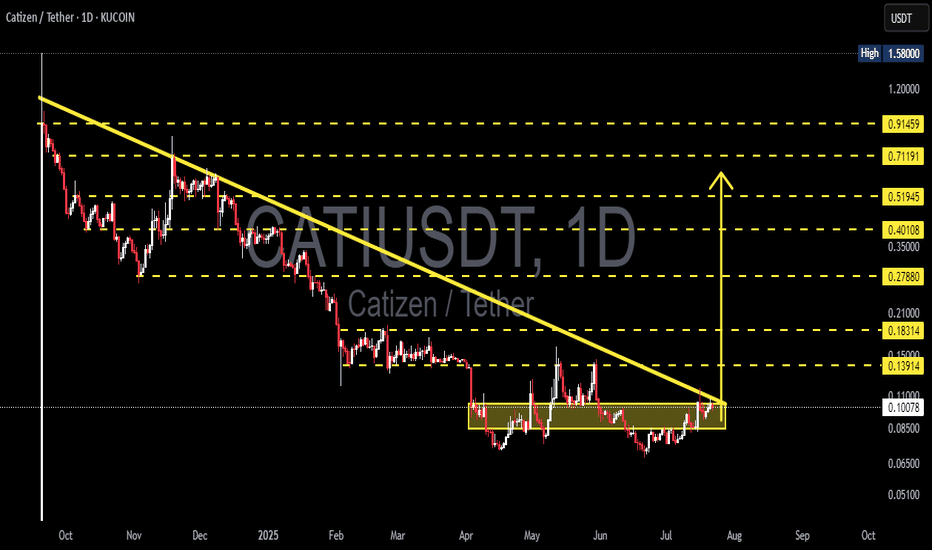

CATI/USDT – Massive Descending Trendline Breakout?🔎 Overview:

CATI/USDT is flashing a major trend reversal signal after months of accumulation and suppression under a dominant descending trendline. For the first time in almost 10 months, price action has successfully broken out of the downtrend, potentially setting the stage for a multi-layered bullish rally.

This breakout is not just a technical level — it’s a psychological shift from bearish to bullish sentiment. The consolidation zone between $0.065–$0.085 has acted as a solid accumulation base, and the breakout past $0.10 marks the beginning of a new phase.

📐 Chart Pattern Explanation:

🔻 Descending Triangle Breakout

Structure: Long-term lower highs with a flat support base.

Breakout Point: Around $0.1029, breaking the descending trendline cleanly.

Volume: A potential rise in volume post-breakout would confirm the breakout’s strength.

Target projection: Based on the height of the triangle, the potential move could extend above 200%.

This pattern is often seen at the end of a downtrend and signals a strong bullish reversal, especially when paired with horizontal accumulation like we see here.

📈 Bullish Scenario – Road to Potential 8x Gains:

If the breakout holds and gains momentum:

✅ First Target: $0.13914 – Previous local resistance.

✅ Second Target: $0.18314 – Strong resistance cluster zone.

✅ Third Target: $0.27880 – Clean psychological and structural target.

✅ Mid-term Target: $0.40108 to $0.51945 – Major Fibonacci level and previous breakdown area.

✅ Moon Target: $0.71191 to $0.91459 – If trend extends with volume and market-wide bullishness.

These targets are based on measured move projections, Fibonacci extensions, and historical price memory.

⚠️ Bearish Scenario – What Could Invalidate the Breakout?

❌ False breakout risk if price falls back below $0.095.

❌ A rejection candle or long wick at $0.13–$0.14 without volume could signal exhaustion.

❌ If Bitcoin or broader market faces correction, CATI might retrace to its base at $0.065 or even revisit $0.051.

Traders should watch for bearish divergence or sudden drop in volume as early warnings of reversal.

🧠 Strategic Notes:

Entry zone: Retest of breakout at $0.095–$0.102 could provide a low-risk entry.

Stop loss: Below $0.085 for conservative risk management.

Position sizing: Scale in during pullbacks. Don’t ape in full at resistance levels.

This setup has the classic ingredients of a low-cap altcoin explosion if momentum sustains.

🔥 Final Thoughts:

CATI/USDT is breaking free from its bearish chains and entering what could be the early stages of a parabolic move. With a textbook breakout pattern, clean structure, and well-defined levels — this is one of those charts traders dream of spotting early.

Keep your eyes on volume and structure — this could be one of the hidden gems of this cycle.

#CATIUSDT #CryptoBreakout #AltcoinGems #TechnicalAnalysis #BullishSetup #CryptoTrading #PriceAction #DescendingTriangle #BreakoutPlay #ReversalPattern

CATIUSDT

CATIUSDT - NO BUYERS!!??Observing CATIUSDT, one might initially perceive a landscape where all indicators point towards an ascent. Indeed, the superficial appearance suggests a market poised for higher valuations. However, a discerning investor must always ask the fundamental question: where are the buyers? This critical element, the genuine influx of demand, appears conspicuously absent.

Despite what might seem like an elevated price, there is a distinct possibility that the blue box I've identified on the chart could be subject to manipulation. This zone, which might otherwise appear as a resistance level, could be used to draw in unwary participants before a more significant move downwards. My current assessment leads me to believe that, following such a potential manipulation, the ultimate target for CATIUSDT's price is indeed lower. The absence of robust buying conviction, despite the seemingly favorable conditions, strongly reinforces this cautious outlook.

In evaluating such scenarios, it is imperative to scrutinize the volume footprint for any signs of artificial strength or distribution. We would look for CDV (Cumulative Delta Volume) divergences that betray the true underlying sentiment, and patiently await low timeframe (LTF) confirmations which, in this instance, would likely validate a bearish thesis rather than a bullish one. One must be particularly vigilant for liquidity hunts, where price might briefly push into or beyond the blue box only to swiftly reverse.

It is worth reiterating that my focus remains exclusively on assets demonstrating a sudden and significant increase in volume, as such movements often precede more substantial price action. The current state of CATIUSDT, lacking this decisive and authentic buying pressure, necessitates a stance of extreme prudence.

Therefore, while the market may present an illusion of impending rise, the intelligent investor remains grounded in the observable facts. The absence of genuine buying activity, coupled with the potential for manipulation around this blue box, suggests that caution is the most appropriate course. One must be prepared for the possibility that the path of least resistance for CATIUSDT is, regrettably, to the downside.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

CATI Memcoin. Main (essentially secondary) trend. Channel. 25 05Logarithm. Time frame 3 days (less is not necessary). Decline from the maximum -94%. As a rule, altcoins (ticker name, legend, imitation of usefulness does not matter) of such liquidity decline in their secondary trend until its reversal by -95-98%.

But, at the moment, there is a significant increase in volume, this is a good sign, if the price goes beyond the resistance of the descending channel, then a trend expanding triangle will form, or as it is also called the Livermore cylinder (dynamic zones of support / resistance of the "participation" phase).

In order not to miss the reversal, if you are afraid to gain a position now, then work with orders for a breakthrough, that is, a trend break.

🟣For 2 months now, a sideways trend with a 100% step, the price is being pulled to the resistance of the descending channel.

Breakthrough of it — trend reversal.

Not a breakthrough , decline to the next "shelf".

Everything is quite simple and logical. All levels and zones of potential minimums and maximums are shown. Remember, the average price of the set and reset is important. The key resistance zone after the reversal, where you will need to dump most of the position, or everything, is highlighted in gray.

AUCTIONUSDT UPDATE

AUCTIONUSDT is a cryptocurrency trading at $14.18. Its target price is $26.00, indicating a potential 100%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about AUCTIONUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. AUCTIONUSDT is poised for a potential breakout and substantial gains

CATIUSDT Analysis: Anticipating a Potential Price CorrectionHello traders!

Following a significant price drop, CATIUSDT appears to be poised for a potential price increase or corrective rebound. This upward movement could offer an opportunity for traders who bought at higher prices or are currently holding the cryptocurrency.

The anticipated price correction is likely to target the 0.382, 0.5, and 0.618 Fibonacci retracement levels. This price increase could contribute to a rebalancing of:

1. BINANCE:CATIUSDT CATIUSDT price

2. CATIUSDT market liquidity

3. CATIUSDT open interest

I have identified potential entry and exit points, as well as resistance levels, on the chart.

Good luck!

CATIUSDT IdeaGreetings, traders.

Observing the CatiUSDT BINANCE:CATIUSDT price trend, it appears poised for a further decline after a brief corrective period. The recent touch of the $0.3200 support area, coupled with the formation of a bearish evening star candlestick pattern on the 2-hour chart, suggests a potential downward movement. This pattern emerges notably above the established uptrend line, reinforcing the bearish signal.

Short-term price targets are identified at $0.2600 and, upon a successful breach of this level, a subsequent decline towards the $0.2000 to $0.2200 range is anticipated.

A prudent entry point for short positions would be on a break below $0.3045.

Best of luck in your trading endeavors.

*Remember that this is just a technical analysis and doesn't guarantee future market movements. Always conduct your own research and manage your risk accordingly.

CATIUSDT Road Map !!!CATIUSDT is forming a falling wedge on Daily timeframe , Up we go if we do breakout. the price can be bullish and I expect the price to go up to the Fibonacci line of 0.618 = 0.8 Stay tuned for more updates, thanks.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Gala/UsdtBINANCE:GALAUSDT

INDEX:GALA / USDT - Weekly breakout candle in preparation!

Growth potential is INSANE! 🚀

Prices could fly toward $0.1050 - $0.1100 🛫, which corresponds to the trend resistance! (W)

⚠️ Key support that will probably be retested to confirm the breakout: $0.0500 - $0.0520 📉 (I'll set buy orders around that zone)!! I prefer to not FOMO on a full green candle. 🐸

You know, patience = profits 💰 🐸 (not financial advice).

Not Financial advice

CATI / USDT: Gearing up for breakout above trendline resistance Cati/USDT: Gearing Up for a Breakout Above Trendline Resistance

Cati/USDT is shaping up for an exciting move 📈 as it approaches a critical trendline resistance zone 📊. The price has been consolidating tightly, creating the perfect setup for a potential breakout 💥. If the breakout happens, we could see a strong bullish trend unfold 🚀. Keep a close eye 👀 on this pair and wait for confirmation before acting.

Key insights:

1. Trendline resistance: Cati/USDT is nearing a long-standing trendline that has previously acted as a barrier. A break above this could mark the start of a strong upward move.

2. Volume surge: Watch for a significant increase in trading volume during the breakout to confirm buyer strength 🔥.

3. Bullish signals: Momentum indicators like RSI and MACD are trending positively ⚡, supporting the case for a bullish breakout.

Steps to confirm the breakout:

Look for a clear 4H or daily candle closing above the trendline 📍.

A noticeable spike in volume during the breakout can signal strong buying activity 📊.

A retest of the broken resistance as a new support zone adds credibility to the move ✅.

Be cautious of fake breakouts, such as sharp reversals or wicks above the trendline ⚠️.

Potential targets (post-breakout):

Risk management strategies:

Use stop-loss orders to manage your risk effectively 🔒.

Ensure position sizing aligns with your overall trading strategy 🎯.

This analysis is for educational purposes only and not financial advice. Always conduct your own research (DYOR) 🔍 before making investment decisions.

CATI 3rd OverviewTA Overview:

Current Price: $0.4405 (up +5.29% in 1 day)

Market Cap: $123.54M

Volume (24h): $62.78M (7.78% increase)

Fully Diluted Valuation (FDV): $439.84M

Circulating Supply: 280.43M CATI out of 1B total supply

1. Oscillators and Momentum (From Technical Indicators)

Relative Strength Index (RSI):

Value: 24.0343 (Buy)

RSI indicates the asset is in oversold territory, suggesting a potential bounce or reversal from this level.

Stochastic %K (14, 3, 3):

Value: 10.6548 (Buy)

Stochastic indicates that the asset is also oversold on a short-term basis, giving further evidence of a possible rebound.

Momentum (10):

Value: -0.0122 (Buy)

Momentum is neutral but edging towards positive territory, supporting the hypothesis of an upward move.

Williams Percent Range (14):

Value: -81.5830 (Buy)

This value further signals that CATI is deeply oversold, increasing the likelihood of a price correction upward.

Commodity Channel Index (CCI 20):

Value: -76.7556 (Neutral)

CCI is near oversold but not giving a definitive signal, requiring confirmation from other indicators.

MACD Level (12, 26):

Not Available.

Summary of Oscillators: The strong buy signal from multiple oscillators (RSI, Stochastic, Momentum, Williams Percent Range) points to CATI being oversold on various timeframes, making it likely to experience a bounce soon. However, traders should wait for confirmation from price action or moving averages before entering long positions.

2. Moving Averages Analysis:

The moving averages suggest a strong sell on higher timeframes, indicating bearish sentiment in the mid-to-long term.

Short-term moving averages (10 EMA, 20 EMA, 50 EMA) are all in Sell mode:

Exponential Moving Average (10): 0.4736 (Sell)

Simple Moving Average (10): 0.4649 (Sell)

Exponential Moving Average (20): 0.5699 (Sell)

Simple Moving Average (20): 0.5553 (Sell)

Long-term moving averages: Not available for deeper analysis.

Summary of Moving Averages: Despite the oscillators showing a potential buy, the trend defined by moving averages suggests the price is still in a bearish phase. The asset may not have bottomed out yet, so caution is warranted until more definitive upward momentum is observed in the short-term averages.

3. Pivot Points and Key Levels:

(Pivots from the image provided)

Support Levels:

S1: 0.3566 (Classic), 0.5193 (Fibonacci)

S2: 0.1619 (Classic), 0.3828 (Fibonacci)

Pivot: 0.7402

This level acts as a key point of contention between buyers and sellers. A price movement above this point could see increased upward momentum.

Resistance Levels:

R1: 0.9349 (Classic), 0.9611 (Fibonacci)

R2: 1.3185 (Classic), 1.0976 (Fibonacci)

Key Observations:

Support Zones at 0.35-0.40 USDT should be carefully monitored for buying interest. Any reversal from these levels could confirm a short-term bottom.

Resistance at 0.70 USDT will be crucial to watch if the price bounces; breaking above it could signal the start of a bullish reversal.

4. Price Action and Chart Analysis (4H Timeframe):

Bollinger Bands: The price is hugging the lower Bollinger Band, suggesting volatility and the possibility of either a bounce from current levels or a breakdown.

Volume Profile:

Significant buying activity appears concentrated between $0.35 and $0.50 USDT, which aligns with strong support zones identified in the pivot points.

Any break above $0.50 USDT with volume would likely trigger a move toward $0.70-$0.80 USDT, where resistance becomes more apparent.

RSI on the 4H chart is rising from oversold territory, indicating strengthening bullish momentum, albeit slowly.

Trendline: There's a visible downtrend in place that will need to be broken for any sustained upward movement to occur. The immediate resistance trendline is around $0.50 USDT.

Key Chart Analysis:

The asset seems to be testing its lower bounds, but indicators suggest that we may be nearing a bottom, with a potential bounce or reversal.

0.50 USDT will act as a critical short-term resistance. Any break above this level could accelerate the bullish scenario.

5. Market Sentiment & Fundamentals:

With a market cap of $123.54M and a daily trading volume of $62.78M, CATI is seeing substantial interest despite recent price drops. The volume relative to the market cap (50.67%) is quite high, indicating significant trading activity.

The 5.29% gain in the last 24 hours could indicate early signs of buying pressure as the asset approaches key support zones.

Final Thoughts: CATI/USDT presents a mixed picture at the moment. While short-term indicators such as oscillators suggest a potential rebound from oversold conditions, moving averages continue to signal bearish pressure. Traders should monitor $0.35-0.40 USDT as a key support zone and $0.50-0.70 USDT for breakout opportunities. Caution is advised, as the overall trend remains bearish until a confirmed breakout of resistance zones occurs. Always use stop losses and risk management strategies to minimize potential losses, particularly with assets in such volatile conditions.

Catizen(CATI) Analysis==>FallingCatizen Telegram game has been listed with BINANCE:CATIUSDT token in various exchanges for less than 5 days .

What is Catizen!?

Catizen is a revolutionary gaming bot on Telegram that seamlessly integrates the Telegram & TON blockchain, transforming Web3 access by enabling practical mobile payments. By leveraging Telegram's immense traffic, Catizen aims to establish a Web3 traffic nexus on a scale of hundreds of billions. Catizen will become a mini-app center, combining the unique features of Launchpool with short videos and e-commerce, attracting and engaging users through gamification and strategic Play-to-Airdrop initiatives. This innovative approach aims to revolutionize the way users access and engage with the Web3 ecosystem.

-------------------------------------------------------

The opinions of Telegram users about this game are that those who spent money in the game were awarded more tokens and the number of CATI tokens did not depend only on the level of your cats in the game, and I think this was a weakness of the game and the criticism of many users brought along

------------------------------------------------------

In terms of Technical Analysis , Catizen(CATI) has succeeded in breaking the Support lines and the Support zone and it is likely to decrease at least until the next Support zone .

Did you participate in the airdrop of Catizen Telegram game!? Your personal experience of this game!?

Catizen Analyze (CATIUSDT), 1-hour Time frame ⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Second Update on CATI Market Update and Technical Analysis Report for CATI/USDT

As of today 29th Sept , CATI/USDT has been experiencing a notable downtrend in recent sessions. Our technical analysis suggests that the token is approaching critical levels that may offer both high-risk and high-reward opportunities. Here’s a comprehensive breakdown of the current market situation:

Price Overview and Current Metrics:

Current Price: $0.6258

Market Cap: $190,877,974

24h Volume: $171,934,054 (down 10.33% in the past 24 hours)

Circulating Supply: 305M CATI (30.5% of the total supply)

Price Performance: Down 6.43% over the last 24 hours.

Technical Analysis:

Descending Channel Formation:

CATI/USDT has been trading within a descending channel on the 4-hour timeframe. This indicates a prolonged bearish trend with lower highs and lower lows being formed. The price is currently trading near the lower boundary of this channel, indicating that we may be close to a key pivot point.

Support and Resistance Levels:

Key Support Levels:

$0.60 - $0.62: The current price is hovering near this important support range. Buyers have shown interest in this zone previously, but a break below it could indicate further downside.

$0.53 - $0.55: If $0.60 fails to hold, the next significant support zone is between $0.53 and $0.55, which has shown historical importance as a base level.

Below $0.53: In the event of a major sell-off or market capitulation, we could see CATI testing even lower levels:

$0.45: The next probable support level below $0.53. This level could attract buyers looking for deep-value opportunities.

$0.40: A psychological support zone, which could come into play if broader market conditions worsen.

Resistance Levels:

$0.65 - $0.67: The first key resistance level is around the 10 and 20 EMA. A break above this level would indicate early bullish signs and could lead to a stronger upward momentum.

$0.75 - $0.80: The volume profile shows significant historical activity in this range, and this is the likely target zone for any bullish breakout in the short term.

Indicators and Oscillators:

RSI (14): Currently at 31.40, signaling that the asset is approaching oversold conditions, though it’s not fully there yet. This could be an early indicator of a potential reversal.

MACD: Bearish with a current sell signal, showing that momentum remains in favor of sellers, though a potential cross over the coming sessions could provide bullish momentum.

Moving Averages: Most EMAs and SMAs (short-term to long-term) are showing sell signals, confirming that we are still in a strong bearish trend. However, shorter-term MAs may shift to buy if we see some upside in the near future.

Projected Scenarios and Entry Points:

Given the current technical setup, we’ve identified several scenarios and potential entry points for traders:

Scenario 1 (Conservative):

Entry Price: $0.58 to $0.60, around the current support range. This is the ideal entry point for traders looking to capitalize on a reversal.

Stop-Loss: $0.53 (just below the major support level).

Profit Target: $0.75 to $0.80, with a potential rally to these levels if CATI can break out above $0.65.

Scenario 2 (Aggressive):

Entry Price: $0.50 to $0.53, targeting lower zones if the current support fails to hold. This would represent an ideal accumulation zone for long-term investors and risk-takers.

Stop-Loss: $0.45, set just below the next key support level to mitigate downside risks.

Profit Target: A conservative target would be $0.65 to $0.75, but a breakout could push prices higher, aiming toward $0.80.

Scenario 3 (Capitulation Zone):

Entry Price: $0.45 to $0.48, in the event of a significant market drop. This deep-value entry point may present a lucrative opportunity for those with higher risk tolerance.

Stop-Loss: $0.40, just below the psychological support.

Profit Target: A bounce from these levels could target $0.60 and beyond, though caution is advised if CATI drops to this range.

Risk and Reward Assessment:

Risk Management: Given the volatility in the market, it's essential to set stop-loss orders carefully. For those entering at $0.58 or $0.60, placing a stop at $0.53 provides a reasonable risk-to-reward ratio. If aiming for deeper accumulation zones, placing stops at $0.45 or $0.40 will help minimize potential losses.

Reward Potential: If the current descending trend breaks, the reward could be significant, especially with targets near $0.75 to $0.80. A break above this level could open the door for further upward movement.

Final Notes:

While CATI/USDT remains in a bearish phase, oversold conditions and high trading volume suggest that a reversal could be imminent. However, risk management remains key in such a volatile environment. Keep a close eye on market movements and be prepared to adjust your strategy accordingly. We mentioned the same on our last report, we just gave a more detailed now.

CATIZEN Analysis Pattern and Price Movement

XABCD Harmonic Pattern: This chart suggests that an XABCD pattern (possibly a harmonic pattern like a Gartley or Butterfly) is being formed, with a potential bullish reversal indicated after the completion of the pattern. This might signal a correction or an upcoming bullish move after a significant price decline.

Descending Channel: The price is trending within a clear descending channel. The upper and lower bounds are marked by resistance and support lines. Price is currently at the lower end of the channel, which could indicate an area of potential support.

Volume Profile : The horizontal volume bars on the right suggest areas of high trading interest. There's a clear volume node around the $0.70-$0.75 level, which coincides with the current price, implying strong support. However, the large node around $0.95 could act as future resistance.

Key Levels:

Current Price : $0.7102

Support Level : The support level lies between $0.65 and $0.70. This aligns with the lower part of the descending channel, suggesting this could be a point for a potential bounce.

Resistance Level: There's a strong resistance level at $0.95 (highlighted as "Strong High" in the chart), which could be the next major target in case of a reversal.

Indicators and Oscillators:

RSI (Relative Strength Index): The RSI is hovering around 40, suggesting that the asset is close to oversold territory but not quite there yet. This could hint at a potential reversal or bounce soon if the RSI moves closer to oversold levels (below 30).

Market Structure:

BOS (Break of Structure) and CHOCH (Change of Character): Multiple BOS and CHOCH markers indicate shifts in the market structure. It shows that the price has been breaking support levels, signaling bearish continuation, but the recent CHOCH hints at a potential bullish reversal.

Projections:

The blue arrows drawn on the chart indicate possible price scenarios.

Bullish Scenario: If the price finds support around $0.70 and breaks out of the descending channel, it could retest the $0.80 to $0.95 level.

Bearish Scenario: If the price fails to hold this support, the next major support could be closer to $0.65.

Conclusion:

At the moment, the market is showing signs of indecision, with a potential for a bullish reversal if the price can hold support around $0.70 and break out of the descending channel. However, caution is advised as the market is still in a downtrend, and any reversal will need confirmation through a break of the resistance levels and volume support. Traders might look for bullish setups on breakouts above the channel, while bears could wait for a breakdown below $0.70.