Another cannabis stock ready to fly high? NYSE:ACB looks very interesting since mid January bottom. Good odds that similiar pattern (inverted H&S) will be playing out, as it was the case before with NYSE:CGC , which is rallying nicely since its breakout in early December.

Canopygrowth

CGC Holding Trendline SupportCGC is seeing a nice bounce today after a successful test and hold at the uptrend line. Assuming that coronavirus doesn't spark fear in traders again this week CGC should see a test of $26, potentially even a break above. Short-term trend remains bullish.

CGC Testing SupportCGC is back to testing an uptrend support line after a recent channel breakout that had looked promising until pandemic fears shook the market today. Currently watching this uptrend line to see whether or not it is able continue propping up price. A bounce here would be bullish for CGC, a break below the uptrend line would put price back to neutral, or no trend with risk of turning bearish again.

Aurora Cannabis - Massive Long Opportunity!Last time we were in overbought territory on the daily RSI was 10 months ago.

This has been the largest downtrend in the stock's entire history. Currently trading under a death cross for quite a very long timenow. So why long now?

Not only has it bounced off the major long-term support line (green), it seems to be forming an inverse head and shoulder at the moment which is bullish and signals a trend reversal.

That along with it being in oversold territory for 8 months and finally breaking out and posting a higher high tells we may be at a price range that we may not see for a very long time, if ever.

A few more daily closes will paint a better picture with regards to the possible inverse head & shoulders. In order for this to play out we would have to reach a price of approximately 1.91 so don't panic if we dip first as it is expected. If we continue to post higher lows and highs in this trend then the swing to the upside could in fact be immense in the next year.

Low risk for a potentially very high reward in my opinion. I don't think we're trying to break this support line because if we do then it's going to be a freefall ;)

Please like & share if you found useful. Leave your feedback below and let me know what you think. Cheers, and safe trading!

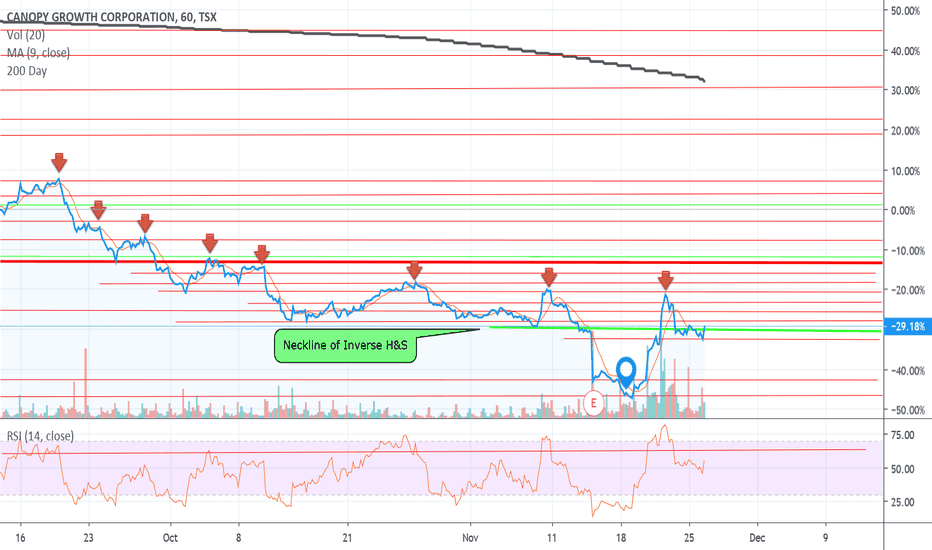

CANOPY Growth Has Bottomed - Inverted Head & Shoulders!Classic Inverted Head & Shoulders pattern is usually not just a bullish indicator but a sign for a trend reversal from bearish to bullish, and we just so happen to be coming off a recent low.

Not only did we bottom but we bottomed right at the .786 Fibonacci retracement level which just also happens to be right at the major support line. Great to see it respected at a healthy retracement level. Anyone who bought here has a good probability to see good profits.

Strategy:

I'm anticipating AT LEAST a move to the yellow circle which is also where the 200 MA is curving down to. This would mean roughly a 20% gain from here alone.

Now a few things can happen there. We can get rejected off the 200 MA and head back down which in that case I would look to buy once again somewhere along the support. Timing is everything as Canopy has plummeted to the down side most of the times of Earnings, so I would also look to reposition myself at that time as well. Looking at the chart I see that can easily happen after we make our test to the 200 MA.

On the flip side since the trend is looking upward at the moment we can easily have our 50MA cross above the 200MA resulting in a golden cross which then I would look for much more gains ahead.

Let me know what you think, I will update over time. Safe trading :)

Aurora Cannabis (ACB) Entering the kill box for shorts After what seems like a never ending cascade ACB and many other MJ sector names are entering major support zones for accumulation. This is where I am looking to enter positions for maximum Risk/Reward. Calculated entries are laddered at daily gap zones inside of this box with half of a position and another half is waiting to be deployed on a move up & out of this zone. Patience is key as there will need to be a new base formed or an explosive volume based bounce.

$CGC Bullish BAT; iH&S, largest volume D in over a year. RSI divCanopy Growth Company. Pretty clean bullish BAT forming on daily. It might be hard to see so zoomed out, but $CGC also broke out of an iH&S pattern with the largest amount of Daily volume in over a year! Looking at the Fib levels, $CGC retraced to a tad below the .786 level, but then it shot back above forming the Head of the iH&S. Some bullish divergence on RSI--which is now converging with price action. Entry in green box: $21.00-$23.00.

MJ volume not high enough...Cannabis stocks have been gaining from the start of this week.

Technical analysis

RSI has been trending upward, but OBV has not, creating a bearish divergence. /Bearish

We saw the same three candlesticks ending on November 21st, 2019, leading to a strong pullback. (Red circle drawn in chart). /Bearish

Fundamental analysis

Since May 2019, cannabis stocks have been shorted creating a downturn for the whole sector.

Many of the biggest companies are undervalued. But stocks can stay undervalued longer than we can accept our losses.

-----

Keeping on a close watchlist.

Canopy seems ready to make a run for it The retracement touched the 78.6% retracement level and now shows clear sign of recovery.

The bullmarket for cannabis could might be coming to an end (smoking potential).

Stoploss at lows gives a great risk/reward.

WATCH OUT FOR A BREAK ON MONDAY 12/23TICKER: $CGC

Will history repeat itself?

Just like last time, CGC is again a daily inside bar with resistance of $20.28 and support of $19.65. I do expect high volume on Monday, but the break is uncertain until it happens. Don't be bias and watch the charts because price action is KING.

I will be watching CGC closely next week and again, will either go long or short depending on how we break. Give me 15mil volume in whatever direction and I will be happy.

But looking longer term, this is a daily inside bar within a weekly inside bar. Depending on how we break on Monday, it would impact how we break on the weekly time frame.

No matter how we break on Monday, my next target will be the weekly resistance and support of $21.14 and $19.45.

Good luck next Monday, don't let your emotions get the best out of you, and remember PRICE ACTION IS KING.

CGC - Swing Idealooks like a good setup for a swing up towards 40s - Market sentiment seems to be slowly changing. Farm payroll on watch w/ fed still dovish.

Pot industry still a few years ahead of itself - so trade wisely. I see this as a win/win, if the market turns - it's a solid spot for a beginning entry position and I'll plot out a long hold - IMO.

Been riding the volatility but love when everything starts to turn - or appear to. It's buying time!

GLTA

Bull Flag or Descending Triangle.Since my post several days ago linked to this chart, you'll notice $WEED is holding the neckline area of the inverse H&S, forming two additional patterns known as a bull flag & descending triangle.

Seeing how the sector has thrown under the bus for the better part of 1 year, I'm expecting to see the Bull Flag play out.. Simply to go against the bearish narrative that's becoming a bit more hysterical by the day..

Time will tell per usual.

Tilray vs the rest Pot stocks have had a rough few months, and shareholders of Tilray have been hit especially hard as shares have dropped 55% since early August. Much of that decline can be traced to disappointing earnings results. In mid-August, Tilray showed sales growth in Q2, as revenue jumped nearly 400%. However, management's aggressive spending produced net losses, and investors responded to the news by shedding shares.

Tuesday's earnings report will likely contain these same themes of high sales growth paired with soaring expenses. That means there's little reason to expect a dramatic shift in Tilray's stock-price trend - at least until investors get more concrete signs that point to the likelihood of sustainable earnings generation in this unproven industry.

The good news is that with shares battered so far in 2019, even a modest step toward profitability could spark a rally in the stock as early as this week.

Drake started from the bottom, but not with Canopy?Or did he?

I mean, technically Drake could have been invested in Canopy for many years now, he's a very business savvy guy, not just rapper / icon. So who really knows what his average cost is.

Anyway, on a 3 month & 6 month chart we can clearly see lower high after lower high, and this recent move may become just that, another lower high... The rsi is very overextended & it looks like an inverse H&S already played out there... But on the actual chart, it appears as though a Inverse H&S may still be forming, only time will tell I guess.

Pot Stocks Bout to FlyFinding support here on a large scale, First Target at weekly resistance, I think they will take it off schedule one or something will be the catalyst to get them flying again.

short term rising wedge on cgclooks like this stock is primed for a dead cat bounce on longer timeframes but short term rising wedge has appeared. This can still breakout but if there is a breakdown with some good volume id cut my losses and find a better entry point around 15-18$ region.

Canopy Growth Corp Technical AnalysisA new sideways trading range is developing. Insite provided by Invest In MJ

$CGC equilibrium mode established$CGC Cup and Handle formation complete. Now in equilibrium mode between 28.74 & 27.85, form a higher low / lower high and then run to close the gap at 29.62 then comes 31.97$.