Cardanoanalysis

Cardano (ADA) a solid play in crypto, a Macro lookHi guys, so with Bitcoin in price discovery mode. It hints at the final phase of Crypto bull in action. With that comes altseason and in my opinion explosive growth in altcoins.

1 particular coin i've been looking at is Cardano (ADA).

This is a macro technical analysis of ADA on the 1 month timeframe. So each candle is 1 month of price action. This is very powerful on its own. And can give signs into where an asset will trend.

If you compare this to majority of other alts, its looking alot more bullish and is ahead of the game.

SO jumping right in.

Lets look at price action. Notice we are in a macro rectangle or sideways pattern.

Upper limit at $1.24

Lower limit at around $0.25.

This indicates a consolidation phase.

Real action is seen above that upper limit. Where we see explosive price action to the upside. Previously in Sept 2021 seeing highs of up to $3.07.

I believe we are making our way up to this $1.24 level.

Which in the short term will be a solid area to take profit due to it being a major supply zone in my opinion or sell zone. With a potential pull back. This is because if you look previously in price history, cardano price movement heavily involves this level with most of price history being either above or below $1.24.

A key sign but not yet confirmation is a breakout above this slanted resistance line we were being pushed down from that was created in 11-2024.

We have an engulfing candle break out currently. But still awaiting confirmation which will require august monthly candle to stay above this line and present a bullish candle print.

We will be on the look out for this.

There are other signs and signals appearing in Cardano (ADA) that support my theory and Price action developments. To take trades i always look for multiple signs that overlap.

Stay tune for more of that where ill go over many different indicators and other aspects that point to ADA being above other alts as a solid trade or investment for the next altseason.

Cardano: Eyeing Alternative Rally ScenarioCardano’s ADA token has realized further gains. As a result, we’ve increased the probability of our alternative scenario—in which the low of the wave (ii) correction is already in place—to 40%. For ADA to take this “shortcut,” the next step would be to break above resistance at $0.86, followed by a move past the $1.32 level. For now, however, we’re maintaining our primary outlook and are preparing for a new low in blue wave (ii). In this scenario, the price should hold above support at $0.31.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Cardano: Low Ahead!According to our primary scenario, Cardano's ADA coin should imminently pull back toward the support at $0.31 to finally complete the blue wave (ii). With this low in place, we see the altcoin breaking out above the resistance at $1.32. If the price manages to rise above this mark without forming a new low first (33% likely), we will have to assume that wave alt.(ii) in blue is already complete.

Cardano: New Low or Off We Go?!For Cardano, we primarily still expect a new low in the blue wave (ii), but the price should stay above the support at $0.31. Once the wave (ii) corrective movement is completed – which theoretically could have already happened – the blue wave (iii) should drive the price significantly above the resistance at $1.32.

Cardano (ADA) is on the verge of an 80% surge (1D)Despite all the positive news, it couldn’t maintain its bullish trend, as seasoned whales typically don't enter the market at the end of bullish waves.

The zone we’ve highlighted is where we believe whales will enter Cardano. Due to heavy buying pressure, the price could experience a 50% to 80% surge.

From the point marked with the green arrow on the chart, Cardano’s bullish phase has begun. It appears to be forming an expanding/diagonal/symmetrical triangle.

We are looking for buy/long positions in the green zone, where the hypothetical wave F might come to an end.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate our buy outlook.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

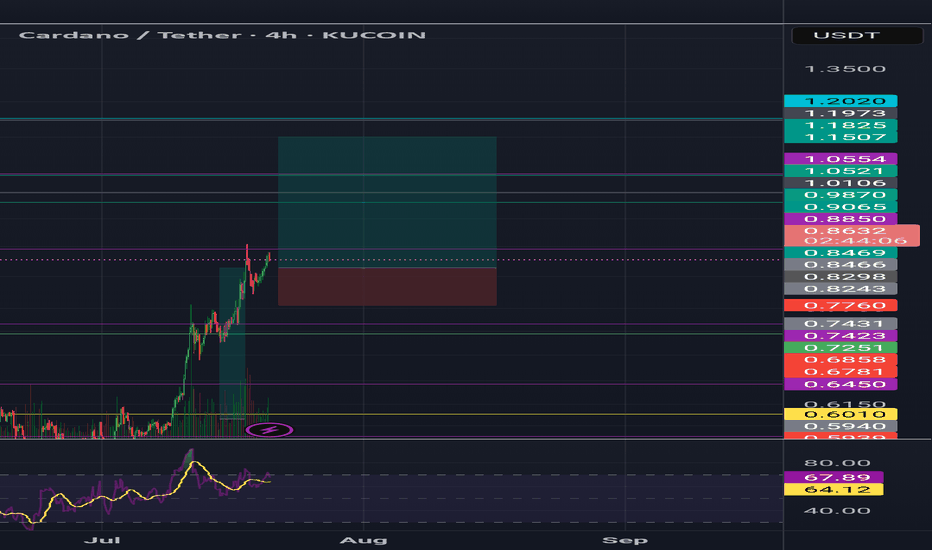

Cardano - Bullish Breakout! Can Bulls Finally Take Control? Cardano (ADA) has recently broken out of a prolonged bearish trend on the 4-hour chart, signaling a potential shift in market sentiment. This breakout suggests that bullish momentum could be building, paving the way for a move higher. The price action indicates that ADA may now target areas of confluence, where technical factors align to create significant levels of interest. The breakout itself is a strong indication that buyers are gaining control, pushing the price above previous resistance levels. This shift in momentum could be the start of a more substantial rally, especially if ADA continues to attract buyers as it moves higher.

The breakout from the bearish trend also marks a change in the broader market structure. Previously, ADA was confined within a downward trend, but now it appears to be transitioning into a more bullish phase. This transition is crucial for traders, as it presents opportunities for both short-term gains and longer-term investment strategies. As ADA moves higher, it will be important to monitor how it interacts with key technical levels, as these will provide insight into whether the breakout is sustainable or if it will be met with resistance.

Short-Term Target: Golden Pocket and Fair Value Gap

The next logical target for ADA is the golden pocket zone (0.618–0.65 Fibonacci retracement level), which coincides with a Fair Value Gap (FVG). This confluence creates a magnet for price action due to several reasons. The golden pocket is a key area where reversals or consolidations often occur after significant moves. It acts as a strong resistance level and is widely monitored by traders because it represents a point where price action tends to stabilize or reverse. Historically, the golden pocket has been a reliable indicator of potential price reversals, making it a critical area to watch for traders looking to capitalize on ADA's current momentum.

The Fair Value Gap (FVG) represents an imbalance in price caused by rapid movement, leaving untraded zones behind. Price tends to revisit these areas to "fill" the gap, making this level crucial for predicting future movements. Gaps like these often get revisited before the market decides on a new trend direction, which means that ADA's approach to this zone could be pivotal in determining its next major move. Additionally, liquidity is likely concentrated around this area, as stop-loss orders from short positions could be triggered here, leading to increased volatility. If ADA reaches this level, traders should closely monitor how price reacts. A strong rejection could signal a move back down, while a clean breakthrough could indicate further upside potential.

Potential Rejection and Support Levels

While the breakout is promising, there remains a high probability of resistance at the golden pocket and FVG zone. If ADA faces rejection here, it could retrace toward key support levels. The primary support zone, which has held firm during recent consolidation phases, will be crucial in determining whether ADA can maintain its bullish momentum. A retest of this area would provide another opportunity for buyers to step in, potentially leading to a continuation of the current trend.

In the event of a rejection, ADA might initially pull back to test its recent breakout levels. If this support holds, it would reinforce the idea that the breakout is legitimate and that ADA is poised for further gains. However, failure to hold these levels could open the door for ADA to drop toward secondary support zones. These areas, typically marked by previous lows or significant trading volumes, would be critical in preventing a deeper correction. If ADA fails to find support at these levels, it could signal a broader reversal in the market, potentially leading to a retest of lower support zones.

Final Thoughts

Cardano’s breakout from its bearish trend presents an exciting opportunity for traders. The golden pocket and FVG alignment around the target zone make it a critical area to watch. Traders should remain cautious as price approaches this resistance level, looking for signs of rejection or continued strength. Monitoring the price action closely will be essential in determining whether ADA has the momentum to push through resistance or if it will be forced back into a consolidation phase.

For now, the key levels to monitor include the resistance at the golden pocket/FVG zone and the support at recent breakout levels. A decisive breakout above resistance could signal further upside potential, while failure might keep ADA within its broader range structure. As ADA navigates these technical levels, traders should be prepared for increased volatility and potential trading opportunities. Whether ADA continues its ascent or faces a pullback, the current market conditions offer a compelling setup for traders looking to capitalize on the cryptocurrency's movements.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

Cardano: New Low or Off We Go?In line with our primary scenario, Cardano’s ADA should develop a new low as part of the blue wave (ii). However, this corrective move should conclude with sufficient distance from the $0.31 support so that the blue wave (iii) can take over afterward and drive the price decisively above the $1.32 resistance. That said, our 40% likely alternative scenario suggests that the low of wave alt.(ii) in blue may have already been settled back in February. Confirmation of this alternative trajectory would arise with a clear breakout above $1.32.

Here is why I think Cardano will be 9 USD in SeptemberPrice currently forming a bullish flag and we are currently in what I think Phase 4 of Wyckoff accumulation which is LPS or Back Up phase. IF Price goes to 24 Fibonacci level it will go to 25 but I think 9 is a realistic target.

Disclaimer: Not a financial advice. Do your own analysis

Cardano ADA Is The Best Donald Trump's Coin EverHello, Skyrexians!

We have already made a lot of analysis on BINANCE:ADAUSDT and all of them plays out great, this coin is very technical moving, so we can predict them with the high probability. Donald Trump recently announced that ADA will be in reserve, so we have to understand how it can affect the price action.

Let's take a look at the weekly time frame. You can see that after a green dot on Bullish/Bearish Reversal Bar Indicator the impulsive waves 1 and 3 have been started. In our opinion now the wave 3 is about to continue. Awesome Oscillator has the highest value in this bull run that's why this is can be only wave 3. The targets are very high. Now we can say that they are located between $2 and $3.5 with the final bull run target at $5.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Cardano AnalysisCardano ADA/USD Analysis

Cardano (ADA/USD) is currently trading at 0.788, having recently breached a critical support level. This breakdown has shifted the asset's technical structure, with the price now retesting the previously broken support zone, which has since turned into resistance. In technical analysis, such a retest of a breached support level often acts as a key confirmation point for the potential continuation of the prevailing trend. If the current candle closes decisively below this newly established resistance level, it could signal a resumption of bearish momentum, potentially opening the door for further downward movement.

The validity of this bearish outlook hinges on several factors, including the volume accompanying the price action and the broader market sentiment surrounding Cardano. Traders should remain vigilant for any signs of rejection or reversal patterns at this critical level, as these could negate the bearish thesis and indicate a shift in market dynamics.

In summary, while the current price action suggests a potential continuation of the downtrend, it is essential to approach the market with caution. We welcome your perspective on this analysis and whether you agree with the potential bearish outlook for Cardano. As always, prioritize responsible trading practices and robust risk management strategies.

Cardano / TetherUSHello dear traders,

This is an analysis of the cryptocurrency Cardano, for which I am providing you with an updated daily analysis. Cardano is currently in a corrective trend and the daily buying zone is currently far from us. An excellent selling zone is marked on the chart. Once the price reaches this zone, we can enter a selling position with technical confirmation. If we do not have technical confirmation, we should also expect a new peak. However, considering the total crypto analysis, which is currently bearish, this cryptocurrency is likely to also trend downwards.

Daily Supports:

Daily Support: 0.3730

Daily Range: 0.3393

Monthly Liquidity : 0.2756

Wishing you all the success!

Fereydoon Bahrami

A retail trader in the Wall Street trading Center (Forex)

Risk Disclosure:

Trading in the crypto market is risky due to high price changes. This analysis is just one person's opinion and shouldn't be taken as financial advice. Before investing, it's best to talk to a financial advisor and do your own research. You are responsible for any profits or losses from this analysis

Public trade #24 - #ADA price analysis ( Cardano )CRYPTOCAP:ADA price was drained quite a bit on 03/02/25, but today it shows one of the best rates of buyback (of course, among the “old” coins with a large market cap)

Let's try to bribe to ourselves with #Cardano

The approximate trade for the investment portfolio is shown on the chart, and also we will take #ADA in copytrading as the price moves, depending on the dynamics.

Do you believe that the price of OKX:ADAUSDT will reach $5.60-6.50 in this 2025 growth cycle?

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Cardano: Target Zone ReachedCardano entered our blue Target Zone between $0.73 and $0.49 during the recent sharp sell-off but quickly rebounded above its upper boundary. While it’s entirely feasible that the low of the blue wave (ii) has already been settled, another dip to finalize this intermediate correction remains possible. Once wave (ii) has indeed found its bottom, the blue impulse wave (iii) should take over and drive the price above the resistance at $1.32.

ADA Cardano Only Your Opinion Counts! ADAUSD No Trigger No TradePlease read the chart annotations for 🟢SeekingPips🟢 insight.

As mentioned on the above chart “Two Traders Can Have The Same Bias But One Will Make Money But The Other One Looses. WHY?

✅Note this ONE IS GOLD…

Write it down. Print It and even stick it to your forehead if you must…

THE BIG SECRET IS TIME. 👌

You know by now already that for 🟢SeekingPips🟢 TIME IS MORE IMPORTANT THAN PRICE.

🕒 TIME 🕕 is the ONE & ONLY THING THAT WE CAN FORECAST WITH 100% ACCURACY.

💡Let That Sink In…

I will TRY & GO INTO DEPTH on this subject over time on this 🟢SeekingPips🟢 Chanel

CARDANO ADA Retesting SeekingPips' KEY PRICE LEVEL🟢Identifying key PRICE LEVELS is key to finding great trading OPPORTUNITIES however SeekingPips' OPINION is that PRICE ALWAYS comes SECOND TO TIME.

ℹ️ If there is REALLY A SECRET SAUCE to trading that is it.

🟢 SeekingPips says "TIME then PRICE" ALWAYS.👌

🌍 FOLLOW NOW TO SEE OUR LATEST IDEAS🌎

Cardano ADA Continues Outperform The Market In JanuaryHello, Skyrexians!

In our recent analysis on BINANCE:ADAUSDT we predicted the price growth above $1.20 when the price was $0.37. When price reached the $1.30 we told you that it's time for retracement to $0.8. Cardano reached exactly this target and has already bounced. You can find all this predictions in this article . Now it's much more important to understand what is the next move.

Let's take a look at the daily time frame. After reaching the local top price has printed red dot on Bullish/Bearish Reversal Bar Indicator and dumped -40%. As always, alerts from this indicator are automatically replicated on my accounts. You can find the information in our article on TradingView .

Dump has been stopped inside the Fibonacci 0.5 zone with the green dot on this indicator. This is the strong sign that corrective wave 2 has been finished. The next target is 1.61-2.61 Fibonacci extensions. We suppose that price can reach $2.5-$3.5 in January-February 2025.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

ADA/USDT Trading Scenario UpdateThe asset has shown a strong upward trend, rising from $0.3190 to $1.3264, indicating increased market interest. This growth was accompanied by higher trading volumes, which confirms its strength. Currently, ADA is in a correction phase, which has already retraced over 40% from its peak.

The key POC (Point of Control) level of the current local uptrend cycle is at $0.5979. This volume-based level could serve as support and potentially mark the beginning of a reversal. For investors, this represents a good entry point to purchase the asset at a more favorable price before a potential altseason.

It’s important to monitor the price action near this level, as its reaction could determine the further direction of movement.

Cardano - Repeating the +3.000% bullish cycle!CRYPTO:ADAUSD is creating price action like back in 2020 and we might see a rally soon.

Looking at the higher timeframes allows you to massively capitalize on overall market swings and cycles. Especially when it comes to Cardano, these cycles are pretty rewarding but also pretty predictable. At the moment, Cardano is repeating price action; we saw the same pattern playing out in 2020 and this break and retest was followed by a rally of +3.000%

Levels to watch: $0.42, $0.25

Keep your long term vision,

Philip - BasicTrading

Cardano ADA Will Outperform Cryptocurrency MarketHello, Skyrexians!

Yesterday we considered the Bitcoin analysis where concluded that the potential growth is not going to be insane, bull market will be finished soon. At the same time on the BINANCE:ADAUSDT weekly chart we can see that price is charged for the flight.

Let's notice, that Cardano has the specific bear market structure, where the corrective wave C has been finished in October 2023. Growth from the bottom was impulsive, so it could not be the wave B, in our opinion it's wave 1 of the new bull market. Since March 2024 most of crypto assets continued the bear market, but drop on ADA was not so big. It means that wave 2 has been formed already.

Look at the green dot on the Bullish/Bearish Reversal Bars Indicator . This is strong bullish signal that this correction is likely to be finished, in conjunction with Elliott waves analysis we can see that the impulsive wave 3 is about to happen soon! Targets can be calculated using Fibonacci Extension. 1.61 and 2.61 corresponds to the area between $1.2 and $1.77. Note that this zone is not likely going to be the end of bull run. This is just wave 3 in this rally. Finally, we expect the new ATH for ADA in 2025.

Best regards,

Skyrexio Team

Cardano ADA price has risen from the "dead"While CRYPTOCAP:BTC is updating ATH, the price of CRYPTOCAP:ADA is finally breaking away from the bottom)

Unfortunately or fortunately, these are the realities.

Very few projects from 20-21 and even more so from 16-17 feel good and confident now, only young, hype and “light” projects are shooting up.

God bless the price of OKX:ADAUSDT to rise to $0.49-0.50, then slightly adjust and then shoot up to $0.80, and if you're lucky, to $1.

And for the #Cardano holders and altruists, patience to wait for that time.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Understanding the Cardano (ADA) Surge: Comprehensive Analysis

Cardano (ADA), the native cryptocurrency of the Cardano blockchain, has recently exhibited a notable uptrend, breaking above the crucial $0.8800 support level. The price has since rallied to trade above the $0.9500 mark, surpassing the 100-hourly Simple Moving Average (SMA).

Technical Analysis: A Bullish Outlook

A closer look at the hourly chart of the ADA/USD pair reveals a key bearish trend line forming resistance near the $1.0200 level. However, a decisive breakout above this trend line could trigger a significant upward move, potentially propelling the price towards the $1.0500 resistance zone.

Key Technical Indicators:

• Relative Strength Index (RSI): The RSI is currently hovering above the 50 level, indicating bullish momentum. A sustained increase in the RSI could signal further price appreciation.

• Moving Averages: The 100-hourly SMA has been acting as a strong support level, and a break above it has confirmed the bullish bias.

• Momentum Indicators: Momentum indicators like the Moving Average Convergence Divergence (MACD) and the Stochastic Oscillator are also showing bullish signals, suggesting that the upward trend may continue.

Fundamental Factors Driving ADA's Price Increase

While technical analysis provides insights into short-term price movements, it's essential to consider the underlying fundamental factors driving ADA's price increase:

• Network Upgrades: Cardano's ongoing network upgrades, such as the Vasil hard fork, have significantly improved the network's scalability and efficiency. These upgrades have attracted more developers and investors to the Cardano ecosystem.

• Growing DeFi Ecosystem: The Cardano blockchain is rapidly emerging as a hub for decentralized finance (DeFi) applications. The increasing number of DeFi projects and protocols built on Cardano can boost demand for ADA.

• Institutional Adoption: Institutional investors and corporations are increasingly recognizing the potential of blockchain technology and cryptocurrencies. As more institutions allocate capital to Cardano, it can further fuel price appreciation.

• Positive Market Sentiment: The overall positive sentiment in the cryptocurrency market, driven by factors such as increasing institutional adoption and regulatory clarity, can also contribute to ADA's price increase.

Potential Risks and Challenges

While the technical and fundamental outlook for ADA appears bullish, it's important to acknowledge potential risks and challenges:

• Market Volatility: The cryptocurrency market is highly volatile, and prices can fluctuate rapidly due to various factors, including macroeconomic events, regulatory changes, and market sentiment.

• Competition from Other Blockchains: Cardano faces competition from other blockchain platforms like Ethereum and Solana. These competing platforms may offer advantages in terms of scalability, transaction fees, and developer ecosystem.

• Regulatory Uncertainty: Regulatory uncertainty remains a significant risk for the cryptocurrency industry. Strict regulations or unfavorable policies could negatively impact the price of ADA.

Conclusion

Cardano's recent price surge and positive technical indicators suggest that the bullish trend may continue in the short term. However, it's crucial to approach investments in cryptocurrencies with caution and consider diversifying your portfolio. As with any investment, conducting thorough research and consulting with financial advisors can help you make informed decisions.