Will Outside Market Influence Today's Cattle Trade? Friday’s Slaughter is estimated at 124,000. 2,000 less than last week, but 5,000 more than the same week last year.

Friday’s Cutout Values

Choice: 271.32, Up .22 from the previous day.

Select: 248.89, Down .72from the previous day.

Choice/Select Spread: 22.43

5 Area Average Cattle Price

Live Steer: 140.52

Live Heifer: 139.41

Dressed Steer: 226.02

Dressed Heifer: 226.00

Live Cattle

Commitments of Traders Update: Friday’s CoT report showed Managed Money were net buyers of 9,265 futures/options contracts, through June 7th. This expands their net long position to 21,350. Broken down, that is 78,753 longs VS 57,403 shorts. In last week's report we noted that this is a historically small position for Managed Money, which could be viewed as Bullish.

Technicals (August): August live cattle failed to get follow through momentum after breaking out above technical resistance on Wednesday. Though the lack of follow through was disappointment for the Bulls (they are probably all used to it by now anyway), there wasn’t any technical damage done on the Thursday/Friday pullback. Previous resistance down near 134.40-135.10 is now significant support. The Bulls must defend this pocket to keep them in control of the technical landscape. On the resistance side of things, 137.90-137.95 is the first hurdle, this was last week’s highs. Above that and we could see the market finally make its way back to the April 25th gap, 138.75-140.275.

Resistance: 137.90-137.95**, 138.75**, 140.275**, 141.625-141.75****

Pivot: 136.65

Support: 134.40-135.10***, 134.40-135.10***

Futures trading involves substantial risk of loss and may not be suitable for all investors. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Cattle

Cattle Continuous Cattle: The gray vertical bars represent the expiration month of labeled contract and have prices of each contract as of today labeled. The 2019 low has provided a pivot for a parallel uptrend line (highlighted in yellow) that has acted as a strong magnet since moving up off the covid crash low. Any of the lines could act as support/resistance. Support area marked in gray, risk area marked in red, and opportunity area marked in green. Deferred contracts can use the uptrend/downtrend lines or highlighted areas as well…

**Could use the shaded areas for 3 way option spreads on deferred contracts**.

Cattle, Corn, S&P500Cattle, Corn, and S&P 500: The fundamentals may be different now compared to in 2008, but I think these 3 markets are well intertwined. The effect of a major drawdown in the equities could impact all markets for a time. It sure seems that Cattle have some strong fundamentals to make a run up as it did from 2010 to 2014, but the timing of when that potential run higher begins is a million-dollar question. If the equity markets find support, beef should be in the race to higher levels with energies and other commodities…. If equities crash further, be careful

LEM22(June Live Cattle) Short SignalShort Signal

Entry LMT - 135.350

TP#1 - 131.600

SL - 138.600

**Trading commodity futures and options involves substantial risk of loss.

The recommendations contained in this letter is of opinion only and

does not guarantee any profits. These are risky markets and only

risk capital should be used. Past performance is not indicative of future results**

live cattle. pollute less. it couldn't be more serious.Consider what effect your lifestyle has on the planet. If you are reading this you are probably in the top percent of people contributing to climate change, therefore, you also have the most potential to help.

You could say these numbers are slightly skewed because of all the children in africa and india that are, lets just say, not contributing much to global warming. Don't let that make you feel better for too long, or you'll probably be one of them the next time around. I'll bet they know how to appreciate the little things a hell of a lot better than you and me.

------

Looks like price will be climbing higher, but I've marked out the major areas very plainly.

mastering elliot waves. whats lean cattle doing?Lean cattle, given the selection of m1 that I have chosen to focus my attention on, is showing Rule 7, condition c.

This is an unfortunate selection for the lazy-hearted. Rule 7 Condition c has a lot of extensions, and given the different circumstances could be labeled with an F3, L3, L5, or sL3. I still don't know what those mean, but I can draw some conclusions based off of how the author is writing that an "Irregular Failure Flat" is linked to L5's, "Contracting Triangles" are linked to L3's, "Expanding Terminal Impulses" are linked with :sL3, and "Running Corrections" are also linked to L5's somehow. Furthermore, I don't know what those terms mean, but I am confident that I haven't drawn any false conclusions. Why doesn't this book come with flashcards?

I can't label m1 all of these things. I will now choose the description that I think fits it most closely:

I selected ":F3" because -- if m1 takes the same amount of time (or less) as m0 or m1 takes the same amount of time (or more) as m2, despite any other circumstances, ":F3" is a good possibility; place ":F3" at the end of m1.

The other choices all needed too many things to be true for them to be the proper designation.

The next closest was an ":L3" designation. I discarded this idea because m2 was supposed to be sharper than m2 and it is not. m0 was very sharp on this one. This was the contracting triangle one, which I don't know what that means exactly, but it does break out of a triangle to the casual viewer.

What do you think would you place an F3 or an L3 at the end of m1?

-----------

Wow, this was a ton of work to come up with a shaky conclusion. Looks like I need to read ahead a little because I have no idea how F3 fits into anything anyways.

Here is the definition of (F3):

This structure label is the abbreviation for "First three (3)." An ":F3" either starts a series, occurs after an "x:c3" or is found between two ":5's" (all variations). If you find two ":F3's" next to each other, a new pattern (of a smaller magnitude) begins with the second ":F3." Circle the start of both ":F3's", but do not attempt to connect the two until the second ":F3" can become part of a polywave pattern using waves which proceed it (a polywave is an Elliot pattern composed of three or more monowaves).

It goes on to give a couple lists of how an F3 would fit into a sequence. An example of that would be

1. ? - F3 - c3 - L5 (circle start of F3).

...And so on.

This is mostly just to say none of this really makes sense to me right now, but I have to keep trying to shape these ideas or else I won't be able to use any of this info. I don't really like this book. I have to read every passage several times to make it stick :/ ... Not nearly as enjoyable as looking for simple patterns.

I was going to give more accurate take on live cattle vs feeder cattle, but now I'm kind of bummed so I'll do that another time perhaps.

cattle pushing tentatively higher.cattle are moseying upward. looking for continuation out of a bull flag with trendline support.

I like the patterns I see here so I will plan to make an overly-complicated Elliot wave translation of what I'm seeing sometime within the next 10 hours.

Regarding seasonality, I can't remember any good details on seasonality, but I can remember reading two pages on this topic in a book like 3 years ago, but I can't remember what was on the pages. I remember a little bit though now that I'm asking for recall. There's like a 3 part life cycle as far as markets are concerned. There is a baby stage, where they just kind of count the numbers of possible cattle for the months ahead.. then a maturation stage, where some of the cattle are big enough to go to market, and some are sent back into the feeder for more growing, then there's the slaughtering stage, where all the large cattle get shipped out. There is a period of the year generally when they are contributing more attention to the growth of cattle than other times of the year, and the count of these numbers maybe could be used to predict shortages or surpluses. I would guess that's spring and summer, but I'm not certain. I am from Wisconsin so it's a little shameful I don't know this. Then obviously the price of raising cattle is dependent on the price of feeding them so if wheat/corn is higher then it costs more to feed them. I'm not sure if the result is farmers feed 900 cattle instead of the regular 1000 or if they just eat the cost and just feed as many cattle as they can regardless of feed prices. That assumption also relies on farmers following strict rule based feeding schedules, which I think they do pretty well if they are running big farms. But you never know.

I could be getting the stages of cattle mixed up with the stages for hogs. My brain wants to lump them together, but I'm also am finding an asterisk so I think there are significant differences that I'm unaware of. Probably better to do your own research. You can maybe tell I'm more of a price action oriented person.

Seasonal Cattle Spread Worked Out Great +$4000 PotentialBoy I must admit, I sure do miss dealing with these spread markets. Far less time effort and less stressful then intraday trading outrights, that is for sure.

Shout out to @NorthStarDayTrading for the awesome Auto Support Resistance Indicator. I love it!

We'll Meat Again, Don't Know Where...This one can be a volatile spread, and that goes both ways.

The idea is to buy Live Cattle and sell Lean Hogs for a trade that runs May though to August. The reason for this trade is seasonal. That is, there is a pattern that tends to repeat itself each year.

Heading into mid-year, Cattle slaughter tends to be high while Hogs are at the opposite end. But that pattern reverses itself when we are past mid-year and looking towards the end of the year. That creates the spread movement.

In the last 25yrs, buying April Cattle and selling Dec Hogs, has lost money only 3 times. 22 out of 25 is not bad. Optimized data of course, but there is a pattern there! The average profit in that time has been over $3500 for one spread. You can also do this spread in nearby contracts, eg Dec Cattle.

It’s a volatile one though. Drawdowns can be, what’s the word…interesting. It makes this trade more about getting entries correct. An early to mid-June pull back has happened in more years than not. Waiting for that can give a better entry time.

Caveat: it ain’t that simple. Spread trading takes knowledge, support, patience and trade management, but the gems are there when we look in the right place.

One last thought: you cannot use 'beef stew' as a password. It's just not stroganoff.

- Please follow and like for more trade ideas and learny stuff! -

Cattle and Corn: An Obscure Spread With Interesting NumbersAn interesting spread here. I’ve traded this one on and off over the years. It’s a long-term hold and some years this spread just has a nice smooth trend.

Think of this spread as a cost of carry, in a way. Or perhaps: wholesale versus retail is a better way to look at it.

Feeder Cattle (young moo cows) + Corn (food) + time equals Live Cattle (grown up ones).

It’s like that math parents do when say “do you realize how much it costs to have a teenager and send him/her to college?”

In futures we can trade that, for cattle and corn at least. We can see where base cost of production is over or undervalued and with a bit of patience, these kinds of trend trades reveal themselves.

This one has a great seasonal pattern. That is, it tends to repeat itself each year. Not every year, but most years. Research says selling Feeders and Corn and buying live Cattle can be quite profitable. On average, an entry late April and exit late Sep has been profitable every year since 2005.

From 2006 onwards: 100% strike rate, average profit $3374 for one spread.

Formula:

(+2*400*Live Cattle) – (1*50* Corn) – (1*500 * Feeders)

Essentially it says one contracts of feeders (50000lbs) plus one of corn (5000 bushels) makes about two live cattle (80000lbs).

Some also trade a 1 Corn: 2 Feeders and 4 Live Cattle. Its’ essentially halving the corn requirement from above.

Remember, there are no rules in spread trading. Our job is to find the correlations and trade them.

Risk:

Hmmm, there are two ways to look at that. The stats say the worst drawdown in the last 15yrs in $5400 and that is about double of most other years in that time. So it’s not a small risk trade.

The other way is to eyeball a chart. That recent move from +2000 to 0 did not take long at all. Unless get a well-timed entry, then stops will have to be wide - a few thousand at least (about 3.3 times ATR). It’s one where you would start with a wide stop and bring it in should you see some equity.

Entries and exit need finesse since it’s not an exchange traded spread. Experienced spreaders only, with knowledge of seasonality. In you are new to these kinds of spreads, mark it down as market knowledge and come back for a look later on.

5 rules that made Warren Buffett so rich by James AltucherI posted an idea about the Myth of Warren Buffett Buy & Hold a while ago. Here is a general description of how he became so rich by James Altucher.

James Altucher is a wall street investor with a lot of hair.

You might know him from recently saying New York was dead forever on television, and some actor insulted him on tv because of this.

You might also know him from his books and articles, including one of my favorite articles which is him ranting on daytrading explaining why it is so distasteful. He used to be a day trader in the 90s when it was in its early days and made some money but obviously far less than just holding the NDX that went up over 2000%, and he hated it.

And finally most people on tradingview from before the 2020 new wave of investors probably know him from defending Bitcoin and selling a "trading masterclass" to crypto "investors".

He wrote a book (or maybe more than 1?) about Buffett, articles, and in particular a complete article with the 5 "rules"/"secrets" I described, in a Quora answer to the question "How did Warren Buffett become so rich?". The answer is of course much more complete than the summary I wrote up.

Warren Buffett obviously has some skill, he outperformed the market even early on before he was famous and got great deals, he has found and held onto great winners and almost always eliminated the losers (Berkshire was his greatest mistake) but it is interesting to see how saint grandpa aw-shucks and his folk wisdom actually rips the competition to pieces.

"Diversification is for idiots" coming from a guy that took thousands of trades and is always on the lookout for an opportunity to make easy money.

He says he could be making 50% a year easily on a small account. From these penny stocks selling at BELOW liquidation price?

We know what companies he bought, he never just gambled it all on 1. Just bet on several decent ones, get rid of the losers and keep the one that continues its trend up.

A quote by Warren Buffett "I will do anything that is basically covered by the law to reduce Berkshire's tax rate. For example, on wind energy, we get a tax credit if we build a lot of wind farms. That's the only reason to build them. They don't make sense without the tax credit."

Also makes him look kind and caring to the population.

There is a good reason big globalist businesses and rich people are all pro socialism, high taxes, and lockdown. In California I remember the government banning small food trucks in favor of big brick and mortar chains, for some BS reason as always. They also shot independent contractors in the leg forcing them to be wageslaves.

High taxes keep the poor people down at the bottom, while a large portion of the poor people - those with the abstraction capacities of a potato - cheer 😑, so the rich even look like they are kind and caring. A bucket of crabs surrounded with giant rich people laughing and dipping crab pinchers in sauce while pushing the crabs about to escape at the bottom saying it's for their own good...

High taxes, socialism, lockdown and so on are good for business not just because they keep the unwashed masses at the bottom. Amazon made record profits.

But more importantly, these multinationals have competition. They will get better deals, bigger revenue, and even a monopoly, if they can not jsut keep the others at the bottom but DESTROY those that climbed to millionaire or upper middle class status, even just middle class. Goodbye competition. More money and more power.

Twitter recently just went full "we're running this show now" and banned a NY Post showing an email that proves Biden knew about his son & Ukraine.

This disgusting tentacular social network is banning anyone that tries to mention this story, they are shutting it down entirely. And since everyone gets their info from those sites...

Twitter is also Antifa means of communication but I digress.

I don't see how any government can completely enforce high taxes without collapsing the entire economy, but even if they magically got billionaires to pay 70%, it is still a small price to kill all competition and be an all powerful overlord of a monopoly that can really take advantage of their power and of their wealth and exploit desperate people (cattle).

So you end up with all powerful sociopathic megabillionaire oligarchs running monopolies WITH THE SUPPORT OF THE PEOPLE (FOOLS!) that decide who makes the laws (gee I wonder if they'll pick people that make laws that go against their interests). If you think it's all fine they have good intentions (lol) even if they had, if fools can get manipulated by 1 group they can be as easily manipulated by another. Let's not forget Hitler came to power with the support of YES Antifa & the communist party, even Röhm was a big socialist with dreams of free stuff. Goebbels started as a marxist in his youth...

Manipulating crowds of idiots is overpowered can god nerf it or something?

Optimists are blissfully ignorant idiots. Pessimists are depressed sad people that miss all opportunities. Adapters are winners. Can't beat them? Join them.

Either you are a superman supergenius with higher standards - in which case you'll be a hated arrogant jerk that thinks he is better than every one - or you become a manipulative shark that does not play fair. If this is what society demands then that's how you win. And the crowd will even cheer for you. No one is more celebrated and sanctified by the public than Elon Musk...

Cattle prices in Brazil. Time for a REVERSAL!!!!With the high demand from China and some plants closing down due to COVID, the cattle prices in Brazil have just gone up since April. Today was the first real candle but it stopped at he 21 exp mov average.

The country has started to reopen the plants, COVId infection likely reached its plateau and we can expect the imbalance of demand supply to go to normality.

It is totally achievable to see prices of 210 or 200 very soon. Cattle prices in the US will bbe highly dependable of USDBRL correlation.

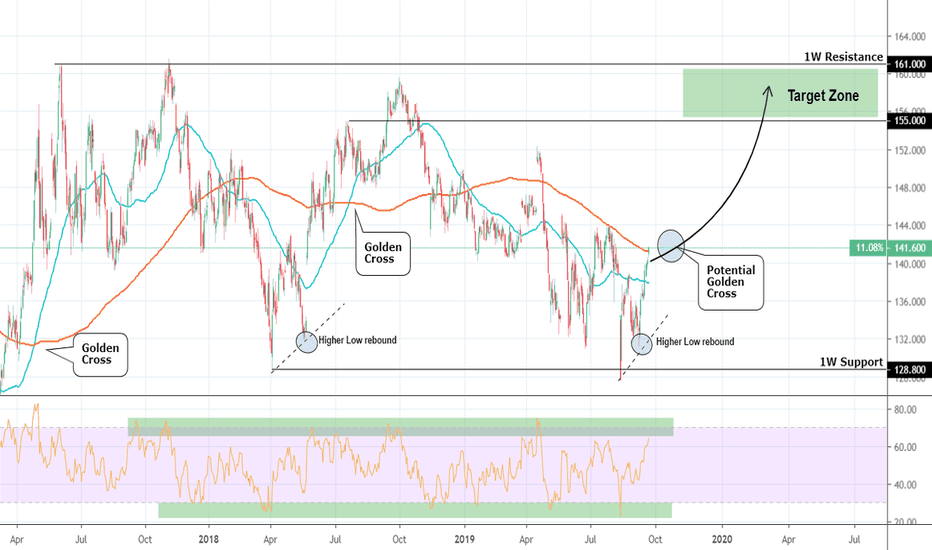

Feeder Cattle: Strong Buy Signal on potential Golden Cross.Feeder Cattle is coming off a strong Higher Low rebound early this month with 1D already on strong bullish technical action (RSI = 60.454, MACD = 0.850, Highs/Lows = 3.0514). Since this bullish sequence started on a strong August rebound on the 128.800 1W Support, it is more likely to see an extension towards the 161.000 1W Resistance.

A potential 1D Golden Cross formation in October should come as validation of this just as it has done twice already since 2017. We are long on GF with 155.000 - 161.000 as our Target Zone.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

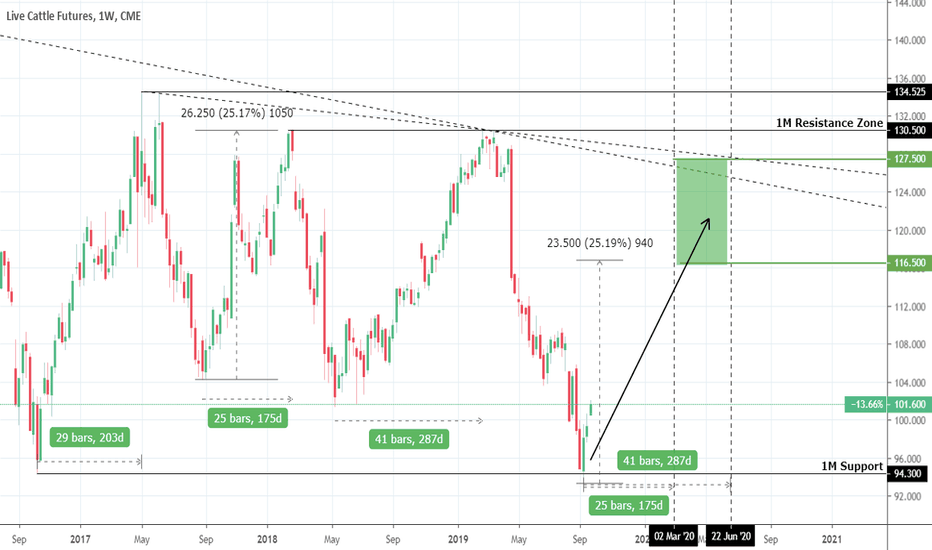

Live Cattle: Strong long term Buy Opportunity.Live Cattle has hit this month the 94.300 1M Support, with the last time we saw these levels being in October 2016. The price appears to be trading within a long term Rectangle within 94.300 and the 130.500 - 134.525 Resistance Zone. The current 3 week rebound on the 1M Support makes LE an automatic long term buy opportunity. We are therefore long at the moment and having calculated all possible scenarios within this Rectangle, we concluded that profit should be taken within 116.500 - 127.500. Take advantage of this opportunity based on your won risk tolerance levels.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Live Cattle: Cyclical sell opportunity.Live Cattle has been trading within a long term 1M Rectangle (RSI = 45.889, CCI = -24.7510, Highs/Lows = 0.0000) roughly since late 2016. This March the price was rejected exactly on the 1W Resistance (130.500 - 134.525) and in April another Lower High attempt failed. This resulted in a strong downfall which is expected to test again the 1W Support Zone (101.625 - 104.150) before another rebound. We are on a long term sell with TP = 104.250.

See the call of this trade before the strong rejection took place:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.