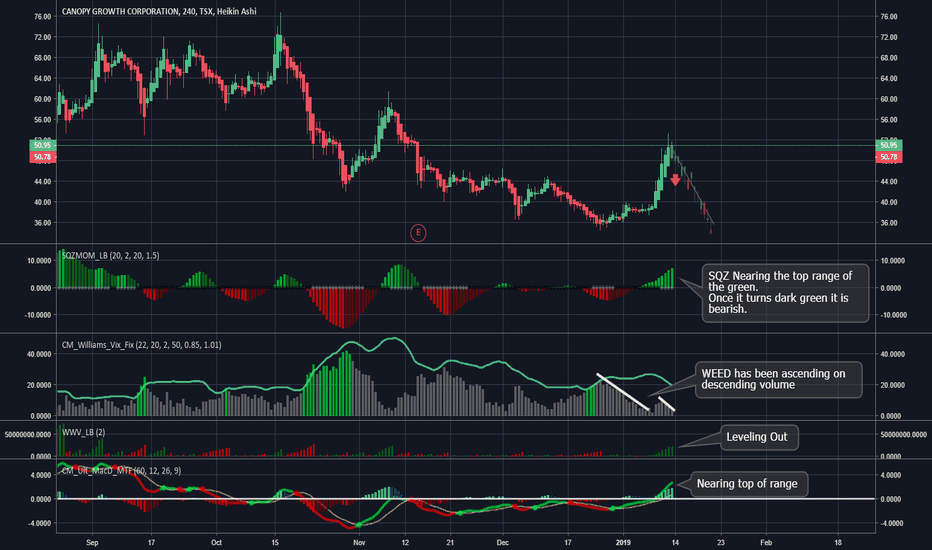

I think Canopy Growth will retest its support in the coming week

I think Canopy Growth will retest its support in the coming weeks. Much based around the accounting error and no short term catalyst to move the SP higher from a already high SP, price near ATH. I think Canopy Growth will find support around $48-55 Cad or as low as $40 Cad, depending on more factors then only Canopy.

And with positive news around the Cannabis market not having a significant impact on the share price, i believe it impact the sentiment to become more positive towards Cannabis market, see it with a little bit less risk.

And with risk in mind, i think most well known companies have there share price reflecting the risk in the market rather then the potential of the market.

When the shift comes from investing for the potential rather then the risk. I think the good companies will have lower volatility and a steady SP and healthy technical moves. Rather then this risk investing climate, with high volatility, fast up and down moves and SP destroyed in a couple of days/weeks.

Based on the belief stated above, i think the SP will move down from 60 range to 40-50 range depending on sentiment/ things unknown to me.

And from there trade in an range until a leg up or down, or a shift in the sentiment.

Canopygrowth

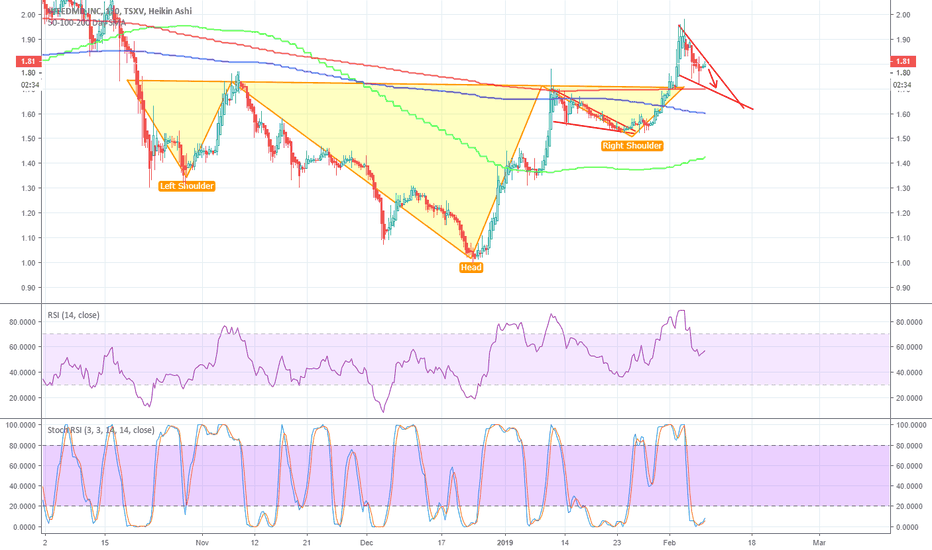

WeedMD Slight Pullback Then LongBurst through H&S and previous resistance, forming bull flag. WEED closed +1.5% today, with WMD closing -0.5%. Divergence between these two never last. Likely pullback to 200D SMA (last support), before breaking through bull flag.

$CGC Second Run?Canopy Growth Company just gave us a buy signal on the Megalodon indicator, and with Marijuana on the rise in America with continuous legalizations, it could be a great buy! If you'd like to try the Megalodon indicator for yourself, send me a message!

CGC Breakout by months endCGC has been stuck in a short term descending triangle. By the end of the month i'm looking to see a breakout.

WEED.TO Bullflag triple top on daily +60 = breakoutWEED.TO has been running on positive sentiments and news of hemp production in New York. They are currently holding strong in a consolidation pattern.

A bull flag will be completed if it runs passed 60 with any amount of decent volume. Buyers are not letting up and they're not letting go of any shares.

If 60 doesn't break it will retrace and retest 54-55 levels.

Let's see what happens

200 shares if it runs passed 60 with any good volume.

*Any idea listed here is just my opinion of what I plan to do and not trading advice.*

CGC/WEED bulls deserve congratulations!I missed this entire move as I've been busy with other life obligations, but no FOMO! This size of this bounce tells me the temporary bottom is in and I'll be looking for an entry in the coming weeks after a healthy pullback so I can join the party and take part in some MJ profit fun!

CGC, 12H, CANOPY GROWTH- Key Resistance LevelsIf we break these 3 levels, we should see new all time highs.

Time for a bounce! CANOPY GROWTH CORPORATION NYSE: CGC WEEDSTOCK

Canopy had a masSive sell of in the recent weeks and its time for a bounce. RSI is oversold and pointing up. Not a trading advice!

Looking for a short-term bounce from these levels

#cgc #canopygrowth #weed #weedstocks

HAPPY TRADING!

CGC, Canopy Growth, 3D, 14 Months $70 USD MinUpdate....believe the bottom support level is here and we will see the end to the consolidation with new ATHs in the coming months.

CGC potential daily lower high on watchWatching CGC first thing Monday to see if the high of Friday or the low of Friday breaks to signal sort term direction

Canopy Growth breaks key daily and weekly supportsClear bear breaks today keep the bulls in full control of CGC and WEED in every timeframe. Currently in an area with a lack of support. A weak afternoon bounce leaves us in an hourly bear flag setup heading into tomorrow morning, bulls must hold the low of today tomorrow as a first step in negating that flag.

Canopy Growth testing key daily support; bear breaks on watchHere's what I'm watching for CGC and WEED. Bears are in control as key support is likely to be tested first thing. There's a lack of support for 25% in the event of a bear break.

CGC tightening patternWatching CGC tightening pattern break for a solid dump or bounce.

R: 34.85

S: 33.08

Will Canopy Growth (TSX:WEED) Give Us an Early Christmas Gift?Like many stocks on the TSX, Canopy Growth Corporation has had a choppy November. The wild swings make for some very fun trading, but quite a bit of risk if you're not interested in holding bags.

Here are four trades picked up by our AllTradeSignals Volume Pressure Gauge over the past couple of weeks:

Trade #1 - 40% gain in 8 days

Trade #2 - 2.5% gain in 30 minutes (!)

Trade #3 - 8.5% gain in 20 hours (!)

Trade #4 - ... where will we end up?

Although 50% in gains in 3 trades is already a solid November... where will trade #4 take us?

For me, I'm all for setting a tight stop loss on this one. No looser than -5% should keep us safe for any immediate swings.

What do you think?

Interested in the AllTradeSignals Volume Pressure Gauge ? Get in touch with us here on TradingView!

CGC up against key daily support zoneCGC is up against a significant area of support including three price levels and the 200 day MA. Watching tomorrow for how this plays out.

Key resistance for bounce continuation & bear flag negation is 32.99

Key support is 31.85

CGC breaks the inside bar bullishCGC had a nice little move after breaking the daily inside bar today. I'm looking for some profit taking tomorrow as the hourly chart needs a new support above 36.67

S: 36.37

R: 41.06, 42.43

Watching CGC hourly trend for clues on this bounceDecided to try something a little different today because I don't want to type up a bunch of analysis.

I'm watching the range of Thursday to break to tell me if we're going to see bounce continuation of a healthy pullback to form a daily higher low, and then try to change the daily trend with a higher high.

Key levels:

S: 35.85

R: 38.28