The dance between the USDZAR and (ZA10Y - US10Y)The chart shows the relationship between the USDZAR and the yield differential between the SA 10-year and the US 10-year (ZA10Y – US10Y).

2025 has been a wild ride for the rand and it has managed to put up a remarkable recovery in the 2Q2025 but where to now for the pair? The pair has not traded below the 200-week MA currently at 17.62, since the March 2022 just before the global rate hiking cycle. The only previous times the pair traded below this moving average was briefly in 2021 before the June/July riots in SA and during the “Ramaphoria” period in 2018.

The 200-week MA also coincides with the 38.2% Fibo retracement from the low in 2021. A brief break below these two support levels will allow the pair to fall onto the 50% Fibo retracement level at 16.62. The yield differential is however suggesting that the rand may not have much room to pull the pair too far below the 200-week MA. The brief break below the 5.00% during December 2024 and January 2025 was a bit of an anomaly given the volatility in the US bond market and I still believe 5.00% is a hard support for the yield differential. A bottom out of the yield differential could see it rise higher towards 7.50% which will be rand negative should the positive correlation hold.

To summarise, the yield differential is suggesting that the rand’s 2Q2025 recovery may be on its last legs but a break below the 200-week MA will allow the rand to pull the pair towards 16.50. I don't see the rand maintaining levels below 16.50 and this level seems like a long-term floor for the pair before another 5-wave impulse to the topside.

Historical trend analysis:

The SA rand is one of the most attractive emerging market currencies due to the carry trade appeal of the currency coupled with SA’s deep and liquid bond market. During periods when there is significant buying pressure on SA bonds, the SA yields will decrease meaning that the yield differential (ZA10Y-US10Y) decreases while in periods when SA bonds are selling off, yields on SA bonds will increase which increases the yield differential, citrus paribus. The USDZAR pair is thus positively correlated with this yield differential.

The chart goes back to 2018 when the USDZAR hit a low of 11.50 following the period dubbed the “Ramaphoria” period. Investor sentiment swinged aggressively positive in this period and the flow of international funds into the SA bond market saw the yield differential drop to a low around 5.00%. The yeld differential has never dropped below this level until early 2025 as indicated on the chart.

The yield differential and the USDZAR pair moved in tandem all the way through to the 1Q2022, maintaining its strong positive correlation. The next period marked the start of the global hiking cycle which saw the US 10-year yield rise from a low of 1.65% in March 2022 to a high of 5.00% in October 2023. This aggressive rise in US 10-year yields marked a period of extensive risk off sentiment and even caused a US banking crises in March 2023. The Fed stepped in and briefly paused their QT to add liquidity to system and provided the US banking system with the bank term funding program to patch up the cracks. The rand sold off due to risk off investor sentiment while the US 10-year yield rose due to the start of the rate hiking cycle which reduced the yield differential. The USDZAR climbed to a high of 19.90 in May 2023 while the yield differential dropped to a low of 7.50%. The yield differential continued to fall until the US 10-year yield topped out at 5.00% in October 2023, after which the positive correlation between the USDZAR and the yield differential was restored.

The next period marked positive sentiment towards SA following the election results and the formation on the government on national unity (GNU). Coupled with the end to the rate hiking cycle, the rand had the wind and risk on investor sentiment in its sails which allowed the rand to pull the pair to a low of 17.03. The optimism of the GNU and the realisation on another Trump presidency however saw the pair bottom out in September 2024. During the last quarter of 2024 the rand experienced sustained selling pressure while the yield differential continued to fall. The break in correlation was largely due to the US10-year yield climbing from 3.60% in September 2024 to a high of 4.80% in January 2025.

Carrytrade

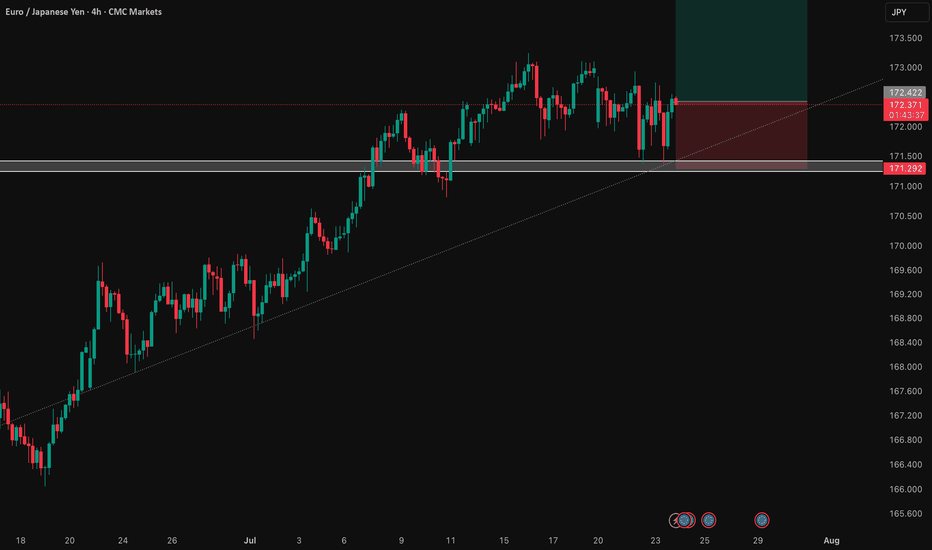

EUR/JPY: Bullish Thesis on Policy DivergenceOur primary thesis is built on a powerful confluence of compelling fundamental drivers and a clear technical structure. We are taking a long position in EUR/JPY with high conviction, anticipating significant upside fueled by a stark monetary policy divergence confirmed by a constructive chart formation.

📰 Fundamental Analysis: The core of this trade is the widening policy gap between the European Central Bank (ECB) and the Bank of Japan (BoJ). While the BoJ is only just beginning to exit its ultra-loose monetary policy, the global environment points toward continued JPY weakness. The upcoming high-impact US news will act as a major catalyst. A "risk-on" reaction to the data would significantly weaken the JPY, providing a strong tailwind for this trade.

📊 Technical Analysis: The chart structure for EUR/JPY is decidedly bullish. The pair has established a clear uptrend, and recent price action indicates a period of healthy consolidation above key support levels. This presents a strategic entry point, as the market appears to be gathering momentum for the next leg higher. The current setup suggests a low-risk entry into a well-defined upward trend.

🧠 The Trade Plan: Based on this synthesis, we are executing a precise trade with a favorable risk profile.

👉 Entry: 172.422

⛔️ Stop Loss: 171.292

🎯 Take Profit: 174.684

⚖️ Risk/Reward: 1:2

NOKJPY – Detailed Macro Analysis & Trade IdeaMacro Bias: LONG NOK / SHORT JPY

Why NOKJPY?

1. Fundamental Macro (ENDO):

Norway (NOK):

Strong inflationary pressure, positive PMI, robust M2 growth.

Massive fiscal surplus driven by energy exports – best debt/GDP ratio in the G10.

Norges Bank still maintaining relatively high interest rates.

Positive Terms of Trade, central bank balance sheet (CBBS) is shrinking (long-term bullish for NOK).

Japan (JPY):

Economic stagnation and deflationary risks, weak PMI and consumer spending.

Negative real yields, central bank remains ultra-accommodative, extreme debt/GDP ratio.

Persistent deflationary sentiment – classic “funding currency” for global carry trades.

2. COT Positioning (Commitments of Traders):

JPY is the most crowded short in the entire G10: hedge funds and leveraged funds are aggressively short JPY.

NOK positioning is neutral to slightly long – no overcrowding risk on the long side.

3. EXO & Sentiment Signals:

Terms-of-trade and projected GDP/CPI all favor NOK.

Sentiment, macro “score,” and risk/reward models consistently generate a long NOKJPY signal.

Exogenous indicators (futures, commodity impulse, sentiment, parity) all support NOK strength.

4. Technicals & Carry Edge:

NOKJPY remains in a strong multi-month uptrend.

Major carry advantage: NOK rates are much higher than JPY, yielding significant positive swap.

Every recent pullback has been bought, and momentum remains bullish.

Key Reasons for the Trade:

Multi-model consensus: No contradiction between macro, COT, exo, and technicals.

NOK is “king of G10” by every fundamental measure; JPY is the weakest currency this cycle.

Textbook carry trade for 2025.

Risks:

Only a sudden global “risk-off” or a central bank policy shock could temporarily disrupt the trend.

Currently, there is no crowding risk on NOK longs.

SUMMARY:

LONG NOKJPY is the cleanest, highest-conviction swing trade for this cycle – every model (macro, COT, exo, sentiment, carry) is in agreement.

Every meaningful pullback is a buying opportunity.

EUR/CAD Bullish Momentum Rising Channel Points to 1.5000 Target EUR/CAD is trading at approximately 1.4800. Your target price of 1.5000 indicates an anticipated upward movement of 200 pips, aligning with a bullish outlook within the context of a rising channel pattern.

Technical analysis on the daily chart suggests a bullish bias, as EUR/CAD continues to trade within an ascending channel pattern. This pattern is characterized by higher highs and higher lows, indicating sustained upward momentum. The pair is approaching the upper boundary of this channel, suggesting potential for further gains toward your target price.

On the 4-hour timeframe, EUR/CAD is trading within a rising channel as it approaches a confluence area. This consolidation pattern increases the likelihood of a bearish outcome, as traders can wait for the break and retest of the trendline support of the channel pattern to confirm a bearish entry.

In summary, the EUR/CAD pair is exhibiting bullish momentum within a rising channel pattern, with technical indicators supporting a potential move toward the 1.5000 target. Traders should monitor key support and resistance levels, as well as fundamental factors influencing the Euro and Canadian Dollar, to make informed trading decisions.

How Does a Carry Trade Work? How Does a Carry Trade Work?

A carry trade is a popular forex trading strategy that takes advantage of interest rate differentials between two currencies, aiming to earn returns from the interest gap. This article explores what a carry trade is, its formula, and how the strategy works, helping traders understand its potential advantages and risks.

Carry Trade: Definition

A carry trade is a popular forex strategy where traders take advantage of the difference in interest rates between two currencies. It involves borrowing money in a currency with a low borrowing cost—this is known as the "funding currency"—and then converting that borrowed amount into another offering higher interest, called the "investment currency." This is done to earn the interest rate differential between the two.

The Mechanics of a Forex Carry Trade

A carry position involves a few key components that work together to create potential opportunities in the forex market.

1. The Funding Currency

The first component is the currency that the trader borrows, the funding currency. Traders typically choose one with low interest costs because the amount to repay will be minimal. Common funding currencies include the Japanese yen (JPY) or the Swiss franc (CHF), as these often have low or even negative borrowing costs.

2. The Investment Currency

The second component is the investment currency, which is the one into which the borrowed funds are converted. This is chosen because it offers a higher interest yield, providing an opportunity to earn returns from the interest rate differential.

Popular investment currencies often include the Australian dollar (AUD) or the New Zealand dollar (NZD), as they tend to have higher borrowing costs. However, in recent years, emerging market currencies, like the Mexican peso (MXN), Brazilian real (BRL), and South African rand (ZAR), have also been favoured due to their high interest yields.

3. Interest Rate Differential

The core concept here is to capitalise on the interest rate differential between the funding and investment currency. If someone borrows in a currency with a 0.5% premium and invests in another offering a 4% yield, the differential (known as the "carry") is 3.5%. This differential represents the potential return, assuming there are no significant changes in the exchange rate.

4. Swaps and Rollovers

Swaps and rollovers are key factors. When you hold a position overnight (roll it over), the difference in interest rates between the two currencies is either credited or debited to your account. This is because when you trade a forex pair, you're effectively borrowing one currency to buy another. The swap rate compensates for the interest rate difference.

Positive Swap Rate: If the interest rate of the currency you are buying is higher than that you are selling, you might receive a positive swap rate, meaning you earn interest.

Negative Swap Rate: Conversely, if the interest rate of the currency you're selling is higher than the one you're buying, you'll pay interest, leading to a negative swap rate.

5. Leverage

Many traders use leverage to amplify their positions. Leverage allows them to borrow additional funds to expand the size of their investment. While this can potentially increase returns, it also magnifies risks. If the position moves against the trader, losses can quickly accumulate due to the leverage.

6. Market Fluctuations

The price of the pair is a crucial factor in the yield of the differential. While the differential offers the potential for returns, any adverse price movement can negate these gains. For instance, if the investment currency depreciates relative to the funding currency, the trader could face losses when converting back to the funding currency.

Conversely, if the investment currency appreciates relative to the funding currency, then they can potentially make an additional gain on top of their interest yield.

7. Transaction Fees and Spreads

Traders must consider transaction fees and spreads, which are the differences between the buying and selling prices of a forex pair. These costs can reduce the overall gains of the operation. Wider spreads, particularly in less liquid forex pairs, can increase the cost of entering and exiting positions.

In a carry position, these components interact continuously. A trader borrows in a low-interest-rate currency, converts the funds to a higher-yielding one, and aims to earn from the differential while carefully monitoring market movements, transaction costs, and swap rates. The overall approach is based on balancing the interest earned, fees, and potential pair’s price movements.

Carry Trade: Formula and Example

To calculate the potential return of a carry trade, traders use a basic formula:

- Potential Return = (Investment Amount * Interest Rate Differential) * Leverage

Let’s examine a carry trade example. Imagine someone borrows 10,000,000 Japanese yen (JPY) at a low interest rate of 0.5% and uses these funds to invest in Australian dollars (AUD), which has a higher borrowing cost of 4.5%. The differential is 4% (4.5% - 0.5%).

If the current exchange rate is 1 AUD = 80 JPY, converting 10,000,000 JPY results in 125,000 AUD (10,000,000 JPY / 80).

They then use the 125,000 AUD to earn 4.5% interest annually:

- 125,000 * 4.5% = 5,625 AUD

The cost of borrowing 10,000,000 JPY at 0.5% interest is:

- 10,000,000 * 0.5% = 50,000 JPY

Converted back to AUD at the original exchange price (1 AUD = 80 JPY), the interest cost is:

- 50,000 JPY / 80= 625 AUD

The net return is the interest earned minus the borrowing cost (for simplicity, we’ll exclude other transaction fees):

- 5,625 AUD − 625 AUD = 5,000 AUD

If the price changes, it can significantly impact the position’s outcome. For example, if the AUD appreciates against the JPY, moving from 80 to 85 JPY per AUD, the 125,000 AUD would now be worth 10,625,000 JPY (125,000 * 85). After repaying the 10,000,000 JPY loan, the trader receives additional returns.

Conversely, if the AUD depreciates to 75 JPY per AUD, the value of 125,000 AUD drops to 9,375,000 JPY (125,000 * 75). After repaying the 10,000,000 JPY loan, the trader faces a loss.

Types of Carry Trades: Positive and Negative

Trades with yield differential can be classified into two types: positive and negative, each defined by the differential between the funding and investment currencies.

Positive Carry Trade

A positive carry trade occurs when the borrowing rate on the investment currency is higher than that of the funding one. For example, if a trader borrows in Japanese yen (JPY) at 0.5% and invests in Australian dollars (AUD) at 4.5%, the differential is 4%. This differential means they earn more interest on the invested currency than they pay on the borrowed one, potentially resulting in a net gain, especially if market movements are favourable.

Negative Carry Trade

A negative carry trade happens when the yield on the funding currency is higher than that on the investment. In this case, the trader would lose money on the rate differential. For example, borrowing in US dollars at 2% to invest in euros at 1% would result in a negative carry of -1%. Traders might still pursue negative yield differential trades to hedge other positions or take advantage of expected market movements, but the strategy involves more risk.

How Can You Analyse Carry Trade Opportunities?

To analyse opportunities, traders focus on several key factors to determine whether a carry position could be effective.

1. Differentials

The primary factor here is the interest rate differential between the two currencies. Traders look for forex pairs where the investment currency offers a significantly higher interest return than the funding currency. This differential provides the potential returns from holding the position over time.

2. Economic Indicators

Traders monitor economic indicators such as inflation rates, GDP growth, and employment figures, as these can influence central banks' decisions on interest rates. A strong economy may lead to higher borrowing costs, making a pair more attractive for a yield differential position. Conversely, weak economic data could result in rate cuts, reducing the appeal of a currency.

3. Central Bank Policies

Understanding central bank policies is crucial. Traders analyse statements from central banks, like the Federal Reserve or the Bank of Japan, to gauge future rate changes. If a central bank hints at raising borrowing costs, it could present an opportunity for a positive carry transaction.

4. Market Sentiment and Risk Appetite

This type of transaction often performs well in low-volatility environments. Traders assess market sentiment and risk appetite by analysing geopolitical events, market trends, and investor behaviour.

Risks of a Carry Trade

While carry trading can offer potential returns from borrowing cost differentials, they also come with significant risks that traders must consider.

- Exchange Risk: If the investment currency depreciates against the funding one, it can wipe out the returns from the differential and result in losses.

- Interest Rate Risk: Changes in the cost of borrowing by central banks can alter the differential, reducing potential returns or even creating a negative carry situation.

- Leverage Risk: Many traders use leverage to amplify returns, but this also magnifies potential losses. A small adverse movement in pairs can push the trader out of the market.

- Liquidity Risk: During periods of low market liquidity, exiting a position may become difficult or more costly, increasing the risk of loss.

A Key Risk: Carry Trade Unwinding

Unwinding happens when traders begin to exit their positions en masse, often due to changes in market conditions, such as increased volatility or a shift in risk sentiment. This essentially means exiting the investment and repurchasing the original currency.

Unwinding can trigger rapid and significant price movements, particularly if many traders are involved, and lead to a much lower return if the exit is timed incorrectly. For example, if global markets face uncertainty or economic data points to a weakening economy, investors may seek so-called safer assets, leading to a swift exit from carry positions and a steep decline in the investment currency.

The Bottom Line

This type of strategy offers a way to take advantage of interest rate differentials between currencies, but it comes with its own set of risks. Understanding the mechanics and analysing opportunities is critical. Ready to explore yield differential trades in the forex market? Open an FXOpen account today to access advanced tools, low-cost trading, and more than 600 markets. Good luck!

FAQ

What Is a Carry Trade?

A carry trade in forex meaning refers to a strategy where traders borrow in a low-interest currency (the "funding currency") and invest in a higher-interest one (the "investment currency") to earn returns from the differential.

What Is the Carry Trade Strategy?

The carry trade strategy consists of borrowing funds in a currency with a low interest rate and using those funds to invest in a currency that offers a higher interest rate. Traders then invest the borrowed funds in the higher-yielding one to earn returns from the borrowing cost differential. The strategy typically relies on both relatively stable forex prices and the interest differential remaining favourable.

How Does the Japanese Carry Trade Work?

The Japanese currency carry trade typically involves borrowing the Japanese yen (JPY) at a low interest rate and converting it into another with a higher yield, like the Australian dollar (AUD). The aim is to take advantage of the gap in borrowing costs.

What Is an Example of a Yen Carry Trade?

An example of a yen carry position is borrowing 10,000,000 JPY at 0.10% interest and converting it to AUD, which earns 4.35%. The trader takes advantage of the 4.25% differential, assuming favourable market conditions.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USD/JPY carry trade explainedCurrently, the USD/JPY pair is trading around 154.26, influenced by upcoming policy decisions from the US Federal Reserve and the Bank of Japan (BoJ). The US Fed's anticipated 25bps rate cut could potentially narrow the interest rate gap, affecting the carry trade's immediate appeal. However, the strong performance of the US economy, with robust job growth and rising inflation, might sustain the dollar's strength, keeping the carry trade attractive. Meanwhile, the BoJ's steady interest rate at 0.25% and potential for future hikes offer a contrasting backdrop, maintaining the yen's role as a low-interest currency. Global economic uncertainties and political changes in both the US and Japan could impact these dynamics, so traders should monitor central bank signals and economic data closely to navigate potential shifts in the carry trade's profitability.

Cardano ADA Will Outperform Cryptocurrency MarketHello, Skyrexians!

Yesterday we considered the Bitcoin analysis where concluded that the potential growth is not going to be insane, bull market will be finished soon. At the same time on the BINANCE:ADAUSDT weekly chart we can see that price is charged for the flight.

Let's notice, that Cardano has the specific bear market structure, where the corrective wave C has been finished in October 2023. Growth from the bottom was impulsive, so it could not be the wave B, in our opinion it's wave 1 of the new bull market. Since March 2024 most of crypto assets continued the bear market, but drop on ADA was not so big. It means that wave 2 has been formed already.

Look at the green dot on the Bullish/Bearish Reversal Bars Indicator . This is strong bullish signal that this correction is likely to be finished, in conjunction with Elliott waves analysis we can see that the impulsive wave 3 is about to happen soon! Targets can be calculated using Fibonacci Extension. 1.61 and 2.61 corresponds to the area between $1.2 and $1.77. Note that this zone is not likely going to be the end of bull run. This is just wave 3 in this rally. Finally, we expect the new ATH for ADA in 2025.

Best regards,

Skyrexio Team

USD/CAD INSANE 22 Year Cup & Handle about to explode higherWith this week's announcement of 25% duties on MX & CA one would do well to survey the markets for opportunities. What better way to push through a trade of this nature than the FX markets?!

The first thing to check in any FX trade is rate differentials:

CA 10Y: 3.22%

US 10Y: 4.27%

MX 10Y: 9.99%

The carry trade dictates we want to be long the currency with a higher yield, and our suspicion given tariffs tend to strengthen the country levying tariffs means we want to be long USD.

MX offers a much higher yield so that would offset the potential in taking a short position on USD/MXN. CA on the other hand has a modest 1% discount to the US 10Y bond. Moreover, rates in the US look fairly steady, and pressure from the tariffs could cause CA to cut in support of its economy.

A technical inspection of USD/CAD shows a staggering 22 year cup and handle formation on the pair. Now could be the right time to accumulate a leveraged FX position, as this trade could have years ahead of it with the advent of a 4 year Trump term.

USDJPY still has more downside on daily & weekly tfStructurally I'm looking for rejection at 147-149.8 range. Look for renewed selling action below 144 to confirm. Still seeing additional unwinding of the yen carry trade as highly likely over subsequent days & weeks. Targeting 136, 131, and 126 handles on weekly structure as we approach Q1 of 2025.

Particularly as the US Federal Reserve is pressured to cut rates further with recent data.

Entering short positions gradually but the majority is already in place.

Why is the Swiss Franc Defying the Odds?In a global economy where central banks are leaning towards softer monetary policies, the Swiss Franc is charting its own course—strengthening against the odds. But what forces are truly at play here? Is it merely the cautious whispers of the Swiss National Bank, or is there a deeper undercurrent, tied to inflation expectations and global safe-haven flows? As we peel back the layers, we uncover a narrative that challenges conventional wisdom. Discover the intricate dynamics that could redefine how we perceive currency resilience in today's volatile market landscape.

The franc's unexpected strength has sparked a flurry of theories. Some point to the SNB's potential reluctance to cut interest rates as aggressively as its peers. Others suggest that the widening gap between Swiss and global inflation expectations could be fueling the franc's appreciation. Yet, the franc's safe-haven status and its role in carry trades add another layer of complexity to this puzzle.

The EUR/CHF currency pair, a barometer of the Eurozone and Switzerland's economic health, is particularly sensitive to the franc's strength. As the franc appreciates, it can impact trade balances, inflation, and overall economic competitiveness.

As the global economic landscape continues to evolve, the enigma of the Swiss franc's resilience persists. Is this a temporary anomaly, or a harbinger of a new era in international finance? Only time will tell.

Risk-off & The Yen Carry Trade Explained Hi guys,

I'm trying something new here.

In this video I explain what risk-off is and what causes it. I break down the recent yen carry trade and what went on there.

It's good to study these events so that next time you have the knowledge in the bank. That way you can plan and make better decisions.

Let me know if you like this sort of thing and I can do more.

Cheers,

Sam

Shift in Carry Trades: Hedge Funds Embrace USDTRYA Shift in Carry Trades: Hedge Funds Embrace the US Dollar

The once-dominant Japanese yen has historically been the preferred currency for carry trade strategies, where investors borrow low-interest-rate currencies to invest in higher-yielding ones. However, a significant shift is underway, as hedge funds increasingly turn to the US dollar as their borrowing currency. This strategic change is driven by a confluence of factors, including the US Federal Reserve's monetary policy stance, the weakening Japanese yen, and the allure of emerging-market currencies.

The Allure of Emerging-Market Currencies

Emerging-market currencies have long been a focal point for carry trade strategies, offering the potential for substantial returns. The relatively high interest rates in these economies, coupled with their often-growing economies, make them attractive investment destinations. However, the choice of borrowing currency plays a crucial role in determining the overall risk-reward profile of such trades.

The Yen's Diminishing Appeal

The Japanese yen has traditionally been a popular choice for carry trades due to its historically low interest rates. However, a combination of factors has eroded its appeal in recent years. The Bank of Japan's ultra-loose monetary policy, aimed at stimulating the economy, has kept interest rates exceptionally low. Moreover, the yen's weakness against other major currencies has increased the risk of exchange rate losses for investors who borrow in yen.

The Rise of the US Dollar

The US dollar, once a less common choice for carry trades, has gained prominence as a borrowing currency. Several factors have contributed to this shift. First, the US Federal Reserve's more hawkish monetary policy, characterized by interest rate hikes and a reduction in quantitative easing, has made the dollar a relatively higher-yielding currency. Second, the dollar's strength against other major currencies has reduced the risk of exchange rate losses for investors who borrow in dollars.

The Case of USDTRY

One notable example of the shift towards US dollar-funded carry trades is the USDTRY pair. The Turkish lira, with its relatively high interest rates, has been a popular target for carry trade investors. However, the increasing political and economic uncertainties in Turkey have made the lira a riskier investment. By borrowing in US dollars, investors can potentially benefit from the interest rate differential while mitigating some of the risks associated with the Turkish lira.

Challenges and Considerations

While the US dollar-funded carry trades offer potential benefits, they are not without risks. The US Federal Reserve's future monetary policy decisions, geopolitical events, and economic fluctuations in emerging markets can all impact the profitability of these trades. Additionally, the increasing popularity of carry trade strategies can lead to market volatility and potential

reversals.

Conclusion

The shift in carry trade strategies from the Japanese yen to the US dollar represents a significant development in the global financial markets. As emerging-market currencies continue to offer attractive investment opportunities, the choice of borrowing currency will remain a critical consideration for hedge funds and other investors seeking to capitalize on these trends. While the US dollar has gained prominence, the potential risks and challenges associated with carry trades should be carefully evaluated before making investment decisions.

$USDJPY Carry trade unwind to continue? $131-108 targetsFX:USDJPY looks like it's set to fall further here.

Equities took a hit when USDJPY went from 152 to 142. Now you can see that price rallied back up into resistance at 148, rejected it and looks set to fall more unless price can recover that 148 resistance.

I could see another move down into that 131 level, however, there's a possibility that price can fall much more than that.

I could potentially see a move all the way down to 115 -108 before price finds support. Those levels would be a successful retest of the bottoming structure price broke out from. After those levels get tested, then I think USDJPY will enter a long-term bull market.

Let's see how this plays out over the coming months.

Yen Carry Trade Unwind: Is It Really Over?The unwind of the Yen carry trade has led to a significant breakdown in the USDJPY, shattering the ascending channel that had been in place since early 2023. We're now witnessing a retest of the channel's lower bound, where crucial resistance levels come into play. As asset managers continue to unwind their short Yen positions to mitigate risk, we may see a sustained strengthening of the Yen, potentially driving the USDJPY even lower.

Thin Markets Unnerve Traders: What to Know About Summer TradingLow trading volume is the market theme of the summer, which is driving investors to question their knowledge and ability to move in and out of markets. Forex, stocks, commodities and even crypto — they all seem more volatile during the summer quarter and there’s a reason for that.

Big-shot traders ditch the trading desks for margaritas, espresso martinis and tan on the Amalfi coast while algo trading gets to slosh around billions of dollars. The result — thin liquidity sinks trades every now and then.

August Trading Shakes and Stirs Markets

The summer months have rolled in and with them a heightened feeling of unease has swept global markets. From a rally in the Japanese yen , to a big meltdown in stocks and crypto market carnage , asset classes got shook from this one market characteristic — volume .

Thinning trading volumes disrupted the usual market rhythm, ushering in an environment dominated by increased volatility and unpredictable swings. Low volumes have the tendency to amplify price declines and increases.

Illiquid August conditions may turn a rather normal move into a violent swing. Fewer shares traded means that a trading instrument is more susceptible to sharp price movements as there are fewer participants to absorb the trades.

Panic Selling and the Carry Trade

A volatility storm swept Japan’s stock market last week, throwing it into its worst single-day performance since 1987. Japan’s broad-based index Nikkei NI225 crumbled 12.4% in a single session while US stocks slumped 3%. Wall Street’s fear gauge, the VIX index of volatility VIX , shot up more than 50% to its highest level in 2020 when the pandemic was wreaking havoc.

A day later, Japan bounced up 10% and the S&P 500 jumped 1%. The VIX shot lower by 28%. Japan ended up in the spotlight due to the unwinding of what’s called the “carry trade” — big hedge funds had borrowed trillions of cheap Japanese yen at near-zero interest rates to buy stocks or jam the cash into Treasury bills that pay a 5% interest. Risk-free.

What’s not to like? The yen’s rise, for one. The sharp appreciation of the yen sent panicked carry traders scrambling to dump their holdings and repay their yen debt, which was getting more expensive.

It’s the Algos’ Market, We All Live In It

In August, traders typically exchange about 9.3 billion of US shares a day. Compared to March, where 13.2 billion shares change hands a day, that’s a 30% decrease in trading volume. Apparently, Wall Street does get a break from trading. Or does it?

The stock market and the currency market, in particular, are dominated by and large by computer-trading algorithms that execute trades at lightning speed based on pre-programmed criteria. These algorithms, or simply algos, are allowed to process huge amounts of data and react to market conditions in milliseconds.

While this can create efficiency and liquidity in normal market conditions, during periods of low volume — such as the summer months — they can contribute to increased volatility, especially if they are levered to the tune of 15, 20, 30 times.

A single large order or a sudden piece of news can trigger a cascade of algorithmic responses, leading to rapid and sometimes exaggerated price movements. In other words, when these algos make a decision, that’s when volatility goes through the roof. Pair it with low volumes and you’ve got an explosion (or implosion) of prices.

How to Survive Wild Markets?

Given the unique challenges of summer trading, traders need to adjust their strategies accordingly. Here are some tips that can help.

Lower Position Sizes : In a thin market, large positions can be harder to exit without moving the market (especially if you’ve loaded up on illiquid meme coins). Reducing position sizes can help mitigate this risk.

Wider Stops : With increased volatility, it may be necessary to widen stop-loss orders to avoid getting wiped out by intraday market noise.

Focus on Liquidity : Stick to trading more liquid instruments where possible, as these will typically be less affected by the summer slowdown. Hint: forex is the most liquid market.

Keep an Eye on Economic Data : Summer doesn’t stop economic data releases , which can lead to outsized market reactions in a light market. Stay informed.

Patience and Discipline : Summer trading requires patience and discipline. The temptation to overtrade in a quiet market can lead to mistakes. It’s often better to wait for clearer setups rather than forcing trades in a challenging environment. While you're waiting for the right moment to step in, test your strategies and find the best moves for future trades.

What Do You Think?

Summer trading presents a unique set of challenges that can unnerve even the most experienced traders. Thin markets, increased volatility, and the dominant role of algorithmic trading create an environment where caution is paramount.

How do you handle volatile markets in thin trading? Let us know in the comments and let’s spin up a nice discussion!

BUY GOLDToday we are monitoring GOLD for a BUY set up. Asia has been accumulating orders, the ideal scenario is a drop from current price of 2301 to sweep liquidity this means we will see a possible level of 2287.10. This should be the lowest price we are expecting before we retrace back up to 2334.77 We have final stop loss at 2277.190

SPX Showing Signs of Weakness at PCZ of a Bearish Alternate BatThe RSI on the daily has begun to rollover as the SPX appears to have rejected off of the Bearish Alternate Bat HOP level. There does not appear to be much nearby support within the range the SPX is currently trading in so if it gets back below the previous All-Time High I could see it coming back down to around $5100 maybe even $5000 - $4800. This all seems to be brought on by the increase in JGB Yields disrupting the Carry Trade. We may see them try to stabilize the carry trade around $5100 but there is a heightened chance of failure.

More on the carry trade can be seen in the related idea below.

Bond Market Hints Towards a Second Wave of Shorts to hit the JPYLate last year the Spread of the US/JP Carry Trade hit the PCZ of a Bearish Shark resulting in it pulling back to the 50% Retrace, this came ahead of Bearish Action in the stock market and strength in the JPY. However, the bounce at the 50% retrace indicates that it could turn into a Bullish 5-0 which would result in higher highs. In addition to that, the leverage ratio on the trade has been forming what looks to be a nice looking Cup with Handle pattern, which if it plays out would bring the leverage ratios up from 500% to well over 800%. This would likely align with higher highs in the SPX, Higher Inflation Rates, Higher Commodity, Import/Export Costs, and a continuation of the falling Japanese Yen.

I will leave the chart of last year's Carry Spread Chart Post below for reference.

BITCOIN|Does the BULLISH trend continue?Bitcoin chart in 4 hours time frame.

In the previous analysis, we saw that there was a significant upward movement in the area of demand that we considered.

I hope you have used this opportunity well.

Currently, Bitcoin is strongly bullish and there are no signs of weakness in the trend, so we should look for more suitable places, areas of valid demand to enter buying positions.

As you can see, Bitcoin had an initial correction up to $46,600, but it came back with demand and is currently trading in the range of $48,300! Until this moment, we have not seen a strong negative reaction from Bitcoin, and this means that the power of the Bulls is still high!

The demand ranges are ($44,900 to $45,500), ($42,800 to $43,300)respectively! In case of an upward trend, its mid-term targets are $50,500 and $52,700 , respectively!

AUDJPY: BAMM Breakout Headed for a 50% RetraceI suspect as the Japanese Carry trade is pressured, that there will be an effort made by institutions to convert to AUD in anticipation of Australian Interest Rates potentially rising above US Interest Rates, this would revive the more traditional Australian Carry Trade and serve to reduce the downwards pressure put on the Japanese carry trade while also reducing their overall leverage and should allow them to prolong the Bull Market in equities at least until the spring. Meantime the conversion to AUD should Temporarily push the value of the AUD up higher and given how much leverage would be going from JPY to AUD, I'd suspect the rise we see in AUD to be a bit on the extreme side which could lead to us very quickly seeing AUDJPY reach the more macro Fibonacci retraces between 139 JPY to 191.567 JPY.

Bullish Shark on the Japanese Yen Futures Feb 16th ContractThere is a Bullish Shark visible on the Japanese Yen Futures contract expiring on Feb 16th 2024, there is also RSI Bullish Divergence on the 4 Hour Timeframe at this level. A higher low bounce in the JPY from here would likely result in further tightening of the Japanese carry trade, which would be bad for stock and particularly bad for REITs and Financial Institutions. Saying as though it is the Feb 16th Contract that this Harmonic has completed on, I would expect the JPY to rise sharply leading into the expiration of this contract.

USDJPY: 3 Line Strike at the PCZ of a Bearish BatSimilarly to around the same time last year when USDJPY was at these levels, it had developed a 3 Line Strike at the PCZ of a Bearish Harmonic, and if it goes like last year, this will result in at least a few months of downside on this pairing.

There is also some Bearish Divergence formed on the RSI at this level.

Additionally, there is a much bigger Macro Bearish Butterfly setup that can be seen here: