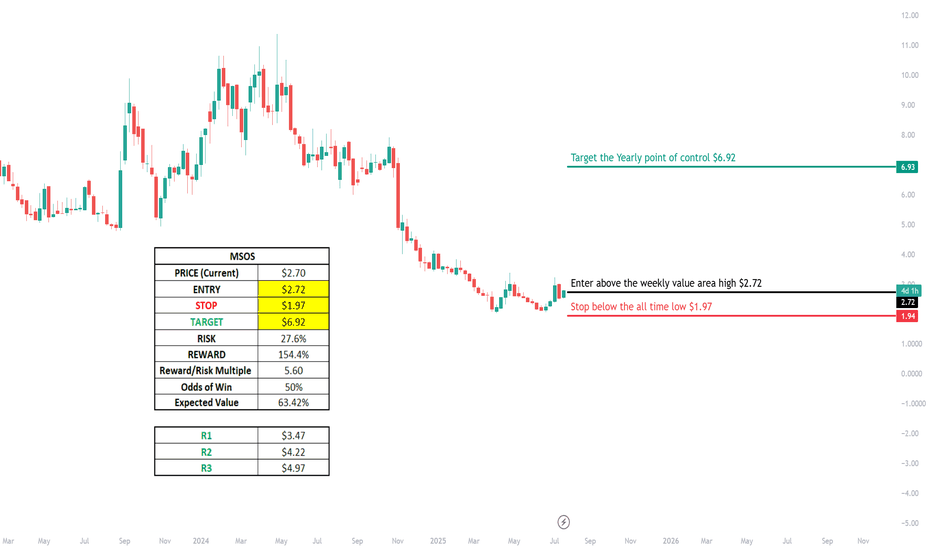

💠 Trade Plan

ENTRY: $2.72 (Break above weekly value area high)

STOP: $1.97 (Below the prior all-time-low)

TARGET: 6.92 (A retest of the yearly point of control from 2024)

RISK: 27.6%

REWARD: 154.4%

R/R Multiple: 5.6X

Probability of Win: 50%

Expected Value: 63.42%

Cannabisstocks

Curaleaf: Target Zone in SightIn small steps, the CURA stock continues to move upward – however, we primarily interpret these movements as the internal structure of the downward wave v in orange. Therefore, the final low of this wave should soon be marked within the orange Long Target Zone between C$0.82 and C$0.37. Upon completion of wave v, the overarching wave II in beige should also end. Once this foundation is laid, a long-term upward movement should begin – initially driven by wave 1 in turquoise, which should carry the price above the resistance at C$4.93.

Innovative Industrial Properties: Low AheadThe stock of Innovative Industrial Properties managed to stabilize somewhat at the upper edge of our green Target Zone (coordinates: $53.48 – $16.80) but should soon initiate the next downward impulse. In the short term, we expect a final corrective movement deeper into our green Target Zone to establish the low of the overarching wave in green. Once the wave low is settled, the impulsive wave in green should take over and carry the stock beyond the resistance at $137.90.

$HITI - Rising with the tide, BIG MOVE INBOUND! High Tide - NASDAQ:HITI 🌊

Daily Chart Analysis:

-Green H5 Indicator

-Bullish Falling Wedge breakout inbound

-Volume Shelf Launch

-Price GAP filled before heading higher

-Weekly chart still intact and looking great

-Weekly Williams Consolidation Box thriving

🔜🎯$4.15

They know this is where the Liquidity Zone is I am bullish on Pot Stocks here but I believe a shakeout is in order before the next bullish impulse and the bear is dead. This clear "support" line if broken will provide ample liquidity for big fish to get in as there are likely many stops and much fears below this trend line. I think this will likely mean a broader pot stock dump before we can finally have a new bull market. Good luck.

Philip Morris: New Motivation!Philip Morris has gained new motivation, stretching visibly higher in its chart. Still, the price has more upward distance to cover before reaching our turquoise Target Zone between $119.47 and $123.80. Once the top of the turquoise wave B has been established there, the stock should sell off below the support at $82.95 and, afterward, into our green Target Zone between $77.61 and $62.42. The low of the green wave should then initiate a bullish trend reversal. However, we consider it 35% likely that the green wave alt. has already been finished. In this case, PM would surpass our turquoise Target Zone.

Bitcoin Quote 😶🌫️Ladies and Gentlemen,

Today, I want to share with you a story about the world of trading investments. It's a realm filled with highs and lows, truth and deception, clarity and confusion. In this game, the reality is often obscured by false signs and misleading indicators. But through it all, one thing becomes clear: it's just a game. A game of life.

We venture into this world with aspirations, hoping to make the right choices, to spot the genuine opportunities amidst the noise. But what is it all for? What are we trying to prove? At the end of the day, it's about who comes out on top, for the winner takes everything.

So, can we be winners or losers? The answer lies in our mindset. Losing happens when we give up, when we let go of our dreams and aspirations. As long as we persevere, we keep the possibility of winning alive.

As the great Winston Churchill once said, "Success is not final, failure is not fatal: It is the courage to continue that counts."

Embrace this journey, face the challenges head-on, and never let temporary setbacks define your future. Remember, every step you take, every effort you make, brings you closer to your goals.

Karma.

Biden Administration Proposes Major Shift in Cannabis PolicyThe Biden administration has taken steps to reclassify marijuana use as a less serious crime. This potential policy change, if finalized, stands to be the most substantial adjustment in federal marijuana regulations in over four decades.

The U.S. Department of Justice, overseeing the Drug Enforcement Administration (DEA), has recommended reclassifying cannabis from a Schedule I drug, which denotes substances with a high potential for abuse and no accepted medical use, to a Schedule III drug. This reclassification would reflect a recognition of marijuana's lower potential for physical and psychological dependence compared to other controlled substances.

Shares of cannabis companies soared in response to the news, with stocks like Tilray, Trulieve Cannabis Corp, and Green Thumb Industries experiencing surges of over 20% in late afternoon trading. This market reaction underscores the significant financial implications of potential regulatory changes in the cannabis industry.

However, it's crucial to note that while the proposed reclassification may lessen the severity of penalties associated with marijuana use, it does not equate to outright legalization for recreational purposes. The shift in classification would likely result in revised sentencing guidelines and potentially open avenues for expanded medical research into cannabis-derived treatments.

The proposal is now in the hands of the White House Office of Management and Budget for review and the finalization of the rule-making process. Despite the positive reception from cannabis advocates and investors, the DEA has yet to officially comment on the recommendation.

The Biden administration's move reflects a growing shift in public attitudes towards marijuana, with an increasing number of states legalizing its recreational or medicinal use. By reevaluating federal cannabis policies, the administration aims to align with evolving societal norms and address longstanding disparities in drug enforcement practices.

Critics argue that the proposed reclassification does not go far enough in addressing broader issues related to drug policy reform, such as racial disparities in marijuana-related arrests and convictions. Nevertheless, proponents view it as a crucial step towards a more rational and equitable approach to cannabis regulation.

Technical Outlook

Canopy Growth Corporation ( NASDAQ:CGC ) stock is up 62% as a result of the Biden Administration policy on cannabis taking the stock to an overbought region with a Relative Strength Index (RSI) of 73.

Further accentuating to the bullish trend is the long "Bullish Harami" candle stick pattern depicted on the daily price chart.

ATAI - 2 potential paths to $5After successfully surpassing the previous swing high with considerable volume, attaining a fresh 52-week peak of $2.85, and witnessing the 50-day moving averages intersecting the 150 and 200 SMAs, ATAI appears poised for a reversal from its downtrend.

**Potential Scenarios:**

**Scenario 1: Triangular Consolidation (Orange)**

ATAI may undergo consolidation within a triangular pattern marked by points A to E. This consolidation phase could indicate a period of indecision in the market as buyers and sellers balance their positions. Typically, triangular patterns suggest that volatility is decreasing, leading to an impending breakout. If this pattern unfolds as expected, a breakout is anticipated around mid-August, potentially triggering a significant move in the stock price.

**Scenario 2: Corrective Pattern (Yellow)**

Alternatively, the stock might experience a corrective phase represented by an A-B-C pattern. This corrective pattern could indicate a temporary pullback or retracement within the broader uptrend. Such corrections often serve to alleviate overbought conditions and provide an opportunity for new buyers to enter the market. In this scenario, ATAI is expected to establish a higher low by mid-August, reinforcing the bullish momentum and setting the stage for further upside potential.

**Price Targets:**

Anticipated Fibonacci targets include 1.414 ($4.45) or 1.616 ($5.54) to be achieved by year-end. These Fibonacci extensions are commonly used by traders to identify potential levels of resistance or support based on previous price movements. Additionally, a more ambitious target exceeding $15 within the next few years is also envisaged. This long-term target reflects the potential for ATAI to capitalize on emerging trends and developments within its industry, driving sustained growth and shareholder value over time.

Daily Consolidation Potential Reboundsince the weekly reversal in favor of bears for AMEX:MJ etf and cannabis stocks, the daily bounce has turned back downward, and is approaching recent multi week lows.

this set of oscilatiry trend regularity indicators show when there is potential for retracement in the opposite direction should these levels hold.

ACB Cannabais Peeny Stock with News LONGCannabis socks got a boost in the past day as the Biden administration seeks a reclassification

of cannabis with the Drug Enforcement Agency ( DEA) This will likely give the entire sector

some momentum. Here on a 60 minute chart, Aurora ACB is seen in a VWAP band breakout,

crossing over the fair vlaue area of the mean VWAP accompanied on the indicators with

confirmatory volume and volatility. On the zero lag MACD, the lines have crossed above the

zero horizontal and above the histogram. I see this as an excellent long entry targeting 4.35

which was the pivot high after the last earnings. This represents a conservative 17-20% upside

with potential upside beyond that price level given the potential impact of the federal news.

Aurora Cannabis Up 44% Amidst Volatility in the Cannabis MarketAurora Cannabis Inc. ( NASDAQ:ACB ) has been soaring to new heights in recent weeks, with its stock surging by a staggering 44% on Wednesday alone. The catalyst? The appointment of industry heavyweight Paul McCarthy as the president of the Cannabis Council of Canada (C3). McCarthy, with his extensive experience at Canopy Growth, brings a wealth of knowledge and strategic insight to Aurora Cannabis, propelling the company further into the spotlight of the rapidly evolving cannabis industry.

But what does McCarthy's appointment mean for Aurora Cannabis and its investors? Beyond the immediate boost in stock price, McCarthy's leadership signals a continued push for favorable regulations and industry growth. With his track record of driving corporate policy and international expansion, McCarthy's influence could prove instrumental in shaping Aurora Cannabis's future trajectory.

Aurora Cannabis's ( NASDAQ:ACB ) meteoric rise isn't solely attributed to McCarthy's appointment. The company has been riding a wave of positive developments, including the Supreme Court of Florida's decision to allow recreational marijuana legalization on the ballot and Germany's move towards partial cannabis legalization. These regulatory advancements hint at a broader acceptance and normalization of cannabis use, opening up new markets and opportunities for companies like Aurora Cannabis.

Moreover, Aurora Cannabis's recent acquisition of MedReleaf Australia for approximately $32 billion underscores its commitment to global expansion and market dominance. Coupled with a more than 5.0% year-over-year increase in revenue for the third financial quarter, Aurora Cannabis is demonstrating resilience and growth in a competitive landscape.

But Aurora Cannabis ( NASDAQ:ACB ) isn't the only player enjoying the cannabis stock surge. Tilray Inc. and other industry peers are also experiencing substantial gains, reflecting the overall bullish sentiment towards cannabis stocks. With Tilray Brands (TLRY) witnessing an 18% surge on Wednesday alone, the cannabis sector is outperforming traditional indices like the S&P 500 and Nasdaq 100, further cementing its status as one of Wall Street's hottest sectors.

The momentum behind cannabis stocks is fueled by anticipation surrounding the potential passage of a cannabis banking bill in the American Senate. This bill, already approved by the House of Representatives, could revolutionize the industry by providing access to mainstream banking services for cannabis companies operating in the US. Such regulatory clarity would alleviate the financial burdens and uncertainties currently plaguing many cannabis businesses, paving the way for accelerated growth and investment.

However, amidst the euphoria surrounding cannabis stocks, there remains a note of caution. The volatility inherent in the cannabis market, characterized by sharp price fluctuations and regulatory uncertainties, poses risks for investors. While major developments like the potential rescheduling of cannabis by the DEA could further fuel stock surges, they also introduce heightened uncertainty and potential for market turbulence.

send $acb back to $1002024 has been very busy for NASDAQ:ACB

- Aurora Introduces Medical Cannabis Pastilles for Patient Relief in Australia

- Aurora Completes Final Repayment of Convertible Senior Notes Representing ~$465 Million in Total Repayments Since 2021; Cannabis Operations Are Now Debt Free

- Aurora Partners with Script Assist to Provide Better Access to UK Medical Cannabis

- Aurora Cannabis Announces CFO Transition and Completion of Previously Announced Share Consolidation

when looking at the chart we can see obvious price discovery to the downside, and the last year of lows have come with heavy market selling. however on the plus side the buy pressure has been positive in the background suggesting someone is happy to scoop up the stock down here.

its only a matter of time before NASDAQ:ACB picks up again given the company are now debt free :-)

TNY is bouncing off of DMA. Bullish Flag...TNY appears to be trading in a bullish flag and bouncing off of the DMA which is inherently bullish.

Lots of speculation around this stock becoming involved with AB-InBev due to new BOD members.

Interesting timing considering DEA re-scheduling and federal reform in America.

Speculation is speculation, but the chart is indicating an upswing.

And the company is expanding in 3 emerging markets.

One to watch.

Ascending Triangle breakout for GTII GTII appears to be one of the cannabis companies in America holding their market cap relatively intact.

There is an ascending triangle pattern on the verge of breaking out, and like clockwork cannabis reform in America is a hot topic to capture voters of all ages.

“There’s no excuse for our not being in the forefront for something that is now legal for 97 percent of the American public and, where people have a chance to vote, they vote to change the policies,” Blumenauer said. “I am hopeful that we can see some action following through on the legislation I passed—but, more importantly, on the things that the American people want.”

RiskMastery's Breakout Stocks - TCNNF EditionWelcome to RiskMastery's Breakout Stocks - Stocks with breakout potential.

In this edition, we'll be looking at OTC:TCNNF ...

I believe this code is at a point of potential volatility.

If price can hold above $10.00 ... Bullish potential may be unlocked.

My key upside targets include:

- $12.11 (Conservative)

- $16.01 (Medium)

- $20.06 (Aggressive)

If however price falls below $7.25 ... Bearish risk potential may be unlocked.

(My key risk targets - C, M,& A - are as noted on the chart)

Enjoy, and I look forward to being of further service into the future.

If you'd like to connect, feel free to reach out and comment below.

Mr RM | Risk Mastery

Disclaimer:

This post is intended for educational purposes only - Publicly available RiskMastery information & content is not intended to be financial advice in any shape or form. Please do your own research and seek advice from a licensed professional before acting on any of the information contained within this post. This post is not a solicitation or recommendation to buy, sell or hold any positions in any financial instrument. All demonstrated trades are merely incidental to the educational training RiskMastery aims to provide. You are solely responsible for your own investment and trading decisions, of which should be made only according to your own opinion, knowledge and experience. You should not rely on any of the information contained on this site or contained in any RiskMastery material on any website or platform. You assume the sole risk of any trade or investment you elect to make. RiskMastery and affiliates shall not be liable to you for any monetary losses or any other damages incurred directly or indirectly, from your use, reliance or reference of RiskMastery materials, content and educational information. Thank you for your understanding and cooperation - We look forward to working with you into the future to navigate the fine line of trading and investment success.

Innovative Industrial Properties: Soon…⌛️👀IIPR is poised to dip into our blue Target Zone between $85.28 and $76.66 to settle the low of the blue wave (ii) and, thus, lay the foundation for the impulsive rise of the blue wave (iii). However, with a moderate probability of 25%, the price might also decide to head further south and breach the support at $69.08, pushing the turquoise wave alt.5 toward a new low.

Philip Morris: Sleepyhead The Philip Morris stock is moving mainly sideways with only a slight hint to the upside. However, to follow our primary route again, the tired Philip should soon awaken from its slumber and regain bullish momentum. The turquoise wave B should extend into our turquoise Target Zone (between $119.47 and $123.80) to establish its high. Only afterward do we reckon with sell-offs, which should push the price into our green Target Zone (between $77.61 and $62.42). The green wave should settle its low in this range before a sustained upward move can be ventured. On the other hand, there is a 35% chance that PM will surpass our turquoise Zone, thus confirming that it is already busy with the green wave alt. .

"Aurora Cannabis: Short-Term Bearish, Eyes Massive Bull Run"Analyzing Aurora Cannabis Stock: Tight Compression Forms Massive Falling Wedge

Aurora Cannabis stock, a prominent player in the cannabis industry, is drawing attention from investors as it undergoes a significant chart pattern characterized by a tight compression formation from a six-year retracement, resulting in a massive falling wedge. Despite recent attempts by bulls to break out, the stock faced rejection at $1 and is currently breaching short-term support levels. While we advocate for long-term accumulation, short-term projections suggest a potential shed of 10 cents per share, presenting an absolute buy opportunity. Let's delve deeper into what Aurora Cannabis stock represents and its current market dynamics.

Understanding Aurora Cannabis Stock

Aurora Cannabis is a Canadian cannabis company that specializes in the production and distribution of medical and recreational cannabis products. With a focus on innovation, quality, and sustainability, Aurora Cannabis has established itself as a leading player in the burgeoning cannabis industry, catering to a diverse range of consumers and markets.

The Tight Compression Formation

The tight compression formation observed in Aurora Cannabis stock is indicative of a period of consolidation and indecision among market participants. This compression has formed over a six-year retracement, culminating in the creation of a massive falling wedge pattern. Falling wedges are bullish reversal patterns characterized by contracting price ranges and declining volume, typically signaling a potential breakout to the upside.

Recent Breakout Attempts and Short-Term Outlook

Despite recent efforts by bulls to break out of the falling wedge pattern, Aurora Cannabis stock faced rejection at the $1 level, highlighting the presence of strong resistance. The failure to sustain momentum has resulted in the breach of short-term support levels, indicating a period of uncertainty and potential downside pressure in the near term.

Accumulation Opportunity

While short-term projections suggest a potential shed of 10 cents per share, we believe that Aurora Cannabis stock presents an attractive long-term accumulation opportunity. The fundamental strengths of the company, coupled with the growth potential of the cannabis industry, position Aurora Cannabis for success in the years to come. As such, investors may consider utilizing the short-term downside as an opportunity to accumulate shares at favorable prices.

Conclusion: Navigating Aurora Cannabis Stock

In conclusion, Aurora Cannabis stock is undergoing a significant chart pattern characterized by a tight compression formation and a massive falling wedge. While recent breakout attempts were met with resistance at $1, the breach of short-term support levels suggests potential downside in the near term. However, we view this as an opportunity for long-term accumulation, as the fundamental strengths of Aurora Cannabis and the growth prospects of the cannabis industry remain intact. Investors should exercise caution and consider their risk tolerance when navigating the short-term volatility of Aurora Cannabis stock.

Altria Group Inc (MO): Navigating Challenges & Driving Growth

In the ever-evolving landscape of the tobacco industry, Altria Group Inc (NYSE: NYSE:MO ) stands as a resilient force, weathering challenges and steering towards growth. The recently released 2023 financial results and 2024 guidance provide a comprehensive insight into the company's strategic moves, financial performance, and its commitment to shareholder value.

Challenges and Resilience:

Altria (NYSE: NYSE:MO ) faced a challenging year in 2023, with a 2.4% decrease in net revenues, reflecting the industry-wide struggle against stricter regulations and evolving consumer preferences. The decline in shipment volumes of traditional cigarettes by 9.9% highlights the ongoing shift away from conventional tobacco products. However, amidst these challenges, Altria (NYSE: NYSE:MO ) demonstrated resilience by achieving a 2.3% growth in adjusted diluted EPS, reaching $4.95. This growth is a testament to the company's ability to adapt to changing market dynamics and capitalize on opportunities in the smoke-free and alternative nicotine products segment.

Strategic Investments and Diversification:

Altria's (NYSE: NYSE:MO ) strategic investments have played a crucial role in its resilience. With a 10% stake in Anheuser-Busch InBev and a 42% interest in Cronos Group, the world's largest brewer and a leading player in the cannabis market, respectively, Altria has diversified its portfolio beyond traditional tobacco. The recent acquisition of Njoy Holdings further exemplifies the company's commitment to staying at the forefront of evolving consumer preferences.

Smoke-Free Initiatives:

Amidst declining cigarette shipments, Altria's (NYSE: NYSE:MO ) focus on smoke-free alternatives has become increasingly evident. The report highlights the company's investment in NJOY vapes and its on! nicotine pouches. Despite a 32.8% growth in on! nicotine pouches shipment volumes, the company faces the challenge of a shifting customer base towards newer nicotine consumption methods. Altria's (NYSE: NYSE:MO ) dedication to innovation and adapting to evolving consumer habits positions it well in the face of increasing competition from alternatives like vapes.

Financial Outlook and Shareholder Value:

Despite a slight decline in quarterly net revenues in its smokable products division and challenging economic conditions leading to some customers migrating to cheaper brands, Altria (NYSE: NYSE:MO ) remains confident in its financial outlook. The announcement of a new $1 billion share repurchase program underscores the company's confidence in its financial stability and its commitment to delivering value to shareholders.

Conclusion:

Altria Group Inc's (NYSE: NYSE:MO ) 2023 performance showcases a company navigating a dynamic market with strategic foresight. The growth in adjusted diluted EPS, coupled with strategic investments and a commitment to smoke-free alternatives, positions Altria (NYSE: NYSE:MO ) as a key player in the tobacco industry's transformation.

Navigating the Green Waves: Tilray Brands' Strategic Moves

Canadian market leader Tilray Brands ( NASDAQ:TLRY ) has weathered storms and is now charting a course towards growth and innovation. Despite recent stock fluctuations and an industry grappling with regulatory challenges, Tilray's resilience and strategic initiatives position it as a compelling player in the cannabis market. This article explores Tilray's recent performance, growth strategies, and the potential for investors as the company navigates through both challenges and opportunities.

Market Snapshot:

Tilray, once a high-flying stock that reached $300 per share in 2018, faced a significant decline but has shown signs of resurgence. With shares hovering around $2.11, the company recently reported record quarterly revenue, signaling a potential turnaround. Despite a lower-than-expected loss, Tilray's sales growth of 34% in the fiscal second quarter is a noteworthy achievement, breaking a streak of three declining quarters.

Diversification Beyond Cannabis:

One of Tilray's key strategies involves diversifying its product portfolio beyond traditional cannabis offerings. The company's 117% growth in alcoholic beverage net revenue during the reported quarter showcases its successful foray into alternative markets. With its recent launch of THC and CBG-infused RIFF BOOST beverages and the introduction of new flavors in its Chowie Wowie cannabis chocolate products, Tilray is carving a niche in the ever-expanding cannabis-infused product segment.

Market Leadership and Global Expansion:

Tilray's 12.5% market share in the Canadian cannabis market reaffirms its position as a leader in the industry. While awaiting potential legalization developments in the U.S., the company is proactively bolstering its alcoholic beverage presence and expanding its footprint globally. With 24 states and Washington D.C. having legalized recreational marijuana, and Germany potentially joining the fold in 2024, Tilray's growth plan focuses on new geographies and innovative product offerings.

Strategic Acquisition and Cost Efficiency:

Tilray's acquisition of rival Hexo Corp for $56 million underscores its commitment to strategic growth. Despite challenges related to pre-acquisition liabilities and exit costs, the company is on track to achieve up to $35 million in annual savings from the Hexo deal. This move not only enhances Tilray's market position but also demonstrates its ability to navigate the complexities of the evolving cannabis landscape.

Challenges and Outlook:

While Tilray has reported a drop in second-quarter income and faces industry-wide profitability challenges, the company remains optimistic about its full-year guidance. The decision to focus on adjusted core profit and achieve cost savings indicates a proactive approach to financial sustainability. Analysts project a full fiscal year loss for Tilray, but the company's strategic moves position it for potential growth in the long term, especially if regulatory environments become more favorable.

Conclusion:

Tilray Brands' journey from its 2018 peak to its current status reflects the dynamic nature of the cannabis market. The company's strategic diversification, global expansion plans, and cost-efficient initiatives make it a compelling player in an industry poised for transformation. While risks and challenges persist, Tilray's commitment to innovation and adaptability positions it as a stock worth watching. Investors keen on tapping into the evolving cannabis market may find Tilray Brands a compelling choice for long-term growth.