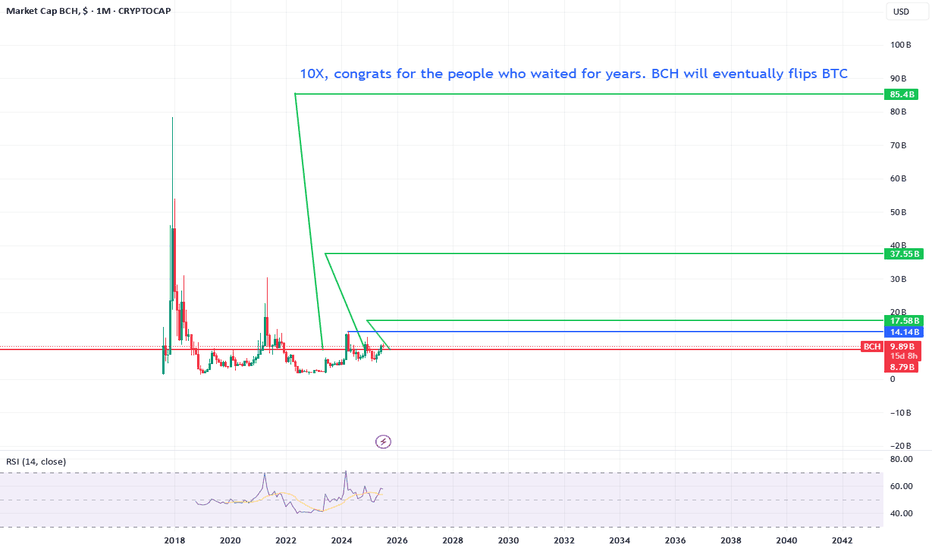

Bitcoin Cash will do a solid 10X For years bitcoin cash is been selling off.

But let me tell you this, we are just getting started.

If we pass the blue line we are officially triggered for a 85 billion marketcap.

Can still take some time but eventually it will happen. Make sure to fomo in when the party is starting!

CASH

#BCHBTC #1W (Binance) Big falling wedge breakoutCRYPTOCAP:BCH just regained 50MA weekly support in sats, performing better than CRYPTOCAP:BTC

Seems likely to continue bullish towards 200MA resistance, probably after a pull-back.

⚡️⚡️ #BCH/BTC ⚡️⚡️

Exchanges: Binance

Signal Type: Regular (Long)

Amount: 7.0%

Current Price:

0.004885

Entry Targets:

1) 0.004657

Take-Profit Targets:

1) 0.006329

Stop Targets:

1) 0.003987

Published By: @Zblaba

CRYPTOCAP:BCH BINANCE:BCHBTC #BitcoinCash #PoW bitcoincash.org

Risk/Reward= 1:2.5

Expected Profit= +35.9%

Possible Loss= -14.4%

Estimated Gaintime= 4-7 months

What is a war chest and lessons we can learn from Blackstone...In case you haven't heard, NYSE:BX is hogging over $100 billion of dry powder that is ready for deployment at the snap of a finger. Now, just because we cant get our hands on hundreds of billions of dollars doesn't mean that we shouldn't have a war chest of our own.

Why a war chest is a must have

Firstly, having dry powder ready for the next trading day could be the determining factor of a make or break trade. Specifically think back to when the current market downturn started. If I had to guess, many of you reading were far too exposed to the market and got scared from the "red wave" that shocked the market heatmaps. I would also like to bet that many of you sold positions for a loss to stop the bleeding and are now looking for a better entry. However, consider what would have happened if you had spare cash on your side to keep your positions alive.

Here is an example of over exposure.

And here's an example of keeping about a 20% war chest by your side...

I understand that it seems like a small amount of money, but trading is a game of pennies and a winning position of pennies is much better than a losing position of $140. This is the same tactic that firms like Blackstone use to protect large positions from poisonous events such as this recent downturn in the market. So in order to make money like a bank, we need to learn to think like a bank...

XSO and Interest cutsIt's easy to get caught up in all the hype around interest rate cuts and thinking of all the money that will start flowing back into smaller caps and risk assets in general. Taking a look back at the 3 previous periods of easing rates, we can see that this isn't necessarily the case.

This graph is overlaying US cash rates as I believe it's a bit of an early indicator, AUS cash rates will typically follow suit but potentially after markets have peaked. Whilst I do believe that low interest rates are good for small caps, it can clearly be a painful decline before the next leg up. These dips in the market do appear to be bottoming out quicker and quicker but this is mainly due to cash stimulation by the government, ultimately leading back to more inflation.

I don't rule out that this time could play out slightly differently, however it's also never bad to mitigate risk and have appropriate risk measures in place.

Can a Water Company Grow at Tech Rates? XylemXylem's Growth in Q2: Resilient Demand Amid Asset Challenges

Xylem Inc. raised its annual profit forecast on Tuesday after posting higher-than-expected second-quarter results, driven by robust demand for its water and wastewater treatment products. The company now anticipates an adjusted profit for 2024 between $4.18 and $4.28 per share, up from its previous forecast of $4.10 to $4.25 per share. CEO Matthew Pine highlighted resilient demand in Xylem’s largest markets as a key factor in this optimistic outlook.

Furthermore, Xylem revised its annual revenue outlook upwards to $8.55 billion from about $8.50 billion. Quarterly revenue surged nearly 26% to $2.17 billion, surpassing analysts' estimates of $2.15 billion. Notably, sales from its water infrastructure unit reached $690 million, beating expectations of $655.28 million. This segment, which focuses on the transportation, treatment, and testing of water, includes a diverse range of products such as water and wastewater pumps.

On an adjusted basis, Xylem reported a profit of $1.09 per share for the quarter ending June 30, exceeding forecasts of $1.05 per share. However, a review of the 8K revealed some asset challenges. Cash and cash equivalents decreased to $815 million from $1,019 million in the prior quarter. Receivables remained relatively unchanged at $1,675 million, compared to $1,617 million previously. Inventories saw a slight increase, rising to $1,057 million from $1,018 million.

While Xylem’s revenue and profit forecasts are encouraging, the decrease in cash reserves and "stable" receivables suggest a need for careful asset management moving forward. This raises the question: Can a water company sustain growth at tech rates? With strategic acquisitions and strong market demand, Xylem shows potential, but effective management of its assets will be crucial to maintain its impressive trajectory in the water technology industry.

Another Rabbit...I wager this is not a beat! "Xylem's Strategic Acquisition of Evoqua Boosts Revenue by 40% - A Deep Dive into Water Technology Innovation"

Xylem's acquisition of Evoqua Water Technologies for $7.5 billion, an all-stock deal, seems to be a strategic move. This acquisition was valued at $52.89 per Evoqua share, a 29% premium based on the companies' closing prices before the deal. Evoqua Water's extensive customer base in high-growth sectors like life sciences, microelectronics, power, and food and beverage, along with their work on emerging contaminant remediation, aligns well with Xylem’s vision.

Xylem's stock price has risen from the low $100s to $140, showing investor confidence in the acquisition and the company’s future prospects. Since March 2024, Xylem's revenues have increased by 40%, but accounts receivable have risen by 46%, which might indicate slower collections or extended credit terms to customers. However, the cash position hasn't seen similar growth, which could point to liquidity management challenges.

The substantial increase in goodwill by 174% reflects the premium paid for Evoqua and indicates significant intangible assets, such as customer relationships and technological expertise. As Xylem reports its earnings, the market will be keen to see if these strategic moves translate into sustained revenue growth, improved cash flows, and effective integration of Evoqua.

Stay Tune

ABFRL - Simple Greedy SetupThe chart itself is self-explanatory. The price is at the bottom of the rising wedge pattern. Here applies the simple rule of risk-reward ratio.

Targets may be 245/275 around. if sustains below 214, will go weak on the charts.

This is only for learning and sharing purposes, not a piece of trading advice in any form.

All the best.

BTC Bitcoin Strong Bullish Will Rise to 37000,46000 and 71000USDBTC Bulls to Retarget $31,500

BTC could be in for a choppy session as investors consider the chances of SEC approvals for the ETFs and US inflation in focus.

the crypto news wires provided much-needed support. News of Fidelity filing for a spot Bitcoin Exchange-Traded Fund (ETF) was the key to the bullish session.

This morning, BTC was down 0.03% to $30,524. A bearish start to the day saw BTC fall from an early high of $30,534 to a low of $30,507.

Looking at the EMAs and the 4-hourly candlestick chart (below), the EMAs sent bullish signals. BTC sat above the 50-day EMA ($30,032). The 50-day EMA pulled further away from the 100-day EMA, with the 100-day EMA widening from the 200-day EMA, sending bullish signals.

A hold above S1 ($30,158) and the 50-day EMA ($30,032) would support a move through R1 ($30,882) to give the bulls a run at R2 ($31,232). However, a fall through S1 ($30,158) and the 50-day EMA ($30,032) would bring S2 ($29,784) into view. A fall through the 50-day EMA would send a bearish signal.

Resistance & Support Levels

R1 – $ 30,882 S1 – $ 30,158

R2 – $ 31,232 S2 – $ 29,784

R3 – $ 31,956 S3 – $ 29,060

Strategy Bullish

3Lots

2 Lots will be excecuted at Profit Target Zones

1Lot will follow the Trend

It will be only!!! excecuted ,if Bullish Trend changes

The stops will be delivered as soon as possible to break even,better some pips above the Buyinh price

I have marked my profit targets

Psychology:

1:The price is always right

2The Market is alwas right

3 The Chart is always right

4 IGNORE THE NEWS; Plan your trades and trade your plan.

5Drawdowns are partof the game

6 Risk management and money mangement is King!

7 wHATEVER HAPPENS;sTICK TO YOUR PLAN!

8 In a bear market no price is weak enough

9 In a bull market no price is strong enough

10 Patience !Wait for confirmation: Control emotions and tensions.

BCH - Still Strong ↗️Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 BCH has exhibited an overall bullish trend , trading inside the rising channel in red.

At present, BCH is undergoing a correction phase and it is currently approaching the lower bound of the channel.

Moreover, it is retesting a demand zone in blue.

🏹 Thus, the highlighted red circle is a strong area to look for buy setups as it is the intersection of the blue demand and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #BCH approaches the lower red circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Niftybank ViewHello everyone,

As we see in last trading session Niftybank shows downward momentum loosing 500points and taking support at our marked trendline.

If it breaks the trendline,then we can expects it's initial support at 43400 level while if it begins to show upward momentum then most probability is that it will touch near 45000 Resistance level .

However, there is a huge selling in option index excluding Nifty Midcap Select because it's data closed positively. We can assume that buying activities are going in Nifty Midcap Select. Cash data was also positive depicting positive momentum.

So here we close our statement.

Have a happy trading.