The Dump & Hold Strategy ($70.94 SOON?)URGENT INSIGHTS:

According to my charts, we're either heading into a crappy 20-year downturn... or a 11,000% increase to $70.94 upside depending on your position!

It is now simultaneously optimal to short while going long and/or sell pre-buy, unless of course you're bullish, in which case ensure your purchase precedes your liquidation, but only if your gains are already post-realized prior to any re-entry in either direction, but be sure to hedge.

JUST REMEMBER:

No matter how long the struggle, there’s always relief.

I'm not a financial advisor.

Cardano

Cardano: New Low or Off We Go?!For Cardano, we primarily still expect a new low in the blue wave (ii), but the price should stay above the support at $0.31. Once the wave (ii) corrective movement is completed – which theoretically could have already happened – the blue wave (iii) should drive the price significantly above the resistance at $1.32.

Cardano the next big Crypto fall to 0.37Cardano is another Crypto that is falling flat due to the tariff implementation.

And we can expect it to do so as long as price remains below 20 and 200MA>

Here are some reasons why we can expect a continued downside.

Escalating Trade Tensions: President Donald Trump's recent tariff announcements have intensified global trade disputes, leading to a broader market sell-off affecting cryptocurrencies like ADA.

Investor Shift to Bitcoin: Amid market volatility, investors are gravitating towards Bitcoin, perceived as a 'blue-chip' crypto, resulting in decreased demand for altcoins such as Cardano.

Whale Sell-Offs: Large holders have sold approximately 120 million ADA tokens recently, exerting additional downward pressure on the price.

And in technical news, the charts agree with major downside to come.

MAJOR M Formation

Price<20 and 200

Target $0.37

Let's see if Crypto is going to endure this Crypto Depression.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Cardano (ADA) is on the verge of an 80% surge (1D)Despite all the positive news, it couldn’t maintain its bullish trend, as seasoned whales typically don't enter the market at the end of bullish waves.

The zone we’ve highlighted is where we believe whales will enter Cardano. Due to heavy buying pressure, the price could experience a 50% to 80% surge.

From the point marked with the green arrow on the chart, Cardano’s bullish phase has begun. It appears to be forming an expanding/diagonal/symmetrical triangle.

We are looking for buy/long positions in the green zone, where the hypothetical wave F might come to an end.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate our buy outlook.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

CARDANO 1week MA50 holding. Sky is the limit.Cardano / ADAUSD is holding its 1week MA50 for the 6th straight week.

The pattern is almost identical to the previous Cycle's:

A Channel Up (that breaks once to the downside for a short time) is used as a guide through the whole Bull Cycle. The final consolidation on the 1week MA50 intiates the final and most aggressive rally of the Cycle.

The previous one in 2021 hit the 3.0 Fibonacci extension.

Based on that, we can expect to see $9 on ADA by the end of the year.

Previous chart:

Follow us, like the idea and leave a comment below!!

ADA - Bearish Reversal Setup from Fair Value Gap🚀 ADAUSDT - 1H Chart Analysis 🚀

📊 Current Market Structure:

ADA is moving within a rising channel 📈, approaching a key resistance zone where a Fair Value Gap (FVG) is present. This area aligns with a significant Fibonacci retracement zone, making it a strong potential reversal point.

📌 Technical Insights:

🔹 Price is trading inside a well-defined bullish channel.

🔹 Approaching a major supply zone with previous reaction points.

🔹 Bearish rejection is expected in this area, leading to a potential drop.

📉 Trade Expectation:

A reaction from the FVG could lead to a downward move, as highlighted by the red arrows. If price confirms a rejection, a bearish shift in structure could occur, offering short opportunities.

⚠️ Risk Management Tip: Always wait for confirmation before acting on a setup. Managing risk effectively is key to long-term success!

📢 What do you think? Will ADA respect the FVG or push higher? Share your thoughts! 💬📉🚀

Cardano - Bullish Breakout! Can Bulls Finally Take Control? Cardano (ADA) has recently broken out of a prolonged bearish trend on the 4-hour chart, signaling a potential shift in market sentiment. This breakout suggests that bullish momentum could be building, paving the way for a move higher. The price action indicates that ADA may now target areas of confluence, where technical factors align to create significant levels of interest. The breakout itself is a strong indication that buyers are gaining control, pushing the price above previous resistance levels. This shift in momentum could be the start of a more substantial rally, especially if ADA continues to attract buyers as it moves higher.

The breakout from the bearish trend also marks a change in the broader market structure. Previously, ADA was confined within a downward trend, but now it appears to be transitioning into a more bullish phase. This transition is crucial for traders, as it presents opportunities for both short-term gains and longer-term investment strategies. As ADA moves higher, it will be important to monitor how it interacts with key technical levels, as these will provide insight into whether the breakout is sustainable or if it will be met with resistance.

Short-Term Target: Golden Pocket and Fair Value Gap

The next logical target for ADA is the golden pocket zone (0.618–0.65 Fibonacci retracement level), which coincides with a Fair Value Gap (FVG). This confluence creates a magnet for price action due to several reasons. The golden pocket is a key area where reversals or consolidations often occur after significant moves. It acts as a strong resistance level and is widely monitored by traders because it represents a point where price action tends to stabilize or reverse. Historically, the golden pocket has been a reliable indicator of potential price reversals, making it a critical area to watch for traders looking to capitalize on ADA's current momentum.

The Fair Value Gap (FVG) represents an imbalance in price caused by rapid movement, leaving untraded zones behind. Price tends to revisit these areas to "fill" the gap, making this level crucial for predicting future movements. Gaps like these often get revisited before the market decides on a new trend direction, which means that ADA's approach to this zone could be pivotal in determining its next major move. Additionally, liquidity is likely concentrated around this area, as stop-loss orders from short positions could be triggered here, leading to increased volatility. If ADA reaches this level, traders should closely monitor how price reacts. A strong rejection could signal a move back down, while a clean breakthrough could indicate further upside potential.

Potential Rejection and Support Levels

While the breakout is promising, there remains a high probability of resistance at the golden pocket and FVG zone. If ADA faces rejection here, it could retrace toward key support levels. The primary support zone, which has held firm during recent consolidation phases, will be crucial in determining whether ADA can maintain its bullish momentum. A retest of this area would provide another opportunity for buyers to step in, potentially leading to a continuation of the current trend.

In the event of a rejection, ADA might initially pull back to test its recent breakout levels. If this support holds, it would reinforce the idea that the breakout is legitimate and that ADA is poised for further gains. However, failure to hold these levels could open the door for ADA to drop toward secondary support zones. These areas, typically marked by previous lows or significant trading volumes, would be critical in preventing a deeper correction. If ADA fails to find support at these levels, it could signal a broader reversal in the market, potentially leading to a retest of lower support zones.

Final Thoughts

Cardano’s breakout from its bearish trend presents an exciting opportunity for traders. The golden pocket and FVG alignment around the target zone make it a critical area to watch. Traders should remain cautious as price approaches this resistance level, looking for signs of rejection or continued strength. Monitoring the price action closely will be essential in determining whether ADA has the momentum to push through resistance or if it will be forced back into a consolidation phase.

For now, the key levels to monitor include the resistance at the golden pocket/FVG zone and the support at recent breakout levels. A decisive breakout above resistance could signal further upside potential, while failure might keep ADA within its broader range structure. As ADA navigates these technical levels, traders should be prepared for increased volatility and potential trading opportunities. Whether ADA continues its ascent or faces a pullback, the current market conditions offer a compelling setup for traders looking to capitalize on the cryptocurrency's movements.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

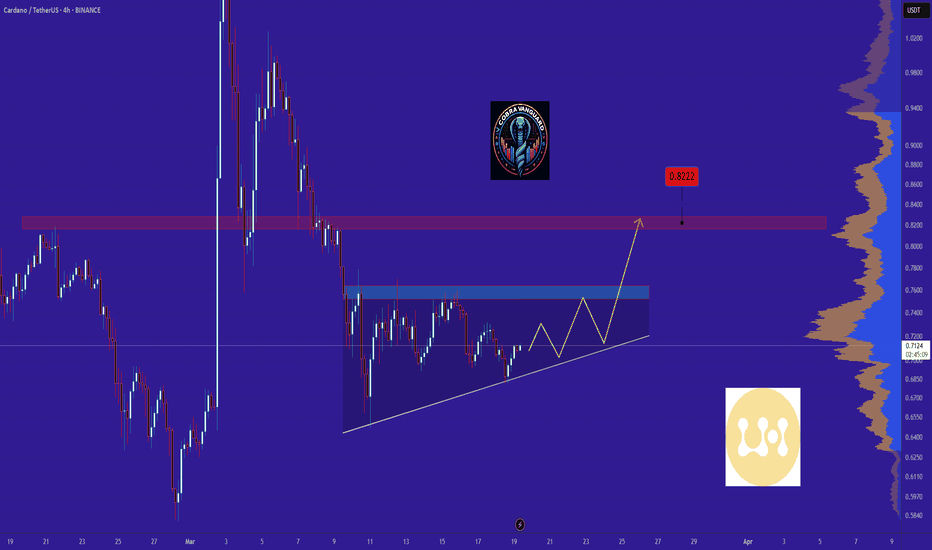

The last bullish chance of CARDANO in mid term!As you can see, the price has now formed an ascending wedge, which is promising. The price could rise to $1 after breaking this wedge...

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

ADA - Next Trade Setups to WatchADA’s been stuck in this sideways grind for a while, and the volume’s basically ghosting us. So, where’s it at, and where’s the next move? Let’s dig in.

ADA’s sitting at $0.6615 right now, trading below the yearly open at $0.8451 and the range’s sweet spot, the POC, at $0.7325. That tells me it’s leaning a bit bearish, but not exactly screaming panic, more like it’s just chilling in this 57 day range. It tapped the monthly open at $0.6328 recently, bounced a little, but without volume showing up, it’s like nobody’s ready to commit yet.

Key Levels

Resistance Zones (Short Opportunities)

1.) Range POC: $0.7325, this is the most traded price within the 57 day range, acting as a magnet for price. A rejection here could signal a short setup.

2.) Yearly Open ($0.8451): a psychological and structural level that could cap upside if momentum remains weak. Trading below this level keeps the yearly bias bearish. A break above with volume would flip the narrative.

Support Zones (Long Opportunities)

1.) Monthly Open: $0.6328, already saw a little bounce here with that swing failure move, perfect setup for a long trade if you were quick on the draw.

2.) Yearly Open 2024 + 21 Monthly EMA: $0.594 - $0.5928, strong confluence with the prior yearly open and a key moving average. This zone aligns closely with the swing low at $0.5801, forming a robust support cluster between $0.5801 - $0.594.

3.) 21 SMA: $0.53, a deeper support level if the above zone fails. This would indicate a more significant breakdown, but it’s a potential accumulation area for longer-term traders.

Market Structure Analysis

Bearish Bias Above Swing Low: Trading below the yearly open and POC suggests sellers are in control unless price reclaims $0.7325 with conviction.

Range-Bound Behaviour: The 57 day range indicates consolidation. Volume is the missing catalyst, watch for a spike to confirm direction.

Swing Low as Key Pivot: The $0.5801 level is critical. A hold here maintains the range; a break below shifts focus to $0.53 and signals capitulation.

High-Probability Trade Setups

Long Setups

1.) Long Setup #1 at Swing Low ($0.5801 - $0.594 Zone)

Entry Trigger: Look for a swing failure pattern (SFP) where price dips below $0.5801, reclaims it, and shows rejection of lower prices (e.g., a bullish candle with a wick below).

Stop Loss (SL): Place just below the swing low

Take Profit (TP): $0.70 (near-term resistance)

Stretch Target: $0.8451 (yearly open), though this requires stronger momentum.

Confirmation: Higher-than-average volume on the reclaim + bullish price action (e.g., engulfing candle).

2.) Long Setup #2: $0.4735 Sniper Entry

Entry Trigger: If ADA takes a bigger tumble, $0.4735 is your sniper’s nest, think of it as catching the knife with style. Could be a wick that snaps back.

This is a deeper, high-reward play. Price has to fall by a lot from here, but if it hits, the R:R is amazing, and it’s below most traders radar. Patience is the name of the game.

Short Setup

At POC ($0.7325) or Yearly Open ($0.8451)

Strategic Outlook

Current Stance: If not in a trade, the $0.5801 level is the highest-probability long setup due to confluence and R:R. The SFP at $0.6328 today was a missed opportunity, but a deeper pullback sets up an even better entry.

Breakout Watch: A decisive close above $0.7325 (POC) with volume shifts focus to $0.8451. Conversely, a break below $0.5801 targets $0.53.

Patience is Key: Low volume suggests waiting for a clear catalyst (e.g., news, BTC move) to drive ADA out of this range.

Wrapping It Up

The $0.5801 swing low long with SL below and TP at $0.7 - $0.8451 is the standout trade right now—low risk, high reward, and backed by confluence. Monitor volume closely, as it’s the linchpin for any breakout or reversal. If ADA holds this support and volume picks up, the retest of $0.8451 becomes plausible.

If you found this helpful, please leave a like and a comment. Happy trading!

ADA Ready for PUMP or what ?The ADA will increase SEVEN cents and reach to the top of the wedge in the coming DAYS.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Cardano: New Low or Off We Go?In line with our primary scenario, Cardano’s ADA should develop a new low as part of the blue wave (ii). However, this corrective move should conclude with sufficient distance from the $0.31 support so that the blue wave (iii) can take over afterward and drive the price decisively above the $1.32 resistance. That said, our 40% likely alternative scenario suggests that the low of wave alt.(ii) in blue may have already been settled back in February. Confirmation of this alternative trajectory would arise with a clear breakout above $1.32.

Cardano - Focus On This One Altcoin!Cardano ( CRYPTO:ADAUSD ) will lead the bullish rally:

Click chart above to see the detailed analysis👆🏻

It really seems to be unbelievable but Cardano is 100% repeating the previous cycle which we saw back in 2018. A double bottom neckline breakout, followed by a significant rally and another break and retest and Cardano is now clearly heading towards the previous all time high.

Levels to watch: $0.6, $2.5

Keep your long term vision,

Philip (BasicTrading)

Cardano Rangebound – Is a Breakout or Breakdown Imminent?📉 ADA is Rangebound! I’m watching closely—if price breaks out of this consolidation, it could set up a strong trading opportunity.

🎯 In this video, we analyze the market structure and price action, breaking down a possible trade setup—if the right conditions align.

🚨 Stay sharp, manage risk—this is not financial advice! 🚀🔥

ADAUSDTADAUSDT Signal 📉

📌 Current Price: 0.7161 USDT

📊 Trend: Bearish ⬇️, but testing a descending trendline 📏

🔑 Key Levels:

🔼 Resistance: 0.9209 🛑

🔽 Support: 0.7782–0.8457 🟢

📉 Next Support: 0.6750 ⚠️

📢 Signal:

🔴 Short (Sell): Enter at 0.7161 if price rejects the trendline.

🎯 TP: 0.6750 | 🛑 SL: 0.7500

🟢 Long (Buy): If price breaks above 0.7284, target 0.7782–0.8457.

🎯 TP: 0.7782–0.8457 | 🛑 SL: 0.7000

⚖️ Risk Management: Use 1:2 risk-to-reward ratio. Control risk as highlighted.

🔍 Monitor for a trendline break! 🚨

Can we be optimistic that this will come true?Can we be optimistic that this will come true? If it follows the triangle pattern, the price will rise by $0.80.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

ADA: Current SituationYou asked, and we delivered:

Cardano (ADA) is currently trading at $0.688, reflecting a volatile yet pivotal moment amid a broader crypto market downturn, with the total market cap down 4.4% over the past 24 hours. Some traders see a falling wedge pattern on the 4-hour chart pointing to a potential breakout, while others note whale activity dumping 100M ADA, suggesting selling pressure. Despite this, ADA’s fundamentals, like its 92M organic transactions and $380M daily DEX volume, hint at underlying strength. The market’s cautious mood, combined with Cardano’s utility-driven ecosystem, sets the stage for a critical juncture.

Technical Indicators and Key Levels

Short-Term (1-Hour and 4-Hour Charts):

Support: $0.65-$0.68 – A key demand zone holding firm so far; $0.53 if selling intensifies.

Resistance: $0.78 – A breakout here could signal bullish momentum; $0.92 as the next target.

Indicators: RSI at ~46 (neutral with upside room), MACD showing bearish momentum. A falling wedge on the 4-hour chart suggests a possible reversal if volume supports a break above $0.78.

Long-Term (Weekly Chart):

Support: $0.60 – A major floor; $0.48 if a deeper correction hits.

Resistance: $1.00 – Psychological and historical barrier; $1.54 as a 2026 target per some forecasts.

Indicators: The 200-day MA is falling, reflecting long-term pressure, but a rising 50-day MA below the price could act as support if tested.

Potential Scenarios

Short-Term:

Bullish Case: If ADA holds $0.68 and breaks $0.78 with strong volume, it could rally to $0.92 or higher. This aligns with the falling wedge breakout narrative from X posts.

Bearish Case: A drop below $0.65 might test $0.53, especially if whale selling persists and volume confirms the move.

Long-Term:

Bullish Case: Holding $0.60 could set up a climb to $1.00 by late 2025, with potential to hit $1.54 in 2026 if adoption grows and market sentiment flips.

Bearish Case: A break below $0.60 risks a slide to $0.48, though fundamentals like network activity could cushion the fall.

Broader Context and Tips

ADA’s strength lies in its research-driven blockchain, scalable PoS consensus, and growing DeFi ecosystem. Long-term, its utility could drive value, but short-term volatility ties to market trends and macro events (e.g., US CPI data). Traders should watch $0.78 for a breakout signal and $0.65 for downside risk, volume will tell the story. Use tight stops (e.g., below $0.65 for longs) and stay alert for news on adoption or whale moves. Investors can lean on Cardano’s fundamentals but should brace for choppiness until the market stabilizes.

Cardano Update: Short-Term Price Action & Long-Term AnalysisThe crypto market is at a pivotal moment, and Cardano (ADA) is no exception. As we approach the highly anticipated Federal Reserve meeting tomorrow, where interest rate decisions will shape global liquidity, ADA finds itself at a critical juncture both fundamentally and technically.

The Macro Picture – Fed, Liquidity, and Risk Sentiment

Tomorrow’s Fed decision could set the tone for risk assets, including cryptocurrencies. A dovish stance, hinting at potential rate cuts, could fuel bullish momentum in the market, driving investors into speculative assets like ADA. On the flip side, a more hawkish Fed—indicating prolonged high rates—might put additional pressure on ADA, making lower support levels a real possibility.

Meanwhile, broader market sentiment is mixed. Bitcoin’s recent consolidation has left altcoins struggling for clear direction, and ADA is no exception. The question remains: will we see a bounce from current levels, or is further downside in the cards?

Technical Setup – A Make-or-Break Moment

Looking at the 1W chart, ADA is currently sitting on a key ascending support line that has been respected for months. This trendline, marked in white, has historically acted as a launchpad for price rebounds. Losing this level could result in a breakdown toward the deeper support zones marked on the chart.

We also see major resistance at $0.8154, where sellers have repeatedly stepped in. To reclaim bullish momentum, ADA must break above this level convincingly. However, if the price fails to hold above the $0.6860 region, things could turn bearish quickly.

EMA & Bollinger Bands – Signs of Compression

The 50 EMA (orange) and 200 EMA (blue) are key indicators to watch. A sustained move below the 50 EMA suggests that ADA is struggling to regain upward momentum. If the 200 EMA is tested, it could act as the last line of defense before a deeper correction.

The Bollinger Bands also indicate a period of price compression, hinting at an imminent breakout. The narrowing bands suggest that volatility is about to increase—either to the upside or downside, depending on how ADA reacts to macro events and technical levels.

Key Support Zones – Where Bulls Might Step In

I've marked three critical zones on the chart that could act as potential areas of interest for buyers:

1. Current Level (~$0.68 - $0.60): This is the first line of defense. If ADA holds this area, we could see a rebound, especially if the Fed decision sparks bullish sentiment.

2. Mid-Zone (~$0.50 - $0.45): If the first support fails, this level could serve as a strong accumulation zone, where buyers have previously stepped in.

3. Final Support (~$0.40 - $0.35): If ADA reaches this level, it could signal a deeper correction before any meaningful recovery.

The Final Verdict – A High-Stakes Scenario

ADA is at a turning point. If the trendline support holds and the Fed decision aligns with market expectations, we could see a strong bounce toward resistance at $0.8154 and beyond. However, if sellers push the price below key support levels, we could be looking at a deeper retracement.

For now, all eyes are on tomorrow’s Fed decision—will it provide the fuel for a breakout, or will we see another leg down? The coming days will be crucial for ADA’s next big move.

Cardano ADAUSD The Week Ahead 17th March ‘25The ADA/USD pair is currently exhibiting a bearish sentiment, sustained by the prevailing downtrend. The critical trading level to monitor is at 8,530, representing the current intraday swing low and the 50-day moving average (DMA) level.

In the short term, an oversold rally from present levels, followed by a bearish rejection at the 8,530 resistance, could lead to a downside move targeting support at 6,576, with further potential declines to 6,000 and 4,846 over a longer timeframe.

Conversely, a confirmed breakout above the 8,530 resistance level and a daily close above it would invalidate the bearish outlook. This bullish scenario could pave the way for a continued rally, aiming to retest the 9,775 resistance, with an extension to 11,244.

Conclusion:

The sentiment for ADA/USD remains bearish, with the 8,530 level acting as a critical resistance. Traders should remain cautious, waiting for either a bearish rejection or a breakout and daily close above this level to assess the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.