Pay Attention to BitcoinPay attention to that long pink trend line. If Bitcoin manages to dip below that line (and I believe it will), we will be in for a substantial drop. It may only drop to the light blue line, or it could drop to or near the bold yellow trend curve. Either way, we may see a slight increase in price in the short term up to the top of the triangle (orange line). But we will see a big drop incoming.

Capitulation

BTCUSD: A repeat of 2014? Worst Case Scenario A $2,500 LowPart 3 of If Bitcoin Repeats History? . This worst case scenario extrapolates the second half of the 2014 bear market going into 2020 with ATL at $2,500 and new ATH in November 2021, as well as reaching $30,000 within the same year. This assumes a double bottom will form in April 2020 prior to the halving, followed by 1.5 years of accumulation/consolidation, with a new ATH being made 4 years after the 2017 ATH.

ZN1! P-Modeling Pt 1. 10 Year T-Note Futures. Extreme CajunZN1! 10 Year T-Note Futures . Extreme Prediction Modeling Architecture on a One Week Time-frame.

The following chart is an very experimental Extreme Long Range Prediction Model, using quantum graphing decoding protocols that were developed to tease out very complex long-range modeling architectures... This has mostly common sense schematics outlined..

Find the 10 year cycle patterns.

Decode the Matrix Residual from those patterns.

Copy/Paste correct residuals into hyperspace.

Gather Geometric Support thru Regression/Vector blueprints of ecosystem.

Post idea and wait...

I honestly see this to be apart of a historic correlation with the SPX ...

I do not expect to be right. Fully..

But, this is potentially a full ecosystem reset ... A Recession Cycle..

Laugh now... Cry Later.. Doubt is an illusion to the truth... Doubt now, Laugh Later.. Love Everything.

Failure is a necessary component of success. ;)

Please see the following charts as evidence to support the evidence towards a full cycle reset...

ZF1!

ZT1!

Welcome to the Hyperspace and thanks for pondering the Unknown with me,

Glitch420

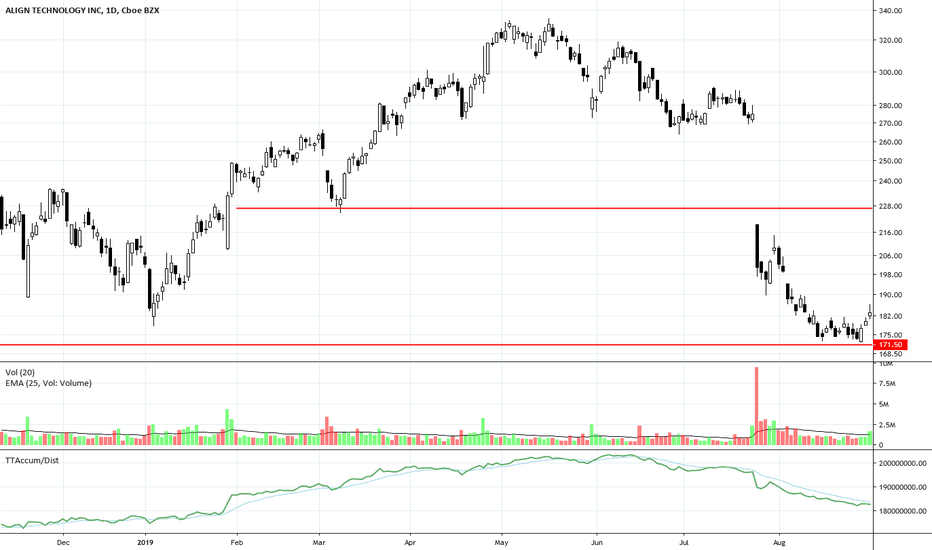

ALGN at Long-Term Support LevelALGN gapped down at the end of July on weak earnings news. It has now collapsed to a strong long-term support level. The final capitulation by Smaller Funds managers has ended. The consistency of the candlestick pattern with closely aligned lows and an early Shift of Sentiment™ pattern on the Balance of Power Indicator reveals some Dark Pool Quiet Rotation™ at this level.

EURUSD needs a catalyst EURUSD is making shallow recovery attempts on Monday after an aggressive plunge late last week. The pair slipped below the 1.10 handle for the first time since May 2017 and remains vulnerable to further losses as the USD demand persists. At this stage, the pair needs a catalyst to switch to a recovery mode.

The common currency has been digesting the arguments for additional easing by the ECB, which include a lower than expected Eurozone CPI and contraction of German retail sales by 2.2%, which confirmed that the country’s economy is losing momentum. As a reminder, the German GDP contracted 0.1% in the second quarter. Weak numbers reinforce expectations for delivering additional stimulus measures during the upcoming ECB meeting this month.

The greenback accelerated the ascent as the US Treasury yields turned into a recovery mode as the US and China signaled readiness to resume the trade talks despite a fresh portion of mutual tariffs came into effect on September 1. In the short term, the pair will likely show a muted trading due to a Labor day in the US and lack of US economic data. Meanwhile, the US jobs report will be the key event for the pair this week.

Possible capitulation candle on xrpusd 4hr chart?Im not saying this is definitely the capitulation candle here but it feels like the ground floor at the moment and we are finally seeing the chance of some bullish patterns picking up some momentum we can see we had a successful inverse bart up from the bear flag and are now forming a smaller but fairly sturdy bullflag that broken up from can take price to 30+ cents. Also if we happen to see resistance and an iniital rejection when priceaction tests the descending purple trendline then we will have an inverse h&s potentially in play that would likely have an even higher price target than the bullflag were it to actually trigger. If we were to see all of these bullish scenarios play out then this very well could be capitulation but for now we wait to see how things unfold awaiting further confirmation.

XRP - capitulation just around a corner?We have INVERTED XRP chart over here. As you can see we are in this bullish triangle and if broken - new short-term lows to follow.

Chart is a bit messy to read, so take a good look.

White rectangles are supply/demand zones.

TARGETS

Measured move would take us to @0.20-0.216$. Then I'll be waiting for 0.18-0.20$ as you can see in the chart. Those targets are VERY important and could be the end of this bear market on XRP. **0.18 would be historical percentage drop from the top in 2018. Only other time we dropped 94-95% from the top was in early stages of xrp price action. So do not be surprised if we get there AGAIN.

Prepare for insane volatility in this pair because we are at the lower warning line of multi-year pitchfork(Check my previous idea on XRP). Xrp should capitulate @0.18-0.20$ and jump very rapidly to close weekly/monthly above that DOTTED BLUE LINE.

Me personally, I'll be adding positions at 0.197 if given.

Important dates are August 19th & 26. These are the pivots for price to turn around.

BULLISH SCENARIO, if we do not break this triangle above, xrp might hit 0.28-0.29$ before attacking that 0.18-0.20$ region on 26th of August.

This is not a financial advise. Stay safe out there, hope you like it.

Inside Information to Make You MILLIONS in the next decade!Knowledge is power. Money and power go hand in hand. If you want to be successful in life you first have to acquire knowledge, and then money, and finally power. This is a cycle just like Elliot Wave Theory.

Elliot waves are building blocks for waves of a bigger time frames. For example, in 2011 Bitcoin completed its first 5 wave Up and then completed and ABC correction after as you can see below.

After the ABC correction what happened next? The price went to the next stage and became an Elliot wave 1 and 2 on to Wave 3 as seen below:

Smaller wave counts resemble larger legs for bigger wavecounts. Are you learning yet?

This is where things get interesting. Alot of people are incredibly bullish on Bitcoin and Crypto right now because they want to get rich.

These people will all lose money, GUARANTEED!

You see alot of these big youtubers and traders on here want to make the most amount of money from influence they can get. If you publish a chart like this I guaranteed only 50 people will view it. If you post a chart where you draw a line to a million bucks screaming BUY BUY BUY, people will get emotional and will want to make millions like everyone else so they will click it.

That is why you have to do your own research like me. Forget short term trading and misleading advice from the moon boys who just want to "win the lottery". The opportunity is still here to make millions if not billions for yourself if you are willing to wait.

I will let you decide for yourself what will happen next after I taught you the basics of how elliot waves resemble larger patterns and repeat themselves.

Bitcoin Capitulation - Did it happen? Monthly BTC AnalysisAbove is a monthly chart comparing 2014 to 2018. You'll see so far, everything is normal in regards to Bitcoin price action. No one can declare Bitcoin dead yet as we can clearly see we're in the 'Bust' part of the Boom and Bust cycle of Bitcoin.

While we do not know for sure if capitulation happened in 2018, we can clearly see where it happened in 2014. In 2014, in ONE month, Bitcoin lost 48% of it's value. Now as you can see, in November 2018, Bitcoin lost 44% of it's value.

While many can claim that this "isn't enough pain yet" and there is still more "blood to run in the streets", you can clearly see in 2014 that a 48% drop was enough.

So the question becomes, can a 44% drop mark capitulation? I believe in my assessment, that the answer is yes, however, I would not enter the market until we see a successful retest of a low OR for the more aggressive trader, buy next month if we happen to go as low as we went this month and set a close stop loss in the event Bitcoin makes a new low. If the sellers fail to make a lower low next month, then the chances of Bitcoin up from there after some sideways price action are fairly high.

The two fundamental items that worry me about Bitcoin in interim is the Mt. Gox settlement where 160,000 Bitcoins will be distributed to Mt. Gox victims by March 2019. Also, I believe if the global economy is not doing well, then high risk assets like crypto currency will become even less attractive.

Either way, it's better to wait for confirmation before entering a trade instead of trying to guess the bottom. There is plenty of room to go up from here once there is confirmation that Bitcoin is unable to make a new monthly low. For me personally, I'll be waiting for the 30 month VWMA to become support again.

BTC: It's Capitulation Time.It's time! (I wish I could add Bruce Buffer's voice right there) It's what many of us have been waiting for, and the rest of us have feared. Within the next week or so, it will begin. Prepare yourselves. There will be great buying opportunities ahead. This (upcoming) could be the last great buying opportunity for Bitcoin EVER! I'm not saying sell the Bitcoin you have. I'm saying sell any belongings you don't need in preparation for what is about to happen. Be prepared to buy BTC, ETH and most of XRP. XRP will once again be the biggest gainer. #0doubt

xrpusd deathcross looming? I anticipate a fakeoutimpending deathcross on xrp. while also in a 1 day bear pennant that has a target of 20 cents...i anticipate this deathcross will be a fakeout and we may see a inverted bart here instead of a bear pennant....however there's also a chance it could break down and the 50ma could briefly cross under the 200ma but if so in that case it would just be capitulation and price would rocket back up bringing a golden cross with it to signal a deathcross fakeout if capitulation happens i don't see it dropping the whole target of the bearflag I have a feeling the 28.5 or the 24.5 horizontal trendline would probably catch it before then...still worth being prepared to buy any kind of dip like that though should it occur.:

BTC CAPITULATIONLongs are currently outweighing shorts at 60/40 whilst price action continues to get rejected at key support areas. The descending triangle formed on BTCUSD could mean we see 8400 sooner than anticipated. I believe if we see 8000s again a lot of people will capitulate and then the real bull run will commence. Remember, the market makers want you to sell lower and buy higher. Best of luck out there.

Bitcoin has started it's descent!The white line marked with a white arrow is the center line in a schiff pitchfork connecting the 2014 and 2019 bear market. This line played a role as support before our drop from 6k to 3k, and it is currently playing a role as very strong resistance. We have hit this line twice now and price has failed to break through. Within that same pitchfork just one line below you can see how it is also playing a role as support and resistance. As you can see the purple fib circle is currently acting as support, notice how the candle wicked down to it then bounced. I think this purple fib circle will basically be our only support on the way down. I am expecting us to make contact with the green fib circle soon and when that happens either we will bounce and stay above which will be bullish... Or we will fall through setting new lows in the 2k range. Since that white line has played such an important role in price action and because it has yet to be broken after being tested twice now, I believe we are topped out and this first drop is just the start of a bigger drop to come.

Im Sure I've Seen This Before. OH YEH CAPITULATION! RIPPLE XRP.Hello Traders,

Having a look at Ripple XRP you can see its formed a decending triangle formation which looks very similar to Bitcoins.

I have just posted another idea which explains why I think Bitcoin is approaching resistance and is due for a 30% correction. When this happens I think Ripple XRP will be taken down with it in EPIC capitulation style. The only bullish thing on the XRP chart is the 200MA in red which has only just became visable on the Poloniex weekly chart. Even so, the 200MA is 13% below the triangle support but I will be watching to see if there is an interaction as the triangle breaks. This could be a 50% short here. Wait for Bitcoin to finish its ending diagonal as Ripple may try one last attempt to reach the top of the triangle and pretend to be bullish. Breaking the triangle bottom with conviction would be a good short entry. Ripple XRP could also be a great buying oppertunity at the bottom but this needs to be analyised nearer the time.

A possible result from current Bitcoin manipulation.I believe manipulation is in full effect currently as these exchanges are trying to cover their butts to liquidate leveraged shorts that have been stacking. As a result this will extend the length of our current bear market, cause a much faster and harder drop and possibly take us to lows lower than previously expected by even the most bearish of bears. Sleep tight! :)